Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Singapore is a leading cryptocurrency hub in Asia, with 30% of its population owning crypto. The small island nation has a 0% capital gains tax on individual investors, making it perfect for long-term or high-volume crypto investments. The country’s open economy has also attracted dozens of fintech companies that readily accept crypto payments.

Trading or investing in crypto is a great way to earn a living or expand your investment portfolio. But you need a dependable crypto exchange to succeed in the crypto space. There are hundreds of exchanges. Our job is to help you find the best crypto exchange in Singapore for your needs.

Here are our top picks for the best crypto exchanges in Garden City.

List of the Best Crypto Exchanges

- Kraken – Overall Best Crypto Exchange in Singapore

- Coinbase – Best Crypto Exchange for Beginner Singaporean Crypto Traders

- Crypto.com – Best Crypto Exchange With an All-in-One Ecosystem

- eToro – Best Exchange in Singapore for Social Trading

- Exodus – Best Mobile Trading Crypto Exchange in Singapore

Compare Crypto Platforms in Singapore

You’d be hard-pressed to pick a single exchange from Singapore’s long list of exchanges. Crypto exchanges are fundamentally the same; they allow clients to sell, buy, stake, and trade crypto assets. However, their functionalities, features, and compatibility differences separate the exceptional from the average.

We understand how frustrating it can be to try and find the best crypto exchange in Singapore. So we took it upon ourselves to test the creme de la creme of crypto exchanges in the Lion City. This involved registering on the said platforms and exploring their functionality, features, usability, and supported assets. A summary of our findings is in the table below.

| Crypto Exchange Singapore | Broker Type | Support Service | Price | Supported Coins | Digital Wallet |

|---|---|---|---|---|---|

| Kraken | Centralized | 24/7 | Free | 200+ | Yes |

| Coinbase | Centralized | 24/7 | Free | 200+ | Yes |

| Crypto.com | Decentralized | 24/7 | Free | 350+ | Yes |

| eToro | Centralized | 24/5 | Free | 100+ | Yes |

| Exodus | Decentralized | 24/7 | Free | 300+ | Yes |

Exchanges Overview

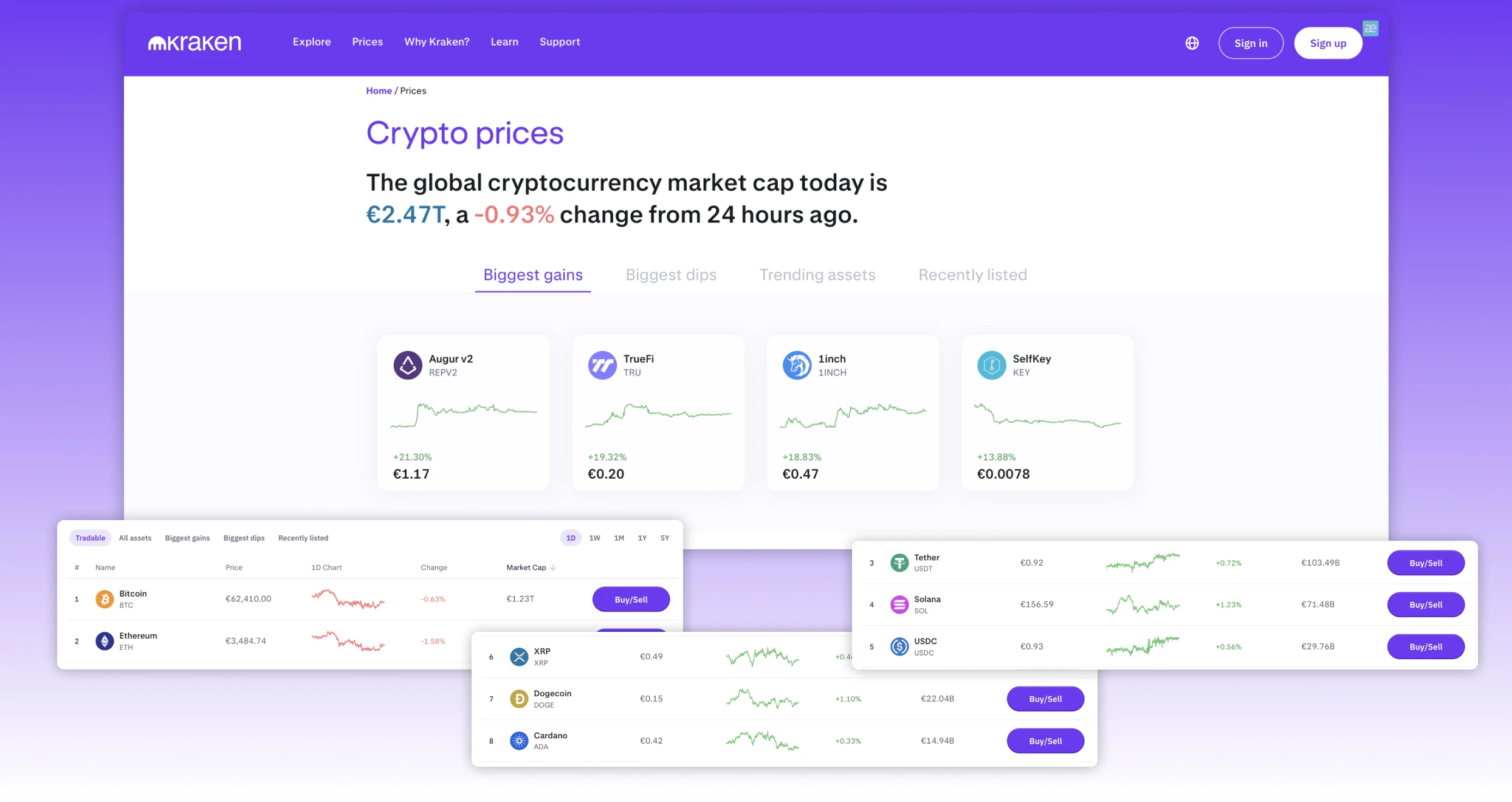

Two factors are of utmost importance when looking for a crypto exchange in Singapore: fees and tradable assets. Crypto assets are excellent investment vehicles, but hefty fees can eat into your returns. This is especially true for full-time crypto traders who transact multiple times daily. An exchange with costly transaction fees could translate to hefty transaction costs and indirect losses in the long run.

An exchange that supports multiple crypto assets also works best for crypto traders. The more tradable assets at your disposal, the more opportunities you have to diversify your portfolio and maximize potential profits. With that in mind, here are tables summarizing the exchange’s fees and supported assets.

Fees

| Crypto Exchange Singapore | Fees and Commissions | Minimum Deposit Requirements |

|---|---|---|

| Kraken | From 0.00%/0.10% maker/taker fees 3% conversion fee | 0.00001 BTC |

| Coinbase | From 0.05%/0.00% maker/taker fees | $0 |

| Crypto.com | From 0.04% | $0 |

| eToro | 1% flat fee | $10 |

| Exodus | None | 10 XRP |

Assets

| Crypto Exchange Singapore | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Solana |

|---|---|---|---|---|---|---|

| Kraken | Yes | Yes | Yes | Yes | Yes | Yes |

| Coinbase | Yes | Yes | Yes | No | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | No | Yes |

| Exodus | Yes | Yes | Yes | Yes | Yes | Yes |

Our Expert Opinions About the Best Crypto Exchanges

There are plenty of conflicting views about the leading cryptocurrency platforms in Singapore. That’s because experience varies significantly from one use to the next despite using the same platform. Beginners, for instance, will have unfavorable opinions about exchanges that cater to an advanced audience. An advanced audience, on the other hand, will find a beginner-friendly exchange too simplistic and lacking in essential features.

As professionals in finance and blockchain, we reviewed Singapore’s best crypto exchanges from beginner, intermediate, and expert crypto traders’ perspectives. Our professional opinions about them are as follows:

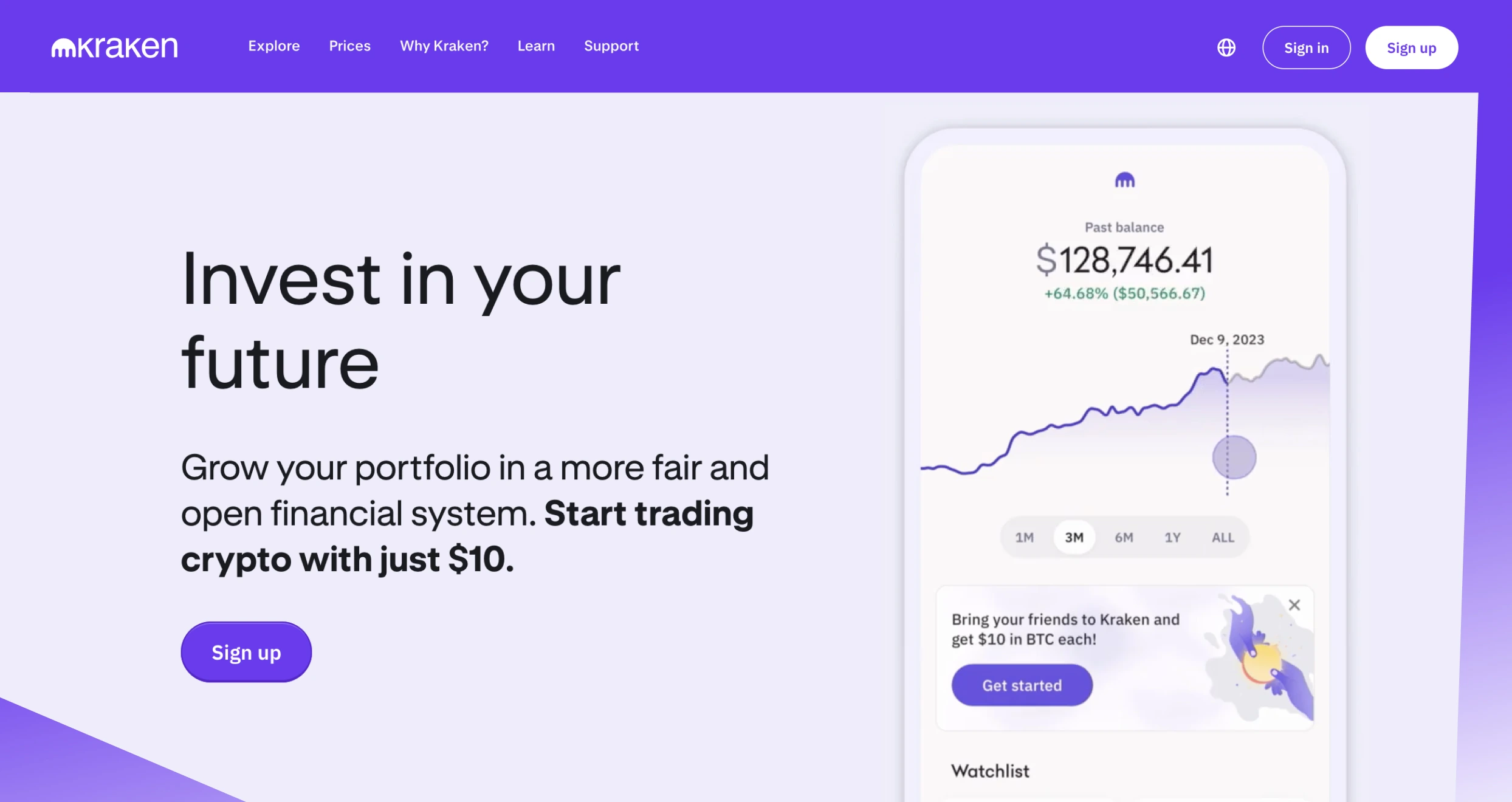

1. Kraken – Overall Best Crypto Exchange in Singapore

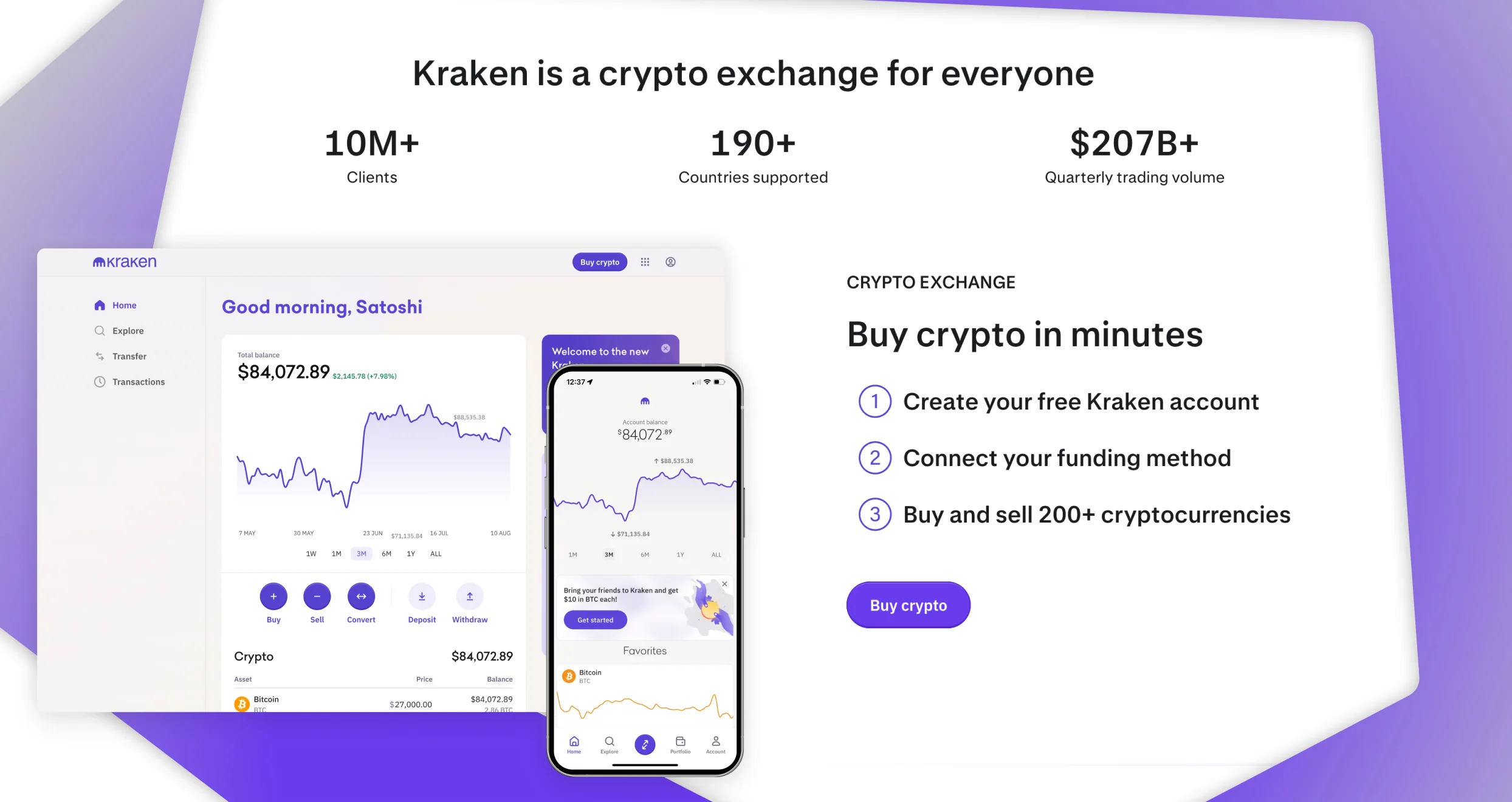

After thoroughly evaluating crypto exchanges in Singapore, we conclusively established that Kraken is the best crypto platform in Singapore. The San Francisco exchange is popular in Singapore and much of the world, boasting over 13 million clients worldwide.

Kraken excels in all essential aspects of crypto trading. In terms of user experience, using the exchange is a breeze on PCs and mobile devices. The dashboard has an organized layout that’s easy to navigate even without prior crypto experience. Moreover, the exchange has high liquidity, considering its many active users. Traders can execute orders instantly with minimal slippage.

Trading fees in Kraken depend on the type of account you opt for. Kraken has a standard and pro account. The latter has lower trading fees and has certain perks like margin trading and complex order types. The standard account, on the other hand, has slightly higher fees than the Pro account, but costs are still reasonable.

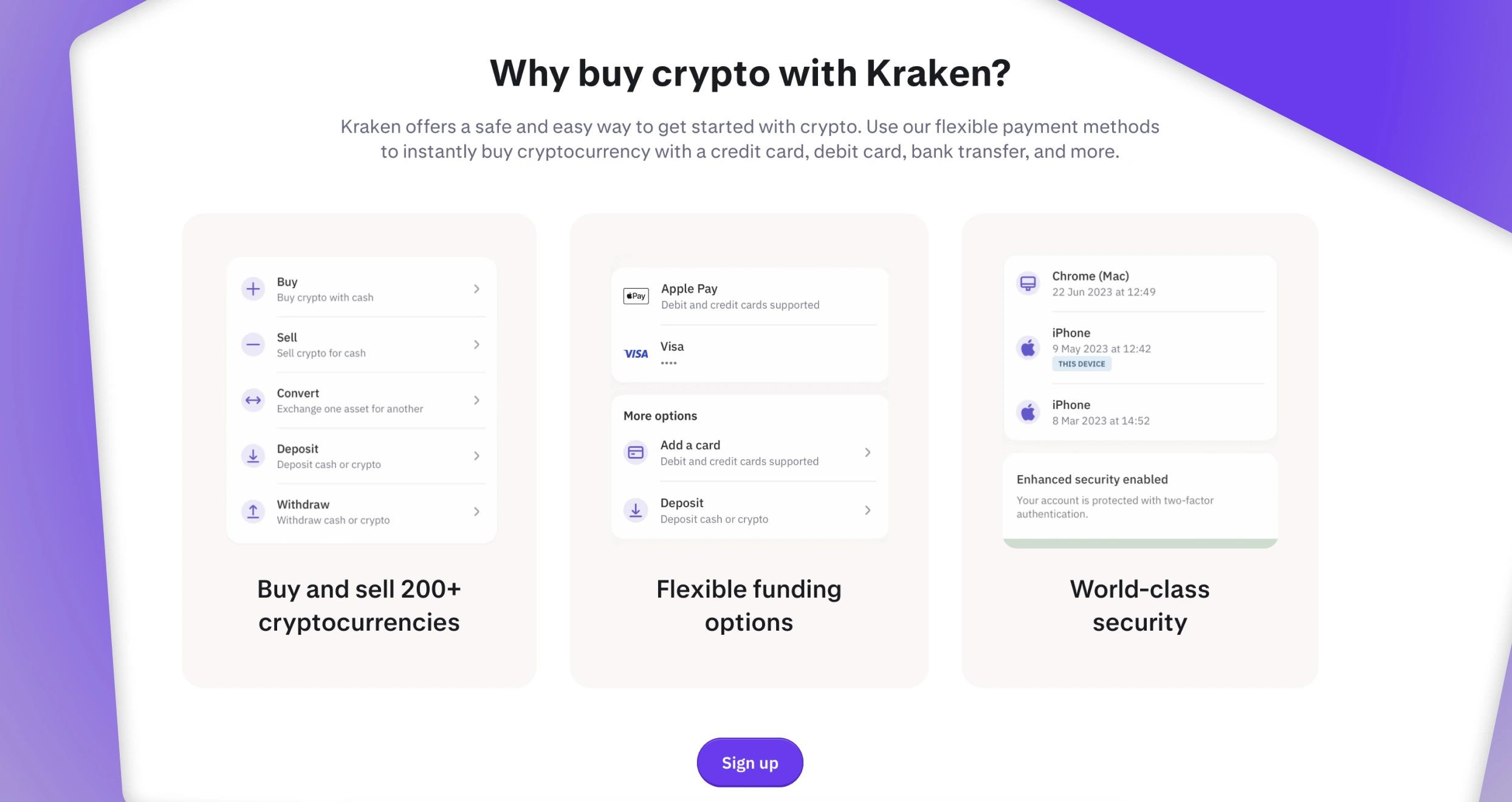

The platform has also implemented tough security measures to stop cybercriminals from gaining unauthorized access to your assets and personal information. Kraken’s security measures include Two-factor authentication (2FA), multi-approval withdrawal processes, and SSL encryption. It also has a bounty program that rewards users for identifying security bugs and loopholes in the security setups.

Pros

- Simple, easy-to-use interface across all platforms

- Ironclad security features with 2FA, SSL encryption, and a bug bounty program

- Low trading fees when using the Pro account with spreads as low as 0.00

- Large selection of digital assets and other financial instruments to trade/invest

- Kraken has high liquidity, translating to lightning-fast transactions with minimal slippage and tight spreads

Cons

- Doesn’t support funding from

- Standard users pay slightly higher fees than pro users

Based on our experience, Kraken is one of the most affordable cryptocurrency exchanges. We signed up for trading and investment accounts and incurred no registration fees. Plus, the exchange’s minimum deposit requirement is $10, which we believe is among the lowest in the financial investment industry.

When it comes to instant buy and sell services, Kraken imposes spreads, which are included in an asset’s price. The spreads may vary, depending on the payment method and platform you use. For instance, the exchange applies a 3% fee for converting balances less than the minimum order size using the “Convert small balances” feature.

For investors using the Kraken Pro platform, expect a maker-taker fee schedule. This comes with volume incentives based on investors’ activities in the past 30 days. On average, you will incur a 0.25% maker fee and a 0.40% taker fee for transactions between $0 and $10,000. Overall, Kraken Pro fees are charged on a per-trade basis.

When it comes to transactions, Kraken supports a variety of deposit methods. Most deposits are free, but expect to incur withdrawal charges, depending on the payment method you transat with. You may also pay a currency conversion fee. This of course will depend on the fiat currency you are converting to.

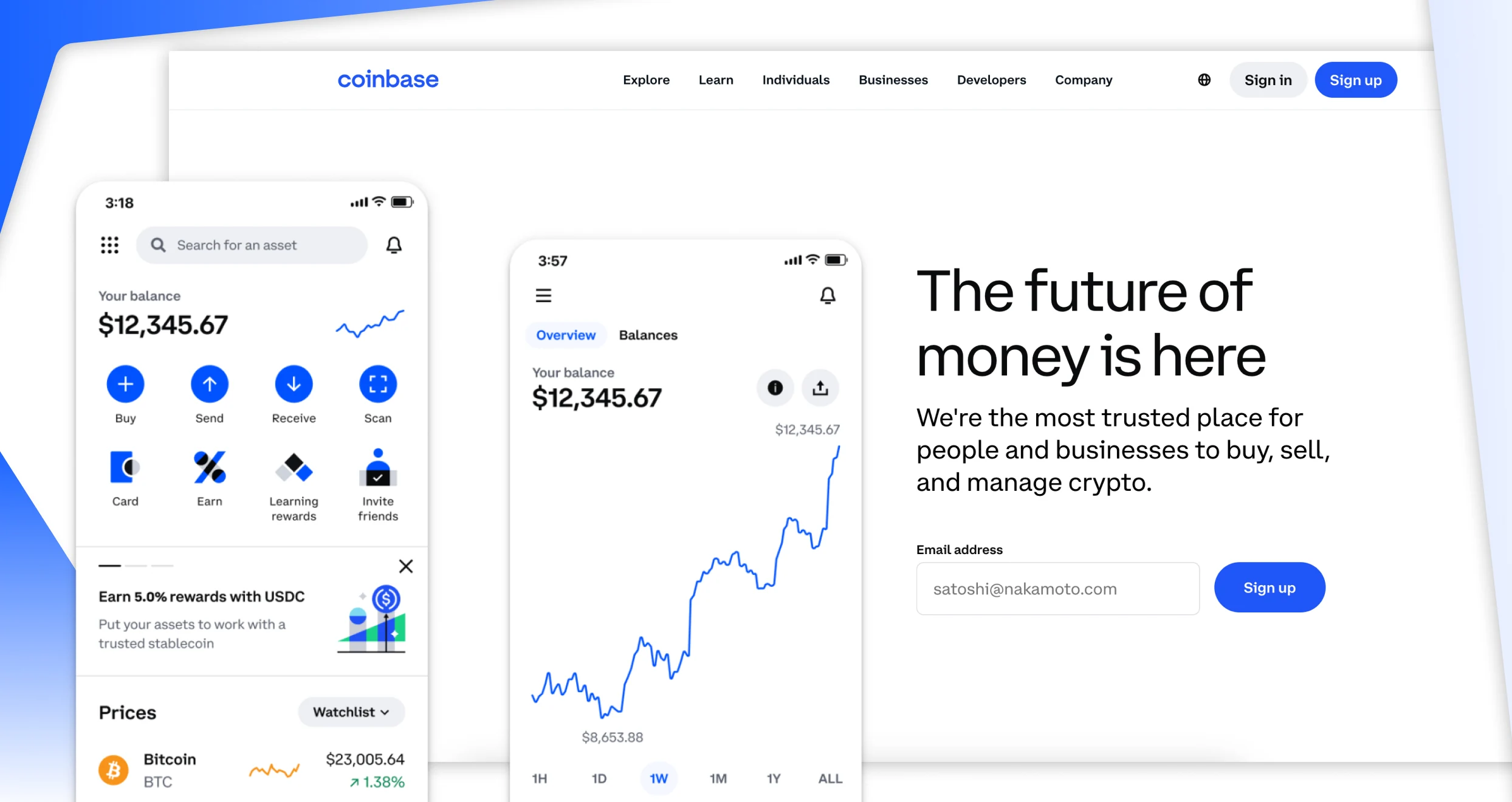

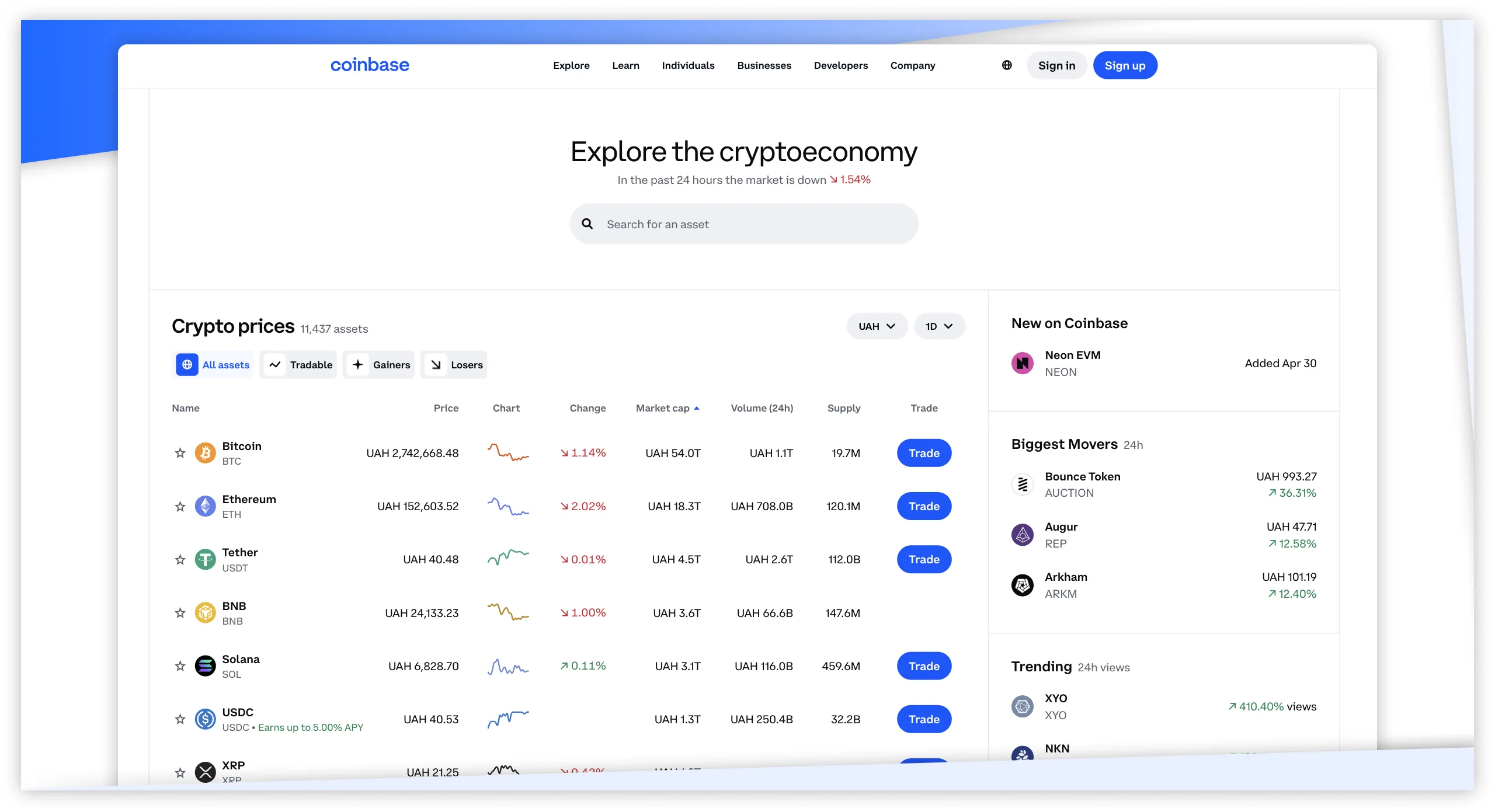

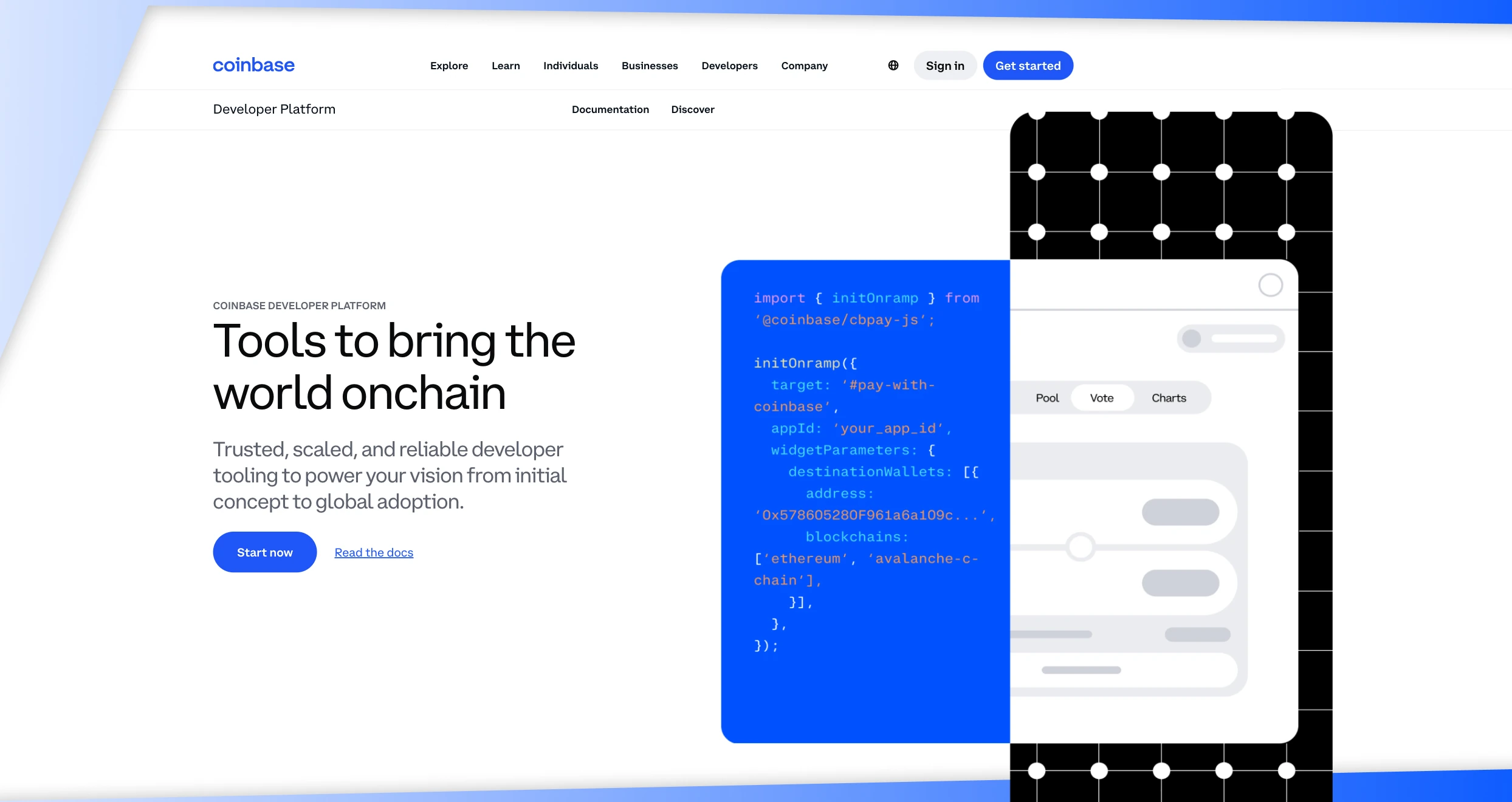

2. Coinbase – Best Crypto Exchange for Beginner Singaporean Crypto Traders

Crypto trading can be incredibly complex and convoluted for beginners. Coinbase is a great exchange for newcomers in the crypto space. For starters, the platform has a simple, intuitive interface that you can easily navigate to execute orders, check your balances, or learn about blockchain and crypto trading. The UI is organized and uncluttered, and the design language is seamless.

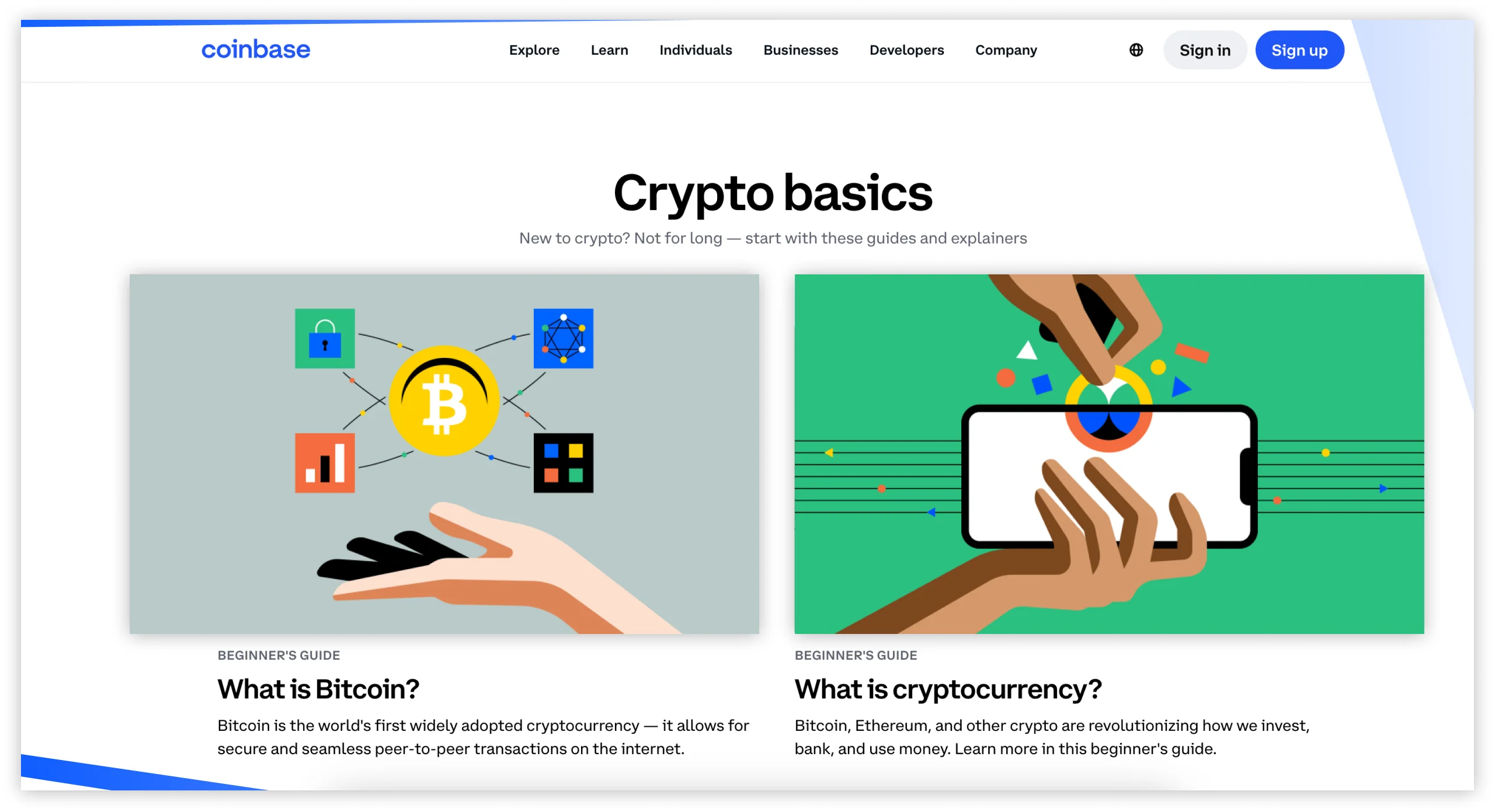

What’s more, Coinbase contains a wealth of educational resources for newbies to quickly learn the ropes and make profitable trades. Coinbase Learn gives users access to a treasure trove of learning materials, including guides, video tutorials, and blog posts. The exchange also provides real-time price alerts and notifications to keep users in the loop of the latest developments in the crypto markets. Coinbase supports more than 550 spot trading pairs, so beginners can pick the trading pairs they’re most comfortable with.

Beginners are often the most vulnerable to hacking and phishing attacks. Coinbase ensures user protection through two-factor authentication, SSL encryption, multi-approval withdrawals, and biometrics for mobile users. What’s more, the exchange is committed to being transparent with its financial management and guarantees a 1:1 customer deposit-to-balance ratio. That said, Coinbase is just as good for beginners as it is for expert traders with Advanced trading features and analytical tools.

Pros

- Coinbase has an easy-to-use interface that is perfect for beginners

- Contains a large collection of educational resources for beginner, intermediate, and expert traders

- Supports an extensive range of crypto tokens and financial instruments

- Watertight security measures and protocols with 2FA, SSL encryption, MPC, and biometrics

- Staking and rewards programs allow users to earn passive income on their investments

- Multiple technical analysis tools for advanced raiders

Cons

- Has a custodial wallet, meaning Coinbase retains users’ private keys

- Transaction and trading fees are higher than most of its peers

Opening and maintaining a Coinbase account is free. You can fund your account and withdraw money using a variety of payment methods, including wire transfers, debit/credit cards, and digital wallets like Apple Pay.

While using FIAT, you may have to pay deposit and withdrawal fees depending on your chosen payment method. ACH transactions are free. But alternatives like wire transfers attract $10 and $25 deposit and withdrawal fees, respectively. That said, you can buy as little as $2 of crypto using a card or funds in your account.

Expect to pay specific fees when you purchase, convert, or sell crypto on Coinbase. Your charges will depend on numerous factors, including the order size, your preferred payment method, and market conditions. For instance, if you place an order at a stipulated market price and it is fulfilled immediately, this exchange will charge you anywhere from 0.05% to 0.60%.

If you place standard buy and sell orders on Coinbase, the platform will include a spread in the specified price. You will also encounter a spread when converting one crypto asset to another. To avoid spreads, join Coinbase Advanced, which is an advanced platform for seasoned traders.

Depending on your jurisdiction, you may stake crypto on Coinbase at no additional costs. However, the exchange will deduct a commission based on your accrued rewards and the involved asset. The standard commission for ADA, SOL, DOT, ATOM, XTZ, and MATIC is 35%. Eligible Coinbase One members can enjoy a commission of 26.3% for the same assets. On the other hand, ETH attracts a 25% commission.

Lastly, Coinbase charges asset recovery fees. If you send an unsupported asset to your Coinbase account, you may try to recover it. If it’s eligible for recovery, the exchange will charge a network fee. If the recovery is over $100, expect to pay a 5% fee. But if it’s less than $100, you won’t have to pay a dime.

3. Crypto.com – Best Crypto Exchange With an All-in-One Ecosystem

Crypto exchanges allow users to buy, sell, trade, or stake their crypto assets. Crypto wallets, on the other hand, are avenues for storing, sending, and receiving crypto tokens. Crypto.com combines its wallet and exchange into an integrated system for seamless use and unmatched convenience. This integration means users can trade or invest their crypto assets without switching platforms.

What’s more, the exchange also supports DeFi services, including yield farming with up to 34.99% rewards per annum via the Crypto.com app. Users can get these unlimited rewards thrice weekly, provided they meet the threshold of 0.00000001 of the crypto asset. The platform also offers Crypto.com Pay, a feature that lets users pay for goods and services via the app or one-time card. It’s worth noting that Crypto Card users can get cashback, rebates, and discounts for regularly using the card.

Besides its comprehensive, all-in-one ecosystem, the exchange also supports more than 350 coins and other financial instruments. It also has solid security features and protocols to keep cybercriminals and other bad actors at bay. Multi-factor authentication, HSM, FIDO2, and passkeys keep users’ assets and sensitive data safe and sound. The platform also has a 1:1 reserve and is clear about its financial affairs and management practices.

Pros

- All-in-one ecosystem, offering unmatched convenience and seamless use

- Offers a wider range of crypto assets and trading instruments compared to its peers

- Industry-leading security protocols ensure users’ balances and information are under lock and key

- Superb staking program (both DeFi and on-chain) offering generous rewards of up to 34.99% per annum

- Exciting rewards for using the platform’s Visa Card, including cashback on purchases, rebates, etc.

- An expansive suite of educational resources to refine trading skills and increase chances of profitability

Cons

- While the platform is transparent about its financial management, its fee structure may be hard to understand

- Slightly more expensive than its counterparts

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

4. eToro – Best Exchange in Singapore for Social Trading

The crypto space enjoys a thriving community of hobbyists, traders, and investors. Social trading lets traders copy the trades of their counterparts. It’s especially ideal for beginners when finding their footing and looking to make profitable trades without the technical know-how.

eToro has a stellar reputation for social trading, boasting the “largest social investing community,” and is trusted by millions worldwide. Its social trading platform, CopyTrader, is a game changer in the crypto community. CopyTrader has a straightforward dashboard that’s easy to use. It also has a resourceful search feature with filtering options for filtering traders based on location, gain, and risk score. The Editor’s Choice segment in CopyTrader highlights some of the most prolific and successful traders worth your attention.

The exchange also shines in other aspects, such as its security features, specifically 2FA and biometric identification, which hinder criminals from siphoning your funds or getting private information. It also has a huge offering of supported crypto assets and other tradable assets, including stocks and options. eToro charges a flat 1% fee on all crypto transactions. This transparent pricing allows more informed trading, but the costs are a tad higher than what other platforms charge.

Pros

- Exquisite copy trading platform for smooth copy trading

- Enjoys a vibrant community of traders and investors eager to share their knowledge and secrets

- The platform is very transparent about its pricing, with no hidden costs

- Excellent reputation in the crypto community, which shows trust and credibility

- The mobile app boasts advanced trading features like Procharts and offline trading for specific orders

Cons

- A 1% flat fee is higher than what its peers charge

- Lack of certain analytical tools that may be essential for advanced traders

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

5. Exodus – Best Mobile Trading Crypto Exchange in Singapore

Exodus may not enjoy the same widespread recognition as some of its counterparts, but it’s no slouch. Launched in 2016, the platform has become a favorite among Singaporean traders, especially those using smartphones and other mobile devices. Exodus combines a crypto wallet and exchange in one platform, so you can transfer funds from your wallet to exchange in seconds.

The best part about Exodus’ mobile app is that it offers the same experience you get on its PC and web-based platforms. As such, users can access all 100,000 plus crypto assets and a host of other trading instruments. Moreover, you can use advanced analysis and charting tools to make better trading decisions. Exodus’ mobile app is also great for beginners. It has a simple interface and a quick and easy onboarding process. It also supports decentralized apps and NFTs and doesn’t charge a transaction fee, although network fees apply.

Despite being a leading exchange, Exodus is somewhat lacking in the security department. For instance, the exchange doesn’t have 2FA or other advanced security features. Still, the platform is keen on anonymity and doesn’t implement KYC protocols for new users; instead, it only implements them for on-chain transactions.

Pros

- Mobile app with full functionality, including

- Supports more than 350 coins and 100,000 plus crypto assets

- The platform is extra keen on client anonymity, snubbing KYC measures when signing up

- Wallet-exchange integration translates to fast transactions and added convenience

- User interface is simple, organized, and easy to navigate, even for newbies.

- Compatibility with dApps and seamless integration with third-party APIs

- Low-cost exchange makes it ideal for beginners and struggling traders

Cons

- Substandard security leaves users vulnerable to cyber attacks

- Doesn’t support direct fiat-to-crypto conversion, meaning clients must use third-party APIs for conversion

Exodus is among the digital wallets that have no fees for downloading and setting up accounts. From our exploitation, the wallet does not charge any fees when you receive and store cryptocurrencies. However, expect to incur network or gas fees when you send cryptocurrencies. The best part is that this Exodus wallet fee can be customized, although this option is limited to Bitcoin, Ethereum, and ERC20 transactions.

Cryptocurrency sending charges vary based on the blockchain network you use. Therefore, always understand applicable charges to plan accordingly. Exodus automatically checks all addresses to ensure seamless transactions with no errors.

Crypto Trading in Singapore

As mentioned, Singapore is a cryptocurrency titan. The small island nation has become a magnet for crypto start-ups and fintech companies promoting crypto. This technological proficiency points to sound government policies, which create a conducive space for crypto traders and investors.

Trading and investing in Singapore is legal, but the government doesn’t recognize cryptocurrencies as legal tender. There are no Singaporean laws that put age restrictions on crypto trading. However, most exchanges only allow users above 18 to trade or stake crypto.

The Monetary Authority Singapore (MAS) is the body that oversees crypto trading and regulates exchanges. The government introduced the Payment Service Act (PSA) in 2019 to create a regulatory framework for MAS-recognized cryptocurrencies or Digital Payment Tokens (DPTs). The law allowed these DPTs to be recognized as actual assets, facilitating better transparency and encouraging crypto acceptance.

How to Choose the Right Crypto Trading Platform in Singapore

There are multiple crypto trading platforms in Singapore. Here are a couple of tips to ensure you pick the right one

All legitimate crypto trading platforms in Singapore have licenses from MAS and other regulatory authorities like the FCA, FSA, etc. Ensure you settle for an exchange with valid licenses from the mentioned bodies to guarantee the safety of your investment and protection from unfair business practices.

It’s important to find a platform with reasonable fees and a transparent pricing structure. Hefty fees might water down your profits and ruin your trading experience. However, be wary of exchanges with ultra-low fees. These may be fraudsters running an illegitimate platform to siphon your deposits.

Other users will tell you everything you need to know about the trading platform you have in mind. As such, read through reviews and testimonials on trusted sites like Google Play or Trustpilot to get a clear picture of what to expect from these exchanges.

A trading platform that supports multiple cryptocurrencies and other financial instruments allows you to diversify your investment portfolio. Choose a platform that supports not only many cryptocurrencies but also NFTs, dApps, and other instruments like stocks, forex, ETFs, and indices.

Traders can utilize different trading software to trade crypto. Ensure you pick an exchange that supports trading software you’re familiar with. Doing so will save you the trouble of learning new software, which requires plenty of time and commitment.

Only exchanges with top-notch customer support are worth your time. When it comes to customer support, consider the availability and customer support channels. Look for an exchange with live chat and a 24-hour hotline for quick responses and problem resolution.

How to Register an Account With a Crypto Exchange

Are you looking to hop on the crypto bandwagon? Well, all you need is a PC or smartphone and a stable internet connection. Check out the brief step-by-step guide below to register with a crypto exchange and embark on your crypto journey.

First things first, visit the exchange’s website on your PC or smartphone. Head over to the “Sign Up” or “Register” button and click. This should open a new page with a sign-up form, taking us to the next step.

Registering for an account with the exchange is a cakewalk. All you have to do is provide details like your full name, phone number, and country of residence. You must also create a strong password, and then you’ll receive a verification code or link in your email. Give correct and truthful details to avoid issues down the line.

Verifying your account is as simple as opening the verification email and tapping or clicking on the link. Some platforms may send a verification code that you’ll enter on the exchange’s website. Your account becomes active once you complete verification.

Next, choose an appropriate deposit method from the exchange’s funding options. Common wire transfers, debit cards, and e-wallets (Paypal, skrill, etc.). Deposit the amount you want, which will immediately reflect in your account balance.

Head to the crypto marketplace on the exchange and pick the cryptocurrency you want. Enter the amount you wish to purchase and confirm your order. This also will show up as your balance.

Now that you have purchased crypto, all that’s left is to select a suitable repository for your assets. Most exchanges come with integrated wallets, where you can store your cryptocurrency. If the one you chose doesn’t have one, you’ll need to register for a third-party wallet.

Final Thoughts

Singapore is a technological metropolis and a vibrant cryptocurrency hub in Southeast Asia. Now that you have a firm idea of the leading cryptocurrency exchanges in the small island nation, the ball is in your court. Give the above-mentioned exchanges a try and find the best crypto platform in Singapore. Just don’t forget to tread carefully with unregulated exchanges and avoid trading platforms with a murky history of board disputes and security issues.

Exchanges with integrated wallets are the most convenient but not always the best. You can pair an excellent crypto exchange with a reliable wallet and still get all the benefits of an exchange-wallet integration. Lastly, remember that trading in crypto is risky, so only trade the amount you’re willing to lose while staking the rest or keeping it as a store of wealth.

I found this article really helpful! It’s amazing how Singapore has become a crypto hub, especially with its 0% capital gains tax.