Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

With millions of registered customers, Plus500 is one of the biggest trading brokers today. The company was founded in 2008 by a group of 6 alumni of the Technion-Israel Institute of Technology. Several factors have contributed to this platform’s spiking popularity over the years, including its wide variety of tradeable instruments and top-quality customer support services.

As of 2025, Plus500 is available in 50+ countries. The Plus500 trading platform boasts over 2800 financial instruments, ranging from forex and crypto to ETFs and commodities. This leading CFD provider is also listed as a public company on the London Stock Exchange.

Our team tested and evaluated Plus500 extensively. We’ve detailed our findings in this Plus500 review.

Why Plus500

We hold Plus500 in high regard since this broker is authorized and regulated by innumerable renowned bodies, from the FCA to CySEC and MAS. Moreover, it has thousands of tradeable instruments, multiple top-notch trading platforms, and commendable customer support. This should be a great site for your trading endeavours.

Let’s run through some of the pros and cons we identified from our Plus500 evaluation.

Pros

- Easy account registration and setup

- User-friendly website interface

- A great variety of tradeable instruments

- Quality support services

- Reasonable minimum deposit

Cons

- $10 monthly account inactivity fee

- No phone support

- No automated trading feature

- Limited platforms

Note: 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Security

Where Plus500 is involved, your money is protected. That is because, first and foremost, this broker keeps your money in segregated bank accounts. So, you never have to worry about Plus500 misusing your funds. They will always be protected in the hands of a licensed and regulated third party. Your money will never mix with the broker’s operational funds, meaning misappropriation is out of the question.

Additionally, Plus500 uses its own money for hedging purposes. Remember, most brokers use hedging for risk management. Suppose a broker hedges with your money. This scenario can lead to a conflict of interest since the company will likely profit from your losses. Moreover, any ill-informed decision on the broker’s part will cause substantial losses, which might eventually trickle down to you if the service provider gets into financial distress. By using the company’s money to hedge, Plus500 protects you from such complications.

Plus500 also doesn’t participate in speculative trading. That means it doesn’t seek profits from trading activities. This broker leaves speculative trading to its clients. By avoiding that, Plus500 focuses on safeguarding client assets and providing top-notch services rather than chasing profits.

Last but not least, Plus500 is licensed and regulated by multiple renowned authorities, including:

- The Financial Conduct Authority (FCA), FRN 509909

- The Australian Securities and Investments Commission (ASIC), AFSL #417727

- The Financial Markets Authority (FMA), FSP No. 486026

- The Financial Sector Conduct Authority (FSCA), Authorised Financial Services Provider #47546

- The Cyprus Securities and Exchange Commission (CySEC), Licence No. 250/14

- The Monetary Authority of Singapore (MAS), Licence No. CMS100648-1

Platforms

Plus500 has a user-friendly web platform. We were impressed by its simple and clear layout. This broker allows traders to open a demo account and sharpen their skills before engaging in live trading. The best part is traders can dive into demo trading on the web platform – no need to download a dedicated app.

While testing Plus500, we discovered one noteworthy downside: this broker offers proprietary trading platforms exclusively. You won’t find third-party options like MT4 or MT5 here. That said, Plus500’s proprietary platforms are loaded with a wide variety of features tailored for newbies (demo account, plenty of educational resources such as a library of eBooks, video tutorials on their Trading Academy) and professionals alike.

Here are the proprietary platforms offered by Plus500:

- Plus500 Invest: This allows you to invest in your favorite stocks. Plus500 gives traders various options, including shares from established Big Tech companies like Netflix, Amazon, Tesla, and Apple. Please note that this platform is available under certain jurisdictions, mainly in Europe, and offers shares from countries like the US, Canada, the UK, and more.

- Plus500 CFD: A platform for trading contracts for differences (CFDs). While on this platform, you can enjoy leveraged trading and invest in CFDs related to forex, shares, options, commodities, and ETFs. Depending on your trading needs and preferences, you can also choose to go long or short.

- Plus500 Futures: This platform allows you to trade the most popular futures, from Bitcoin and gold to oil and the S&P 500. However, it’s only accessible to US traders.

Fees

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

Product Offerings

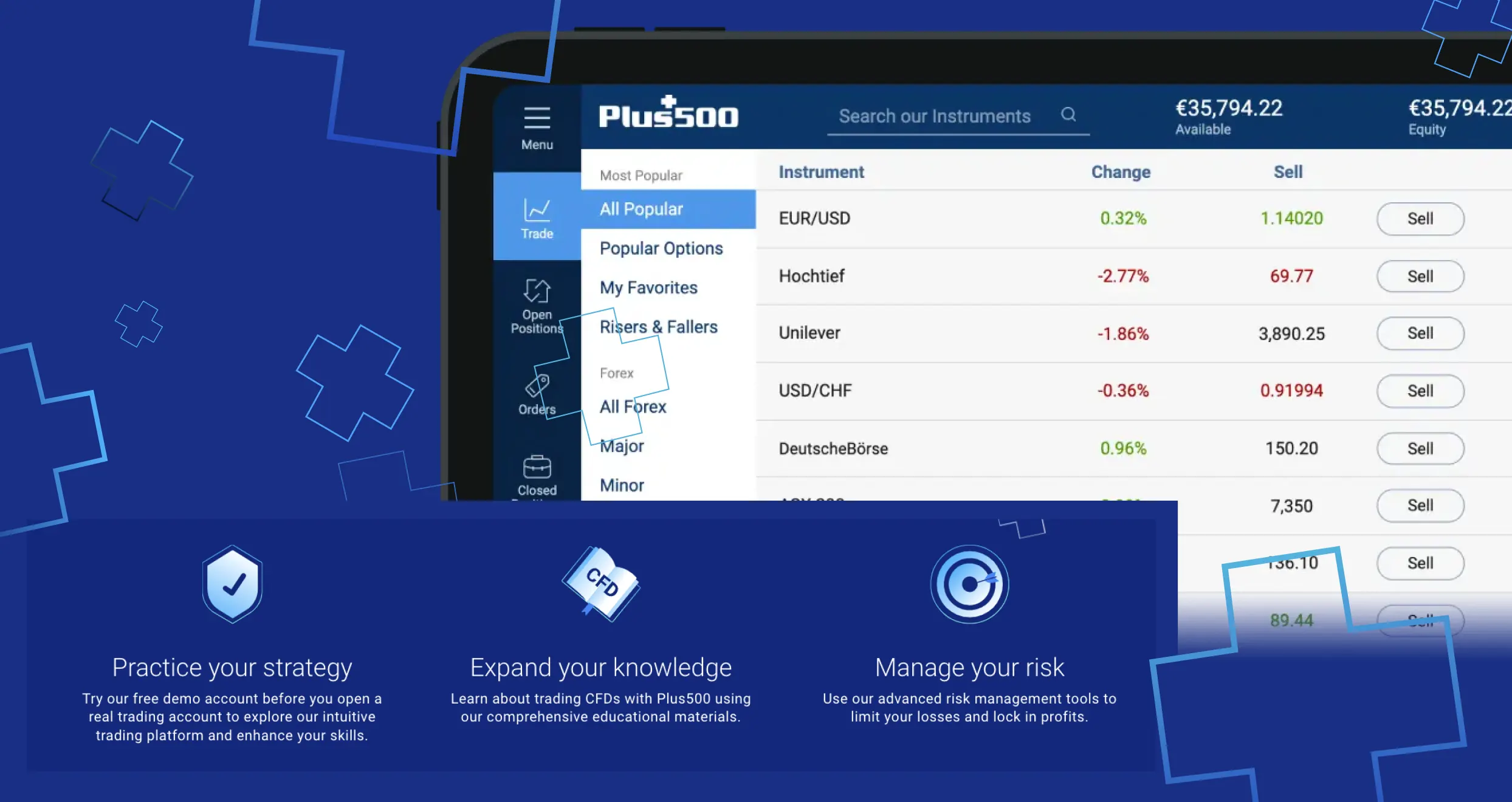

Plus500 primarily supports CFD trading. Therefore, this broker allows traders to speculate on the price movements of specific assets without owning them. Presently, this broker offers over 2800 CFD-related financial instruments, including:

- Shares: Plus500 allows traders to invest in shares from numerous countries, including the US, the UK, South Africa, Spain, Singapore, Hong Kong, and Australia. The most popular options include NASDAQ, NVIDIA, Apple, Tesla, Netflix, and AMEX. Through this platform, you can also trade share CFDs from top cannabis companies like Canopy Growth, Aurora Cannabis, and Tilray Brands.

- Forex: If you are a forex enthusiast, trading with Plus500 will allow you to invest in over 60 currency pairs. They include popular choices like EUR/USD, EUR/ GBP, GBP/USD, USD/CAD, and AUD/USD. Exotic pairs such as NZD/CAD, NZD/CHF, and CHF/DKK are also supported by this platform. Plus500 allows users to trade FX pairs from Monday at 08:00 Sydney time to Friday at 16:00 New York Time.

