Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Matt Murphie’s brainchild, FP Markets, was founded in 2005 in Sydney, Australia. This forex and CFD broker platform is headquartered in Australia and serves global traders, including those in the UK, Seychelles, South Africa, and more. It gives thousands of traders uncapped access to diverse financial instruments, from currency pairs to stock CFDs.

FP Market’s popularity and reputation encouraged us to vet its performance. We tested it rigorously and scoured platforms like Trustpilot for user testimonials. After extensive evaluation, we have prepared this FP Markets review, which details our findings and opinions.

Why FP Markets

As seasoned trading experts, we highly recommend FP Markets. Based on our exploration, FP Markets is an excellent broker since it adheres to mandates from FSA, ASIC, and other noteworthy authorities. The platform also supports world-class trading platforms, including MT4, MT5, and cTrade.

Here’s a brief list of the pros and cons we discovered while vetting FP Markets. Use them to determine if this broker aligns with your trading needs and preferences.

Pros

- Spreads as low as 0.6 pips

- An extensive array of trading platforms

- Free deposits and withdrawals

- No inactivity fees

- Excellent customer support

Cons

- Only offers investor compensation in Cyprus

- The broker is unavailable in many regions, including the US, Afghanistan, Iran, Palestine, and the Russian Federation

Security

Before handing over our information and funds to broker FP Markets, we evaluated the broker’s security standards, and they didn’t disappoint. The first thing that our team noticed is that this company keeps trader funds in AA-rated Australian banks. These instructions adhere to strict regulatory standards and boast impeccable financial health.

Moreover, the AA-rated Australian banks enable FP Markets to segregate client funds. So, while using this platform, rest assured that your money will be safe and separate from the broker’s operational funds. This company will never use your funds to cover operational costs.

While signing up for an account, FP Markets will ask you to share personal details, including your name, address, and contact details. In the hands of malicious actors, such information can turn your life into a living hell. Luckily, FP Markets uses top-tier encryption protocols to secure your data from cybercriminals. This broker also employs continuous monitoring, which enables its security systems and technicians to identify and address suspicious activities before they escalate.

FP Markets also protects retail trader accounts with negative balance protection. This feature ensures you never lose more money than you’ve deposited in your account. That way, if you go on a losing streak, the situation won’t escalate to a point where you owe your broker money. Note that FP Markets offers negative balance protection to traders in specific jurisdictions, such as the UK and Canada.

We can’t fail to mention FP Market’s compensation scheme. As of 2025, First Prudential Markets Ltd, FP Market’s CySEC-regulated EU entity, offers its clients up to EUR 20,000 protection through its Investor Compensation Fund. This program is unavailable in other regions, including the US, the UK, and Australia.

Finally, FP Markets is licensed and regulated by the following recognized bodies:

- The Australian Securities and Investments Commission (ASIC), License No: 286354

- The Cyprus Securities and Exchange Commission (CySEC), License No: 371/18

- The Financial Sector Conduct Authority (FSCA), FSP Number 50926

- The Financial Services Authority (FSA), License No. SD 130

Platforms

FP Markets has a delectable site. It’s well-organized and easy to navigate. The site loads fast and displays crucial information, so you’ll know what you’re signing up for. We love it. That aside, this forex and CFD broker supports a variety of platforms, including:

- MetaTrader 4: FP Markets allows you to harness the power of advanced charting tools, real-time price charts, and next-gen technical indicators through MT4. We discovered multiple juicy features on this platform, from customizable interfaces to one-click trading and MT4’s trademark Expert Advisors (EAs). MT4 is available for MAC, Windows, Android, and IOS users.

- MetaTrader 5: If you need an advanced trading platform, try MT5 via FP Markets. You will enjoy a vast selection of top-notch features, including spreads starting at 0.00 to flexible leverages of up to 500:1. This platform also has an improved strategy tester, 8 order types, and 21 time frames.

- TradingView: This is one of FP Market’s newest incorporations. It offers advanced charting functionality and uncapped access to over 100,000 public indicators. You can use it to track and trade diverse global markets and assets, including forex, stocks, and commodities. While trading with it, you also get the opportunity to interact with a social community of fellow investors and traders.

- cTrader: The cTrader platform offers an advanced charting solution tailored for experienced professional traders. We were dazzled by this platform’s feature-rich charting applications and user-friendly interface.

- WebTrader: As the name suggests, this platform allows you to trade from your web browser, saving you from downloading a dedicated app. With it, you can reap the benefits of trading with MT4 or MT5. It has numerous delectable features, including an easy-to-use interface, leverage of up to 500:1, and multiple execution modes and order types.

- Mobile Trading App: The FP Markets Mobile Trading App allows you to trade on the go. This feature-packed app has everything you need to trade like a pro, including multiple tradable assets, technical indicators, and stop-loss/ take-profit limits. It’s compatible with most iOS devices and Android smartphones.

- Iress ViewPoint: This is a comprehensive platform for active traders. It has numerous advanced functionalities, including 59 technical indicators,50+ drawing tools, and customizable chart templates. You can also benefit immensely from the platform’s multiple timeframes, real-time price quotes, and flexible leverages of up to 20:1.

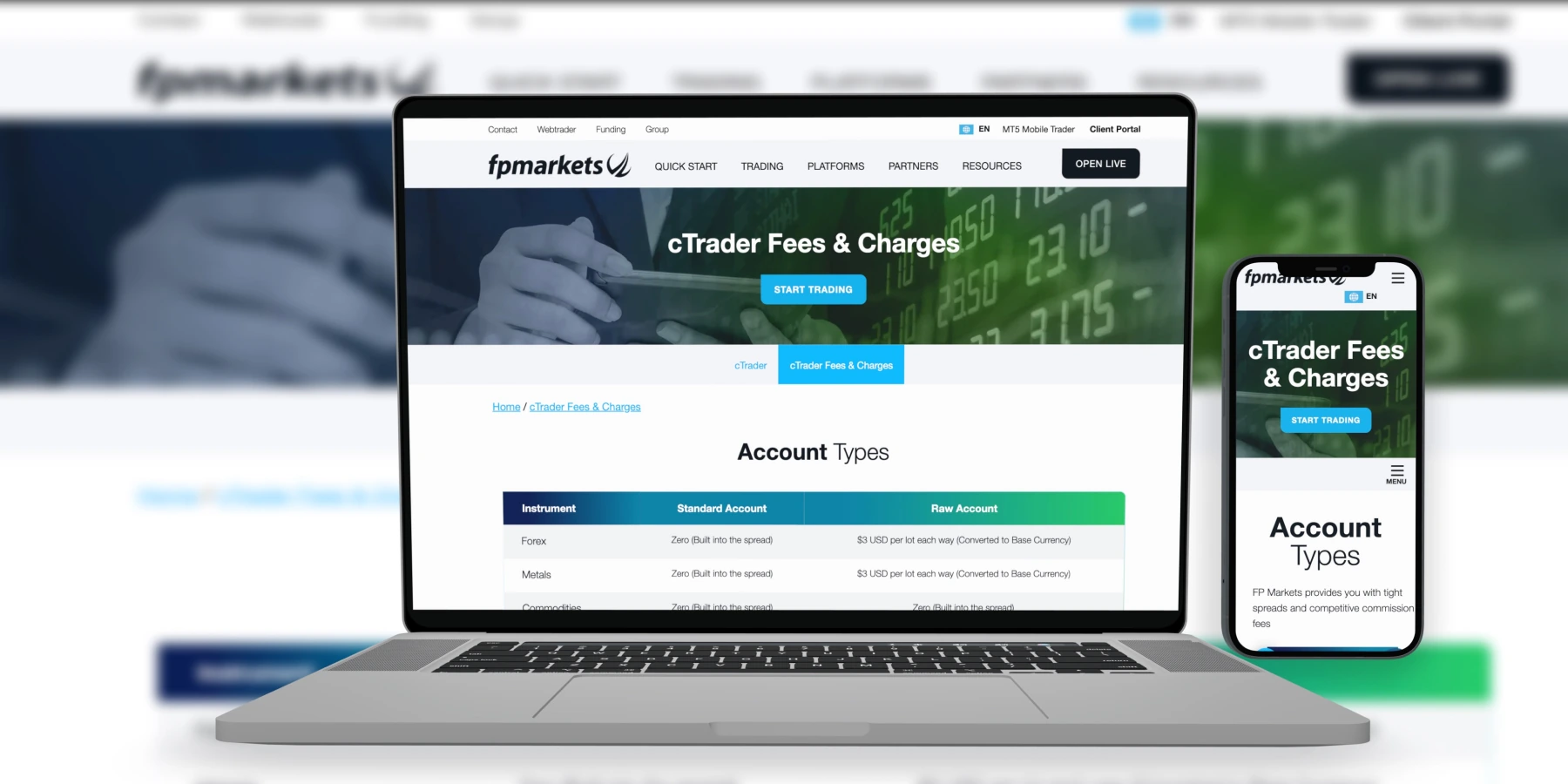

Fees

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

Product Offerings

FP Markets lets its clients pick their favorite assets from over 10,000 tradable instruments. This broker mainly deals with CFDs, which let you trade and capitalize on price movements in different markets. But you can also trade forex here.

Below is a comprehensive list of all FP Market’s product offerings:

- Forex: You can trade forex with FP Markets and access 70+ currency pairs, flexible leverages of up to 500:1, and minimum spreads of up to 0.0.

- Shares: FP Markets offers you the opportunity to trade 10,000+ Australian and international share CFDS. The share CFDs come from different markets, including London, Amsterdam, and Hong Kong.

- Metals: If you’d like to trade metal CFDs, try FP Markets. This broker gives you access to tradeable CFDs related to precious metals like gold, silver, and palladium.

- Indices: Various index CFDs are supported by FP Markets. They range from EUREX TO NASDAQ 100 and S&P 500.

- Commodities: FP Markets allows you to diversify your portfolio by trading commodities CFDs. You will get uncapped access to CFDs related to diverse commodities, including gold, silver, and oil.

- Cryptocurrencies: With an FP Markets account, you can trade crypto CFDs whenever you like. The platform supports popular digital currencies, including Bitcoin, Ripple (XRP), and Ethereum.

- Bonds: Bond trading is available on FP Markets. It’s a fitting option for traders who prefer dealing with lower-volatility markets.

- ETFs: The FP Markets trading platform offers a wide variety of ETFs, including ACWI, EEM, and QQQ.

Customer Service

FP Markets has multilingual customer support agents who are available 24/7. You can reach them through various means, including phone calls. We tried this option and highly recommend it since it facilitates prompt issue resolution.

The other options are live chat and email. Live chat is an excellent substitute for phone calls. All you have to do is fill out a form to chat with a live agent. The last alternative is email support, which is ideal for non-urgent inquiries requiring detailed explanations.

If you can’t use the listed channels, visit this platform’s FAQ section. FP Markets has provided detailed answers to numerous frequently asked questions on this page. You may find the information you need here.

How to Sign up For an Account at FP Markets

FP Markets doesn’t require new signees to jump through hoops. This broker’s registration process is quick and easy. We’ve outlined the process you should follow below. Please share valid information to avoid any complications that may undermine your ability to trade seamlessly on FP Markets in the future.

Visit FP Markets’ official site. We’ve shared links that you should use to access the website quickly and avoid fake sites pretending to be FP Markets. Check if the broker accepts clients from your region.

Click “Start Trading” or “Open Live.” Submit your personal information, including your email and password. You can also sign up with Google or Facebook. Ensure you create a strong password to prevent unauthorized access to your account. Please continue to complete the registration form with relevant information, including your date of birth, address, and financial information. Read the broker’s Terms and Conditions and agree by ticking the box. The attached documents are legally binding, so read everything carefully. Click “Accept and Open Account.”

You will be redirected to the official site. Activate your account by visiting the Profile section and uploading the required documents, including a clear copy of your government-issued ID or driver’s license and a proof of residence document, like a utility bill. Wait for FP Markets to review your application and approve your account.

Once your account is active, visit the Funding section and fund it. You can use supported payment methods like credit/debit cards or bank transfers. Remember that FP Market’s minimum deposit is $100. We highly encourage novices to start with small deposits.

Go to your preferred trading platform and choose an instrument to trade. If you’re a rookie, reduce your risk exposure by starting small and managing your money wisely. Also, follow a specific trading plan, set strict rules, and never let your emotions affect your trading decisions.

Final Thoughts

We highly recommend this Australian CFD and forex broker because it’s licensed and regulated by reputable authorities like ASIC and CySEC. Moreover, the platform has a demo account for newbies and a simplified registration process for new signees. FP Markets also has a commendable support team you can contact at any time of the day or night whenever you have a question or concern.

Before interacting with FP Markets’ platforms, note that online trading exposes you to financial risks. If you are a newbie, first learn to trade with FP Market’s academy. Then, test and hone your skills with a demo account. Good luck!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals