Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

As a Nigerian, you have access to countless online stock brokers. These entities allow you to open a new account and trade or invest in stocks. But you shouldn’t pick the first broker you encounter. We advise you to choose carefully since some platforms are either sub-standard or downright fraudulent.

We understand that vetting the stock brokers in Nigeria is an immense task since many are up and running today. We’d like to make things easier for you and streamline the process. Our team has done the legwork by testing for you testing and analyzing top service providers. After spending countless hours, we have hand-picked 5 of the best and reviewed them in our guide.

In a Nutshell

- Most of the best stock brokers in Nigeria support CFD trading. However, a few also allow their customers to invest in real stocks.

- In our opinion, the best stock traders in Nigeria include OANDA, FP Markets, Pepperstone, AvaTrade, and FxPro.

- Each recommended stock broker has its strengths and weaknesses. Choose carefully to ensure you sign up with a platform that aligns with your goals and needs.

- Remember, the best broker in Nigeria must be licensed or regulated by the Securities and Exchange Commission (SEC). It must also be authorized by other reputable international regulators.

- Before diving into stock trading or investing, remember these activities are risky. Don’t risk what you can’t afford to lose.

- All the stock brokers recommended here were tested and evaluated by Invezty’ skilled and experienced experts. Our opinions are based on first-hand experience and verified information.

List of the Best Stock Brokers in Nigeria

- Pepperstone – Best Stock Broker for Mobile Trading

- AvaTrade – Best Stock Broker for Copy Trading

- OANDA – Overall Best Stock Broker

- FP Markets – Best Broker for Stock CFDs

- FxPro – Best Stock Broker for Advanced Traders

Compare Stock Brokers in NG

Thousands of international stock brokers are up and running today, and many of them accept Nigerian traders. Having said that, we’ve been in the financial industry long enough to know that not all brokers have your best interests at heart. For that reason, our team went on a fact-finding mission with one objective: to find the most credible and reliable stockbroker for you.

We conducted extensive research and vetted hundreds of stock brokers. Finally, our team narrowed down the best options and compared them against each other. We then picked 5 based on different factors, including regulatory status, reputation, product offerings, and customer support. These are the crème de la crème, and we highly recommend them.

Before we dive into our list, please note that our reviews are unbiased. We’ve tailored them to be informative and factual. Every aspect we’ve discussed here is based on first-hand experience, thorough assessment, and honesty. What’s more, we’ve compared our discoveries with online testimonials left by real-life traders like yourself. So, rest assured that we aim to guide you toward the best brokers in Nigeria.

With that in mind, we’ve prepared the following comparison table to help you understand what makes our top stocker outstanding.

| Best Stock Broker Nigeria | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | SEC, FCA, ASIC, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Flutterwave, Skrill, PayPal | Yes |

| AvaTrade | SEC, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, FSCA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| OANDA | SEC, B.V.I FSC, FCA, CySEC, ASIC | 24/5 | MT4, MT5, fxTrade App | Credit/debit cards, Bank/wire transfer, Skrill, Neteller | Yes |

| FP Markets | SEC, ASIC, CMA, CySEC, FSCA, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| FxPro | SEC, FCA, FSCA, SCB | 24/7 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Bank wire transfers, Credit/debit cards, Neteller, PayPal, Skrill | Yes |

Platforms Overview

Besides what’s listed above, we also assessed every broker’s minimum deposit requirement, fees, and commissions. We aim to help you find a platform that’s not only affordable but also offers all the assets you need to build and diversify your portfolio.

The comparison table below will introduce you to the fees and assets we identified while evaluating the best stockbrokers in Nigeria.

Fees

| Best Stock Broker Nigeria | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Fee | $0 |

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of non-use |

| OANDA | $0 | From 0.8 pips | $20 withdrawal fee | $10 monthly fee, kicks in after 12 months of inactivity |

| FP Markets | $100 | From 0.0 pips | Free | $0 |

| FxPro | $100 | From $3.50 per lot | Free | $0 |

Assets

| Best Stock Broker Nigeria | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | No | No |

Our Opinion about the Best Stock Brokers in Nigeria

Let’s review the best stockbrokers in Nigeria in detail. To reiterate, we conducted multiple tests and thorough research, so everything we’ve discussed is accurate and up-to-date. Moreover, our team tested these brokers with both live and demo accounts. Our recommendations and reservations are based on first-hand experience.

1. Pepperstone – Best Stock Broker for Mobile Trading

We had a wonderful time assessing and trading with Pepperstone. The main reason we have included this broker on our list is it focuses on enabling traders to trade wherever they are. You can access all the platforms that this broker offers using your iPhone or Android device, including MT4/5, cTrader, and TradingView. What’s more, you can download Pepperstone’s dedicated app or trade using your browser.

Pepperstone’s designated app supports click-trading, an indispensable tool that simplifies the trading process and allows you to focus on strategizing and market analysis. With the app, you can switch between charts quickly, trade on live streaming prices, and manage positions in real time.

Not to forget, Pepperstone’s mobile platform has diverse UK, US, German, and AU CFD shares. These come with commissions as low as 0.07% and free deposits and withdrawals.

Pros

- Low commissions starting from 0.07% for share CFDs

- Dedicated support representatives are available 24/7

- Free deposits and withdrawals

- Zero inactivity fees

- Top-notch trading platforms like MT4/5 and cTrader

- No minimum deposit requirement

Cons

- Only CFDs available

- Limited product range

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. AvaTrade – Best Stock Broker for Copy Trading

Copy trading enables you to copy more knowledgeable stock traders and benefit in the process, even with limited knowledge. If you’d like to use this hack to take your experience to the next level, sign up with AvaTrade in Nigeria.

We consider AvaTrade the best platform for Nigerian copy traders for several reasons. First, this broker allows you to connect the AvaTrade site with ZuluTrade and automate copy trading. Most importantly, as an AvaTrade client, you get uncapped access to AvaSocial. While using this platform, you can use insights from expert traders to make the best investment decisions and conquer the market.

AvaTrade supports countless popular stock CFDs and lets you access major exchanges like FTSE, NYSE, and US Tech100. When trading CFD shares on this platform, you get flexible leverages of up to 20:1 and world-class educational resources. You also get access to a myriad of powerful trading platforms besides AvaSocial, including MT4, MT5, and the AvaTradeGO mobile app.

Pros

- Top-quality educational tools and materials

- Free deposits and withdrawals

- Knowledgeable support available 24/5

- Provides powerful trading platforms like MT4 and MT5

- Exceptional research tools

Cons

- Only CFDs available

- Higher inactivity fees than its peers

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

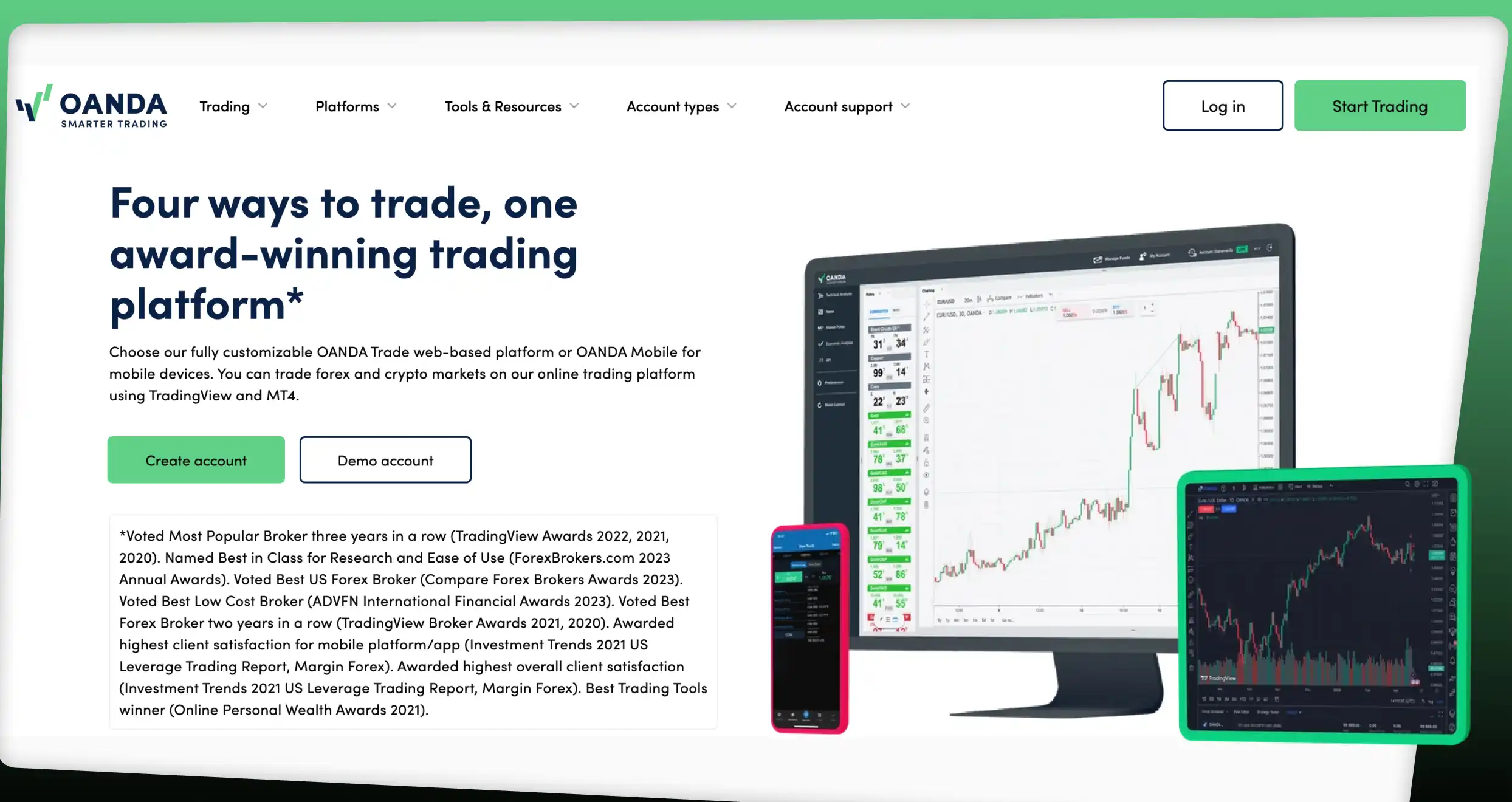

3. OANDA – Overall Best Broker

OANDA is at the very top of our lists for good reasons. We tested this platform, and the first thing that caught our eye was what it offers. OANDA has over 2,200 shares from different regions, including France, Germany, Britain, and Spain. The best part is that this broker allows traders to trade share CFDs and invest in real shares.

Thanks to OANDA, you can invest in real shares from the US commission-free. And when investing with investment platform NG in the European shares market you get to enjoy commissions as low as 0.15%. Countless real shares are available on this platform, including stocks from popular companies like Tesla, Netflix, and Starbucks. Besides buying and owning shares, you can trade 1600+ share CFDs on OANDA.

We also hold OANDA in high regard because this broker has a wide array of trading platforms. They range from OANDA’s dedicated mobile app to TradingView and MetaTrader. What’s more, this platform allows new customers to start trading and investing with whatever they can afford and enjoy zero deposit fees.

Pros

- Real stocks and CFD shares are available

- No minimum deposit requirement

- Reasonable spreads starting from 0.8 pips

- Proprietary and third-party trading platforms available

- Excellent customer support

- Free deposits

Cons

- Withdrawals attract a $20 fee

- $10 inactivity fees

When testing OANDA, we opened a live account and funded it. We didn’t encounter any OANDA minimum deposit requirements, which was a good thing. That allowed us to start with a few dollars. While preparing to fund our account, we noticed that this broker doesn’t charge deposit fees for cash transfers, credit cards, and debit cards. The same applies to e-wallets like Neteller, Skrill, and Wise. But withdrawals aren’t entirely free.

OANDA allows traders to make one free withdrawal per month to their debit or credit cards. Anyone who exceeds this threshold has to pay. The exact fees vary depending on account currency. On the other hand, all bank-related withdrawals incur charges. The fees you’ll pay while using a bank to withdraw funds from OANDA depend on the number of bank withdrawal transactions you’ve made in that calendar month and account currency.

We also noticed that OANDA has overtime financing charges. If you keep a position open after a trading day has ended, OANDA assumes you’ve held it overnight and either credits or charges your account. Visit OANDA’s Financing Costs page to learn more.

Lastly, OANDA charges a $10 monthly inactivity fee on accounts that have been dormant for 12 or more months. If OANDA deems your account legible for inactivity fees, the broker will levy it until you terminate the account, resume trading, or deplete your account balance.