- Cryptocurrencies: You can trade crypto CFDs on Plus500. While trading crypto, you get up to 1:2 leverage. Unlike many other products on this platform, crypto trading is available 24/7. Not to forget, Plus500 gives you everything you need to interact with digital currencies. You don’t need to get a unique digital wallet or use an exchange account.

- Indices: If you want to trade popular indices like US-TECH 100, France 40, and S&P 500, Plus500 should be your go-to broker. This platform supports all these indices and more. Moreover, it allows indices traders to enjoy leverages of up to 1:20.

- Options: Plus500 allows investors to trade options with up to 1:5 leverage. The platform supports many options, including Natural Gas, the S&P 500, the US-TECH 100, NVIDIA, VIX, and ARM. Meta, German 40, and oil are also available on the platform.

- ETFs: If you’re an ETF trading enthusiast, Plus500 offers you the opportunity to dive into the market with up to 1:5 leverage. And you can get started with as little as $100. Available ETFs range from USO-Oil Fund and GLD Gold to NUGT and VOO.

- Commodities: Commodities are plentiful on Plus500. You can trade a wide range of options, including natural gas, oil, heating oil, silver, gold, and aluminum—the list goes on. When trading commodities, the available leverage is set according to ASIC regulations: up to 1:20 for gold and up to 1:10 for other commodities.

Customer Service

If you have any questions or concerns, you can contact Plus500’s support team. The company’s experts should respond within 24 hours on any given day, excluding weekends and holidays. That said, you can only contact Plus500 via email or chat.

The first time we tried to contact Plus500’s support team, we used the contact form embedded on the website. We filled it out with the required information, including our name, email address, and query description. After a few hours, the Plus500 team reached out and addressed our question. The support technician who responded was professional and knowledgeable.

We also tested Plus500’s WhatsApp chat feature, which offers 24/7 support. We asked a simple question regarding the company’s minimum deposit requirement, and a support representative responded within a few minutes.

Unfortunately, Plus500 doesn’t have phone support.

How to Sign up For an Account at Plus500

Before testing what Plus500 offers, we signed up for an account first. The process was straightforward. If you’d like to open an account with this broker, the steps you should take are outlined below.

Before we dive in, you might be a novice, asking yourself: Is Plus500 good for beginners? The answer is a resounding yes. Why? Plus500 demo account and numerous educational materials are available here. Check them out before signing up for a live account.

Visit the Plus500 official website. Before you start the account registration process, do some exploration. Check if everything you need is provided, including your preferred financial instruments and trading software. Then, click “Start Trading” and select “Don’t have an account? Create one now!”

As a new signee, Plus500 will ask you to provide a plethora of personal information, including your email, full name, and date of birth. Fill in the application form with valid details to avoid any complications. Also, while setting a password for your account, remember to use unique characters and avoid any phrase or name that someone can guess.

Before getting permission to trade for the first time with Plus500, you must verify your identity and residential address. That requires you to submit a government-issued ID, like your driver’s license, and a residential verification document, like a bank statement. Ensure you take clear photos and submit copies of documents bearing your name and address.

Plus500 will give you the green light after verifying your details. Depending on how busy the broker’s team is, the process might take minutes or hours. Once your account is verified, fund it using one of the available funding options. Don’t forget to deposit an amount equal to or higher than the broker’s minimum requirement.

You can choose a financial instrument and trade live with a funded account. Remember to pick something you’re familiar with to avoid making mistakes and incurring significant losses. If you are a newbie, your first stake should be small. You can always increase the amount once you become confident in your abilities.

Final Thoughts

We consider Plus500 one of the best CFD brokers today for good reasons. This platform has simplified its registration and invested heavily in an intuitive website. It has sought licensing and regulation from top-tier authorities like the FCA, ASIC, and FSCA. What’s more, it offers countless financial instruments and products to traders.

You should check out Plus500 today. But before you do that, note that trading is risky. Ensure you have sufficient knowledge and skills before putting your hard-earned money on the line. More importantly, if you are a novice, try the Plus500 demo account before signing up for a live account. Good luck!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

But here’s where it falls short for me: no phone support (sometimes, you just need to talk to a human), an inactivity fee (annoying if you take a break), and no automated trading or third-party platforms like MT4/MT5.

Would I use it? Maybe for some short-term CFD trades, but for my main trading platform, I’d probably go with something more flexible. What do you think?

Interesting read! I've tried a few brokers already, and Plus500 is new to me. Seems like a solid platform, so I'll give it a shot and see how it compares. Thanks for the insights!