We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Are you an aspiring or seasoned trader in the UK? We have some good news. As a resident of the UK, you have access to numerous forex trading platforms, such as eToro, AvaTrade, and FxPro. These are the best of the best, and we’ve reviewed them in our guide.

Before preparing this guide, we weeded through countless UK forex brokers. Our main goal was to isolate 6 platforms with all the right qualities, including tip-top security, reliable performance, and an untainted reputation. After many hours of skimming shoddy service providers and sifting through innumerable user testimonials, our team isolated the best of the best.

In a Nutshell

- As a forex trader, your success hinges on the broker you choose. Hundreds of service providers may be available in the UK, but not all deserve your time or money.

- While choosing a reliable and trustworthy UK forex broker, you must consider factors like licensing, security, fees, and online reputation.

- Our experts used the aforementioned factors to gauge the service providers available in the UK. After extensive tests and evaluation, we picked 6 of the most outstanding brokers.

- Before engaging with any of the brokers mentioned here, remember that financial losses are common in forex trading. Risk what you can afford to lose.

- This guide offers unbiased information and opinions from experts. We always aim to provide educative, informative, and factual content.

List of the Best Forex Brokers

- Pepperstone – Best For MT4 Users

- eToro – Overall Best Forex Trading Platform UK

- AvaTrade – Best Forex Broker for Beginners

- Plus500* – Leading Broker for Trading CFDs on FX Pairs

- Spreadex – Best UK Forex Broker for Financial Spread Betting

- FxPro – Best Forex Broker for Mobile Trading

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Compare Forex Trading Platforms

We are dedicated to providing you with the best guidance. Since we’ve been trading actively for many years, we know that the trading platform you use can either make you or break you. Our experts are here to prevent the latter from happening. That is why we spend a massive chunk of our time handpicking and comparing UK forex brokers, as well as meticulously reading through countless user reviews.

After extensive comparisons and reviews, we selected 6 of the best forex trading platforms in the UK based on different sets of determiners. The elements we considered included licensing, customer support, trading platforms, and demo accounts. We’ve summarised them below.

| Best Forex Broker UK | Licence & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| eToro | FCA, CySEC, FSCA, ASIC, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| AvaTrade | FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Plus500* 82% of retail investor accounts lose money when trading CFDs with this provider. | FSCA, CySEC (#250/14), FCA, ASIC, FMA, MAS | 24/7 | Plus500 Invest, Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| Spreadex | FCA | 24/5 | Online platform, Mobile trading, Charting package, TradingView | Credit/debit cards, Apple Pay, Bank transfer | No |

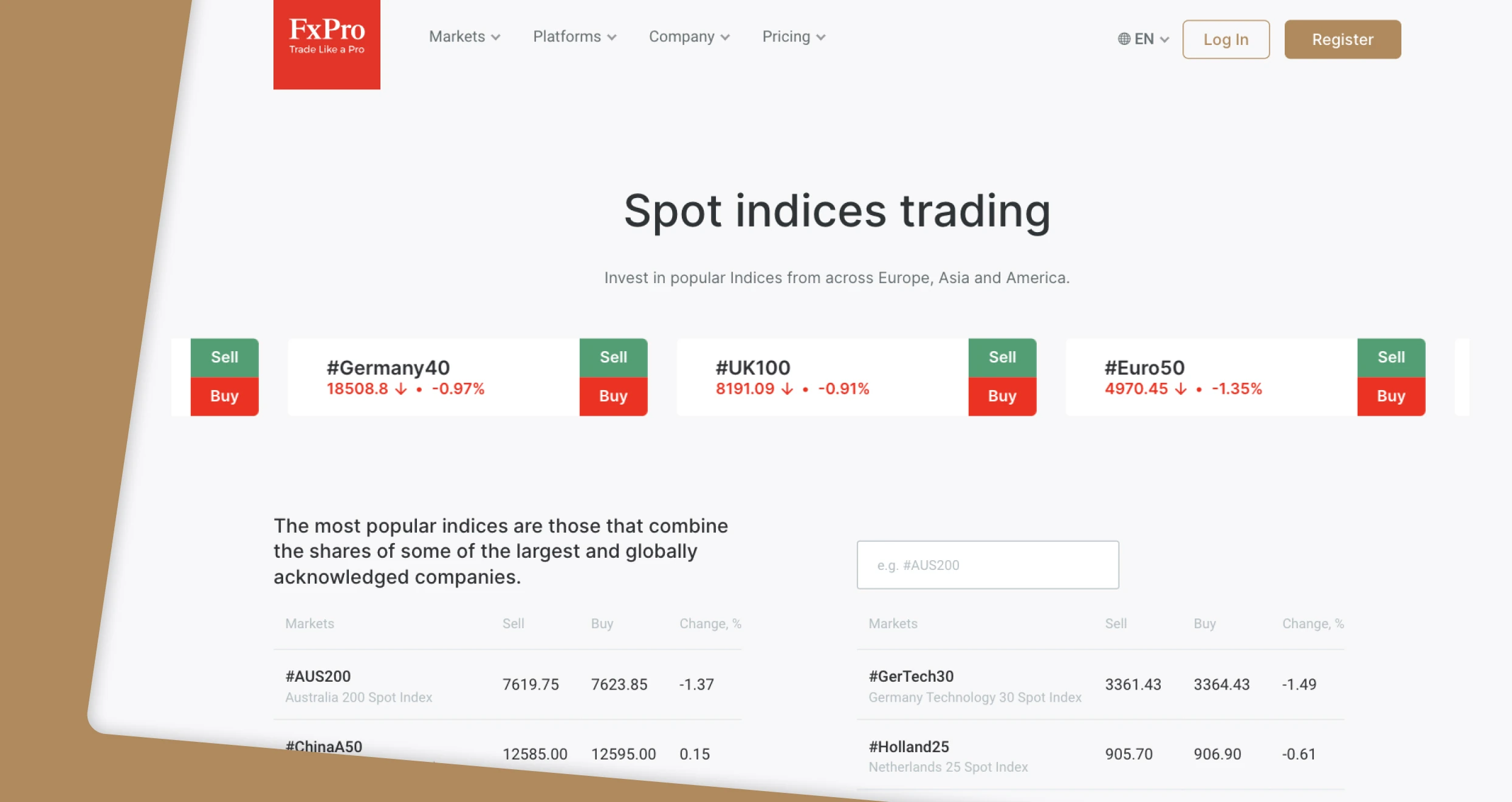

| FxPro | FCA, CySEC, FSCA, SCB | 24/7 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes |

Brokers Overview

Our experts also selected the best forex brokers in the UK based on their fees and product offerings. We couldn’t leave these elements out. After all, trading with an affordable broker is essential for maximizing returns, right? Plus, you can only have the best trading experience with a forex broker that offers all the financial instruments you need to excel. Considering the above, we’ve compared the fees and assets associated with the best UK forex brokers in the tables below.

Fees

| Best Forex Broker UK | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | £0 | From 0.0 pips | Free | £0 |

| eToro | £100 | From 0% | £5 withdrawal fee | £10 monthly |

| AvaTrade | £100 | From 0.13 pips | Free | £50 after every 3 consecutive months of inactivity |

| Plus500* | £100 | From 0% | Free | $10 monthly after three months of inactivity |

| Spreadex | £0 | From 0.6 points | Free | £0 |

| FxPro | £100 | £3.50 per lot | Free | £0 |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Assets

| Best Forex Brokers UK | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Our Opinion about Best Forex Brokers

The service providers that we consider the best forex brokers in the UK possess multiple admirable qualities. All are FCA-licensed, but many are also regulated by numerous international governing bodies, including ASIC and CySEC.

However, they all have additional unique perks and quirks that make them suitable for different categories of traders and trading activities. For instance, AvaTrade has outstanding educational material, making it ideal for beginners. On the other hand, FxPro boasts feature-rich dedicated apps, which makes this UK forex broker best suited for mobile trading.

Let’s review the best forex trading platforms in the UK in deeper detail.

1. Pepperstone – Best For MT4 Users

Pepperstone is an award-winning forex broker we primarily recommend to MT4 users. Based on our experience, it has a user-friendly and modern design platform compatible with desktop and mobile devices. We like that its MT4 platform supports quality resources for forex trading, thus maximising its clients’ experience. For instance, there is a wide range of technical analysis tools, currency trading software, social trading, and algorithmic trading software. The best part is that accessing the MT4 platform requires no minimum deposit requirement. All you have to do is download it on your desktop and mobile device to start enjoying its features.

Besides MT4, Pepperstone gives users access to MT5, cTrader, and TradingView platforms. We discovered over 90 currency pairs, which you can trade with spreads starting from 0.0 pips. Moreover, the broker hosts additional instruments for portfolio diversification. They include shares, commodities, ETFs, indices, and more. You can test this forex broker via its £50,000 virtually funded demo account before making a commitment.

Pros

- Its MT4 platform hosts quality resources for an exciting experience

- No minimum deposit requirement for UK clients

- Lists over 90 currency pairs

- Lists multiple classes for portfolio diversification

Cons

- The MT4 platform does not support advanced stop-loss and take-profit limits

- Only CFD and spread betting are supported. No buying and taking ownership of the listed assets

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – Overall Best Forex Trading Platform UK

In our opinion, eToro is the best forex trading platform in the UK. And the 30 million+ people who use this platform will agree with us. eToro is nothing short of exceptional. When it comes to forex, this broker has everything that you need, from majors like EUR/USD, AUD/USD, and CAD/USD to cross pairs like EUR/GBP, GBP/CAD, and AUD/CAD. You can go long or short on these currencies and earn juicy returns.

eToro isn’t just a hub for forex currencies; it also offers other tradable instruments, including ETFs, commodities, and indices. But here’s what sets eToro apart: this platform allows users to invest in cryptocurrencies and real company stocks. In other words, as an eToro client, you can buy shares from renowned organizations like Meta or acquire and hold crypto for long-term benefits.

Pros

- 55+ forex currency pairs

- A wide variety of other instruments, including real stocks and cryptos

- 0% commission for ETF trades and real stocks

- Fantastic customer support available 24/5

- It comes with an insurance policy of up to £1 million

Cons

- It doesn’t support popular trading platforms like MT4 and MT5

- Inactive eToro accounts attract a £10 monthly fee

- Charges £5 for every withdrawal request

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. AvaTrade – Best Forex Broker for Beginners

We’ve been in the industry for many years but have yet to encounter a trading platform better suited to beginners than AvaTrade. This broker is dedicated to providing new traders with all the tools and resources they need to advance to the next level. If you’re a novice trader, visit the AvaTrade Education Center for UK traders and explore the available materials.

AvaTrade’s educational centre has a wide array of basic and advanced guides and tutorials. You’ll find simple articles that introduce readers to fundamental concepts like the essentials of trading signals and spread betting. However, this platform is also home to advanced resources that professional traders who value ongoing education can use.

Education aside, AvaTrade gives its users uncapped access to CFDs on forex pairs and other instruments, including cryptos, commodities, and stocks. Additionally, this broker supports popular trading platforms like MT4 and MT5.

Pros

- Top-quality guides and tutorials

- Supports unlimited demo account

- A broad range of tradable assets

- Beginner-friendly interface

- Advanced platforms like MT4 and MT5

- Supportive customer representatives available 24/5

Cons

- Dormant accounts incur high inactivity fees

- Limited product offerings

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

4. Plus500 – Leading Broker for Trading CFDs on FX Pairs

If you are interested in trading CFDs on forex markets, we highly recommend Plus500. This broker gives users uncapped access to 60+ tradable currencies. They range from major pairs like EUR/USD and GBP/USD to minors and exotic currency pairs, including GBP/SEK. While trading FX pairs with this broker, you can leverage up to 1:30 and limit your risk exposure with top-tier tools like Guaranteed Stop Loss.

What’s more, Plus500 allows you to diversify your portfolio with many other instruments. You can trade commodity CFDs, stock CFDs, index CFDs, etc. Also, if you are a seasoned pro, you can open a Professional Account with Plus500 and enjoy numerous outstanding perks, including cash rebates, client money protection, and uncapped access to FOS.

Note: 82% of retail investor accounts lose money when trading CFDs with this provider.

Pros

- Supports 2,800+ CFDs across diverse assets

- Offers special accounts with unique features to professional traders

- Responsive support representatives available 24/7

- Spreads as low as 0.0 pips

- Free deposits and withdrawals

Cons

- Dormant Plus500 accounts attract a $10 inactivity fee after 3 months

- No advanced third-party platforms like MT4 and MT5

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

5. Spreadex – Best UK Forex Broker for Financial Spread Betting

Founded in 1999, Spreadex is a popular forex broker headquartered in St Albans, England. We consider it the best platform for financial spread betting for several reasons. First, it offers you the golden opportunity to speculate on diverse FX pairs and profit from rising and falling prices. Also, this broker offers low spreads starting from 0.6 pts on popular pairs like EUR/USD.

Although spread betting is Spreadex’s forte, it isn’t the only activity that this broker supports. Spreadex also allows users to trade CFDs on a broad range of instruments, including shares, commodities, and indices. As one of its customers, you also get access to different trading platforms, including TradingView and a mobile trading app.

Pros

- Offers 0% commissions to spread bettors

- No minimum deposit requirement

- Knowledgeable customer support available 24/5

- Zero deposit and inactivity fees

- World-class risk management tools, including Guaranteed Stop

Cons

- The site’s interface looks clunky and outdated

- Limited range of product offerings

From our assessment of Spreadex’s fees, we concluded that this broker offers one of the most cost-friendly platforms. Why? For starters, Spreadex has $0 minimum deposit requirements. That means you can deposit whatever you can afford and start trading immediately. Moreover, while funding your account, you won’t have to pay any deposit fees – it’s free! The same applies to withdrawals.

That is exceptional news since Spreadex supports myriad payment methods, from debit and credit cards to Apple Pay and Easy Bank Transfer. You can use these options without fretting over any charges undermining your profits.

We also recommend Spreadex because this broker doesn’t penalize dormant accounts. Your Spreadex trading account can remain inactive for an extended period without attracting inactivity fees, which separates this company from its peers.

Spreadex offers exceptional rates on spreads. This broker’s spreads start from 0.6 pips for CFD trading. This trading broker should be your go-to if you want lower overall trading costs and improved profit margins.

That said, Spreadex charges overnight funding for shares rolling positions. If you keep a position open through the close of the relevant exchange, Spreadex will keep it open for the following day’s trading. But that will attract a funding adjustment. The fees you’ll incur at any given time will be a combination of the Adjusted ARR and Spreadex’s charges. However, holding futures overnight won’t attract any charges.

6. FxPro – Best Forex Broker for Mobile Trading

FxPro is an excellent broker that offers a modern trading platform. We were impressed by the site’s stylish look and alluring aesthetics from the get-go. Our appreciation for this platform grew even more after trying out their mobile version. FxPro allows its customers to trade on the go with a fantastic dedicated app.

The FxPro mobile app allows you to trade different instruments on the go, including forex pairs, indices, shares, and metals. This platform offers numerous attractive features, from advanced full-screen charting and hundreds of indicators to 2FA and fingerprint verification for optimising the security of your assets. You can use FxPro to trade with MT4, MT5, and other popular software.

Pros

- User-friendly app with advanced tools and features

- Free, instant deposits and withdrawals

- A reasonable collection of tradable instruments

- Dormant accounts attract zero inactivity fees

- Simple account registration process

- Customer support team is available 24/7

Cons

- Primarily supports CFDs

- High commission compared to some of its peers

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Forex Trading in the UK

Forex trading is popular in the UK, with hundreds of thousands of Britons engaging in the market. Sadly, this activity is risky, and around 76% of retail traders lose money in the long run. But that shouldn’t put you off. On the contrary, it should encourage you to educate yourself, practice consistently, and practice proper risk management.

And remember that forex trading is supervised by the Financial Conduct Authority (FCA) in the UK. This reputable governing body’s primary responsibility is to ensure financial markets and brokers operate fairly and efficiently. For the best outcomes, trade with FCA-licensed platforms exclusively. Additionally, use the tips we’ve discussed below to distinguish reliable trading brokers from less reputable entities.

How to Choose the Right Forex Trading Platform UK

Britons have access to hundreds of forex trading platforms, making it challenging to choose the best broker. However, don’t take the shortcut of signing up with the first brand you find. Doing so could expose you to fraud, identity theft, transaction delays, and numerous other issues.

You should pick your brokers carefully and vet every platform based on the following factors:

Trading with a secure platform is the surest way to guarantee the safety of your data and assets. Security goes hand in hand with regulation. Therefore, look for a broker licensed by the FCA and other authoritative bodies. Also, check if the platform optimizes security with solutions like SSL protocols and Firewalls.

We urge you to read online reviews before signing up with a particular broker. You can find countless testimonials on platforms like TrustPilot, Google Play, and the App Store. Avoid the involved broker if the reviews point out too many recurrent issues. You can also seek the opinions of fellow traders from community forums.

Look for a broker with affordable fees and commissions. Affordability in this context depends on your budget and trading goals. Avoid platforms with exorbitant charges since they will erode your profit margins and might lead to significant losses in extreme cases.

Which platform do you prefer trading with? Ensure your chosen broker supports it. And remember that some service providers only offer proprietary software while others also support third-party platforms. Go through the available options to avoid disappointment in the future.

Brokers have different product offerings. Some are CFD-centric, while others allow unique options like investing in real shares. While choosing an ideal trading platform, factor in your preferred instruments and assets. Prioritise service providers who offer what you need the most and a reasonable number of additional options for portfolio diversification.

Issues like delayed transactions and sign-in errors are common in forex trading. Most importantly, they demand timely resolution. Any unnecessary delays can interfere with your trading activities and might even lead to significant losses. With that in mind, you should limit your trading endeavours to brokers with exceptional customer support.

How To Register an Account with a Forex Broker

We, too, were beginners at some point, and registering a new account seemed like a herculean task to us. But back then, things were murky, and signing up with most brokers was an arduous process. Fortunately, the best brokers have made everything seamless now. Today, you can apply for a new account and start trading quickly. Below, we’ve summarised the standard registration process for the best forex broker in the UK.

At this point, you have selected a specific broker, right? Visit the company’s official website. To be safer, double-check if everything you need is available, including the necessary instruments and software. If you like everything you see, hit the registration button.

FCA-regulated forex brokers have KYC protocols. Therefore, they must ask for personal information, from your legal name and email address to your gender and phone number. Some providers may also ask questions tailored to assess your employment and financial situation. Answer everything truthfully to avoid complications like future account termination.

Brokers need verification documents to counter-check if the information you’ve provided is valid. So don’t be surprised when your service provider asks you to share copies of documents like your driver’s license or government-issued ID alongside a utility bill or bank statement.

Brokers take anywhere from a few minutes to several hours to check new applications, so be patient. Once your account is approved, fund it with a supported payment method and adhere to minimum deposit requirements. Ensure you choose the most convenient payment method for quick and seamless transactions.

The platforms we’ve recommended here support quick transactions. Your deposit request should be processed almost instantly. When your account is ready, choose an instrument, size your position, and start trading. If the trading platform has risk management tools, use them to mitigate losses. Most importantly, if you are a newbie, open a demo account and practice with it before putting your resources on the line.

Conclusion

There you go, a list of the forex trading platforms in the UK. We’ve done the legwork for you, so you don’t have to sift through hundreds of brokers while searching for a good service provider. But your work isn’t done. It’s now your turn to assess any platform that seems ideal. Research it further and review its testimonials; you may be surprised.

Most importantly, if you are a novice, invest in your education and enhance your skills before interacting with any of the best UK forex brokers.

Great overview! If you're looking for more options, I’d also suggest checking out IG Group for its powerful platform and research tools, and XTB, which offers excellent educational resources

I started trading forex with AvaTrade, and as a beginner, their guides and simple layout really helped me feel more confident