Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

As a Nigerian, you can earn a living or supplement your income with proceeds from forex trading. Many people are already doing that, and so can you. However, your success in this field will depend on various factors, including your chosen broker. We’ve been trading actively for many years, and here’s what we have to say. You need an outstanding broker to make it in forex trading.

Finding a good broker can be tricky since so many options are available in Nigeria. But don’t worry; we are here to help. Our team has done the heavy lifting on your behalf by testing countless platforms, conducting extensive, and preparing a comprehensive list of the best forex traders in Nigeria. The only thing you have to do is choose a fitting company.

In a Nutshell

- Nigerian brokers allow forex traders to trade different minor, major, and exotic currency pairs, from EUR/USD to USD/NGN.

- Many forex brokers operate in Nigeria. While choosing the best, consider factors like licensing, supported instruments, provided platforms, and stipulated fees.

- If you are always on the move or prefer trading on the go, look for a broker with feature-rich dedicated mobile apps.

- Prioritize trading with a broker with excellent customer support for quick issue resolution, especially in emergencies.

- Remember to risk what you can afford to lose while funding your account and trading forex. Also, don’t let your emotions get the best of you.

- Our guide was compiled by seasoned experts who devoted considerable time to testing and assessing the forex brokers in Nigeria. We’ve recommended the best platforms based on first-hand experience and unbiased evaluation.

List of the Best Forex Brokers in Nigeria

- AvaTrade – Best Forex Broker for Beginners

- Pepperstone – Best Forex Broker for Professionals

- OANDA – Best Forex Broker for Mobile Traders

- FP Markets – Best Forex Broker for Low-Cost Trading

- IG Markets – Overall Best Forex Broker in Nigeria

Compare Forex Brokers in NG

We’ve listed what we consider the best forex brokers in Nigeria. But how did we identify and choose these platforms? It’s simple. As seasoned traders and financial experts, we spent hundreds of hours sifting through the forex brokers available in this country. We vetted and compared all companies based on features like regulation, security, reputation, reliability, charges, and support.

All brokers mentioned here have all the right qualities, including proper licensing and untainted reputations. That is why we’ve recommended them. Most importantly, we value honesty and transparency. Our primary objective is to educate and guide you. Rest assured that everything discussed here is factual and unbiased.

Please check the comparison table we’ve prepared below. It showcases the elements we used to compare and pick the best forex brokers in Nigeria.

| Best Forex Broker Nigeria | License and Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| AvaTrade | SEC, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, FSCA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Pepperstone | SEC, FCA, ASIC, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Flutterwave, Skrill, PayPal | Yes |

| OANDA | SEC, B.V.I FSC, FCA, CySEC, ASIC | 24/5 | MT4, MT5, fxTrade App | Credit/debit cards, Bank/wire transfer, Skrill, Neteller | Yes |

| FP Markets | SEC, ASIC, CMA, CySEC, FSCA, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pa | Yes |

| IG Markets | SEC, FCA, BaFin, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, BMA, CySEC | 24/5 | Online trading platform, Mobile trading app, Progressive web app, ProRealTime, MT4, L2 Dealer | Credit/debit cards, bank transfer, PayPal | Yes |

Platforms Overview

While choosing an ideal forex broker, you must factor in offered assets because they will determine your access to trading opportunities. A platform with a broad range of assets allows you to maximize your earning potential and diversify your portfolio. Also, you can’t ignore fees and commissions. That is because these elements influence your expenditure and profit margin.

To help you make the best decisions, we’ve outlined the assets, fees, commissions, and minimum deposit requirements associated with the forex brokers we recommend in this guide.

Fees

| Best Forex Broker Nigeria | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of non-use |

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| OANDA | $0 | From 0.6 pips | $20 | $12 monthly fee is charged after 2 years of inactivity |

| FP Markets | $100 | From 0.0 pips | Free | $0 |

| IG Markets | $0 | From 0.1 points | Free | $12 monthly fee charged after 2 years of inactivity |

Assets

| Best Forex Broker Nigeria | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| IG Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about the Best Forex Brokers

Below, we have discussed the best forex brokers in Nigeria. Before compiling this guide, we tested every platform extensively. We applied all the tricks and skills we’ve mastered over the years to ensure everything we report is as it should be. Use this information to identify a broker that offers everything you need to achieve astronomical success.

1. AvaTrade – Best Forex Broker for Beginners

We consider AvaTrade an ideal broker for forex beginners because it’s affiliated with Ava Academy, a bottomless source of trading courses. If you’re a newbie, we strongly recommend sampling this program. It has countless materials and resources you can use to expand your knowledge base and understanding of the fundamentals of forex trading.

AvaTrade also allows traders to open demo accounts and test the available trading platforms, including WebTrader, MT4, and MT5. As a novice, you can use an AvaTrade demo account to familiarize yourself with the essentials of forex trading.

Not to forget, AvaTrade is one of the most user-friendly platforms today. It’s easy to navigate, making it a good choice for beginners. If you want to gain experience without facing innumerable hurdles, start your forex journey with AvaTrade.

Pros

- Regulated by tier-1 authorities like CySEC and ADGM

- 60+ major, minor, and exotic pairs

- Free, top-quality educational tools and resources

- Demo accounts are available across all supported trading platforms

- Simple but intuitive user interface

- A wide array of trading platforms to choose from

Cons

- High inactivity fees

- Higher spreads for forex traders

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

2. Pepperstone – Best Forex Trader for Professionals

If you are an experienced professional trader, check out Pepperstone. This broker allows people like you to open a Professional Client Account, which comes with numerous juicy features. For starters, this account will enable you to exploit higher-than-average leverages up to 1:500. Additionally, after opening it, you’ll get unlimited access to a dedicated relationship manager and priority service.

Pepperstone’s Professional Client Account also allows you to improve your execution by customizing your trading sizes. With it, you can trade over 90 currency pairs alongside other major instruments. Moreover, it gives you uncapped access to numerous trading programs, from TradingView and cTrader to MT4/5 and Social Trading.

Note that you must be eligible to enjoy the perks of Pepperstone’s pro account. This broker will test your knowledge and gauge your net assets before allowing you to join this premium platform.

Pros

- Tight leverages starting from 0.0 pips

- Zero deposit, withdrawal, and inactivity fees

- Priority support for professional traders

- A rich collection of trading platforms, including MT4/5 and TradingView

Cons

- Pro account holders must have minimum net assets worth AUD$2.5 million

- Limited educational tools and materials

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

3. OANDA – Best Forex Broker for Mobile Traders

Mobile trading is incredibly convenient because it allows you to trade and invest on the go. You only need a smartphone and a reliable internet connection. The good news is that OANDA supports mobile trading. We checked out this broker’s mobile apps and highly recommend them. Why?

First, OANDA’s forex trading app is compatible with Android and iOS phones. And it comes with a customizable interface that allows you to set your preferred default parameters. Moreover, the app is equipped with countless technical tools, from 9 charts to 11 drawing tools and 32 overlay indicators. The best part is you can place orders quickly using the mobile charting functionality on the app.

With an OANDA mobile app, you can trade major pairs like EUR/USD and enjoy spreads as low as 0.6. This broker supports 68+ minor and major FX pairs.

Pros

- Over 68 tradeable currency pairs

- Dedicated mobile apps with advanced charting features

- No minimum deposit requirement

- Reasonable spreads starting from 0.6 pips

Cons

- $20 withdrawal fee

- $10 monthly inactivity charges

When testing OANDA, we opened a live account and funded it. We didn’t encounter any OANDA minimum deposit requirements, which was a good thing. That allowed us to start with a few dollars. While preparing to fund our account, we noticed that this broker doesn’t charge deposit fees for cash transfers, credit cards, and debit cards. The same applies to e-wallets like Neteller, Skrill, and Wise. But withdrawals aren’t entirely free.

OANDA allows traders to make one free withdrawal per month to their debit or credit cards. Anyone who exceeds this threshold has to pay. The exact fees vary depending on account currency. On the other hand, all bank-related withdrawals incur charges. The fees you’ll pay while using a bank to withdraw funds from OANDA depend on the number of bank withdrawal transactions you’ve made in that calendar month and account currency.

We also noticed that OANDA has overtime financing charges. If you keep a position open after a trading day has ended, OANDA assumes you’ve held it overnight and either credits or charges your account. Visit OANDA’s Financing Costs page to learn more.

Lastly, OANDA charges a $10 monthly inactivity fee on accounts that have been dormant for 12 or more months. If OANDA deems your account legible for inactivity fees, the broker will levy it until you terminate the account, resume trading, or deplete your account balance.

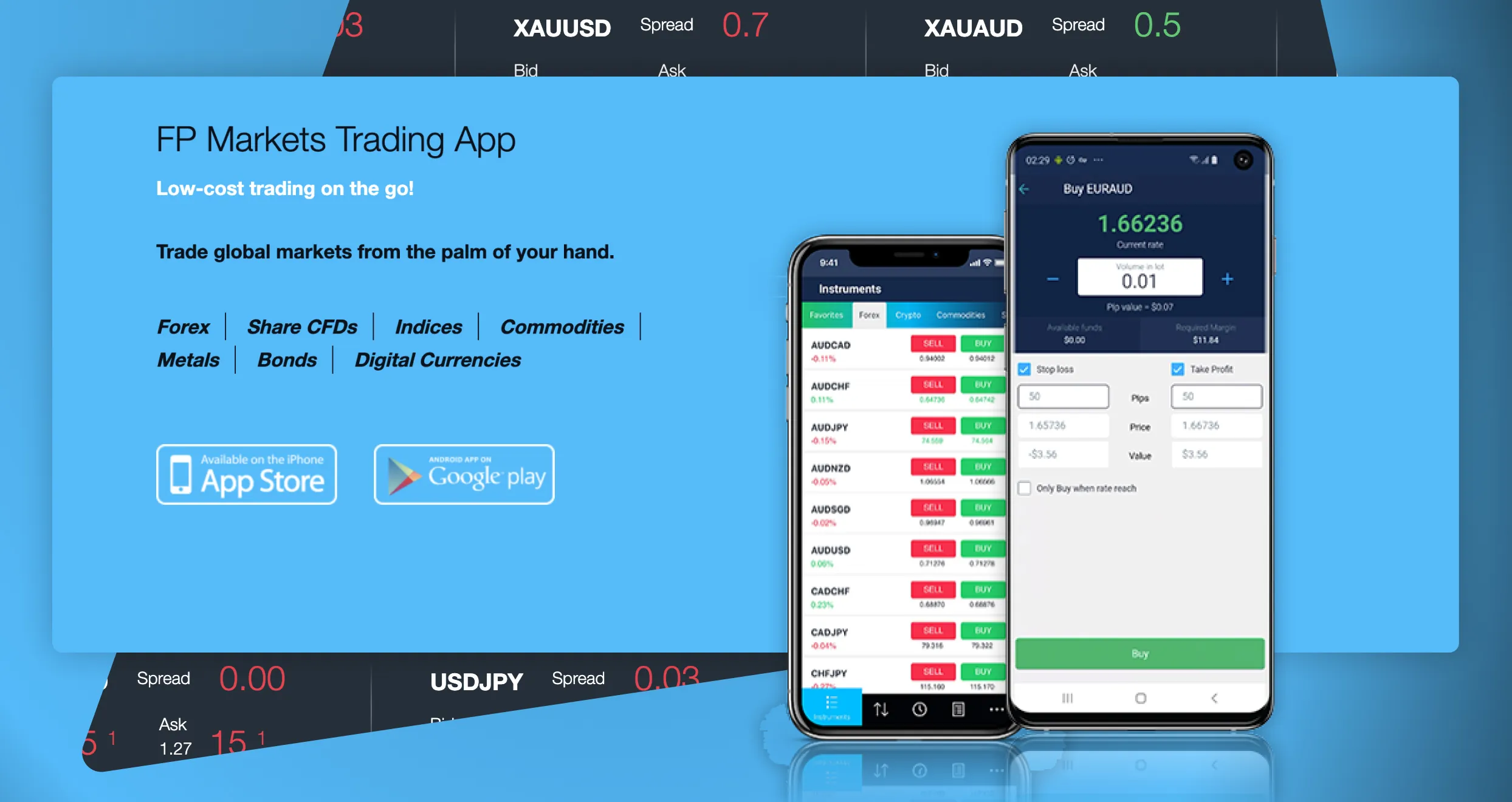

4. FP Markets – Best Forex Broker for Low-Cost Trading

High costs reduce your profit margins, which isn’t good since a trader’s primary goal is making money. Luckily, you can avoid your expenses by trading forex on FP Markets. With this broker, you can enjoy free deposits and withdrawals when you use payment methods like credit and debit cards. Moreover, your account can remain dormant for extended periods without attracting inactivity fees.

FP Markets also offers you tight spreads starting from 0.0 pips. With this platform, you will enjoy reduced costs while trading over 70 global currency pairs, including AUD/CAD, AUD/USD, and EUR/GBP. Professional traders also get outstanding leverages of up to 500:1 and minimal price slippage.

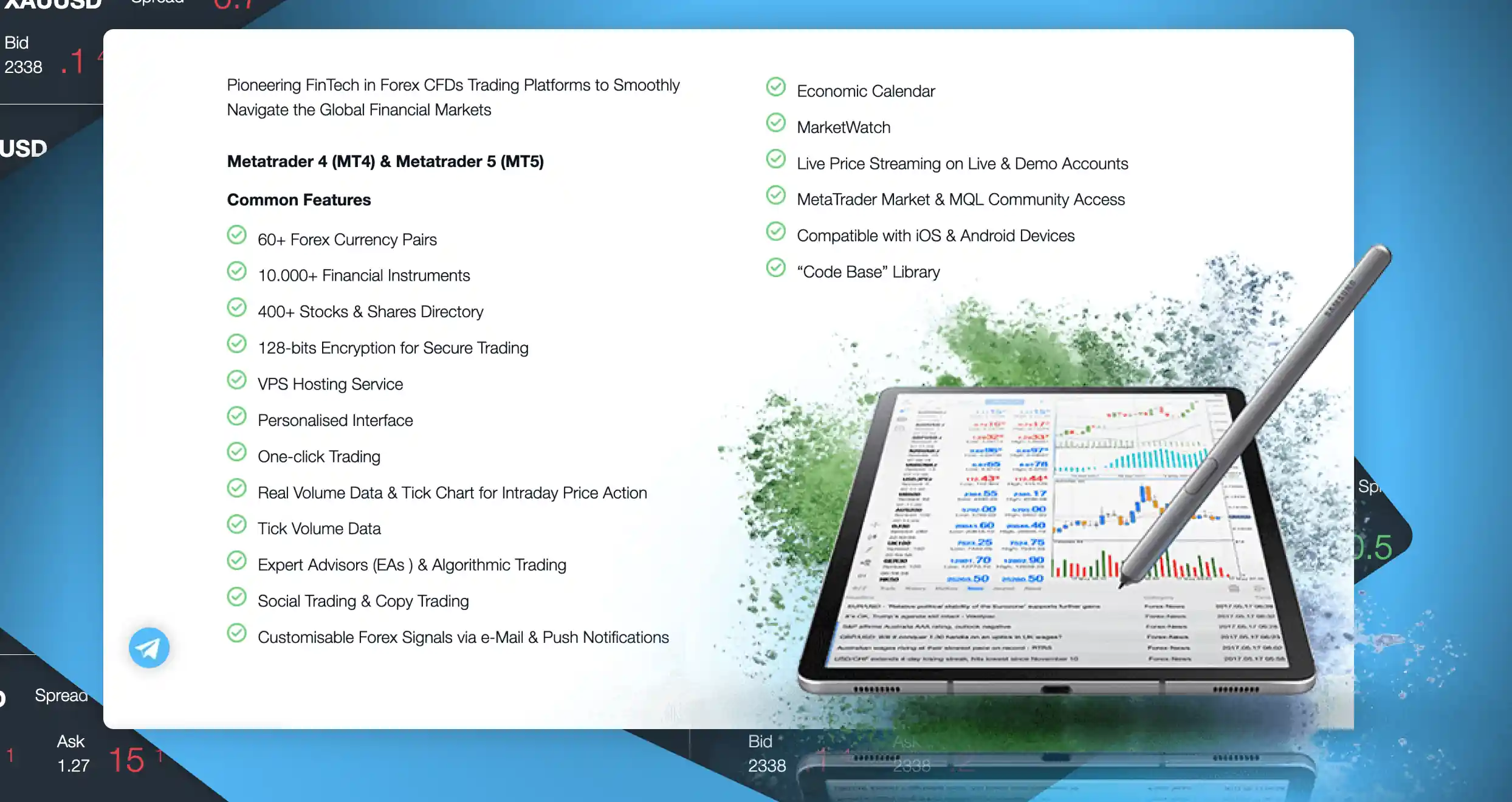

Costs aside, we were impressed by FP Markets’ range of trading platforms. This platform gives forex traders access to popular options like MetaTrader 4/5, TradingView, cTrader, and IRESS. These come with indispensable features, including advanced charting and technical tools.

Pros

- Low spreads starting from 0.0 pips

- Competitive leverages of up to 500:1

- No deposit, withdrawal, or inactivity fees

- A broad spectrum of top-tier trading platforms

- 24/7 customer support services

Cons

- Some payment methods attract withdrawal fees, including Skrill and Neteller

- Limited high-quality research tools

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

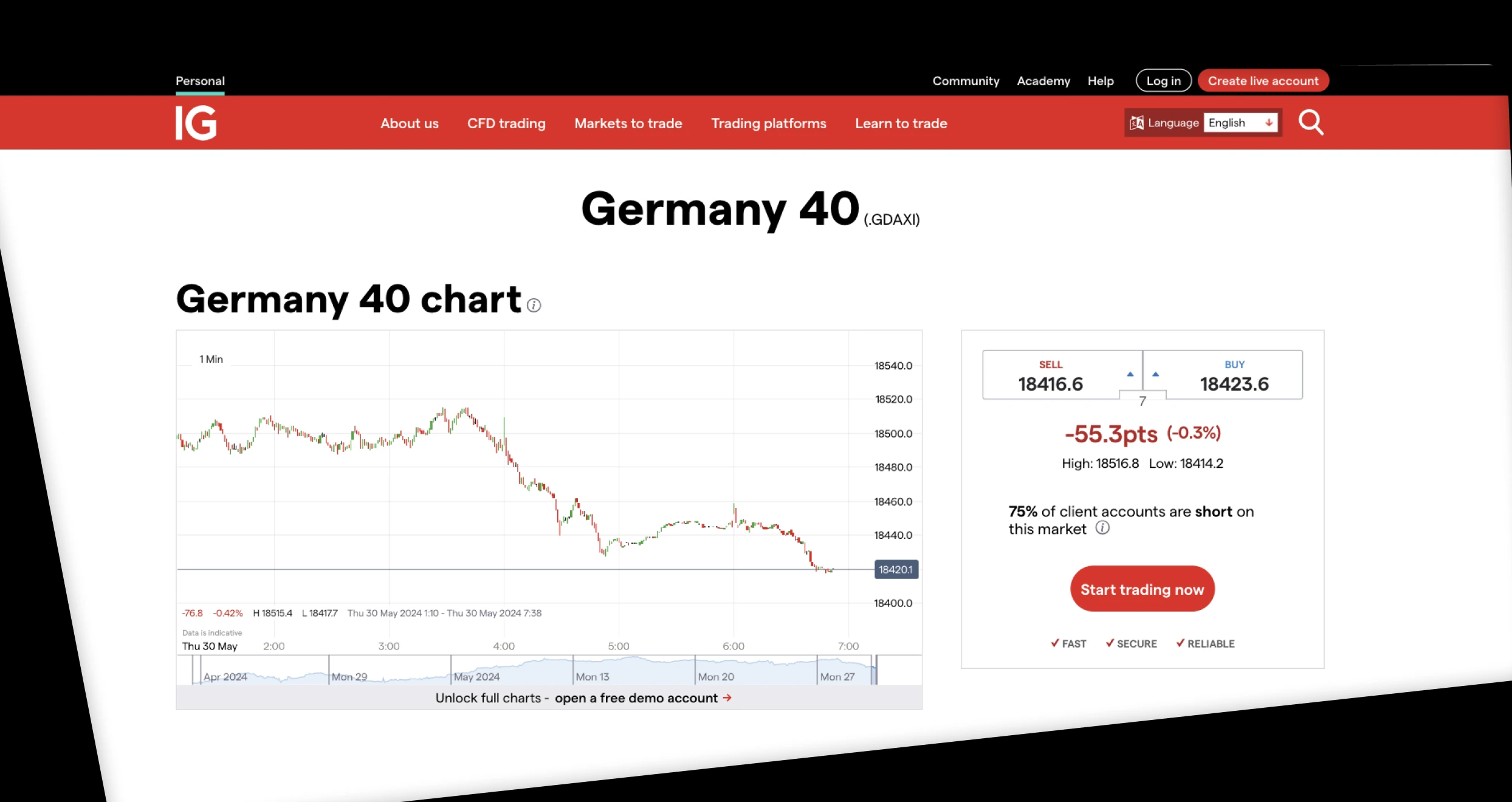

5. IG Markets – Overall Best Forex Broker

IG Markets is our best overall forex broker in Nigeria. Based on our experience, this company offers a well-rounded experience. We traded forex with it, and our experience was phenomenal. The first aspect that impressed us is IG Market’s broad range of FX instruments. This broker has over 80 major, minor, and exotic pairs. They range from USD/CAD to EUR/USD, USD/CHF, and NXD/USD.

While trading forex with IG Markets, you will enjoy retail margins as low as 0.5% for major pairs like EUR/USD and USD/JYP. You will also be better positioned to use flexible leverages of up to 1:200 for professional traders. You can use these elements to increase profitability.

We were also fascinated by IG Market’s supported trading platforms. As an avid trader, you can use IG Market’s intuitive online platform or trade on the go with the broker’s dedicated mobile apps. Other options are also available, including MetaTrader 4, L2 Dealers, and ProRealTime. All these platforms allow you to start with a demo account before switching to live trading.

Pros

- Licensed by respected authorities like the FCA and the FSCA

- Reasonable spreads starting from 0.8 for major currency pairs

- Free deposits and withdrawals

- No minimum deposit requirement

- Advanced trading platforms like MT4 and ProRealTime

Cons

- $12 monthly inactivity fee

- Limited supported payment methods

IG Markets’ fees vary depending on the asset you are trading. The broker has come a long way and tries to accommodate both low-budget and high-budget traders. We noticed that the broker doesn’t have a minimum deposit requirement. This allows you to trade with any amount you can afford.

Regarding spreads and commissions, IG Markets imposes some of the lowest fees. For instance, you will explore the currency market with spreads from 0.6 pips. Major indices also attract spreads from 0.8 points and 0.1 points on commodities.

Unfortunately, IG Markets’ share trading fees are high compared to its counterparts. For instance, you will incur 2 cents per US share and 0.18% on Hong Kong shares. The good news is that the broker allows free deposits and withdrawals. Its inactivity fee of $12 monthly also applies after 24 consecutive months.

Forex Trading in Nigeria

Nigeria’s Security and Exchange Commission (SEC) governs and regulates the companies mentioned in this guide. Every broker we’ve recommended adheres to the SEC’s stringent rules and regulations. So, their legitimacy is unquestionable.

As a Nigerian, you have access to innumerable forex brokers. That can make choosing the right company challenging. And, if you make a slight error of judgment and sign up with an untrustworthy platform, you will expose yourself to numerous issues, including data theft and immense financial losses. To avoid that, you need to choose carefully.

Most importantly, remember that forex trading is risky before putting your money on the line. You don’t want to be one of the 80% of day traders who quit prematurely after incurring hefty losses.

How to Choose the Right Forex Broker in NG

Some of the brokers in Nigeria are shoddy or downright fraudulent. To avoid them, vet every company you come across based on the following factors:

Prioritize trading with brokers regulated by respected organizations like the SEC, the FCA, ASIC, and CySEC. This is crucial because these authorities have mandated regulations tailored to optimize your safety and security. Moreover, licensed brokers are transparent about their operations and have no hidden motives.

Since you are interested in forex trading, you should look for a broker that supports FX-related instruments. Most importantly, your preferred trading platform should have currency pairs that align with your trading goals and strategies. If it features additional asset classes, this is a plus, as you will easily diversify your portfolio. Avoid brokers with limited product offerings because you’ll have a tough time diversifying your portfolio and maximizing your profit potential.

Before opening an account with any broker, scrutinize available trading platforms. Ensure there’s everything you need to succeed when trading forex. Don’t forget to test the speed, performance, and reliability of the available platforms. Plus, confirm the availability of learning and research materials. Those with demo accounts are also worth trying.

Brokers have different commissions, fees, and spreads. Review every broker’s trading and non-trading charges before signing up to avoid unnecessary headaches and nasty surprises that may undermine your profitability. The charges to confirm include minimum deposit requirement, spreads/commission, inactivity fees, overnight charges, and more. Ensure your broker fits your budget.

As a forex trader, you might encounter diverse challenges and issues in the future. The key to smooth sailing is finding a broker with excellent customer support. If you trade with a broker with an exceptional support team, your issues will be resolved promptly. Therefore, confirm the support team’s availability and ensure it aligns with your trading schedule. They must also be contacted via convenient channels, whether by phone, email, or live chat.

The internet has made it easier for traders to gauge the reliability of brokers without breaking a sweat. All you have to do is go through online reviews and testimonials on platforms like Trustpilot, the App Store, and Google Play. User testimonials will help you pinpoint every company’s strengths and weaknesses quickly. But keep an eye out for exaggerated or biased appraisals because they are misleading.

How To Register an Account with a Forex Broker NG

Most reputable forex brokers have a simple registration process. But they require you to go through all the necessary steps. That is because they are regulated by authorities that require them to do everything they can to prevent fraud and optimize security, including implementing KYC policies.

With that in mind, you can open a forex trading account today by following these general steps:

Once you’re there, read the terms of use and privacy policies. Additionally, consider installing the broker’s app on your iOS or Android mobile device to easily manage your activities while on the move. If you agree with the stipulated conditions, click the Sign-Up, Join, or Register button.

Submit the requested information. Most brokers ask new signees to share their email, legal name, address, location, phone number, etc. To avoid rejections, provide valid details. Double-check everything to avoid detrimental mistakes that may impede the registration process. Also, create a unique username and password for an added layer of safety to your account.

Provide the necessary documents. These may include a government-issued ID, bank statements or utility bills, and a recent passport-sized photo. The broker will use these documents to verify your identity and location.

Check the minimum deposit requirement and fund your account. Use a supported payment method to avoid any complications. Remember to fund your account with money that you can afford to lose.

Pick your preferred currency pairs and start trading. Remember to size your positions wisely to minimize losses. Most importantly, avoid emotional trading, stick to your trading plan, and avoid chasing losses at all costs.

Conclusion

After laboring incessantly and evaluating countless sites, we highly recommend the forex brokers reviewed here. They have all it takes to be outstanding, from proper licensing and unmatched security to the best trading platforms and instruments. Go through each platform and isolate one that suits your needs and requirements.

We can’t sign off without reiterating this: forex trading is risky. Joining the best forex broker in Nigeria alone won’t guarantee success. You must also educate yourself, implement proper risk management, and remain disciplined to maximize your potential.

I’ve been trading forex for a while, and finding the right broker really makes a difference. AvaTrade worked well for me as a beginner, especially with their educational resources and user-friendly interface. However, I’ve also tried OANDA for mobile trading, and their app’s charting tools are great for on-the-go trades.