Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Australia is one of the global regions known to host local and international forex traders. Because of this, the financial sector in the region has made it easier for brokerage firms to offer their services to Aussies. This is, of course, if they abide by the Australian Securities and Investment Commission (ASIC) regulations.

With hundreds of forex brokers in Australia, traders are struggling to make suitable choices. To ensure you are motivated to start trading forex, we decided to recommend some of the top options. Our guide will also take you through the simple steps for getting started. Ultimately, you will be able to make the best choice and decisions before embarking on forex trading.

In a Nutshell

- Many Australian traders are venturing into forex. This activity involves exchanging one currency for another on a decentralised market. Traders also speculate on currency price movements to benefit from exchange rate fluctuations.

- To trade forex in Australia, it is crucial to learn how the market works to maximise your potential.

- There are many forex brokers in Australia. Trading with ASIC-regulated ones guarantees a secure trading environment.

- As professionals with decades of experience, we conducted thorough market research to create the list of top forex brokers below.

- Besides learning forex and choosing an ASIC-regulated broker, confirm other broker features for an exciting trading experience. We will guide you through the selection process in this guide.

List of the Best Forex Brokers

- Pepperstone – Best Forex Broker With Excellent Support Service

- Plus500 – Top CFD* Provider for Australian Traders

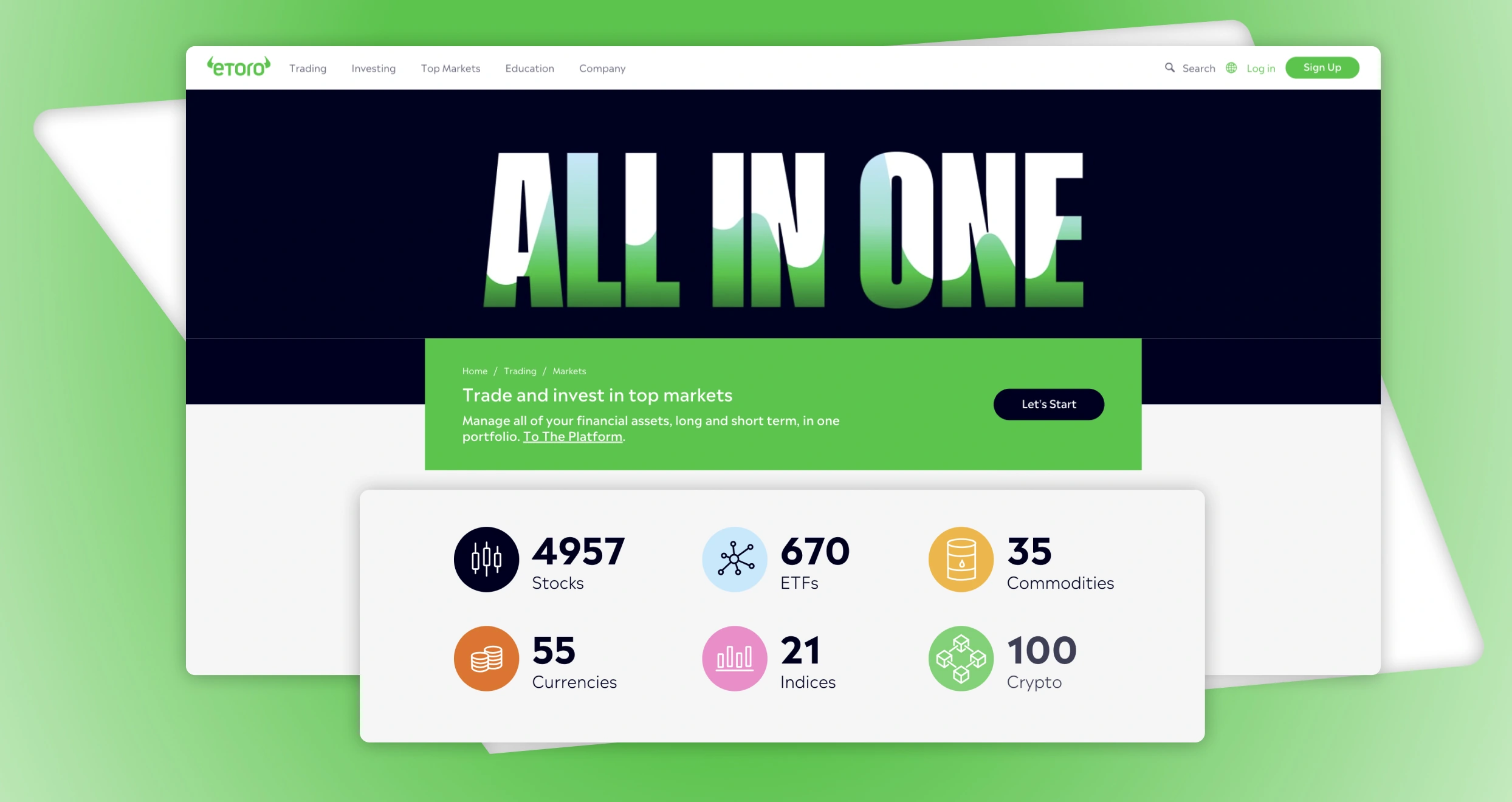

- eToro – Beginner-Friendly Forex Broker in Australia

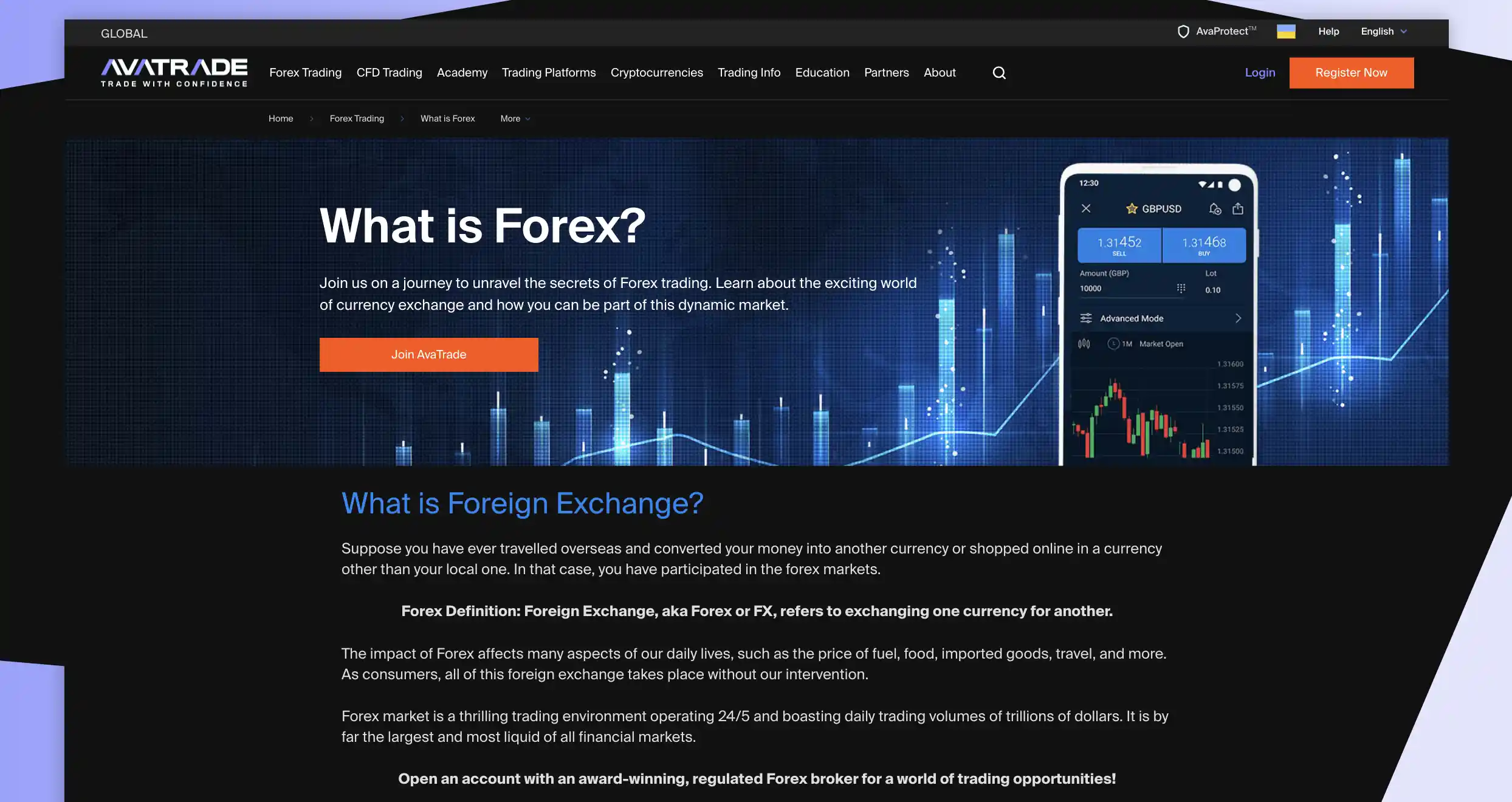

- AvaTrade – Top Forex Broker For MT4 Users in Australia

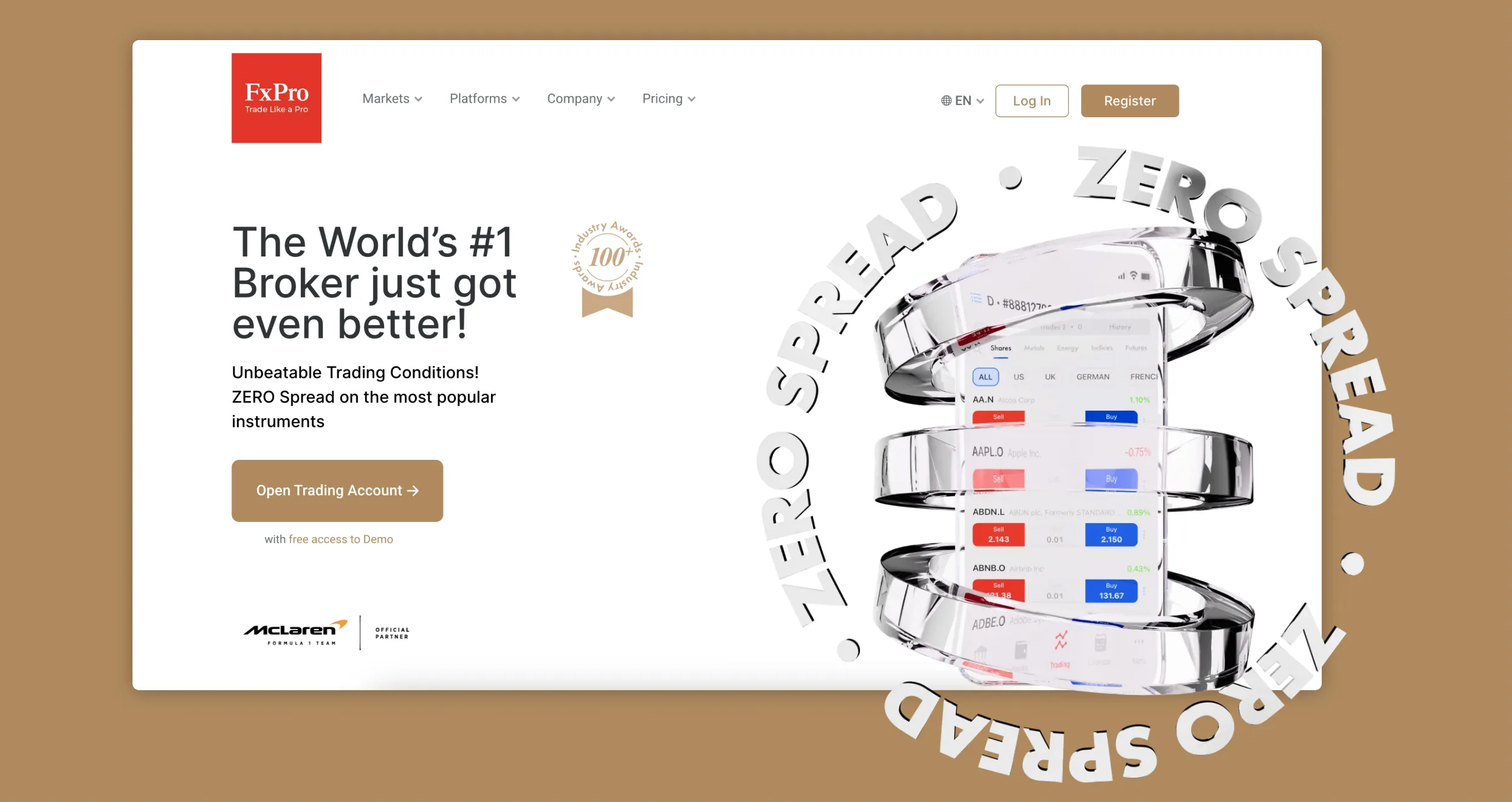

- FxPro – Overall Best Forex Broker in Australia

- FP Markets – Best Forex Broker For Professional Traders in Australia

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Forex Trading Platforms in Australia

To come up with our recommendations list above, we tested and compared hundreds of forex brokers in Australia. We considered various elements in this process, including legality, reliability, support service availability, and more. Only those that met our specifications were shortlisted for recommendations.

Since we pride ourselves on unbiased recommendations, we combined our test results from the above process with findings from user testimonials. By visiting legit sites like the App Store, Trustpilot, and Google Play, we understood each broker’s strengths and weaknesses from a user perspective.

Here is our comparison table with some of the top elements that made our top forex brokers in Australia stand out.

| Best Forex Broker Australia | License | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, SEBI, ASIC, DFSA | 24/7 | MT4, MT5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes |

| Plus500 | FCA, CySEC (#250/14), ASIC, FSCA, MAS, FSA | 24/7 | Plus500 Webtrader, Plus500 Pro | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes |

| eToro | ASIC, CySEC, FSCA, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Credit/debit cards, PayPal, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes |

| AvaTrade | FCA, CySEC, ASIC, CIRO, FSCA | 24/5 | MT4, MT5, AvaSocial, DupliTrade, AvaOptions, AvaTradeGO | Bank transfers, Skrill, WebMoney, Neteller, credit/debit cards | Yes |

| FxPro | FSCA, FCA, ASIC | 24/5 | cTrader, WebTrader, MT4, MT5 | Bank transfer, broker to broker, Skrill, Neteller, PayPal, Visa, Maestro, Mastercard | Yes |

| FP Markets | CySEC, ASIC, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Yes |

Brokers Overview

When it comes to choosing a forex broker in Australia, you must confirm certain features to ensure a broker suits your forex trading needs. Based on our market analysis, many traders prioritize brokers they can afford. They also check the availability of currencies and other assets that will enable them to easily diversify their portfolios.

With hundreds of forex brokers in Australia, comparing brokers’ fees and asset offerings can be lengthy and overwhelming. We decided to do all the legwork to help you save time. Below, we have highlighted a summary of these broker features for informed decisions and choices.

Fees

| Best Forex Broker Australia | Minimum Deposit Requirement | Commission/Spreads | Deposits/Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | A$0 | From 0.0 pips | Free | None |

| Plus500 | A$100 | From 0.0 pips | Free | $10 monthly after three months of inactivity |

| eToro | A$100 | From 1 pip | A$5 withdrawals | A$10 monthly |

| AvaTrade | A$100 | From 0.9 pips | Free | A$50 quarterly |

| FxPro | A$100 | From 0.0 pips | Free | A$10 monthly |

| FP Markets | A$100 | From 0.0 pips | Free | None |

Assets

| Best Forex Broker Australia | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Opinion about the Best Forex Brokers

1. Pepperstone – Best Forex Broker With Excellent Support Service

Trading forex at Pepperstone exposed us to over 90 currency pairs. We like that the broker is user-friendly and customisable—an element that makes it an excellent choice for all types of traders. Moreover, Pepperstone has no minimum deposit requirement, and forex trading attracts low fees, starting from 0.0 pips. We also discovered an additional 1,200+ instruments, such as forex, cryptos, indices, commodities, and more for portfolio diversification.

Since support service reliability is an element many traders consider when selecting a broker, we decided to test Pepperstone’s response rate. Overall, we found the team to be professional since we were satisfied with all the solutions and assistance we received. Plus, responses were prompt via phone, email, and live chat. You can test Pepperstone via its demo account to see whether it fits your forex trading needs.

Pros

- Hosts advanced third-party trading platforms, including MT4, MT5, cTrader, and TradingView

- No minimum deposit requirement for Australian clients

- Lists over 90 currency pairs

- Its support service is responsive and offers relevant solutions via multiple channels

Cons

- No buying and taking ownership of the featured instruments

- Once activated, the demo account lasts for only 60 days

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. Plus500 – Top CFD Provider for Australian Traders

Plus500 allows Australian traders to trade forex and other CFD instruments across various asset classes. This best forex trading platform in Australia, has a minimum deposit requirement of A$100, with no transaction charges. From our hands-on experience, Plus500’s account opening procedure is straightforward. Beginners also have a demo account at their disposal to test its performance and gauge their skill levels in a risk-free environment.

When it comes to currency pair availability, we discover over 60 options as CFDs that you can trade commission-free. Plus500’s spreads are also low, starting from 0.0 pips on major pairs. Moreover, the leverage limits go up to 1:30 for retail clients and 1:300 for professionals. Although Plus500 has no third-party platforms like MT4, it hosts the Plus500 Pro platform with advanced tools for professional traders. Plus500CY Ltd is authorized & regulated by CySEC (#250/14).

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- Low forex trading fees from 0.0 pips

- Free deposits and withdrawals

- Quality learning tools and a demo account for newbies

- Favorable leverage limits for all types of traders

Cons

- No third-party platforms like the MT4

- Its inactivity fee of $10 monthly kicks in after only three months

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

3. eToro – Beginner-Friendly Forex Broker in Australia

eToro is one of the brokers in Australia with user-friendly interfaces. Moreover, the broker hosts quality learning resources, from guides and articles to webinars and seminars. We also like its demo account, which is virtually funded with A$100,000 to help users navigate the financial landscape in a risk-free environment. It is an excellent option for traders looking for the best forex trading platform for beginners in Australia.

We noticed that eToro has a low minimum deposit requirement of A$100 for Australian traders. All deposits are free, and you can transact using multiple payment methods. Moreover, the broker lists over 51 currency pairs, which you can trade with spreads starting from 1 pip. For traders looking to diversify their portfolios, eToro offers additional assets, including stocks, commodities, cryptos, indices, and more.

Pros

- Hosts an award-winning CopyTrader platform for social and copy trading

- Low minimum deposit requirement

- Plenty of learning materials for beginners

- A user-friendly and modern-design platform

Cons

- High forex trading fees compared to its peers

- No third-party platforms like the MT4

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

4. AvaTrade – Top Forex Broker For MT4 Users in Australia

AvaTrade is an excellent option for MT4 traders since the broker hosts quality trading tools for all users. We explored it and liked its user-friendly and modern design platform. Moreover, we noticed that AvaTrade’s MT4 platform hosts trading signals from top providers. Plus, it supports Expert Advisors for algorithmic trading and custom indicators to help users develop their own custom mathematical tools.

When it comes to creating a trading account, AvaTrade has a seamless procedure. Its minimum deposit requirement is A$100, with no transaction charges. Moreover, the broker lists more than 50 currency pairs, which you can trade with spreads from 0.9 pips. We also like AvaTrade’s AvaTradeGO app, which operates seamlessly on iOS and Android devices. Beginners can rely on this broker’s educational section for quality resources to advance their skills.

Pros

- Low minimum deposit requirement

- Quality trading resources on its MT4 platform

- A user-friendly and modern-design platform

- A highly-rated AvaTradeGO app for iOS and Android mobile devices

Cons

- It has a A$50 quarterly inactivity fee that kicks in after only three months

- Only forex and CFD instruments supported for Australian traders

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

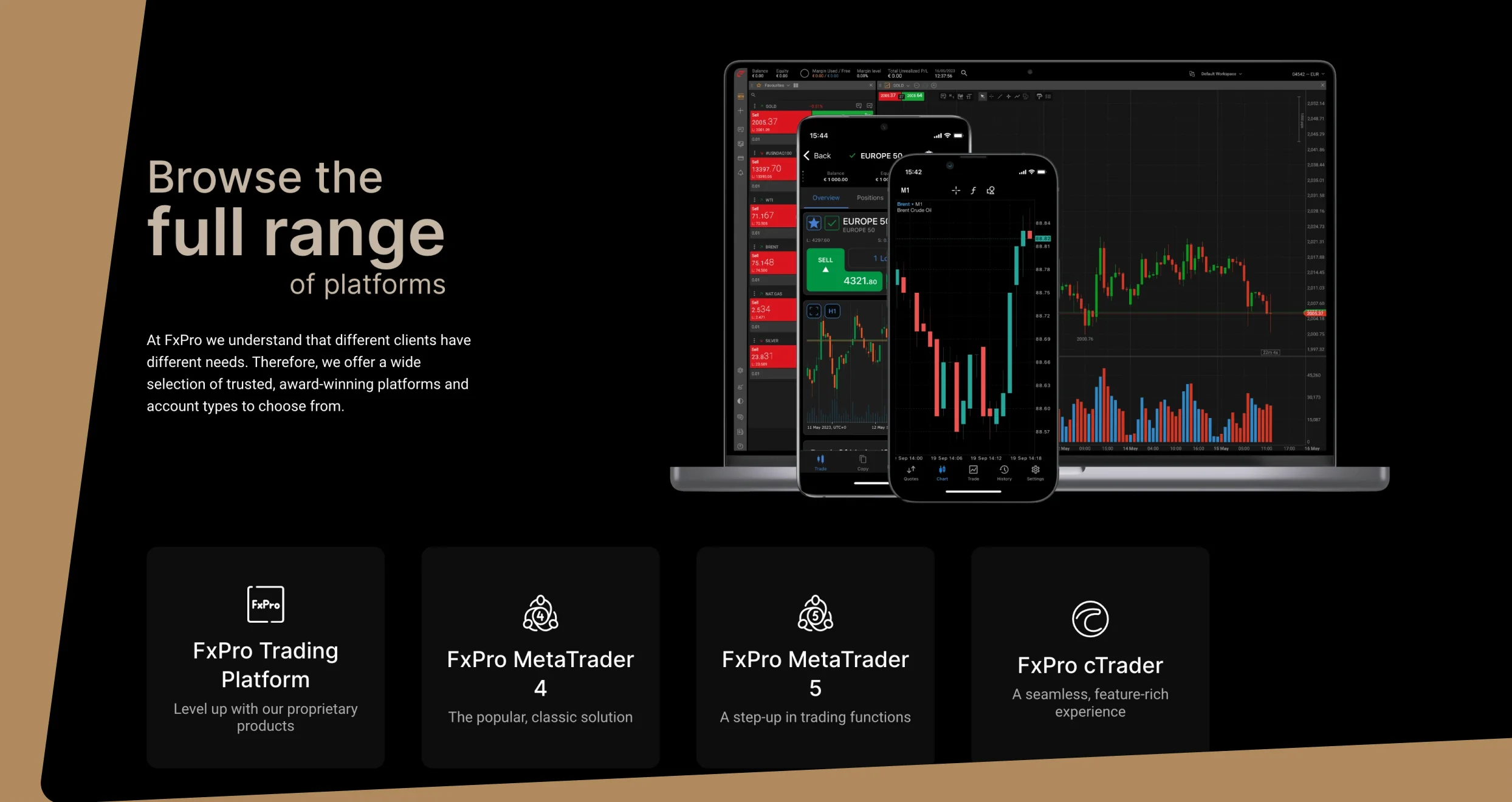

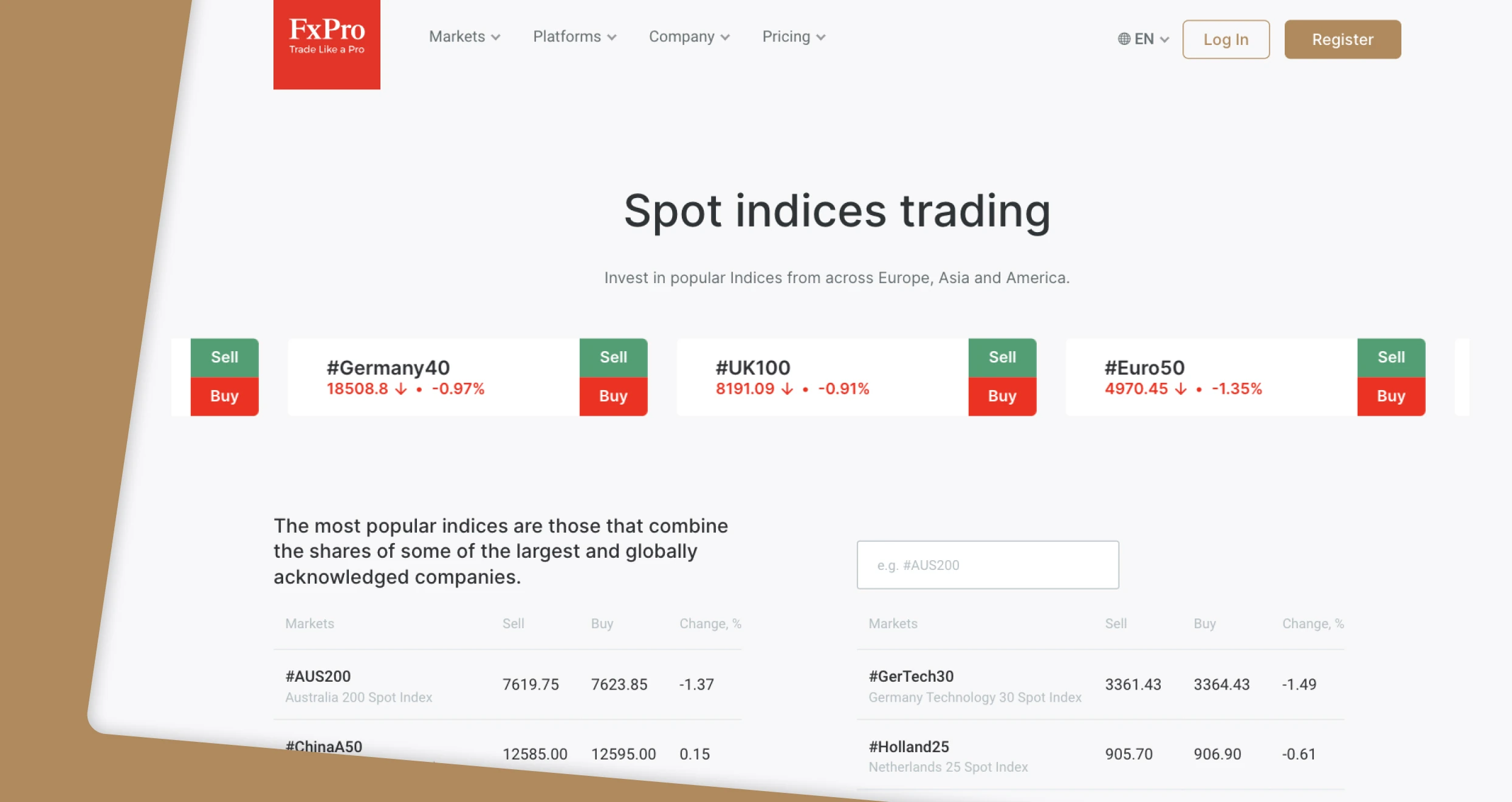

5. FxPro – Overall Best Forex Broker in Australia

FxPro has been around for nearly two decades and continues to adjust to the advancing technology to ensure all traders are satisfied. We tested the broker and were impressed by its user-friendly and intuitive design trading platform. The broker has a minimum deposit requirement of A$100, allowing low-budget traders to explore the currency market. Moreover, we noticed adequate learning resources to help newbies in forex trading easily develop their skills.

FxPro lists over 70 currency pairs, which we explored at low spreads starting from 0.0 pips. Moreover, it hosts an additional 2,100+ assets to benefit forex traders looking to diversify their portfolios. When it comes to market analysis tools, FxPro hosts an excellent selection on its cTrader, MT4, and MT5 platforms. The best part is that these platforms support trade sizes from 0.01 micro lots and automated trading.

Pros

- Low minimum deposit requirement

- Hosts multiple trading platforms, including the MT4, which is known to be a preferred option to forex traders

- Lists over 70 currency pairs

- Hosts extensive selection of market research and learning materials

Cons

- Supports only CFD instruments

- It has a A$10 monthly inactivity fee that kicks in after only six months

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

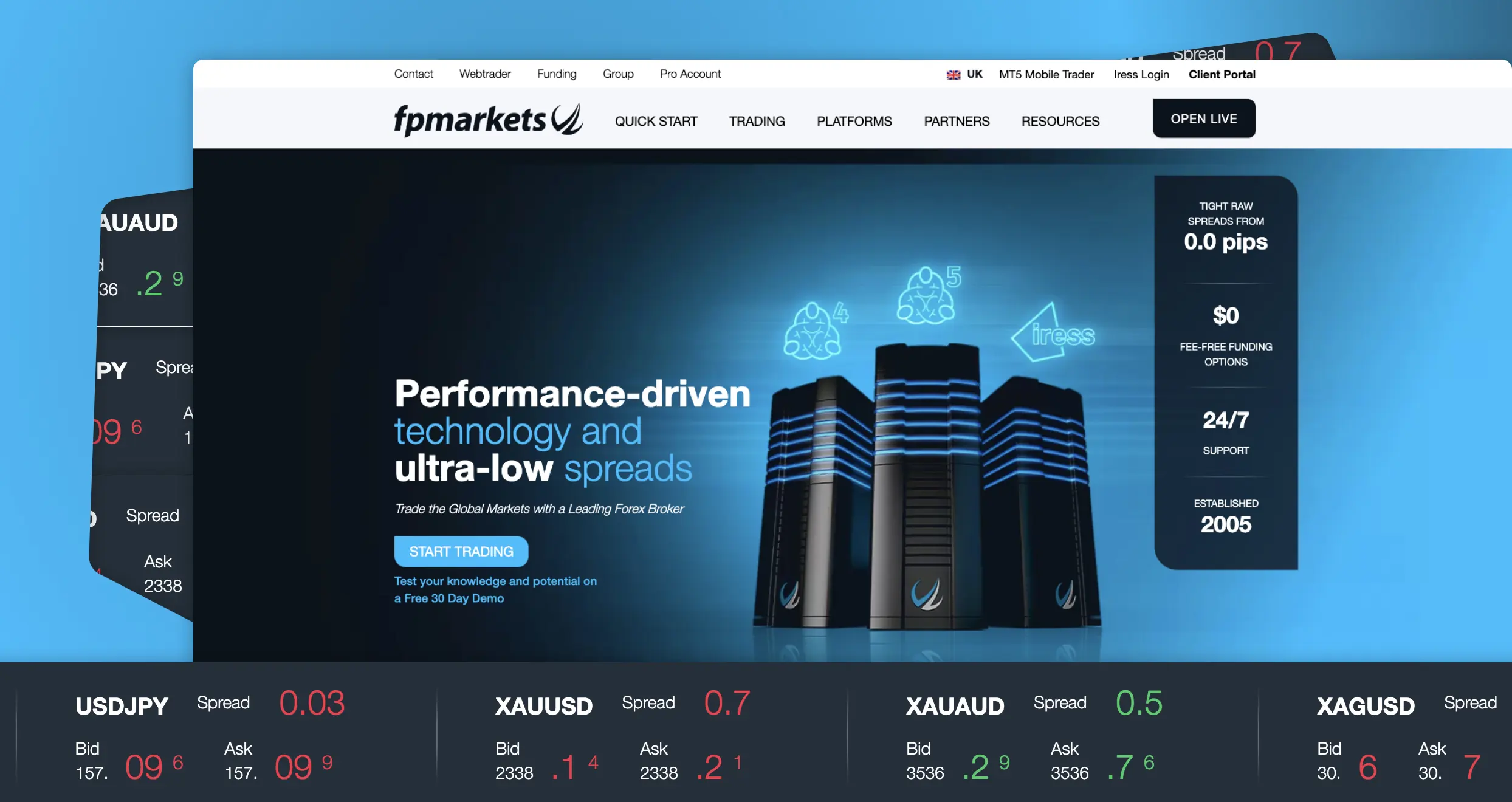

6. FP Markets – Best Forex Broker For Professional Traders in Australia

FP Markets hosts quality trading tools for all types of forex traders on its MT4, MT5, cTrader, and TradingView platforms. We tested FP Markets’ performance and were impressed with its user-friendly interface. We also like its ability to execute trades seamlessly on mobile and desktop devices. You can rely on this forex trading platform in Australia for quality resources, including automated trading, social trading, advanced charting tools, technical indicators, and more.

Overall, FP Markets lists over 70 currency pairs. You can trade them at low spreads, starting from 0.0 pips, and leverage limits that go up to 1:500 for professional Australian traders. Besides forex, we noted that FP Markets supports stocks, commodities, indices, ETFs, and more for portfolio diversification. Its 24/7 support service has also proven reliable when handling users’ questions or concerns.

Pros

- Lists over 70 currency pairs to trade at low spreads

- Powerful trading platform, including cTrader, TradingView, MT4, and MT5

- Fast trade execution speed on desktop and mobile devices

- Advanced market research tools and EA for automated trading

- Low minimum deposit requirement of A$100

Cons

- Supports only CFD instruments

- Its Iress account is more focused on share trading than forex

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

Forex Trading in Australia

Forex trading is legal and popular in Australia, and every day, new individuals are looking for secure ways to explore this market. Derived from “foreign exchange,” forex trading allows investors to exchange currencies through decentralised online platforms. Australian traders can buy and sell currency pairs, hoping to profit from exchange rate fluctuations.

Note that forex is the largest and most liquid market in the financial space. Various elements influence the price of currencies, including economic factors, political factors, and more. As a trader, you must stay abreast with the currency rates to know the best time to open a position. Also, choose a highly regulated forex broker with additional features suitable for your needs for an exciting experience.

In Australia, the Australian Securities and Investment Commission (ASIC) is the primary regulator of financial markets in the region. This authority has laid down rules and restrictions that all brokerage firms must adhere to. The main goal is to protect traders in the region, ensuring they have a secure environment for trading.

For instance, ASIC requires all brokers in the region to secure traders’ funds in segregated accounts. Another restriction is compulsory negative balance protection for unprofessional clients. Plus, ASIC overseas brokers in adhering to rules regarding leverage limits. In forex, the limit goes up to 30:1 for retail traders.

Check out our other article to dive deeper into High-leverage brokers in Australia.

How to Choose the Right Forex Trading Platform in AU

Trading forex in Australia requires the best broker. Being the best means the broker must have features aligning with your trading requirements. Below are the elements you must consider to ensure you make a suitable selection.

Start by confirming the security features employed by the best broker for forex Australia. The best option must be licensed and regulated by ASIC. Remember, there are many fraudulent brokers in the region, and failing to check this feature can lead you to the hands of scammers. ASIC-regulated brokers provide a secure trading environment for traders. Your funds will be secured in segregated accounts, and you get to trade under the best favourable terms.

It is also crucial to check whether a broker is highly encrypted. You want your personal data highly protected from unauthorised access.

The best forex broker in Australia must have a user-friendly platform, whether for desktop or mobile devices. It must also have a high trade execution speed and host quality market research tools for strategy development. For beginners, confirm the availability of learning materials, including articles, guides, videos, webinars, and more. Most importantly, settle with a broker hosting a demo account. This will enable you to easily explore the currency market and gauge your skill level before investing real money.

Choose a broker listing the right currencies you are looking to trade. Also, it is best to prioritise those with additional asset classes like shares, ETFs, commodities, cryptocurrencies, and more. The best element about brokers with numerous asset classes is that they allow you to diversify your portfolio on a single platform.

We always advise our readers to have a budget and stick to it while trading forex or any other asset. You see, the financial market can be volatile, and with asset prices changing from time to time, you should only risk what you are comfortable losing. Therefore, check a broker’s trading and non-trading charges to ensure they fit your budget. Confirm its minimum deposit requirement, inactivity fees, commissions/spreads, financing costs, and more.

Check a broker’s support service availability and ensure it aligns with your trading schedule. Some brokers offer 24/7 support service, while others operate only five days a week. Also, contact them and gauge their responsiveness via supported channels, whether by phone, email, or live chat. You want a broker with a support service team that is very responsive and offers relevant solutions to maximise your experience.

It is crucial to choose a broker you are fully confident in regarding performance and reliability. Therefore, besides confirming the above elements, analyse what other users say regarding their experience with a broker. You will get honest reviews and testimonials on legitimate platforms like Google Play, the App Store, and Trustpilot.

How To Register an Account with a Forex Brokers AU

From our experience, signing up for forex trading accounts with Australian brokers is straightforward and takes minutes to complete. If you have been skeptical about getting started, below are the simple steps. Note that the steps are similar for all ASIC-regulated brokers, including the ones referenced in our mini-reviews above.

Start by visiting a broker’s website. If you have chosen an option from our recommendations list, we share links on this page for quick access. On the site, start by understanding the terms of service. You should also install the broker’s trading app to easily track your activities while on the move.

Click the sign-up or register button to create a forex trading account. Your broker will require you to share your personal details for this procedure. These include your name, email, location, source of income, and more. You will also be required to create a unique username and strong password for an added layer of safety to your account.

It is a standard protocol for all ASIC-regulated brokers to verify traders’ accounts to keep the online trading environment safe from imposters. Therefore, your broker will engage you in this process to verify your identity and location. You will be requested to share copies of your personal documents, including your ID card, passport or driver’s license, and a recent utility bill or bank statement, respectively.

After your account is fully activated and you have received an email notification, it is time to make a deposit. Note that brokers have varying minimum deposit requirements, so ensure you select the one you can afford. The good news is that our recommendations above support deposits using multiple payment methods. You simply need to transact with the most convenient ones and quickly access the listed currency pairs to trade.

You will automatically be redirected to the listed currency pairs once your broker confirms your deposit. Choose the ones you have fully conducted research on, and select your desired trade size before opening a position. Remember, forex trading is all about taking risks. While you can earn profits, losses are inevitable. Therefore, invest with funds that you are comfortable losing. Also, stick to your trading plan and apply risk management controls to mitigate massive losses.

Conclusion

Whether you are a beginner or an expert trader in Australia, forex trading requires a diligent approach. Having the best broker is not a sure-fire way to success. You still need to be strategic and track the currency exchange rates to identify the best time to trade. Have a plan and understand the applicable tax for forex trading as stipulated by the Australian Tax Office (ATO). It is also crucial to track your activities to ensure everything works out as planned. The best way to do so is via brokers’ trading apps that allow you to manage your positions while on the go.

After reading this article, I’m even more convinced that choosing the right broker is essential to success in forex trading. I really appreciate how the guide breaks down the various brokers in Australia