Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

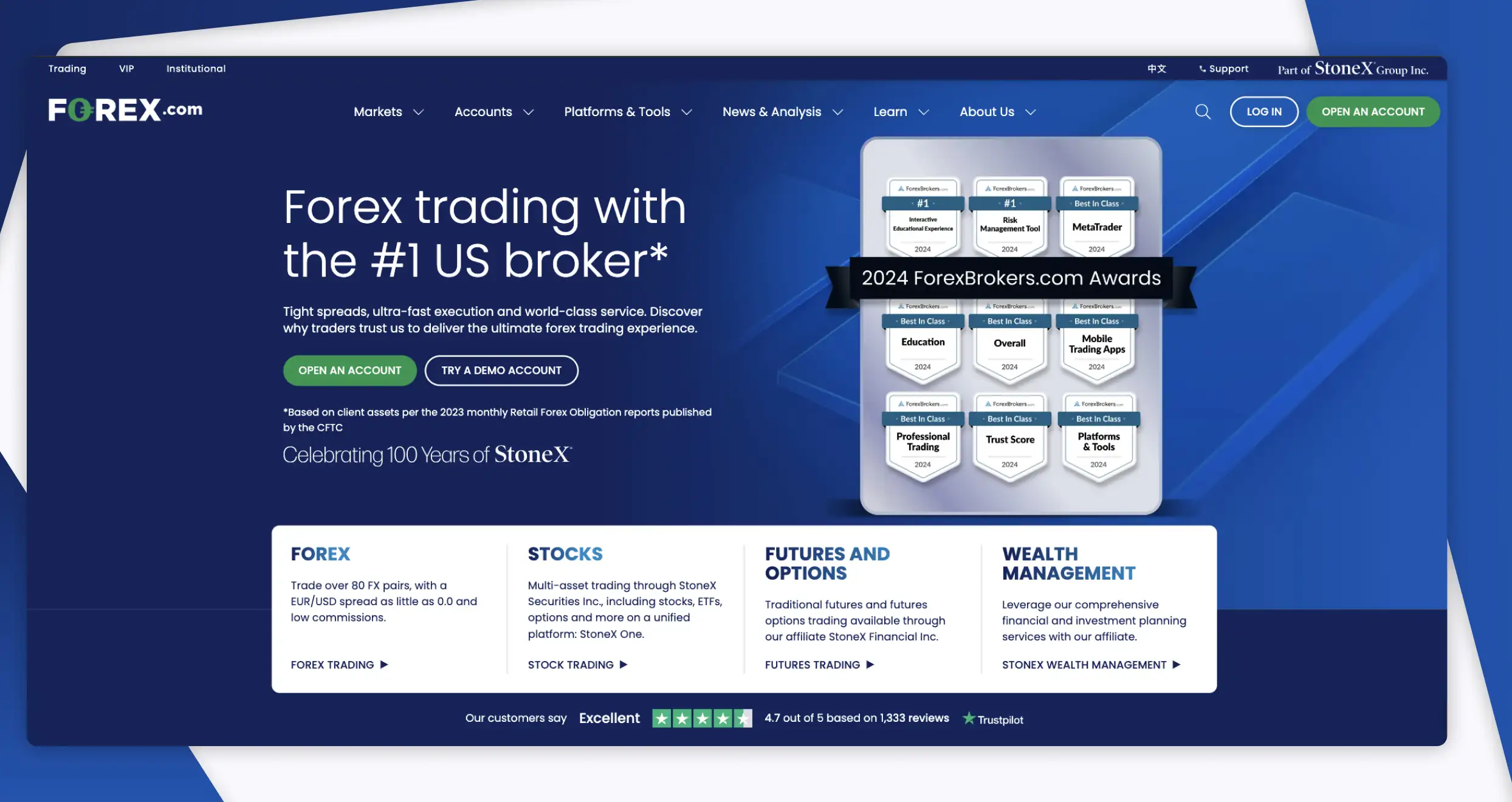

Forex.com is a prominent platform with over a million customers. The company started operating in 1999 and has been around for over a decade. It offers experienced traders access to most of the tools they need to thrive, including advanced platforms like MetaTrader 5 and TradingView. This broker also allows rookies and gurus alike to open and use demo accounts before shifting to live trading.

If you’d like to join Forex.com, read this review first. It has all the fundamentals you need to know before taking the final step. Everything we’ve discussed here stems from hours of research, tests, and evaluation. The information herein is unbiased and tailored to help you decide if Forex.com is worth your time and money.

Why Forex.com

Our extensive evaluation of Forex.com led to numerous discoveries. For starters, we found that this broker has many perks that outweigh the shortcomings. To give you a sneak peek, Forex.com is regulated by authoritative bodies like the FCA and accepts clients from over 100 jurisdictions. This broker also supports indispensable platforms like MT4 and MT5.

Here are the pros and cons we identified while interacting with Forex.com:

✔Zero fees for card deposits and card withdrawals

✔A broad range of trading platforms, including MT4 and 5

Pros

- Forex.com is licensed by several respected authorities, including CySEC, ASIC, and the FCA

- Reasonable minimum deposit requirements for Standard accounts

- Zero fees for card deposits and card withdrawals

- The broker accepts clients from 100+ countries, including the US, the UK, and Japan

- A broad range of trading platforms, including MetaTrader 4 and 5

Cons

- Supports fewer payment methods compared to its peers

- Limited product portfolio

- No investor protection privileges for US residents

Security

You want your hard-earned money to be in safe hands, and that’s understandable. Well, Forex.com is one of the safest brokers out there. Let’s discuss how this broker protects your money.

First, Forex.com keeps all retail client funds in segregated accounts held and maintained by top-tier financial institutions. The broker has signed trust letters to ensure your money never mingles with Forex.com’s assets. So, you can be at ease knowing this broker will never use your money to fund operations, cover debts, or for any other unauthorized purposes. Also, Forex.com uses its own resources to hedge client trades.

With Forex.com, you also get additional coverage against adverse circumstances that may negatively impact the broker’s ability to compensate you. That is because Forex.com is a member of the Investor’s Compensation Fund (ICF). Check Forex.com’s ICF statement for more information.

While signing up, Forex.com ask for personal details like your full name, financial statements, and contact info. The broker secures this information with top-class security systems and software, including encryption technologies like SSL.

Finally, trading with Forex.com is a splendid idea since this broker is registered and authorized by numerous regulatory bodies, including:

- The Canadian Investment Regulatory Organization (CIRO) in Canada

- The Cyprus Securities & Exchange Commission (CySEC) in Cyprus

- The Financial Services Agency (FSA) in Japan

- The National Futures Association (NFA) in the US

- The Commodities Futures Trading Commission (CFTC) in the US

- The Monetary Authority of Singapore (MAS) in Singapore

- The Cayman Islands Monetary Authority (CIMA) in the Cayman Islands

- The Financial Conduct Authority (FCA) in the UK

- The Australian Securities and Investments Commission (ASIC) in Australia

Platforms

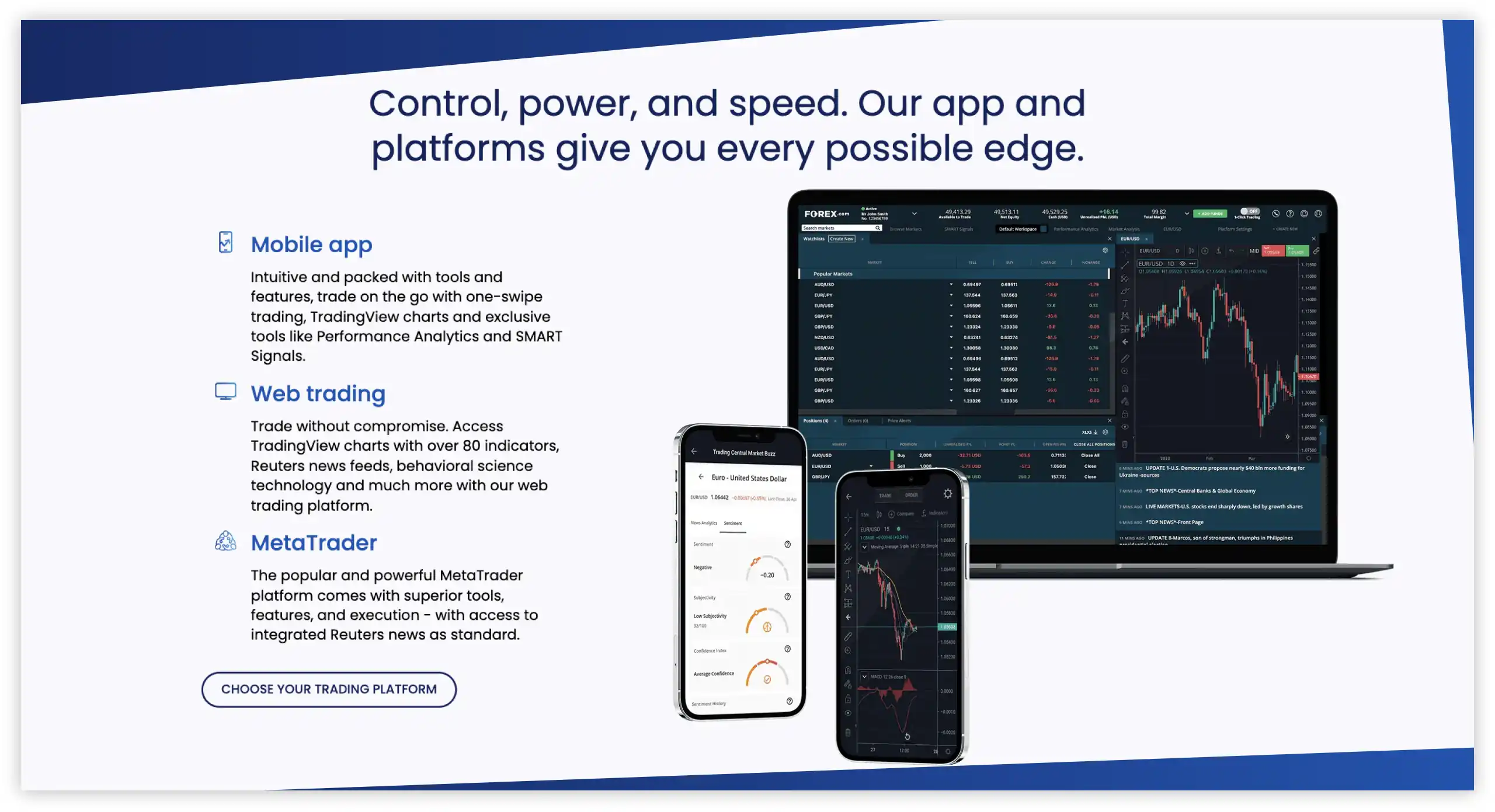

Forex.com has a wide array of web and mobile trading platforms. We tested all of them, starting with Forex.com’s web trader. It was to our satisfaction. Our team commends the platform’s simple but intuitive layout. Anyone can use it without any difficulties, including rookies.

Let’s explore all the platforms that Forex.com offers:

- Web Trader: The Web Trader trading platform is equipped with everything you need to trade seamlessly. That includes advanced Trading view charts that let you create new orders and edit existing ones from the same place. This platform has 80+ technical indicators, 50+ drawings, and 14 time intervals. While using it, you also get access to price, trade, and order alerts. These notifications save you from spending countless hours glued to your PC or mobile screen.

- Mobile App: Forex.com has a mobile app that you can use to trade on the go and seize opportunities wherever you are. This powerful app gives you the opportunity to open positions quickly with one-swipe trading. It also gives you access to exceptional TradingView analysis and charting tools. Additionally, with the app, you can monitor fundamental markets through custom watchlists. The best part is you can trade from the Forex.com mobile app while on the move using an iPhone or Android smartphone.

- MetaTrader 5: If you’re a fan of MetaTrader, you’ll be happy to know that Forex.com supports MT5. With this platform, you get access to 500+ markets. And that’s just the tip of the iceberg. Combining Forex.com with MT5 facilitates faster trading and allows you to exploit a wide variety of tools, including 15 custom indicators and 9 Expert Advisors (EAs).

- MetaTrader 4: You can use Forex.com to trade with MT4 and leverage a suite of countless apps and features, including Expert Advisors and one-tap trading. The latter is incredibly useful in accelerating the order execution process. MT4 also offers 30 powerful technical indicators, 9 time frames, and uncapped access to a vibrant community of traders and investors.

- TradingView: Forex.com allows its traders to connect their accounts with the popular TradingView platform. You can do that today and become part of a community with 30 million+ analysts, traders, and investors. TradingView also has a screener for scanning markets and dynamic alerts that ensure you never miss crucial opportunities.

Since Forex.com supports a plethora of trading platforms, choose carefully. Consider each platform’s offerings and compare them to your trading needs and objectives. Most importantly, you should use demo accounts to test the available platforms.

Fees

The best decision you can take as a trader is to join a platform with friendly, transparent fees. Luckily, Forex.com values transparency and cost-friendliness. We tested this broker using Standard and RAW Spread accounts. Here’s what we found out.

First, you must fund your account before trading live with this broker. When doing that, keep in mind that Forex.com’s minimum deposit is $100. Therefore, your first deposit should be $100 or higher. But don’t worry about deposit charges. Forex.com charges zero fees for incoming deposits from bank transfers and debit cards.

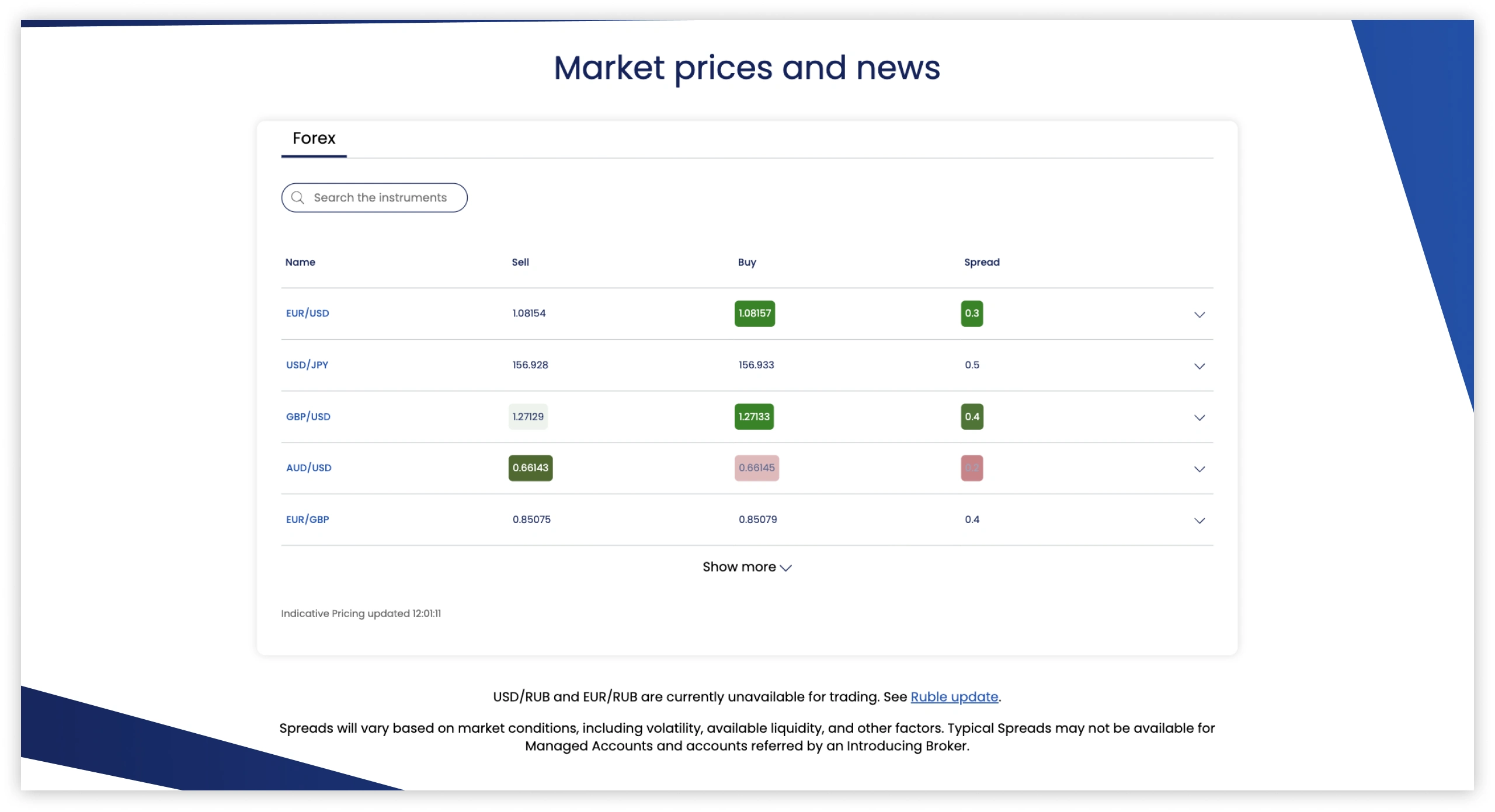

The other costs and charges you will incur while trading with Forex.com depend on your preferred account. The costs associated with standard accounts are included in the bid/ask spread. A Standard account’s spreads start from 0.8 pips. Additionally, this account will only require you to pay commissions if you invest in equities. But the good news is that Standard account owners can earn cash rebates on cryptos, equities, FX, and other assets.

If you go with a Forex.com Raw Spread account, you will enjoy commissions as low as $5 per $100k you trade. This account also allows you to lower your trading costs with cash rebates of up to $50 for every $1 million you trade. Furthermore, with it, you can trade FX majors and enjoy tight spreads starting from 0.0.

Commissions and rebates aside, Forex.com levies rollover fees for positions held overnight. The exact rollover rates vary depending on factors like the prevailing market conditions. Furthermore, this broker requires dormant account owners to cover a $15 monthly inactivity fee. The last fee kicks in after an account has remained inactive for 12 months.

Product Offerings

With a Forex.com account, you can diversify your portfolio with a wide array of activities. For instance, you can trade CFDs on currency pairs and indices or invest in precious metals like gold and palladium bars. Moreover, the broker offers thousands of securities, including 4,500+ share CFDs from established companies like Adidas and Amazon.

Here’s an overview of all the products you’ll find on Forex.com:

- Forex: This broker lets you speculate on the price movement of different currency pairs, including majors like EUR/USD, CAD/JPY, and AUD/USD. What’s more, you can dive into FX trading and enjoy commissions as low as 0.0.

- Indices: Do you seek unmatched access to global index markets? Forex.com can put you in a position to trade 15+ popular indices, ranging from US SP 500 and UK 100 to Wall Street and Germany 40.

- Stock CFDs: Forex.com allows traders like you to trade CFDs related to stocks from famous corporations like Apple, Tesla, and Nvidia.

- Cryptocurrencies: If you want to profit from cryptos without owning these assets, get a Forex.com account. It will enable you to trade different crypto CFDs with competitive leverages. Forex.com supports thousands of cryptos, including popular assets like Bitcoin, Ethereum, and Litecoin.

- Commodities: As a Forex.com account holder, you can trade CFDs on commodities like oil, coffee, and precious metals. Commodities CFD trading is ideal for hedging against inflation and profiting from falling and rising markets.

Customer Service

Good customer support is indispensable to your success as a trader. As such, our team vetted Forex.com’s support services extensively. Here’s what we recommend. Use Live Chat if you have an urgent issue or need quick responses. The broker’s agents will connect with you in no time at all. You can also call this broker’s support agents and get fast responses.

If you are unable to chat or call a live agent, you can use the contact form embedded on the website to send a message to Forex.com. This will open a request, and a specialist will contact you as soon as possible. You can also email the Forex.com support team if you have a concern or question requiring elaborate answers.

Finally, if you prefer finding answers to your questions at your own pace, check out Forex.com’s FAQs page. Here, the broker’s experts have addressed different popular queries, from how to open an account with Forex.com to how to download the MetaTrader trading platforms.

How to Sign up For an Account at Forex.com

Like most of its peers, Forex.com has simplified and streamlined the account registration process. That said, legal and regulatory obligations require this broker to confirm every new customer’s identity with a mandatory KYC process.

Before signing up with Forex.com, ensure you have no problems sharing sensitive information and crucial ID documents. You can’t sign up without them. Also, when registering, provide accurate information and documentation to avoid issues like rejection.

Here’s how you can sign up with Forex.com:

Visit Forex.com’s official site. Use the incorporated navigation links to access different sections of the website. While doing so, evaluate everything you consider important, including fees and product offerings. You can also download an app for trading on the go from the official site.

Click “OPEN AN ACCOUNT”. Choose your preferred platform from the available options, which include Standard Account, Raw Spread Account, and MetaTrader accounts. Fill out the application form with the correct information, including your country of residence, email address, legal name, date of birth, and mobile number.

Verify your identity with valid copies of documents such as a government-issued ID and a recent utility bill. Forex.com verifies new accounts almost instantly, so don’t worry about extended waiting periods. But, avoid providing false or unclear copies of your documents since they will impede your progress.

Fund your account with at least $100, which is what Forex.com’s minimum deposit requirements dictate. Also, note that this broker accepts specific payment methods, like cards, wire transfers, and Skrill. You can’t use any option that isn’t on Forex.com’s list.

Choose a security and start trading. Only trade with what you can afford to lose since this activity is risky and exposes you to significant losses. Also, keep a close eye on your portfolio to prevent underperforming assets from snowballing into massive financial losses.

Final Thoughts

Our Forex.com review has introduced you to crucial aspects you must know before trading with Forex.com. We’ve discussed everything, from how secure this platform is to the tradeable products it offers. Use this information to gauge how well Forex.com aligns with your trading goals and expectations.

Most importantly, don’t stop here. Scour the internet for additional insights regarding this broker. Then, use everything you’ve learned to make an informed decision.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Man, those spreads are painful sometimes. I'm paying noticeably more per trade compared to my buddies using other brokers, and when you're doing volume it really adds up