Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

The world of forex trading offers endless opportunities for profit. But, to reap juicy returns, forex traders must trade with outstanding platforms with splendid qualities like top-notch security and reasonable fees. That said, the forex trading scene in New Zealand is populated with hundreds of service providers, which makes picking the right one challenging.

But don’t give up yet. We are here to help you find the best forex broker in New Zealand – a service provider that will help you take your career to new heights. We’ve done all the heavy lifting by researching, testing, and comparing New Zealand forex brokers. After sifting through countless platforms, we identified 5 that can help you unlock your full trading potential.

In a Nutshell

- Hundreds of forex brokers accept traders from New Zealand. However, you should be cautious since some service providers are unscrupulous and downright fraudulent.

- When choosing a broker, the first thing you should consider is regulation. Prioritise trading with a company regulated by the FMA and other international authorities.

- We’ve researched and evaluated the trading platforms in New Zealand, so you don’t have to. Just choose a suitable service provider from our guide.

- While identifying the best New Zealand forex brokers, we considered regulation status, fees, assets, and other indispensable factors. Our guide has informative insights based on hours of research, first-hand experience, and testimonials from Trustpilot, Google Play, and the App Store.

- Over 70+ of retail traders lose money. To avoid becoming a statistic, learn the basics, practice with a demo account, and avoid emotional trading.

List of the Best Forex Brokers

- FxPro – Overall Best Forex Broker

- Plus500 – Standout Forex CFD* Broker for Margin Trading

- eToro – Best Forex Broker for Portfolio Diversification

- Spreadex – Best Broker for Advanced Forex Traders

- AvaTrade – Best Forex Broker for Beginners

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Forex Brokers in New Zealand

Forex brokers are plenty in New Zealand. If you go online today and do a quick search, you will be bombarded by innumerable options, all claiming to be the best. But here’s an indispensable tip from experts: never take a broker’s word at face value. After researching and trading for countless years, we’ve realised that many service providers are all show and no action.

With that in mind, our experts thoroughly vetted and tested the trading brokers recommended here. We also compared each platform with its peers, keeping in mind indispensable factors like licensing, product offerings, and provided trading software. The companies recommended in our guide stood out from the rest regarding such aspects.

But we didn’t stop at picking the best New Zealand forex brokers based on such factors and how they performed against their competitors. We also reviewed each platform’s reviews and ratings on Google Play, the App Store, and Trustpilot. Our primary goal is to provide unbiased and factual insights. That is why we always go above and beyond.

Let’s kick off with a brief comparison table of the best brokers in New Zealand.

| Best Forex Broker New Zealand | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| FxPro | FMA, FCA, CySEC, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes |

| Plus500 | FMA, FSCA, CySEC (#250/14), FCA, ASIC, MAS | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| eToro | FMA, FCA, CySEC, FSCA, ASIC, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| Spreadex | FMA, FCA | 24/5 | Online platform, Mobile trading, Charting package, TradingView | Credit/debit cards, Apple Pay, Bank transfer | |

| AvaTrade | FMA, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

Brokers Overview

Here’s another priceless tip from seasoned pros: prioritise trading with affordable brokers. That is crucial since the less you spend, the more you earn, and vice versa. Also, since you need to trade familiar assets to make informed decisions, you should assess every broker’s suitability based on its product offerings.

Here’s a brief breakdown of the fees and assets we discovered while evaluating the best trading platforms in New Zealand.

Fees

| Best Forex Broker New Zealand | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| FxPro | $100 | From 0 pips | Free | $10 monthly |

| Plus500 | $100 | From 0% | Free | $10 monthly after three months of inactivity |

| eToro | $1,000 | From 0% | $5 withdrawal fee | $10 monthly |

| Spreadex | $0 | 0.6 pts | Free | $0 |

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of inactivity |

Assets

| Best Forex Broker New Zealand | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about Forex Brokers

Our guide outlines the forex brokers in New Zealand. Before we compiled it, our experts spent considerable time evaluating each service provider. We assessed everything and paid close attention to the regulatory status. Why? A regulated broker is more likely to be secure, trustworthy, and reliable.

Use the reviews and insights below to pick a fitting service provider from our list of the best forex brokers in New Zealand.

1. FxPro – Overall Best Forex Broker

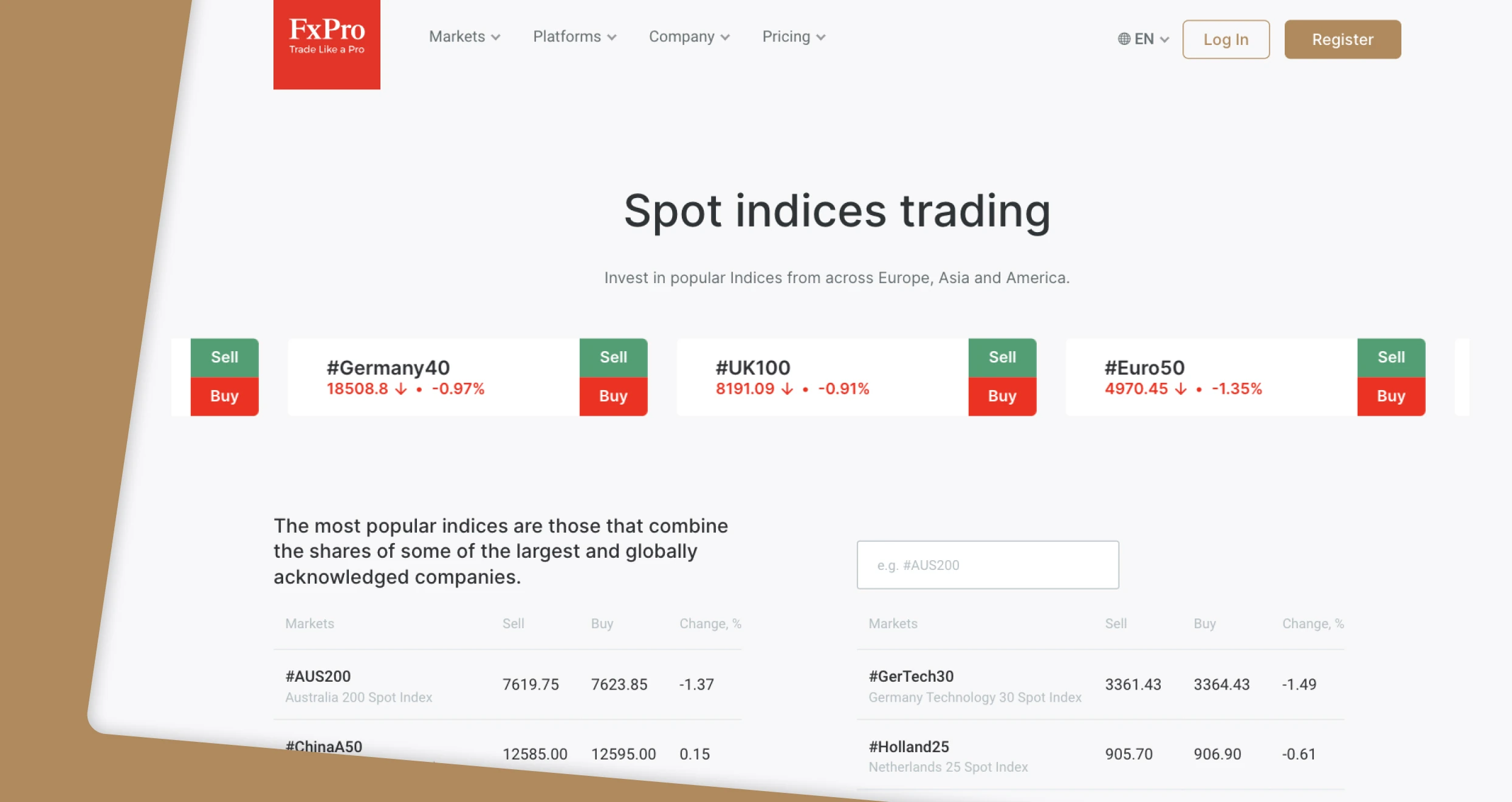

With over 7.8 million registered users, FxPro is one of the most popular forex brokers today. The company was founded in 2006 and, based on merit, is our overall best forex trading platform in New Zealand. Let’s begin with product offerings. FxPro allows users to trade CFDs on over 70 FX pairs, including AUD/NZD, GBP/NZD, and NZD/CAD. These come with reasonable spreads and commissions as low as $3.50 per lot.

We also encourage you to consider trading with FxPro since it has a wide variety of trading platforms. You can access the FxPro WebTrader from your browser or trade on the go with the FxPro Mobile App. Furthermore, this forex broker hosts third-party software like MetaTrader 4, MetaTrader 5, and cTrader.

While trading forex with FxPro, you can diversify your portfolio with different instruments, including shares, indices, and metals. What’s more, you’ll get the opportunity to reduce costs with free deposits and withdrawals.

Pros

- Offers over 2100 CFD assets, including 70+ FX pairs

- Hosts remarkable platforms like MT4, MT5, and cTrader

- Transparent pricing model with no hidden fees

- Negative balance protection

- Free deposits and withdrawals

- Spreads as low as 0 pips for Raw+ and Elite account holders

Cons

- Only offers CFDs

- $10 monthly inactivity fee

- Higher minimum deposit requirements for Raw+ and Elite accounts

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

2. Plus500 – Standout Forex CFD Broker for Margin Trading

As a margin trader, you can use leverage to amplify your profit potential while trading with a small capital. With that in mind, Plus500 is, in our opinion, the best NZ forex CFD broker for margin trading. This provider allows traders to access flexible leverages of up to 1:30. This is a moderate number ratio that gives you the opportunity to increase potential without risking catastrophic losses.

You can use Plus500’s leverage to trade different major, minor, and exotic pairs. They range from NZD/USD and USD/CAD to AUD/NZD and GBP/SEK. Moreover, you can mitigate risk exposure by diversifying with CFDs on shares, crypto, commodities, and more. Plus500 also provides diverse risk management tools, including guaranteed stop loss, trailing stop, and stop limit orders.

When it comes to charges, Plus500 is an incredible platform due to its tight spreads and friendliness. You can trade popular pairs like EUR/NZD with this broker and enjoy spreads as low as 0.03%. Deposits and withdrawals are cost-free* on Plus500. Plus500CY Ltd authorized & regulated by CySEC (#250/14), FCA, ASIC, MAS, and more.

*other fees may apply

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- Offers 2800+ financial instruments, including 60+ currency pairs

- Free deposits and withdrawals

- Low spreads starting from 0 pips

- Simple, user-friendly interface

- Top-tier risk management tools, including guaranteed stop order

Cons

- No third-party trading platforms like MT4/5

- $10 monthly inactivity fee after three months of inactivity

- New Zealanders can’t invest in stocks or trade futures

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy free deposits and zero internal withdrawal fees.

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports commission-free trades.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

3. eToro – Best Forex Broker for Portfolio Diversification

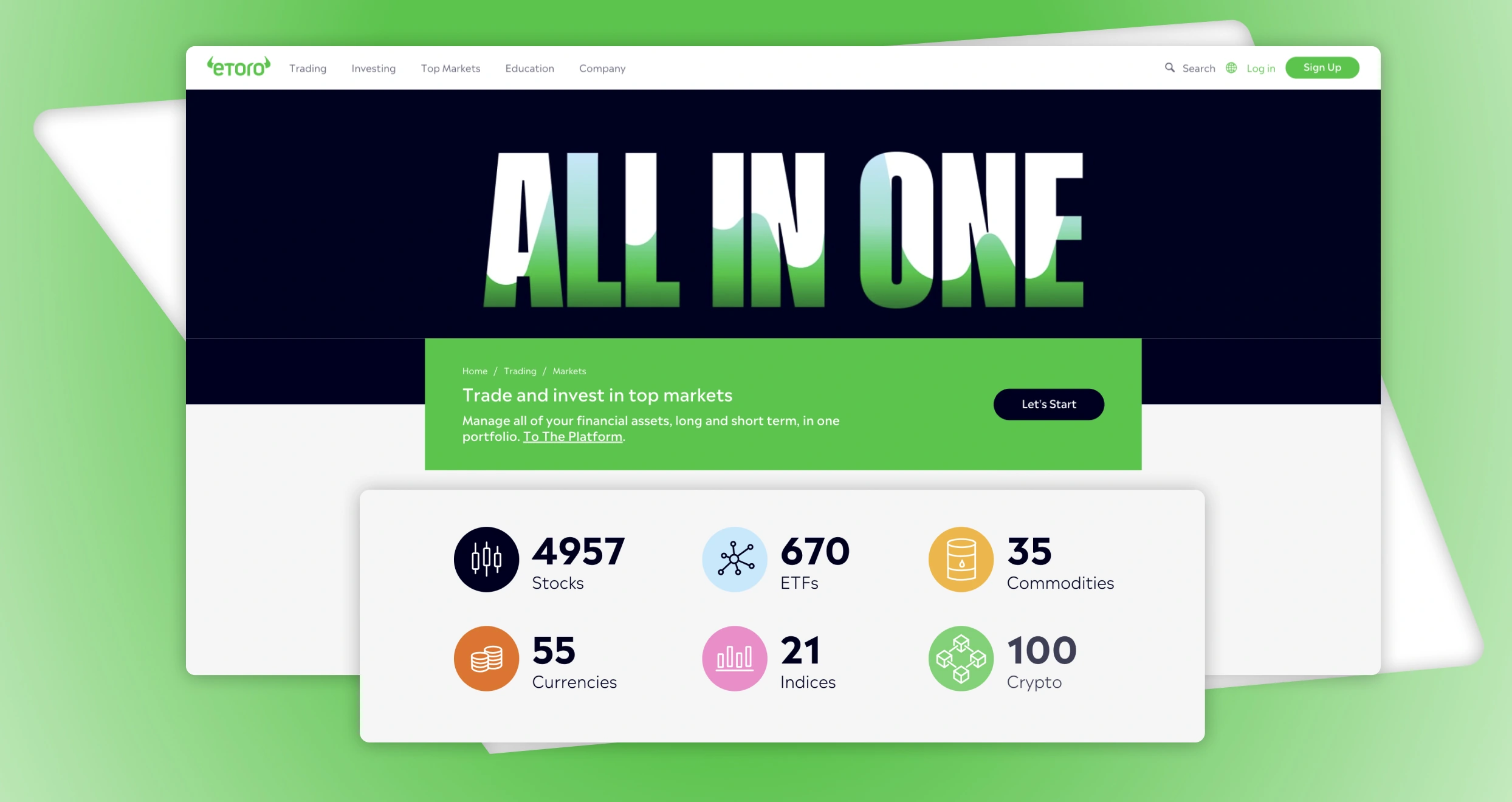

Admittedly, all the brokers we’ve listed here have different instruments forex traders can diversify with. But none is better than eToro. Here’s why. eToro has a broad range of assets besides FX pairs. That includes standard instruments besides FX pairs, like CFDs on cryptocurrencies, ETFs, and commodities. However, you can also invest in real stocks and crypto with eToro. That is what makes this broker exceptional.

eToro allows forex traders to enhance their portfolios with stock investments from infamous corporations like Lyft, Nintendo, and BMW. The platform also supports crypto staking, which means you can earn rewards by purchasing and holding the cryptos that eToro supports. eToro offers zero commissions to stock investors and ETF traders.

Lastly, eToro offers copy trading, which allows you to copy the most successful traders and boost your profit potential.

Pros

- 5,000+ assets, including real stocks and cryptos

- Top-quality academy and educational resources

- Exquisitely designed user interface

- Excellent customer support service

- Supports copy trading

Cons

- Higher spreads for FX pairs compared to other top brokers

- $1,000 minimum deposit for traders in NZ

- Every withdrawal request is subjected to a $5 fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

4. Spreadex – Best Forex Broker for Advanced Forex Traders

While exploring Spreadex, we discovered numerous features that make it ideal for advanced forex traders. This platform has sophisticated charts that allow users to open, close, or edit their positions seamlessly. With Spreadex, you can also optimise your analysis with advanced technical tools or use automation tools to leverage pattern recognition’s power.

We also recommend Spreadex to seasoned pros since this broker allows them to apply for a special Professional Clients status, which comes with numerous unique perks. For instance, as a Spreadex professional client, you can access more markets than standard retail traders. Professionals also get hospitality invitations, tighter margins, lower spreads, and more.

Spreadex offers over 60 major, minor, and exotic currency pairs. Users can also diversify with thousands of other instruments, including ETFs, commodities, and shares.

Pros

- Gives special privileges to professional clients

- Supports paper trading through TradingView

- No minimum deposit requirement

- Fee-free deposits and withdrawals

- Zero inactivity fees

Cons

- No demo account

- Limited third-party platforms

From our assessment of Spreadex’s fees, we concluded that this broker offers one of the most cost-friendly platforms. Why? For starters, Spreadex has $0 minimum deposit requirements. That means you can deposit whatever you can afford and start trading immediately. Moreover, while funding your account, you won’t have to pay any deposit fees – it’s free! The same applies to withdrawals.

That is exceptional news since Spreadex supports myriad payment methods, from debit and credit cards to Apple Pay and Easy Bank Transfer. You can use these options without fretting over any charges undermining your profits.

We also recommend Spreadex because this broker doesn’t penalize dormant accounts. Your Spreadex trading account can remain inactive for an extended period without attracting inactivity fees, which separates this company from its peers.

Spreadex offers exceptional rates on spreads. This broker’s spreads start from 0.6 pips for CFD trading. This trading broker should be your go-to if you want lower overall trading costs and improved profit margins.

That said, Spreadex charges overnight funding for shares rolling positions. If you keep a position open through the close of the relevant exchange, Spreadex will keep it open for the following day’s trading. But that will attract a funding adjustment. The fees you’ll incur at any given time will be a combination of the Adjusted ARR and Spreadex’s charges. However, holding futures overnight won’t attract any charges.

5. AvaTrade – Best Forex Broker for Beginners

Most experts recommend AvaTrade to newbie forex traders, and rightly so. We evaluated this broker, and our discoveries encouraged us to follow suit. The first reason why we strongly urge beginners to sign up with AvaTrade pertains to the broker’s academy.

AvaTrade is home to AvaAcademy, a world-class educational and training program. It offers over 200 free courses, lessons, and quizzes that beginners can reap immensely from. The available forex trading courses cover critical topics like how to start trading FX pairs and the fundamentals of using advanced strategies and techniques.

This broker also allows novices to use demo accounts to practice and familiarise themselves with hosted platforms. Every AvaTrade demo account comes with $10,000 in virtual funds and lasts 21 days, though users can request an extension.

Pros

- Unparalleled educational materials and resources

- Simple, intuitive user interface

- Free deposits and withdrawals

- Hosts MT4 and MT5 trading platforms

- Protects traders against losses of up to $ 1 million via AvaProtect

Cons

- High inactivity fees

- Limited product offerings compared to competitors

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

Forex Trading in New Zealand

You can confidently trade forex online if you are a New Zealander aged 18 and above. This venture is 100% legal in this country, meaning you won’t land into any legal trouble. Moreover, the best New Zealand forex brokers are authorised and supervised by the Financial Markets Authority (FMA). You can join any of the reputable platforms we’ve recommended, and rest assured that you’ll enjoy unparalleled integrity and protection.

That aside, you must have heard of numerous people who have made fortunes from forex. A good example is George Soros, who raked in approximately $1.5 billion from a single trade. But here’s something you may know. Before such people started earning handsome returns, they educated themselves and practised constantly. They’ve lost tidy sums over the years.

The bottom line is the secret to succeeding in forex trading lies in education and practice. Before you put your money on the line and earn juicy returns, cultivate your understanding of forex markets and practice constantly with demo accounts. Don’t stop honing your skills until you generate consistent profits while in demo mode.

Also, familiarise yourself with the risks of forex trading. And remember that trading and potential losses go hand in hand. Don’t trade with more funds than you’re prepared to lose. Most importantly, choose your broker wisely.

How to Choose the Right Forex Broker in NZ

Since many forex brokers accept new customers from New Zealand, picking a reliable service provider can be tricky. The innumerable fraudulent trading platforms operating today make the process more challenging. But you can use the following factors to identify a solid and reliable trading platform:

Check every broker’s licensing and regulation status for optimum safety and security. Choose service providers authorised and regulated by renowned authorities like the FMA, CySEC, and the FCA. Avoid trading platforms that lack proper licensing since they might be fraudulent.

Based on its reviews and ratings, you can quickly tell if a forex broker is reliable. Visit popular sites like Trustpilot, Google Play, and the App Store and testimonials from past users. Stay away from platforms whose users have reported too many unresolved issues.

The right forex broker for you should have your preferred assets. It should also offer all the financial instruments you need to protect your capital against catastrophic losses. Remember, if you invest in a single asset and it performs poorly, you may lose most, if not all, of your money.t

Forex brokers have proprietary trading platforms. Before interacting with them, check their features and functionalities. You should also test them with demo accounts whenever possible. Also, ensure that any trading platform you choose hosts your favourite third-party trading software.

Excessive costs compromise your profit margins. Therefore, you should prioritise trading on platforms with reasonable trading and non-trading fees. Before signing up, you should also check every broker’s minimum deposit requirement and hidden charges.h

Excellent customer support is crucial in prompt and effective issue resolution. While choosing the best forex broker, consider customer support availability. If possible, interact with every service provider’s support representatives before opening a live trading account.e

How To Register an Account with a Forex Broker in NZ

To newbies, registering a trading account might sound like an arduous task. That said, the best brokers in New Zealand have made this process incredibly simple. You just have to follow this standard step-by-step process:

Before signing up, you must visit your broker’s official site since everything is outlined there. Look around and assess indispensable factors like the supported assets and trading platforms. Don’t forget to review your service provider’s fee structure and policies.

Most brokers allow new signees to register from their web platform or mobile apps. If you prefer the latter option, download a dedicated app and start registering. While signing up, submit the required information, including your name, date of birth, and mobile number. Also, set a unique, strong password that no malicious actor can guess.

To access all the services your chosen broker offers, you must verify your account. To do so, you must submit copies of documents like a government-issued ID and proof of address, such as a bank statement. Ensure that the copies you share are clear and eligible.r

Account verification should take a couple of hours max. Once this process is over and you have a verified account, fund it using one of the available payment methods. If your broker has no minimum deposit requirement, load your account with any amount. Otherwise, adhere to the stipulated mandates.

With money in your trading account, you can pick a financial instrument and trade. But have a set goal in mind and stick to your trading plan. Don’t let your emotions get the best of you since they can cloud your judgement and lead to lousy investment decisions.

Conclusion

Based on findings from our research, the best forex brokers in New Zealand range from Plus500 and eToro to FxPro, AvaTrade, and Spreadex. Pick one platform from this list. While choosing a service provider, consider factors like product offerings, hosted trading software, and customer support.

Not to forget, non-stop trading can lead to fatigue, lousy decisions, and immense losses. You should take regular breaks and unwind with healthy activities like meditation and physical exercise.

Yeah, brokers love to show off the potential profits, but they don’t highlight how quickly you can get wiped out. Leverage is a double-edged sword—great if you're disciplined, disastrous if you're not.