Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

FxPro is considered one of the most reliable and trustworthy brokers today. Why? It’s authorized and licensed by multiple tier-one bodies, including the FCA, CySEC, and the FCSA. FxPro has also bagged 110+ international awards over the years, making it one of the most respected and recognized forex and CFD brokers today.

We highly recommend FxPro. But before you become a member of the broker’s ever-expanding empire, you should familiarize yourself with several topics. We’ve addressed them in our FxPro review 2025, from this broker’s security situation to the trading platforms it offers. Enjoy!

Why FxPro

As expert traders and researchers, we vouch for FxPro. Our team evaluated this broker and spotted numerous aspects that make it outstanding. For instance, it’s regulated by renowned organizations like the FCA, a top-tier UK regulator. Plus, this broker supports exceptional trading platforms like MT4 and MT5.

Pros aside, we identified several cons associated with FxPro. Here’s a summary of all you need to know before trading with this broker.

Pros

- The broker is licensed by recognized authorities like the FCA and the FSCA

- Traders can start with low deposits of up to $100

- No deposit or withdrawal fees

- 24/7 multilingual support is available

- Quick and easy signup

- Supports third-party platforms like cTrader, MT4 and MT5

Cons

- FxPro offers fewer tradeable assets compared to its peers

- Features only CFD instruments

- The broker offers limited educational materials and resources

Security

FxPro offers traders a secure trading platform protected by the highest data encryption protocols. A good example is SSL encryption, which the broker uses to encrypt all traffic. Moreover, FxPro uses Cloudflare to stave off distributed denial-of-service attacks (DDoS) and bcrypt to hash all passwords cryptographically.

Not to forget, FxPro has a dedicated team consisting of skilled and experienced technicians. These experts conduct regular check-ups and tests to ensure the broker’s trading platforms remain in tip-top shape. They also use ongoing security assessments to probe the provided platform and identify new potential vulnerabilities before bad actors exploit them.

Where your trades are involved, FxPro goes the extra mile in several ways. For starters, this broker offers negative balance protection to traders in every jurisdiction. So, you don’t have to worry about losing more money than you have or becoming indebted to your broker.

Moreover, the trading platform allows you to enhance your safety and security by using additional measures like two-factor authentication to prevent unauthorized access to your account. Also, the broker sends automated email confirmations every time your password changes. That means no one can change your FxPro account password without your knowledge or authorization.

What’s more, FxPro segregates all client funds from the company’s financial resources. That means that any money you deposit with this broker won’t be used for any other purposes besides what you authorize. And as an FxPro client, you can also enjoy investor protection privileges since this company is a member of several compensation schemes, including the Investor Compensation Fund (ICF).

We also consider FxPro one of the safest brokers out there since it’s licensed and regulated by several reputable organizations, including:

- The Financial Conduct Authority (FCA), registration number 509956

- The Cyprus Securities and Exchange Commission (CySEC), license number 078/07

- The Financial Sector Conduct Authority (FSCA), authorization number 45052

- The Securities Commission of The Bahamas (SCB), license no. SIA-F184

Platforms

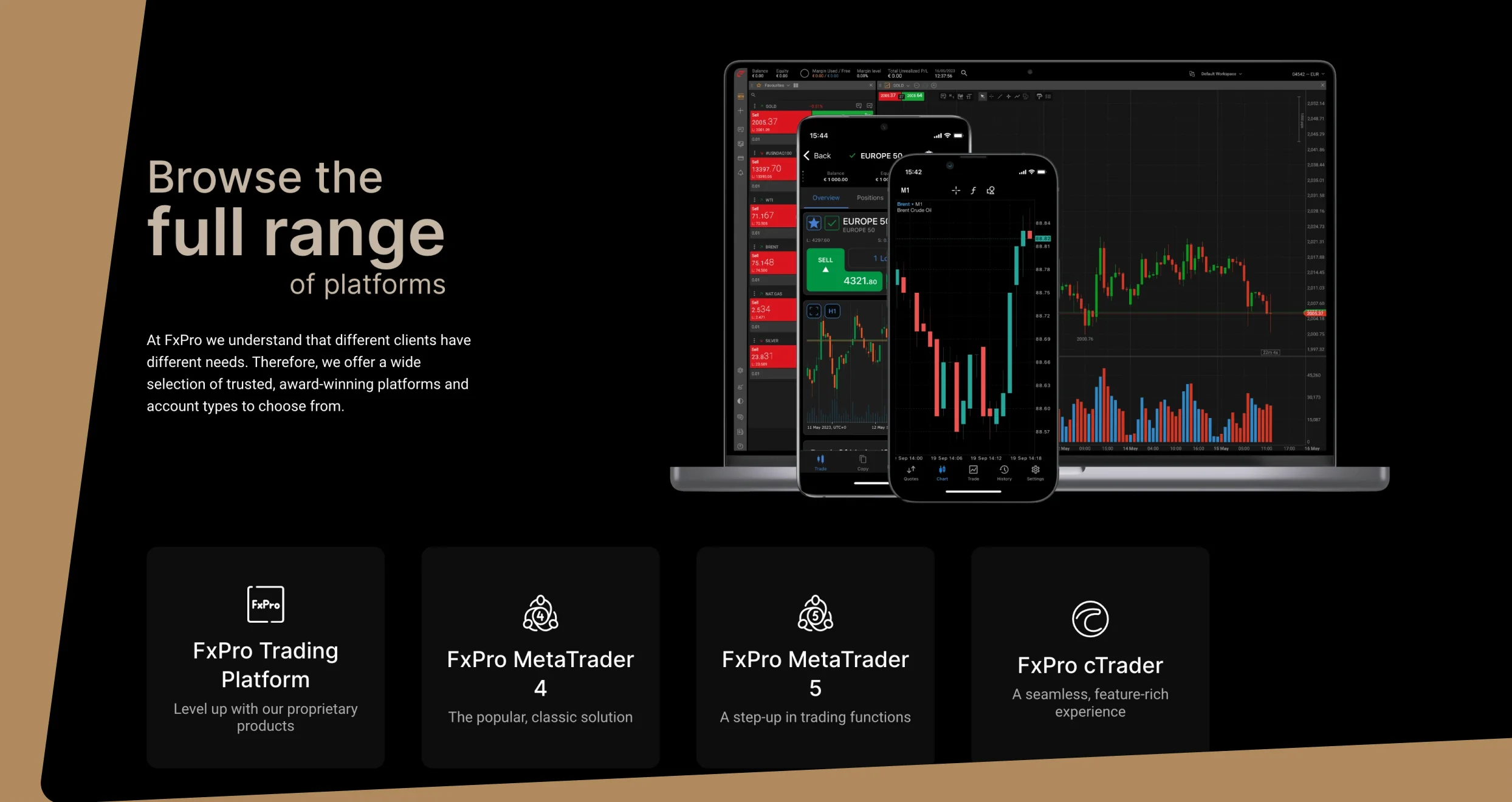

With FxPro, you get access to numerous platforms, including:

- The FxPro Trading Platform: The FxPro broker’s online trading platform is the first we checked out. It’s user-friendly and attention-grabbing. It’s designed to excite and impress traders, and it does that pretty well. The site is also easy to navigate.

- MetaTrader 4: This CFD trading broker allows you to get the most out of MT4, an infamous platform that offers you everything you need to chart, open, and manage your positions. You can download MT4 for your Android smartphone, Windows PC, or MAC and link it to your FxPro account today. That will allow you to leverage numerous advanced tools and features, like over 50 preinstalled technical indicators, 1-click trading, and trailing stop.

- MetaTrader 5: FxPro supports MT5, which comes with more features than its predecessor, MT4. You can customize this platform to suit your trading needs and preferences. Moreover, it comes with an exceptional environment you can exploit if you’re a skilled EA (Expert Advisor) developer. This platform boasts over 38 preinstalled technical indicators and 44 analytical charting tools, among other features.

- cTrader: As an FxPro client, you get access to the advanced cTrader platform. It comes with over 55 pre-installed technical indicators, 28 timeframes, and 6 chart types. The platform has many other exciting features that you can use to take your trading endeavors to the next level, including advanced order protection, trailing stop, and an integrated economic calendar. The best part is you can access this platform using a PC, tablet, or smartphone.

- FxPro Edge: This is a proprietary spread trading platform accessible to all FxPro UK Limited clients residing in the UK. With it, you can trade six asset classes containing hundreds of tax-free instruments. The platform offers you numerous top-notch features, including custom quick trade setups and 50+ technical indicators.

- FxPro Trading App: FxPro has an excellent mobile trading app. It’s equipped with multiple features and functionalities, from the incorporated advanced TradingView charting to economic events and fund management tools. You can download the app from Google Play or the Apple Store. Additionally, the app has 3 account types for you to choose from: FxPro MT4 Standard, FxPro Raw+, and FxPro Elite.

Fees

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Product Offerings

Signing up with FxPro will enable you to trade a wide variety of assets, including:

- Forex: Over 70 FX currency pairs are available on FxPro, ranging from EUR/GBP to USD/CHF and EUR/USD. You can trade CFDs on such pairs and enjoy fast order execution and tight spreads.

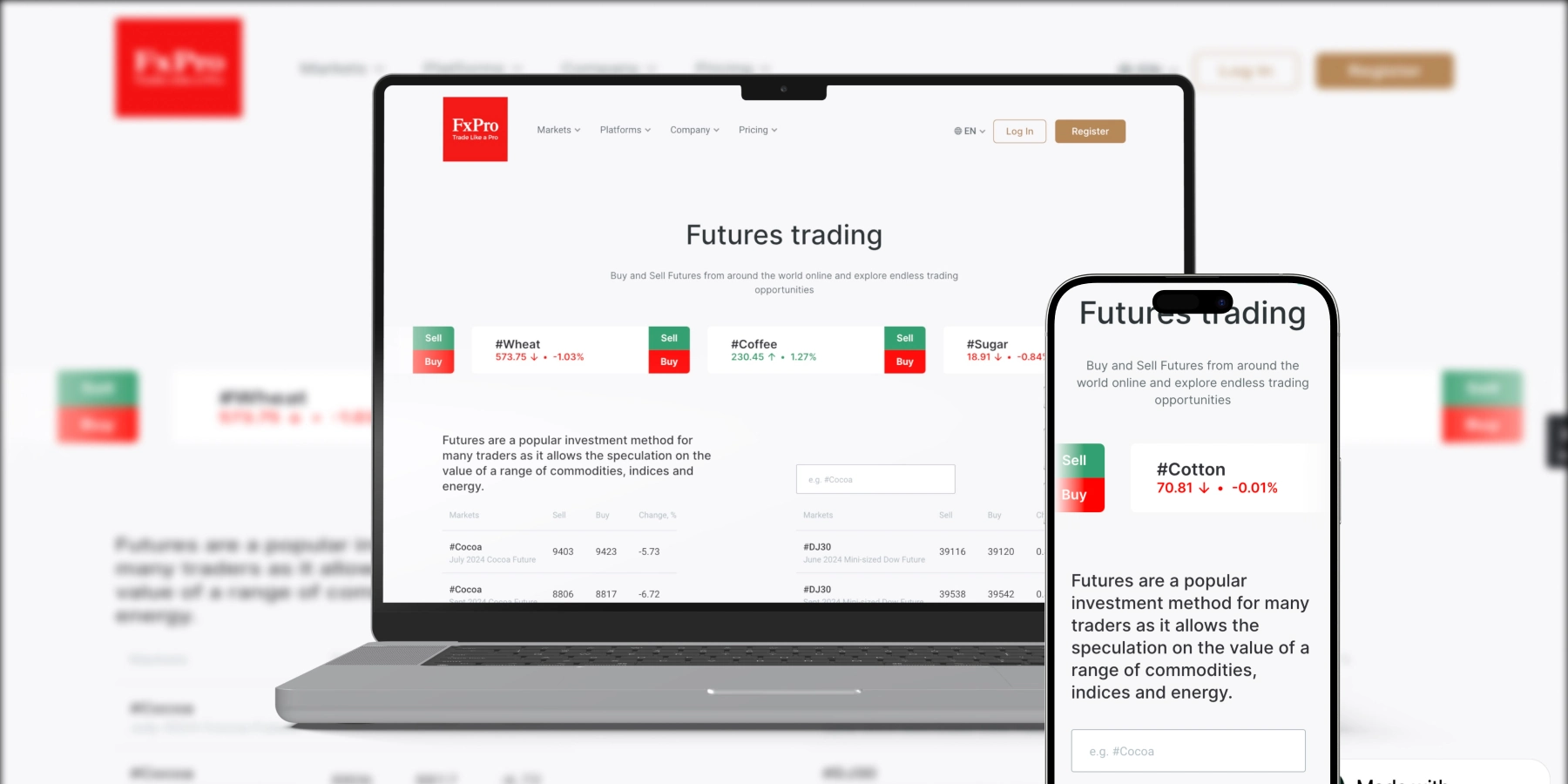

- Futures: FxPro offers you the opportunity to trade CFDs on futures such as Sugar, Cotton, and Wheat. Courtesy of this platform, you can speculate on the prices of different assets and earn returns.

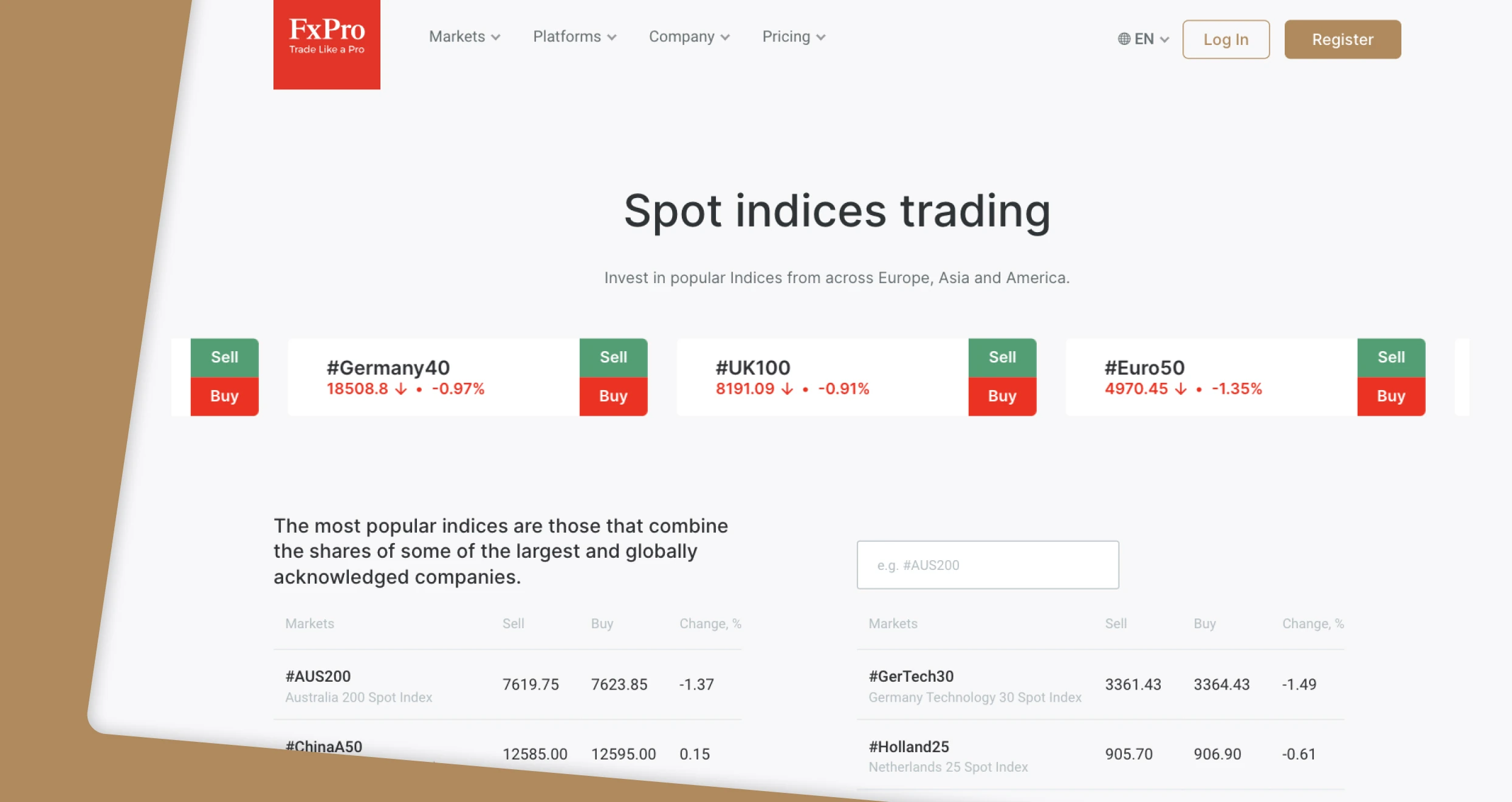

- Indices: With FxPro, you can index CFDs from different regions, including America, Asia, and Europe. This broker has a long list of indices consisting of shares from some of the most established global companies. Available options range from Germany 40 to AUS200 and UK100.

- Shares: If you prefer trading shares and stocks CFDs, FxPro has you covered. As an FxPro trader, you get access to instruments from different companies, including American Airlines Group Inc, Yum China Holdings, and many more.

- Metals: FxPro allows traders like you to trade CFDs on platinum, gold, and palladium. Other metals, including copper, silver, and lead, are also available on this broker’s trading platforms.

- Energy: When trading with FxPro, you can invest in popular spot energy commodities like Natural Gas and Brent Oil. These are ideal instruments for short-term trading and portfolio diversification.

- Cryptocurrencies: Very few brokers offer crypto CFDs, and FxPro is on this list. This broker gives you access to some of the most coveted CFD-related assets, including Bitcoin, Litecoin, and Ethereum.

Customer Service

The FxPro customer support center is open 24/7. That means you can contact this broker at any time of the day or night, Monday through Sunday. The company supports multiple support channels, including phone, email, and Live Chat.

Our team tried contacting FxPro through all available support channels. We concluded that phone and live chat are better suited for critical cases because they allowed us to get in touch with technicians promptly. Moreover, these options put us in a better position to acquire personalized assistance.

We also emailed the FxPro support team and got a response within the hour. Consequently, we recommend using this channel for non-pressing issues or queries.

If you don’t want to contact FxPro’s support team, visit the platform’s Help Section. This page answers most Frequently Asked Questions (FAQs) and has articles covering diverse topics, including the procedures for depositing funds into your FxPro account to uploading verification documents.

How to Sign up For an Account at FxPro

Opening an account with FxPro was the easiest thing we’ve ever done. We don’t expect you to encounter challenges here.

With that in mind, prepare to share and submit crucial information and documents. Regulations require FxPro to request these elements for identity verification. Valid details and documentation are also indispensable in curbing financial crimes. To increase your odds of success and avoid future complications, submit accurate information and valid documents.

Please note that FxPro has different minimum deposit requirements. Depending on your account, you may have to deposit anywhere from $100 to $30k. If you are working with a limited budget, open a Standard Account on MT4 or MT5. You can fund it with as little as $100.

Let’s jump into the account registration process:

Visit FxPro’s official site to see what the broker offers. There, you can find detailed information about crucial aspects like pricing, supported software, and product offerings. If you’re new to trading, open a demo account first and educate yourself with FxPro’s materials.

Depending on your preferences, you can open your account from the web platform or download an app and do it from there. Either way, start the registration by clicking “Register” and specify your country of residence, email, and password. Before proceeding, please read the Terms and Conditions thoroughly, as they are legally binding. Then, click “Register with FxPro.”

Select your preferred account. This broker offers various options, including Standard, Raw+, and Elite. Check them out before taking your pick. Fill in the registration with the required details, including your name, country of residence, email address, date of birth, and phone number. Also, Provide the requested info, including your employment and financial status.

Submit photos of verification documents, such as your driver’s license and a bank statement issued within the last 6 months. Document processing may take up to 2 business days. Provide clear and valid copies of your documents to avoid prolonged delays and do-overs.

Fund your account with at least $100 since that’s what FxPro minimum deposit requirements mandate. If you are a seasoned trader, you can start with FxPro’s recommended amount: $1000. But we strongly recommend smaller deposits to novice traders. Use an accepted funding method like bank wire transfers, Skrill, or debit cards.

Once your account is funded, choose an instrument and place your order. To avoid enormous losses, size your positions wisely, monitor all trades, and use risk management tools like stop-loss and take-profit orders.

Final Thoughts

Our FxPro broker review has scratched the surface and introduced fundamentals you should be familiar with before trading with FxPro. But this should be your be-all and end-all. There’s so much information surrounding FxPro, but we couldn’t cover everything here. That is why we recommend additional research. Begin with a thorough evaluation of online customer reviews and testimonials, and then use a demo account to test this broker.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Thanks for the detailed review! As someone new to trading, I found it super helpful—especially the breakdown of platforms and security features. FxPro sounds solid, but I’ll definitely start with a demo account to get a feel for it first. Appreciate the insights!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals