Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

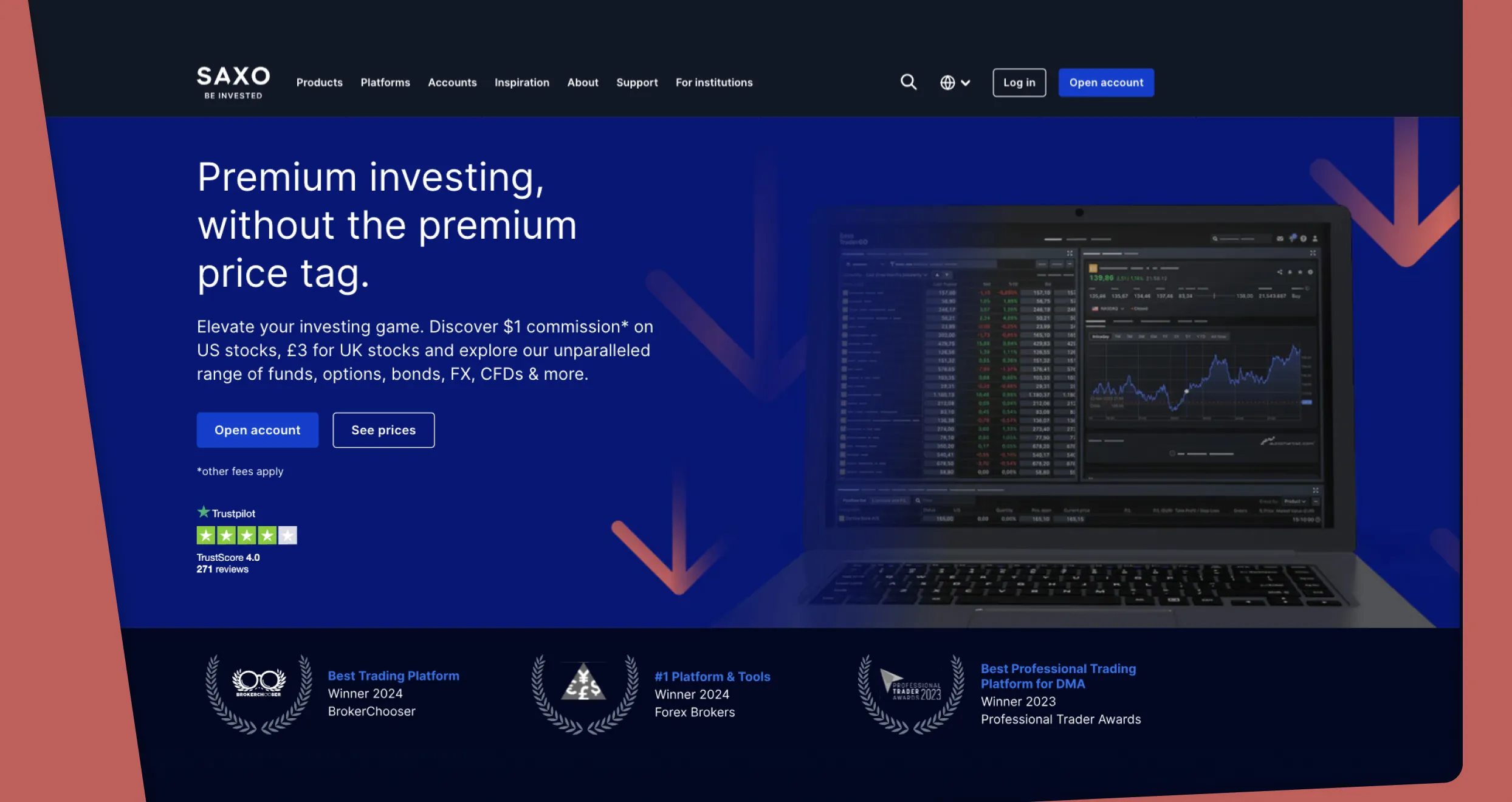

Saxo is one of the most popular brands. This trading and investment platform caters to over 1.2 million clients. Several factors have encouraged millions to join and stick with Saxo. They include a vast selection of products. As a Saxo client, you can invest in diverse assets, including stocks and ETFs. You also get uncapped access to thousands of tradeable instruments, including futures, commodities, and options.

But before you partner with this broker, read this Saxo review. It will give you a sneak peek of what to expect, from offered products to available trading platforms. We spend countless hours testing and vetting Saxo before preparing this piece.

Why Saxo

We tested Saxo and spotted numerous outstanding pros. To begin with, this broker adheres to stringent regulations mandated by top authorities like the FCA. Moreover, it allows traders to pick fitting accounts depending on their preferences and objectives. What’s more, this broker supports innumerable instruments and friendly charges.

With that in mind, our team identified a few must-know cons while assessing Saxo. We have reviewed everything you need to know.

Pros

- Licensed and regulated by numerous authorities, including the FCA and MAS

- No minimum deposit requirements for Classic account holders

- Zero deposit, withdrawal, and account inactivity fees

- Reasonable commissions and spreads

- A Broad range of investment and tradeable products

- Quick and easy account registration process

Cons

- Restricted access in countries like the US

- No third-party platforms like MT4/5

- High minimum deposits for Platinum and VIP accounts

Security

We reviewed Saxo’s security terms and policies, and they were exceptional. This broker takes a proactive role in protecting its clients and their resources. Our team noticed that, first, Saxo is dedicated to safeguarding client data and information. This broker supports everything traders need to protect their accounts from bad actors, including two-factor authentication.

Furthermore, Saxo boasts a licensed Danish bank that is well-funded and regulated. The Saxo Bank Group has over a million clients and holds billions in client assets. So, this isn’t an unknown entity you’re dealing with. The broker is part of a vast, profitable venture that makes millions of dollars annually.

Since the FCA regulates Saxo, the company protects client money through segregation. The FCA requires all regulated brokers to segregate client funds, and Saxo follows this rule to the letter. This broker holds your money as a trader in a segregated trust account, where it can’t mingle with the company’s operational funds.

Suppose you let your profits sit in the segregated account while you continue trading with Saxo. You can rest assured your funds will be safe and secure. Saxo won’t use the accrued profits to cover other traders’ deficit balances or margin obligations. Moreover, this broker will never use your money to hedge its own positions.

We also consider Saxo 100% secure since this broker is authorized, licensed, and regulated by multiple authorities, including:

- The UK Financial Conduct Authority (FCA)

- The Monetary Authority of Singapore (MAS)

- The Financial Services and Markets Authority (FSMA)

- The Securities & Futures Commission of Hong Kong

- The Australian Securities and Investments Commission (ASIC)

Platforms

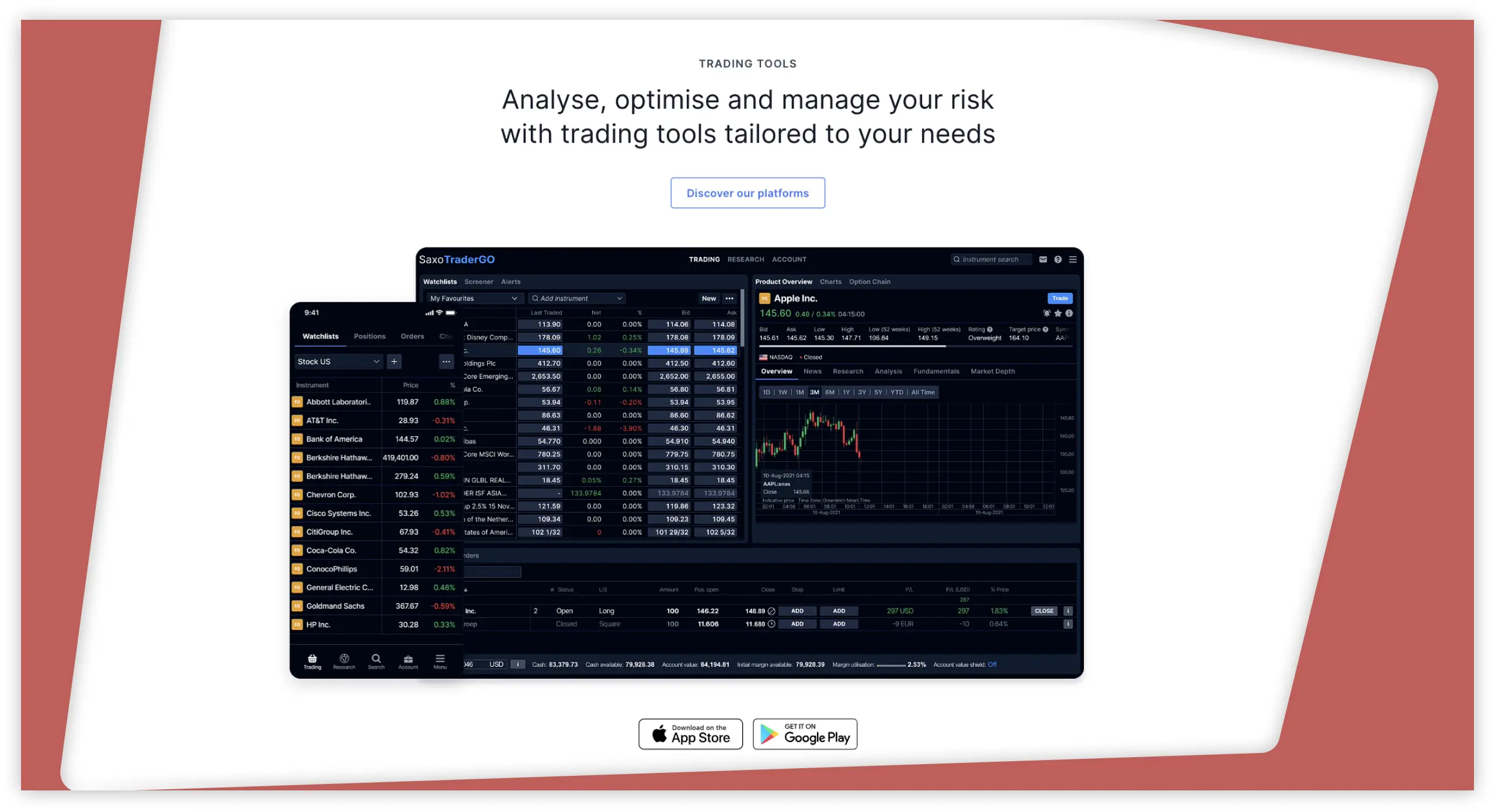

While vetting Saxo, our team discovered a few things. First, the Saxo platform is simple, but it could be better. The layout is neat, but you won’t find most of the crucial information on the homepage. You have to dig a little deeper.

That aside, Saxo offers a demo account that you can use to test the broker’s suitability and hone your skills before trying your hand at live trading. It comes with a 20-day free demonstration period and $100,000 virtual currency. Once you’ve ascertained that you’re ready to trade live, you can pick any of these platforms: SaxoInvestor, SaxoTraderGo, or SaxoTraderPro.

SaxoInvestor is a simple, user-friendly platform that can be used even by novices and professional traders. It allows traders like you to invest in assets like stocks and ETFs and manage your investments from your phone or PC. While using this platform, you can explore relevant market trends, view curated stock lists, and harness the full potential of Morningstar analyst ratings. Moreover, SaxoInvestor offers market-leading entry prices, low commissions, and tight spreads.

You can go with Saxo’s SaxoTraderGo if you are a seasoned trader or rookie and manage your trades on the go. And don’t be fooled by the platform’s simplicity. It has powerful trading and investing features, including advanced fundamental and technical analysis tools. It also comes with an extensive charting package loaded with live integrated charts, drawing tools, and over 40 technical indicators.

A SaxoTraderGo account also comes with a portfolio summary, which allows you to view historical and current reports of your net holdings. Additionally, it gives you access to an in-depth research hub that helps you make informed decisions through global sales trading market updates and asset-specific news.

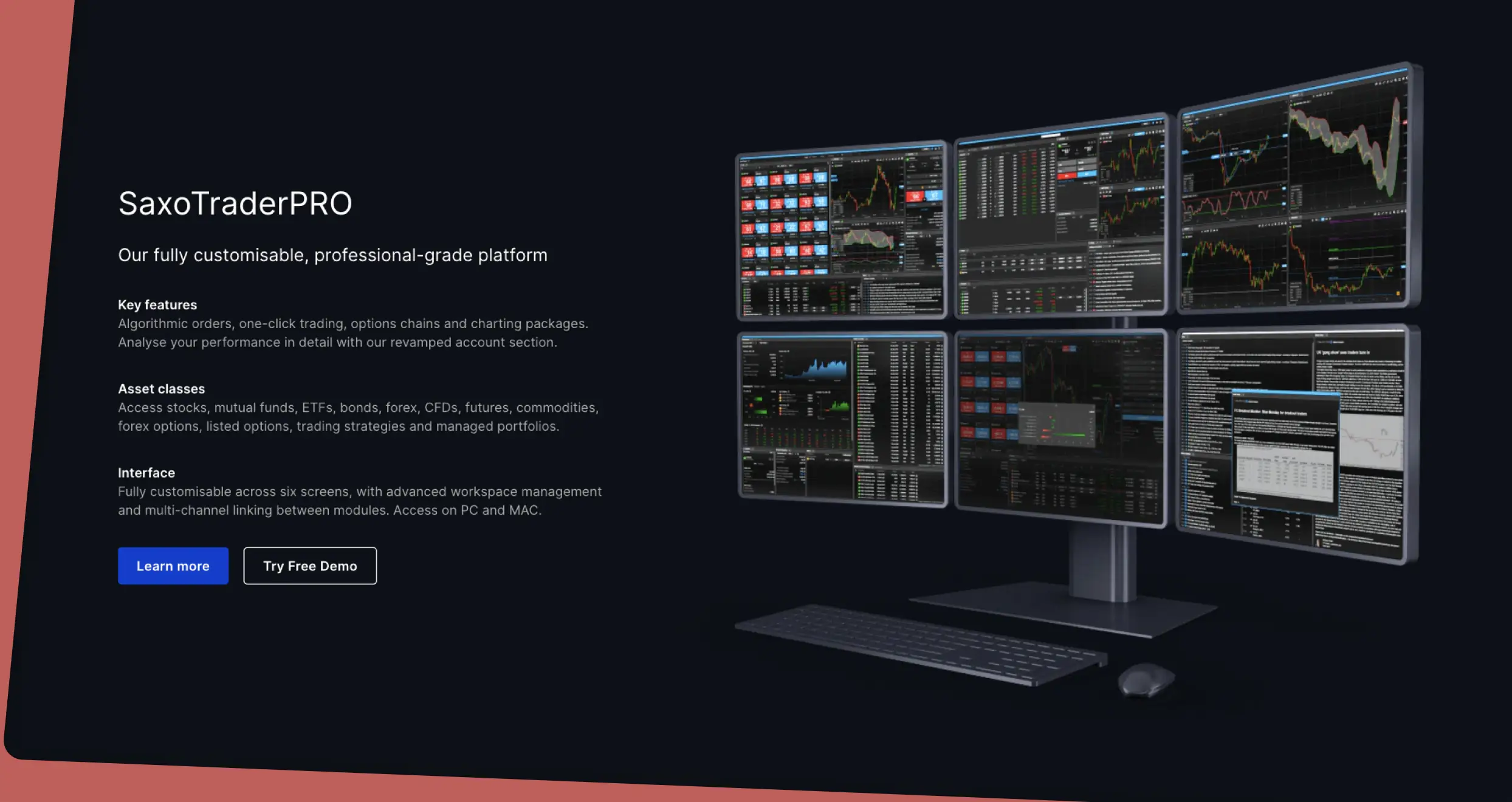

Saxo’s other platform is SaxoTraderPro, which boasts numerous advanced features. The first one is advanced trade ticket tailored for optimum productivity and speed. Time and sales data are also available here. They allow you to view real-time order executions on some exchanges and use generated insights to make informed decisions. Lastly, this platform has algorithmic orders, fully integrated charts, and 50+ technical indicators.

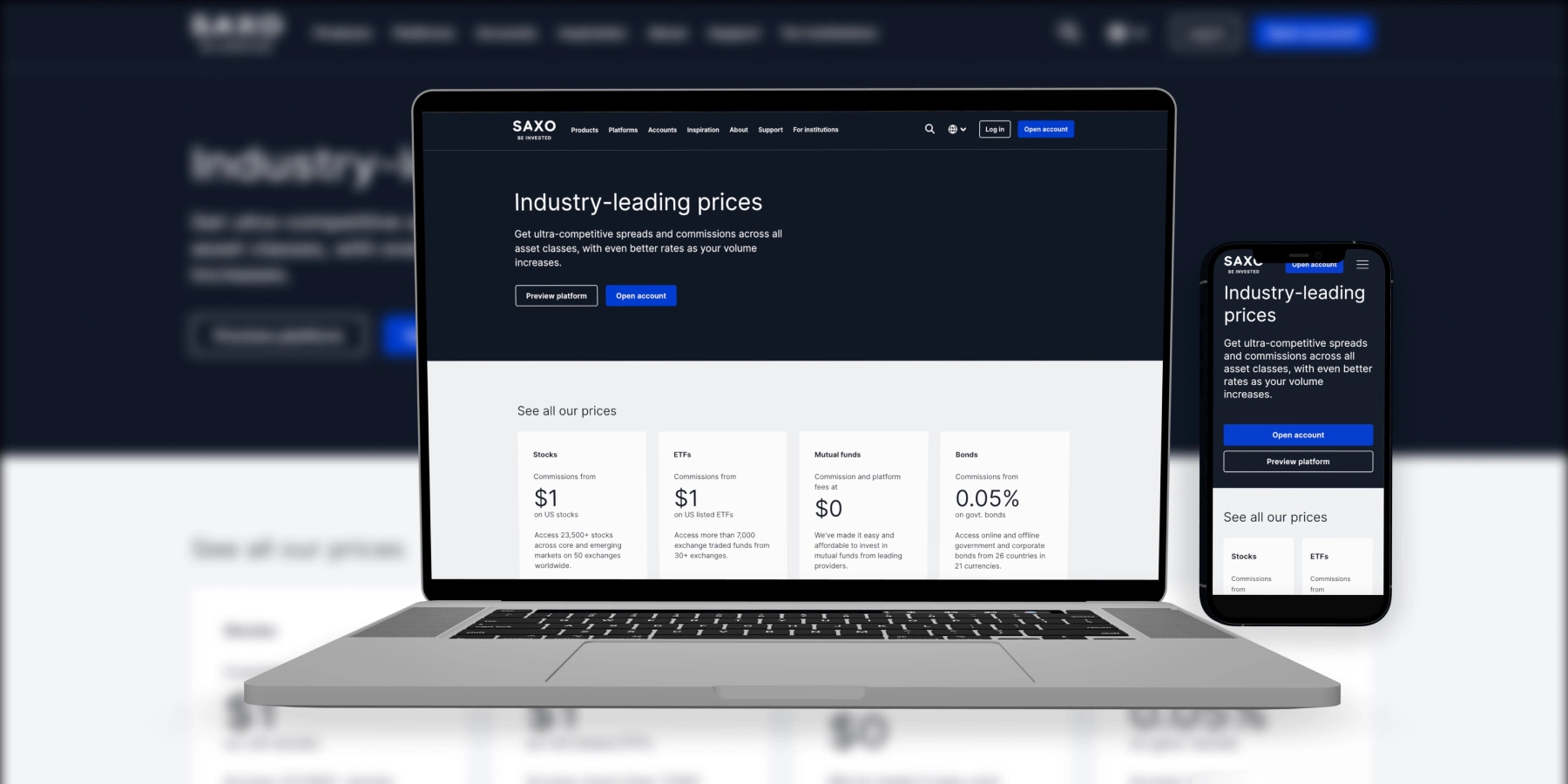

Fees

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

Product Offerings

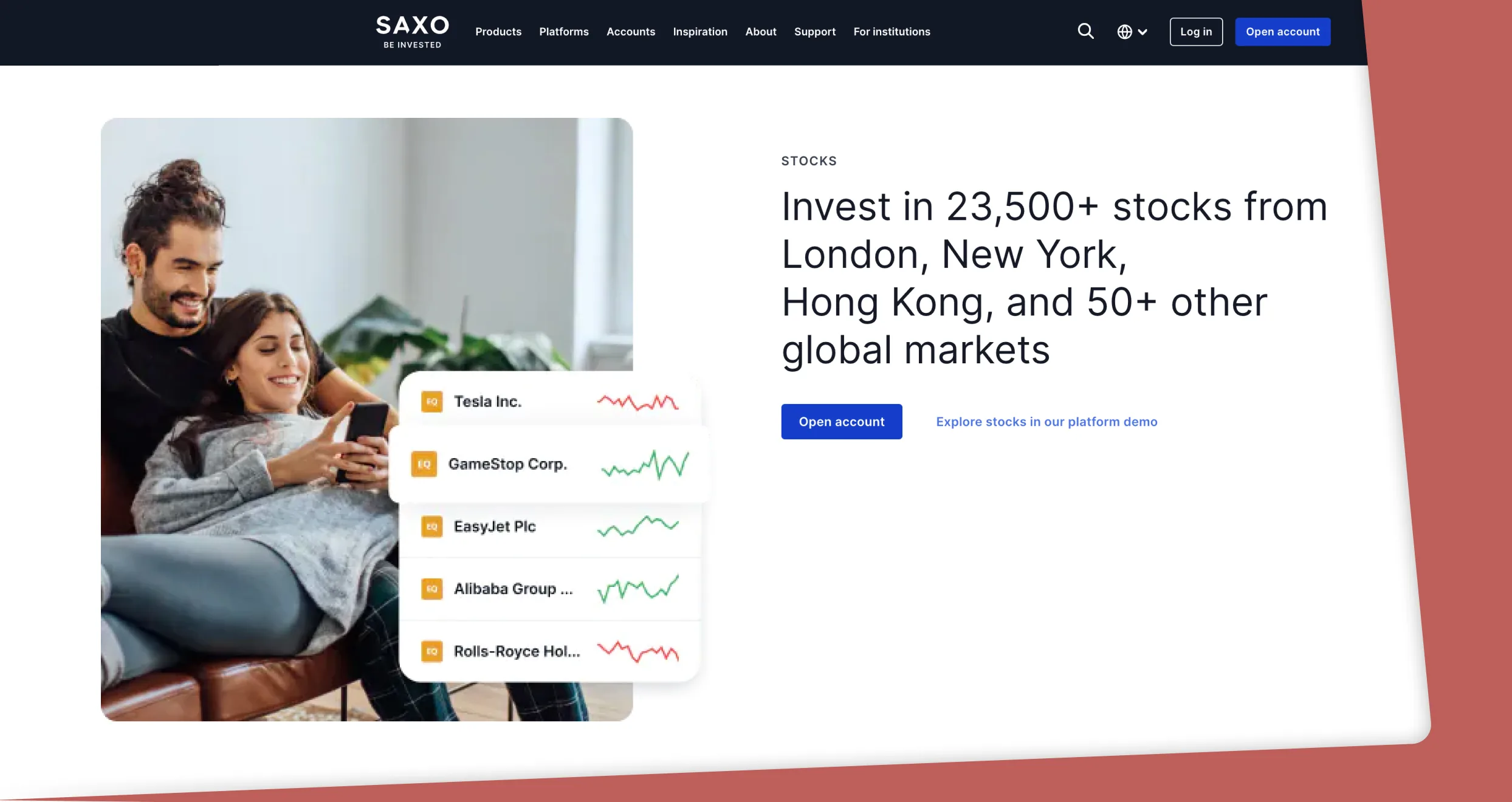

Saxo offers over 70,000 products categorized into investment and leveraged products.

Joining Saxo gives you the opportunity to invest in diverse products, including stocks, mutual funds, and bonds. There are over 23,500 stock options, 17,700+ mutual funds, and 5,900+ corporate and government bonds alone. The exact numbers may vary depending on your geographical location.

When it comes to leveraged products, traders like yourself are spoiled for choice. Saxo offers you access to a rich product range with options like:

- Options

- Futures

- Forex

- Forex options

- Crypto FX

- CFDs

- Commodities

All you have to do is pick an investment or leveraged product, make the right decisions, and earn juicy returns. But be careful. Trading and investing are risky endeavors. If you are not a skilled professional, educate yourself and hone your skills before putting money on the line.

Customer Service

You can seek professional support from Saxo’s team whenever you have any queries or concerns. Saxo broker’s gurus are available 24/5 and always ready to offer assistance. You can reach them via a phone call, which allows you to get prompt assistance which is crucial in addressing urgent matters. We called this broker’s technician and got a prompt response.

If you can’t call Saxo’s support team, you can send an email. An agent will respond as soon as possible and address your concerns. Lastly, you can use live chat for prompt issue resolution.

Alternatively, you can find answers to most questions in Saxo’s FAQ section. Here, the broker has addressed the most crucial topics, from the intricacies of Saxo’s platforms to how to troubleshoot technical issues.

How to Sign up For an Account at Saxo

Luckily, Saxo has simplified the registration process. We opened an account with this broker without any hassles. Remember that Saxo is regulated by multiple authorities that require brokers to use protocols like KYC to verify client identity and optimize safety. Prepare to submit factual personal information and the mandated documents.

Not to forget, trading is risky. We strongly recommend opening a demo account and testing your skills before transitioning to live trading. If you deplete the provided virtual funds without making your desired returns, take some time to improve your strategies. Most importantly, never risk more than you can afford to lose.

You can open a trading account with Saxo today by following these steps:

Visit Saxo’s official website and examine it. Verify if everything you need to trade seamlessly is provided, including your favorite leveraged financial instruments and investment products. Don’t forget to check the broker’s pricing structure and incorporated charges. If you prefer trading on the go, you should also download a dedicated app from this page.

Click “Open Account” at the top-right corner. Fill in the form with the required details, including your name, email, location, and more. For optimum safety, create a unique username and strong password. Then, enter your postcode, employment, and income details.

Prove your residency and identity with the required documents, including a valid government-issued ID and bank statement. To avoid complications, ensure your shared documents are clear and belong to you. Remember that brokers verify applications manually.

Choose your preferred account type and base currency. Submit your application and wait for approval. Saxo will respond within 2 working days. Finally, fund your account with any amount since Saxo has no minimum deposit requirements. If you’re new to online trading, you can start with a small deposit and increase the amount gradually.

Choose an instrument, size your position, and place your trade. Use tools like take-profit and stop-loss to maximize profitability and mitigate losses. Afterward, assess the outcomes and decide where to go from there. For instance, if you lost, check where you went wrong and rectify the mistake.

Final Thoughts

We hope you’ve derived gold nuggets from our Saxo review. Use them to gauge the suitability of this broker. Remember, the right broker is the key to enjoying optimum trading experiences, minimizing losses, and maximizing profits.

But don’t sign up yet. To ensure you’re making the right decision, conduct further research. Read online reviews and testimonials regarding Saxo. You’ll get a rough picture of what to expect before opening and funding your account.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Saxo’s platform is powerful, and their support team is super helpful, but the fees can sting. It’s great if you trade big, but for smaller investors, there are cheaper and simpler options.

Would you recommend this provider?