Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

The financial landscape in the UAE has transformed over time from traditional land-based to online trading. Thanks to technological advancement, investors can now access trading platforms online from the comfort of their homes. The onset of the best trading apps in the UAE has made things much more manageable. Traders can easily manage their activities using mobile devices anywhere, anytime.

Today, we explore the top trading apps that have proven safe and reliable for UAE traders. Our list below has been approved by industry professionals after multiple tests and comparisons. If you are new to mobile trading, we will also guide you in selecting the right app, registering for an account, and more.

In a Nutshell

- The financial landscape in the UAE is dynamic. This means that financial instruments’ prices tend to change from time to time. Ensure you conduct a thorough market analysis before embarking on online trading in the UAE.

- With many fraudulent trading platforms in the market today, ensure the trading app you select is hosted by a broker licensed and regulated by the Dubai Financial Services Authority (DFSA) or the the Securities and Commodities Authority (SCA).

- Choose a UAE trading app with features that align with your trading requirements for an exciting experience.

- Beginner traders in the UAE should opt for trading apps with demo accounts. This way, they can start exploring the financial market and gauge an app’s performance risk-free without spending real money.

- If you are trading assets as derivatives, understand that over 76% of retail traders lose money in the activity. Therefore, know the risks associated with these trading methods and develop solid strategies for increased profitability.

- At Invezty, we leave no stone unturned in our research. Only apps that meet our specifications qualify for inclusion in our recommendations list.

List of the Best Trading Apps

- Pepperstone – Best With Multiple Trading Platforms

- Plus500 – Top Trading App for CFD Trades in the UAE

- AvaTrade – Overall Best Trading in the UAE

- FP Markets – Best Stock Trading App in the UAE

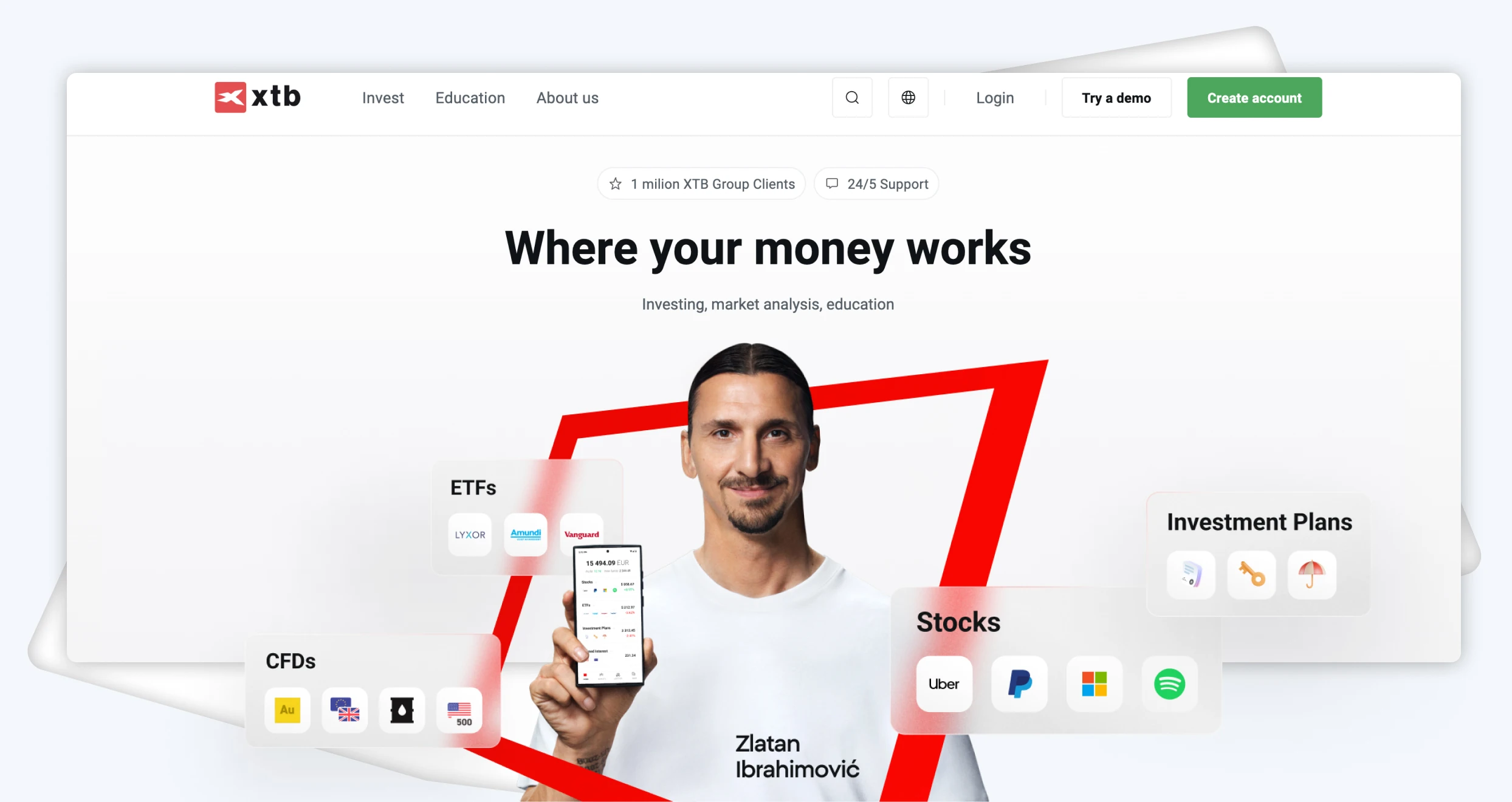

- XTB – Cheapest App for Trading in the UAE

- Forex.com – Best UAE App for Forex Trading

Compare Trading Apps in the UAE

We spent hours conducting thorough market research, testing, and comparing as many trading apps in the UAE as possible. We looked into various elements in this process to shortlist the best options for recommendations. These features include the apps’ security measures, platform performance, costs, support service reliability, demo account, and more.

Furthermore, we visited Google Play, the App Store, and Trustpilot to analyze and sample user testimonials regarding their experiences with the apps. By combining the results from these two processes, we were able to create this recommendations list.

See our comparison table below, which shows the features that made these UAE trading apps stand out.

| Best Trading App UAE | License | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Credit Cards, Bank Transfer, PayPal | Yes |

| Plus500 | FCA, SCA, CySEC (#250/14), ASIC, FSCA, MAS, FSA, SCA | 24/7 | Plus500 Webtrader, Plus500 Pro | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes |

| AvaTrade | FSRA, FCA, SCA, CySEC, ASIC, CIRO, FSCA | 24/5 | MT4, MT5, AvaSocial, DupliTrade, AvaOptions, AvaTradeGO | Bank transfers, Skrill, WebMoney, Neteller, Debit/credit cards | Yes |

| FP Markets | FSRA, CySEC, SCA, ASIC, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Yes |

| XTB | DFSA, SCA, FCA | 24/5 | xStation Mobile, xStation 5 | Credit/debit cards, Bank Transfer, Skrill | Yes |

| Forex.com | DFSA, SCA, CFTC, NFA, FCA | 24/5 | Advanced Trading Platform, Web Trading, Mobile Trading, MT5, TradingView | Bank transfer, Credit/debit cards, Skrill, Neteller | Yes |

Apps Overview

You need a solid plan to maximize your chances of executing successful trades in the UAE. Besides understanding the markets you want to trade, choose a suitable trading platform or app. The app must have features aligning with your requirements. Some elements to prioritize in your choice include app fees and asset offerings.

We understand that comparing the fee structures and asset offerings of hundreds of trading apps in the UAE can be overwhelming. Therefore, we decided to do all the legwork and share the tables below of the apps’ fees and assets for informed decisions.

Fees

| Best Trading App UAE | Minimum Deposit Requirement | Commission/Spreads | Deposits/Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| Plus500 | $100 | From 0.0 pips | Free | $10 monthly after three months of inactivity |

| AvaTrade | $100 | From 0.09 pips | Free | $50 quarterly |

| FP Markets | $50 | From 0.0 pips | Free | None |

| XTB | $0 | From 0.1 pips | Free | $10 monthly |

| Forex.com | $100 | From 0.7 pips | Free | $15 monthly |

Assets

| Best Trading App UAE | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Plus500 (CFDs) | Yes | Yes | No | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | No |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Forex.com | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about the Best Apps for Trading

As mentioned earlier, we conducted multiple tests and comparisons on hundreds of UAE trading apps. Based on our hands-on experience, we share our unbiased opinion on the top options that meet our specifications. We hope that you will be able to understand each app’s features and make a suitable choice.

1. Pepperstone – Best With Multiple Trading Platforms

After testing and comparing many UAE trading apps, we found Pepperstone a standout choice for traders looking for third-party platforms. Based on our hands-on experience, this app is user-friendly and has an intuitive design. Its seamless operation and fast trade execution speed make us highly recommend it for newbies and active traders. Moreover, we like its multiple third-party platforms with quality resources like automated and social trading, advanced stop loss and take profit levels, customisable charting/indicators, and more. The platforms are MT4, MT5, cTrader, and TradingView.

Besides the third-party platforms, the Pepperstone app has its own proprietary platform with unique resources. The platform operates seamlessly on desktop devices, allowing users to alternate between desktop and mobile trading. Through the app, we traded over 2,400 CFD instruments, including shares, commodities, indices, ETFs, and more. You can start trading with this app with any amount of capital you can afford. This is because Pepperstone has no minimum deposit requirement, and all transactions are free.

Pros

- No minimum deposit requirement

- Low trading costs from 0.0 pips on major currency pairs

- One of the most highly rated trading apps by users on Google Play, the App Store, and Trustpilot

- No inactivity fee

Cons

- UAE traders can only trade the featured securities as CFDs

- The MT4/5 platforms do not support the advanced stop-loss and take-profit levels

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

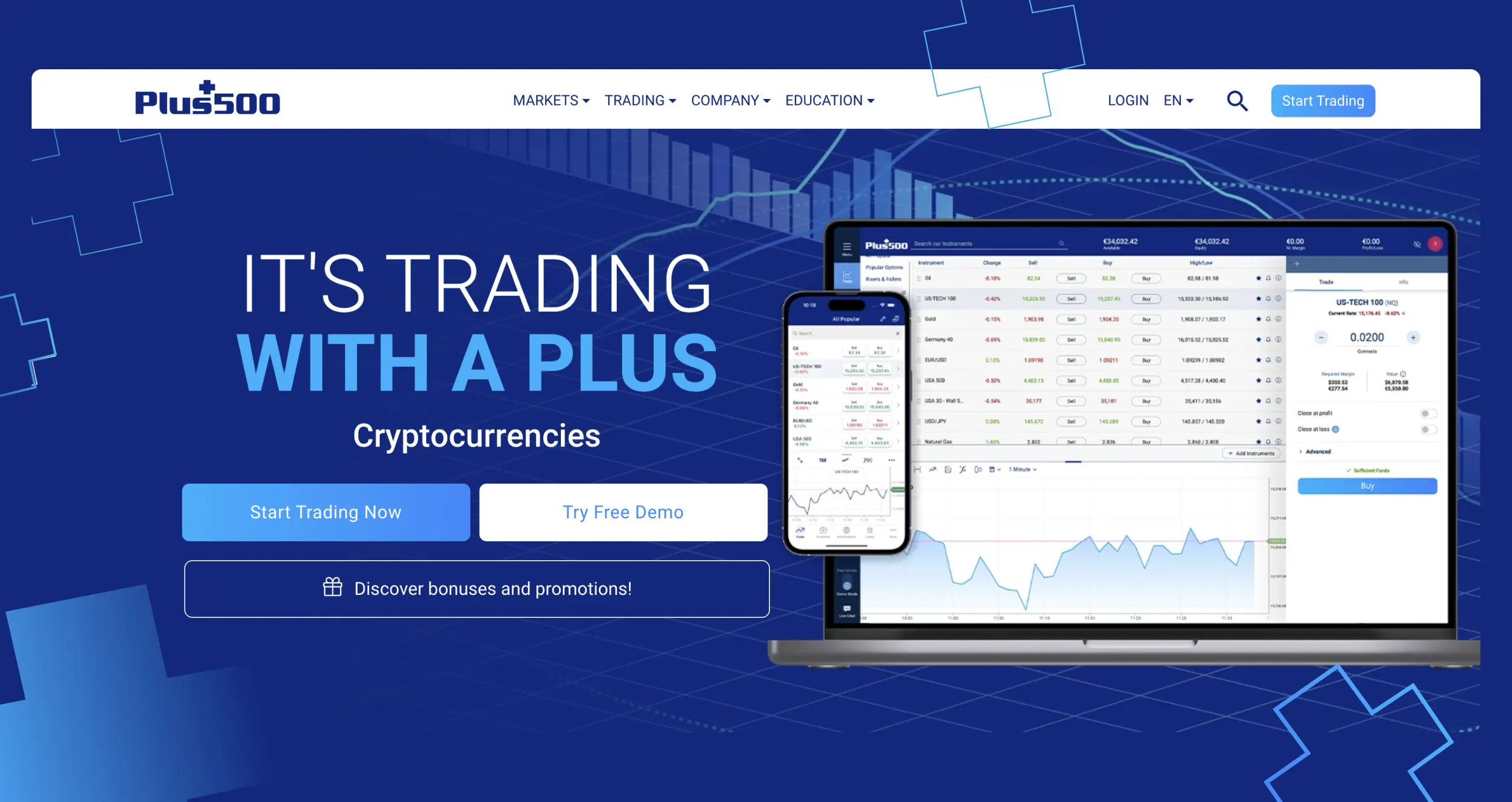

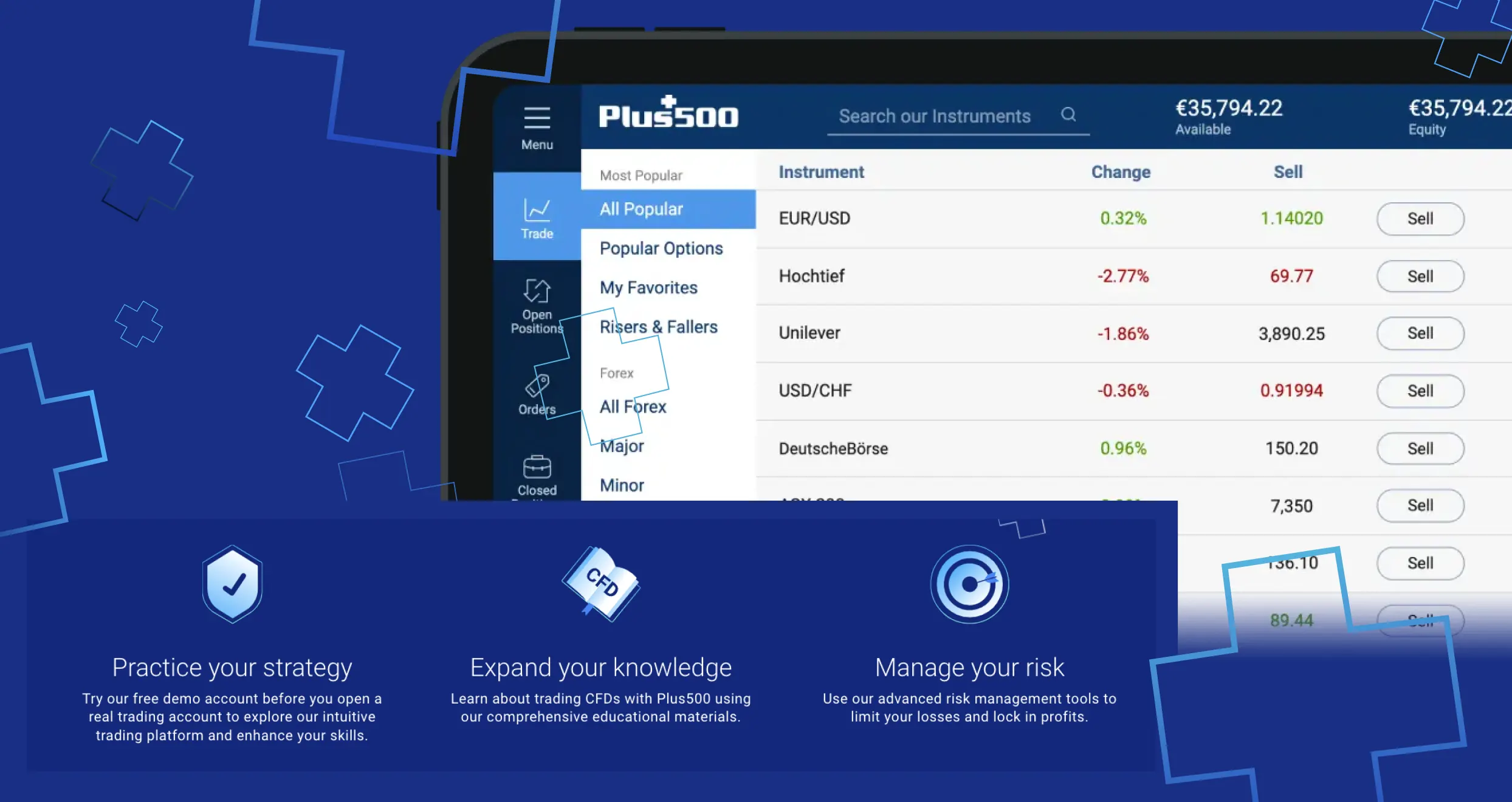

2. Plus500 – Top Trading App for CFD Trades in the UAE

CFD traders in the UAE will have an amazing experience with Plus500. While exploring the app, we noticed that it has a user-friendly and modern design platform. Plus, it features a virtually funded demo account for testing it without spending real money. These features gave us a good head start in our ventures with the app. Hence, we highly recommend it to newbies trying to get started with CFD trading ventures.

Experienced traders are not left behind with Plus500. The app has a “Premium Service” platform with advanced resources for expert traders. Plus500 is available in multiple languages, allowing traders from all walks of life to explore the financial markets. We also discovered that it is among the most highly rated by users. Most importantly, getting started with Plus500 requires a minimum deposit of only $100. And, trading charges are low, from 0.0 pips. There are no commission charges*. Plus500CY Ltd authorized & regulated by CySEC (#250/14).

* other fees may apply

Pros

- A reliable and responsive 24/7 support service via phone, email, and live chat

- Competitive spreads from 0.0 pips

- A user-friendly and modern-design trading app

- Multiple global payment methods for transactions

Cons

- The inactivity fee kicks in after three months of account’s dormancy

- Features only CFD instruments

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

3. AvaTrade – Overall Best Trading App in the UAE

We tested hundreds of trading apps in the UAE, and AvaTradeGO stood out as our overall best trading app in Dubai. This is primarily because it has a user-friendly platform and quality trading tools to accommodate all types of traders. Moreover, AvaTradeGO features social and copy trading. This allows you to socialize with other traders and mirror expert positions with increased profitability.

We also like this app because of its ability to accommodate multiple trading platforms. These include MT4, MT5, DupliTrade, ZuluTrade, AvaOptions, and Automated Trading. With these platforms, UAE traders get to enjoy advanced features that guarantee an exciting experience. Moreover, AvaTrade has a low minimum deposit requirement of $100 and charges low fees, starting from 0.9 pips. It is also suitable for low-budget UAE traders.

Pros

- A highly rated app by users on Google Play, the App Store, and Trustpilot

- Features automated trading and is compatible with Expert Advisors

- Low spreads for UAE traders, starting from 0.9 pips

- Regulated by top-tier authorities, including the Financial Services Regulatory Authority (FSRA) of Abu Dhabi, the UK’s Financial Conduct Authority, and more

Cons

- Limited asset offerings compared to its peers

- Features on CFD assets to trade. No buying and taking full ownership of the assets

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

4. FP Markets – Best Stock Trading App in the UAE

FP Markets is another best stock trading broker you should consider. While testing it, we traded over 650 stocks on global exchanges. We traded the assets on cTrader, TradingView, MT4, and MT5 platforms, which are known for having quality resources and providing an exciting experience. The best part is that traders using FP Markets can choose between standard and raw accounts, depending on their preference.

Besides stocks, FP Markets is a home for additional CFD securities. These include forex, commodities, indices, ETFs, and more. The app allows you to easily diversify your portfolio without seeking other apps. For beginners, FP Markets has an extensive selection of learning resources to help you confidently boost your skills. Plus, a virtually funded demo account is at your disposal to test the app’s performance before committing.

Pros

- Low minimum deposit requirement of $50

- Low trading charges with spreads starting from 0.0 pips

- Quality trading platforms with advanced resources

- A user-friendly and intuitive design platform

Cons

- You can only trade shares as CFDs. No buying and taking full ownership

- No price plans

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

5. XTB – Cheapest App For Trading in the UAE

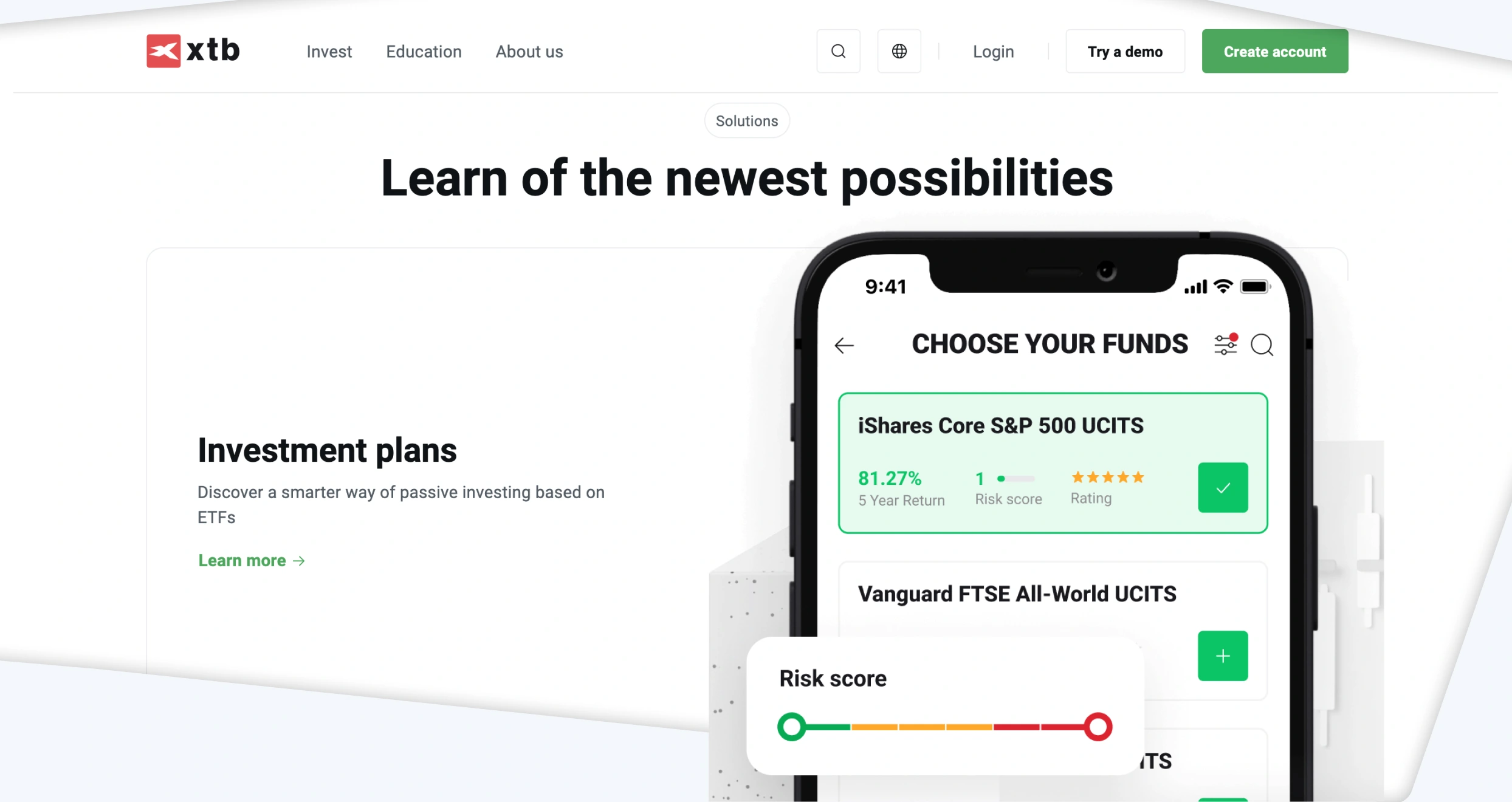

XTB has proven to be the cheapest app for trading in the UAE. From our experience, its xStation Mobile app has no minimum deposit requirement. Trading charges are also low, starting at 0.1 pips. Moreover, the app has no deposit or withdrawal charges. It is an excellent app for newbies and budget-conscious traders to get started with. Plus, its platform is user-friendly with a modern design interface to ensure an exciting experience.

When it comes to asset selection, we discovered that XTB Lists over 5,800 options across various classes. These include forex, shares, commodities, indices, and more. Although it does not have third-party platforms, its proprietary options are loaded with quality trading resources for all types of traders. Users can also rely on the app’s responsive support service for relevant solutions to any concerns or questions.

Pros

- No minimum deposit requirement

- Low trading fees

- Excellent selection of research and learning materials

- A highly rated xStation mobile app on Google Play, the App Store, and Trustpilot

Cons

- Features only CFD instruments

- No third-party platforms like TradingView and MT4

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

6. Forex.com – Best UAE App For Forex Trading

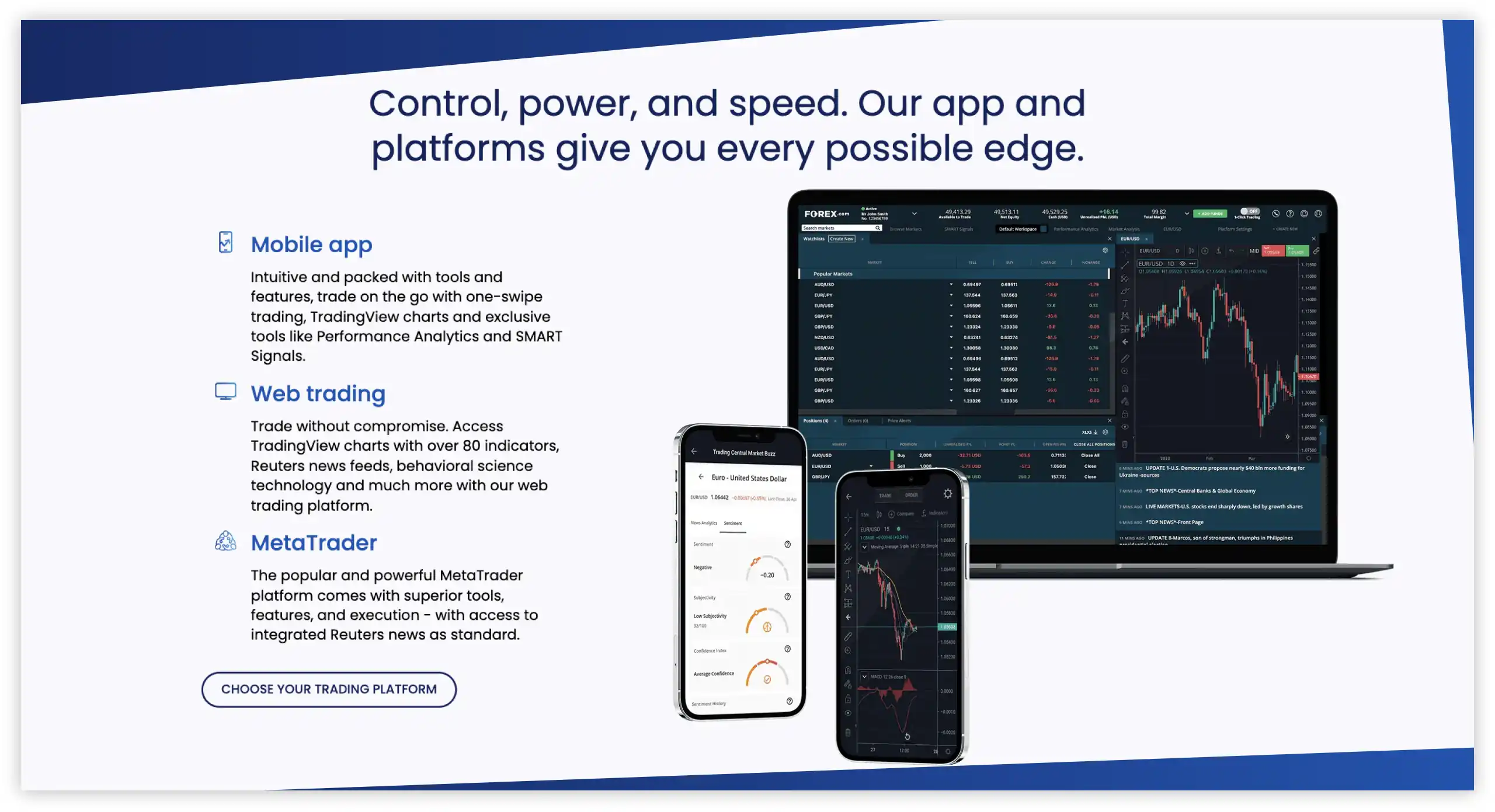

Among the UAE apps we tested, Forex.com is our favorite for forex trading. The app has proven to be user-friendly and lists over 80 currency pairs. Moreover, Forex.com offers quality trading resources on its cutting-edge platforms, such as MT5 and TradingView. We also noted that forex trading fees are low, starting from 0.0 pips on major currency pairs.

We like that Forex.com lists a variety of asset classes to allow users to easily diversify their portfolios. These include indices, shares, commodities, cryptocurrencies, options, and more. Its platform is also user-friendly, and the support service team is available via multiple channels. With low spreads and commission from $5 per $100k traded, Forex.com is worth a try. You can explore its features and offerings via its demo account before making a commitment decision.

✔Zero fees for card deposits and card withdrawals

✔A broad range of trading platforms, including MT4 and 5

Pros

- Low minimum deposit requirement of $100

- Low commissions and spreads from 0.0 pips

- A user-friendly and intuitive design platform

- Reliable and responsive 24/5 support service via multiple channels

Cons

- No MT4 platform for UAE traders

- Product portfolio is limited to forex and CFDs

The best decision you can take as a trader is to join a platform with friendly, transparent fees. Luckily, Forex.com values transparency and cost-friendliness. We tested this broker using Standard and RAW Spread accounts. Here’s what we found out.

First, you must fund your account before trading live with this broker. When doing that, keep in mind that Forex.com’s minimum deposit is $100. Therefore, your first deposit should be $100 or higher. But don’t worry about deposit charges. Forex.com charges zero fees for incoming deposits from bank transfers and debit cards.

The other costs and charges you will incur while trading with Forex.com depend on your preferred account. The costs associated with standard accounts are included in the bid/ask spread. A Standard account’s spreads start from 0.8 pips. Additionally, this account will only require you to pay commissions if you invest in equities. But the good news is that Standard account owners can earn cash rebates on cryptos, equities, FX, and other assets.

If you go with a Forex.com Raw Spread account, you will enjoy commissions as low as $5 per $100k you trade. This account also allows you to lower your trading costs with cash rebates of up to $50 for every $1 million you trade. Furthermore, with it, you can trade FX majors and enjoy tight spreads starting from 0.0.

Commissions and rebates aside, Forex.com levies rollover fees for positions held overnight. The exact rollover rates vary depending on factors like the prevailing market conditions. Furthermore, this broker requires dormant account owners to cover a $15 monthly inactivity fee. The last fee kicks in after an account has remained inactive for 12 months.

Mobile Trading in the United Arab Emirates

The United Arab Emirates’ financial landscape has grown exponentially, thus attracting global traders and investors. With technological advancement, mobile trading has also become popular in the region. Traders and investors with mobile devices can now manage their activities anytime, whether at home or on the go. Another benefit of mobile trading in the UAE is that traders can easily conduct market analysis and get real-time data and alerts.

As a trader, choosing a mobile trading app hosted by regulated brokers is crucial. In the UAE, the financial landscape is regulated by the Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA). So, choosing apps adhering to these authorities’ regulations will keep you from falling victim to scammers.

It is also crucial to confirm whether the best trading app in the UAE adheres to other global authorities’ regulations. The top-tier authorities to verify include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and more.

How to Choose the Right Trading App

Now that you know the top trading apps in the UAE, it is essential to trade with a suitable one for an exciting experience. This means that you should confirm various features in an app before making a commitment, including:

Prioritize the security measures employed by a trading app in the UAE. This way, you are guaranteed that your personal data and finances are safe. Choose an app hosted by a broker overseen by the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority (SCA). If other global regulators, like the FCA, ASIC, and more, oversee an app, it further proves its credibility.

The best element about trading with regulated apps is that you avoid falling victim to scammers. Plus, it’s easy to take legal action against the broker in case of a disagreement. In addition to regulation, check whether an app is highly encrypted and allows you to secure your account using passwords, two-factor authentication, face ID, and more.

Consider the fees and charges of trading apps in the UAE to budget accordingly. It is essential to trade with funds you are comfortable losing, considering that the financial market is unpredictable. That being said, check an app’s minimum deposit requirement, commissions/spreads, inactivity fees, overnight charges, and more.

The best app for trading in the UAE must have a user-friendly and intuitive design platform on your Android or iOS mobile device. The app must also execute trades at a high speed so you can take advantage of potentially profitable opportunities. Most importantly, check the availability of trading tools, whether for research or skills development. If you are a newbie, consider apps with demo accounts to enable you to test their performance and practice trading in a risk-free environment.

Whether you plan to trade forex, stocks, commodities, indices, and more, choose an app supporting your preference. It is also crucial to consider one with multiple offerings. This way, you can efficiently diversify your trading portfolio and limit the risks that come with investing in a single asset.

You do not want to overlook this element as it is as important as the ones above. Whether you are a professional or a new trader, challenges in the financial landscape tend to occur. With a reliable support service, you can easily manage any issues without disrupting your ongoing activities. Therefore, consider an app with a responsive support service. The app’s team should be available via convenient channels like live chat, email, or phone. Also, consider their availability and ensure it fits your schedule since some support service teams are available 24/7 while others are available only five days a week.

Analyze what other users have to say regarding their experiences with a trading app in the UAE. This will help you understand an app’s strengths and weaknesses, thus making the best decisions. Therefore, visit Google Play, the App Store, and Trustpilot to sample user comments for informed decisions.

How To Register an Account with a Trading App UAE

We registered for accounts with trading apps in the UAE and must admit that the process was straightforward. Keep in mind that we used apps overseen by the local authorities in the region, so the procedures are similar on such platforms. Below, we shed light on the simple steps to follow so you can be prepared to start trading in the UAE’s financial landscape.

Whether you are using an Android or iOS mobile device, start by downloading the app. Then, read and understand the broker’s terms and conditions to avoid being inconvenienced once you are fully invested. Double-check the app’s features and ensure they align with your trading preference. If an app is hosted by a broker, visit the broker’s website for an easier account registration process.

Click the “Sign Up,” “Register,” or “Join Now” button to register for a trading account. Your broker will provide a form to fill with your personal details, including your name, email, phone number, residence, and more. You will also be required to create a unique username and password for an added layer of safety.

All regulated brokers in the UAE have a standard protocol that requires all traders and investors to verify their identities and locations. This ensures the online trading environment remains safe and free from imposters. Therefore, your broker may request that you share a copy of your original ID cards and a recent utility bill to verify your identity and location, respectively. Depending on the broker, verification may take up to 2 days. You will receive an email notification once your account is fully activated.

Once your account is verified and activated, make a deposit per the app’s minimum deposit requirement. Most regulated apps, like the ones we recommend, have flexible payment methods, such as credit/debit cards, e-wallets, and bank transfers. Choose a convenient method for you so you can dive into trading once your deposit has been confirmed.

Select your preferred asset and open a position based on your strategy. Remember, the financial market can be volatile. Therefore, always trade with funds you are comfortable losing. Most importantly, apply risk management controls like stop-loss and take-profit orders. This way, you get to mitigate massive losses in case a trade doesn’t work out in your favor.

Conclusion

Online trading in the UAE is skyrocketing, thanks to trading apps that make it easier for traders to explore the financial markets. We list above some of the best options in the market. However, not all of them will suit your trading preference. That is why taking advantage of their demo accounts to test them will help you gauge their performance before making a commitment.

If you are a beginner, start by learning how online trading works and choose an asset you are familiar with. Do not go into online trading expecting quick profits since losses are inevitable. Instead, start small, apply risk management controls, continue learning from your mistakes/losses, and be patient. With time, everything will fall into place, and you will start reaping the benefits of your hard work.

Solid breakdown of the top apps. I've tried a few, and Pepperstone stands out for its speed and flexibility. Just remember—always double-check the platform's regulation status before committing.