Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

eToro is a world-class trading and investment platform that boasts over 30 million registered users. Since its inception in 2007, eToro has risen through the ranks and is now considered one of the best brokers in the world. With this platform in your arsenal, you will have unparalleled access to 5000+ instruments, top-notch support services, and seamless trading experiences.

Our team spent countless hours thoroughly testing and reviewing eToro’s features and services. We assessed and gauged everything, from the broker’s trading platforms to product offerings and customer support services. We had a fantastic experience and highly recommend this company to all savvy traders and investors.

This review will help you understand why we recommend eToro for your trading and investment needs.

Why eToro

Trading with eToro can be beneficial in numerous ways. For instance, you get to enjoy unparalleled security and unlimited access to thousands of quality instruments. Not to forget, this broker is licensed by reputable organizations like the FCA and CySEC. That aside, eToro has a couple of downsides you should know of. Let’s explore the pros and cons associated with eToro.

Pros

- Hassle-free account opening

- Low minimum deposit requirement

- Compatible with desktop and mobile devices

- 5000+ tradeable instruments, including stocks, forex, cryptocurrencies, and more

- Features social and copy trading

Cons

- $5 fee for all withdrawal requests

- Many users report slow support

- $10 monthly inactivity fee

Note: {etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Copy Trading does not amount to investment advice. Your investments value may go up or down. Your capital is at risk. Other fees apply.

Security

eToro is dedicated to ensuring your money is safe and secure. That is why, for starters, this broker keeps your funds in tier-1 banks. As of 2025, eToro banks with J.P. Morgan, Deutsche Bank, Coutts, J. Safra Sarasin, Pictet, and UBP. These well-established and globally recognized institutions are known for their financial stability and reliability.

To avoid misappropriation, eToro keeps traders’ funds in segregated accounts. That means the company can never use your money for its operations. If it ever becomes insolvent, which is highly unlikely, the segregated accounts guarantee you’ll be compensated.

Besides infamous banks, eToro holds client funds in Qualifying Money Market Funds. Some of the QMMFs that eToro uses include JP Morgan Asset Management and Blackrock. Even in QMMFs, your money as a trader is still segregated from eToro’s corporate assets.

Moreover, eToro uses SSL encryption to safeguard all personal information. This protocol protects every communication and transaction between your devices and eToro’s services. You can also enhance your security by activating two-factor authentication (2FA). With 2FA, you’ll have to use a verification code sent to your phone to access your account. It’s a perfect deterrent to unauthorized access by malicious actors like hackers.

Lastly, eToro is licensed and regulated by top-tier authorities, including:

- The Financial Conduct Authority (FCA), Firm Reference Number: 583263

- The Cyprus Securities and Exchange Commission (CySEC), license number 109/10

- The Malta Financial Services Authority (MFSA), Company No. C97952

- The Financial Services Regulatory Authority (FSRA), Financial Services Permission Number 220073

- The Australian Securities & Investments Commission (ASIC), License number: 491139

- The Financial Services Authority Seychelles (FSAS), License number: SD076

- The U.S. Securities and Exchange Commission (SEC), SEC #8-70212/SEC CIK #0001753042

Platforms

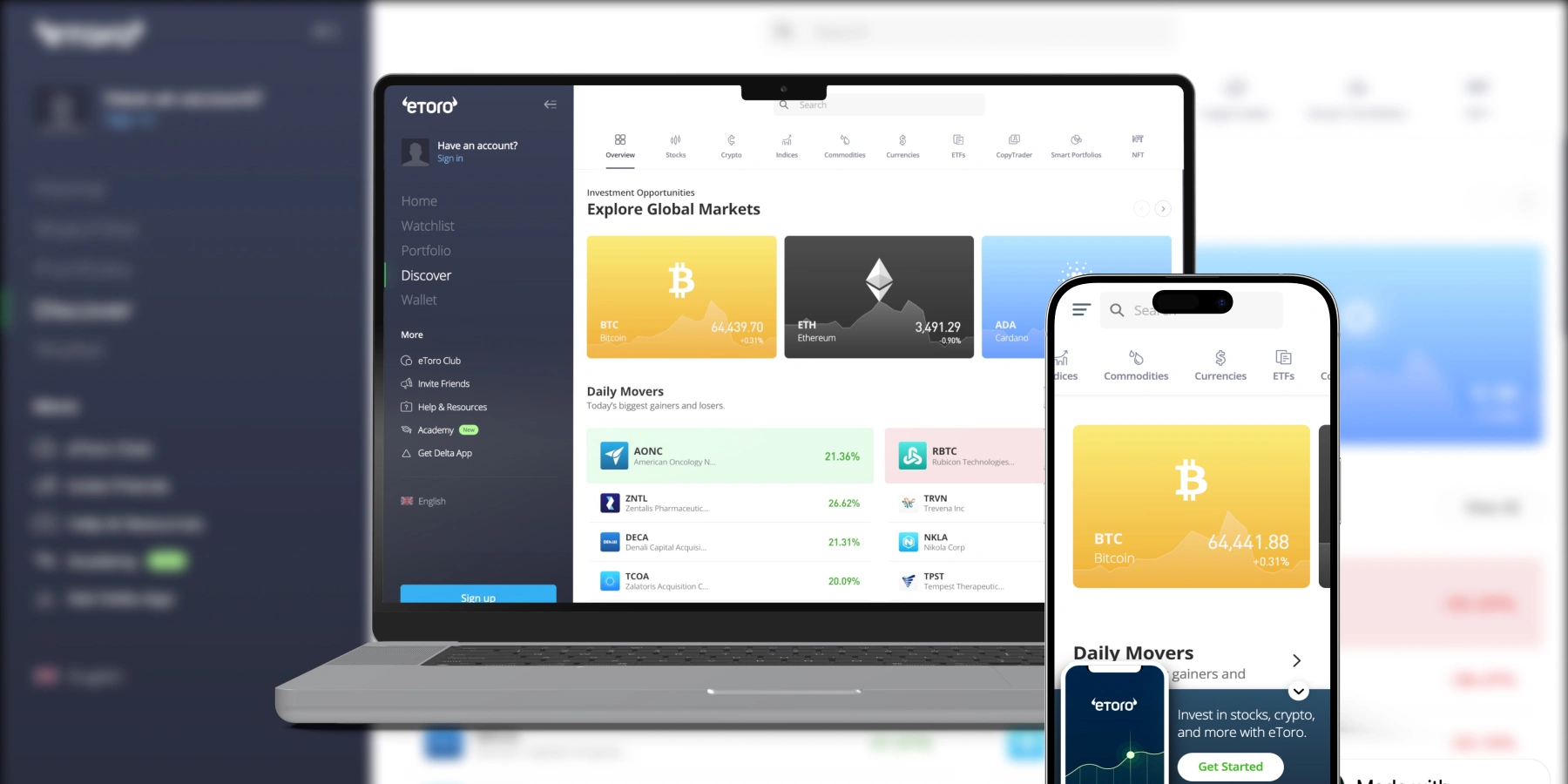

The first platform we encountered on eToro was the web trading site. Its intuitive and easy-to-use interface grabbed our attention. The platform is well-designed and user-friendly, and we were able to navigate it without any challenges.

We also came across eToro’s social trading feature. We tested it and found the available community of traders and investors nothing short of exemplary. The platform has a bustling network where we interacted with numerous traders and sourced invaluable ideas. We discovered countless people sharing their strategies and decisions on the embedded social news feed.

Our team also tested eToro’s CopyTrader platform, which allows traders to copy top-performing investors. We consider this feature a must-try for several reasons. For starters, it supports automation. Every trade you copy replicates in your portfolio in real time. What’s more, the eToro copy trading function is free. However, the minimum deposit required to start enjoying this feature can be high, especially for budget-conscious traders. You must deposit at least $200.

Afterward, we explored this broker’s Smart Portfolios. If you are a smart investor, you should try this product. With Smart Portfolios, you can leverage innovative, long-term portfolios prepared by eToro’s skilled analysts. Each portfolio comes with a unique investment strategy and allows you to exploit significant market trends without incurring additional portfolio management fees.

Our exploration concluded with eToro’s mobile trading apps. We tested both the iOS and Android versions. Our team was able to use these products to trade seamlessly and alternate between smartphones and tablets. Several features on eToro’s mobile app impressed us, including one-click investing, which simplifies order execution, and face ID, designed to optimize security.

Fees

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

Product Offerings

eToro is chock-full of product offerings. From our exploration, we unearthed the following:

- Stocks: We explored eToro’s stock offerings and encountered many juicy options commission-free. They include Apple, Microsoft, NVIDIA, and Meta.

- Indices: After joining eToro, you can follow and invest in indices from multiple leading global markets. The indices on this platform vary from SPX500 to NASDAQ1OO and GER40. We recommend such indices to investors looking to diversify their portfolios and minimize risk exposure.

- ETFs: eToro offers a wide variety of exchange-traded funds (ETFs). This platform has hundreds of ETFs, including popular options like SPY, VOO, INDA, and QQQ. The best thing about these products is that they are ready-made. Investing in them means you won’t have to spend time and energy cherry-picking assets individually.

- Currencies: Our team discovered over 40 currency pairs on eToro. We tested a few popular options, including EURUSD, USDJPY, AUDJPY, USDCAD, and EURCAD. We also found numerous exotic pairs on this platform, such as EURHUF, USDTRY, EURPLN, and USDILS.

- Commodities: eToro gives traders uncapped access to 40+ commodity markets, making it a superb platform for speculators or retail investors. Through this broker, you can trade and invest in commodities such as gold, oil, silver, corn, platinum, cocoa, and palladium.

- Cryptoassets: eToro has 100+ vetted cryptoassets, including popular ones like Bitcoin, Ethereum, Solana, and XRP. You can buy, sell, and transfer most of these digital currencies to your eToro Money wallet.

Customer Service

eToro has an automated chatbot that’s available 24/7. It uses advanced AI tech to address inquiries. We tried this feature, and it’s commendable. The chatbot answers questions instantly; we encountered no delays whatsoever.

If you prefer to interact with a real-life agent, eToro has this option. All you have to do is seek support via Live Chat. This function lets you interact with a dedicated customer service agent in real time. You can use it at any time of the day or night, from Monday to Friday.

The other support option we found on eToro is called Ticket. As the name suggests, this channel allows you to open a ticket in eToro’s Customer Service Center. Finally, there’s a WhatsApp support option. But that is exclusively for eToro Club members.

How to Sign up For an Account at eToro

We had a pleasant experience while opening an account with eToro. The process was straightforward and easy to maneuver. We only spent a couple of minutes setting up. If you’d like to join this platform, do the following:

Go to eToro’s official homepage and take a look around. Do you see everything you need, especially your favorite financial instruments? If yes, you can proceed to the next step. You can also download and install the eToro app if you prefer trading on the go.

Hit “Join eToro” to open a new account. You can sign up with Google or Facebook. You can also manually key in your email, username, and password. Remember to set a strong password with uppercase and lowercase letters, numbers, and unique symbols. Also, when filling out the application form, be truthful. eToro will verify everything and falsified details will complicate issues. Don’t forget to read the terms and conditions.

To enjoy everything eToro offers, you must verify your account with a government-issued ID and proof of address document. You can use your app to scan the required documents. But ensure whatever you share is clear and easy to read. Most importantly, the documents should have your full details, including your legal name and address.

On eToro, verification often happens within a few minutes. Wait for the broker to update your verification status, then fund your account. Use a supported funding method and adhere to eToro’s minimum deposit requirements for your region.

eToro supports instant transactions, so the deposited funds should appear in your trading quickly. You can now choose an instrument to trade or invest in. And remember that these activities come with considerable risk. Use the risk management tools on eToro to mitigate losses and maximize profits.

Final Thoughts

Based on what we’ve discovered and revealed here, you should be better positioned to decide if eToro is the broker you’re looking for. Of course, we highly recommend this platform. However, you should do your own research and consider everything outlined here before trading with eToro. Ensure everything that this broker offers aligns with your needs and requirements. Good luck in your endeavors!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals