Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Finding a reliable and trustworthy partner is indispensable in a world chock-full of brokers. For you, that partner can be Spreadex, an FCA-licensed spread betting and CFD trading broker. Spreadex was founded in 1999 and is now a popular platform that caters to thousands of traders. It offers trading enthusiasts like yourself the golden opportunity to trade thousands of markets, including commodities, shares, forex, and more.

Since we are committed to providing factual information and helping you find a fitting trading broker, our team went on a fact-finding mission. We tested and evaluated everything associated with Spreadex, from the registration process to the available trading platforms. Our Spreadex review will introduce you to what we discovered. Use it to make informed decisions.

Why Spreadex

In our opinion, Spreadex is a fantastic broker for both seasoned and rookie traders. That is because it’s licensed and regulated by the FCA, the most powerful regulator in the UK. Moreover, this broker values transparency and has no minimum deposit requirements. But despite being outstanding, Spreadex has a few drawbacks.

Let’s explore some of the pros and cons we discovered while vetting this company.

Pros

- Licensed and regulated by tier-one financial authorities

- No deposit, withdrawal, or inactivity fees

- No minimum deposit requirements

- Tight spreads starting from 0.6 pips

Cons

- The trading platform is only licensed in the UK

- No demo account

Security

At Spreadex, the security of customer resources is a top priority, and it shows. While vetting this broker, we realized several things. First, this company holds all client money in segregated bank accounts. This rule can only be broken if a trader or investor enters a special written agreement with Spreadex.

Trading with Spreadex, which keeps client money in segregated accounts, is advisable because it protects your funds from misappropriation and ill-advised broker investments. If Spreadex becomes bankrupt or insolvent, the segregated accounts will ensure your funds are out of the reach of creditors and other entities.

Besides keeping your money in segregated accounts, this broker has implemented a system for distributing assets to customers in case of insolvency. Assets, in this instance, refer to the cash you’ve deposited in your trading account, accrued winnings, and even uncleared cheques.

Additionally, while trading with Spreadex, you can enjoy negative balance protection. This is an indispensable element since spread trading can lead to rapid losses. With negative balance protection in place, you will never lose more money than is in your account. That said, you need a “Limited Risk” account to enjoy this feature.

Spreadex also optimizes security by employing secure socket layer (SSL) encryption and allowing you to set additional measures like Touch ID login on the iPhone/IPAD apps. 2FA and biometric identification are also available to Spreadex mobile trading app users.

Finally, Spreadex is licensed and regulated by The Financial Conduct Authority (FCA), registration number 190941. FCA is one of the most authoritative bodies in the UK.

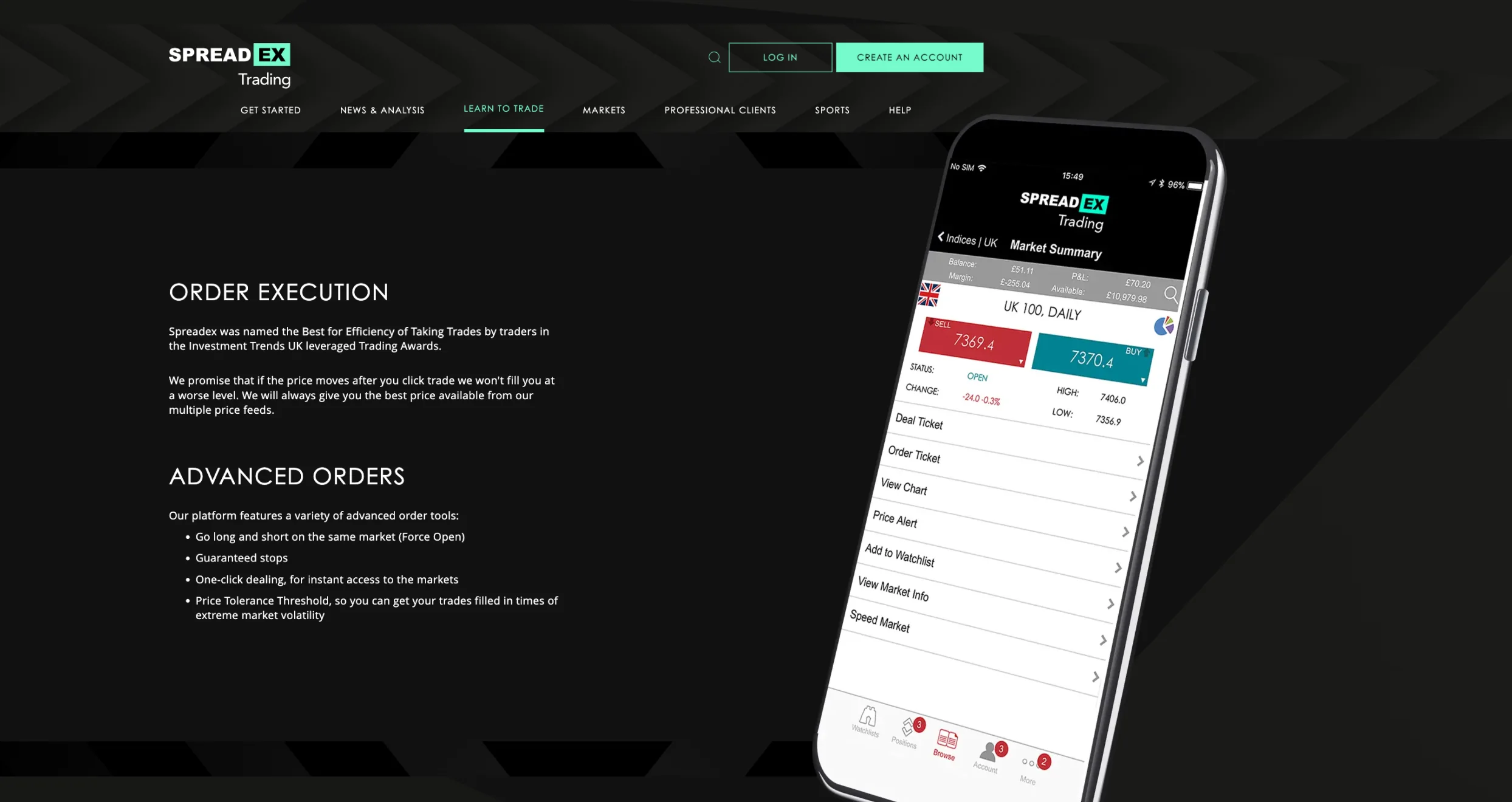

Platforms

The Spreadex trading website is something to behold. It’s eye-catching and professionally designed, and we had no problems navigating it. We were impressed by the platform’s fully customizable interface, which allowed us to organize all our trading activities seamlessly. Our faith in it was also bolstered by the fact that this powerful site received an Investment Trends UK leveraged trading award for best for efficiency of taking trades.

Spreadex’s online trading platform boasts numerous juicy features. They include advanced order tools like guaranteed stops, Price Tolerance Threshold, and one-click dealing. Additionally, this platform enables you to take advantage of every available opportunity through timely price alerts that you can receive through email, push messages, or text.

We also discovered that the Spreadex online trading platform supports TradingView. This platform allows you to take your trading experience to a new level with supercharged analytical and charting tools. This broker’s online trading platform is compatible with iPhones, iPads, and Android smartphones and tablets.

Fees

From our assessment of Spreadex’s fees, we concluded that this broker offers one of the most cost-friendly platforms. Why? For starters, Spreadex has $0 minimum deposit requirements. That means you can deposit whatever you can afford and start trading immediately. Moreover, while funding your account, you won’t have to pay any deposit fees – it’s free! The same applies to withdrawals.

That is exceptional news since Spreadex supports myriad payment methods, from debit and credit cards to Apple Pay and Easy Bank Transfer. You can use these options without fretting over any charges undermining your profits.

We also recommend Spreadex because this broker doesn’t penalize dormant accounts. Your Spreadex trading account can remain inactive for an extended period without attracting inactivity fees, which separates this company from its peers.

Spreadex offers exceptional rates on spreads. This broker’s spreads start from 0.6 pips for CFD trading. This trading broker should be your go-to if you want lower overall trading costs and improved profit margins.

That said, Spreadex charges overnight funding for shares rolling positions. If you keep a position open through the close of the relevant exchange, Spreadex will keep it open for the following day’s trading. But that will attract a funding adjustment. The fees you’ll incur at any given time will be a combination of the Adjusted ARR and Spreadex’s charges. However, holding futures overnight won’t attract any charges.

Product Offerings

Spreadex offers a wide range of tradeable products through CFDs and spread betting. With a Spreadex account, you get uncapped access to 10,000 global markets and instruments.

That said, you should be extremely careful. CFD trading and spread betting are risky endeavors. 64% of retail investors part with their hard-earned money while betting on spreads and trading CFDs on Spreadex. If you’re a novice, learn the ropes and hone your skills with a demo account before risking your resources. Note that this broker limits spread betting to specific regions, including the UK and Ireland.

Here are the product offerings we discovered on Spreadex:

- Forex: As a Spreadex client, you can speculate on 60+ currency pairs and enjoy competitive spreads. The spreads start at 0.6 and 0.9 points for EUR/USD and GBP/USD, respectively. This broker gives you 24-hour access to most FX trading markets and offers world-class technical analysis tools like advanced indicators with drawing tools, pattern recognition, and Pro Trend Lines.

- Shares: Spreadex’s share trading feature allows you to profit from rising and falling equity and stock prices. The available shares are from 15+ countries, including Europe, Asia, and the UK. This broker supports out-of-hours trading on German, UK, and US shares. Not to forget, any profits you rake in from spread trading on shares are free from Stamp Duty and Capital Gains Tax.

- Bonds and Interest Rates: Suppose you’re interested in speculating on the direction of bond prices and interest rates. Spreadex’s trading platform lets you do that. This broker lets you choose your favorite assets from a comprehensive list of 19+ bond and interest markets from Europe, the US, and the UK.

- Commodities: After joining the Spreadex broker trading platform, you can place CFD trades and spread betting on commodity futures markets. The best part is that you can enjoy low spreads starting from 0.5 pts on Gold. Also, all your profits from trading spreads or commodities CFDs are exempted from Stamp Duty and Capital Gains Tax.

- Indices: Spreadex allows you to trade indices with tight spreads starting from 1 pt on the UK 100 and Germany 50. This broker also supports out-of-hours trading, meaning you can trade most of the available indices around the clock. There are over 30 indices markets on Spreadex’s trading platform.

- ETFs: Spreadex supports ETFs, which bundle different stocks together. With an ETF, you get exposure to a basket of assets, saving you from the hassles of trading individual constituents. There are over 200 ETFs on Spreadex. Moreover, all profits from ETF spread trading are exempt from Capital Gains Tax.

- Cryptocurrencies: Join Spreadex to speculate on the prices of digital currencies like Bitcoin, Ripple, and Litecoin. However, this product is exclusively for traders in the Professional Clients program.

Customer Service

Spreadex has a knowledgeable and responsible customer support team. We contacted this broker’s technicians via phone, and they responded instantly. The representative we talked to addressed our questions excellently and provided invaluable information. We recommend you call whenever you’re facing an issue that requires prompt resolution.

You can also email Spreadex’s customer support agents. You should consider using this channel when facing a non-urgent problem that won’t derail your trading activities. It’s also ideal for complex issues that demand detailed explanations or solid records. Additionally, by sending emails, you can communicate your issues and concerns with Spreadex’s team even after working hours. The agents will get back to you when they are available.

Note that Spreadex doesn’t offer 24/7 support. The broker’s agents are available from 8:00 a.m. to 5:30 p.m., Monday through Sunday. Furthermore, this platform has FAQ pages that address diverse topics, from the difference between spread betting and trading the underlying market to how to open a live account. You may find what you seek on these pages; check them out.

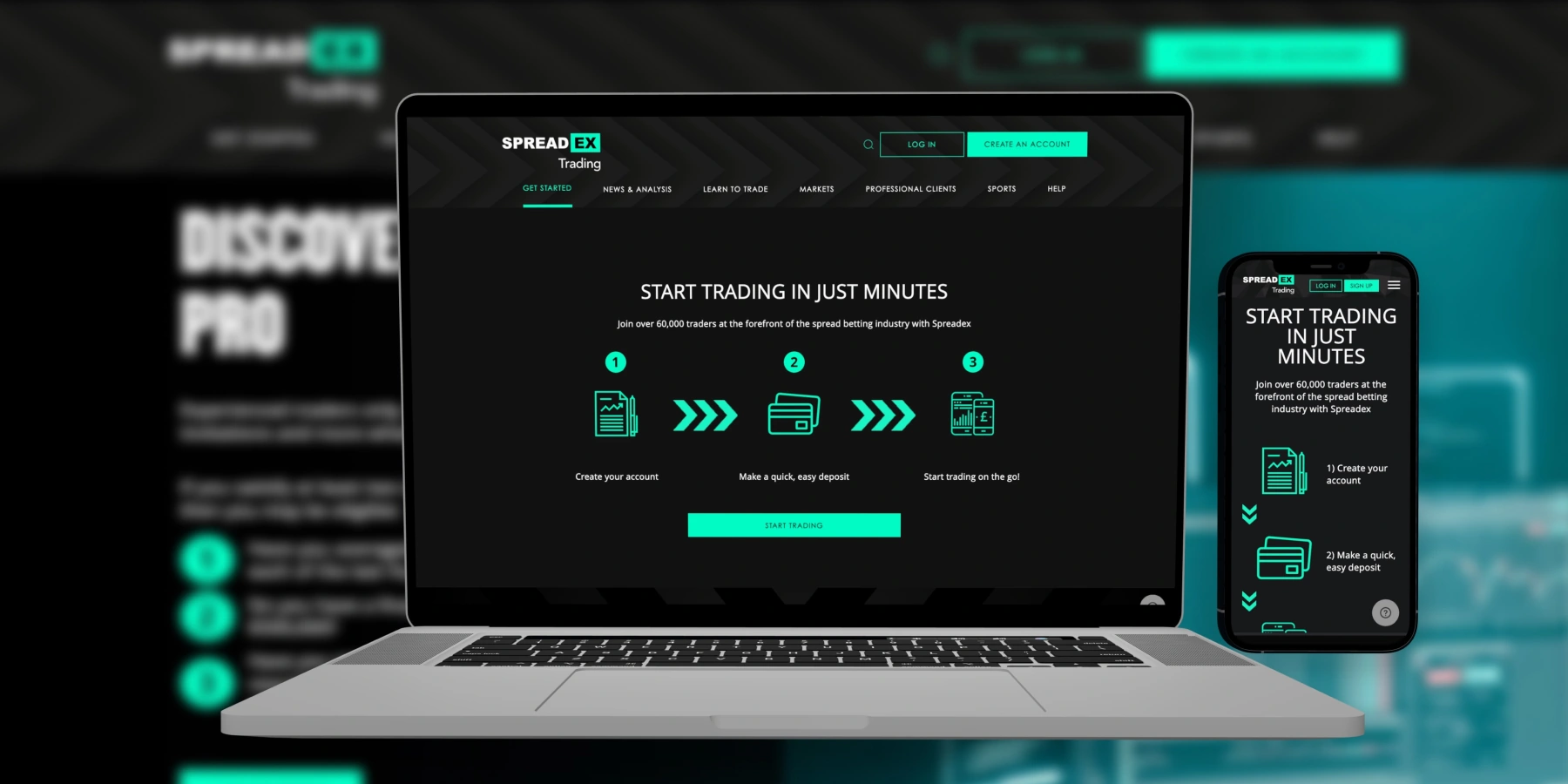

How to Sign up For an Account at Spreadex

Testing what Spreadex offers required us to open a live trading account. Luckily, the process was manageable, and we faced no significant hurdles. If you’re ready to sign up with this broker, follow the simple steps we’ve outlined below.

Before we proceed, you should know that Spreadex will ask you to provide certain information and documents during registration. The company needs these elements to verify your identity and satisfy KYC obligations from regulatory bodies. Please provide relevant details and documents to avoid getting banned from the Spreadex trading platform.

Visit the Spreadex official homepage and select the FINANCIAL TRADING website. Give everything a once-over while looking for everything you need, including your preferred financial instruments. If you plan to trade with a mobile device, go to the bottom of the page and download the right app.

Find and Click the “CREATE AN ACCOUNT” button in the top right corner. Read what’s on the pop-up, then click “Get Started.” Fill in the application form with the correct details, including your name, email address, and username. Set a strong password for your account. Avoid using info that someone can guess, like your pet’s name. Read all the terms and conditions. The Ts & Cs carry legal obligations, so review them carefully.

Activate your account by submitting the required information, including your date of birth, phone number, and postcode. Note that you can only provide an address where you’ve lived for at least 3 years. Create your trading profile. Check the correct answers to the questions you’ll encounter. Provide the documents Spreadex needs to verify your identity and residency, including a photo of a government-issued ID and a utility bill with your name and address.

Wait for Spreadex’s team to approve your application. Then, fund your account, pick an asset, and start trading. Since Spreadex has no minimum deposit requirements, you can start with any amount within your budget.

Start trading by choosing an instrument that you’re familiar with. To avoid significant losses, newbies should start with a smaller trading capital. If you lose all your money prematurely, review your strategies and practice with a demo account before returning to live trading.

Final Thoughts

We recommend Spreadex because this broker is licensed and regulated by one of the most powerful authorities: the FCA. Moreover, its trading platform has diverse tools and product offerings that any trader, especially seasoned professionals, can leverage today.

Unfortunately, this broker doesn’t offer demo accounts. That said, the platform has an extensive education hub that novices can use to enhance their knowledge and skills. Moreover, you can benefit immensely from Spreadex’s zero minimum deposit and transaction fees as a rookie.

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

That being said, I really wish they offered a demo account.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals