Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Your chosen broker will determine how successful you become while trading stocks. If you trade with an unreliable service provider, you’ll have a lousy experience and might fall prey to crippling issues like loss of funds. But if you sign up with an outstanding brand, you’ll get uncapped access to the best trading platforms, low fees, excellent support, and many other perks.

We are here to help you find the best Singapore stock broker and take your experience to the next level. Our team has vetted countless service providers and cherry-picked 6 that deserve your attention. Note that we’ve thoroughly analyzed and assessed the recommended brands based on factors like regulatory status, reputation, fees, and assets.

In a Nutshell

- Stock trading is 100% legal in Singapore, and many Singaporeans are reaping juicy returns from this venture.

- To enjoy a profitable experience, you must trade with the best Singapore stock broker.

- The best stock brokers are regulated by MAS in Singapore. To avoid losing your money, don’t interact with unregulated service providers.

- Also, when choosing the best stock broker, consider factors like fees, assets, and customer support service.

- Our team researched and evaluated the stock brokers available in Singapore. We’ve recommended the top 6 in our guide.

- This guide is unbiased and tailored to inform you. That is why we evaluated every service provided thoroughly and also factored in reviews on Google Play, the App Store, and Trustpilot.

List of the Best Stock Brokers in Singapore

- Pepperstone – Top Option For Social Trading

- Interactive Brokers – Overall Best Stock Broker in Singapore

- eToro – Best Singapore Stock Broker for Beginners

- Saxo – Best Singapore Stock Broker for Advanced Traders

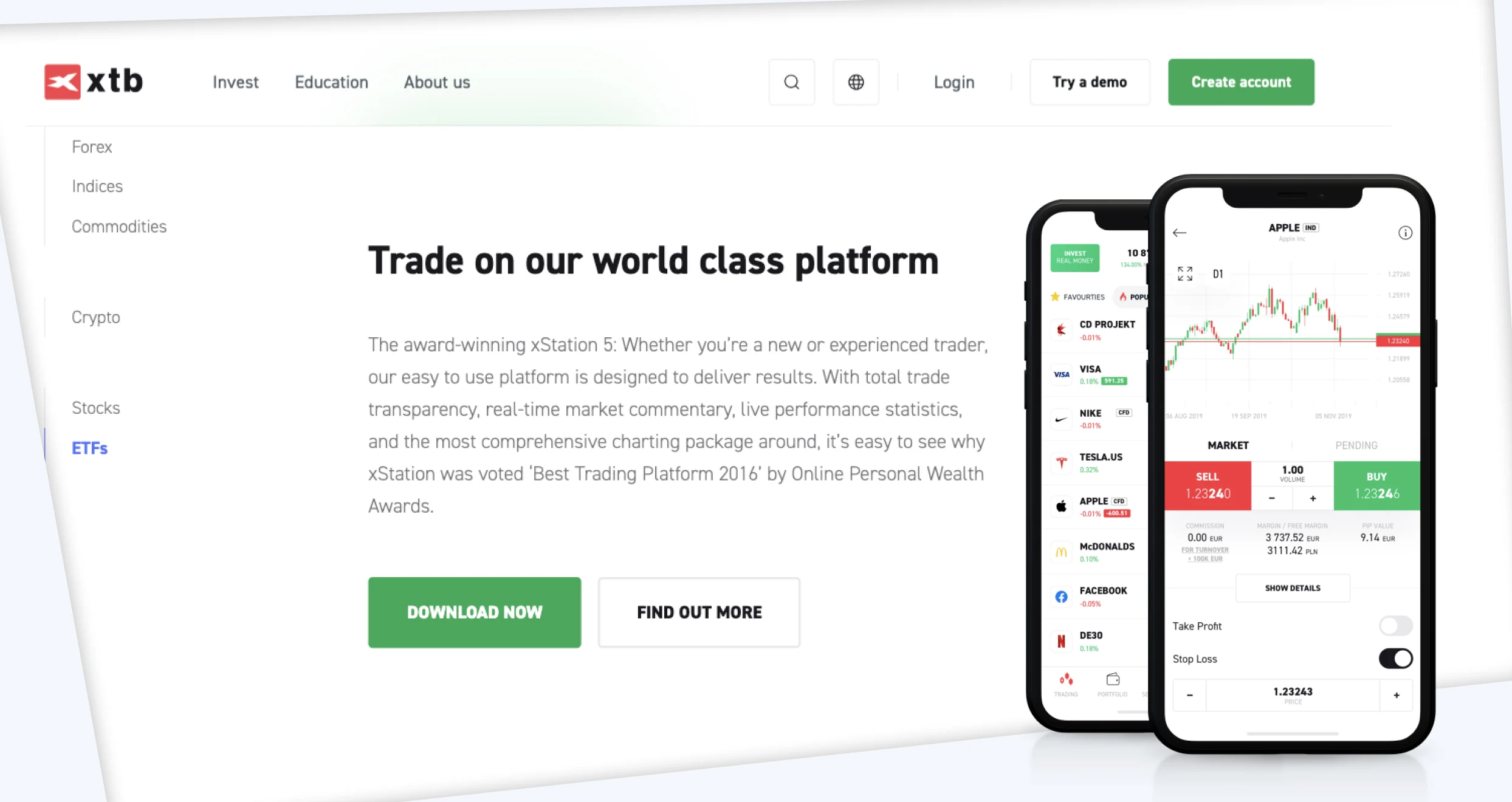

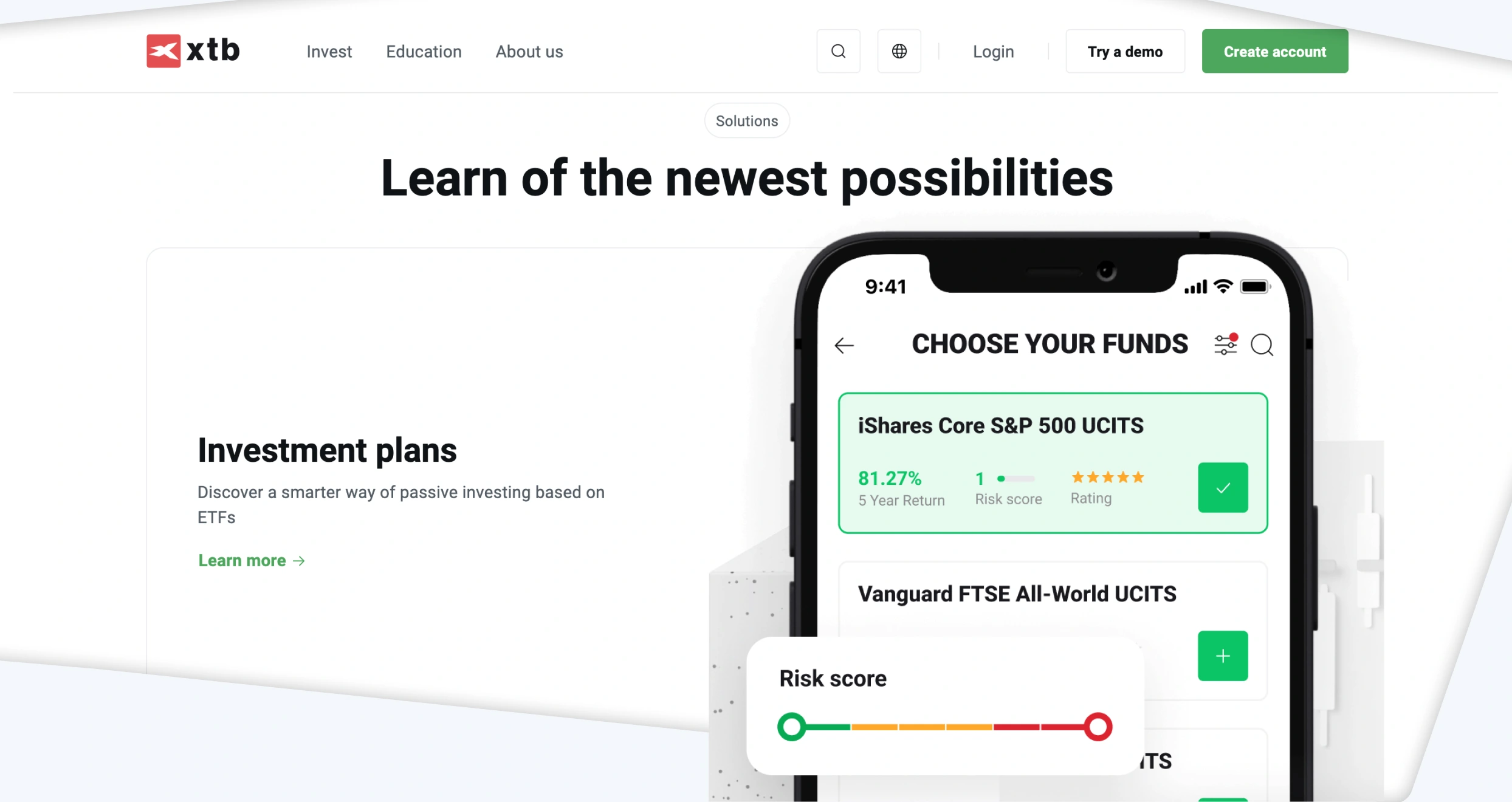

- XTB – Best Stock Broker for Cost-Conscious Investors in Singapore

- OANDA – Best Stock Broker for Forex Traders

Compare Stock Trading Platforms in Singapore

Singaporeans have access to a broad selection of stock brokers, both good and bad. There are many lousy service providers out there. Avoiding them is mandatory since they expose you to countless issues, from high fees and poor customer service to frequent downtime and, in extreme cases, fraud and scams. Luckily, we’ve introduced you to 6 service providers you can sign up with and avoid such problems.

| Best Singapore Stock Broker | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | MAS, FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes |

| Interactive Brokers | MAS, SEC, FINRA, CFTC, ASIC, ICS, FCA, CIRO, CBI, HKSFC | 24/5 | IBKR Desktop, Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader, Client Portal, IBKR APIs | Bank transfer, Wise transfers | Yes |

| eToro | MAS, FCA, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| Saxo | MAS, FCA, FSA, FINMA, JFSA, SFC, ASIC, AFM, FSMA | 24/5 | SaxoTraderGo, SaxoTraderPRO | Bank/wire transfer, debit card | Yes |

| XTB | MAS, MiFID, FSCA, ASIC, CySEC, FSA, FCA | 24/5 | xStation 5, xStation Mobile | Neteller, Credit/debit cards, Bank transfer, Skrill, PayPal | Yes |

| OANDA | MAS, FCA, CFTC, PFSA, IIROC, ASIC, FSA, FSC BVI | 24/5 | OANDA Mobile, OANDA Web, MetaTrader 4, TradingView | Credit/debit cards, Bank transfer, Wire transfer, Skrill, Neteller | Yes |

That said, we strongly advise you to pick one trading platform from the ones we’ve recommended and stick with it. Trading with multiple brokers is often hectic and confusing. While juggling different platforms, you’ll have a hard time keeping track of your login credentials, open positions, account balances, etc.

While choosing the best broker to trade with, you should compare the recommended service providers using specific factors. For starters, consider licensing, customer support, and provided trading platforms. Also, check the supported payment methods and the availability of demo accounts. The table below will help you compare our recommended brands and isolate the best stock trading platform in Singapore based on the aforementioned factors.

Brokers Overview

You should also consider fees and assets when evaluating service providers and choosing the best stockbroker in Singapore. That is crucial since increased costs negatively impact potential returns. On the other hand, you need to trade with a platform that supports a broad range of assets to get access to more profitable trading opportunities and reduce risk exposure through portfolio diversification.

Use the tables below to compare the fees and assets associated with our recommended service providers and identify the best broker for you.

Fees

| Best Singapore Stock Broker | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | None | $0 |

| Interactive Brokers | $0 | From $0 commissions | From $1 withdrawal fee | $0 |

| eToro | $50 | From 0% | $5 withdrawal fee | $10 monthly |

| Saxo | $0 | From 0.03% | $0 | $0 |

| XTB | $0 | From 0% | Free | $10 monthly |

| OANDA | $0 | From $0 | $20 withdrawal fee | $10 monthly |

Assets

| Best Singapore Stock Broker | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | No | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Opinion about the Best Stock Brokers in Singapore

After researching, evaluating, and testing the best stockbrokers in Singapore, we’ve compiled the mini-reviews below. Please note that everything we are about to mention comes from first-hand experience and hours of intensive research. We’ve also factored in reviews on numerous reputable platforms, including Google Play, the App Store, and Trustpilot.

Before diving in, we couldn’t cover everything concerning the recommended brokers in a single guide. Our experts have only touched on the most noteworthy aspects. We encourage you to go the extra mile and do additional research before signing up with any trading platform.

1. Pepperstone – Top Option For Social Trading

Singapore stock traders looking for a reliable broker with social trading features should consider Pepperstone. Based on our experience, this award-winning broker allows users to interact with other global traders on its chat platform. And the best part is that social trading is supported on multiple platforms, including MT4, MT5, cTrader, and TradingView. We also like that social trading is free, and accessing this feature and more requires no minimum deposit requirement. You are free to start trading with any amount you can afford.

Stock trading at Pepperstone exposed us to popular equities listed across the UK, the US, Germany, Australia, and Hong Kong. In addition, Pepperstone hosts other asset classes, such as forex, commodities, and more, which we believe will be helpful in portfolio diversification. If you are a beginner, rest assured that Pepperstone has plenty of quality learning materials. On top of that, a demo account is provided to gauge your skill level before making a commitment with real funds.

Pros

- Lists multiple resources for market analysis and skills development

- No minimum deposit requirement

- Free deposit and withdrawals

- Social trading is supported across multiple platforms

Cons

- Limited asset offerings compared to its peers

- You get to trade the assets as CFDs only

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. Interactive Brokers – Overall Best Stock Broker in Singapore

Our overall best stock broker, Interactive Brokers (IBKR), caters to millions of traders and investors. It gives users the opportunity to trade stocks on over 90 market centers and enjoy low commissions starting from $0. Plus, stock traders and investors can enjoy zero additional spreads, account minimums, and ticket charges while trading with IBKR.

Interactive Brokers is also at the top of our list since its users have ample opportunity to diversify their portfolios. The trading platform offers many other financial products besides stocks, ranging from ETFs and currencies to crypto and precious metals. Most of the available assets have tight spreads and commissions, making them ideal for cost reduction and maximizing potential returns.

Moreover, IBKR is ideal for both low-budget and high-budget traders since it has no minimum deposit requirement. With this trading platform, you can start with whatever you can afford. Moreover, the broker offers cost-free deposit and zero account inactivity fees.

Not to forget, IBKR has given special priority to beginners. The broker has a campus and an academy stocked with materials and resources tailored for newbies who need to learn the basics before diving in. Numerous advanced materials for seasoned pros are also available.

Pros

- A vast assortment of financial instruments

- Low commissions starting from $0

- No minimum deposit requirement

- Top-notch educational resources

- Powerful proprietary trading platforms

- Zero account inactivity fees

Cons

- Some funding methods have high withdrawal fees, including bank transfer

- Offers proprietary trading platforms exclusively

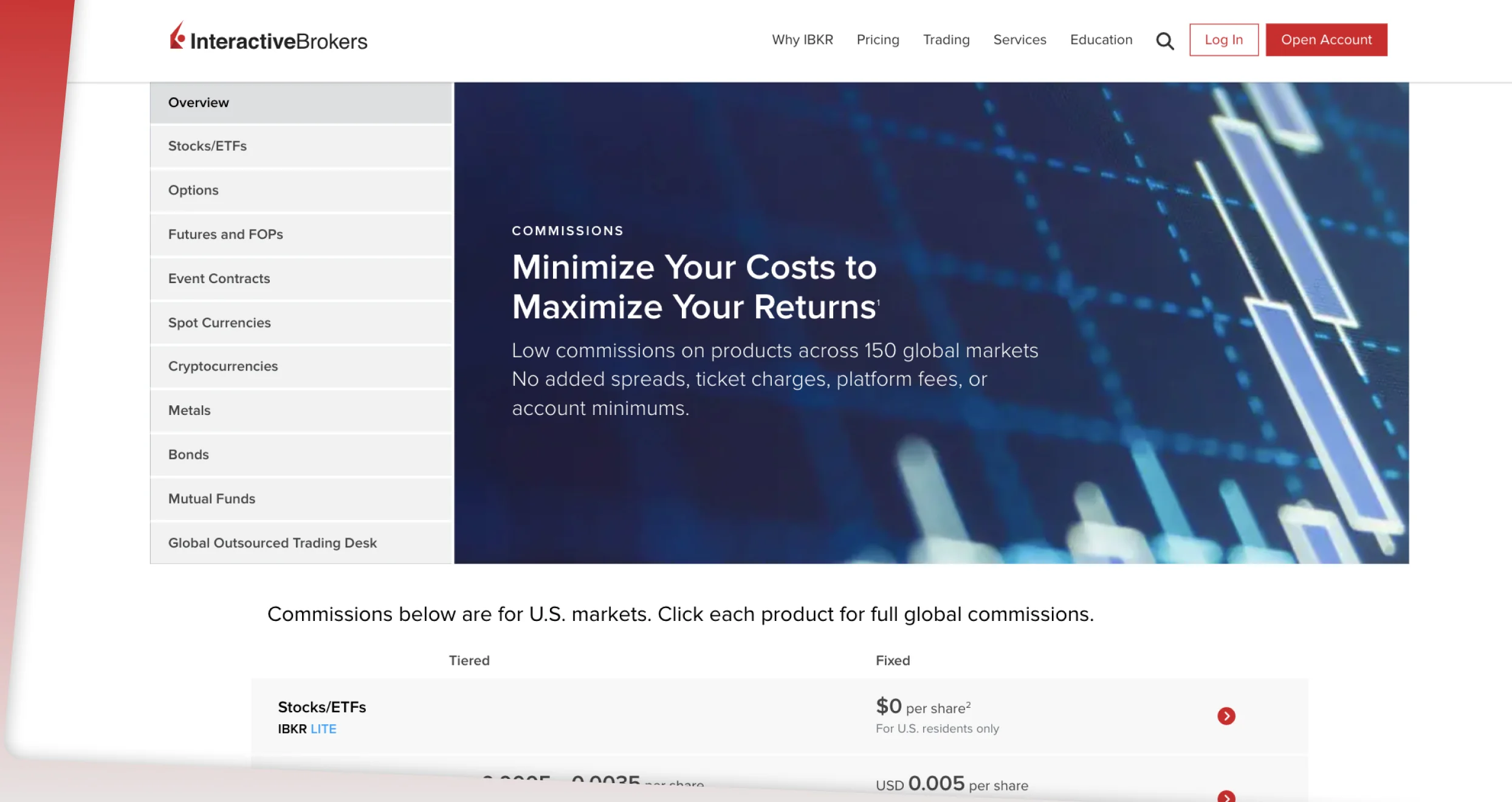

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

3. eToro – Best Singapore Stock Broker for Beginners

eToro has a simple, user-friendly interface that makes it the perfect platform for beginners. It’s superbly organized and very easy to navigate. What’s more, it offers users access to over 6,000 assets. Today, you can trade CFDs on popular stocks on this platform. You can also diversify your trading portfolio with other tradable instruments, including currencies, indices, and commodities.

We also consider eToro to be an exceptional broker since its users have access to diverse investment products. For starters, with an eToro account, you can invest in stocks and receive juicy dividends. Some real stocks offered on eToro range from Meta and Lyft to Apple and Disney. The best part is that eToro has no commissions for stock trades.

Besides stocks, eToro users can invest in different crypto assets, including Bitcoin, Litecoin, and Ripple. Plus, the broker offers a digital wallet where investors can keep their crypto safe and an exchange for crypto trading enthusiasts. Furthermore, eToro users can diversify their investment portfolios with popular ETFs like VOO, SPY, and GLD.

We can’t sign off without discussing education. eToro has a top-notch academy that beginners can use to advance their knowledge and skills. The eToro Academy has hundreds of free courses, webinars, podcasts, and many other learning materials. It’s the best place for a newbie to start before trading live.

Pros

- Offers a fully-stocked academy with hundreds of learning materials

- Well-organized, beginner-friendly user interface

- Over 6,000 financial products are available

- Free deposits and withdrawals

- Reasonable minimum deposit requirements

- Low stock trading commissions

Cons

- Every withdrawal request incurs a $5 fee

- $10 monthly account inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

4. Saxo – Best Singapore Stock Broker for Advanced Traders

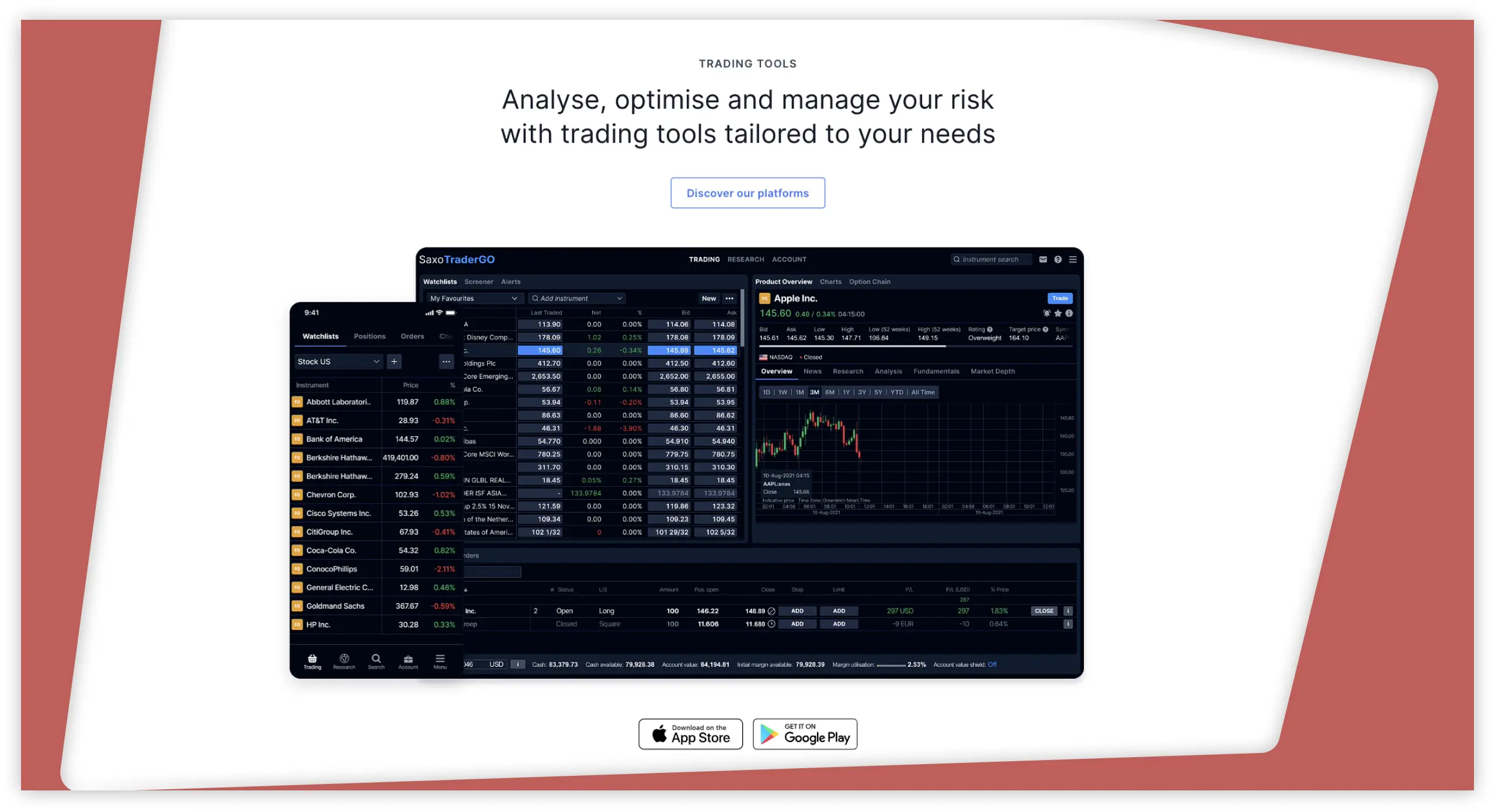

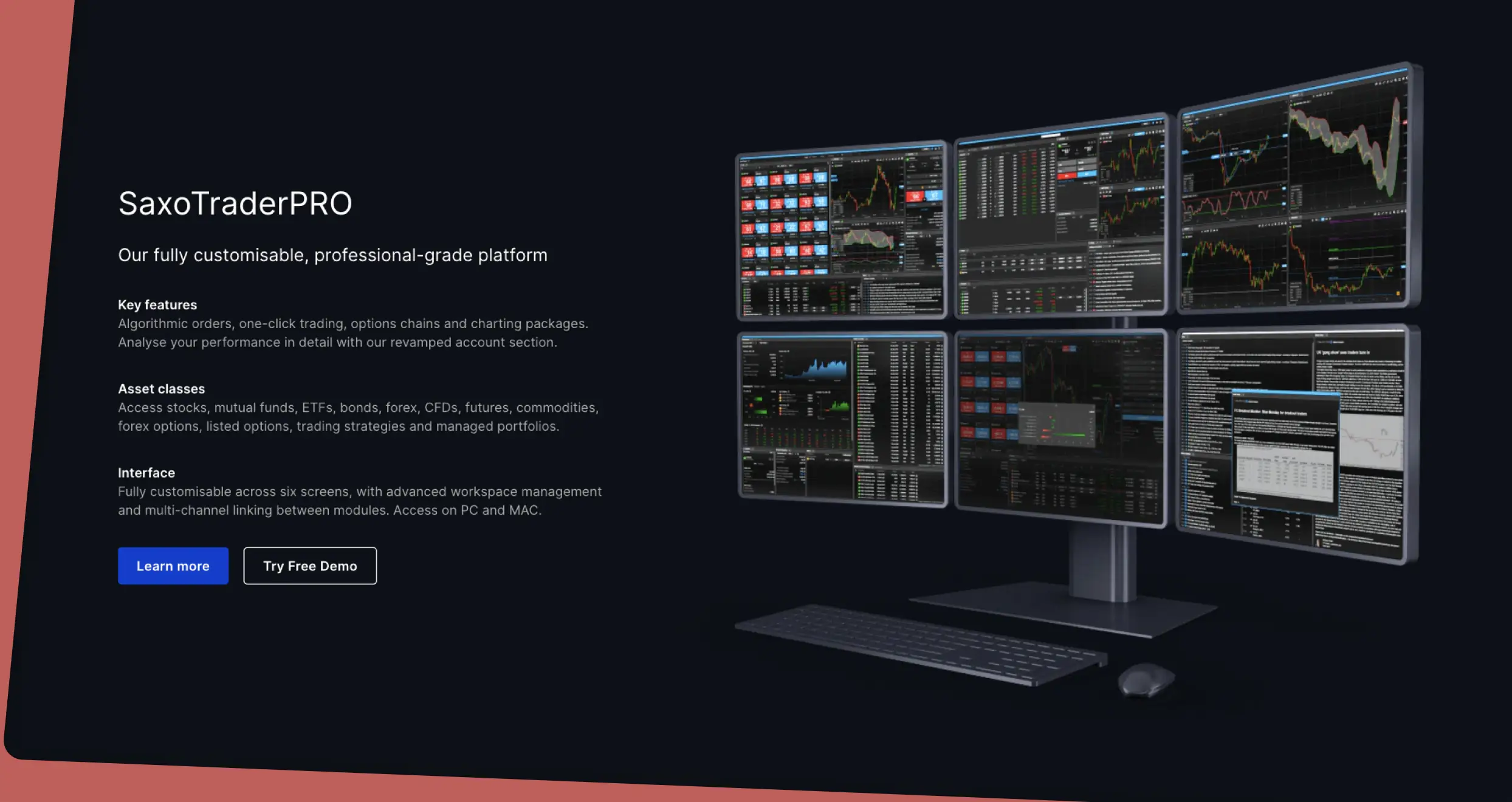

After vetting multiple stock brokers, we’ve ranked Saxo as the best for advanced traders for several reasons. First, it offers numerous outstanding platforms to its users. We were especially impressed by SaxoTraderPro, which is tailored for professional traders. It’s fully customizable and equipped with premier trading features, including high-performance charting tools, algorithmic orders, and advanced trade tickets.

Moreover, SaxoTraderPro comes with a special feature known as an account shield. It’s designed to help you mitigate losses by acting as a stop-loss that covers your entire account value. That aside, Saxo also allows advanced traders to trade on the go with SaxoTraderGo, a powerful, award-winning app. Furthermore, the broker offers SaxoInvestor, a robust platform that gives users uncapped access to investment products like stocks, bonds, and ETFs.

Speaking of products, Saxo offers a whopping 71,000+ financial assets and instruments. The platform alone has over 23,500+ stocks that you can trade or invest in. While dabbling in stocks, you can diversify your portfolio with many other instruments, ranging from commodities and FX pairs to options, futures, and mutual funds.

Pros

- Offers over 71,000 assets, including 23,500+ stocks

- Ultra-low commissions starting from 0.03% /$1

- No minimum deposit requirement

- Free deposits and withdrawals

- Zero account inactivity fees

- Excellent customer support service

Cons

- Limited educational resources for beginners

- No third-party trading software is available

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

5. XTB – Best Singapore Stock Broker for Cost-Conscious Traders

If you’re looking for a Singapore stockbroker that can help you minimize expenses, we highly recommend XTB. Founded in 2002, XTB is a favourite for over a million people. We think it’s ideal for cost-conscious individuals since it has no minimum deposit requirement and doesn’t require users to cover additional costs for deposits and withdrawals.

Additionally, XTB users can invest in stocks and enjoy 0% commissions. There are over 2,800 stocks on XTB, ranging from Netflix and Tesla to Amazon and Alphabet Inc. What’s more, the broker allows investors to start buying stocks with anything from $10. Additionally, it provides free real-time quotes and allows users to make better investment decisions using an advanced stocks scanner feature.

XTB also supports share CFD trading. That means you can trade stock-based CFDs if you don’t want to own real stocks. Moreover, you can reduce your risk exposure by diversifying your portfolio with other instruments, including CFDs on forex, commodities, and indices.

Pros

- No minimum deposit requirement

- Users have access to thousands of stocks and other assets

- Low commissions starting from 0%

- Supports free deposits and withdrawals

- Investors can buy stocks with as little as $10

Cons

- $10 monthly account inactivity fee

- Withdrawals below $50 attract fees

- Limited educational resources

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

6. OANDA – Best Stock Broker for Forex Traders

We strongly encourage stock traders and investors to diversify with forex. Why? For starters, forex markets support 24-hour trading. That means traders can leverage different opportunities and profit at any time of the day or night. With that in mind, in our opinion, OANDA is the best forex broker for stock traders who want to diversify with forex pairs.

Let’s start with OANDA stock offerings. With an OANDA account, you can invest in over 2,200 shares and enjoy low commissions starting from 0%. Note that the zero-commission offer only applies to specific US shares. However, the platform also allows users to invest in shares from the UK, Germany, Spain, and France.

Stock investors interested in forex trading can access over 200 currencies. These include popular pairs like GBP/JPY, EUR/GBP, and GBP/USD. Many of these products have tight spreads below 1 pip. In addition to stocks and currency pairs, OANDA offers CFDs on indices, ETFs, commodities, and more. Lastly, we recommend OANDA because the trading platform has no minimum deposit requirement.

Pros

- No minimum deposit requirement

- Ultra-tight commissions from $0

- Offers thousands of stocks and 200+ currency pairs

- Multiple platforms are available, including MT4, MT5, and TradingView

- Excellent support service

Cons

- Limited learning materials

- High withdrawal fees

When testing OANDA, we opened a live account and funded it. We didn’t encounter any OANDA minimum deposit requirements, which was a good thing. That allowed us to start with a few dollars. While preparing to fund our account, we noticed that this broker doesn’t charge deposit fees for cash transfers, credit cards, and debit cards. The same applies to e-wallets like Neteller, Skrill, and Wise. But withdrawals aren’t entirely free.

OANDA allows traders to make one free withdrawal per month to their debit or credit cards. Anyone who exceeds this threshold has to pay. The exact fees vary depending on account currency. On the other hand, all bank-related withdrawals incur charges. The fees you’ll pay while using a bank to withdraw funds from OANDA depend on the number of bank withdrawal transactions you’ve made in that calendar month and account currency.

We also noticed that OANDA has overtime financing charges. If you keep a position open after a trading day has ended, OANDA assumes you’ve held it overnight and either credits or charges your account. Visit OANDA’s Financing Costs page to learn more.

Lastly, OANDA charges a $10 monthly inactivity fee on accounts that have been dormant for 12 or more months. If OANDA deems your account legible for inactivity fees, the broker will levy it until you terminate the account, resume trading, or deplete your account balance.

Stock Trading in Singapore

Anyone aged 18 and above can trade stocks in Singapore—it’s legal. That said, Singaporeans should sign up and trade exclusively with MAS-regulated service providers. MAS is a top-tier authority that monitors brokers and ensures they are qualified and reliable. Never interact with unregulated Singapore stockbrokers to avoid losing money and facing significant issues like unfair practices.

Also, note that many Singaporeans have lost fortunes to online trading. To avoid being a statistic and increase your odds of earning consistent returns, master the basics of online trading, maintain discipline, and stick to your rules and strategies.

How to Choose the Right Stock Trading Platform in Singapore

Choosing the right stockbroker increases your odds of becoming a successful broker. That said, different service providers are available in Singapore. You may sign up with a lousy or fraudulent platform if you are not cautious. To avoid that and boost your chances of finding the best stock trading platform in Singapore, vet every service provider based on the factors outlined below:

Since regulated stock brokers are the most secure, check the regulatory status of every service provider before signing up. Always go with a brand that is authorized and regulated by MAS in Singapore as well as other reputable international authorities like CySEC, the FCA, and ASIC. Also, evaluate the measures that your chosen broker uses to protect your data and funds.

If you have a favorite third-party trading platform like MT4 or MT5, you should look for a broker that supports it. That way, you’ll have the opportunity to exploit your favourite features and maximize your profit potential. And if you pick a service provider that doesn’t host third-party software, test the available proprietary platforms before committing.

The best stock broker in Singapore should offer you uncapped access to myriad asset classes, from stocks and ETFs to forex, options, etc. Remember, even while trading stocks, you’ll need to diversify your portfolio to mitigate losses and boost potential returns. Most importantly, as a stock trader, ensure you sign up with a broker that offers stocks and shares.

Before committing financially, check if your chosen broker has a transparent, easy-to-understand fee structure with zero hidden charges. Also, ensure everything from trading and transaction charges to account maintenance and inactivity fees is reasonable and cost-effective.

Good customer support is the key to prompt assistance and effective issue resolution. Before opening an account, test the availability and responsiveness of your chosen broker’s support team. Also, check whether the provided supported channels work for you. Avoid trading platforms with poor quality or non-existent support at all costs.

If you want to enjoy the best experiences, find a reputable platform. How? Use online ratings and reviews. While evaluating a specific broker’s suitability, visit independent sites like Google Play, the App Store, and Trustpilot. Check past user feedback, complaints, and testimonials. Avoid brands with too many dissatisfied past users.

How To Register an Account with a Stock Broker in Singapore

Pick the best broker after reading our reviews and comparing the recommended service providers. Then, open a trading account. You’ll need to follow the steps outlined below and provide the required information and documents:

The first thing you should do is go to your broker’s official site and do everything necessary, from checking elements like fees and supported platforms to reading the terms and conditions. Also, if you need a dedicated app, you’ll find it there.

Click the sign-up button and complete the registration form. Fill it out with the correct information, including your name and physical address. Since the broker will verify every detail, don’t try to falsify anything. Also, when it’s time to set a password, set the strongest one possible, with a blend of lower- and uppercase letters, numbers, symbols, etc.

You can’t trade and enjoy all associated perks with an unverified account. To comply with regulations, MAS-authorized brokers ask new sign-ups to submit identity and address verification documents. Check your service provider’s stipulations and act accordingly.

Give your broker enough time to check your application and verify your account. Then, pick one of the available funding methods and use it to top up your account. If your chosen broker doesn’t have set minimum deposit requirements, start with a small capital and test the waters, especially if you’re a beginner.

Pick your favourite stocks and start trading. You can also buy real shares if your broker supports it. Don’t forget to mitigate risk exposure by trading and investing in other financial products. Lastly, employ risk management tools and strategies. Trading is risky, and you will incur significant financial losses if you don’t practice proper risk management.

Conclusion

The most successful stock traders are skilled and knowledgeable. They also know how to budget effectively and avoid emotional trading. If you are a beginner, boost your odds of making decent profits by educating yourself first. Learn everything from the essentials of stock trading to the best risk management strategies. Additionally, before opening a live account, spend as much time as possible practicing using a demo account with virtual funds. Most importantly, ensure you’re comfortable losing whatever capital you invest.

I’ve had a great experience with Interactive Brokers due to its low commissions, vast asset selection, and excellent educational resources

Nice breakdown - helps to see fees and assets side by side. Makes it easier to spot what actually fits your trading style.