Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Cryptocurrency investing is legal and skyrocketing in New Zealand. With many cryptocurrency exchanges popping up in the region, every investor looks to partner with the best for an exciting experience. Note that various providers claim to be reliable, but consider settling for those regulated by the Financial Markets Authority (FMA), which is New Zealand’s financial regulator. Other elements must also be taken into account to ensure you identify an exchange that suits your trading requirements.

We understand how lengthy the procedures for testing and comparing crypto exchanges here can be daunting. In this regard, we did the research for you and listed below the best crypto exchanges in New Zealand in 2025. As a Kiwi investor, our guide will also enlighten you on how to approach the financial market and increase your chances of success.

In a Nutshell

- The cryptocurrency market in New Zealand is highly volatile, hence the need for the best crypto exchange.

- The best crypto exchanges offer favourable conditions and host quality resources for market analysis and strategy development.

- At Invezty, we leave no stone unturned to ensure we recommend the best crypto exchanges. Multiple tests and comparisons are conducted by our experts.

- Prioritise your trading or investment needs when selecting a crypto exchange in New Zealand. Most importantly, the exchange must be secure and be overseen by the FMA.

- Understand the tax implications of trading cryptocurrencies in New Zealand to plan accordingly.

- It is also important to understand other users’ opinions on various exchanges in New Zealand for informed choices.

List of the Best Crypto Exchanges

- Kraken – Overall Best Cryptocurrency Exchange in New Zealand

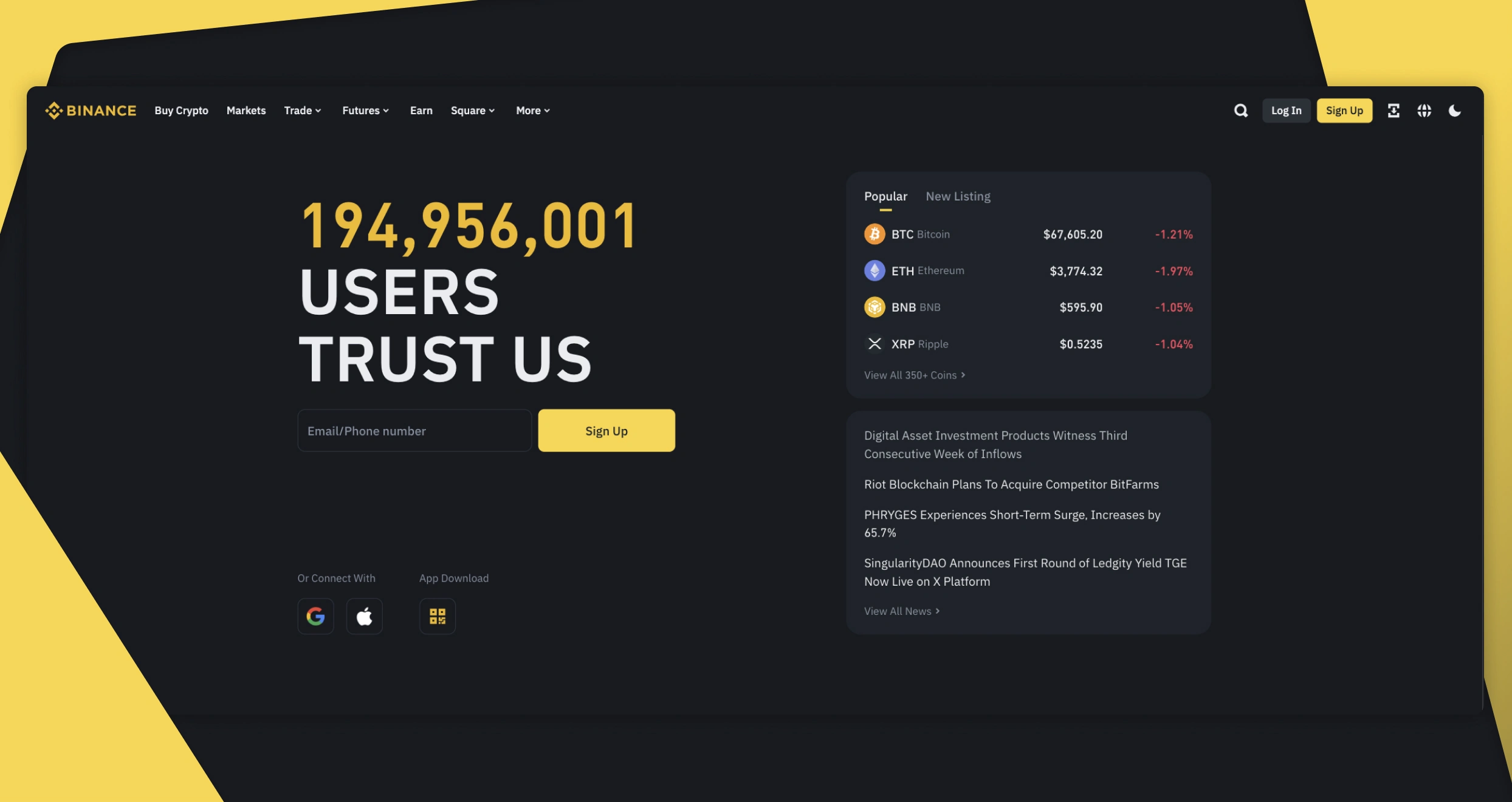

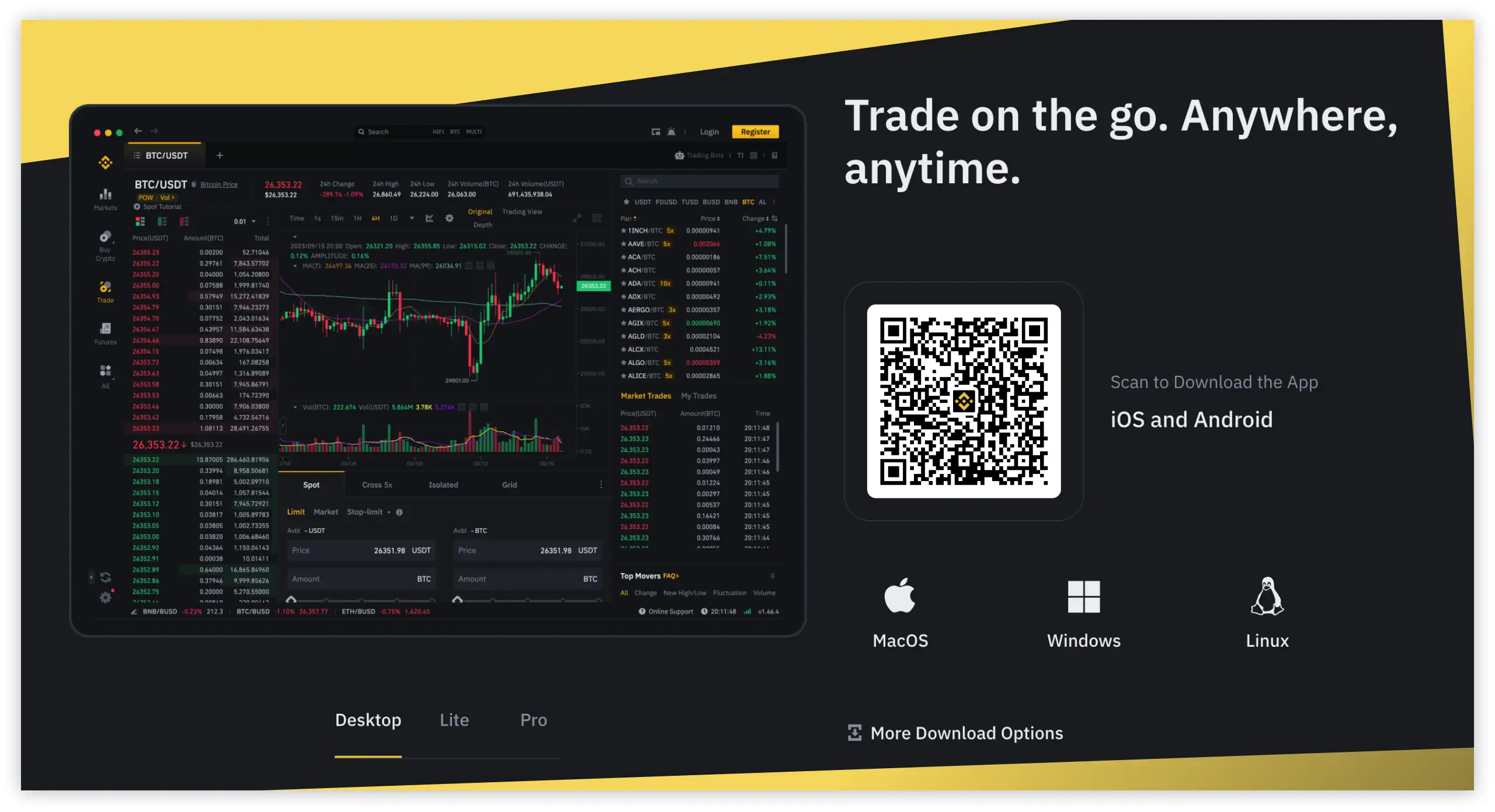

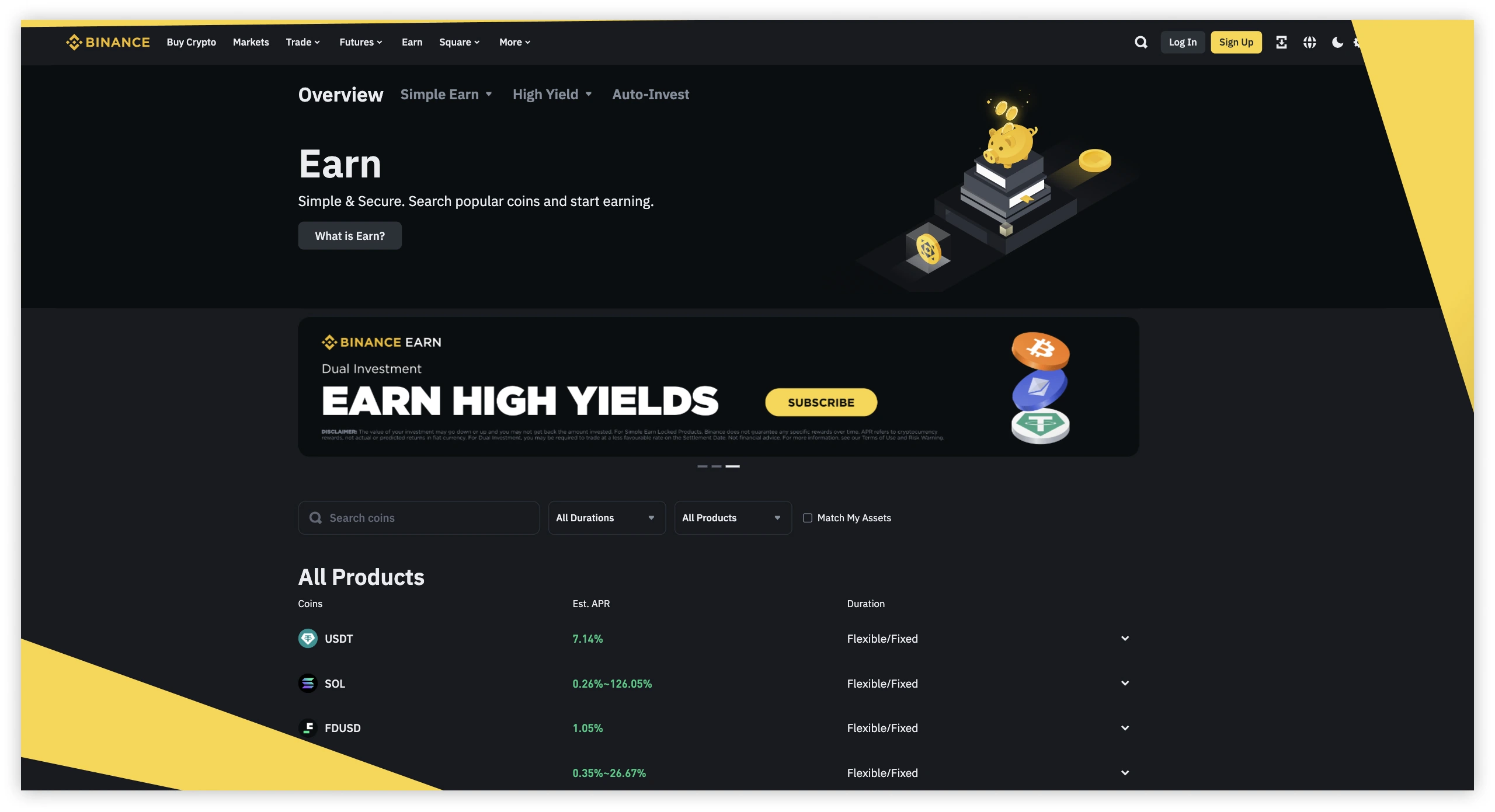

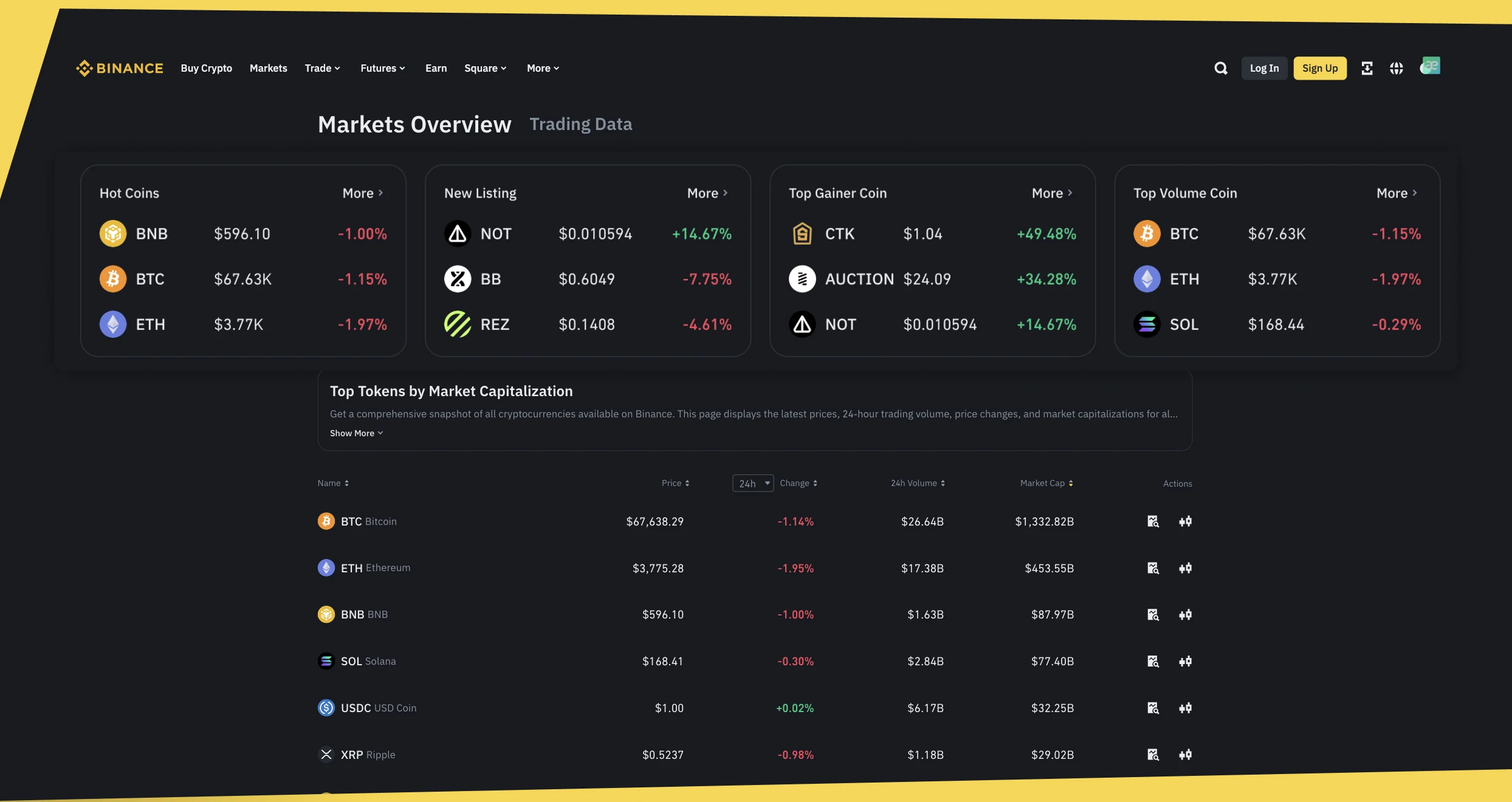

- Binance – Beginner-Friendly Crypto Exchange in New Zealand

- Crypto.com – Cheapest Cryptocurrency Exchange in New Zealand

- Coinbase – Top Crypto Exchange With Wide Asset Offerings

- HTX – Top Exchange For Professional Kiwi Investors

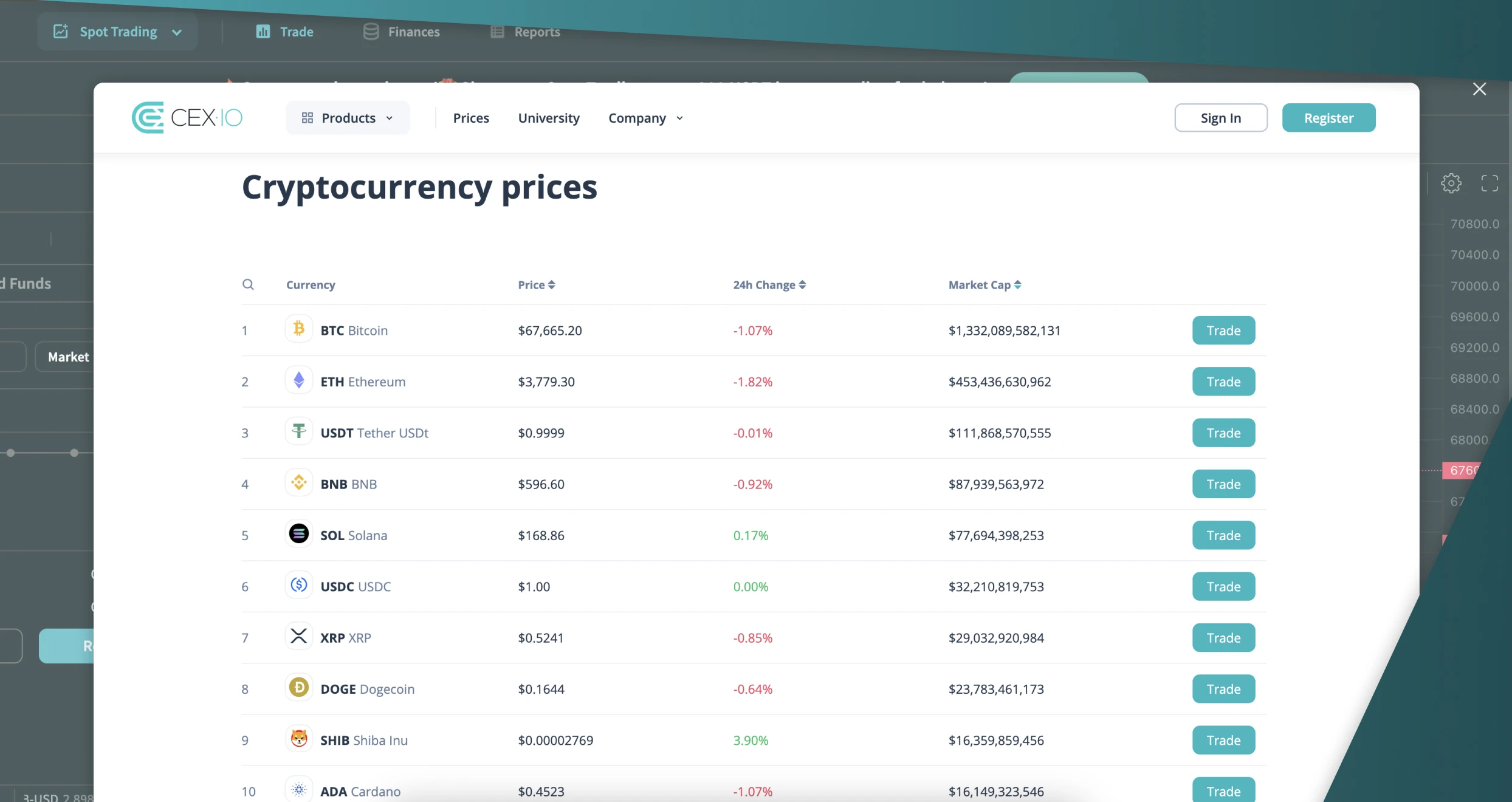

- CEX – Best Cryptocurrency Exchange For Mobile Trading

Compare Crypto Exchanges in NZ

As investors with decades of experience in the financial landscape, we understand how challenging it can be to select the best crypto exchange in New Zealand. For this reason, we embarked on a thorough exchange evaluation so you do not have to.

This process involved sampling as many exchanges as we could and comparing them based on various features. We also tested them multiple times and reviewed user testimonials to come up with this list of recommendations.

To ensure you are fully aware of the features that come with every exchange we reference here, our team has prepared a comparison table below. It shows the supplementary features of our recommendations so you can make an informed choice that aligns with your requirements.

| Best Crypto Exchange New Zealand | Exchange Type | Support Service | Price | Supported Coins | Digital Wallet |

|---|---|---|---|---|---|

| Kraken | Centralised | Email, Phone, Live Chat | Free | 200+ | Yes |

| Binance | Centralised | Phone, Email, Live Chat | Free | 350+ | Yes |

| Crypto.com | Decentralised | Phone, Email, Live Chat | Free | 350+ | Yes |

| Coinbase | Centralised | Phone, Email, X | Free | 200+ | Yes |

| HTX | Decentralised | Live Chat, Email | Free | 700+ | Yes |

| CEX | Decentralised | Phone, Email, Live Chat | Free | 200+ | Yes |

Exchanges Overview

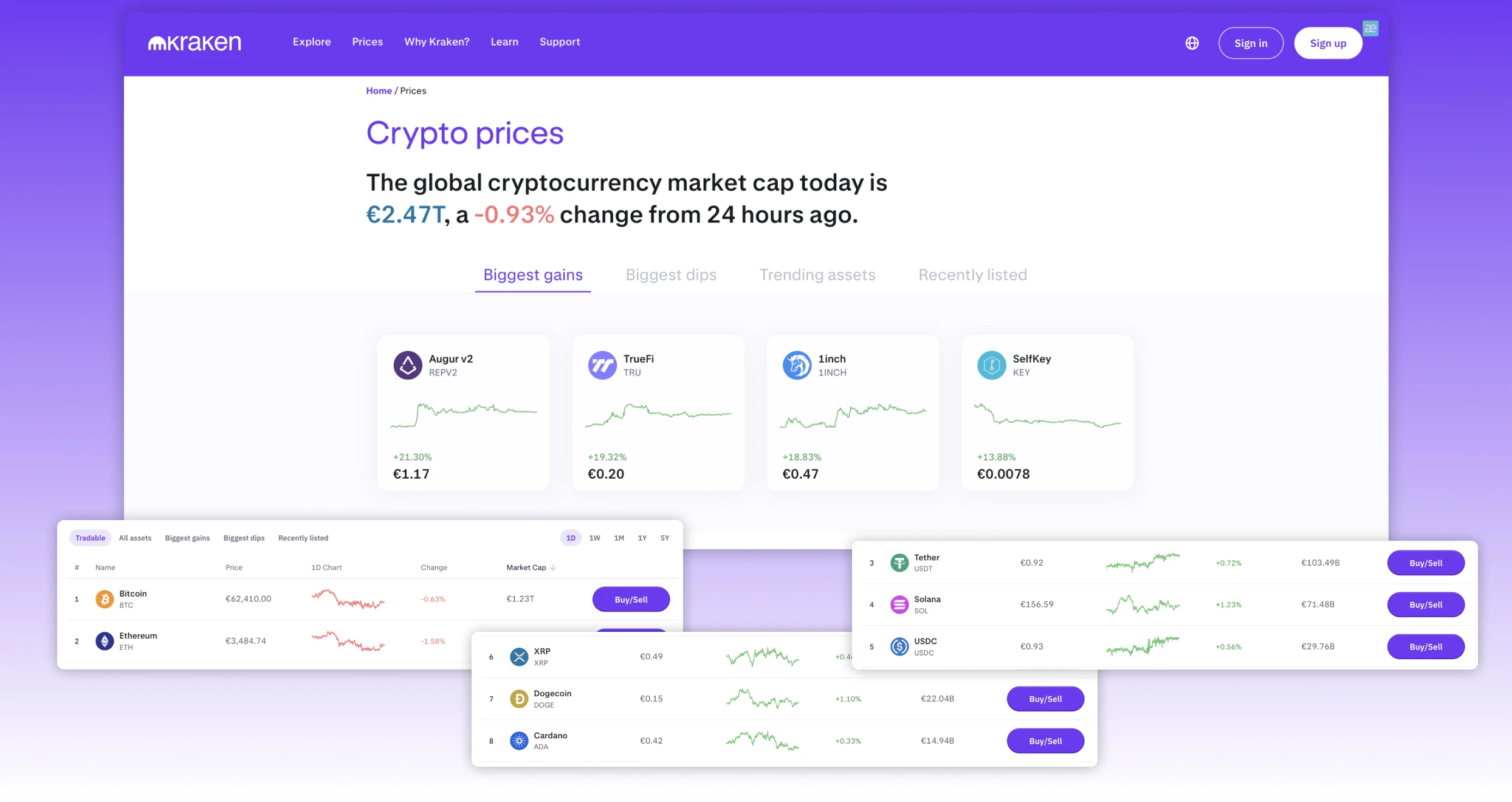

The cryptocurrency landscape in New Zealand is volatile, meaning that tokens’ values constantly change. In this regard, it is crucial to choose a digital asset you are familiar with and ensure your exchange hosts it. Most importantly, your exchange must be affordable and fit your budget to avoid risking what you are not comfortable losing.

To help you make the best decision, we share below, highlighting the fee structure and available assets on our recommended cryptocurrency exchanges in New Zealand.

Fees

| Best Crypto Exchange New Zealand | Fees | Minimum Deposit Requirement |

|---|---|---|

| Kraken | Fee ranges from 1 pip | $10 |

| Binance | From 0.1% | $0 |

| Crypto.com | From $5 to $50 for a single transaction | None |

| Coinbase | 1% on all swaps | None |

| HTX | From 0.2% | USDT 100 |

| CEX | From 0.01% | $20 |

Supported Assets

| Best Crypto Exchange New Zealand | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Dogecoin | Solana |

|---|---|---|---|---|---|---|---|

| Kraken | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Binance | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Coinbase | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| HTX | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| CEX | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about the Best Crypto Exchanges

We sampled hundreds of cryptocurrency exchanges and tested them to come up with the list of recommendations above. Below, we share mini-reviews of our top crypto exchanges based on our hands-on experience. Rest assured that the information we share here is solely based on our findings from the exchanges’ official websites, and there are no biases.

1. Kraken – Overall Best Cryptocurrency Exchange in New Zealand

After thoroughly testing numerous exchanges in New Zealand, Kraken stood out as the overall best for various reasons. Besides hosting over 9 million global clients, we discovered that the exchange has a quarterly trading volume of $207 billion. This proves its credibility, and we believe Kiwi investors will have the best experience. The exchange suits both beginners and expert investors in New Zealand.

We explored Kraken’s 200+ cryptocurrencies, including popular options like Bitcoin, Ethereum, Litecoin, Dogecoin, and more. Getting started is also streamlined with a $10 minimum requirement. When it comes to platform reliability, Kraken is user-friendly on both desktop and mobile devices. Plus, it has an in-built cold storage and robust encryption, which instilled confidence in our trading activities. We also like its rewards to clients that go up to 10% annually through asset staking. Other elements you will enjoy at Kraken include advanced order placements via the Kraken Pro app, 5x leverage, and round-the-clock customer support.

Pros

- Up to 10% rewards are offered annually for staking your assets with Kraken

- Low spreads on non-instant buys

- High liquidity across various markets

- Availability of popular cryptocurrencies

- Low minimum deposit requirement

Cons

- Rewards are only available on selected assets

- Many elements are featured, which newbies may find challenging to explore

Based on our experience, Kraken is one of the most affordable cryptocurrency exchanges. We signed up for trading and investment accounts and incurred no registration fees. Plus, the exchange’s minimum deposit requirement is $10, which we believe is among the lowest in the financial investment industry.

When it comes to instant buy and sell services, Kraken imposes spreads, which are included in an asset’s price. The spreads may vary, depending on the payment method and platform you use. For instance, the exchange applies a 3% fee for converting balances less than the minimum order size using the “Convert small balances” feature.

For investors using the Kraken Pro platform, expect a maker-taker fee schedule. This comes with volume incentives based on investors’ activities in the past 30 days. On average, you will incur a 0.25% maker fee and a 0.40% taker fee for transactions between $0 and $10,000. Overall, Kraken Pro fees are charged on a per-trade basis.

When it comes to transactions, Kraken supports a variety of deposit methods. Most deposits are free, but expect to incur withdrawal charges, depending on the payment method you transat with. You may also pay a currency conversion fee. This of course will depend on the fiat currency you are converting to.

2. Binance – Beginner-Friendly Crypto Exchange in New Zealand

Our analysis of Binance as one of the top cryptocurrency exchanges in New Zealand leads us to recommend it as the ideal choice for beginners. This exchange boasts over 350 cryptocurrencies for trading, buying, and selling. We also noticed that Binance is integrated with a cryptocurrency wallet, which offers a secure means of storing digital assets. The platform goes a step further in supporting beginners by providing educational resources through its Academy platform.

Additionally, Binance ensures convenience with diverse payment options, including credit/debit cards, Apple Pay, Google Pay, and cash balances. The best part is that the exchange is compatible with both desktop and mobile devices. You can use Binance to trade cryptos on spot and margin markets. It also has a P2P platform for buying and selling digital tokens and an NFT marketplace to manage NFTs.

Pros

- User-friendly platform perfect for newbies

- Excellent collection of learning resources for skills development

- Low trading fees

- P2P platform for direct interaction with other cryptocurrency traders

- Numerous cryptocurrencies to choose from

Cons

- Has a history of hacking

- Less regulated compared to its peers

We signed up for investment accounts at Binance, and there were no registration charges. The exchange also does not have a minimum deposit requirement, thus allowing us to get started with any amount of money we could afford.

We analyzed Binance’s fee structure and concluded that it is among the most affordable cryptocurrency exchanges we have tested. Its maker and taker fees are low, but this depends on the trading volume and Binance Coin balance. Simply put, higher-volume trades are subject to low trading fees.

Regarding transactions, Binance does not charge deposit fees for cryptocurrency deposits. However, investors will incur withdrawal charges depending on the crypto token they use to transact.

You can also transact using fiat currencies at Binance. While some currencies do not attract deposit fees, others do. For instance, you will pay a 0.65% deposit fee when you make deposits using the AED currency via online banking. Withdrawal charges on fiat currency transactions also apply depending on the currency you transact with.

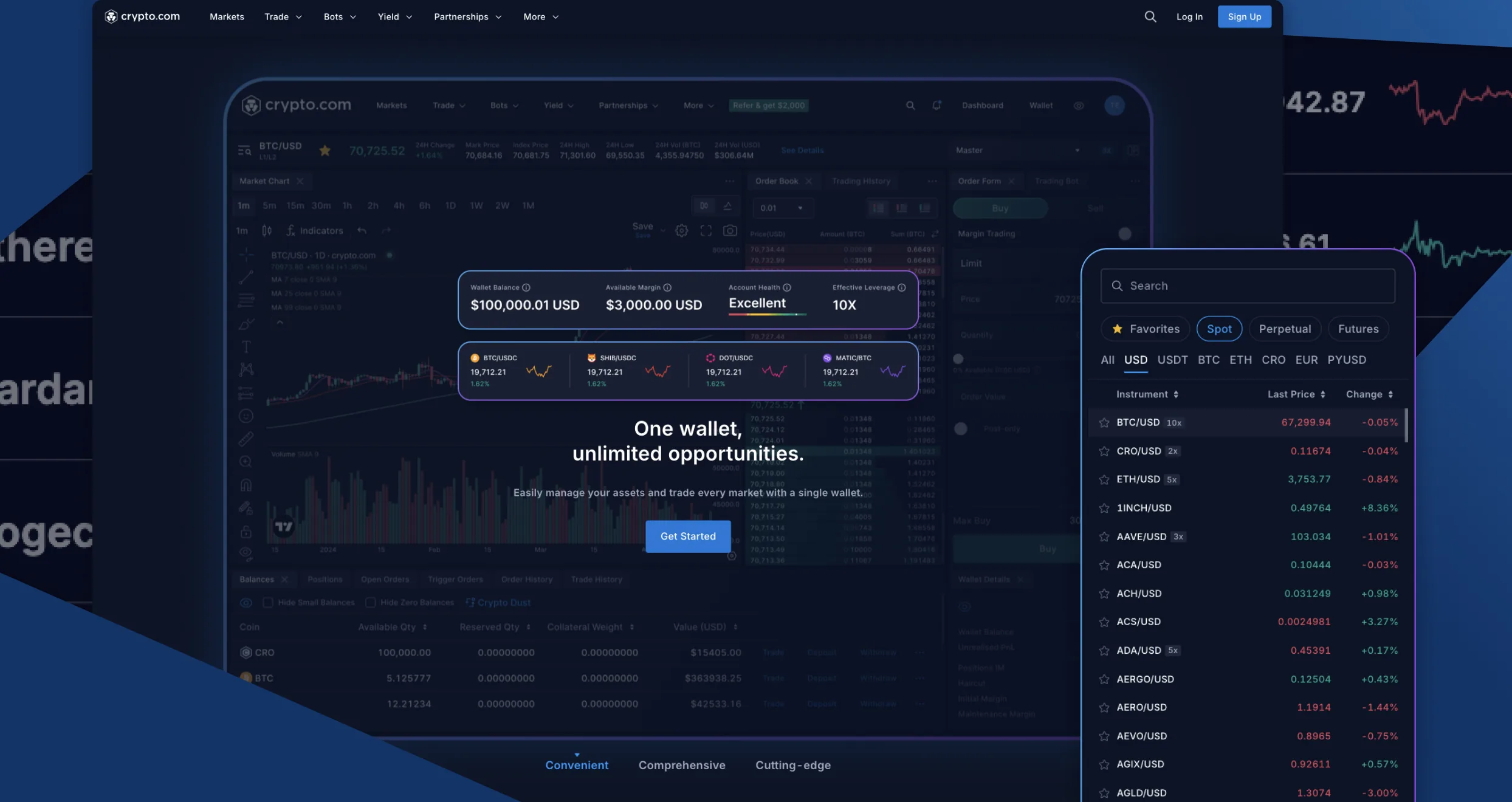

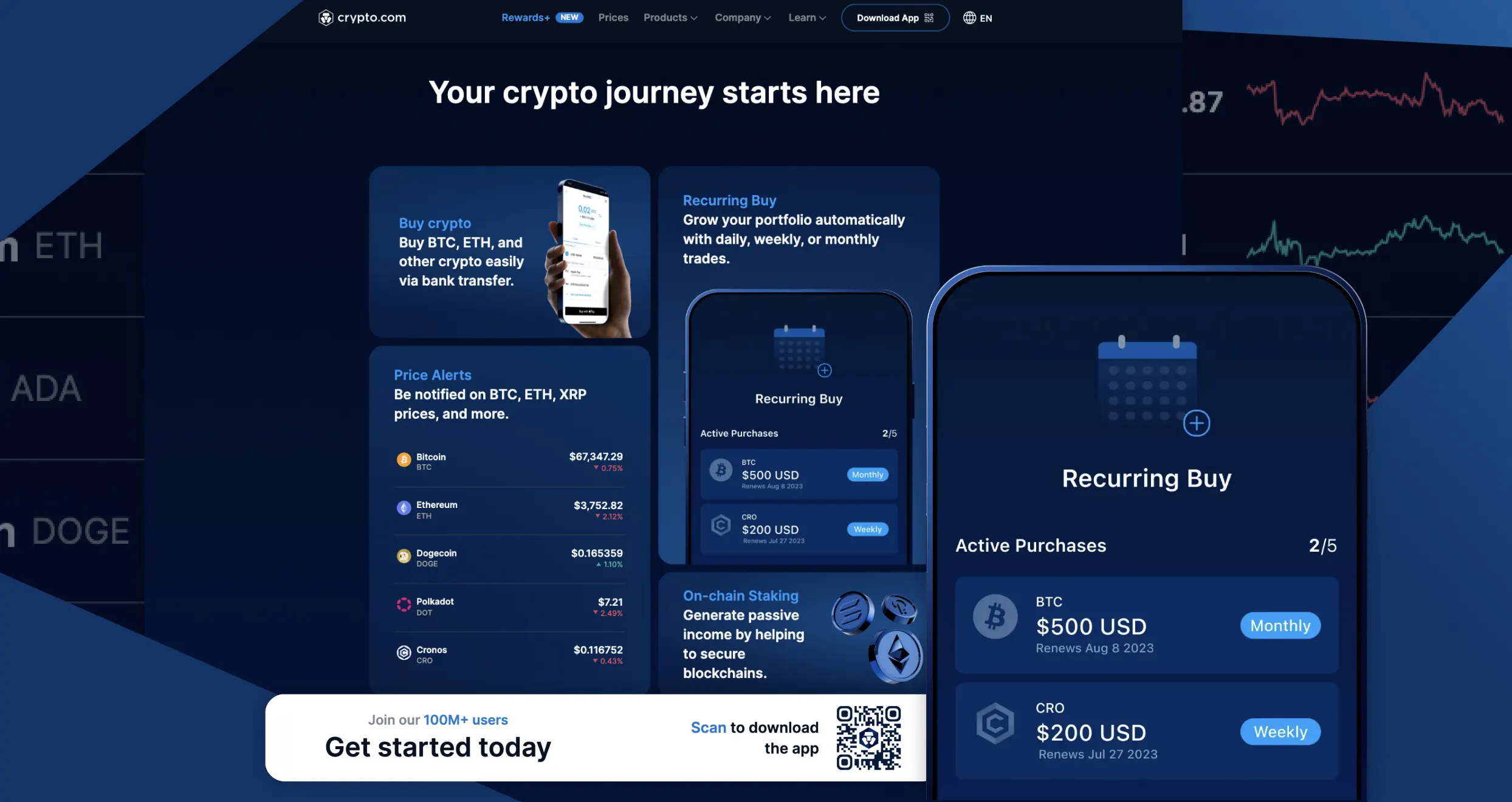

3. Crypto.com – Cheapest Cryptocurrency Exchange in New Zealand

Although there are plenty of crypto exchanges with affordable trading and transaction rates, Crypto.com tops the list. Besides offering access to non-fungible tokens (NFTs), we like that it gives users access to a DeFi wallet. We explored over 350 cryptocurrencies, including popular ones like Ethereum. Crypto.com also offers a user-friendly app for trading Bitcoin. Regarding fiat currency transactions, it supports more than 20 options, including the NZD.

We like that Crypto.com imposes low trading fees for Kiwi investors. There are no transaction charges for making deposits or inactivity fees, allowing you to plan accordingly and trade at your own convenient time. Traders also enjoy various payment options, including bank transfers, Advcash, debit/credit cards, and more. And for traders looking to explore more options, Crypto.com’s Visa card allows you to manage and spend funds anytime.

Pros

- Low trading fees

- Compatible with desktop and mobile devices

- In-built DeFi wallet, giving you total control of your assets

- Offers a 5% cashback on its Crypto.com credit card expenditures

- A wide range of cryptocurrencies offered

Cons

- You get to pay more for low trading volumes

- Withdrawing cryptos to external addresses attracts a fee

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

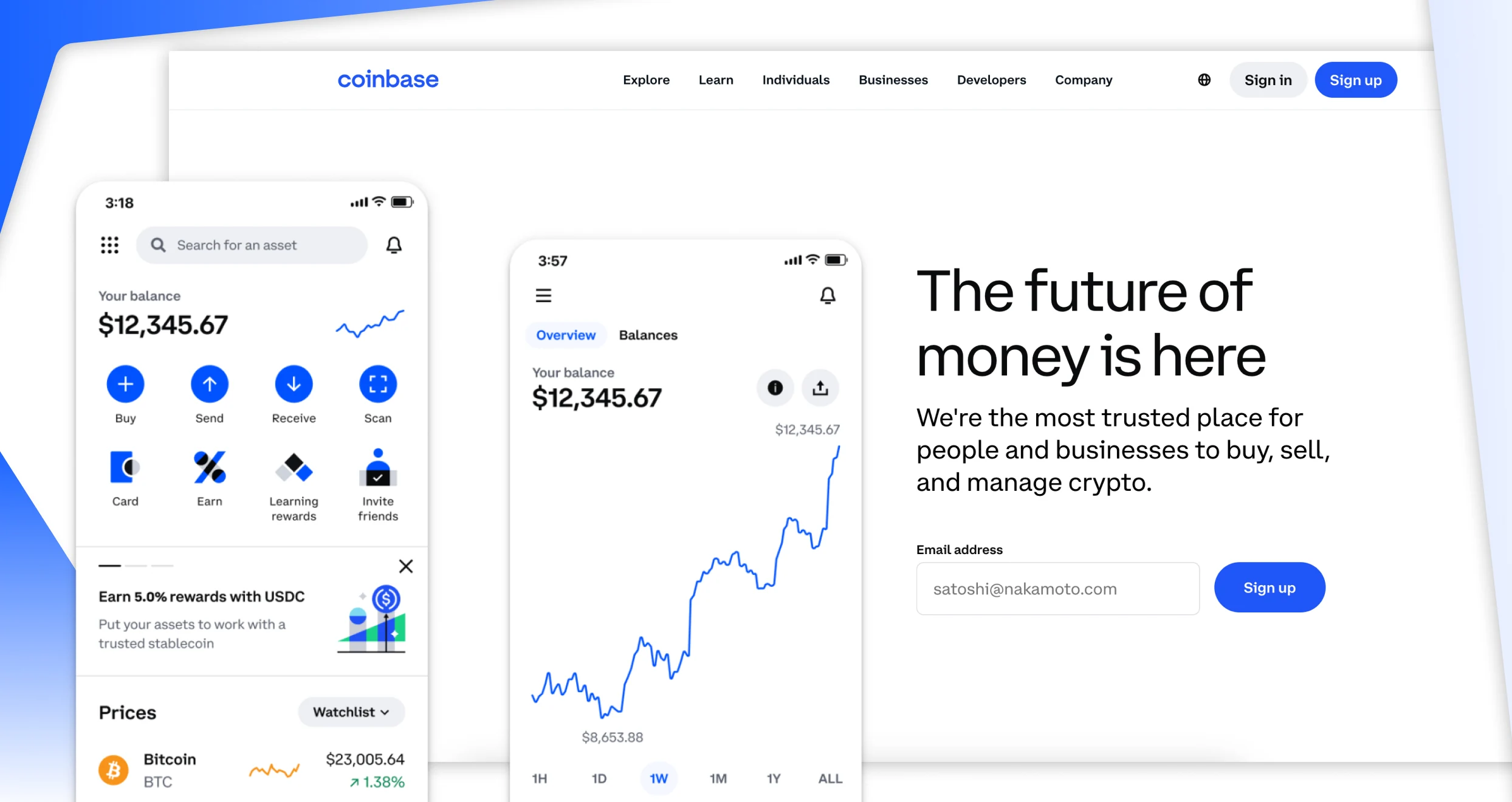

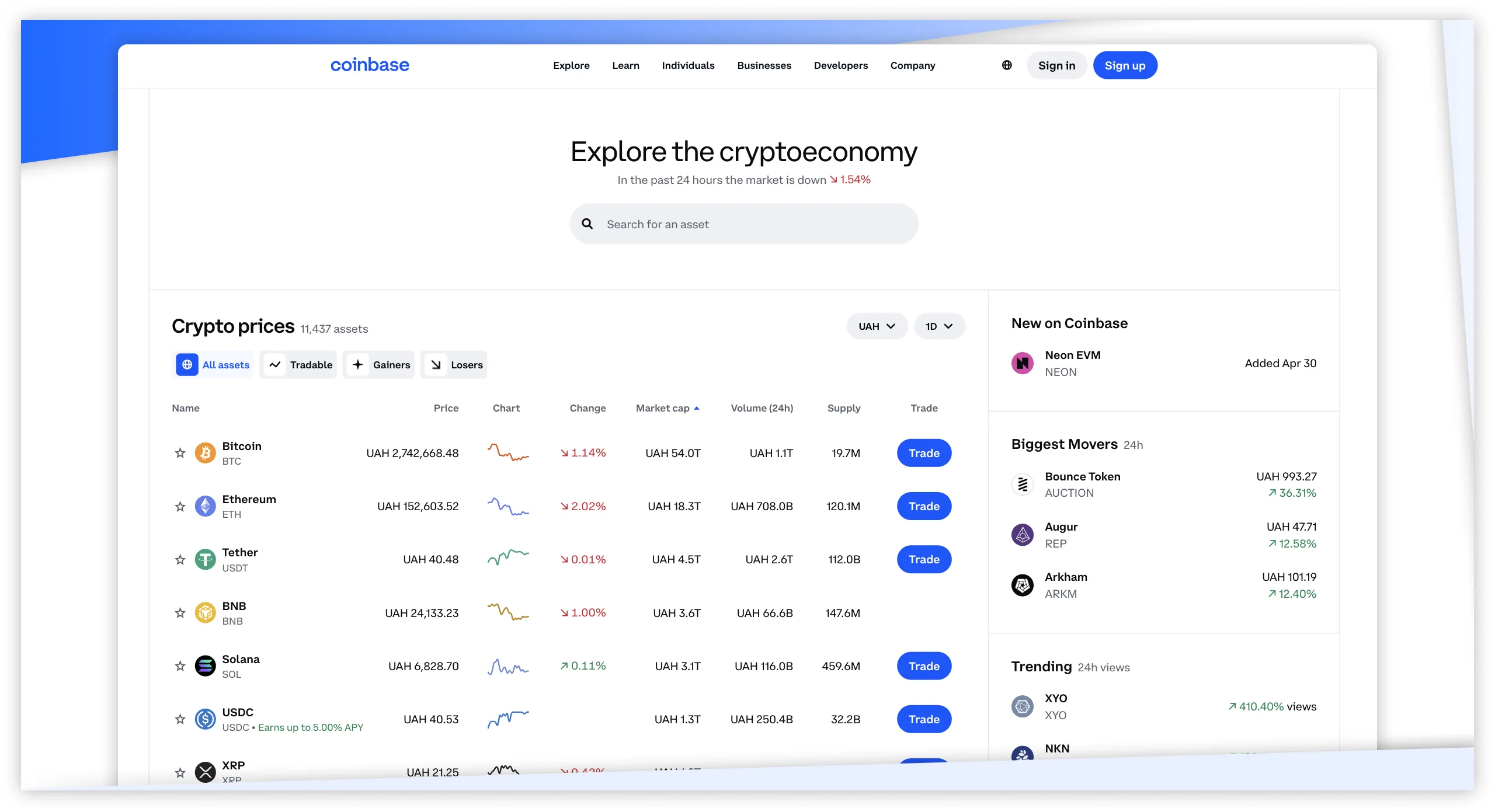

4. Coinbase – Top Crypto Exchange Wit\ Wide Asset Offerings

We also tested Coinbase and found it to be an excellent option for traders and investors seeking to explore a wide range of assets and features. With over 98 million users, Coinbase offers a user-friendly platform for buying, selling, and monitoring popular cryptocurrencies. It operates as a centralised exchange, ensuring the security of transactions and assets. Coinbase also provides the option to secure assets on a cold wallet and boasts 24/7 asset monitoring.

Coinbase boasts of being one of the largest global crypto exchanges. It is overseen by the FMA and other global authorities, proving it is a secure investment. We also like that this exchange hosts powerful trading tools powered by TradingView with EMA, MA, MACD, RSI, and Bollinger Bands. For mobile traders you can download its app from Google Play or the App Store to enjoy your experience.

Pros

- User-friendly platform

- In-built centralised crypto wallet backed up by an insurance policy

- Over 200 cryptocurrencies, including popular options like Bitcoin, Ethereum, and more

- Opportunities to earn cryptocurrencies by buying and holding assets

- Quality learning resources for newbies

Cons

- High transaction charges on its primary platform

- Its Coinbase card is only available for US clients

Opening and maintaining a Coinbase account is free. You can fund your account and withdraw money using a variety of payment methods, including wire transfers, debit/credit cards, and digital wallets like Apple Pay.

While using FIAT, you may have to pay deposit and withdrawal fees depending on your chosen payment method. ACH transactions are free. But alternatives like wire transfers attract $10 and $25 deposit and withdrawal fees, respectively. That said, you can buy as little as $2 of crypto using a card or funds in your account.

Expect to pay specific fees when you purchase, convert, or sell crypto on Coinbase. Your charges will depend on numerous factors, including the order size, your preferred payment method, and market conditions. For instance, if you place an order at a stipulated market price and it is fulfilled immediately, this exchange will charge you anywhere from 0.05% to 0.60%.

If you place standard buy and sell orders on Coinbase, the platform will include a spread in the specified price. You will also encounter a spread when converting one crypto asset to another. To avoid spreads, join Coinbase Advanced, which is an advanced platform for seasoned traders.

Depending on your jurisdiction, you may stake crypto on Coinbase at no additional costs. However, the exchange will deduct a commission based on your accrued rewards and the involved asset. The standard commission for ADA, SOL, DOT, ATOM, XTZ, and MATIC is 35%. Eligible Coinbase One members can enjoy a commission of 26.3% for the same assets. On the other hand, ETH attracts a 25% commission.

Lastly, Coinbase charges asset recovery fees. If you send an unsupported asset to your Coinbase account, you may try to recover it. If it’s eligible for recovery, the exchange will charge a network fee. If the recovery is over $100, expect to pay a 5% fee. But if it’s less than $100, you won’t have to pay a dime.

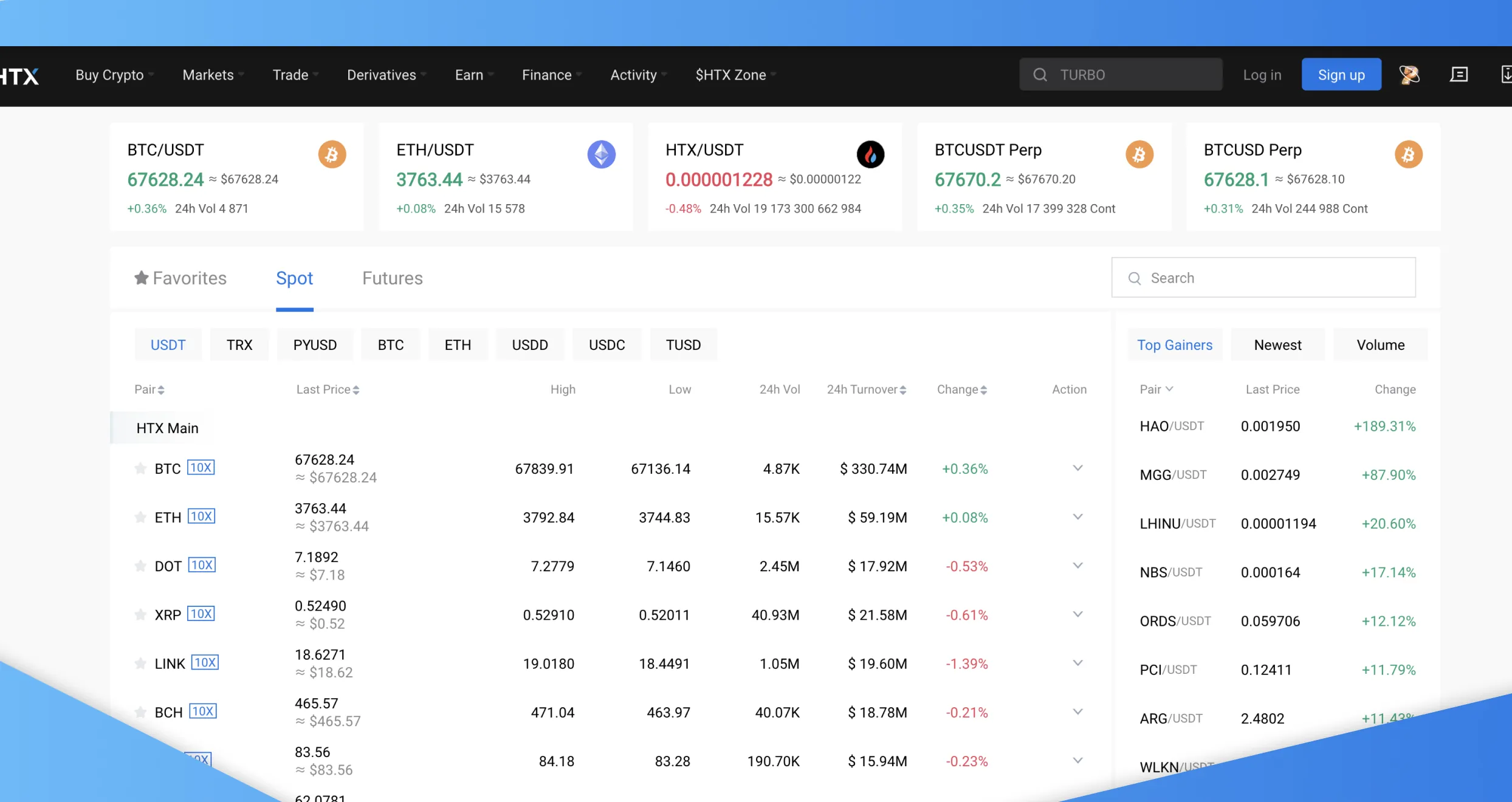

5. HTX – Top Exchange For Professional Kiwi Investors

HTX is a decentralised exchange that offers fast and secure cryptocurrency transactions through its P2P platform. We tested the exchange and primarily recommend it to professional Kiwi investors. With over 20,000 BTC in security funds and a cold wallet for asset protection, we consider it a secure platform for trading. HTX also provides a web-based platform and a reliable mobile app for on-the-go trading. You can also utilise its numerous educational resources to advance your skills.

HTX hosts over 700 cryptocurrencies, including popular options like Bitcoin, Ethereum, and more. It maintains a high daily trading volume of over $13 million, proving that it is trustworthy. Plus, we like that it features copy trading, which allows users to interact, follow professional ones, and copy traders’ positions with increased profitability.

Pros

- A wide range of cryptocurrencies offered

- P2P platform for direct interaction with other traders

- Compatible with all mobile devices

- Excellent 24/7 support service

- Cold wallet available for safe storage of traders’ cryptocurrencies

Cons

- A challenging platform to navigate, making it unsuitable for newbies

- Less unregulated compared to its peers

Since unplanned-for charges can increase your trading costs and reduce your profits, we decided to evaluate HTX’s fees and inform you accordingly. That way, you can prepare beforehand and avoid nasty surprises.

From our evaluation, we realized a few things. First, you can use this exchange’s P2P platform and enjoy zero transaction fees. You can enjoy the same perk when using an AdvCash wallet to deposit and withdraw RUB (Russian Ruble). Additionally, people using RUB to buy crypto on HTX incur zero transaction charges.

This exchange charges 0.02% and 0.05% transaction fees for makers and takers, respectively. These fees are for USDT-margined trading. The actual amount that makers and takers pay while trading with HTX depends on numerous factors, including the filled quantity, transaction prices, and contact face value.

And if your situation requires you to use HTX’s OTC Desk, you can start smiling now. That is because this platform doesn’t have any transaction fees. Everything you’ll pay while using it is included in the “all-inclusive” price you’ll see.

But before you fund your HTX account and start trading, you should know a few additional things. For starters, this exchange’s minimum deposit is 100 USDT. If you send a lesser amount to the exchange, it won’t be credited to your account. You’ll have to deposit more USDT to the address you used before until your deposit amount hits or exceeds this threshold.

6. CEX – Best Cryptocurrency Exchange For Mobile Trading

We consider CEX the best New Zealand crypto exchange for mobile trading since it has gained high ratings and numerous user testimonials on Google Play and the App Store. Plus, we like its seamless trade execution on mobile devices, making it easier for Kiwi traders to manage their activities on the go. With this exchange, you can buy, trade, sell, hold, and earn cryptocurrencies, including popular options like Bitcoin, Ethereum, Litecoin, Tether, USD Coin, and more. It also features trade automation, which simplifies your activities.

We like CEX’s professional 24/7 support service, which you can contact via phone, email, and live chat. Its takers and makers fees are also reasonable, and you only need to deposit at least $20 to get started. The exchange supports transactions with credit/debit cards, Google/Apple Pay, Neteller, PayPal, and more. Its in-built wallets make it easier for you to buy, sell, and store cryptocurrencies.

Pros

- Its mobile app is user-friendly and navigable

- Low minimum deposit requirement

- Wide range of crypto assets supported

- Offer traders the opportunity to earn cryptocurrencies

- Crypto-collateralised loans offered

Cons

- Features many products and services, which can overwhelm newbies

- Offers lower liquidity compared to other leading cryptocurrency exchanges

Opening an account with CEX.IO won’t cost you a dime- it’s free of charge. That said, when funding your account, you will incur specific charges depending on your preferred payment method.

While using VISA and Mastercard, you will have to cover fees ranging from 2.99% to 3.99% and a service charge that will depend on your country of origin and service provider. The same applies to Apple Pay, Google Pay, and PayPal. On the other hand, CEX.IO requires you to pay a $2.99 deposit commission for alternative payment methods like SWIFT, domestic wire, Faster Payments, and SEPA. The other options, which include Epay, Neteller, and Skrill, charge $3 and above for deposit commissions.

Also, while funding your account, keep in mind that CEX.IO has unique minimum deposit requirements for the supported payment method. For instance, the daily minimum deposit for VISA, MasterCard, domestic wire, and Google/Apple Pay users is $20. Conversely, people who use SWIFT can’t fund their accounts with less than $300. Also, the minimum deposit for Skrill users is $35.

CEX.IO also levies withdrawals. The exact fees vary depending on payment methods. Take VISA, SWIFT, and domestic wire as an example. If you cash out from CEX.IO using VISA, you will incur a service charge (up to 3% + $1.20) and a commission of up to $3.80. On the other hand, SWIFT and domestic wire attract $2.99 deposit charges. Lastly, CEX.IO has maker and taker fees starting from 0.25% and 0.15%, respectively.

Visit CEX.IO’s Limits and Commissions page to get a detailed overview of the accepted payment methods as well as their deposit/withdrawal limits and commissions. Also, note that you can deposit and withdraw crypto from your CEX.IO account.

Crypto Trading in New Zealand

Cryptocurrency trading in New Zealand is legal, and many investors consider it a way to supplement their income. The market is overseen by the Financial Markets Authority (FMA), meaning that all cryptocurrency brokers or exchanges in the region must comply with FMA regulations.

Note that there are no specific regulations for cryptocurrencies or stablecoins in New Zealand. Venturing in this sector is risky, and you want a credible exchange or broker by your side. The crypto market is known for rapid changes, and digital tokens’ prices constantly change.

To trade or invest securely, always conduct a thorough market analysis and develop solid strategies before opening a position. Most importantly, invest with funds you are comfortable losing. This is whether you are investing long-term or short-term using leverage.

When it comes to tax rules regarding cryptocurrency trading in New Zealand, note that the Inland Revenue Department (IRD) treats the activity as a business venture. This means that all proceeds from cryptocurrency investing and trading must be subjected to tax deductions. The specifics regarding tax deductions for cryptocurrency investment profits can be complex. Therefore, we encourage you to stay abreast of New Zealand tax rules since they may vary based on the types of transactions and individual situations.

How to Choose the Right Crypto Exchange in NZ

Despite many fraudulent exchanges available in New Zealand, you can avoid falling victim by committing to an exchange that will help you reach the next level. But finding a fitting platform isn’t as easy as going with any exchange that claims to be legit or exceptional. You have to evaluate every company you encounter based on the following factors:

A secure crypto exchange in New Zealand protects your assets from malicious actors and staves off significant financial losses. As such, you should check if a platform employs measures guaranteed to optimise security before trusting it with your assets. Prioritise working with exchanges that enhance the safety of your crypto with outstanding measures like 2FA and SSL encryption. They should also be FMA-regulated to ensure you invest under favourable conditions.

There are three types of crypto exchanges, including centralised, decentralised, and hybrid. The type of exchange you need will determine which platform you choose. For instance, choosing HTX should be wise if you seek a decentralised exchange and Coinbase for those who prefer centralised. Also, consider the wallet in which you want to secure your token, whether cold or hot.

You should verify if a New Zealand crypto exchange supports your preferred cryptocurrencies to avoid disappointment in the future. Also, prioritise trading and investing with platforms that support popular assets and newer tokens since you may need to diversify with them at some point. The broader the range of supported assets, the better.

A suitable cryptocurrency exchange must be user-friendly and have a modern design to guarantee an exciting experience. For beginners, consider an NZ exchange with numerous quality learning materials and reliable support services. Most importantly, your exchange should be mobile-friendly so you can efficiently manage your positions at home or while on the move.

Review every New Zealand crypto exchange’s costs before signing up to avoid unexpected or excessive expenses. Assess everything from transaction charges and commissions to maker and taker fees. You should also watch out for hidden costs that are likely to inflate your expenditures in the long run. Simply put, your exchange should fit your budget.

Before choosing a particular exchange, evaluate its customer support services and ensure its availability aligns with your trading schedule. The exchange’s team should be contacted via convenient channels, whether by phone, email, live chat, or social media platforms. They will come in handy when you encounter an urgent issue.

You can gauge an exchange’s reputation and reliability from past user feedback. But for unbiased insights, use testimonials from Trustpilot, the App Store, and Google Play. This will give you a glimpse of an exchange’s strengths and weaknesses and help you make the best decisions.

How To Register an Account with a Crypto Exchange in NZ

Based on our experience, opening a trading or investment account with an FMA-regulated broker in New Zealand is a straightforward process. You simply need to master the procedures and provide accurate details as requested to complete the registration in minutes. If you are new to cryptocurrency trading, below is how you can set up a trading account using an FMA-regulated broker.

Begin by selecting the best crypto exchange New Zealand like the ones we recommend in our mini reviews above. Research various platforms, considering the above elements, to make a suitable choice. Opt for an exchange that aligns with your preferences and has a positive track record in the crypto community.

Before you start your registration process, read and understand the terms of service attached to an exchange. Also, install its trading app on your mobile device. This will enable you to manage your position even while on the go.

Click the “Join Now”, “Sign Up”, or “Register” button on your exchange website’s homepage to begin the account registration procedure. Provide the required information, including your name, email address, password, and more. Most importantly, participate in the KYC verification. The FMA has established this protocol to ensure the online trading landscape in New Zealand remains free from imposters. Follow the registration process carefully and ensure that all details are accurate.

Set up your crypto wallet to store your tokens once purchased. Note that some exchanges offer integrated wallets, while others recommend external wallets for added security. Regardless of your preference, ensure you follow the proper procedures for setting it up. Do not forget to add additional security measures to your wallet, including enabling two-factor authentication and using strong, unique passwords.

After setting up your wallet and exchange, deposit funds into your account. The good news is that most exchanges, like the ones we recommend above, support deposits in fiat currency (like NZD). So, follow the exchange’s instructions for depositing funds and be aware of any associated fees. You should also transact with a convenient method, whether credit/debit card, e-wallets, or bank transfers. This will streamline transactions, thus allowing you to focus more on activity management.

With funds in your account, navigate the asset offerings and choose a crypto token for which you have conducted a thorough market analysis. Then, choose a trade size and amount you wish to invest before making a purchase.

Remember, always stick to your budget and risk what you are comfortable losing. The cryptocurrency market is volatile, and success is not guaranteed. Therefore, have a plan and be open to learning from your losses when they occur. You can also apply risk management controls like stop-loss orders to mitigate massive losses should a trade fail to work out in your favour.

Conclusion

New Zealand is becoming one of the leading hubs for cryptocurrency trading, thanks to the availability of numerous exchanges. With the regulatory oversight by the Financial Markets Authority, investors are guaranteed a safe and exciting experience. Simply choose a suitable New Zealand crypto exchange like the ones we recommend above to get started.

Remember, success in cryptocurrency investment requires discipline and commitment. While choosing a suitable exchange is crucial, constantly conducting market analysis and staying abreast with the latest developments for solid strategies are also important. If you are not confident with your strategy, take your time and keep learning. The good news is that the exchanges we recommend above support their clients with quality learning materials. They are also backed up by a team of professionals to assist and offer guidance if need be.

Great article! It's interesting to see how the cryptocurrency market is growing in New Zealand