Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

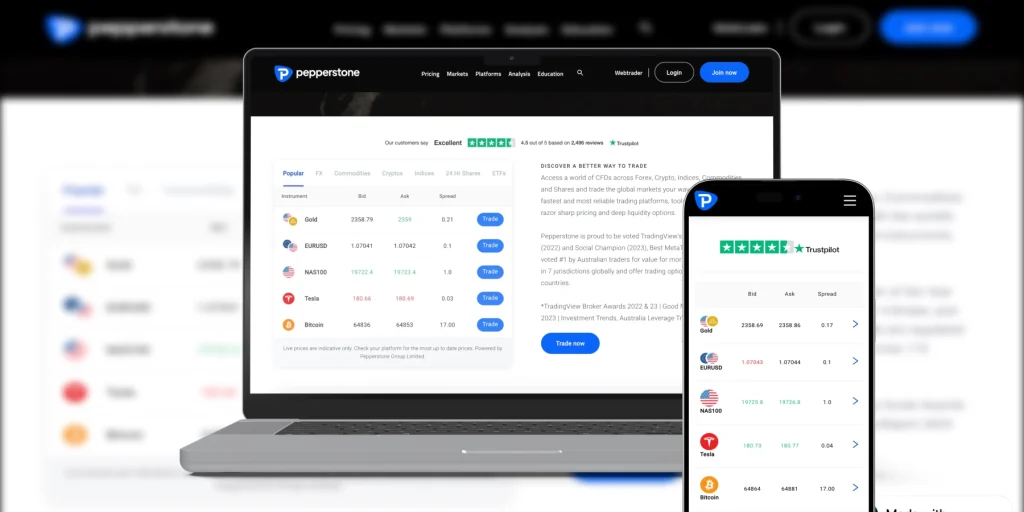

Founded in 2010, Pepperstone is an outstanding forex and CFD trading platform. It’s trusted and preferred by over 400,000 traders. Why? First, the Pepperstone trading platform is licensed and regulated by numerous authoritative bodies, including the FCA, ASIC, and CySEC. Furthermore, it gives users access to 800+ instruments, including CFDs, commodities, and currency pairs.

Since we’ve heard so many good things about Pepperstone, our team decided to put this broker on the test. We opened a trading account and tested every indispensable aspect, from the broker’s security to the quality of the available trading platforms and customer support service. Here’s what we discovered.

Why Pepperstone

Our evaluation of the Pepperstone broker platform enabled us to discover the myriad perks this company offers. These include negative balance protection, free transactions, and super-friendly deposit requirements. That is why we recommend you try this broker. Additionally, thanks to our exploration, we also unearthed a couple of shortcomings.

Here’s an overview of some of the pros and cons we identified.

Pros

- Robust selection of trading platforms, including MT4, MT5, cTrader, TradingView, and more

- Free deposits and withdrawals

- No activity fee

- Easy registration and account setup

- No minimum deposit requirement

Cons

- Fewer tradeable instruments compared to other top brokers

- Slow customer support via email

- Supports only forex and CFD instruments

Security

Security is paramount to traders, and Pepperstone does all it can to secure its traders’ resources. For starters, this company keeps customer funds in a trust account that the platform holds with a bank regulated by the Australian Prudential Regulation Authority (APRA). The bank is an authorized deposit-taking institution (ADI). Since Pepperstone keeps your money in a segregated trust account, you don’t have to worry about misappropriation.

Additionally, Pepperstone doesn’t hedge with retail client money. When hedging trades with other counterparties, this broker puts its own funds on the line. So, if things go south, Pepperstone loses its resources, but client accounts remain unaffected.

We also vetted Pepperstone’s security based on licensing and regulation. The results were satisfactory since this platform is licensed and regulated by:

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investment Commission (ASIC)

- The Dubai Financial Services Authority (DFSA)

- The Cyprus Securities And Exchange Commission (CySEC)

- The Capital Markets Authority of Kenya (CMA)

- The Securities Commission of The Bahamas (SCB)

- The Federal Finance Supervisory Authority (BaFin)

Note: The negative balance protection applies only to UK, Australia, and the European Union retail clients. This means that there is no compensation scheme for professional traders.

Platforms

Pepperstone’s vast selection of trading platforms leaves nothing to be desired; this broker goes above and beyond. Here are the platforms that we discovered and explored:

- Pepperstone Trading Platform: This is the first platform we tested. It’s pretty impressive. Pepperstone has designed it to help you find and trade CFD assets across various classes, including commodities, indices, cryptos, and forex. Several of this platform’s features, including Quick Switch, left an indelible impression on us, making swapping between chats a breeze.

- TradingView: Pepperstone’s TradingView platform gives you access to advanced charting tools and allows you to connect with over 30 million people on the largest social trading network. We also loved the platform’s wide range of indicators, news features, and innovative charts. In fact, we were able to trade directly from TradeView’s charts, making the experience more fulfilling.

- MetaTrader 4: If you’d like to trade on MT4, the most popular trading platform for forex trading, you can do it through Pepperstone. You only need to download the MT4 app and link it to your Pepperstone account. Once you do that, you’ll put yourself in a better position to leverage a wide array of advanced features, from top-notch charting tools and custom indicators to algorithmic trading and automated trading systems.

- MetaTrader 5: MT5 is the successor to MT4. This platform is faster and more advanced than its predecessor. Fortunately, Pepperstone supports it. You can link your Pepperstone account with MT 5 today and kickstart your journey to next-level trading with features like automated trading and strategy testers.

- cTrader: cTrader is a fantastic platform we couldn’t get enough of. Everything about it was impressive, from its intuitive interface to the available charting tools and indicators. What’s more, this platform facilitates fast trading and supports extensive customizations. We highly recommend cTrader to forex enthusiasts.

- Social Trading: We discovered one indispensable tool on Pepperstone’s Social Trading platform: copy trading. With it, you can mirror the actions and strategies of successful traders. The platform’s replication process is automatic and doesn’t cost a dime. It’s also facilitated by systems like MetaTrader Signals and Signal Start, which integrate seamlessly with Pepperstone accounts.

If you’re a trading newbie, don’t pick a platform and trade before testing and honing your skills with a Pepperstone demo account. The account will help you practice and enhance skills with virtual funds for up to 50 days. It’s your key to familiarizing yourself with Pepperstone’s trading platform, building confidence, and improving your strategies.

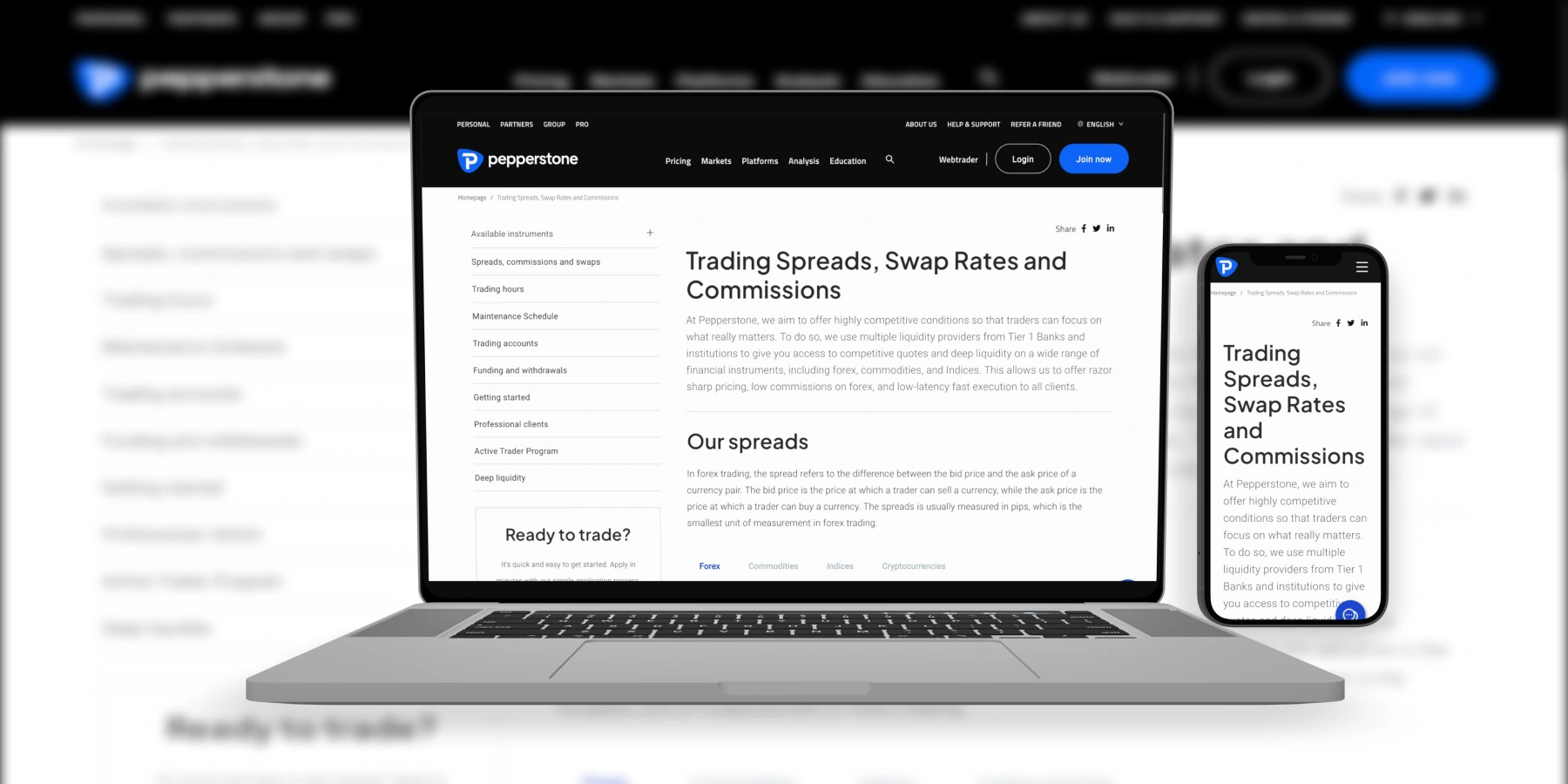

Fees

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

Product Offerings

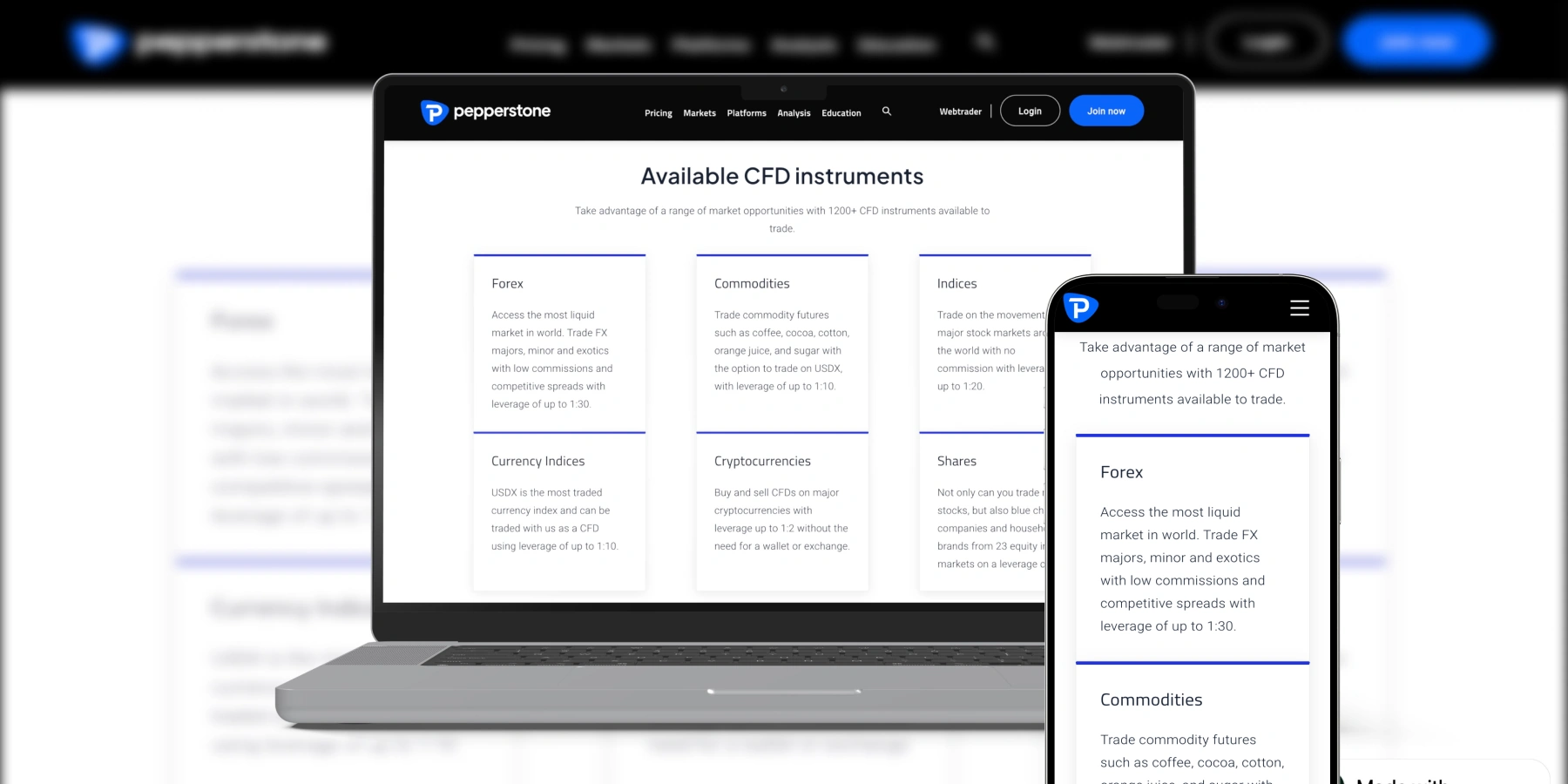

The product offerings on Pepperstone didn’t disappoint. This broker allows traders to open a universe of possibilities with diverse assets. We saw over 800 CFDs on this platform, including:

- Commodities: Pepperstone allows traders to trade a wide variety of commodities. Available options include cotton, coffee, sugar, orange juice, cocoa, and more. Precious products like silver, gold, palladium, and platinum are also offered. You can use any of these assets to diversify your portfolio and minimize risk exposure, especially during market turmoil. The best part is that Pepperstone’s commodities come with zero commissions.

- Forex: Are you a forex enthusiast? Check out Pepperstone’s products; we did, and they were impressive. This broker has everything, from majors to minors and exotics. Moreover, the platform lets you dive into forex trading while enjoying competitive spreads and low commissions. That’s not all. While trading forex on Pepperstone, you get flexible leverage and high-quality execution.

- Indices: Pepperstone’s trading platform is chock-full of tradeable indices. They offer you the golden opportunity to capitalize on the movement of 14 major global stock markets. Pepperstone’s indices have no hidden markups, re-quotes, or dealing desk.

- Currency indices: Pepperstone gave us ample opportunity to profit from shifts in the value of different currencies against baskets of other currencies. The platform did that through currency indices.

- Shares: Upon joining Pepperstone, you can go short or long on a variety of top US shares. Available options range from Alibaba and Boeing to Apple and Tesla. Note that you need MetaTrader 5 to trade shares on Pepperstone.

Customer Service

If you have any questions or concerns, you can contact Pepperstone via different channels. First, you can call the broker’s support team. We prefer this option because it offers quick issue resolution. It should be your go-to whenever you have a challenge or question that needs prompt addressing or personalized assistance.

If you can’t or don’t want to call Pepperstone’s support agents, you can send an email. We tried this option. Luckily, the support technicians responded within the hour. Pepperstone’s other support channel is live chat, which is available 24/5. It’s quick and convenient since it allows interaction with a live support agent.

How to Sign up For an Account at Pepperstone

Our Pepperstone review concludes with the account signup process. It’s quick and easy. We only spent a couple of minutes registering our account. Here’s what you should do:

Visit Pepperstone’s official website and verify if this broker aligns with your needs and preferences. Evaluate everything, from pricing to hosted platforms. Should everything be alright, you can either download the app or register from the web platform.

Click “Join now” to sign up. Signing up with Apple, Facebook, or Google can make the process easier. Or, you can continue with email. To create your profile, provide the required information, from your country of residence and full name to your phone number and email address. Set a strong, unique, and unguessable password to protect your account. Remember to read Pepperstone’s privacy policy and terms & conditions.

After providing all necessary details, verify your identity with a photo ID and a proof of address document. The former can be your driver’s license; the latter can be a recent bank statement. Pepperstone might ask you to retake this step or reject your application if you don’t share clear or valid documents. So, be careful.

On average, your Pepperstone account should be verified within 4-8 hours. You can fund it after receiving approval. Remember to deposit money with a supported payment method. Since the Pepperstone minimum deposit requirement is set at $0, you can fund your account with any amount you’re comfortable with.

The last thing you should do is pick an instrument to trade. For the best outcomes, size your positions correctly, implement risk management, and prioritize diversification. If you’re a novice, don’t put money on the line before gauging your knowledge and skills with a demo account.

Final Thoughts

Our review has disclosed nearly everything you need to know about Pepperstone. Hopefully, you’ve noted crucial aspects like this broker’s trading platforms and stipulated. You can’t afford to ignore them since they will determine your trading experience and profitability. If you have any more questions, contact Pepperstone’s support team.

Before signing off, don’t forget to do some extra digging. Although we recommend this broker based on our tests and experience, you should do your own research and weigh your options carefully. Compare what Pepperstone offers to your trading needs before taking the final leap. We wish you all the best!

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

Would you recommend this provider?

Fees

Account opening

Customer service

Deposits & Withdrawals

The tight spreads and solid MetaTrader integration make it my go-to broker, though I do wish they offered stock trading alongside their excellent forex and CFD selection.