Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Founded in 1974, IG Markets is a financial services company headquartered in London. With it, you can trade forex, spread betting, and CFD instruments across diverse asset classes. The broker has a solid reputation and multiple regulations, making it a secure brokerage firm. Today, the company’s shares are listed on the London Stock Exchange (LSE). It is also a part of the FTSE 250 index and serves over 313,000+ global clients.

We signed up for trading accounts at IG Markets. We aimed to familiarize ourselves with the broker’s offerings and confidently share this IG Markets review. Overall, we are impressed by IG Markets’ features, and we hope you also find it suitable for your trading activities.

Why IG Markets

IG Markets is one of the brokers that support traders with quality trading tools for an exciting experience. However, like any other broker, we discovered that it falls short in certain areas. To ensure you make the best decision, here are the pros and cons of trading with IG Markets.

Pros

- Regulated by top-tier authorities across multiple jurisdictions, including the US, UK, South Africa, Australia, and more

- List over 17,000 tradable assets

- Offers negative balance protection for UK and EU clients

- Multiple trading platforms, including Web, MT4, and ProRealTime

- Numerous quality learning and market research tools

- No minimum deposit requirement

Cons

- No guaranteed stop losses for US clients

- The broker does not allow the buying and taking full ownership of featured assets.

- High stock CFD trading fees compared to its counterparts

Security

IG Markets broker employs high security measures to ensure its users’ funds and data remain safe from unauthorized access. For instance, the broker encourages users to use strong passwords for their trading accounts. Plus, employ two-factor authentication and be aware of fraudsters pretending to be IG Markets. The broker will only send notifications via the email address on its official website through the contacts you share with them.

Besides being highly encrypted, IG Markets is licensed and regulated by multiple world-renowned authorities. This status guarantees that your funds will be safe. The broker secures your money in a segregated account only accessible to you. Moreover, such regulations make the trading environment more exciting, thus maximizing your experience and potential.

See below the complete list of IG Markets’ financial regulators.

- IG Markets Limited (IGM) and IG Index Ltd UK – Financial Conduct Authority (FCA). Has a negative balance protection of £85,000 for UK clients.

- IG Europe GmbH – Federal Financial Supervisory Authority (BaFin). Has a negative balance protection of €20,000 for clients in Europe except those in the UK and Switzerland.

- IG Bank S.A. – Swiss Financial Market Supervisory Authority (FINMA). Has a negative balance protection of CHF 100,000 for clients in Switzerland.

- IG US LLC – Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA). No negative balance protection for US clients.

- IG Markets Ltd, Australia – Australian Securities and Investment Commission (ASIC). No protection for Australian clients.

- IG Markets Ltd, Australia – Financial Markets Authority (FMA). No protection for New Zealand clients.

- IG Asia Pte Ltd – Monetary Authority of Singapore (MAS). No protection for Singaporean clients.

- IG Securities Ltd – Japanese Financial Services Authority (FSA). No protection for Japanese clients.

- IG Markets South Africa Limited – Financial Sector Conduct Authority (FSCA). No protection for South African clients.

- IG Limited – Dubai Financial Services Authority (DFSA). No protection for United Arab Emirates clients

- IG International Limited – Bermuda Monetary Authority (BMA). No protection for international clients.

Platforms

IG Markets is an advanced online broker that adapts to advancing technology to ensure users enjoy their experience. The broker lists over 17,000 trading assets and hosts multiple trading platforms. IG Markets aims to ensure that all traders, whether newbies or professionals, trade on a suitable platform that maximizes their potential.

Here are IG Markets’ trading platforms.

- Online Web Platform: This platform is available in your browser and features a simple, clean interface. It also has some of the best trading tools for all types of traders. You can trade with your preferred currency here and explore additional features like guaranteed stops for watertight protection.

- MT4: IG Markets also hosts the third-party MT4 platform, known to be the best for forex trading. The best element about this platform is that it supports algorithmic trading. It also allows you to trade small sizes from 0.01 lots and enjoy powerful charts.

- ProRealTime: This is another platform supporting automated trading and features advanced technical analysis resources for professional traders. With ProRealTime, you will have access to over 100 indicators, an opportunity to build your own algorithms, some of the best charts, and more.

- L-2 Dealer: L-2 Dealer is a direct market access (DMA) platform. With it, you can trade forex or share CFDs straight through the order books of international exchanges. Like the above platform, L-2 Dealer hosts quality trading tools. However, it is only available to users in specific regions, like the UK.

Note that the above platforms are easily accessible via desktop and mobile devices. We tested the broker’s app and found it user-friendly on both desktop and iOS devices. The app’s platform was easily navigable, leaving us to recommend it to newbies and professional traders.

Fees

IG Markets’ fees vary depending on the asset you are trading. The broker has come a long way and tries to accommodate both low-budget and high-budget traders. We noticed that the broker doesn’t have a minimum deposit requirement. This allows you to trade with any amount you can afford.

Regarding spreads and commissions, IG Markets imposes some of the lowest fees. For instance, you will explore the currency market with spreads from 0.6 pips. Major indices also attract spreads from 0.8 points and 0.1 points on commodities.

Unfortunately, IG Markets’ share trading fees are high compared to its counterparts. For instance, you will incur 2 cents per US share and 0.18% on Hong Kong shares. The good news is that the broker allows free deposits and withdrawals. Its inactivity fee of $12 monthly also applies after 24 consecutive months.

Product Offerings

As mentioned earlier, IG Markets lists over 17,000 trading instruments. You can trade these assets as CFDs or spread betting. Note that spread betting applies only to UK and Ireland clients. However, the broker doesn’t support mutual funds trading. See the featured assets at IG Markets below.

- Forex: IG Markets lists over 80 currency pairs. These include major, minor, emerging, and exotic pairs.

- Stocks: Access 18,000+ global shares. This is from Asia, the US, and international companies using the best platforms.

- Cryptocurrencies: This broker also allows you to trade cryptocurrency CFDs on popular digital assets. There are 11 options in total, including Bitcoin, Litecoin, Cardano, and more.

- Commodities: There are over 35 commodities to trade with IG Markets. These include iron, copper, natural gas, zinc, nickel, and more. You can also trade a range of commodity stocks and ETFs.

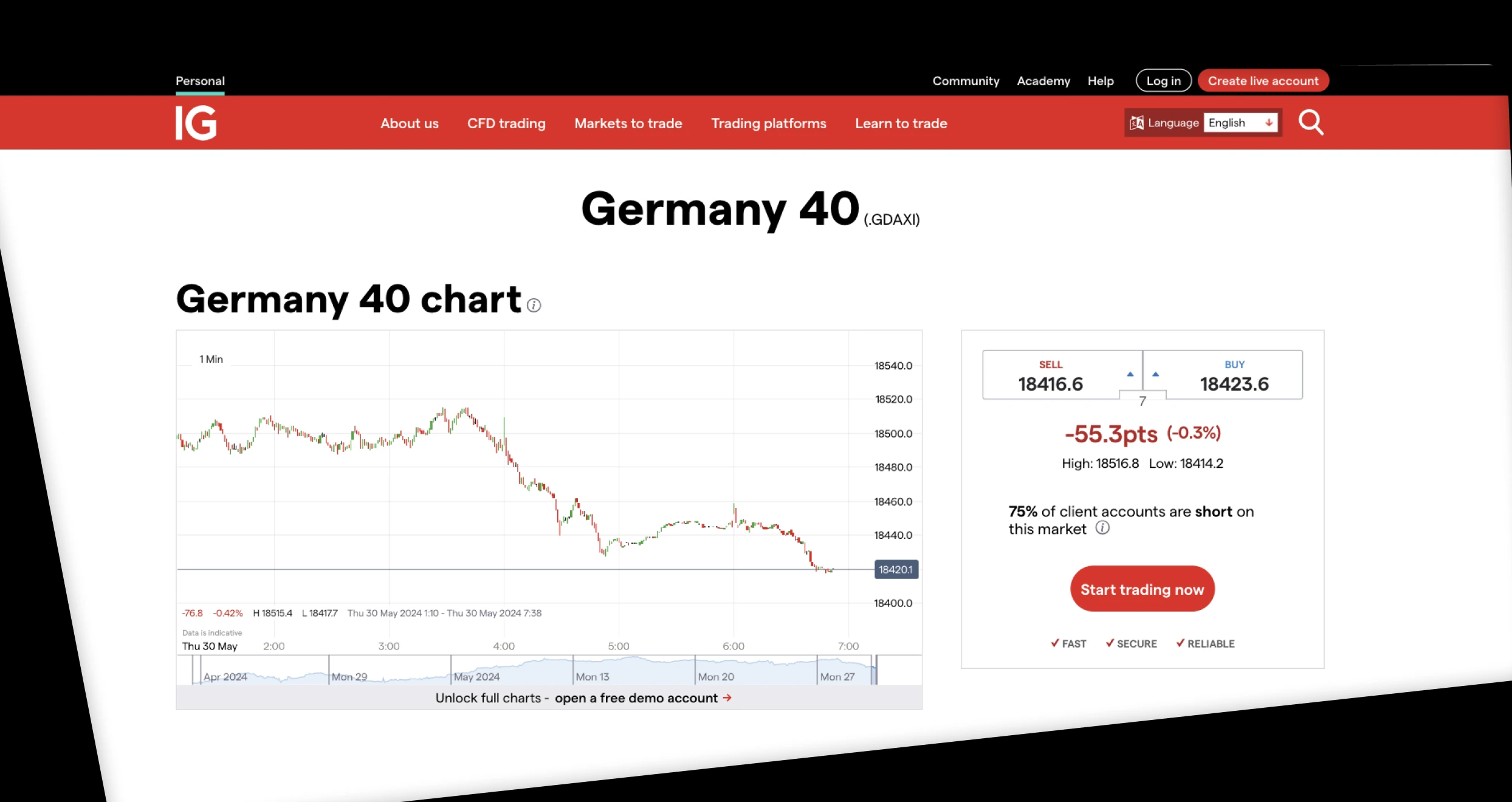

- Indices: IG Markets also features over 80 indices. With this asset, you will incur spreads from 1 point on the FTSE 100 and Australia 200 and 0.4 on the US 500.

- Options: For traders who prefer options trading, IG Markets allows you to enjoy this asset at low fees.

- Futures: Futures trading is available across diverse instruments, including indices, commodities, and a selection of bonds.

- ETFs: Explore over 5,400 ETF markets across multiple securities such as indices, sectors, commodities, and currencies.

- Bonds: IG Markets allows bonds trading on global markets. These include German, Italian, Japanese, and US government bonds.

One thing we like about IG Markets is its wide selection of trading instruments. With the above options, it will be easier for you to diversify your portfolio. This way, you get to mitigate the risks that come with investing in a single asset.

Customer Service

IG Markets’ customer service team is responsive and reliable when it comes to offering relevant assistance. You can contact IG’s team via phone, email, WhatsApp, and live chat. However, the IG Markets team is available five days a week. This can inconvenience active traders who never want to miss out on a daily potentially profitable opportunity. Therefore, before committing to IG Markets, ensure it aligns with your trading requirements and schedule.

Besides human support, IG Markets has a comprehensive FAQ section. On the page, you will find the most commonly asked questions by traders. IG Markets tries to handle and share such questions. It aims to ensure you quickly dive back into your activities and keep enjoying your experience.

How to Sign up For an Account at IG Markets

IG Markets is a highly licensed and regulated forex and CFD broker. It employs stringent and straightforward account opening procedures to ensure the online trading environment remains safe. Below, we guide you on signing up for an account with this broker. Remember, be honest when sharing your personal details to avoid future inconveniences once you are fully invested with the broker.

Start by visiting the IG Markets website and reading its terms of service before creating a trading account. For mobile traders, you may consider installing the broker’s app on your mobil device to efficiently manage your activities on the go.

Click “Create Live Account” to begin the registration process. There is also the demo account, which we encourage newbies to opt for. Fill in the simple form provided using your personal details, including your name, email, location, and more. You should also create a strong username and password for added safety.

Participate in account verification, a standard protocol for many regulated brokers. With IG Markets, you will be required to share copies of your documents. These include your ID or driver’s license and a utility bill or a bank statement. Verification may take up to 48 hours, after which the broker will send an email notification.

Once your account is fully activated, make a deposit per IG Markets’ minimum deposit requirement. Fortunately, the broker supports multiple payment methods, including debit/credit cards, e-wallets, and bank transfers. So, deposit funds using your preferred method and experience fast and efficient transactions.

Go to IG Markets’ dashboard and select your preferred securities to trade. As a beginner, start small and do not invest more than you are willing to lose. It is also crucial to diversify your portfolio and apply risk management controls to avoid massive losses.

Final Thoughts

IG Markets has been around for approximately five decades and keeps adjusting its features with the advancing technology. It is a reliable and secure broker with quality resources for all types of traders. Whether you are looking for learning tools or technical analysis materials, IG Markets has your back. With its wide selection of assets, numerous platforms, fast order execution speed, and more, we highly recommend this broker. However, ensure you fully understand this IG trading platform review and test the broker via its demo account. This is to ensure the broker fits your trading requirements before committing.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?