Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Choosing the right broker is crucial for a successful and satisfying trading experience. Sadly, finding the best among hundreds of options continues to be daunting. As professional researchers and traders, we decided to do all the legwork for you. Below, we present our findings on the best brokers for trading in South Africa. Whether you are navigating the complexities of the financial markets for the first time or seeking an upgrade to your current trading platform, join us as we dissect and analyse the leading brokerage options. We aim to provide you with a comprehensive overview to empower you to make the most informed choice for your trading journey.

In a Nutshell

- Although trading in the financial market in South Africa can be profitable, losses are inevitable. Therefore, always understand the assets you trade and create solid strategies for maximum experience.

- Traders should choose brokers licensed and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa for a secure trading experience.

- The best brokers in South Africa should offer features aligning with traders’ requirements.

- Prioritise brokers with robust security measures, such as encryption and two-factor authentication, to safeguard your personal and financial information.

- As Invezty experts, we ensure our recommended brokers for trading in South Africa are thoroughly tested and approved based on our specifications.

- Mobile trading in South Africa is skyrocketing. Therefore, choose brokers with reliable apps for on-the-go access to the markets.

- If you are a beginner trying to explore the South African financial space, find brokers with demo accounts. This will make it easier for you to practise and familiarise yourself with the platform and assets before committing real capital.

List of the Best Brokers for Trading

- Pepperstone – One of The Cheapest Options

- Plus500*- Leading Broker For CFD Trading in South Africa

- eToro – Best Broker For Social and Copy Trading in South Africa

- FP Markets – Best Stock Broker in South Africa

- AvaTrade – Best Broker For Trading Cryptocurrency in South Africa

- Spreadex – Beginner-Friendly Broker in South Africa

- FxPro – Best Forex Broker in South Africa

- Interactive Brokers – Overall Best Broker in South Africa

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare the Best Brokers for Trading in South Africa

In our pursuit of recommending the optimal brokers in South Africa, we go beyond mere testing – we thoroughly compare each contender. Our goal is to leave no table unturned, ensuring that you receive a comprehensive overview before making crucial decisions. Below, we present a detailed table comparing the features of our recommended brokers. Explore this information to make well-informed choices tailored to your trading preferences.

| Best Broker South Africa | License | Support Service | Software | Payment | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FSCA, FCA, ASIC, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| Plus500* CFD service. Your capital is at risk | FCA, CySEC, ASIC, FSCA, MAS, FSA | 24/7 | Plus500 Webtrader | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes |

| eToro | ASIC, CySEC, FSCA, FCA, FSAS | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Credit/debit cards, PayPal, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes |

| FP Markets | CySEC, ASIC, FCA, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Yes |

| AvaTrade GO | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA, SEBI | 24/5 | MT4, MT5, AvaTradeGO, AvaOptions, AvaSocial, DupliTrade, Capitalise.ai | Credit/debit cards, Wire transfer, Paypal, Skrill, Neteller, WebMoney | Yes |

| Spreadex | FCA, SEBI | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No |

| FxPro | SEBI, FCA, CySEC, FSCA, SCB, FSCM | 24/5 | FXPro Trading Platform, MetaTrader 4, MetaTrader 5, cTrader | Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill | Yes |

| IBKR | FSA, FCA, SEBI, ASIC, FINRA, CIRO | 24/5 | Trader Workstation, IBKR Mobile, IBKR EventTrader, IBKR GlobalTrader, IMPACT | Bank transfers, e-wallets, credit/debit cards | Yes |

Brief Overview of Our Recommended Brokers’ Fees and Assets

Selecting the best brokerage for your South African trading ventures is a pivotal decision. However, comparing brokers’ features can be daunting for traders and even lead to wrong choices. To streamline your research process and decision-making, we share tables below highlighting the fees and assets of our recommended brokers for informed choices.

Fees

| Best Broker South Africa | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Pepperstone | From 0.0 pips | $0 | Free | None |

| Plus500* | From 0.0 pips | $100 | Free | $10 monthly after three months of inactivity |

| eToro | 2 pips | $50 | $5 withdrawal | $10 monthly |

| FP Markets | From 0.0 pips | $100 | Free | None |

| AvaTrade | 0.03 pips | $100 | Free | $50 quarterly |

| Spreadex | From 0.6 pips | $0 | Free | None |

| FxPro | From 0.1 pips | $100 | Free | $15 one-off maintenance fee |

| Interactive Brokers | From $0.01 commission on US stocks | $0 | Free | None |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Assets

| Best Broker South Africa | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | No | No |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Our Opinion & Overview of the Best Brokers for Trading

Kickstarting your trading journey in South Africa necessitates informed choices. Our in-depth research and rigorous testing have culminated in a comprehensive overview of top-performing brokers. Below, we share our opinions based on hands-on experience, providing valuable insights to assist you in making well-informed decisions tailored to your trading preferences and goals.

1. Pepperstone – One of The Cheapest Options

Among the brokers we tested in South Africa, Pepperstone was among the cheapest, and we highly recommend it to low-budget traders. Getting started with the broker is easy, and there is no minimum deposit requirement. Plus, we discovered that trading the featured financial instruments attracts low fees, with spreads starting from 0.0 pips on major currency pairs. Other non-trading charges that make this broker a viable choice for budget-conscious traders include free deposits and no inactivity fee.

We discovered over 1,200 instruments for trading at Pepperstone, including forex, shares, indices, ETFs, and commodities. However, you can only trade the securities as CFDs since there is no buying and taking ownership of the assets. On top of that, Pepperstone hosts quality resources for skills development and market analysis. They are all available on its proprietary web and third-party MT4, MT5, cTrader, and TradingView platforms.

Pros

- No minimum deposit requirement

- No deposit and withdrawal fees

- No inactivity fees

- Offers free learning and market analysis tools on its web, MT4, MT5, cTrader, and TradingView platforms

Cons

- You can only trade the assets as CFDs

- Limited asset offerings compared to its peers

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. Plus500 – Leading Broker For CFD Trading in South Africa

For traders prioritising CFD speculation over direct stock ownership, Plus500 is your go-to broker in South Africa. On its website, we explored over 2,000 CFD tradable assets, including shares, forex, indices, ETFs, and more. This made us like this broker even more, as users can easily explore diverse investment opportunities. Note that Plus500 is regulated by esteemed authorities like the Financial Sector Conduct Authority (FSCA), thus attaining global popularity for its commitment to transparency and reliability.

What sets Plus500 apart is its dedication to low trading charges, making it a favourite among South African traders. We traded the featured CFD assets commission-free with minimal spreads, starting from 0.0 pips. Plus500 stands out as a cost-effective option as there are no transaction charges with a modest $100 deposit to commence CFD trading. From our thorough tests, we confidently award Plus500 a 4.7-star rating.

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- A user-friendly and intuitive design platform with quality trading tools

- Has a virtually funded demo account for beginners to test the market risk free

- Reliable and responsive 24/7 customer service via phone, email, and live chat

- No deposit and withdrawal charges

Cons

- Only a single proprietary trading platform is available, limiting traders looking for more advanced platforms like the MT4 and 5

- Limited asset offering compared to some of its peers

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy free deposits and zero internal withdrawal fees.

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports commission-free trades.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

3. eToro – Best Broker For Social and Copy Trading in South Africa

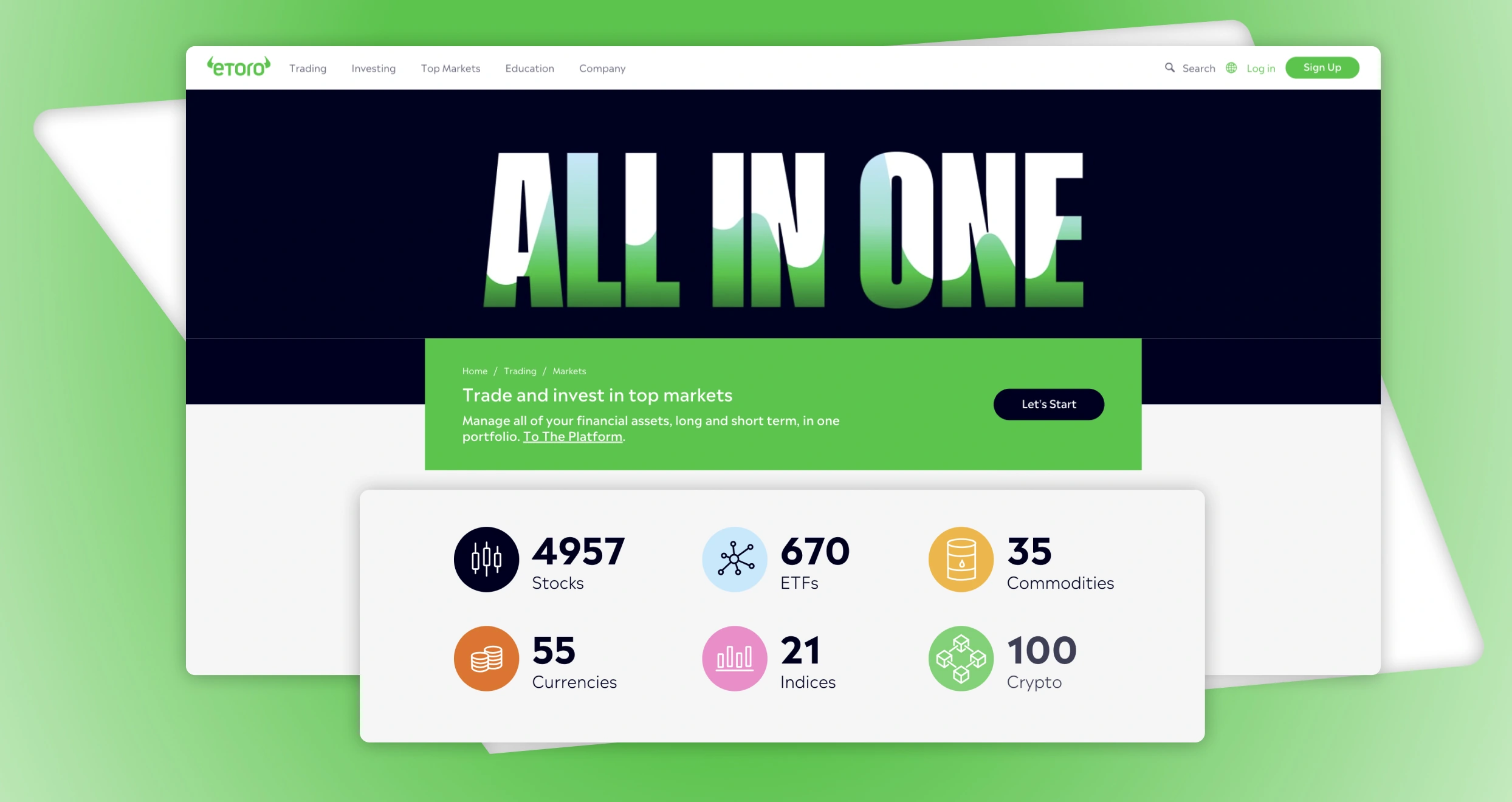

We find eToro the best broker in South Africa for social and copy trading. Renowned for its user-friendly interface and modern design, eToro excels as the best broker for those venturing into the dynamic world of social trading. From our experience, the broker offers social trading on its CopyTrader, which users can enjoy with no additional charges. The minimum amount required to copy a trader is $200, and the least amount for each copied position is $1. With a generously funded $100,000 paper trading account, beginners can test eToro before committing real funds.

eToro’s extensive portfolio, featuring over 4,500 securities, including stocks and cryptocurrencies, invites exploration into diverse markets. While its trading charges can be high compared to its peers, we like the broker’s user-friendly platform featuring quality trading tools. You can get started with a minimum deposit of $2,000 for live trading, which doesn’t attract deposit fees. Comparing eToro to other brokers, we give it a 5-star rating.

Pros

- No time constraints on paper trading

- $100,000 virtually funded paper trading platform

- $50 minimum deposit required when switching to the live trading account

- An award-winning social and copy trading platform

Cons

- Spreads can be high for some trading assets like forex and commodities

- Support service availability is only five days a week

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

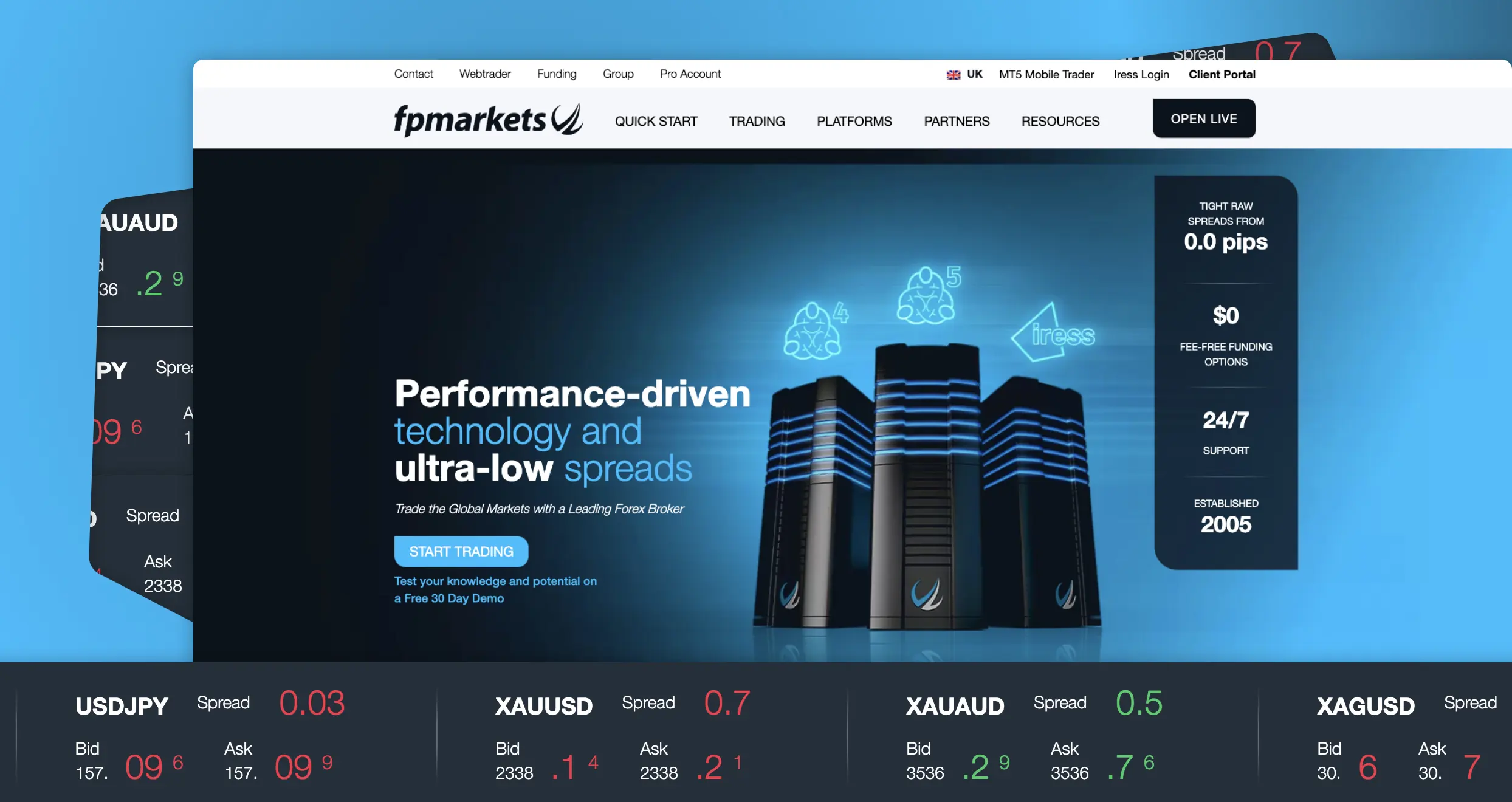

4. FP Markets – Best Stock Broker in South Africa

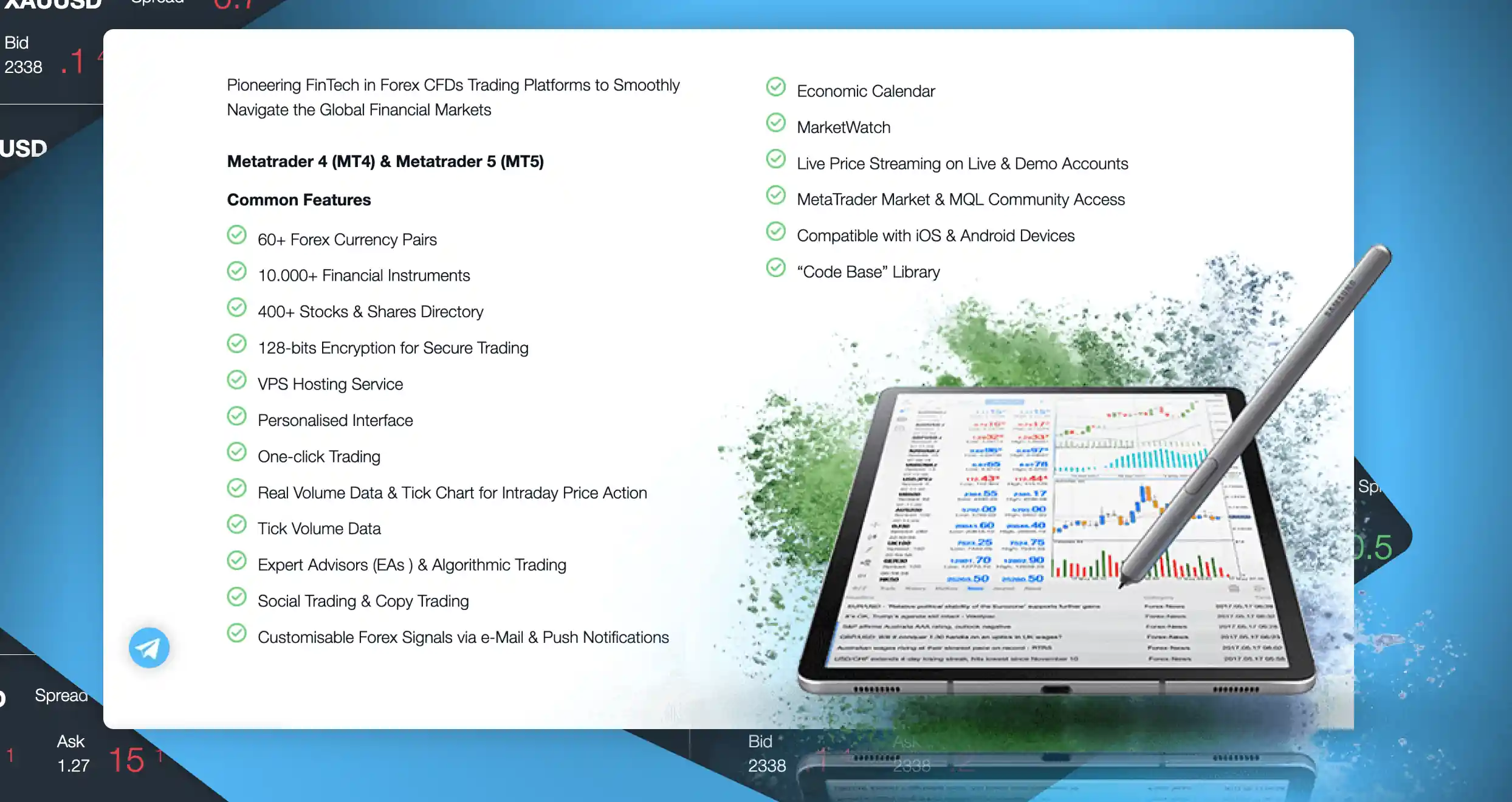

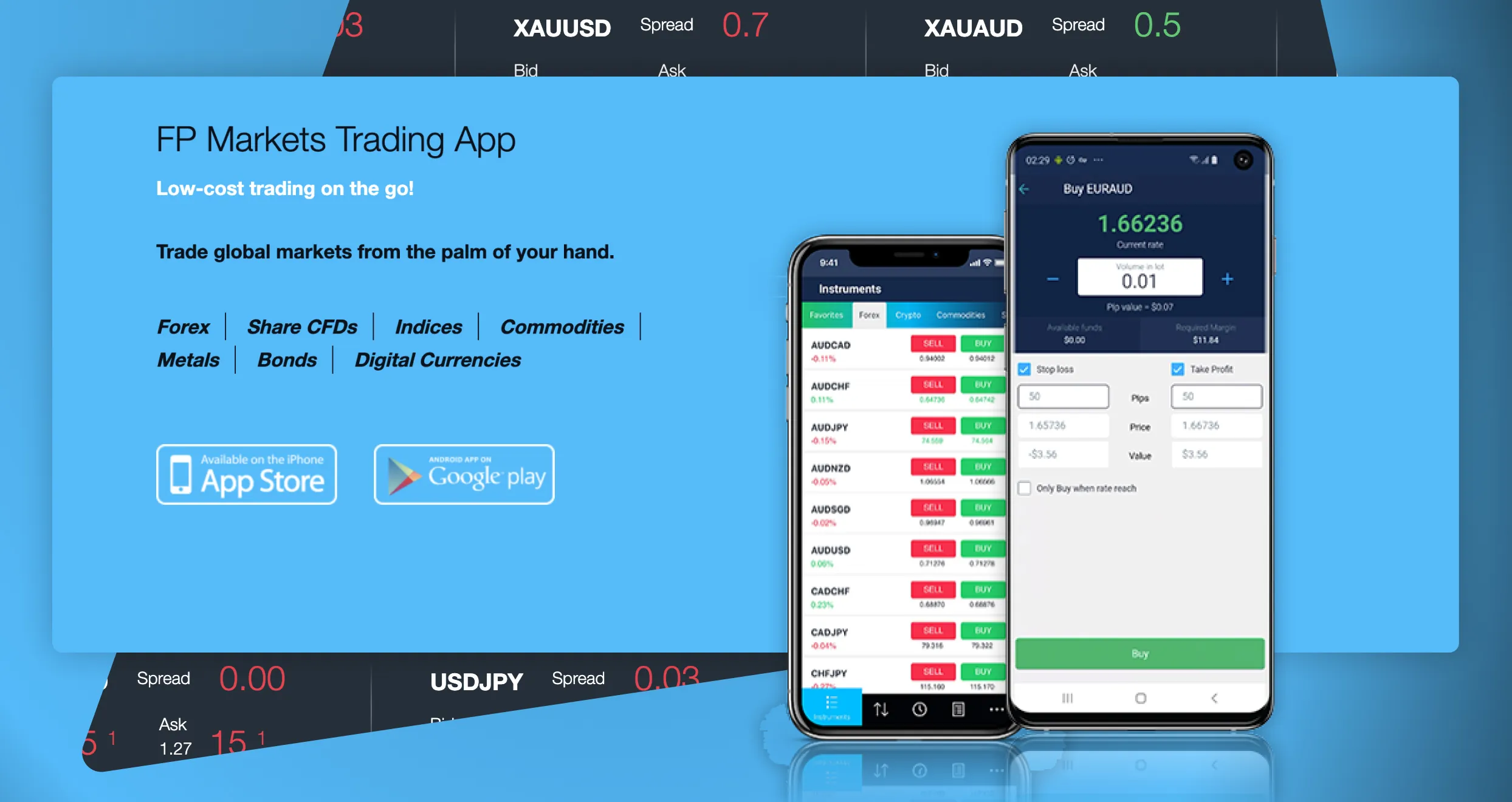

We also tested FP Markets and found it to be a considerable choice for stock traders in South Africa, particularly those excelling in CFD trading. Offering over 10,000 Australian and international share CFDs, stock CFDs, and indices across four continents, FP Markets stands as a comprehensive platform for CFD trades. Traders benefit from access to stock CFDs on the Iress and MT5 platforms, along with a diverse range of securities, including forex, commodities, ETFs, and more, facilitating portfolio diversification.

Notably, FP Markets’ Iress platform introduces an exceptional Direct Market Access (DMA) execution for stock trading, enhancing the precision of trades. The unique feature of earning dividends on long positions without physical ownership of shares further sets FP Markets apart. The platform’s unwavering 24/7 support service via phone, email, and live chat adds to the overall user experience. For these standout features and more, FP Markets’ app earns a well-deserved 5-star rating.

Pros

- Plenty of shares to trade

- Low minimum deposit requirement with free transactions

- Quality learning and research materials

- Features a social trading platform that allows users to connect, share various trading ideas, and copy potentially profitable positions

Cons

- FP Markets does not allow traders to buy and take full ownership of the listed stocks. You can only trade them as CFDs

- No price plans

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

5. AvaTrade – Best Broker For Trading Cryptocurrency in South Africa

Comparing it to others, we believe AvaTrade is the best broker for cryptocurrency trading in South Africa. AvaTrade’s commission-free cryptocurrency trading, coupled with low spreads, provides a cost-effective solution for traders. With a minimum deposit of $100 and free transactions, the broker caters to various budget levels. However, traders should be mindful of a $50 per quarter inactivity fee after three months of account dormancy.

We like AvaTrade’s AvaSocial feature, which fosters trader interactions, thus maximising the potential for success. Novice traders can hone their skills through the platform’s demo account before venturing into live markets. AvaTrade’s compatibility with the powerful MT4 and MT5 platforms introduces advanced features like automated trading and algorithmic tools for an enriched trading experience. The AvaTradeGO app further enables on-the-go cryptocurrency trading. With an extensive array of features and a commitment to user-friendly trading, AvaTrade rightfully earns a 5-star rating from us.

Pros

- Low spreads for cryptocurrency trading

- Features award-winning social and copy trading platforms

- Advanced MetaTrader platforms to maximise your potential

- Low minimum deposit requirement

Cons

- Inactivity fee applies after three months only

- Only five days a week support service

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

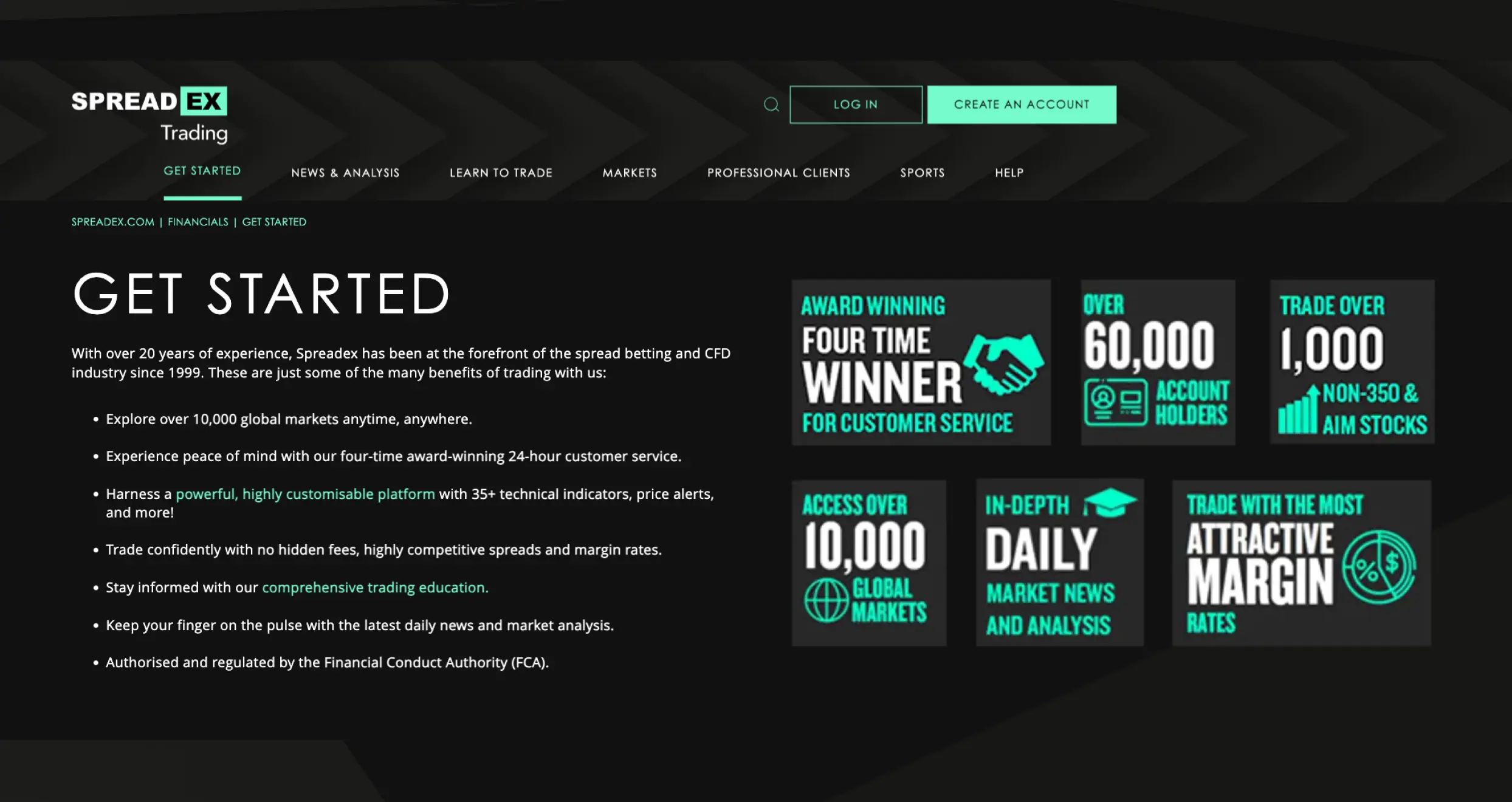

6. Spreadex – Beginner-Friendly Broker in South Africa

From our extensive testing and professional experience, Spreadex has proven to be a beginner-friendly broker in South Africa. With no minimum deposit requirement, Spreadex empowers newcomers to venture into online trading with affordability and flexibility. The best part is that Spreadex lists numerous asset offerings, including forex, shares, commodities, ETFs, and more. All these are available to trades with fees as low as 0.6 points.

Spreadex’s platform, marked by user-friendliness and customisation options, enhances the learning curve for novice traders. We found abundant learning resources on this broker’s platform, including guides and articles, which contribute to a robust foundation for skill development. Although there is no demo account at Spreadex, its support service is one of the most reliable. We can assure beginners of quality assistance that will encourage you to dive straight into the financial market. Our experience deems Spreadex deserving of a 4.5-star rating.

Pros

- A user-friendly and modern design trading app

- No minimum deposit requirement

- Low trading fees

- Allows social trading on the TradingView platform

Cons

- Limited research resources compared to its peers

- No demo account

From our assessment of Spreadex’s fees, we concluded that this broker offers one of the most cost-friendly platforms. Why? For starters, Spreadex has $0 minimum deposit requirements. That means you can deposit whatever you can afford and start trading immediately. Moreover, while funding your account, you won’t have to pay any deposit fees – it’s free! The same applies to withdrawals.

That is exceptional news since Spreadex supports myriad payment methods, from debit and credit cards to Apple Pay and Easy Bank Transfer. You can use these options without fretting over any charges undermining your profits.

We also recommend Spreadex because this broker doesn’t penalize dormant accounts. Your Spreadex trading account can remain inactive for an extended period without attracting inactivity fees, which separates this company from its peers.

Spreadex offers exceptional rates on spreads. This broker’s spreads start from 0.6 pips for CFD trading. This trading broker should be your go-to if you want lower overall trading costs and improved profit margins.

That said, Spreadex charges overnight funding for shares rolling positions. If you keep a position open through the close of the relevant exchange, Spreadex will keep it open for the following day’s trading. But that will attract a funding adjustment. The fees you’ll incur at any given time will be a combination of the Adjusted ARR and Spreadex’s charges. However, holding futures overnight won’t attract any charges.

7. FxPro – Best Forex Broker in South Africa

FxPro emerges as the epitome of excellence for forex trading in South Africa, catering to traders of all levels. We like its user-friendly features, which we believe make it accessible for beginners. FxPro also seamlessly executes trades with speed and reliability, ensuring a convenient trading experience anytime, anywhere. Plus, we traded over 70 currency pairs across multiple platforms, including cTrader, MT4, and MT5. It’s a no-brainer that FxPro stands as a comprehensive solution for diverse trading preferences.

Beyond its technical capabilities, we noticed that this broker provides ample learning resources for traders to expand their trading knowledge. As a No Dealing Desk forex broker, FxPro grants direct access to interbank markets, distinguishing itself in the industry. The broker is commission-free and has a $100 minimum deposit requirement. This makes it stand as a low-risk yet high-quality forex trading broker in South Africa. As a result, it earns our strong recommendation and a 4.5-star rating.

Pros

- Low minimum deposit requirement

- Reliable support service via multiple channels

- Quality learning resources

- A minimum deposit requirement of $100

Cons

- Research materials are limited

- Limited asset offerings compared to some of its peers

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

8. Interactive Brokers – Overall Best Broker in South Africa

For those seeking the epitome of excellence in South African trading, Interactive Brokers (IBKR) stands out as the overall best broker. Tailored for newbies and professional traders, it distinguishes itself with an outstanding broker listing thousands of securities across various asset classes. We also like the broker’s ability to eliminate the minimum deposit requirement. This allows for seamless entry into the financial space, especially for traders who are sceptical of trading with a lot of money.

While we find IBKR’s desktop platform challenging for newbies to use, the broker has a GlobalTrader mobile app with user-friendly functionality. There is also a $1,000,000 virtually funded demo account for risk-free trades before transitioning to the live trading account. However, note that IBKR’s demo account has a 30-day expiration period, so utilise it while it lasts. From our analysis, Interactive Brokers check most of the boxes on our list, thus earning a 5-star rating from us.

Pros

- No account minimum requirement

- Excellent research resources

- $1,000,000 virtual funds to trade with

- A highly secured and FSCA-regulated broker

Cons

- A challenging platform for newbies to navigate

- Paper trading expires after 30 days

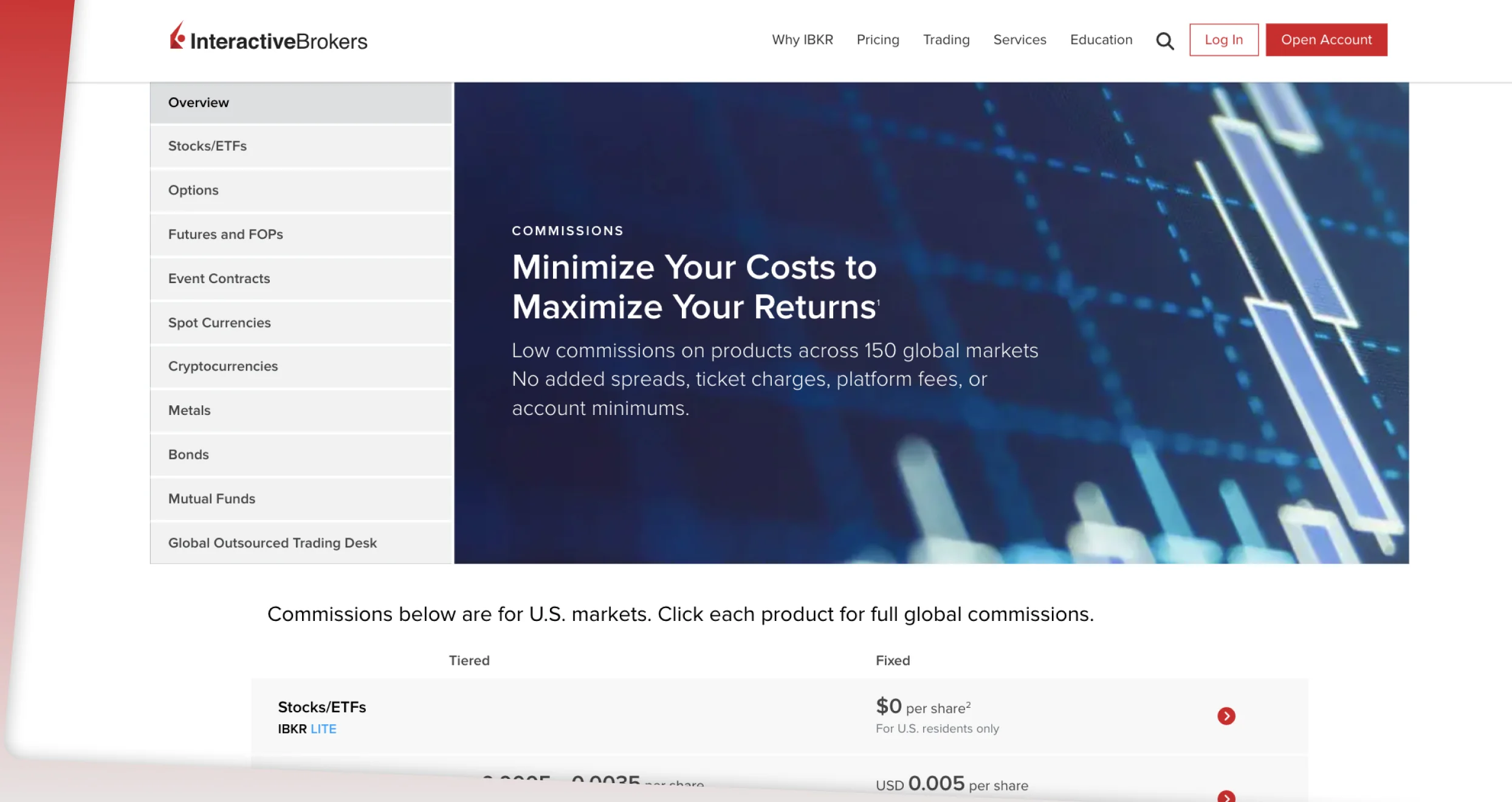

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

How to Start Trading in South Africa

Trading in South Africa can be a seamless and rewarding experience when approached with the right procedure. Understanding the assets you plan to trade is fundamental. Leverage brokers’ learning resources, dive into informative YouTube videos, and tune into online podcasts to familiarise yourself with market intricacies. This initial investment in knowledge will serve as a solid foundation for your trading endeavours.

Once armed with knowledge, identify the best broker from our above recommendations list. Then, follow the step-by-step guidelines below to initiate your trading venture in South Africa.

Begin by navigating to the website of the chosen broker. This is your gateway to a world of trading opportunities. Familiarise yourself with the interface, explore available tools, and understand the layout of the platform. A user-friendly website enhances your overall trading experience. You must also agree with the broker’s terms and conditions and install its trading app for on-the-go trading experience.

Register on the broker’s platform by providing necessary personal details. Ensure accuracy, as these details will be used for account verification and secure communication. Most brokers will ask for standard information such as your name, contact details, financial information, and more. Creating a strong and secure password is also essential to protect your account.

Comply with the FSCA-regulated broker’s verification process. This step ensures security and regulatory adherence. Brokers often require documentation, such as a copy of your ID or passport, to verify your identity and proof of address, like a utility bill or bank statement. This step is crucial in maintaining a secure trading environment and protecting both your funds and the integrity of the financial system in South Africa.

After successfully creating and verifying your account, the next step is to fund it per your broker’s minimum deposit requirement. Most brokers offer various payment methods, including bank transfers, credit/debit cards, and e-wallets. Choose the method that suits you best and deposit the desired amount into your trading account. This deposit serves as your trading capital.

With a verified and funded account, you are ready to dive into the exciting world of online trading. Utilise the knowledge acquired and apply strategic approaches to make informed decisions. Start with a small investment and gradually increase your exposure as you gain experience and confidence in your trading strategy. Most importantly, keep a close eye on market trends, economic indicators, and news that may impact your chosen assets.

You should also remember that there are various ways to trade in South Africa. So, whether you prefer buying and taking full ownership of an asset or trading it as CFDs or indices. In this case, ensure you fully understand your chosen trading method for maximum experience.

How to Choose the Right Broker for Trading in South Africa

Managing your trading activities effectively in South Africa hinges on selecting the right stock trading app. Whether you choose a broker from our recommendations list above or conduct your own research, the goal should be identifying the ones with features suitable for your trading requirements. To make an informed decision, consider the following key factors.

Regulatory oversight is critical for the safety of your trading funds. Therefore, choose a stock trading app regulated by the Financial Sector Conduct Authority (FSCA) to ensure compliance with industry standards and a secure trading environment. Your broker should also be highly encrypted to guarantee your personal information security.

Obviously, you want a broker featuring the right assets that will give you an exciting experience. These can be forex, stocks, commodities, cryptocurrencies, ETFs, and more. Having a broker with additional trading instruments is a plus. This is because you can try new options in your free time and easily diversify your portfolio without seeking another broker.

Understand the fee structure of each broker, whether through commissions/spreads or non-trading costs like deposits and withdrawals. Note that different stock trading apps in South Africa have varying charges. So carefully assess how these fees align with your budget to avoid any negative impact on your overall trading capabilities.

A broker’s trading platform is your gateway to the market. Therefore, choose an app with a user-friendly interface to streamline your trading experience. Also, look for platforms that cater to your skill level, offering essential trading tools, insightful research materials, and demo accounts to assist in refining your strategies.

Deposits and withdrawals are integral aspects of trading in South Africa. So, ensure the broker you choose supports a range of convenient payment methods, from debit and credit cards to e-wallets and bank transfers. This minimises the need for currency exchanges that can be costly and time-consuming. With the best deposit and withdrawal methods, you will efficiently transact and focus on strategy development for your next trade.

Trading can present challenges, and responsive customer service is crucial. As a trader, prioritise brokers with reliable customer support to swiftly address concerns or issues. Confirm their availability and assess whether it aligns with your trading schedule.

South Africa Regulation

In South Africa, navigating the financial landscape requires a keen understanding of the regulatory framework overseen by the Financial Sector Conduct Authority (FSCA). As a cornerstone of financial oversight, the FSCA plays a crucial role in ensuring the stability and integrity of South Africa’s financial markets.

For individuals engaged in trading activities, particularly through online platforms and brokers in South Africa, compliance with FSCA regulations is not merely a legal requirement but a fundamental step toward accessing a secure and transparent trading environment. Brokerage firms operating in the country must be duly authorised and regulated by the FSCA, aligning with industry standards to provide traders with a trustworthy platform for their financial endeavours.

Beyond authorisation, the FSCA actively promotes investor protection, market conduct, and ethical practices within the financial sector. Its regulations are designed to safeguard traders’ funds, foster fair market practices, and uphold transparency throughout financial transactions. The authority also places a strong emphasis on consumer education, encouraging traders and investors to stay informed about market dynamics, risks, and potential rewards.

Through rigorous monitoring and supervision, the FSCA enforces compliance with regulations, contributing to a high level of accountability within the financial industry. Operating within this regulatory framework is not just a legal obligation but a commitment to maintaining the overall integrity and stability of South Africa’s financial markets.

Conclusion

Before trading in South Africa, it’s crucial to acknowledge the inherent risks in the financial market. However, with the right broker and a well-crafted strategy, these risks can be effectively managed, maximising your chances of success. Opt for reputable brokers, as highlighted in our guide, ensuring regulatory compliance and reliability.

Implementing robust risk controls is also paramount. Set clear limits on investment amounts and embrace stop-loss orders to safeguard your capital. For beginners, the journey begins with a risk-free exploration through demo accounts. These platforms offer a secure environment to hone your skills, understand market dynamics, and develop confidence without exposing your funds to potential losses. Remember, in the volatile world of trading, knowledge and precautionary measures are your allies on the path to financial success.

I like Interactive Brokers for its wide range of assets and research tools, but it can be a bit tricky to use at first.

I’ve found that sticking to a clear strategy and using reliable tools makes all the difference in managing risk. It’s easy to get distracted by hype, but consistency is key for long-term success.