Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

The United Arab Emirates is among the most renowned and highly regulated global hubs for investments. The region welcomes both local and international stock brokers to offer investment services to residents. The brokers have access to the Abu Dhabi Securities Exchange (ADX) and other global exchanges, including the NYSE, NASDAQ, LSE, and more. This means stock investments in the UAE offer diverse opportunities in the stock market. You simply need to identify the best stock brokers in the UAE for you.

With hundreds of stock brokers in the UAE, our experts thoroughly evaluated various options. We list below our top brokers that we believe will offer an exciting experience.

In a Nutshell

- Stock trading in Dubai can be profitable. However, to increase your chances of success, you need the best broker and solid investment strategies.

- The Dubai Financial Services Authority (DFSA) is the financial regulator for Dubai-based brokers. However, the Securities and Commodities Authority (SCA) oversees all non-banking financial services in the country, including brokerages.

- Choose a stock broker regulated by local and international authorities, such as those in the UK and EU. You do not want to fall victim to scammers.

- Ensure the broker you select has access to your preferred exchanges and allows you to trade stocks as derivatives.

- The best stock broker in Dubai must feature elements aligning with your trading needs for an exciting experience.

- At Invezty, we conduct thorough market research and comparisons before recommending the best stock brokers for UAE investors.

- The best element about our recommended UAE stock brokers is that they allow you to transact in Dirhams (AED) and other global currencies like the USD, GBP, and more.

List of the Best Stock Brokers

- Pepperstone – Best For Automated Trading

- Plus500 – Top UAE CFD Stock Broker

- eToro – Beginner-Friendly Stock Broker in the UAE

- AvaTrade – Top Stock Broker For Mobile Trading

- IG Markets – Overall Best Stock Broker in the UAE

- Saxo – Best Stock UAE Broker For Professional Traders

Compare Stock Brokers

The UAE hosts numerous stock brokers. As professionals in the global financial landscape, we did thorough research on international stock brokers. Through multiple tests and comparisons, we considered various elements in this process, including fees, security, platform performance, demo accounts, and more. Only those that met our specific criteria were shortlisted for the next step.

We also analyzed user testimonials on Google Play, the App Store, and Trustpilot. User ratings help us fully understand the brokers’ strengths and weaknesses from a user perspective. We then combined our test results with findings from user testimonials to ensure we remain unbiased in our recommendations.

That being said, here is our comparison table highlighting the elements that made our top stockbrokers in the UAE stand out.

| Best Stock Broker UAE | License | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Credit Cards, Bank Transfer, PayPal | Yes |

| Plus500 | FCA, SCA, DFSA, CySEC (#250/14), ASIC, FSCA, MAS, FSA, SCA | 24/7 | Plus500 Webtrader, Plus500 Pro | Bank Wire Transfer, Credit/debit cards, PayPal, Skrill | Yes |

| eToro | ASIC, CySEC, FCA, DFSA, SCA | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Debit cards, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes |

| AvaTrade | CBI, DFSA, SEC, CySEC, ASIC, BVIFSC, FSA, ADGM, ISA | 24/5 | MT4, MT5, WebTrader, Automated Trading, AvaTradeGO, AvaOptions, AvaSocial, DupliTrade, Capitalise.ai | Credit/debit cards, Wire transfer, Paypal, Skrill, Neteller, WebMoney | Yes |

| IG Markets | FCA, CySEC, SCA, DFSA | 24/5 | MT4, IG trading platform, ProRealTime, Web platform, Trading apps, L2 Dealer | Debit cards, Bank transfer, PayPal, HK FPS | Yes |

| Saxo | FCA, SCA, DFSA | 24/5 | SaxoTraderGO, SaxoTraderPRO | Bank Wire transfer, Debit cards | Yes |

Brokers Overview

During our market analysis process, we noticed that many stock investors in the UAE opt for stock brokers they can afford and host their preferred securities. Although it is essential to consider other elements, we did all the legwork for you. We have prepared the tables below showing the applicable fees and available assets offered by our best stock brokers in the UAE.

Fees

| Best Stock Broker UAE | Minimum Deposit Requirement | Commission/Spreads | Deposits/Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| Plus500 | $100 | From 0.0 pips | Free | $10 monthly after three months of inactivity |

| eToro | $100 | Spreads from 0.15% | $5 withdrawal | $10 monthly |

| AvaTrade | $100 | Spreads from 0.13% | Free | $50 quarterly |

| IG Markets | $0 | From 2 cents on US shares | Free | None |

| Saxo | $0 | Commission from $1 | Free | None |

Assets

| Best Stock Broker UAE | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Plus500 (CFDs) | Yes | Yes | No | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| IG Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion About the Best UAE Stock Brokers

Since we tested the top stockbrokers in the UAE, we thought it best to share our opinions regarding our experiences with them in these reviews. We aim to ensure you get clear insights into what the brokers offer and make suitable choices that will provide an exciting experience.

1. Pepperstone – Best For Automated Trading

After comparing and testing various stock brokers in the UAE, we found Pepperstone worth recommending to traders seeking automated platforms. This is primarily because it offers automated trading support on some of the best trading platforms in the industry. These platforms include cTrader, TradingView, MT5, and MT4. You can automate your trades not only across shares but also other securities like forex, commodities, indices, ETFs, and more.

Share trading at Pepperstone was seamless when using our desktop and mobile devices. We discovered that the broker does not have a minimum deposit requirement, and all transactions are free. On top of that, there is no inactivity fee, and the commissions you will incur for share trading are low. Besides automated trading, share traders will enjoy social trading. The feature allows you to interact with other traders and learn more trading tips.

Pros

- Offers an opportunity to automate trades across global share markets like the US, UK, Germany, Hong Kong, and Australian

- No minimum deposit requirement

- No inactivity fees

- Features a Razor and Standard account to trade with based on individual preference

- A user-friendly and customisable share trading platform on desktop and mobile devices

Cons

- No buying and taking ownership of the listed equities

- No advanced risk management tools

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. Plus500 – Top UAE CFD Stock Broker

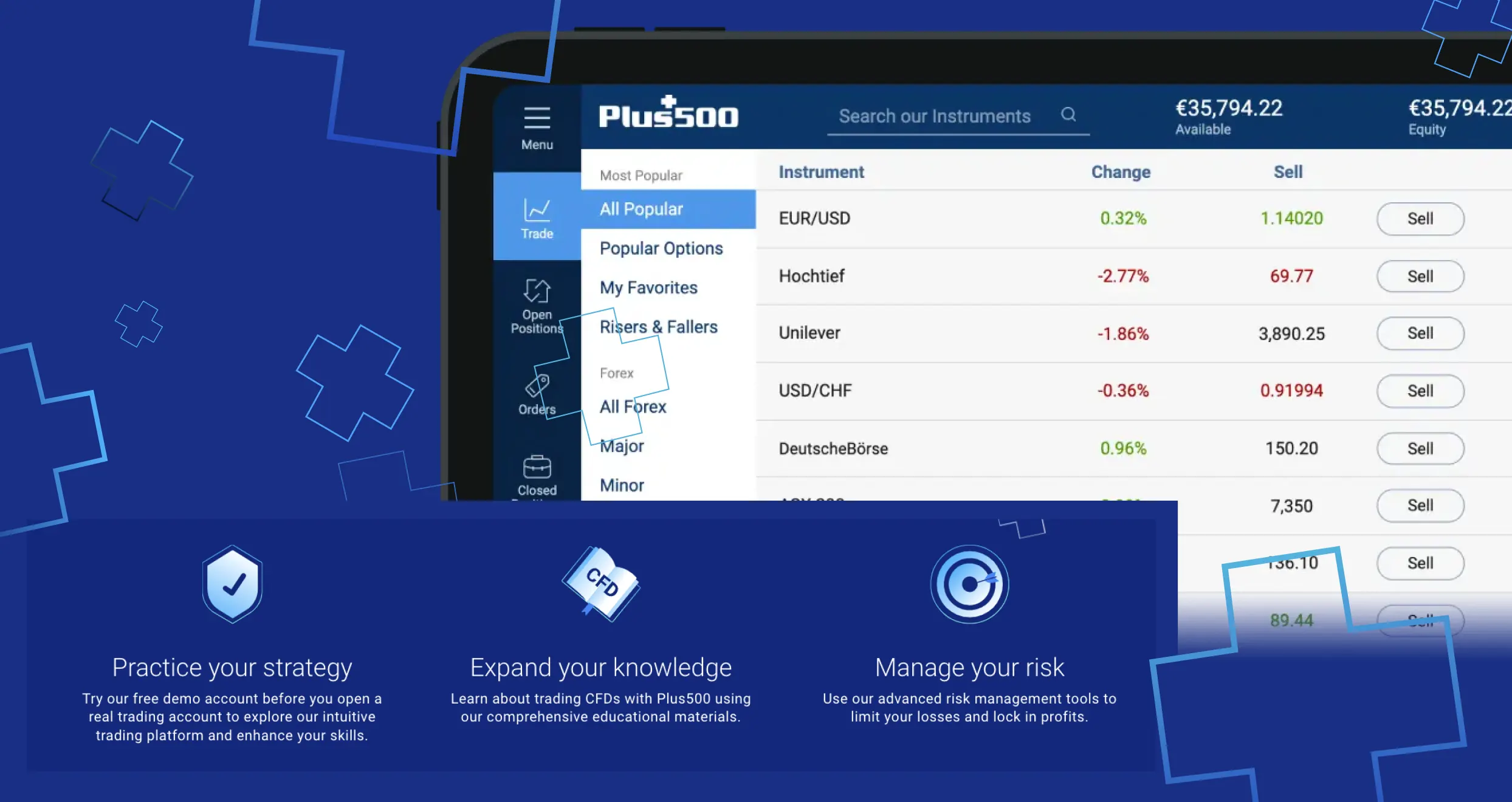

CFD stock traders looking for a top broker should consider Plus500. Our experience with the broker was seamless, from enjoying a user-friendly platform to exploiting quality trading tools on its proprietary and “Professional Trading” platforms. Note that Plus500 lists over 2,000 shares as CFDs, including popular options like Meta, Tesla, Microsoft, Alphabet, and more. All these shares are available to trade with competitive spreads* starting from 0.0 pips.

We also like that Plus500 is regulated in the UAE and by other global authorities, such as the Cyprus Securities and Exchange Commission (CySEC #250/14). Moreover, stock traders can diversify their portfolios with additional securities the broker hosts, including forex, commodities, ETFs, indices, and more. You can get started with as little as $100 while enjoying free transactions. For beginners, explore Plus500’s virtually funded demo account and commit to live trading should you find it suitable for your CFD stock trading needs.

*other fees may apply

Pros

- Low spreads from 0.0 pips

- Free deposits and withdrawals

- High leverage limits of up to 1:300 for professional traders

- A user-friendly and intuitive design platform, perfect for newbies

Cons

- Its $10 monthly inactivity fee kicks in after only three months

- Plus500 does not support buying and taking full ownership of the featured assets

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

3. eToro – Beginner-Friendly Stock Broker in the UAE

We find eToro the best for beginners, thanks to its user-friendly and intuitive design platform. Plus, the broker hosts an extensive selection of learning materials, which newbies will find helpful in boosting their skills. Moreover, it offers a virtually funded demo account where newbies can gauge their skill levels before risking real money on live accounts. Getting started requires only a $100 minimum deposit for UAE traders.

When it comes to stocks, the broker allows you to explore them as CFDs or indices or buy and take full ownership. You will explore over 4,500 stocks from 20+ global exchanges with a low minimum trade of $10. The best part is that you can invest in fractional shares and diversify your portfolio across other asset classes. These include indices, ETFs, cryptos, commodities, and more.

Additionally, as a leading forex broker in the UAE, it provides access to a wide range of global markets.

Pros

- Opportunity to trade real stocks commission-free

- Hosts an award-winning social trading platform that can be beneficial to newbies

- Numerous learning materials and a demo account

- Stock CFD spreads from 0.15%

Cons

- No third-party platforms like MetaTrader, cTrader, and more

- Charges a $5 withdrawal fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

4. AvaTrade – Top Stock Broker For Mobile Trading

We also conducted in-depth research and tests on AvaTrade and found it a suitable option for mobile traders in the UAE. Besides being among the most highly rated apps by users, our experience with its AvaTradeGo app was seamless. The app’s platform was easily navigable, and its intuitive design made it worthwhile. Getting started was also straightforward, with a minimum deposit requirement of only $100.

When it comes to stock offerings, AvaTrade lists diverse options, including those from global companies listed on the NYSE, NASDAQ, LSE, and more. We traded over 600 stocks at the AvaTradeGo app, including Tesla, Meta, Microsoft, and more. Although you can only trade the stocks as CFDs, we noticed that its leverage limit goes up to 5:1 for this asset class. Plus, the app hosts diverse platforms, including MT4, AvaSocial, MT5, ZuluTrade, and DupliTrade, each with its own unique features.

Pros

- Low minimum deposit requirement

- A highly rated AvaTradeGo app on Google Play, the App Store, and Trustpilot

- Low stock trading spreads from 0.13%

- Features automated trading on the MT5 platform

Cons

- High inactivity fee of $50 quarterly after only three months

- Low stock asset offerings compared to its peers

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

5. IG Markets – Overall Best Stock Broker in the UAE

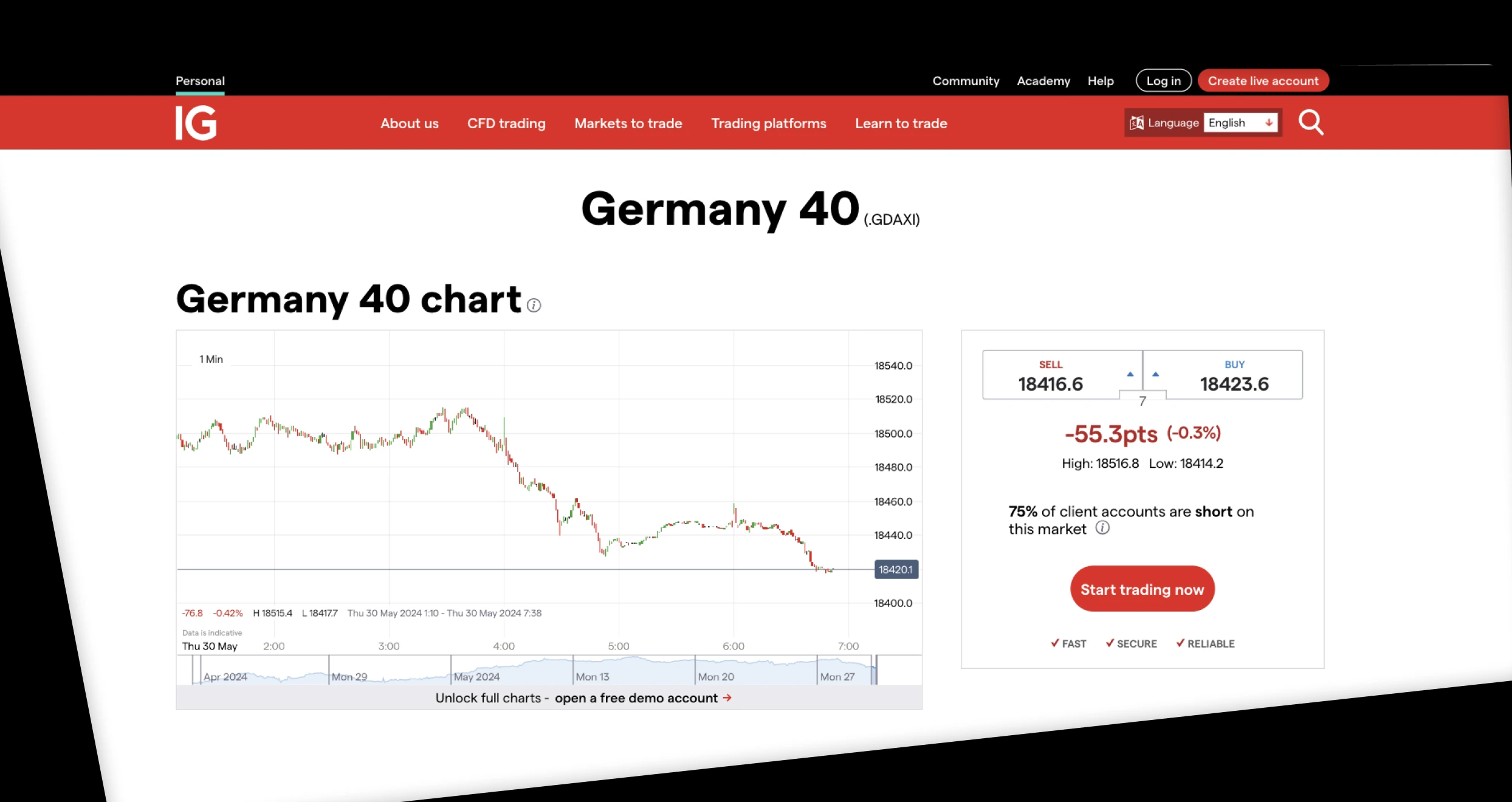

After thoroughly testing and comparing hundreds of stock brokers in the UAE, IG Markets stands out as our overall best. We find it suitable for both newbies and professional stock traders since it has a user-friendly and modern design platform. Moreover, IG Markets hosts quality learning resources to help newbies boost their skills. There is also a social trading platform that allows you to interact with other global traders and mirror potentially profitable trades from expert traders.

For professional traders, this broker offers advanced resources on its MT4, L-2 Dealer, Web, and ProRealTime platforms. Trading stocks with the broker allows you to explore over 13,000 Asia, US, and international stocks, such as Tesla, Microsoft, Netflix, Google, and more. When it comes to stock trading fees, IG Markets charges low commissions, starting from 2 cents per US share and 0.18% on Hong Kong shares. And for those looking to diversify their portfolios, IG Markets offers additional asset securities. These include forex, commodities, cryptocurrencies, indices, ETFs, and more.

Pros

- Features automated trading on its MT4 and ProRealTime platforms

- No minimum deposit requirement

- Has an IG Community platform for social and copy trading

- Offers an opportunity to explore global stocks listed on various exchanges

Cons

- You can only trade shares as CFDs

- Share trading charges are higher compared to its peers

IG Markets’ fees vary depending on the asset you are trading. The broker has come a long way and tries to accommodate both low-budget and high-budget traders. We noticed that the broker doesn’t have a minimum deposit requirement. This allows you to trade with any amount you can afford.

Regarding spreads and commissions, IG Markets imposes some of the lowest fees. For instance, you will explore the currency market with spreads from 0.6 pips. Major indices also attract spreads from 0.8 points and 0.1 points on commodities.

Unfortunately, IG Markets’ share trading fees are high compared to its counterparts. For instance, you will incur 2 cents per US share and 0.18% on Hong Kong shares. The good news is that the broker allows free deposits and withdrawals. Its inactivity fee of $12 monthly also applies after 24 consecutive months.

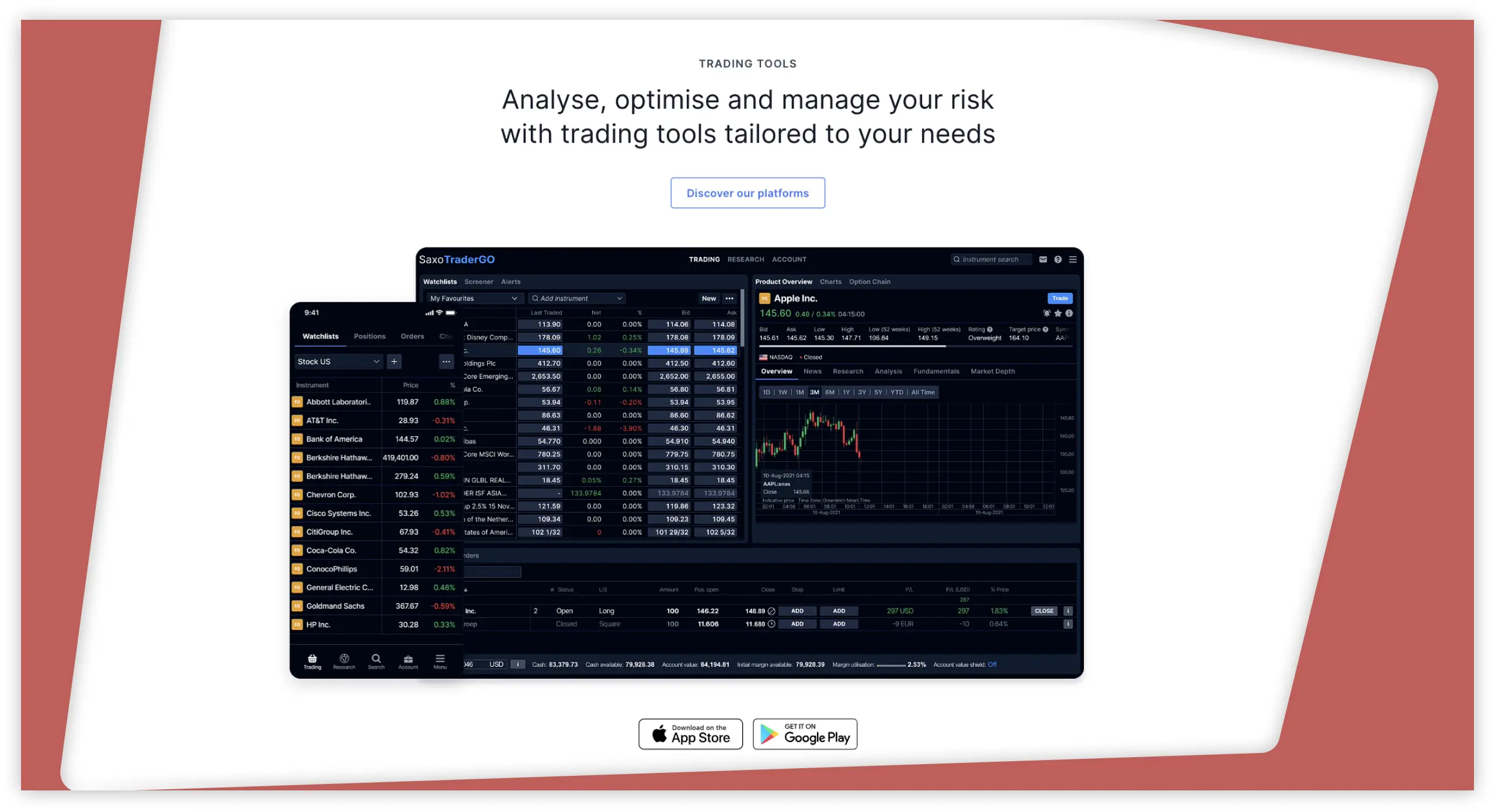

6. Saxo – Best Stock UAE Broker For Professional Traders

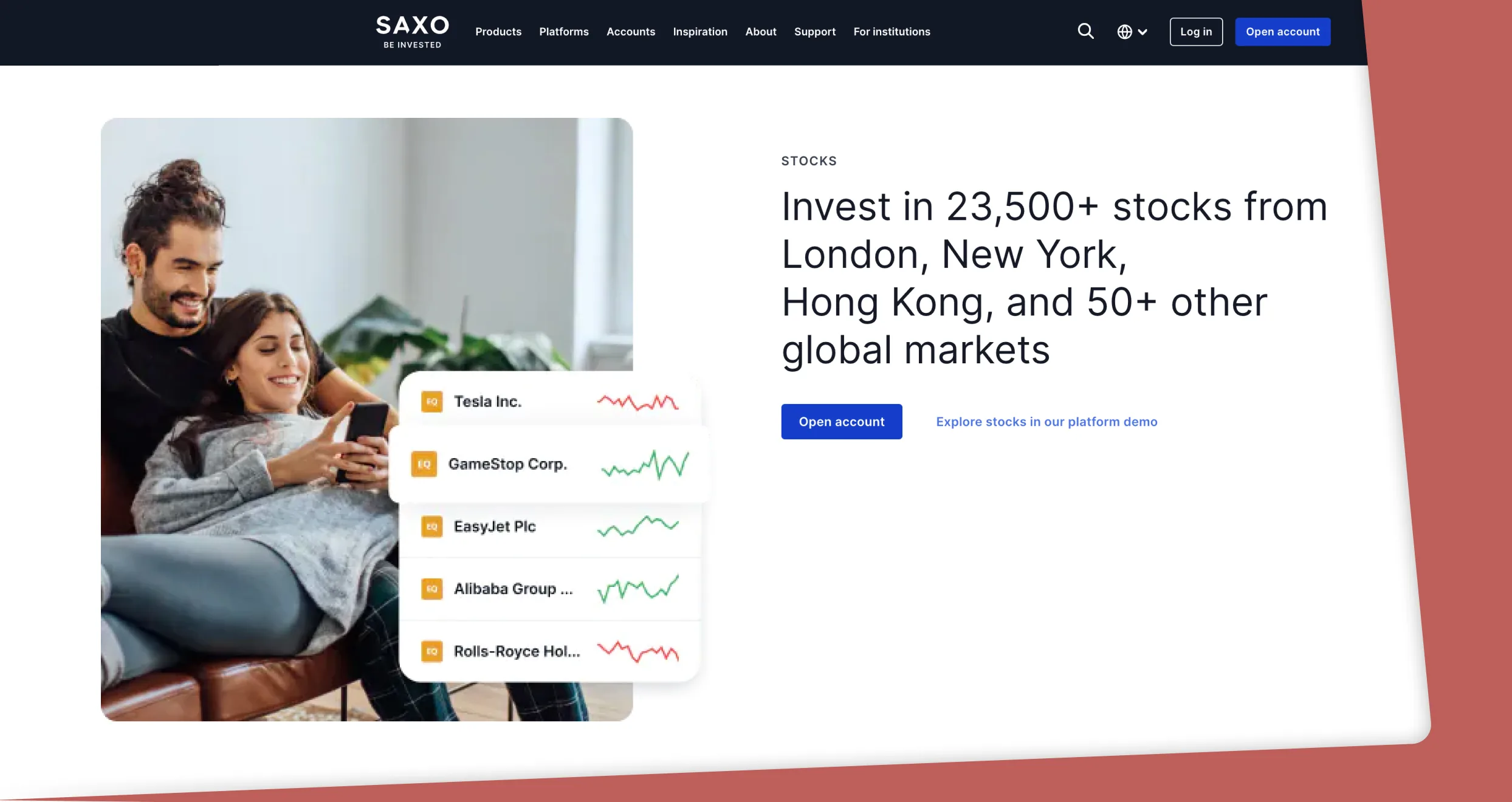

Saxo is one of the best stock brokers, hosting quality resources that can help professional traders efficiently explore the stock market. We tested it and found it user-friendly with a modern design. We explored over 23,500 from 50+ global markets, including Hong Kong, New York, London, and more. The best part is that you can start investing in company stocks with as little as $1 commission for American shares.

Besides buying and taking ownership, Saxo allows you to trade stocks as CFDs. Plus, users can diversify their portfolios using additional asset classes. These include forex, commodities, indices, mutual funds, ETFs, and more. We noticed that Saxo has no minimum deposit requirement, and all transactions are free. This makes it a suitable option for low-budget stock traders and investors in the UAE.

Pros

- Low minimum deposit requirement

- Over 23,500 stocks to explore

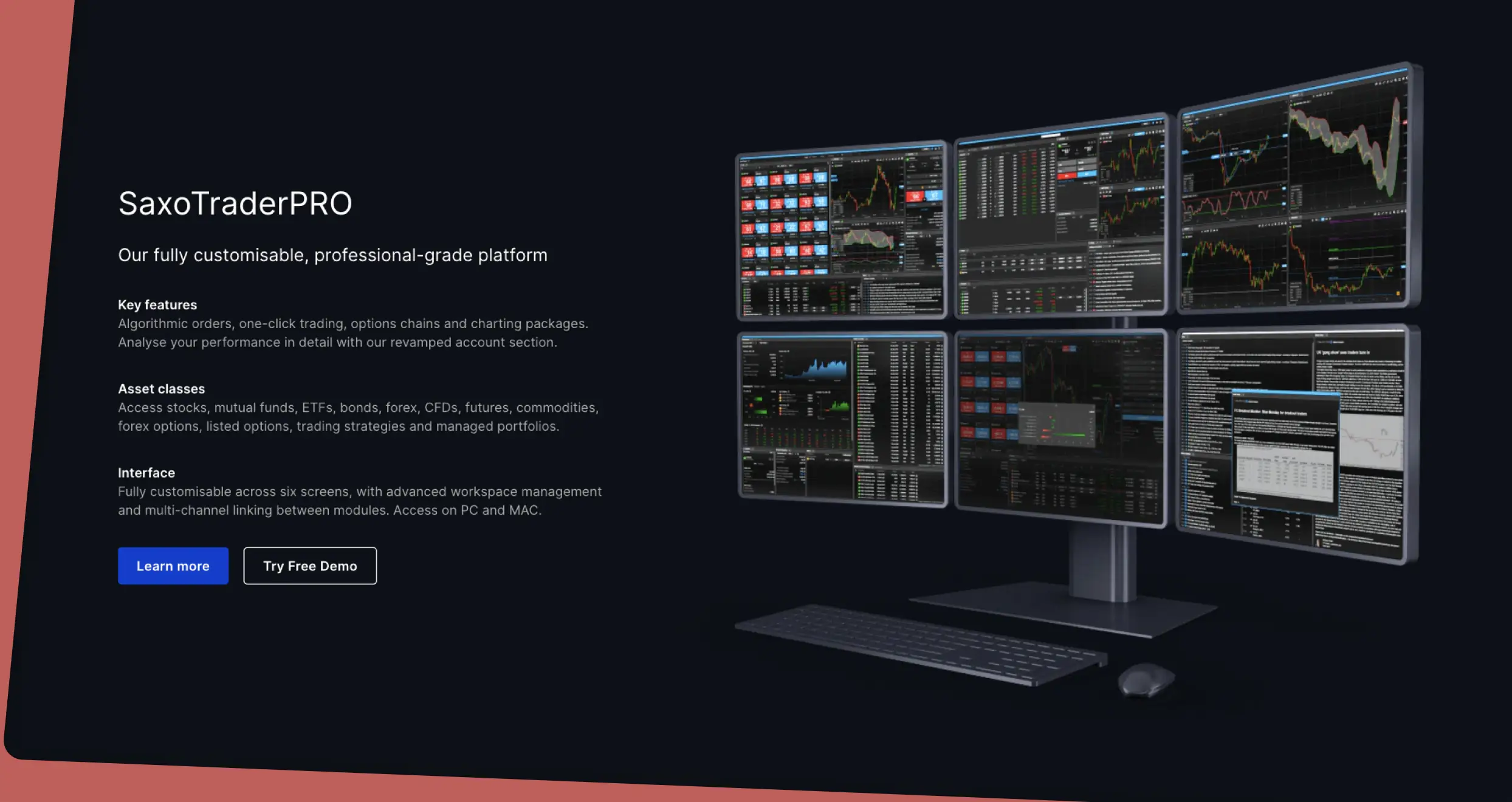

- Hosts a SaxoTraderPro platform with advanced resources for professional traders

- Has a reliable and responsive 24/5 support team via phone, email, and live chat

Cons

- Stock investment commission is higher compared to its peers

- No third-party platforms like MT4, MT5, and more

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

Stock Trading in the United Arab Emirates

Stock trading in the United Arab Emirates is becoming more lucrative, especially since the region accommodates both local and international brokers. Traders and investors can now explore company stocks from various stock exchanges.

Note that the stock market in the region is regulated by the Dubai Financial Services Authority (DFSA) or the Securities and Commodities Authority (SCA). This means that all international stock brokers offering their services to UAE clients must be overseen by such authorities.

The best part is that our recommended stock brokers above have multiple licenses and regulations, which confirm their credibility. They are overseen by top-tier global authorities, including the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Financial Conduct Authority (FCA) in the UK, and more.

You can choose to buy stocks from UAE exchanges, including the Dubai Financial Market (DFM), the Abu Dhabi Securities Exchange (ADX), and the NASDAQ Dubai. You also have the option to diversify your portfolio across company stocks listed on global exchanges like the NYSE, LSE, NASDAQ US, and more. Simply identify stock brokers in Dubai with access to your preferred exchange.

Regardless of the stocks you select, ensure you conduct a thorough market analysis and are familiar with the asset before putting up your money. The share market can be volatile, and you must be armed with solid strategies to maximize your potential in this dynamic landscape.

How to Choose the Right Stock Broker

Trading or investing in stocks in the UAE requires the best broker with features that align with your needs. Whether you choose from our recommendations list of stock brokers in Dubai or conduct your own research, consider these factors to make the best choice.

Security should be a priority when considering a stockbroker in the UAE. Ensure the broker you invest with is highly encrypted to secure your personal data from unauthorized access. Plus, the broker should be licensed and regulated by local and international tier-one authorities. These include the Securities and Commodities Authority (SCA) in the UAE, the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and more.

Observing this element ensures you invest in a secure environment where your funds are protected in segregated accounts. You will also avoid falling victim to scammers.

Choose a UAE stock broker you can afford to avoid overspending and digging deep into your nest egg. Check the broker’s trading and non-trading charges, including commissions/spreads, minimum deposit requirement, inactivity fees, overnight charges, and more.

Whether you want to invest in stocks and take ownership or trade them as derivatives like CFDs or indices, ensure the broker you select allows you to do so. The broker should give you access to various exchanges so you can make a suitable investment choice. Moreover, ensure a stock broker hosts additional asset classes. This will allow you to easily diversify your portfolio on a single platform and limit the risks of investing in a single instrument.

The best stock broker in the UAE should have a user-friendly and intuitive design platform. The platform should have a fast trade execution speed and host quality resources for your skills development and market analysis. If you are a beginner, confirm the availability of a demo account. The account makes it easier for you to test a broker’s performance and gauge your skill level before making a commitment.

A stock broker UAE with a reliable and responsive support service is worth considering. You see, trading and investing in the stock market comes with various challenges. With the best broker support, you will easily handle any arising issue without affecting your ongoing investment activities. Therefore, check the availability of a broker and ensure it aligns with your schedule. The broker’s team must also be accessible via convenient channels, whether by phone, live chat, or email.

It is also crucial to analyze user testimonials regarding their experience with a stock broker. Therefore, head to Google Play, the App Store, and Trustpilot for honest user feedback. Understand a broker’s strengths and weaknesses from a user perspective and make suitable choices aligning with your investment needs.

How To Register an Account with a Stock Broker

Registering an account with a stockbroker in the UAE is straightforward based on our experience. Below, we guide you through the simple steps to ensure you are fully prepared to make your first trade or investment.

Visit your chosen broker’s website to kickstart your account registration process. Before you do, ensure you understand the broker’s terms of service. Plus, install its trading app on your mobile device. This is so you can manage your positions even while on the move.

Once you are confident in your broker, click the Sign-Up or Register button to begin account registration. Fill out the provided form with your personal details, including your name, email, phone number, residence, and more. You will also be required to create a unique username and password for an added layer of safety to your account.

Before having your account fully activated, your broker will engage you in an account verification procedure. You will share copies of your original ID card or passport and a current utility bill to verify your identity and location. Note that the verification process may take hours or days to complete, depending on the broker. Your broker will send an email notification once everything is set.

Deposit funds into your trading or investment account per your broker’s minimum deposit requirement. Also, transact using a convenient payment method supported by your broker. It is essential to make quick deposits so you can focus on utilizing opportunities that could bring about good profits.

Your broker will confirm your deposit and automatically redirect you to its listed stocks and other securities. Choose the options you want to trade or invest in and your preferred strategy. It is also important to apply risk management controls like stop-loss or take-profit orders. This will help mitigate huge losses in case a trade works against your expectations.

If you are a beginner, we advise you to utilize a broker’s demo account when starting your stock investment ventures. With a demo account, you can easily test the broker’s performance and gauge your skill level in a risk-free environment. And when you transition to live trading, put up funds you are comfortable losing.

Conclusion

Trading stocks in the UAE requires the best broker, and our guide above lists the best options in the market. You can identify a suitable one by comparing their features. For beginners, utilize broker’s demo accounts and kickstart your venture with a small capital. Then, increase the amount as you become more familiar with the stock market. Remember, the UAE stock market can be unpredictable, and asset prices change unexpectedly. With a budget and solid strategies, it’s easy to maneuver the stock market and maximize your chances of executing profitable trades and investments.

For beginners in the UAE, I recommend eToro due to its user-friendly platform and educational resources.