Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Identifying a reliable and trustworthy trading app in South Africa can be nightmarish. Why? Hundreds of brokers are available in this great nation, and most have mobile trading platforms. Sadly, some of these are poorly designed and expose you to myriad features, including fraud. But don’t worry; we are here to help you pick the best trading app.

Our team tested and assessed countless trading platforms in South Africa. We also compared them based on factors like licensing, reliability, costs, and financial instruments. Finally, we selected 5 apps with the best quality, features, and functionalities. Use them to elevate your trading game.

If you’re a novice, we urge you to educate yourself and improve your skills with free demo accounts before diving into live trading.

In a Nutshell

- Many brokers allow traders in South Africa to download and use dedicated apps to trade on the go.

- We conducted thorough research and identified several providers ideal for mobile traders in SA: eToro, Pepperstone, FP Markets, XTB, and AvaTrade.

- Our skilled and experienced team tested the best trading apps in South Africa and categorized them according to their competencies. This guide is centred on first-hand experience and insights from hours of extensive research.

- To choose the best app for your trading needs and preferences, consider factors like security, available assets, fees, and customer support.

- Ensure any app you use comes from a broker licensed and regulated by reputable authorities like the Financial Sector Conduct Authority (FSCA).

- Trading exposes you to financial losses. Don’t risk more than you can afford to lose.

List of the Best Trading Apps

- Pepperstone – Best app for CFD trading

- eToro – Overall best trading app

- AvaTrade – Best trading app for beginners

- FP Markets – Best app for trading forex

- XTB – Best app for advanced traders

Compare Trading Apps in South Africa

The internet is swamped with online trading apps. Consequently, you may wonder which criteria we used to identify the best and discard the rest. The answer is simple. We conducted thorough research and selected a few reputable platforms. Then, our experts tested the chosen apps and isolated the top 5, based on numerous factors, including security, assets, platforms, fees, and customer support.

At Invezty, we are dedicated to providing accurate, unbiased, and insightful information. We aim to help you pick trading apps that will fuel your success. As such, we review and recommend the best platforms based on first-hand experience and extensive research. We also factor in insights from testimonials on Google Play, the Apple Store, Trustpilot, and countless financial forums.

Check the comparison table below for an overview of the elements that we evaluated while picking the best trading apps in South Africa.

| Best Trading App South Africa | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FSCA, FCA, ASIC, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| eToro | FSCA, FCA, CySEC, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| AvaTrade | FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| FP Markets | FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| XTB | FSCA, ASIC, CySEC, FSA, FCA | 24/5 | xStation 5, xStation Mobile | Neteller, Credit/debit cards, Bank transfer, Skrill, PayPal | Yes |

Apps Overview

We’ve also recommended these platforms based on their assets and fees. We couldn’t skip that since you need a platform with the right products to elevate your trading career and diversify your portfolio accordingly. Moreover, we know that trading with an affordable service provider is the key to cutting costs and maximizing your returns.

Use the comparison table below to identify an app that fits the bill where assets and charges are concerned.

Fees

| Best Trading App South Africa | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| eToro | $2,000 | From 0% | $5 withdrawal fee | $10 monthly |

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of non-use |

| FP Markets | $100 | From 0.0 pips | Free | $0 |

| XTB | $0 | From 0% | Free | $10 monthly |

Assets

| Best Trading App South Africa | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Opinion about the Best Trading Apps

Our list of the best trading apps in South Africa has 5 outstanding service providers. Our experienced team tested all these platforms to ensure we give you valid information and insights. Go through our reviews and pick a provider guaranteed to fuel your growth and success as a trader in South Africa.

1. Pepperstone – Best App for CFD Trading

We tried Pepperstone, and it stood out as the best when it comes to CFD trading. This app supports over 1,200 CFD-related instruments, from currency pairs and commodities to indices and stocks. You can trade these CFDs on the go with Pepperstone’s mobile-friendly app. It’s compatible with Android and IOS devices. You can download the dedicated app or access this provider with your browser.

Several of Pepperstone’s features caught our attention. For starters, the platform has one-click trading, which allows you to close or open a position with a single click. What’s more, while using the app, you can swap between charts seamlessly, thanks to the Quick Switch feature, and gather comprehensive insights with multiple analysis and charting tools.

As a Pepperstone client, you can harness the potential of powerful trading platforms, including TradingView, cTrader, MT4, and MT5. All you have to do is download the right solution for your device and link it to your Pepperstone account. Furthermore, while using this provider’s app, you enjoy spreads as low as 0.0 pips and ultra-fast execution speeds.

Pros

- No minimum deposit requirement

- Free deposits and withdrawals

- Low spreads starting from 0.0 pips

- Excellent support services are available 24/7

- No inactivity fees

Cons

- The platform primarily focuses on CFDs

- Limited educational resources compare to other industry leaders

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – Overall Best Trading App

After testing numerous platforms, we concluded that eToro is the overall best trading app in South Africa. Several aspects encouraged us to do that. First, the eToro app is simple and easy to use. It’s also available on Google Play and the Apple Store.

Most importantly, the eToro app gives you access to over 5,000 assets. If you are an avid CFD trader, you can use this platform to trade CFDs on stocks, ETFs, commodities, currencies, crypto, and indices. Furthermore, with the app, you can invest in real stocks from popular companies like Microsoft, Apple, and Deutsche Bank. That means you can buy and own shares with eToro.

The other outstanding aspect we noticed regards crypto. Thanks to the eToro app, you can invest in and trade diverse digital assets, including Bitcoin, Ethereum, and Solana. The platform supports over 100 vetted and certified crypto assets.

Pros

- Simple, feature-rich mobile app for iOS and Android users

- Numerous top-notch platforms are available, including CopyTrader and Social Trading

- Low commissions starting from 0% for stock trading

- A wide variety of tradable assets are supported, from currency pairs to crypto and options

- Supports investing in assets like crypto and company shares

Cons

- $2,000 minimum deposit for South Africans

- $10 monthly inactivity fee

- Algo trading isn’t supported

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. AvaTrade – Best Trading App for Beginners

AvaTrade is the best trading app for beginners in South Africa. If you are a novice, choosing this service provider is advisable for several reasons. For starters, it allows you to access and use free trading courses provided by AvaAcademy. This program has countless resources you can use to master the art of trading stocks, FX pairs, commodities, indices, and more.

Also, AvaTrade has a beginner-friendly trading app that is compatible with Android and IOS operating systems. It comes with a sophisticated, easy-to-navigate dashboard and a rich set of clear charts and risk management tools. Moreover, the app offers a step-by-step guide to opening trades, 24/5 customer support, and constant feedback on your activities.

The AvaTrade app lets you switch between demo and live accounts whenever necessary. You also get the option to manage multiple MT4 accounts and trade over 250 instruments, including currency pairs, cryptos, stocks, and commodities.

Pros

- Top-quality, free educational materials

- Beginner-friendly mobile app

- Free deposits and withdrawals

- Responsive and helpful customer support

Cons

- High account inactivity charges

- A limited number of asset offerings compared to other industry leaders

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

4. FP Markets – Best App for Trading Forex

South Africa is home to approximately 190,000 forex traders. If you’re in this category, check out FP Markets. We highly recommend it because this broker has an app that gives you uncapped access to over 70 currency pairs. Also, while trading with it, you enjoy flexible leverages of up to 500:1 and spreads starting from 0.0 pips.

The FP Markets forex app in SA is compatible with most Android and IOS devices. While testing it, we discovered a few unique aspects. First, it allows you to build a custom favorites menu, which saves time and streamlines trading. Moreover, the platform supports other instruments forex traders can use to diversify their portfolios, including CFDs on shares, commodities, and indices.

FP Markets also allows mobile traders to link their accounts with diverse trading platforms, including MT4, MT5, and cTrader.

Pros

- Over 70 major, minor, and exotic FX pairs

- Zero deposit, basic withdrawal, and inactivity fees

- Knowledgeable support representatives available 24/7

- Quality platforms are supported, including cTrader, MT4, and MT5

- Competitive spreads starting from 0.0 pips

Cons

- Some payment methods have withdrawal fees, including Skrill and PerfectMoney

- Features only forex and CFD offerings

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

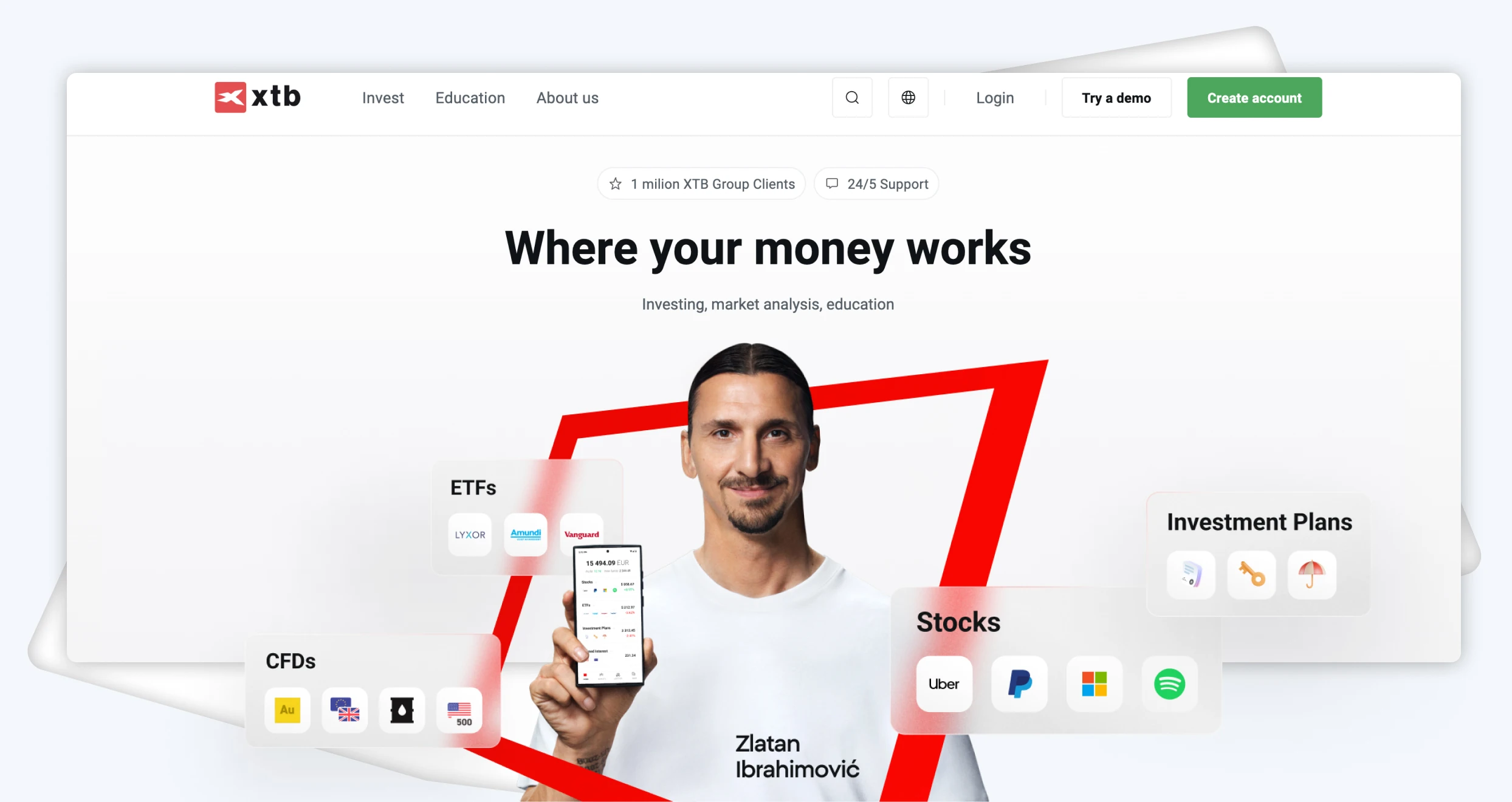

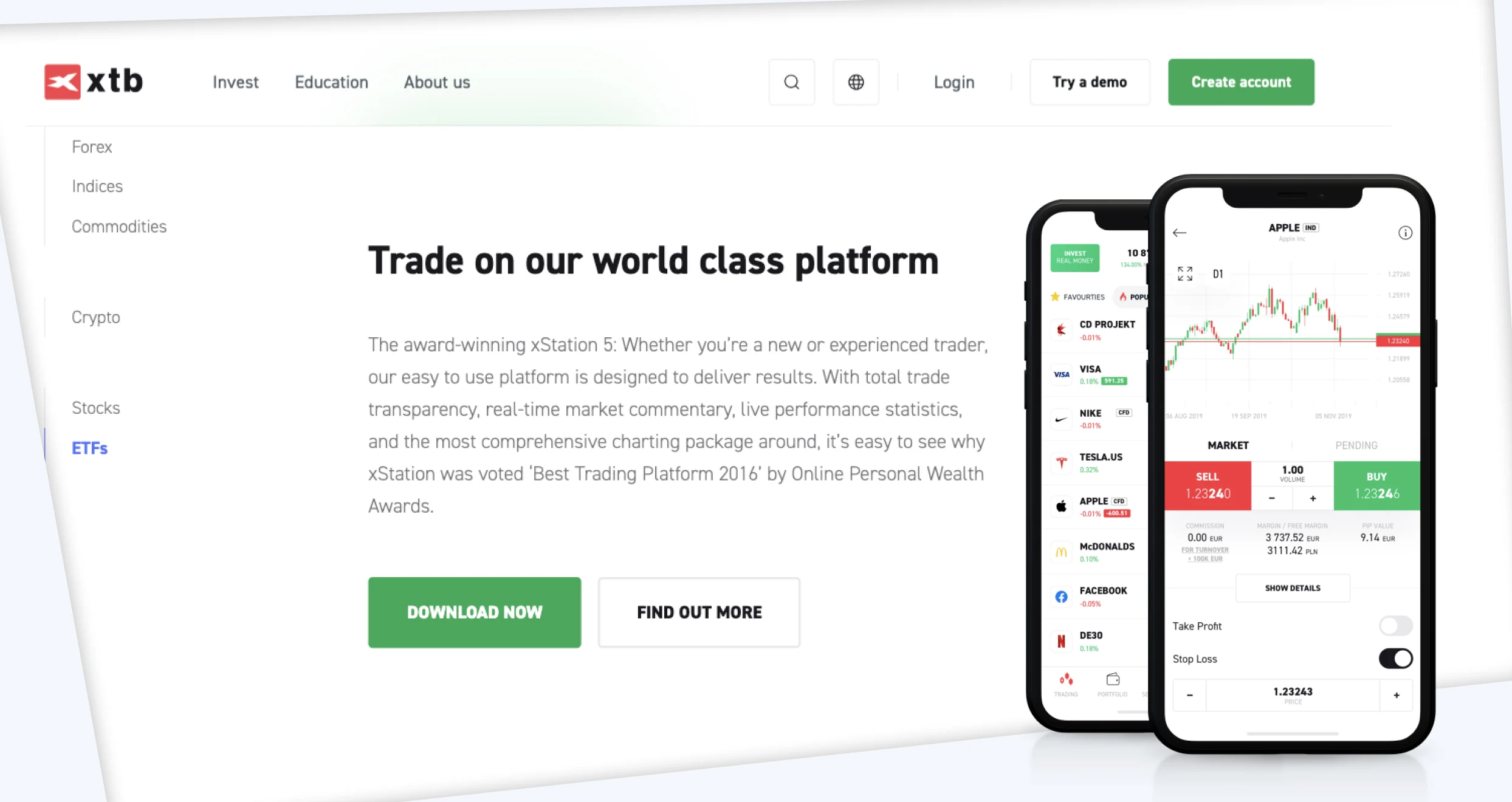

5. XTB – Best App for Advanced Traders

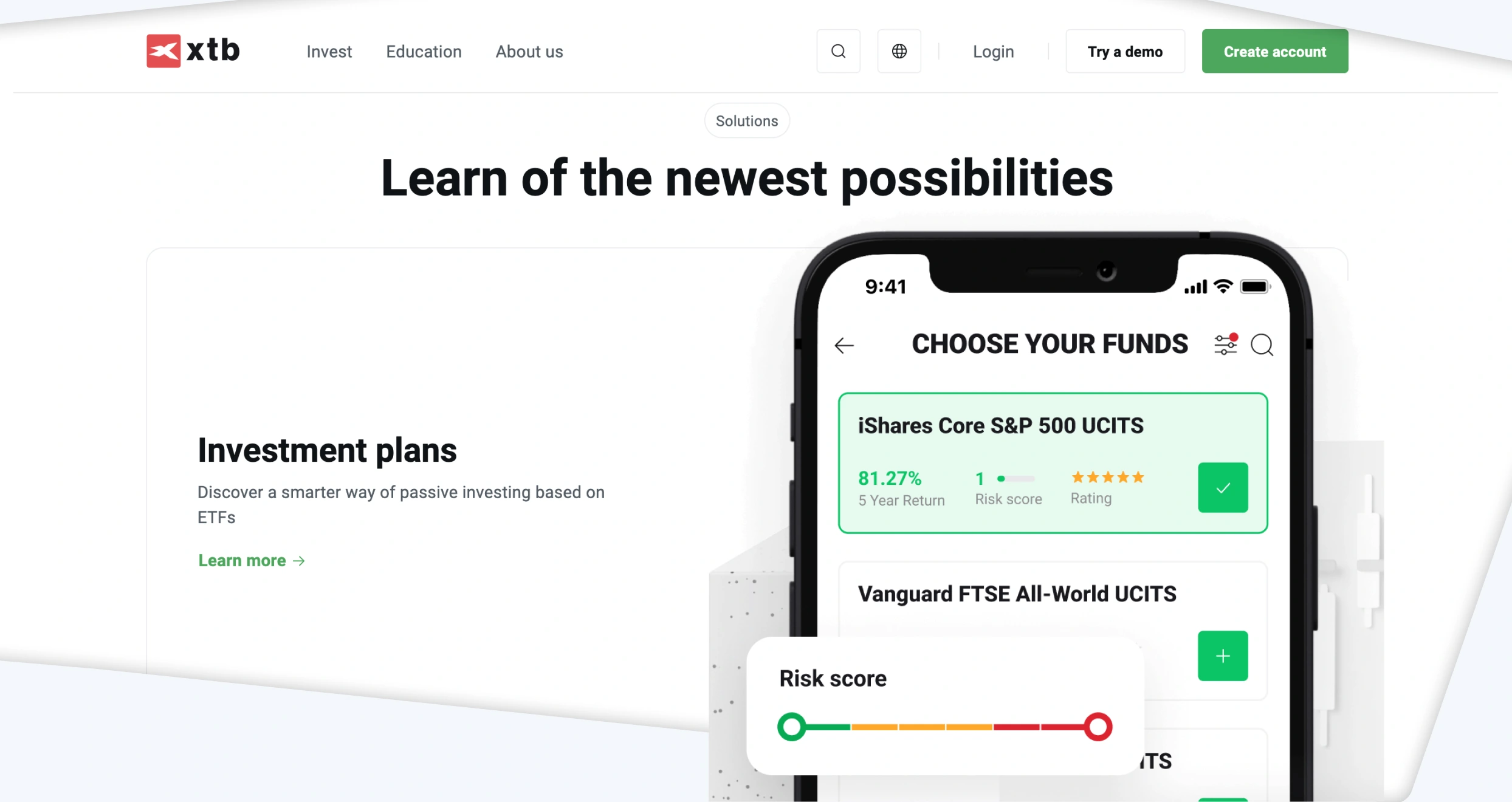

If you’re searching for an advanced trading platform, look no further than the XTB’s xStation Mobile app. It allows traders like you to access global financial markets on the go. With it, you can trade 5,800+ CFD products, including stocks, FX pairs, indices, commodities, and crypto assets.

XTB’s mobile app has a simple, intuitive design that allows you to manage your trading account without any hassle. It also comes with transparent horizontal charts that you can use to track all market movements seamlessly. Furthermore, thanks to the app’s Take Profit and Stop Loss levels, you can manage your risk exposure and maximize returns.

Not to forget, the xStation mobile app gives you uncapped access to market sentiments. With it, you will be able to monitor the positions of other experienced traders and make informed decisions.

Pros

- Supports over 5,000 tradable financial instruments

- No minimum deposit requirement

- Free deposits and withdrawals

- Simple and intuitive app design

- Quality charting and analysis tools

Cons

- Limited trading platforms

- $10 account inactivity fee

- Currency exchange attracts commissions of up to 0.8%

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

Mobile Trading in South Africa

Mobile trading is incredibly convenient. You can use your mobile phone to trade anytime and anywhere without the limitations of being tied down to a specific place. Moreover, the best mobile trading apps are user-friendly and intuitive, making them ideal for professionals and newbies.

To enjoy the full perks of mobile trading, you need to trade with outstanding apps. Take the platforms listed here. They are provided by brokers that are reputable and regulated by numerous authorities, including the Financial Sector Conduct Authority (FSCA) in South Africa. While trading with them, you can rest assured that your funds and data are in good hands.

You must be extra cautious when choosing a trading app. The slightest error in judgment can expose you to significant issues, including hefty financial losses. Also, before registering with any platform, learn the risks associated with mobile trading and how to mitigate them.

How to Choose the Right Trading App in SA

Never commit to the first trading app you come across. For the best results, vet every platform based on the following elements:

For unmatched safety and security, choose apps from brokers licensed and regulated by respected authorities, like the FSCA, the FCA, and CySEC. Such organizations have regulations that protect you from financial losses, unfair practices, etc.

Before using a trading app, check its ratings on Google Play or the Apple Store. Also, check what past users say about it by reading reviews on sites like Trustpilot. These hacks will help you gauge every platform’s reliability before signing up.

You should look for an app that supports your preferred assets. Better yet, prioritize platforms with a broad range of instruments since you’ll need them to diversify your portfolio and manage your risk exposure.

Since you’re a mobile trader, you should register with a broker that offers reliable mobile trading apps. The apps should have an intuitive and user-friendly interface. They should also be equipped with robust security measures and all the tools you need to trade seamlessly.

Before downloading a trading app, check the service provider’s customer support policies. Evaluate availability, response time, and support channels. Additionally, check online what other users say about support quality. Remember, you may need prompt assistance at some point. If you choose a platform with shoddy support, resolving your issues in a timely manner will be almost impossible.

How To Register an Account with a Trading App SA

Registering an account with trading apps is very easy. So don’t worry; you can do it, even if you’re a beginner. That said, since the FSCA and other financial bodies regulate these platforms, they are required to collect personal information and verification documents. Submit accurate info and valid documentation to avoid complications like premature account suspension.

You can open an account with a trading app in South Africa today by doing the following:

Go to the broker’s official site and read the Terms & Conditions. If the Ts & Cs are okay, look for a dedicated mobile app. Choose whether to download it from the Apple Store or Google Play, depending on your phone’s operating system.

You’ll need to provide indispensable details, like your full name, phone number, email address, and location. After sharing this info, submit the required verification documents. Depending on your preferred broker, you may submit photos of your government-issued ID and recent bank statements.

Wait for your service provider to verify your account. Then, use the supported payment methods to fund your trading account. Ensure you adhere to stipulated minimum deposit requirements. If the app has no minimum deposit and you’re a novice, start with the smallest amount possible and test the waters. You can top up your account with more money in the future.

Choose an asset and start trading. Use your app to monitor your positions closely. Additionally, if your app supports it, minimize your risk exposure with tools like stop loss and take profit orders. You can withdraw all proceeds via the supported payment methods.

Conclusion

After testing numerous trading apps in South Africa, we recommend eToro, Pepperstone, FP Markets, XTB, and AvaTrade. But don’t take our word for it. You should download and test these apps. That is the surest way to identify a platform with features guaranteed to meet your trading needs and requirements. While picking a suitable app, remember to consider factors like fees, assets, and customer support.

Also, to maximize profitability, trade assets you’re familiar with. If you encounter an alien instrument you’d like to dabble in, study its fundamentals before putting your money on the line.

I’ve found that while these apps are great, it’s crucial to start with a demo account to really understand each platform before trading with real money.