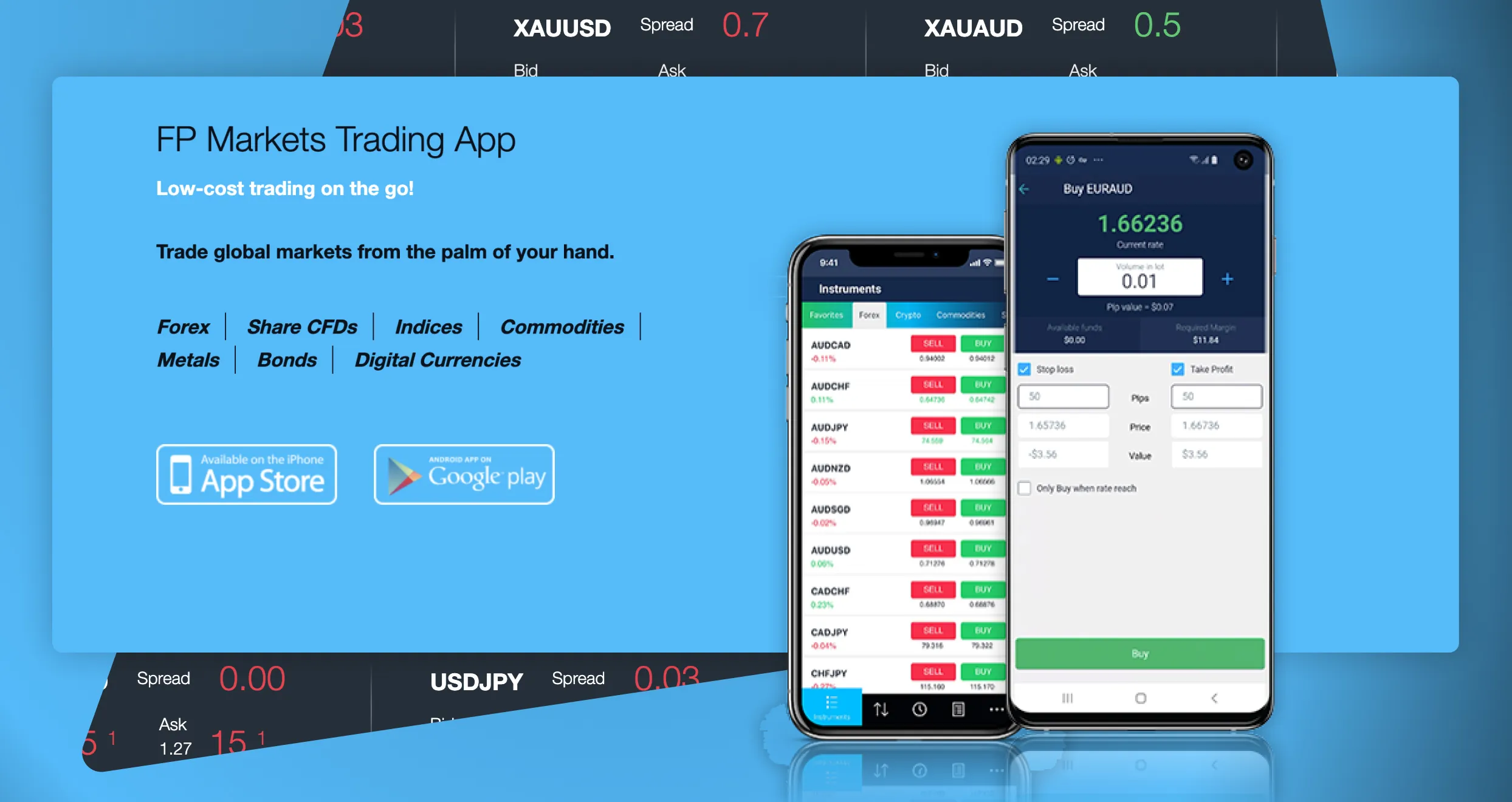

4. FP Markets – Best Broker for Stock CFDs

If you’d like to profit from stocks without buying and owning the underlying assets, trade CFD shares with FP Markets. We highly recommend this broker because it offers a broad range of tradeable CFDs on stocks from different global markets, including Paris, London, New York, and Hong Kong.

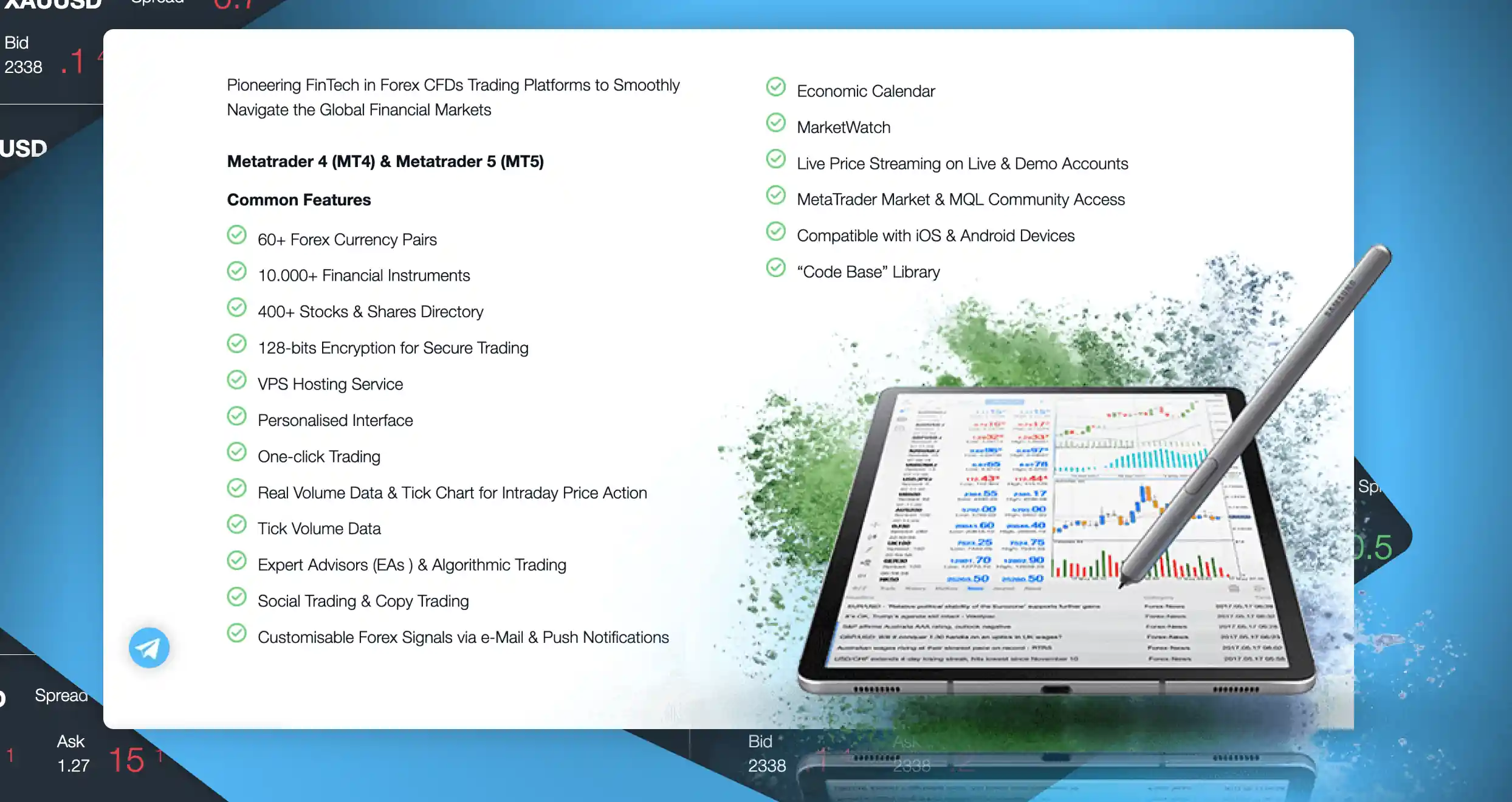

While evaluating FP Markets, we also discovered that this broker allows CFD stock traders to use MetaTrader 5 and Iress. The former supports 1000+ stocks, but Iress has over 10,000 instruments. What’s more, Iress comes with Direct Market Access, which lets you access the order books of exchanges.

Trading stock CFDs with FP Markets also helps you cut costs. This broker has zero deposit, withdrawal, and inactivity fees. Furthermore, its spread starts at 0.0 pips.

Pros

- Over 10,000 share CFDs available

- Tight spreads starting from 0.0 pips

- Free deposits and withdrawals

- No inactivity fees

- Advanced trading platforms available

- 24/7 customer support

Cons

- Only CFDs are available

- Below-average educational content

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

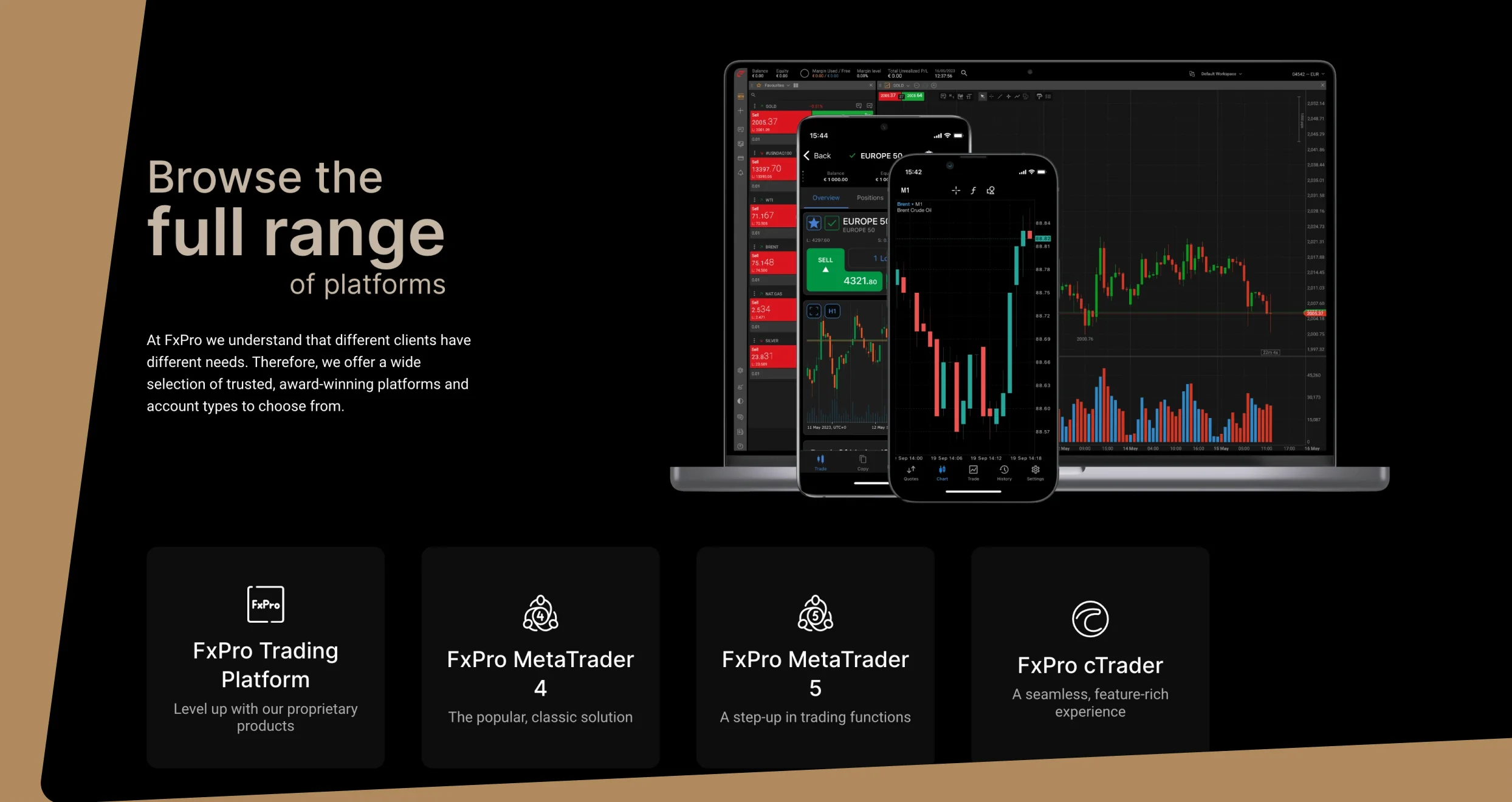

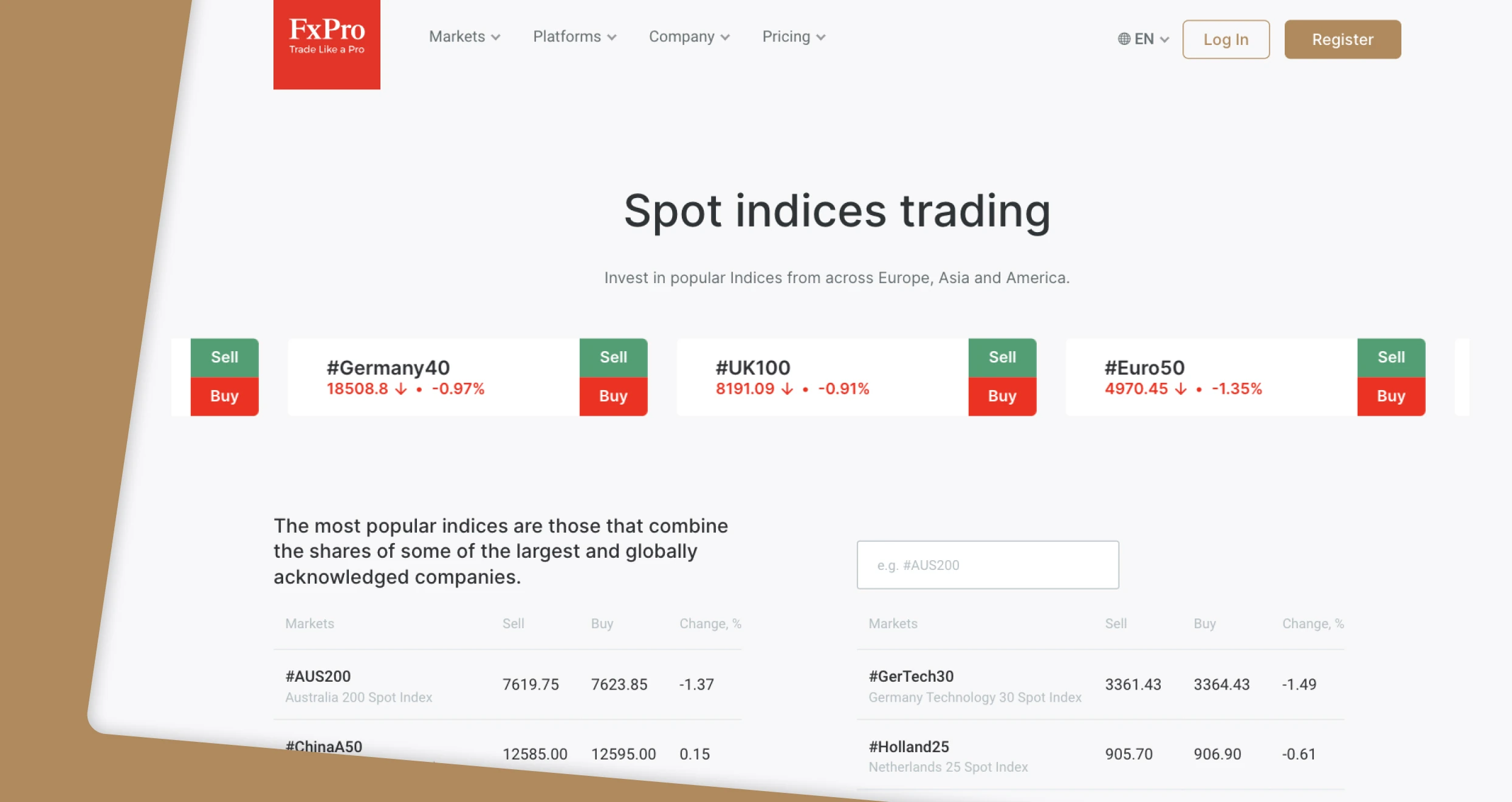

5. FxPro – Best Stock Broker for Advanced Traders

We consider FxPro as the best broker for advanced Nigerian traders, and right so. The first thing we noticed when we opened this broker’s site was its immaculate design. Everything is incredibly easy to find. What’s more, FxPro has provided a long list of top-shelf trading platforms, from the proprietary FxPro WebTrader to cTrader and MetaTrader 4/5. These platforms come with a wide variety of advanced technical indicators, charting tools, and more.

As a pro, you can trade thousands of CFD shares on FxPro, leverage competitive trading conditions, and enjoy super-fast order execution. This broker supports CFDs on stocks from all over the world, including Europe, the UK, and the US. What’s more, it helps you to increase your profit margins through free deposits and withdrawals.

Pros

- A rich selection of advanced trading platforms, including cTrader and MT5

- Zero deposit, withdrawal, and inactivity fees

- Skilled support technicians are available 24/7

- Competitive spreads, starting from $3.50 per lot

- User-friendly, well-designed interface

Cons

- Only CFDs are available

- Limited educational resources

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Stock Trading in Nigeria

Before proceeding, note that the outstanding brokers we’ve reviewed here are governed by the Securities Exchange Commission (SEC) in Nigeria. Therefore, rest assured they adhere to regulations and mandates set by the SEC to protect you as a trader or investor.

That said, hundreds of online stock brokers accept traders from Nigeria. That is a good thing since it gives you the opportunity to choose a platform that aligns with your needs and preferences. Sadly, it makes picking an ideal broker time-consuming and frustrating. Moreover, it increases your odds of signing up with an unfitting platform and regretting it in the future.

But not all is lost. The tips we’ve outlined below should help you pick the best stockbroker for you and register a live account within no time.

How to Choose the Right Stock Broker in NG

When choosing a suitable stockbroker, consider the following factors:

A secure broker should be licensed and regulated by multiple authorities, including the SEC. It should also use the best technologies and protocols to guarantee your security, from SSL encryption to 2FA and biometric identification. Avoid platforms with questionable security since they expose you to issues like identity theft and financial losses.

Before registering with a specific broker, check if it offers your preferred assets. Don’t skip that because you might not find what you need. Furthermore, prioritize joining a platform with a wide variety of instruments since they will prove indispensable during portfolio diversification.

Affordability is crucial to a trader. That said, check every stock broker’s account and trading fees. Keep an eye out for spreads, commissions, and account maintenance charges. Most importantly, scrutinize every detail to ensure there are no hidden costs that will reduce your profit margins in the future.

Test every platform before signing up with a specific stock broker. Ensure the available platforms have clear, intuitive, and user-friendly interfaces. Moreover, check if the platforms come with features you need to succeed while trading stocks, like quality research and charting tools.

Before committing to a specific broker, go online and peruse through past user reviews and testimonials published on popular sites like Trustpilot. Be on the lookout for common themes based on specific strengths and weaknesses. If possible, you should also gauge the broker’s reputation on popular financial communities and forums.

To ensure you get timely assistance when you need it most, factor in customer support while choosing a suitable broker. Note that different companies have different policies. For instance, some offer support 24/5. If you prefer trading on the weekend, joining such brokers is inadvisable since if you encounter any issues, you won’t get prompt assistance.

How To Register an Account with a Stock Broker NG

Supposing you are new to stock trading, you might be wondering how you can open an account. The good news is the outstanding brokers covered here have simple application processes. However, note that they require you to provide factual information and relevant documents. If you don’t do that, these companies will reject your application or prevent you from trading in the future.

With that in mind, follow these steps to open a new stock trading account in Nigeria:

Signing up through a broker’s official site is the key to avoiding issues like fraud and data theft. Once you’re on the verified platform, read all terms and conditions. Don’t proceed if you don’t agree with the stipulated T&Cs. Also, if you prefer trading on the go, check if the broker has a dedicated app and download it.

If you’re ready to sign up, hit the registration button. Since most regulated stock brokers have KYC requirements, you will have to provide personal details like your full name, home address, phone number, email, and income status. Ensure the information you share is accurate and valid.

A regulated broker should ask for documents that prove your identity and location. You can use your driver’s license, passport, or ID for identity verification. On the other hand, to verify your identity, you have to submit a document that proves your address, like a bank statement or utility bill. Note that the exact documents that you’ll be required to submit will depend on your preferred broker.

Check which payment methods the broker supports and pick a fitting one. Before funding your trading account, check if the platform has a minimum deposit requirement. The good news is that the best stock brokers support instant deposits. So, if you join an excellent platform, you’ll have access to your funds in no time.

After funding your account, pick an instrument and start trading. If you’re a beginner, we advise you to trade with smaller sums and increase your stake with time. Most importantly, remember financial losses are part of stock trading. Don’t trade with money you can’t afford to lose.

Conclusion

Our guide has introduced you to what we consider the best stock brokers in Nigeria. It’s now your turn to choose a provider that matches your goals, needs, and preferences. We remind you to consider factors like supported assets, trading platforms, and fees while picking an ideal stockbroker.

And before you start trading stocks in Nigeria, familiarize yourself with the risks associated with this venture. Furthermore, look for strategies and recommended practices for minimizing losses and maximizing returns.

I found AvaTrade a bit challenging to navigate, especially with its copy trading feature

I’ve been comparing brokers for a week now. Does OANDA actually let you buy real stocks in Nigeria or is it just CFDs like the others? I don’t want to get hit with hidden fees later.