Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Europe is hands down the epicentre of global forex trading, with London alone accounting for approximately a third of daily trading volume. But trading forex in this region isn’t easy; just when you have the perfect strategy mapped out, you’re thrown into the dense jungle of forex brokers.

I myself have struggled with finding reliable forex brokers that are fully licensed and regulated by top European authorities like CySEC in Cyprus, BaFin in Germany, and AMF in France. Before pinpointing the service providers I use now, I had to try everything from the big names to their lesser-known competitors. It was a lot of work. To save you the trouble, I’ve compiled the ultimate ranking of the best-regulated European forex brokers I came across.

List of European Forex Brokers

- Plus500* – Overall top as CFD

- eToro – Best for social trading

- Axi – Top Option For MT4 Users

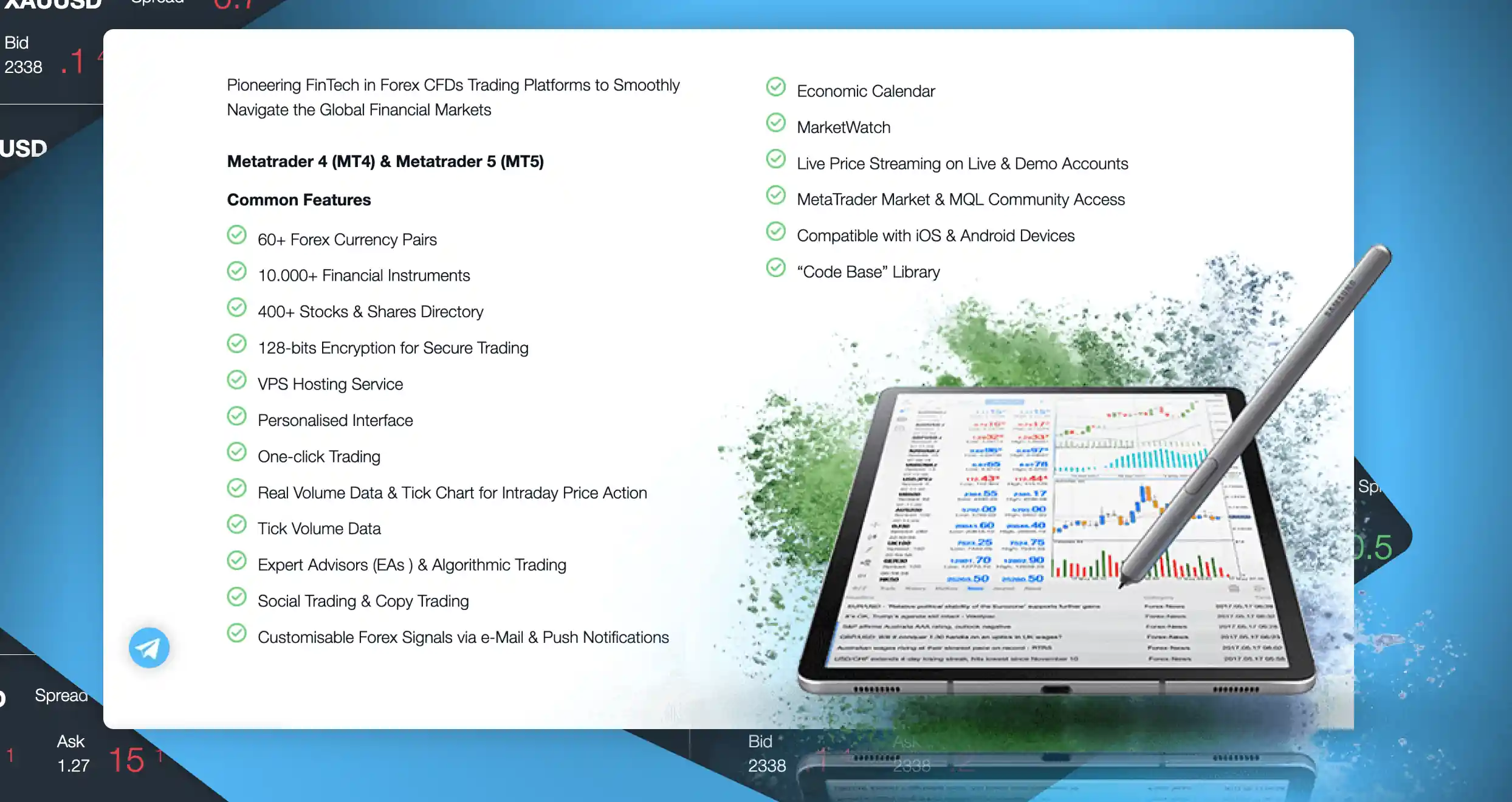

- FP Markets – Best for low spreads

- XTB – Best for advanced trading tools

- Interactive Brokers – Best for professional traders

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Compare Brokers Table

Years of experience trading currency pairs have given me insight into some of the most crucial elements to consider when choosing a good forex broker in Europe. I’m talking about everything from the fundamentals, like trading platforms, to the finer details, like spreads, support availability, and payment methods. Most traders don’t have the time or patience to rummage through dozens of reviews and get all the necessary info to make a well-informed decision.

I compiled the table below comparing the top European forex brokers based on the most crucial factors determining a broker’s reliability. That way, you can see how each broker stacks up against the rest and find the best one for your trading needs.

| Forex Broker | License and Regulation | Minimum Deposit | Commissions and Spreads | Support Service | Software | Payment Methods | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Plus500* 82% of retail investor accounts lose money when trading CFDs with this provider. | CySEC, ASIC, FMA, MAS, DFSA, FCA | €100 | From 1.1 pips | 24/7 | Plus500 CFD | Credit/Debit cards, e-Wallets, Bank Transfer | Yes | No |

| eToro | ASIC, MAS, FCA, CySEC, ADGM, MFSA, SEC | €50 | From 1.0 pips | 24/5 | eToro online trading platform, mobile app, CopyTrader | Credit/Debit cards, PayPal, eToro Money, Bank Transfer, Trustly (EU only) | Yes | Yes |

| Axi | FCA, ASIC, CySEC | €5 | From 0 pips* on Pro accounts | 24/7 | MT4 | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer | Yes | Yes |

| FP Markets | ASIC, MAS, FCA, FSCA, CySEC, FSA | €100 | From 0.0 pips | 24/7 | MT4, MT5, Iress ViewPoint, WebTrader, Mobile App, cTrader, TradingView | Bank Transfer, Credit/Debit Cards, e-wallets, Online Banking, Crypto, Xpay | Yes | No |

| XTB | IIROC, FCA, CySEC, FSC | €0 | From 0.00008 pips | 24/5 | xStation 5, Mobile App | Bank Transfer, Credit/Debit Cards, e-Wallets | Yes | Yes |

| Interactive Brokers | ASIC, FCA, MAS, CBI, CIRO, SEC | €0 | From 0.1 pips | 24/7 | IBKR Desktop, IBKR Mobile, IBKR GlobalTrader, Trader WorkStation, IBKR APIs. IBKR ForecastTrader, IMPACT | Bank Transfer, cheque-mailing, cheque-scanning, ACH transfer, Bill Payment, EFT (Canada only) | Yes | Yes |

*Commission charges apply.

Platforms Reviews

Experiences with forex brokers vary from one trader to the next. What I consider a perfect broker for my strategy and trading style might be a complete disaster for another trader. However, by sticking to the facts, we can objectively establish which brokers shine above the rest and why they made it to our list.

Reviewing the different brokers in Europe was no easy task and involved countless hours of signing up, downloading, and testing the various platforms. My main focus was the brokers’ spreads, how quickly trades were executed, and customer support responsiveness. I also skimmed through dozens of reviews on sites like Trustpilot and read comments on Reddit and similar forums.

This gave me a glimpse into what the forex trading community thinks of the top forex brokers in Europe. Following hours of research, I compiled the following mini-reviews to give you a clear picture of what to expect from the best European forex brokers.

1. Plus500 – Overall Top as CFD

Plus500 easily takes the crown as the best forex broker (CFDs) in Europe. My experience with the broker was nothing short of riveting. For starters, the broker had regulation from top global regulatory bodies, from CySEC to the FCA. This meant I could rest easy knowing my money was in safe hands and fair trading practices were guaranteed.

I was also blown away by the broker’s trade execution speed. Most of my orders were executed within 1-2 seconds. This speed meant I could capitalise on market opportunities with almost zero slippage.

Plus500 is no slouch in this user interface department either. The broker’s proprietary platform is simple, well laid out, and intuitive. Despite being a big fan of third-party software, I didn’t feel like anything was amiss while trading with Plus500’s web-based platform. Analysing charts, creating watchlists, and placing and monitoring trades was nothing short of a dream.

Interface aside, the broker also has some of the lowest costs in Europe and is thus a great option for beginners or cash-strapped traders. However, I wasn’t impressed by the broker’s lacklustre educational offering and closed system that locks out third-party tools and software.

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Pros

- Simple, easy-to-use platform

- Highly regulated by tier-1 regulators, including CySEC

- Fast and reliable execution speeds

- Intuitively designed mobile platform

Cons

- No third-party software support

- Educational content needs improvement

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

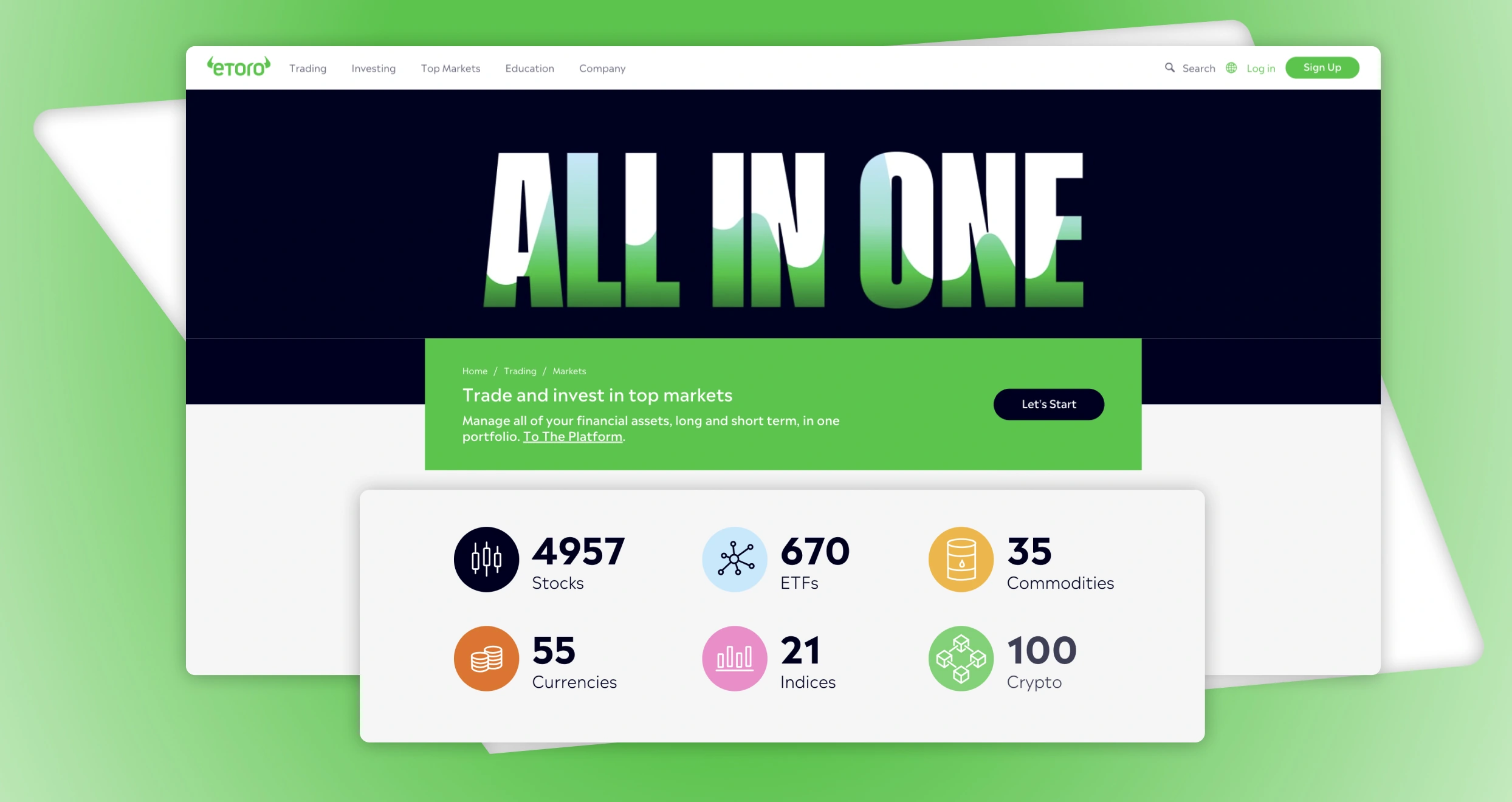

2. eToro – Best for Social Trading

One of the best aspects of trading forex is its social aspect. Traders can interact, share strategies, and thrive as a trading community. When it comes to social trading in Europe, eToro reigns supreme.

The broker’s social trading platform, CopyTrader, is its most notable feature, making eToro “the world’s leading social trading network.” CopyTrader is a hotbed of opportunity and collaboration with over a million users from 140-plus countries. Beginners can borrow a leaf from more experienced traders and copy their trades directly before getting their foothold.

If you’re a newbie, you can also learn volumes from eToro Academy with guides, tutorials, courses, and other educational material. These materials are free, so don’t fret over spending your hard-earned money and reducing your trading capital. Plus, signing up with eToro is a walk in the park. Traders can register with the platform and begin trading in less than half an hour.

eToro enjoys a stellar reputation for its safety in the trading community, with licenses and regulations from top authorities, including ASIC, SEC, FCA, etc. And while it’s been considered a broker for novices, the wide range of technical analysis tools and professional grade charting capabilities tell another story.

Pros

- Industry-leading social trading platform

- Extensive educational resources at eToro Academy

- Intuitive trading platform on both desktop and mobile devices

- Regulated by tier-1 authoritative bodies, including CySEC and CBI

- Professional trading tools and features also available in the mobile app

Cons

- Doesn’t support third-party trading software

- Supports fewer base currencies compared to its counterparts

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

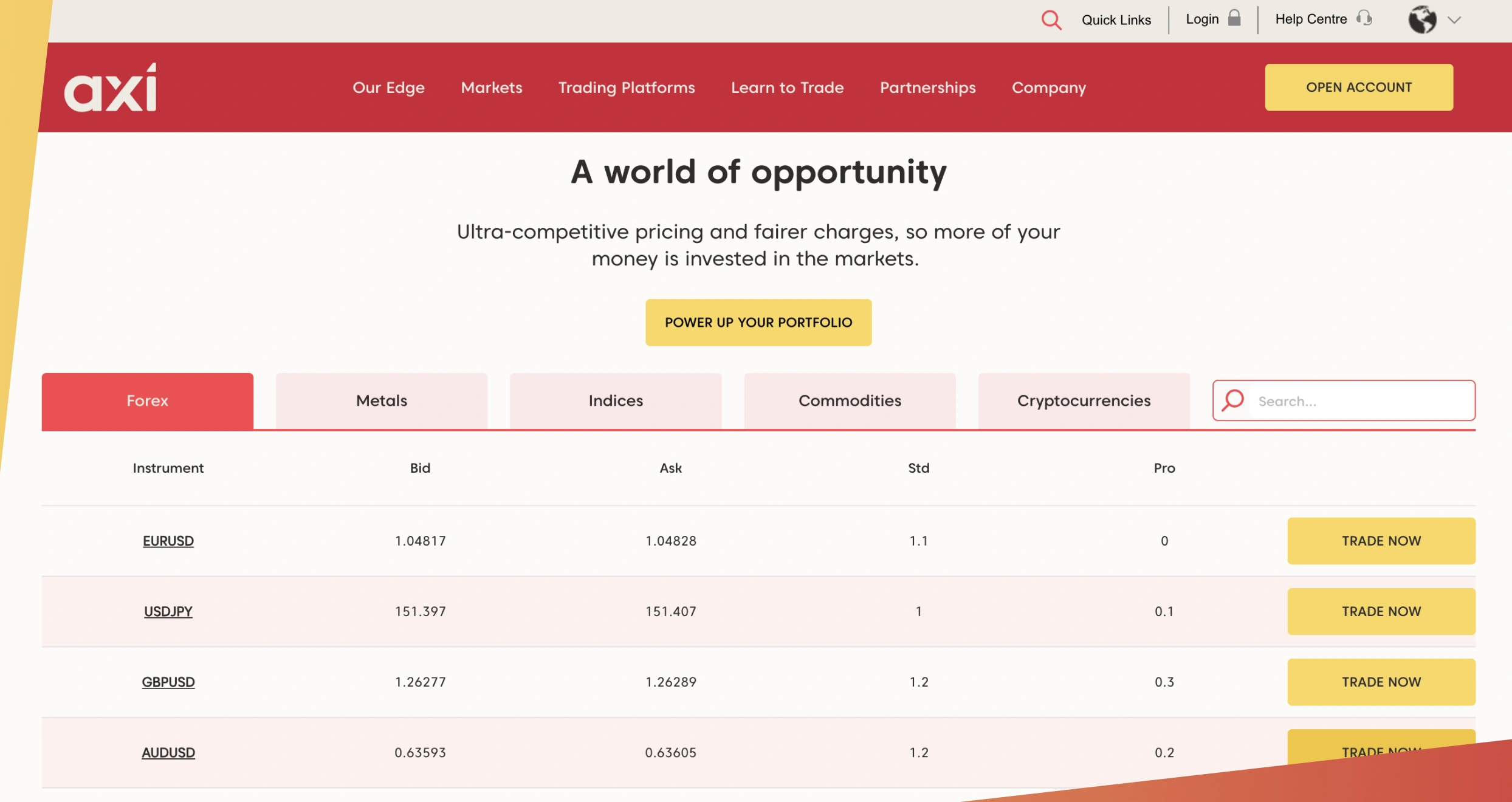

3. Axi – Top Option For MT4 Users

Axi is one of the best forex brokers hosting the MT4 platform. My experience with it was terrific, as I was able to set up a trading account in minutes. I also like its execution speed and the fact that it allows users to custom build their Expert Advisors for automated trading. You can get started with as little as €5, which you can deposit using multiple payment methods. Note that Axi lists over 70 currency pairs and additional assets for portfolio diversification.

Axi’s MT4 operate seamlessly on both desktop and mobile devices. If you have used the MT4 platform before, you know that it is full of functions like charts, price alerts, custom indicators and analysis tools. You can access it using Axi’s Standard or Pro accounts and also enjoy leverage limits of up to 30:1 for retail clients. Beginners are guaranteed quality learning tools and a virtually funded demo account for gauging their skill level.

For professional traders, Axi has a professional trading account with eligibility requirements. You must have traded in significant size in leveraged markets an average of 10 times in each of the last four quarters. You must also have an investment portfolio exceeding €500,000 and have worked for at least a year as a professional in the financial sector.

Pros

- The professional trading account has a higher leverage limit of up to 500:1

- Low minimum deposit requirement for EU clients

- A substantial number of currency pairs are available

- Supports automated trading through custom-built Expert Advisors

- Quality learning and market analysis tools on its MT4 platform

- A reliable and responsive 24/7 support service

Cons

- There is no buying and taking ownership of the supported assets

- No alternative trading platforms besides the MT4

Promoted by AxiTrader Ltd. CFDs carry a high risk of investment loss. Not available to AU, NZ, EU & UK residents. Spreads and other fees apply.

The Axi Copy Trading App is provided in partnership with London & Eastern LLP.

The Axi Select program is only available to clients of AxiTrader Limited. CFDs carry a high risk of investment loss. In dealings with you, AxiTrader acts as a principal counterparty to all of your positions. AxiSelect is not available to residents of AU, NZ, EU, and the UK. For more information, please refer to the AxiSelect Terms of Service.

4. FP Markets – Best for Low Spreads

Starting out as a penny-pinching forex trader meant I couldn’t afford to lose a considerable chunk of my profits to outrageous spreads. Years in the game, and I haven’t changed much, but that’s beside the point. If you’re a penny pincher looking for a European forex broker with super low spreads, then FP Markets is just what the doctor ordered.

With spreads as low as 0.0 pips, it’s hard to go wrong with this broker. That said, tight spreads are just part of why FP Markets made it to our list. Using FP Markets has been sublime, especially because of its fast trade execution speeds, with most orders taking less than 40 milliseconds.

The broker’s ultra-low latency means you can maximise opportunities with minimal slippage. Couple that with efficient and intuitive trading platforms like MT4, and you have one of the best trading experiences a trader could ask for. Not to forget, this broker doesn’t require Europeans with dormant accounts to pay inactivity fees.

Regarding financial instruments, FP Markets is packed with over 10,000. As an FP Markets platform user, you can trade everything from European stock indices like EURO STOXX 50 to stock CFDs such as DAX 30 and FTSE 100.

Pros

- Offers some of the industry’s lowest spreads starting from 0.0 pips

- 10,000+ tradable securities

- Compatible with popular trading platforms like MT4 and MT5

- Equinix servers for super fast trade execution

- Powerful AI-powered analytics with TradeMedic

- No inactivity fees

Cons

- Educational content could use some improvement

- Copy trading platform lacks access to fundamental tools

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

5. XTB – Best for Advanced Trading Tools

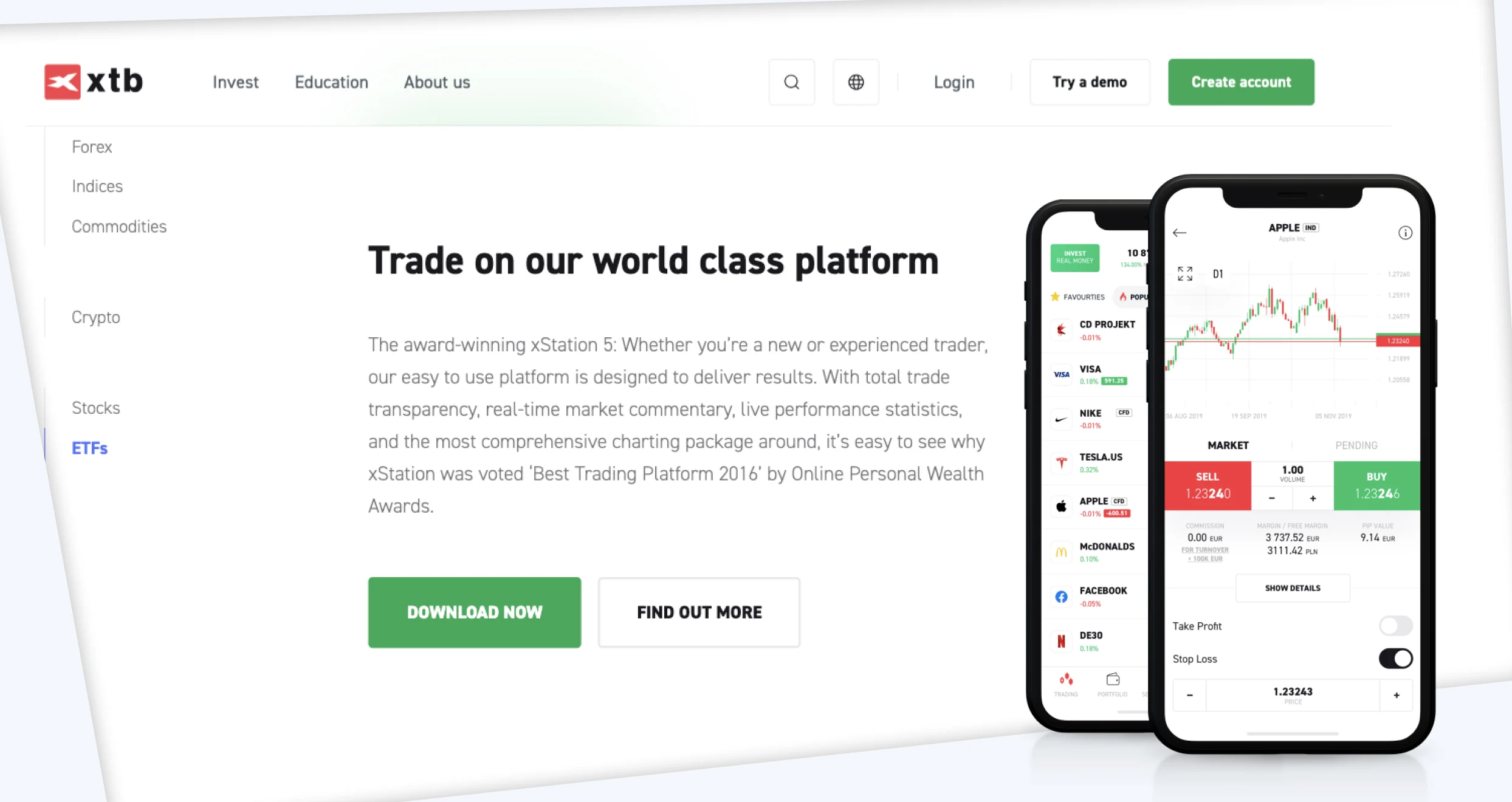

XTB is perfect for European traders who live and breathe trading charts. I’ve tried my hand with XTB’s proprietary platform, xStation 5, and it’s unparalleled. Xstation has everything from essential charting tools to pro-level technical indicators like the Ichimoku Cloud.

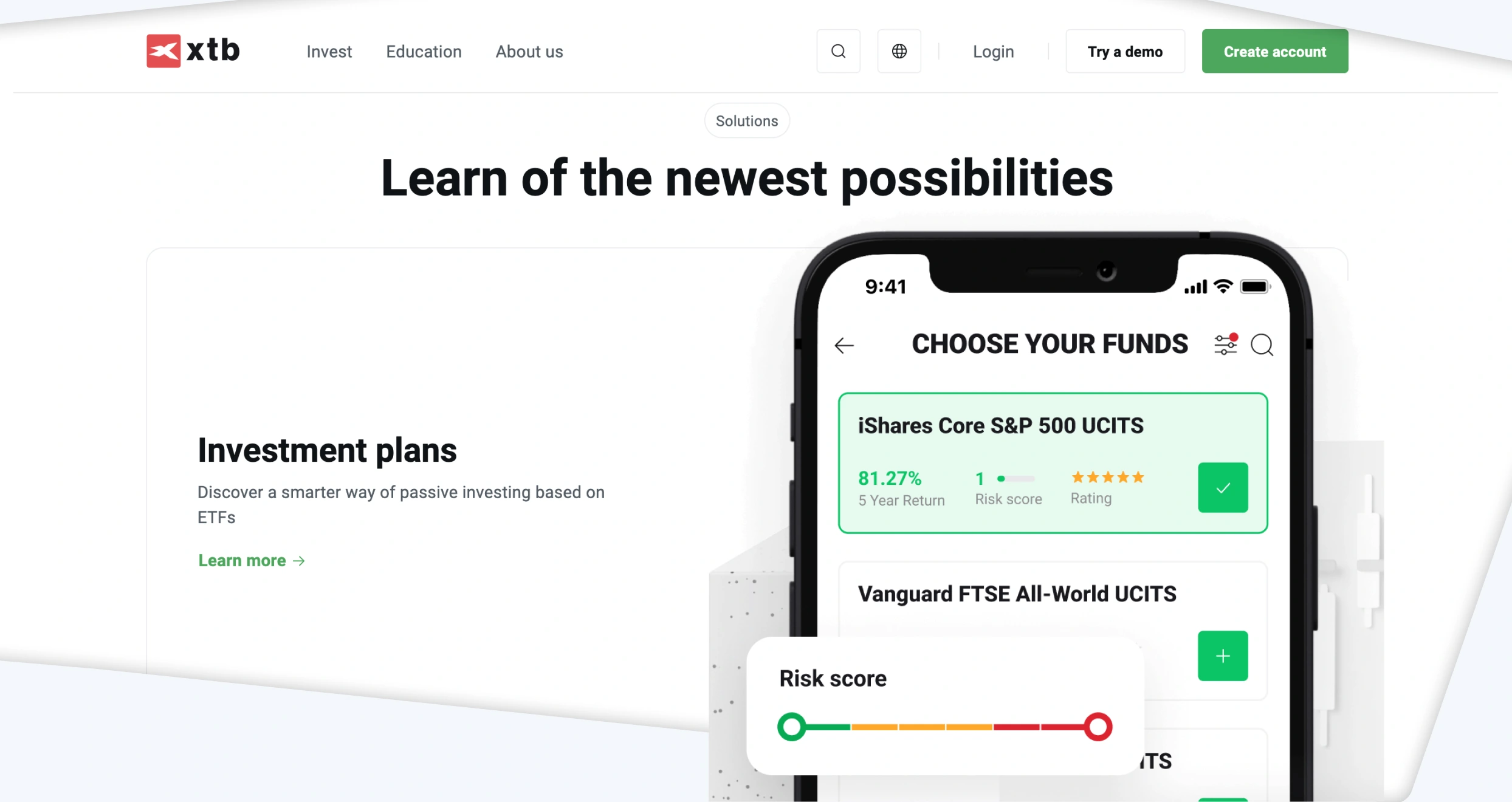

The platform also has extra tabs to broaden your view and understanding of the markets. The tabs put market sentiment, top movers, and heat maps in full view to guide your trading decisions. Besides its decked-out trading platform, XTB enjoys a good standing with the trading community as one of the pioneer forex brokers. It’s among the most highly regulated platforms and is a safe bet for beginner and advanced traders.

While trading forex with XTB, you can also invest in Europe’s most popular stocks and ETFs. They range from stocks associated with financial institutions like Banco Santander to ETF baskets such as iShares Core MSCI Europe UCITS ETF.

Lastly, XTB offers robust educational content for beginners and experts, including step-by-step guides for its proprietary platform, educational pieces, and the latest market news and insights.

Pros

- Well-equipped trading and investment platforms

- Reputable broker with decades in the industry

- Comprehensive educational center

- Investment products like stocks and ETFs available

- Low spreads and commissions, from 0.00008 pips and 0%, respectively

Cons

- Doesn’t support third-party trading platforms

- $10 monthly inactivity fee

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

6. Interactive Brokers – Best for Professional Traders

If there’s one thing I know about professional forex traders, they don’t settle for anything less than precision, speed, and complete control over their trades. And that’s where Interactive Brokers (IBKR) comes in.

IBKR is world-renowned for its cutting-edge trading platforms that offer efficiency at every level. The platform uses an agency execution model, allowing traders direct market access. The result is super fast trade executions with low latency and unmatched transparency. IBKR’s proprietary trading platform, TraderWorkStation (TWS), is also in a class of its own.

TWS contains all the advanced tools you need for professional-grade trading. I’m talking about everything from institutional grade charting to algo trading features. Beyond the advanced tools, IBKR is regulated by tier-1 regulatory authorities and approved by the London Stock Exchange (LEI: 549300GVM9BQWJXPI223).

This means you can invest as much as possible without fear of losing your hard-earned cash. The money insurance (ICS and ICBE) of up to €20,000 is also a nice touch, as it is a safety net for massive losses. With that in mind, IBKR may not be as appealing to beginner traders since the platforms seem a tad complicated and the advanced tools superfluous.

Pros

- Advanced trading tools suitable for professional traders

- Extensive industry experience with decades in the forex broking industry

- No minimum deposit requirement

- In-depth balances page for proper leverage and risk management

- Zero inactivity fees

Cons

- No third-party software support

- TWS might be too advanced for even moderately experienced traders

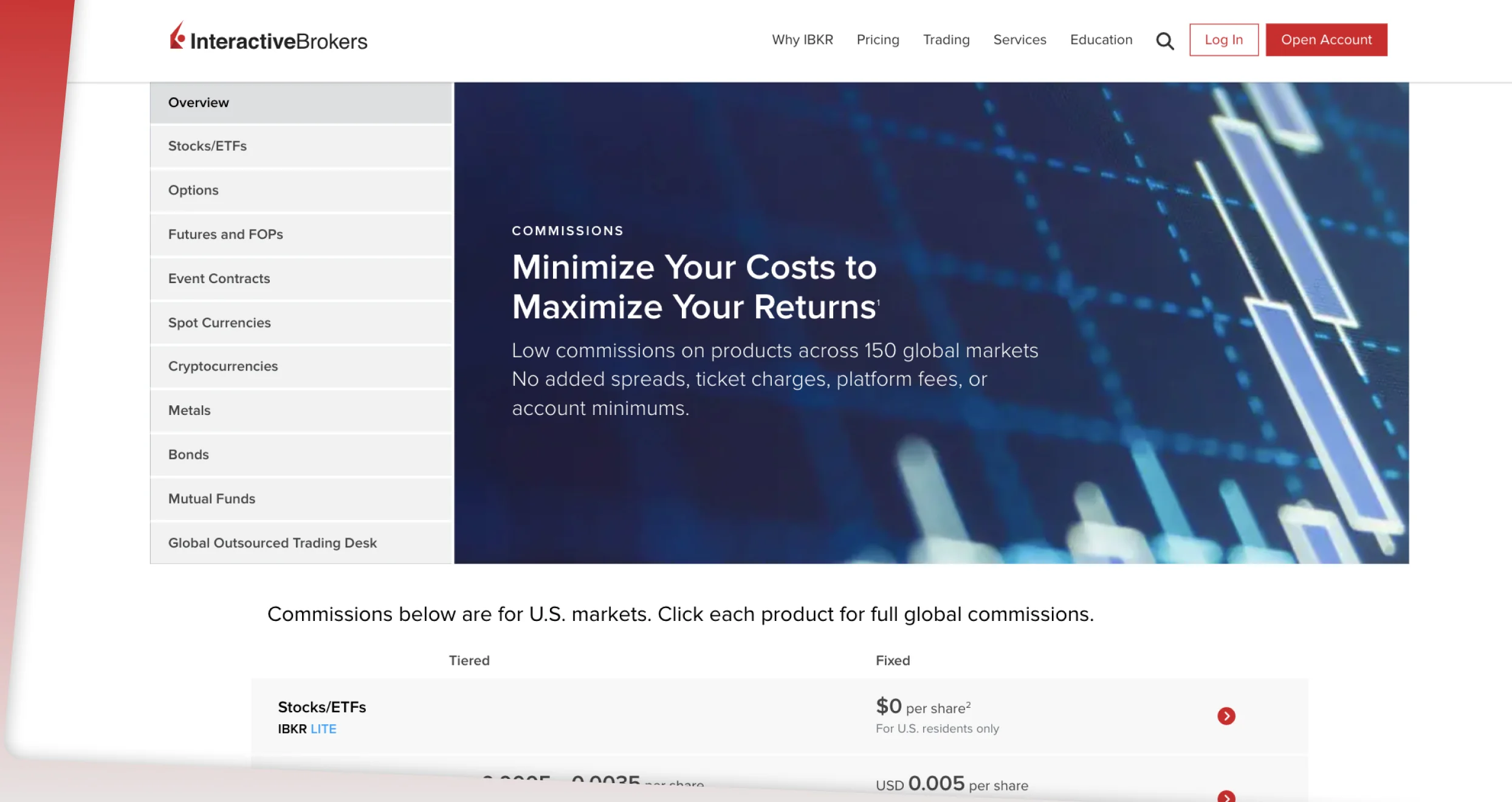

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

How to Choose a Forex Broker

Now that we have the best European forex brokers on lock, all that’s left for you to do is take your pick. I wish it could be as simple as picking the first broker on our list, but it’s not. It takes plenty of introspection and homework to find the best forex broker to help you reach your financial goals. Here’s how to choose the right forex broker and boost your trading.

Any reputable broker will fully comply with the regulations set out by top authoritative bodies. The forex market is essentially a free-for-all market, but regulations help safeguard traders from fraud, unethical practices, and market manipulation.

For instance, MiFID II, introduced in 2018, covers every aspect of the European Union’s financial industry. MiFID II is just one of the regulations, and while this is an umbrella regulation, certain regulations apply to specific jurisdictions.

As such, it’s vital to settle for a broker that complies with regulations for your jurisdiction and has all the required licenses. It’s also worth noting that regulatory bodies are tiered based on their stringency and level of oversight. Forex brokers regulated by tier-1 regulators (SEC, FCA, BaFin, etc.) maintain high standards and adhere to strict compliance measures.

Forex brokers must get their cut for facilitating the exchange of foreign currencies. This “cut” comes in the form of commissions and spreads. A commission is a percentage of the profit you make, while the spread is a tiny amount the broker adds into the buy and ask price of a currency pair. The higher the spread and commission, the lesser the profit you take home.

Always check a broker’s spread or commission before settling for the broker. Look for brokers with tight spreads and commissions. But keep in mind that these charges are subject to change and also vary from one currency pair to another. Usually, volatile currency pairs attract wider spreads to make up for the market volatility.

Trading forex is a versatile trade with multiple platforms suited for various trading styles and levels of proficiency. Naturally, you’ll want a forex broker that supports a trading platform you’re already familiar with.

Some of the most popular platforms for copy traders include MetaTrader 4, 5, and cTrader. It’s not uncommon for brokers to use proprietary software like XTB’s xStation 5 and IBKR’s IBKR Lite. Each trading platform has its pros and cons. The trick is to find a platform that matches your strategy and has features you can understand and use.

The forex market is teeming with more than 70 currency pairs. However, it’s worth noting that not all forex brokers support all currency pairs. Some don’t even support a couple of the most traded currency pairs (majors). You need a forex broker with access to as many forex markets as possible. This will allow you to try your hand at different currency pairs and make the most of your trades.

No one was born a forex wizard. In fact, it takes a great deal of practice and learning to become a proficient forex trader. The best European traders offer a wealth of educational resources to help traders refine their skills. Some of these educational materials include courses, guides, and video tutorials.

With that in mind, a demo account is the most effective educational tool a forex broker can offer. This account simulates real-world market conditions and allows traders to trade with virtual cash.

Demo lets new traders practice different trading strategies, test their skills, and familiarise themselves with the broker’s platform without risking real money. It will also help you become a confident trader, develop discipline, and refine your decision-making process before transitioning to a live trading environment.

You’re bound to encounter a few hiccups during your trading journey. The last thing you want is unavailable or non-responsive customer service. This is especially true when you have a lot of money at stake.

Find a forex broker that provides round-the-clock customer service to address issues as they occur, especially if you trade irregular hours. Just to be sure, test every company’s support quality and promptness before signing up.

How We Test

At Invezty, we take a well-rounded approach to testing forex brokers, ensuring we check all the boxes and leave no stone unturned. Our standardised testing methodology explores the core elements determining a broker’s reliability, efficiency, and overall value to traders.

We boast a comprehensive team of financial and tech experts who spend weeks researching every nook and cranny of every forex broker we isolate. The result is an accurate and unbiased review of the platforms with professional insights and fact-based evaluations. That said, it’s important to understand that trading carries considerable risk.

There’s no guarantee of profitability, even with the best broker and trading strategy. I advise you to only invest what you’re willing to lose and to avoid putting all your eggs in one basket. With adequate education and the right risk management practices, you’ll stand a better chance of making a killing with trading.

Conclusion

Forex trading is a goldmine if you pick the right forex broker and employ effective trading strategies. The above information will be your guiding light when choosing a forex broker in Europe. Remember, achieving success in this market takes time and effort. Even forex market legends like George Soros and Stanley Druckenmiller had to start from somewhere.

So, regardless of your skill level, keep your head up high and learn everything you can. You never know; you might be the next big name in the industry!

I think IG Markets should be on the list too. It's a reliable broker with a wide range of assets and a strong reputation in Europe. I’ve had a positive experience with their platform and customer support.