Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Founded in 1978, Interactive Brokers (IBKR) is a world-renowned online brokerage firm that conducts its broker/dealer business across 150+ global markets. It provides direct access trade execution and clearing services on various electronically traded assets. These include forex, shares, futures, commodities, cryptos, and more. Today, the broker prides itself in executing over 2,350,000 trades per day.

IBKR is one of the safest brokers in the financial space, with multiple regulations from tier-one authorities. We tested it and share below our honest Interactive Brokers review. We hope you will gain enough insights to decide whether it is worth using to explore the financial markets.

Why Interactive Brokers

Interactive Brokers has been serving millions of global clients for over four decades. This means there are some positive elements that attract traders to it. However, like any other brokerage firm, IBKR has a few pitfalls. Here are the pros and cons to note.

Pros

- Accepts clients in over 200 countries globally

- Allows users to fund their accounts and trade in 27+ currencies

- Commission-free trades on US-listed stocks and ETFs

- Opportunity for traders to earn interest of up to 4.83% on available balances

- Powerful trading platforms with quality trading resources

- A user-friendly and intuitive design IBKR GlobalTrader app

Cons

- Support service response rate via email is not as prompt as other brokers.

Security

Security is paramount for any trader looking to explore the online trading and investment landscape. At Interactive Brokers, you are guaranteed maximum safety. The broker has taken safety measures by incorporating SSL encryption technology. This ensures your funds and data remain safe and free of unauthorized access.

We also like that this broker is licensed and regulated by top-tier global authorities. This feature guarantees the safety of your funds. Interactive Brokers will store your money in a segregated account that is only accessible to you. This means the broker will not access your funds and you can easily reclaim them if it goes bust.

That being said, below are the financial regulators overseeing Interactive Brokers’ activities across various global regions.

- Interactive Brokers (U.K.) Limited: Licensed and regulated by the Financial Conduct Authority (FCA) under license number 208159. It has a clients compensation scheme of up to £85,000.

- Interactive Brokers LLC: Licensed and regulated by the Financial Industry Regulatory Authority (FINRA) and the US Securities and Exchange Commission (SEC). Its compensation scheme goes up to $500,000 for US clients.

- Interactive Brokers Canada Inc: Overseen by the Canada Investment Regulatory Organization (CIRO). Its client compensation scheme goes up to CAD 1,000,000.

- Interactive Brokers Ireland Limited: Licensed and regulated by the Central Bank of Ireland (CBI). It has client protection of up to £20,000 for clients in northern and western Europe.

- Interactive Brokers Hong Kong Limited: Overseen by the Hong Kong Securities and Futures Commission. No protection amount for clients in the region.

- Interactive Brokers Australia PTY LTD: Licensed and regulated by the Australian Securities and Investment Commission (ASIC). There is no client compensation scheme for Australian clients.

- Interactive Brokers Singapore PTE LTD: Overseen by the Monetary Authority of Singapore (MAS). It also has no client protection for traders in Singapore.

- Interactive Brokers Securities Japan Inc: Licensed and regulated by the Financial Services Agency (FSA). No compensation scheme for Japanese clients.

Platforms

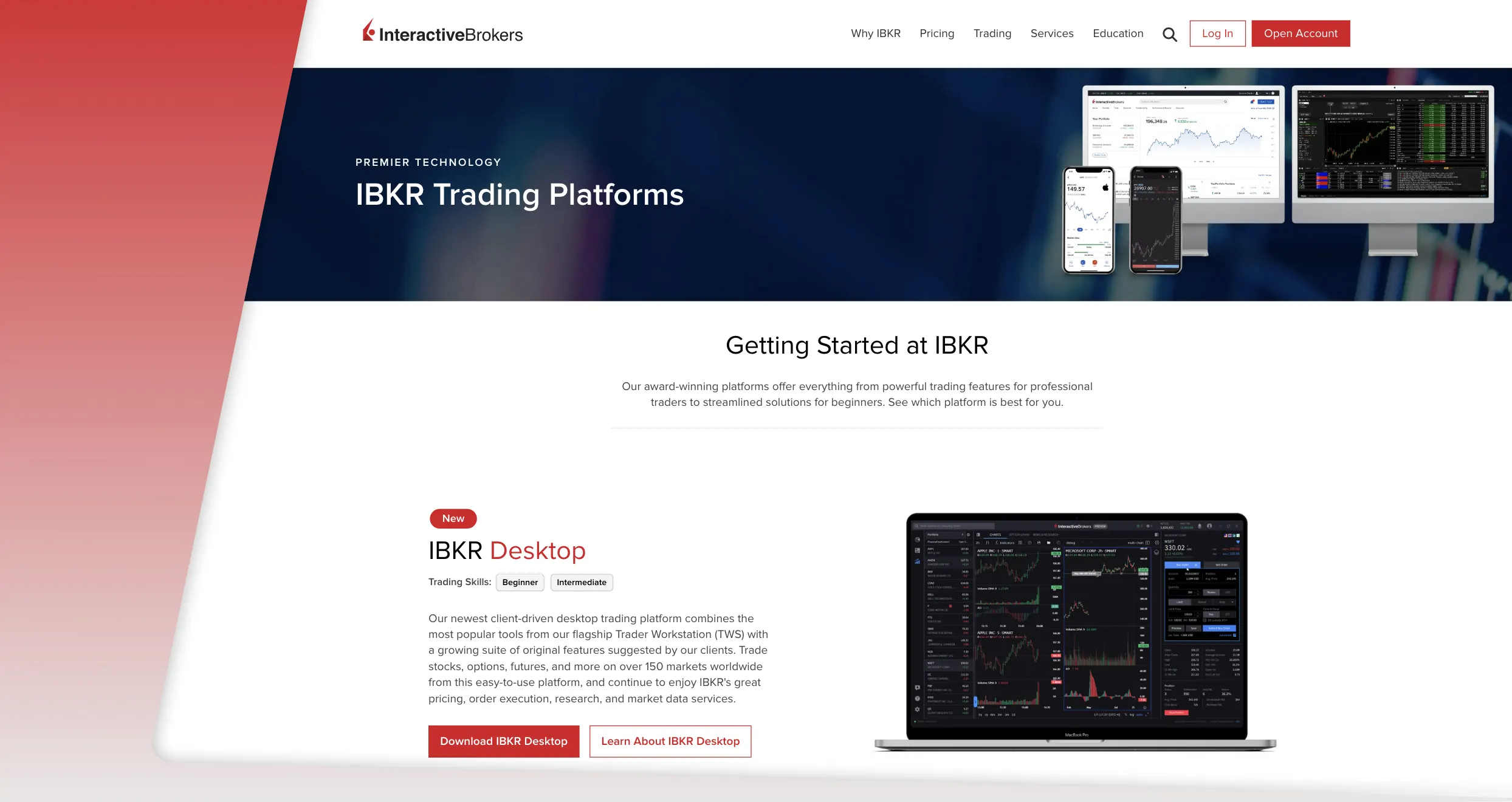

We like the IBKR Desktop platform primarily because it features numerous trading and learning resources for an exciting experience. We enjoyed its easy charting, options analysis, screener, news feeds, and more. Its trade execution speed is fast, and activities are more streamlined than the IBKR Trader Workstation. Moreover, the platform has a modern interface, which gives the experience every trader deserves.

There is also the IBKR Trader WorkStation designed for seasoned and active traders looking for more flexibility. You will explore advanced resources here, including algo trading, portfolio management tools, and more. The platform is available in various languages, including English, French, Spanish, Italian, Japanese, Russian, German, and more.

Besides the desktop and web platforms, Interactive Brokers has the IBKR Mobile and IBKR GlobalTrader apps. Based on our analysis, these apps are user-friendly and suitable for beginners. You can get started with them for as little as $1. They also have demo accounts, perfect for kickstarting your trading or investment ventures without spending real money.

Fees

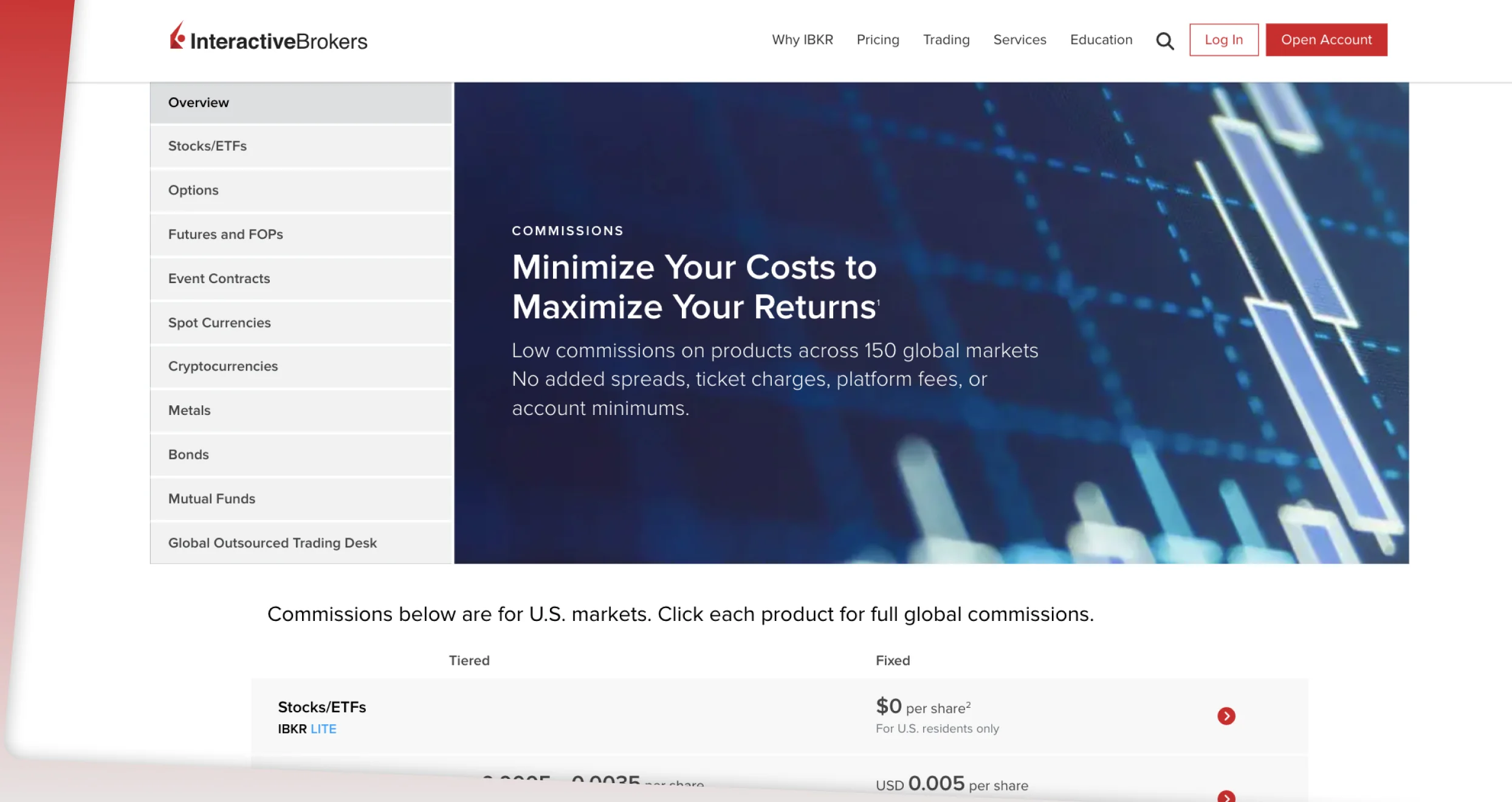

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

Product Offerings

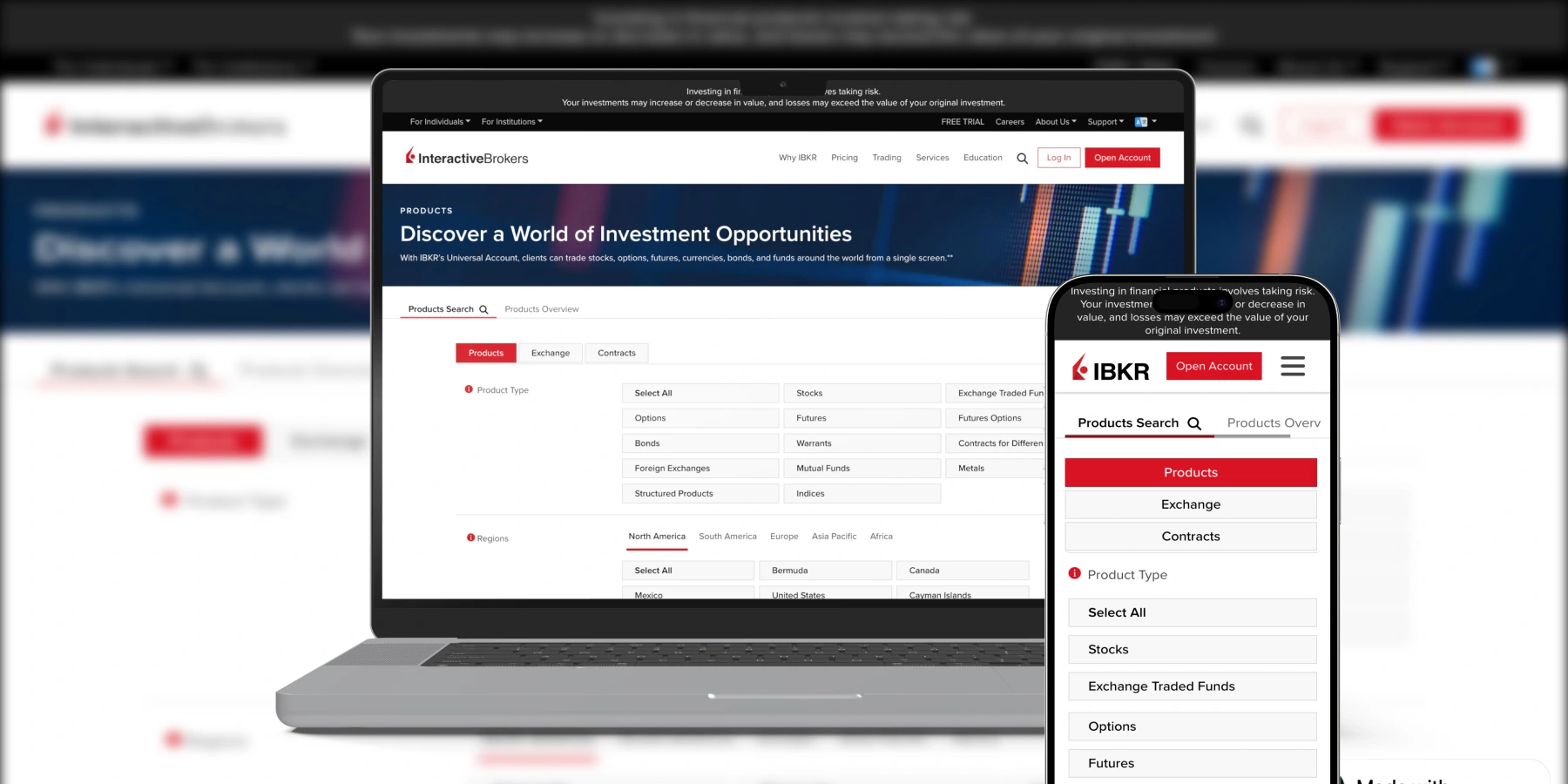

Interactive Brokers offers access to thousands of tradeable instruments across 150+ markets. See below the list of products you will explore once you commit to IBKR.

- Stocks/ETF: As mentioned earlier, IBKR offers commission-free trading for US-listed stocks and ETFs. You will also incur low commissions for other stocks with IB SmartRouting. Stocks are available from 90+ market centers, and you can buy the shares in fractions.

- Options: Options trading at IBKR attracts low commissions, from USD 0.15 to 0.65 per US option contract. You can trade the asset globally in 30+ market centers.

- Futures: IBKR allows you to trade commodity futures across 30+ market centers. The best part is that you will incur low commissions from USD 0.25 to 0.85 per contract.

- Forex: The broker lists over 100 currency pairs. You will trade with low spreads as narrow as 1/10 PIP on major currency pairs. The best part is that you will enjoy deep liquidity and real-time quotes from 17 world’s largest forex dealers.

- Mutual Funds: Have access to over 48,000 global funds with IBKR. Over 19,000 options do not come with transaction fees, while others attract low commissions and zero custody fees.

- Commodities: Commodities like Spot Gold come with low commissions at Interactive Brokers.

- Bonds: For those looking to invest in bonds, this broker got your back. Here, you will explore over one million options with no spreads but low commissions. You will trade directly with other IBKR clients.

Customer Service

We were impressed by Interactive Brokers’ support service, which is available 24/5. Although the team’s response via email was not as prompt as we had expected, we received quality assistance. The solutions we got from the concerns we raised were helpful, making us jump back into our investments.

Besides email, IBKR’s support service team is reachable via phone and live chat. There is also a comprehensive FAQ section. On the page, you will quickly find answers to some of the questions traders ask. That being said, if you are looking for fast responses, consider contacting the broker’s team via phone. The contact details are available on the IBKR support page.

How to Sign up For an Account at Interactive Brokers

Our experience signing up for trading accounts with Interactive Brokers was seamless and straightforward. So, if you are new to this broker, below are the simple steps to get you started.

Visit Interactive Brokers’ website by clicking one of the links we have shared on this page. Read, understand, and accept the broker’s terms and conditions. You should also install its IBKR Mobile or IBKR GlobalTrader app. This will help you easily manage your positions on the go.

Click the “Open Account” button to start the registration process. Fill out the available form using your personal details, including your name, email, phone number, country, and more. Your broker will also require you to create a unique username and password for extra safety. Ensure you provide accurate details since you will be required to verify them in the next step.

Share copies of your documents as required by the broker. These include your ID card or passport and a recent utility bill or bank statement. IBKR will send you a notification via email once your account is fully activated.

With your account fully activated, make a deposit based on your budget, as this broker does not have a minimum deposit requirement. Fortunately, Interactive Brokers support multiple payment methods for these transactions. These include credit/debit cards, e-wallets, and bank transfers. Choose the most convenient one for quick deposits.

Explore the featured instruments and start trading/investing in your most preferred options. Remember to apply risk management controls. This is whether you buy the asset or trade it as CFDs/indices. For beginners, take advantage of IBKR’s free trial account to gauge your skill level and test its performance before risking real money.

Final Thoughts

From our experience, we find Interactive Brokers to be the best for both new and experienced traders. We like Interactive Brokers fees, from commission-free trades on US-listed stocks and ETFs to low trading charges for other assets. We believe this will help you plan and budget without worrying about spending much money.

Moreover, Interactive Brokers has a $1,000,000 virtually funded Free Trial/simulated account. We encourage newbies to take advantage of this to learn how Interactive Brokers operate before transitioning to live trading.

For professional traders, the broker offers advanced trading tools. These include over 100 optional order types, 200+ free and premium research and news providers, and more. Undoubtedly, IBKR is a reliable and credible brokerage firm. We can’t wait to hear about your experience with it.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals