Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

A select few brokers boast over a million customers, and XTB is one of them. This broker started accepting clients in 2002 and has become infamous ever since. Presently, XTB has regional offices in 13+ countries, including Poland, the UK, and France. It’s also authorized and regulated by the FCA, CySEC, and IFSC– today’s most respectable regulatory bodies.

Before you join XTB, there are some things you should know, including the broker’s security protocols, fees, and trading platforms. We’ve discussed them in this XTB broker review. Before preparing this piece, our team tested XTB extensively. We also read countless user reviews and testimonials.

Why XTB

After testing and evaluating XTB, we’ve ranked it with some of the best brokers today. The perks we discovered, including proper licensing, low spreads, and a wide range of instruments, encouraged our experts to hold this broker in high regard and recommend it to you. But we also unearthed a few shortcomings you should know before joining XTB. We’ve reviewed some of this broker’s pros and cons below:

Pros

- Licensed and regulated by multiple authoritative bodies like the FCA, CySEC, and more

- Excellent customer support available 24/5 via phone, email, and live chat

- Over 5,800 trading instruments, including stocks, forex, indices, commodities, and more

- No minimum deposit requirement

- Low spreads starting from 0.1 pips for Pro accounts

Cons

- XTB restricts users from many countries, including the US, Japan, and Australia

- $10 monthly inactivity fees levied on dormant accounts

- Currency conversion fees can reach 0.8% on weekends

Security

XTB uses different protocols and solutions to boost security and safety. First, this broker invests heavily in state-of-the-art encryption technologies, including SSL. These optimize the platform’s security and guarantee the safety of your personal information and investments. The security measures encrypt all connections, even those involving your smartphone app and XTB servers.

While interacting with the XTB trading platform, there are some actions you can take to enhance your security. First, you can set a strong password that no one can guess. You can also protect your trading account from unauthorized access by enabling 2FA and biometric authentication.

And you don’t have to worry about the misappropriation of your funds or losing your money to bankruptcy or insolvency. XTB keeps client funds in segregated bank accounts. If things go downhill, the broker can’t use your money to fund company operations or pay debtors.

Finally, XTB is licensed and regulated by numerous elite bodies. In the UK, it is authorized and regulated by the Financial Conduct Authority, FCA, FRN 522157. In Cyprus, this broker is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), Licence number 169/12. Lastly, this broker is authorized and regulated by the International Financial Services Commission (IFSC), License number 000302/438.

Platforms

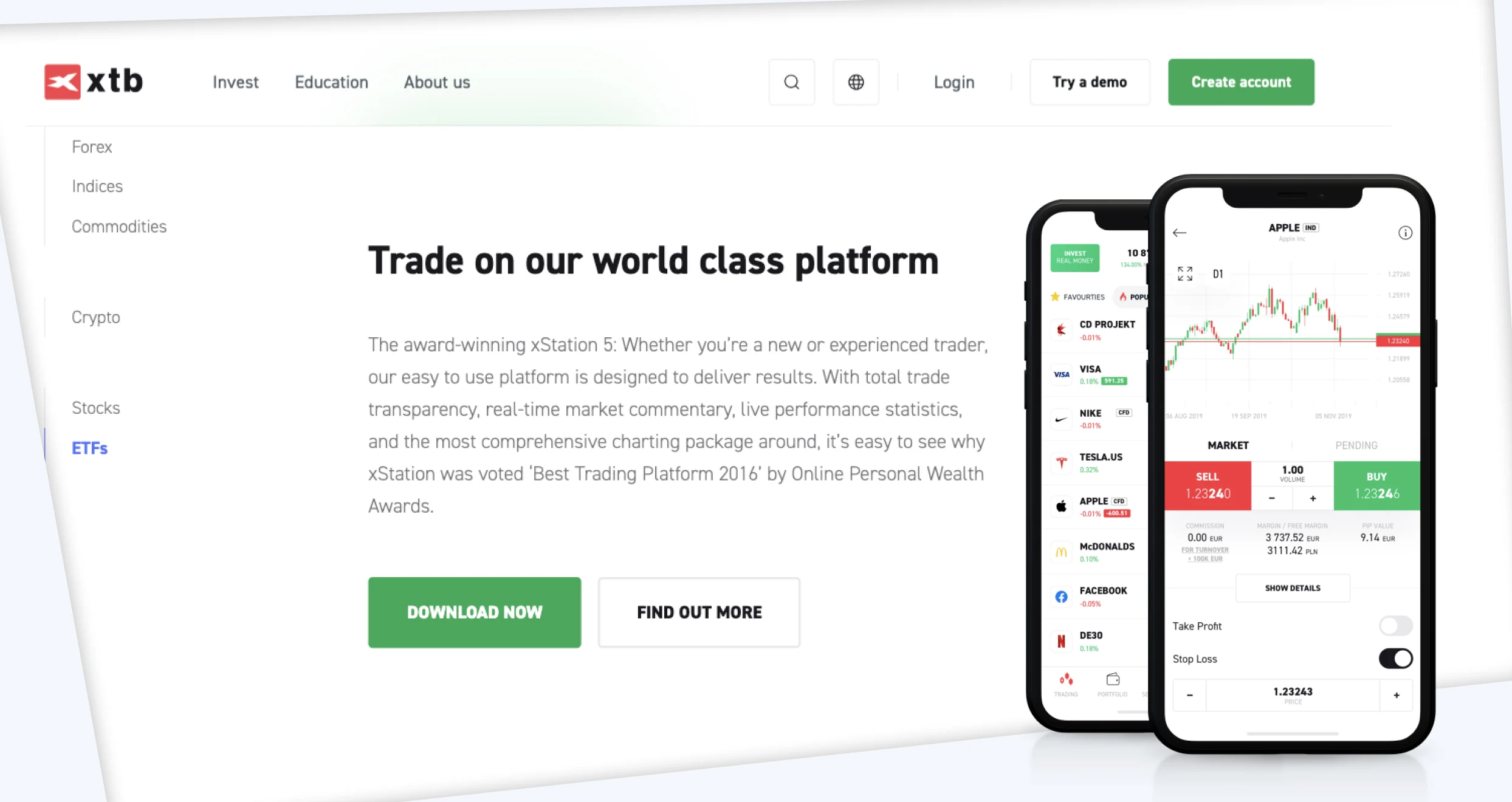

We encountered two exceptional trading platforms on XTB. The first one is xStation 5. This platform is well-designed and easy to use. It has a simple and intuitive interface and excellent features that all professionals and novices can benefit from.

With XTB’s xStation 5, you can trade 2100+ forex, commodities, ETFs, Indices, and Stocks CFDs. You can also invest in over 3,000 real stocks and ETFs and enjoy commissions as low as 0.2%. Spreads are also tight on this platform, starting from 0.2 pips, and you can enjoy flexible leverages of up to 30:1. xStation 5 also offers 24-hour support from Sunday through Friday.

We checked out xStation 5. Several aspects caught our eye besides what we’ve discussed above. First, this platform has a dedicated mobile app you can download today. It’s a fantastic app ranked as the Best Mobile App for Investing 2019 & 2020 by Rankia. This app allows you to trade all instruments on the xStation 5 web platform. You can also get the same benefits by downloading the xStation 5 desktop app.

XTB also offers the xStation Mobile app, which allows you to trade over 5,800 CFD instruments, including currency pairs, ETFs, and cryptocurrencies. You can download it from the Google Play Store today.

Fees

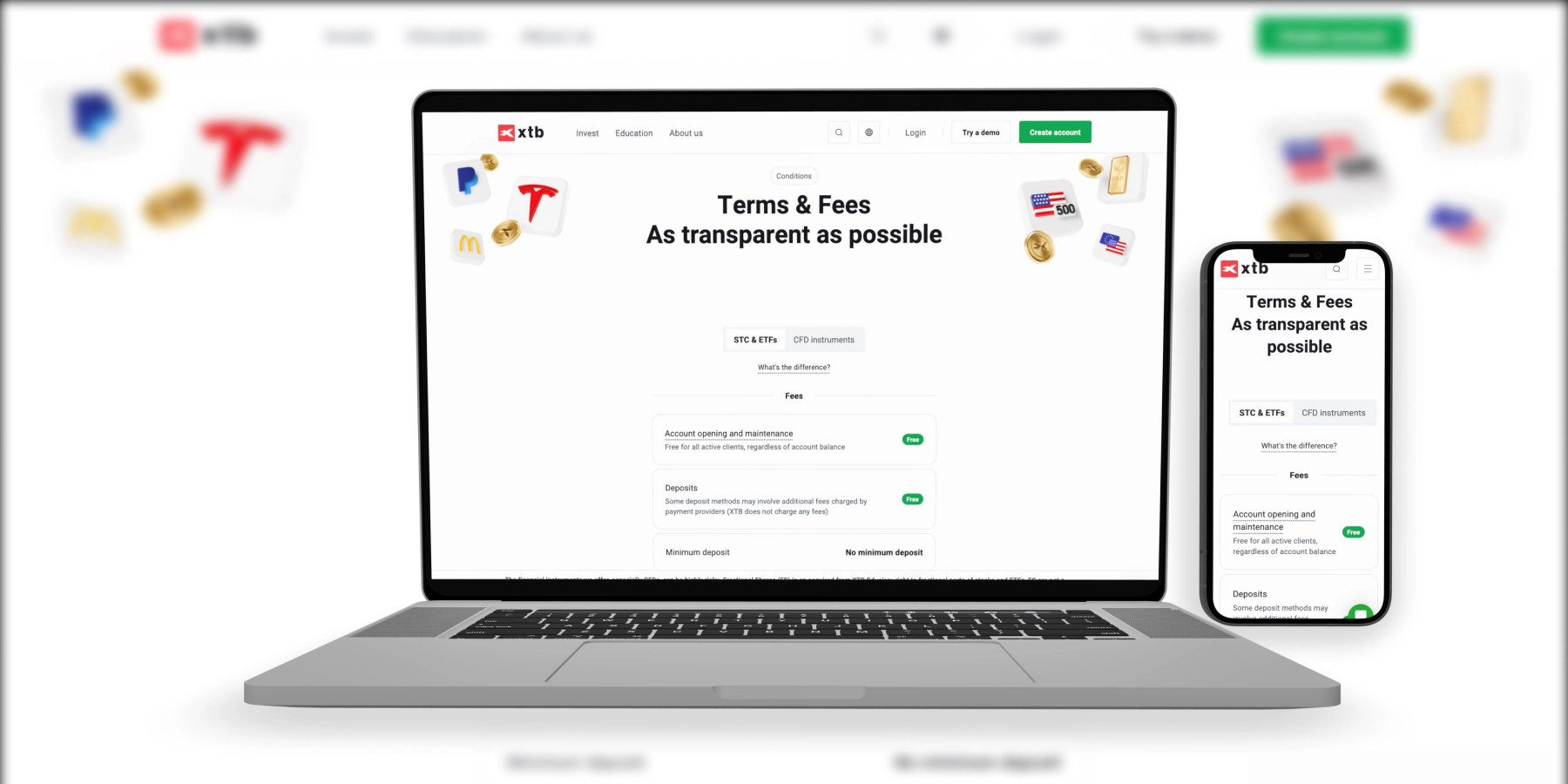

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

Product Offerings

XTB’s product catalog is impressive. We found many investment and trading options that other brokers don’t offer. Here’s a list of all the instruments and assets you’ll have access to while interacting with this company:

- Stocks: XTB allows its clients to invest in real stocks from popular companies like Netflix, Tesla, and Amazon. You can choose any asset from a list of over 2800 stocks from 16 popular global exchanges. While investing in stocks, you get uncapped access to free real-time quotes and competitive commissions of up to 0.2% for monthly turnovers above $100,000.

- ETFs: XTB offers you a cost-effective way to invest in ETFs. What’s more, you can start with as low as $10. There are over 300 ETFs on this platform, and you can access all of them from a single account. Moreover, you get the opportunity to take your experience to the next level with an advanced ETF scanner. This tool helps you find ETFs quickly based on whichever criteria and metrics you specify.

- CFDs on Forex: If you are a forex enthusiast, you can trade forex CFDs on XTB. This broker supports 48 currency pairs and allows you to trade 24 hours a day, 5 days a week. Microlot trading is also available here. Some of the currencies on this platform include EUR/USD, AUD/USD, and USD/TRY.

- CFDs on Indices: You can trade index CFDs on the XTB online trading platform and enjoy numerous perks. They include competitive spreads and up to 500:1 leverage. XTB gives you access to 20+ indices from different corners of the globe, including China, the US, and Germany. Available options range from UK 100 to US 2000 and FRA40.

- CFDs on Commodities: XTB provides traders with a wide variety of commodities, including gold, silver, and oil. You can trade CFDs on commodities with this broker 24 hours a day and enjoy competitive spreads and up to 500:1 leverage.

- CFDs on Cryptocurrencies: As an XTB account holder, you can access over 10 crypto CFDs, including BTC and ETH. The best part is that, unlike other instruments, crypto CFDs support 24-hour trading, even on weekends. This broker also offers you tight spreads starting from 0.22%.

Customer Service

If you have questions regarding XTB or how to open an account with this broker, you can call its support team at any hour of the day or night on weekdays. We recommend using this channel for urgent queries or concerns; you’ll get prompt feedback and personalized assistance.

Besides calls, you can chat with XTB’s live agents, who are available 24/5, or send an email, and you’ll get the assistance you need. Alternatively, you can find answers to your questions in XTB’s extensive FAQs published on the Help Center page. They cover everything, from the fundamentals of investing with this broker to defining elements like Fractional Shares.

How to Sign up For an Account at XTB

XTB is regulated by numerous authorities that require brokers to obey strict KYC mandates. As such, this company requires all individuals opening a trading or investment account to follow a specific procedure and provide all the necessary documents and information. If you fail to do that, XTB will reject your application. Your account may also be suspended or terminated in the future.

With that in mind, you can open a new XTB account by following these steps:

Visit the broker’s official site and review it. Pay attention to indispensable elements like the supported financial instruments. If you are a newbie, go to XTB’s Education page and learn all you need to know. Then, return to the homepage and sign up, or download a mobile app and use it to open your account.

Click “Create account” in the top right corner. If you are a newbie, we recommend you begin with a demo account. Click “Try a demo” and register. Enter your email address and choose your country. Remember that XTB doesn’t accept applications from some jurisdictions, including the US, India, Syria, Pakistan, and Iraq. Check the boxes and give XTB permission to send commercial information and process your data. Then, create a strong password and go to the next step. Fill in the application form with factual details, including your name, phone number, and date of birth.

Submit your ID and proof of address documents and wait for XTB to verify and approve your application. You should receive a response within a few hours. Note that your application may fail to go through if you provide false documentation or share hard-to-read copies.

Use a supported payment method like PayPal, a debit card, or a credit card to deposit money into your trading account. Fortunately, you can start with any amount you please since XTB has no minimum deposit requirement. But don’t risk anything you can’t afford to lose.

With money in your account, you can start trading. But limit your endeavors to financial instruments you’re familiar with. Most importantly, avoid behaviors that can lead to unnecessary losses, like chasing losses or trading due to FOMO (fear of missing out).

Final Thoughts

Our XTB review has introduced everything we discovered after testing and evaluating this broker. To summarize, XTB offers you the opportunity to trade and invest in over 5,800 instruments. Moreover, this broker has no minimum deposit, trader-friendly charges, and easy-to-use trading platforms.

But don’t take our word for it. Although we’ve discussed almost everything about XTB, you should do additional research. Furthermore, use a demo account to test this broker’s trading platforms before opening a live account and committing financially.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals