Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Mobile trading has become a game-changer for Indian traders, offering unparalleled convenience and accessibility. In the fast-paced world of stocks, using trading apps is crucial for real-time data, instant trade execution, and on-the-go portfolio management. As seasoned researchers and traders, we’ve undertaken the legwork to compile a list of the best stock trading apps in India. Our guide not only simplifies app selection but also equips readers with comprehensive insights into stock trading, ensuring they are fully prepared to navigate the complexities of the Indian stock market.

In a Nutshell

- Stock trading involves buying and selling shares of publicly traded companies on stock exchanges, with the aim of capitalising on price fluctuations to generate profits.

- The best app for stock market India should be easy to navigate, providing a seamless experience for users of all levels.

- Stock traders in India should consider apps with quality resources for learning and strategy development.

- Security is paramount when trading stocks in India. Therefore, consider apps hosted by brokers regulated by tier-one authorities such as the Securities and Exchange Board of India (SEBI). Robust security protocols, including encryption and two-factor authentication, should also be in place to safeguard sensitive financial information.

- The best trading apps in India should have seamless integration with Indian stock markets, allowing access to a wide range of stocks, indices, and other financial instruments.

- As Invezty experts, we conduct thorough market research to recommend the best stock trading apps that guarantee an exciting experience.

- The best stock market app India should allow you to trade the asset as derivatives (indices and CFDs) or make purchases and take full ownership.

List of the Best Stock Trading Apps in India

- Interactive Brokers – Overall Best Stock Trading App

- Pepperstone – Cheapest Stock Trading App

- FP Markets – Best CFD Stock Trading App

- AvaTrade – Best Stock Trading App For Social and Copy Traders

- Spreadex – Beginner-Friendly Stock Trading App

- Saxo– Best Stock Trading App For Professional Traders

Compare the Best Indian Stock Trading Apps

Stock trading in India does not just require a vast understanding of the stock market. You also need the best stock app, like the ones we recommend above. Below, we have prepared a table highlighting additional key features of our recommended apps to help you make the best decisions:

| Best Stock Trading App India | License | Support Service | Software | Payment | Demo Account |

|---|---|---|---|---|---|

| Interactive Brokers | FSA, FCA, SEBI, ASIC, FINRA, CIRO | 24/5 | Trader Workstation, IBKR Mobile, IBKR EventTrader, IBKR GlobalTrader, IMPACT | Bank transfers, e-wallets, credit/debit cards | Yes |

| Pepperstone | FCA, SEBI, ASIC, DFSA | 24/7 | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes |

| FP Markets | CySEC, ASIC, FCA, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust FasaPay | Yes |

| AvaTradeGO | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA, SEBI | 24/5 | MT4, MT5, AvaTradeGO, AvaOptions, AvaSocial, DupliTrade, Capitalise.ai | Credit/debit cards, Wire transfer, Paypal, Skrill, Neteller, WebMoney | Yes |

| Spreadex | FCA, SEBI | 24/5 | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No |

| Saxo | FSA, CIRO | 24/5 | SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer, Debit cards | Yes |

Overview of Our Recommended Stock Trading Apps’ Fees and Assets

Before choosing a stock trading app in India, it is crucial to confirm its features for the best decisions. Some of the top elements to check are the available assets and trading/non-trading fees. To aid your research, we have prepared tables below highlighting some of the assets and fees applicable to our recommended apps for stock trading.

| Best Stock Trading App India | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Interactive Brokers | From 0.08 points | $0 | The first withdrawal per calendar month is free. Subsequent withdrawals cost $2 per withdrawal | None |

| Pepperstone | From 0.0 pips | $0 | Free | None |

| FP Markets | From 0.0 pips | $100 | Free | None |

| AvaTrade | 0.03 pips | $100 | Free | $50 quarterly |

| Spreadex | From 0.6 pips | $0 | Free | None |

| Saxo | From $0.01 | $0 | Free | $100 |

Assets

| Best Stock Trading App India | Forex | Cryptos | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| IBKR | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Stock Trading Apps

As professional researchers, we did all the legwork in identifying the best stock trading apps in India. This includes conducting multiple tests and comparisons, which took hundreds of hours. Below, we share our opinions regarding our experiences with these apps. Our goal is to ensure our readers fully understand the apps’ offerings and can make the best decisions.

1. Interactive Brokers – Overall Best Stock Trading App

From our analysis as professional traders and researchers, Interactive Brokers (IBKR) stands out as the best stock market app in India. With thousands of stocks to trade, it provides a user-friendly GlobalTrader mobile app featuring a seamless interface. Notably, it imposes no minimum deposit requirement and zero transaction charges. The commission on trades starts from ₹6 to ₹20 per order, making it an ideal choice for all types of traders, whether newbies or budget-conscious ones.

We like Interactive Brokers’ IBKR BestX platform, which, from our experience, incorporates advanced trading technologies. Moreover, this stock trading app lists additional assets such as forex, ETFs, indices, and commodities, fostering portfolio diversification. While compared with other apps, we believe it deserves a 5-star rating.

Pros

- No minimum deposit requirement

- Features thousands of stocks and additional assets for portfolio diversification

- Its GlobalTrader app is user-friendly with a modern design

- Allow its users to earn high-interest rates of up to 4.83 on instantly available cash

Cons

- Its desktop platform can be challenging for newbies to navigate

- Support service is only available 24/5

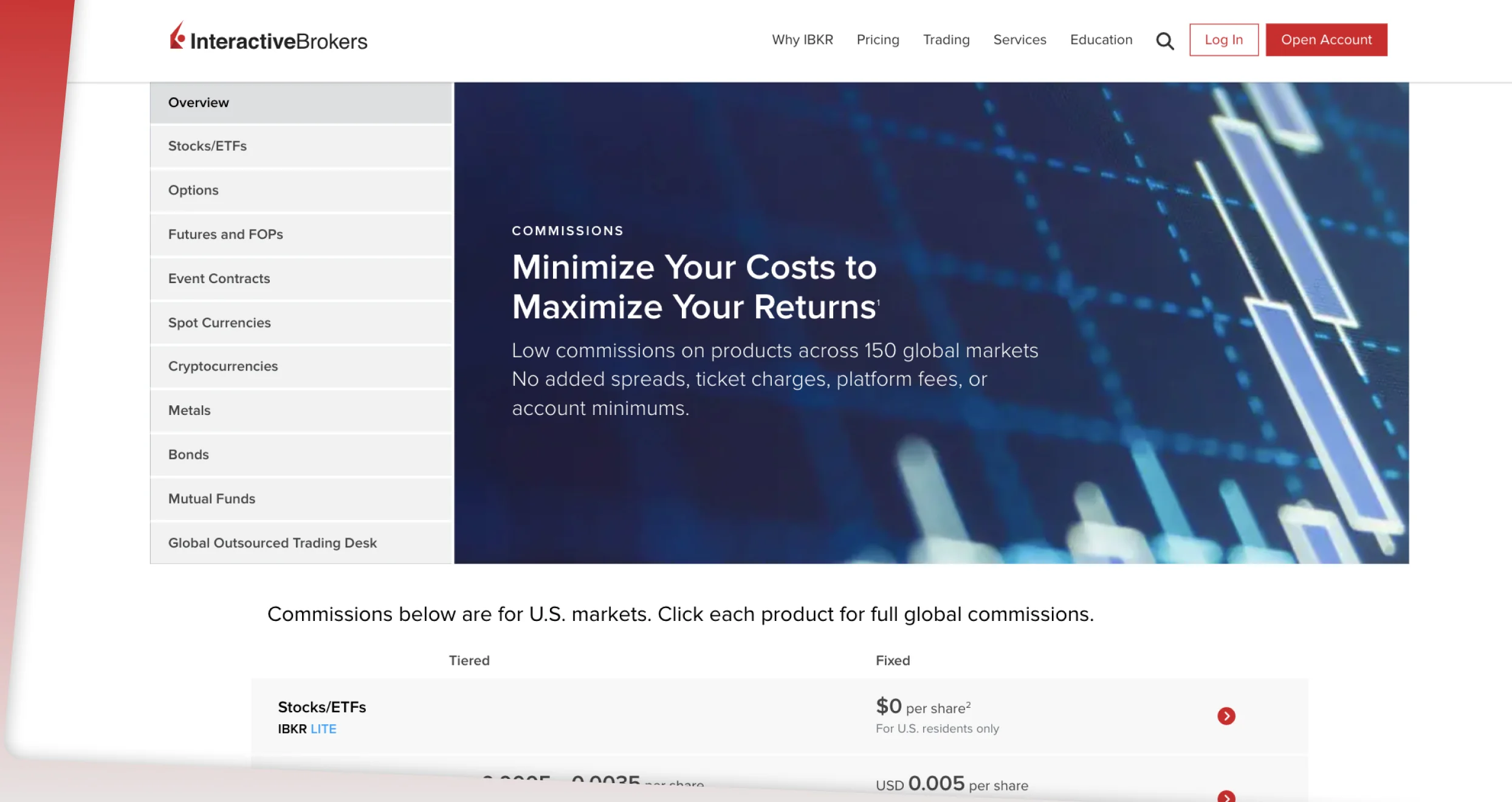

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

2. Pepperstone – Cheapest Stock Trading App

As professional traders, our conclusion is that Pepperstone stands out as the most cost-effective stock trading app in India. With no minimum deposit requirement (though Indian traders are recommended to start with at least $200), this app makes it easier for newbies and those on a low budget to explore the stock markets. Moreover, we noticed that Pepperstone offers share CFDs on leverage across a broad range of markets. Stock trading commission starts from $0.02, and leverage limits go up to 1:500 for professional traders.

Besides being one of the most affordable stock trading apps in India, Pepperstone provides various platforms, including cTrader, TradingView, MT5, and MT4, along with features like social trading. Its user-friendly and customisable stock trading app allows for thousands of stocks to trade as CFDs, alongside additional securities like forex, indices, cryptos, and more for portfolio diversification. From our analysis, we give it a 4.7-star rating.

Pros

- Low trading fees with commissions from $0.02 on stock CFD trades

- Free transactions

- Features social trading whereby you get to interact with other traders and mirror potentially profitable positions

- Free deposits and withdrawals

Cons

- Limited asset offerings compared to its peers

- Does not allow buying and taking full ownership of the assets

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

3. FP Markets – Best CFD Stock Trading App

Our assessment designates FP Markets as the best CFD stock trading app in India. Boasting over 10,000 Australian and international share CFDs, stock CFDs, and indices across four continents, FP Markets is a comprehensive platform for CFD trades. Traders can access stock CFDs on the Iress and MT5 platforms, with additional securities, including forex, commodities, ETFs, and more, for portfolio diversification.

The best element about trading stocks at FP Markets’ Iress platform is the opportunity to enjoy the Direct Market Access (DMA) execution. We also noticed that the app allows earning dividends on long positions without physical ownership of shares. Its reliable 24/7 support service via phone, email, and live chat further enhances the user experience. For the above reasons and more, we give FP Markets’ app a 5-star rating.

Pros

- Plenty of shares to trade

- Low minimum deposit requirement with free transactions

- Quality learning and research materials

- Features a social trading platform that allows users to connect, share various trading ideas, and copy potentially profitable positions

Cons

- FP Markets does not allow Indian traders to buy and take full ownership of the listed stocks. You can only trade them as CFDs

- No negative balance protection under SEBI

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

4. AvaTrade – Best Stock Trading App For Social and Copy Traders

From our analysis, AvaTrade’s AvaTradeGO emerges as the best stock market app in India for social and copy traders. With a $100 minimum deposit requirement, we believe any user, whether a newbie, expert, or budget-conscious person, can get started with it. We tested its social trading platforms and had one of the best experiences. Social trading is available on platforms like DupliTrade, ZuluTrade, and AvaSocial, although the minimum deposit required to access ZuluTrade and DupliTrade is high.

There are thousands of stocks to trade as CFDs and additional securities for portfolio diversification at the AvaTradeGO app. Traders can access major exchanges, including NYSE and FTSE, making AvaTrade an ideal choice for those who prefer trading global markets. Moreover, you can rely on this app’s support service any time you experience challenges in your trades. Comparing AvaTradeGO with other apps, we give it a 5-star rating.

Pros

- Multiple copy and social trading platforms to choose from

- Low minimum deposit requirement

- Low stock trading fees

- Quality learning and research materials

Cons

- Limited asset offerings compared to its peers

- High minimum deposit requirement to access the DupliTrade and ZuluTrade social and copy trading platforms

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

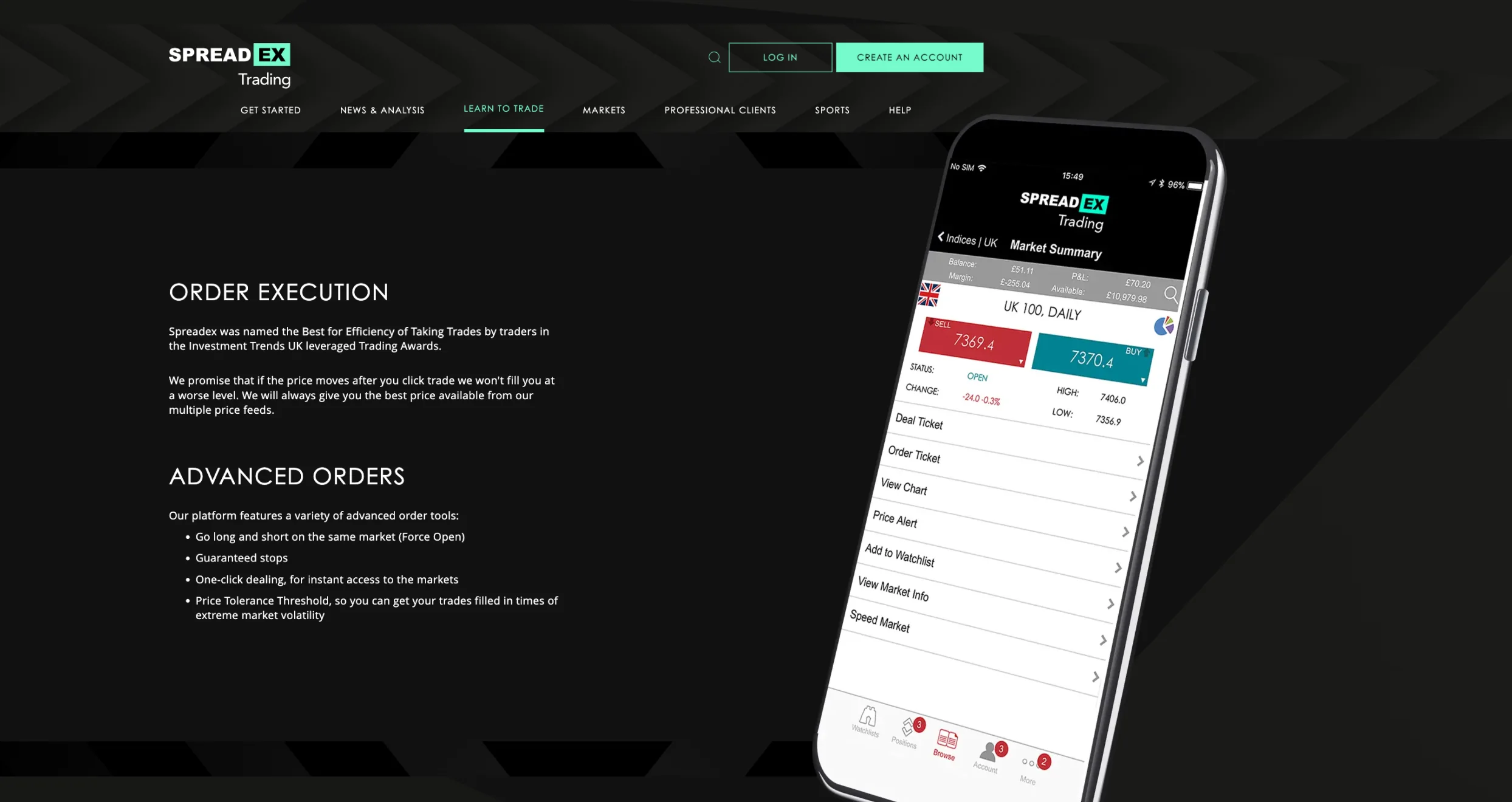

5. Spreadex – Beginner-Friendly Stock Trading App

Our conclusion as professional traders designate Spreadex as the best stock trading app for beginners in India. With no minimum deposit requirement, Spreadex allows newbies to start stock trading with any amounts they can afford. Moreover, you will have access to thousands of global equities, including AIM stocks, with a market capitalisation of £5m+. The platform allows users to choose from shares in over 15 countries, featuring spreads from 0.6 pips.

Spreadex’s user-friendly and customisable platform, along with quality learning resources, including guides and articles, makes it an excellent choice for skill development. The app supports trading shares as CFDs and spread betting, with additional assets such as forex, commodities, interest rates, bonds, ETFs, options, and more for portfolio diversification. From our experience, this stock trading app deserves a 4.5-star rating.

Pros

- A user-friendly and modern design trading app

- No minimum deposit requirement

- Low trading fees

- Allows social trading

Cons

- Limited research resources compared to its peers

- No negative balance protection

From our assessment of Spreadex’s fees, we concluded that this broker offers one of the most cost-friendly platforms. Why? For starters, Spreadex has $0 minimum deposit requirements. That means you can deposit whatever you can afford and start trading immediately. Moreover, while funding your account, you won’t have to pay any deposit fees – it’s free! The same applies to withdrawals.

That is exceptional news since Spreadex supports myriad payment methods, from debit and credit cards to Apple Pay and Easy Bank Transfer. You can use these options without fretting over any charges undermining your profits.

We also recommend Spreadex because this broker doesn’t penalize dormant accounts. Your Spreadex trading account can remain inactive for an extended period without attracting inactivity fees, which separates this company from its peers.

Spreadex offers exceptional rates on spreads. This broker’s spreads start from 0.6 pips for CFD trading. This trading broker should be your go-to if you want lower overall trading costs and improved profit margins.

That said, Spreadex charges overnight funding for shares rolling positions. If you keep a position open through the close of the relevant exchange, Spreadex will keep it open for the following day’s trading. But that will attract a funding adjustment. The fees you’ll incur at any given time will be a combination of the Adjusted ARR and Spreadex’s charges. However, holding futures overnight won’t attract any charges.

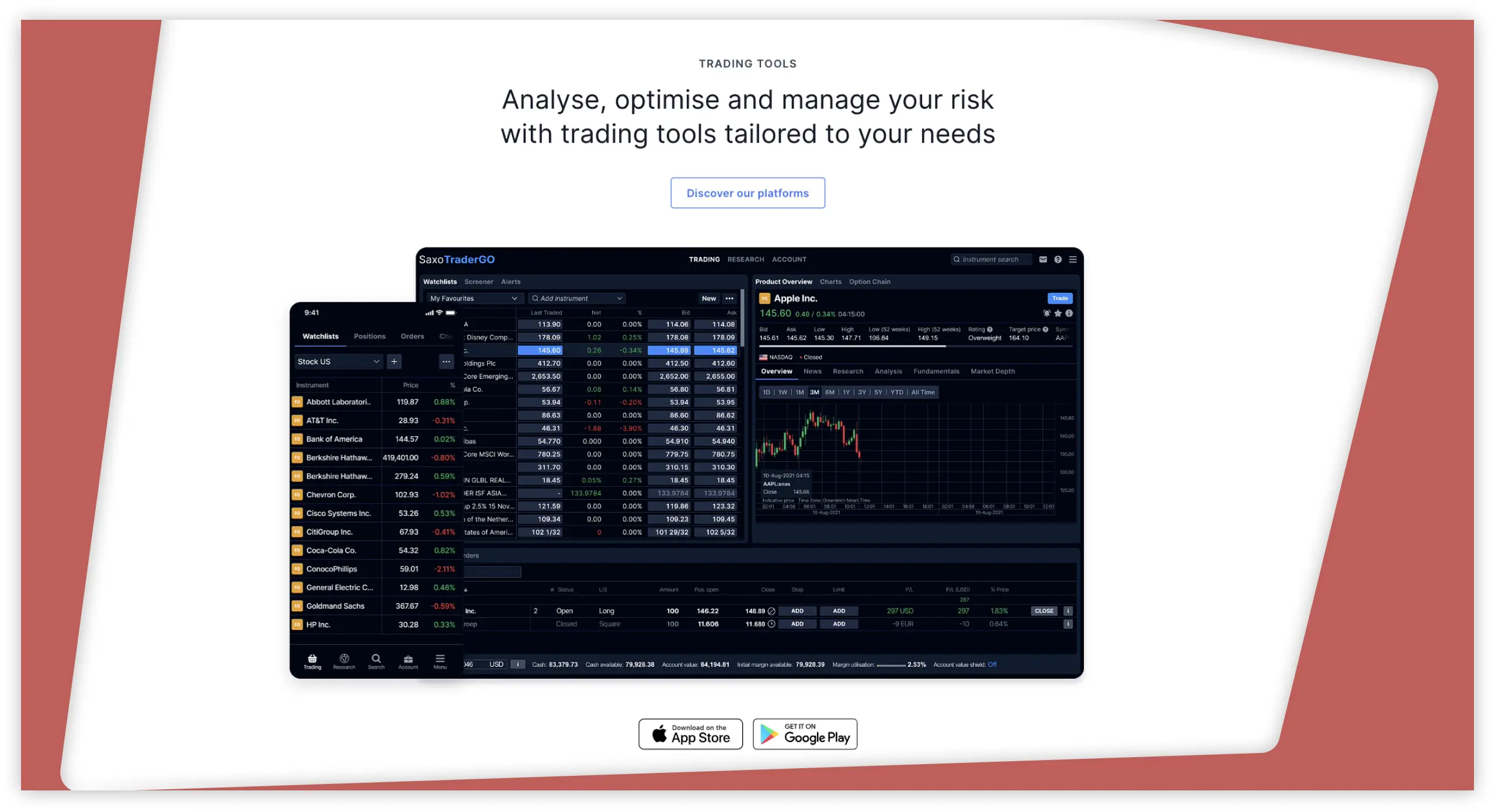

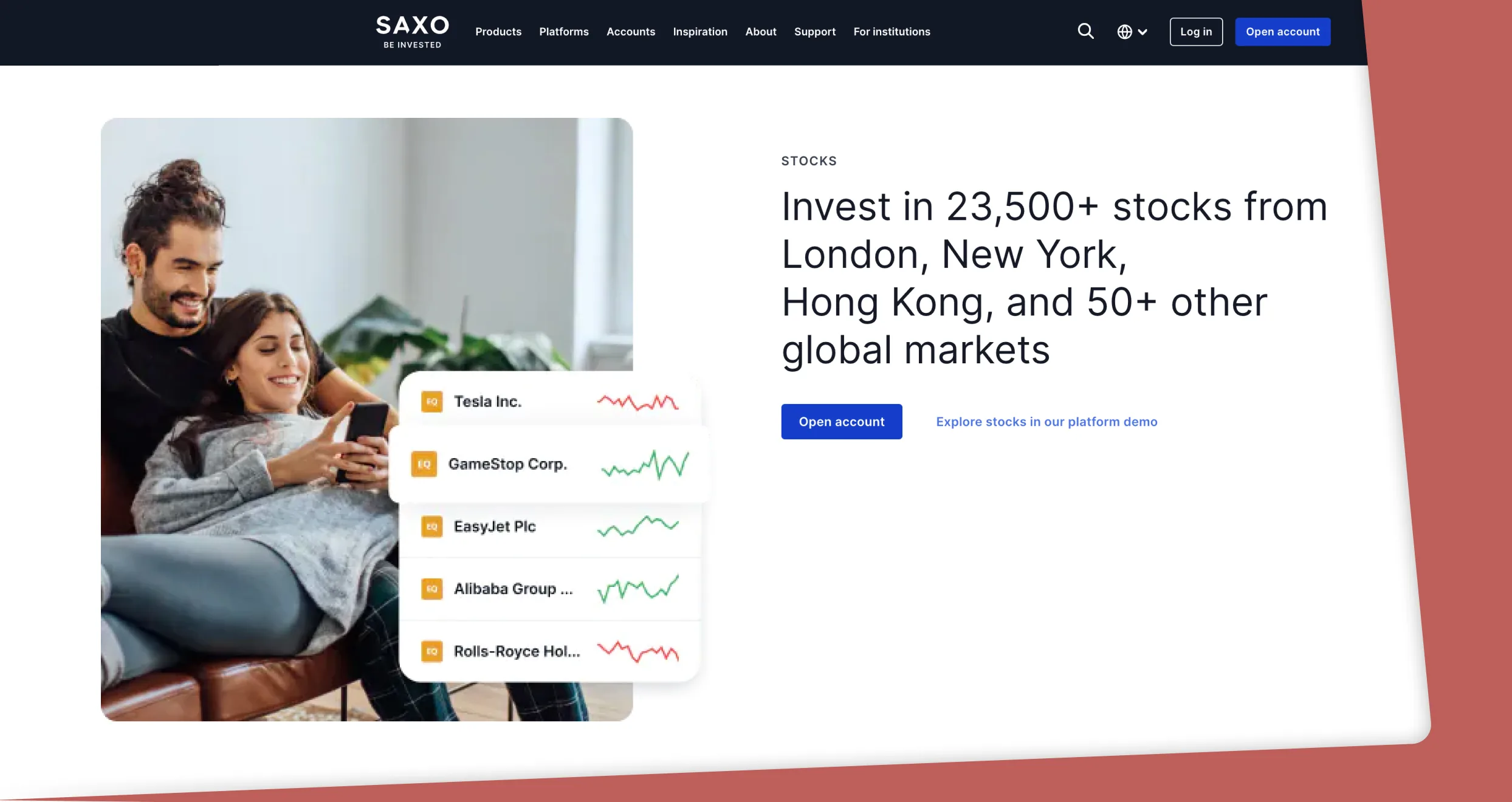

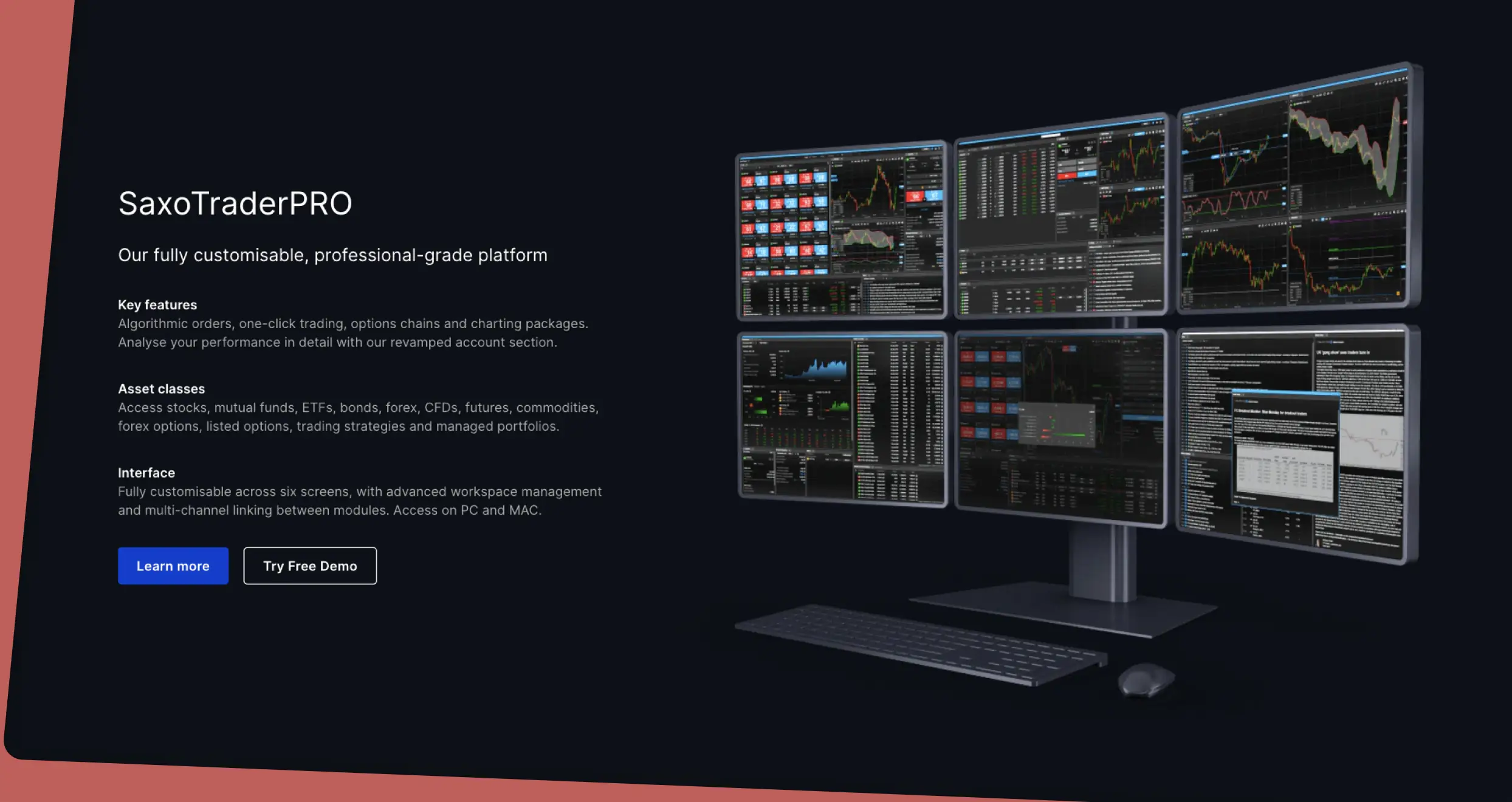

6. Saxo – Best Stock Trading App For Professional Traders

Saxo stands out as the best stock trading app for professional traders from our analysis as professional traders. With access to 23,500+ stocks from global markets, you have a wide variety of options to explore from as low as USD 1. Moreover, the app supports additional securities like forex, commodities, cryptos, and more for portfolio diversification. All these are available with no minimum deposit requirement, meaning you can start stock trading with any amount you can afford.

We discovered that Saxo’s SaxoTraderPRO platform, specifically tailored for professionals, offers full customisation and compatibility with iOS and Windows devices. It provides an unparalleled user experience with advanced trading resources and algorithmic orders. You will also benefit from its unique feature of earning interest on uninvested funds—an element that maximises your profitability.

Pros

- Features automated trading on its “Managed Portfolios” section

- Excellent research tools for market analysis

- A user-friendly and intuitive design platform

- Trade global stocks from as low as $1

Cons

- Has an inactivity fee of $100, which kicks in after 6 months

- Limited learning tools compared to its peers

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

How to Start Trading Stocks with a Mobile App in India

In the dynamic world of stock trading, leveraging the power of mobile apps can elevate your experience and provide unparalleled accessibility. Our carefully curated recommendations offer a starting point, but the key lies in choosing an app that resonates with your trading preferences. You should also understand how the stock market works to easily develop solid strategies. If you are a newbie, we share below the simple procedures to trade stocks in India.

Begin by selecting a stock trading app that aligns with your preferences and requirements. Our recommendations list provides insights into the best options, but it’s crucial to compare and test them to find the one that suits your trading style. Evaluate factors such as user interface, available features, real-time data accuracy, and customer support.

Download the chosen stock trading app from your device’s Google Play or the App Store and visit its official website for additional information. Then, initiate the registration process by providing necessary personal details such as your name, contact information, source income and create a secure password. Always provide accurate details for a seamless account registration process.

Participate in the account verification process as stipulated by the app/broker. This often involves submitting identification documents, including copies of your ID card and utility bill, to comply with regulatory requirements. The verification step is mandatory in all SEBI-regulated brokers/trading apps as it ensures online trading remains safe and free from imposters.

Once your account is verified, proceed to make an initial deposit. Familiarise yourself with the app’s supported payment methods and security measures for fund transfers. Ensure that the app provides a secure and straightforward process for depositing funds into your trading account.

Once your deposit is confirmed, you are free to explore the app’s features, such as stock quotes, charts, and market research tools. Then, choose your preferred stocks based on thorough analysis. Utilise the app’s order placement tools to initiate your first trade. Whether you are a beginner or an experienced trader, start with a small investment and gradually expand your portfolio.

How to Choose the Right Stock Trading App in India

Choosing a suitable stock trading app in India is a pivotal decision for any aspiring investor. With many options available, selecting the best one can be challenging. Below, we outline essential factors to consider, ensuring you find a reliable stock trading app that not only guarantees an exciting experience but also maximises your potential for success.

Prioritise stock trading apps hosted by brokers licensed and regulated by SEBI in India and other global authorities. This ensures compliance with regulatory standards, offering a layer of protection for your investments. Also, look for encryption protocols such as SSL/TLS to secure data transmission and safeguard your personal and financial information. Regulatory compliance allows you to take legal action in case of any disputes or breaches of agreement, providing an added level of security.

Evaluate an app’s fee structure, considering brokerage fees, transaction charges, account maintenance fees, and any other associated costs. Choose an app with transparent pricing and competitive rates, aligning with your trading frequency and budget constraints. Consider the overall cost implications of both trading and non-trading activities to make informed financial decisions.

Assess an app’s platform performance during different market conditions, especially peak trading hours. Look for a user-friendly interface with advanced trading tools such as real-time charts, technical analysis indicators, and customisable features. A responsive platform enhances your trading efficiency and provides essential tools for comprehensive market analysis.

Diversification is key to managing risk. Therefore, besides stocks, choose an app offering additional assets, including forex, commodities, cryptocurrencies, indices, and more. A diverse range of assets allows you to create a well-balanced portfolio, aligning with your investment goals and risk tolerance. Ensure the app provides access to both Indian and international markets for a globally diversified investment strategy.

To gain practical experience without financial risk, take advantage of platforms that provide demo accounts, like our top 5 apps for stock trading in India. Additionally, it’s essential to seek out comprehensive educational resources such as tutorials, webinars, and articles to deepen your understanding of trading principles. These resources serve as valuable tools for continuous learning and skill development, benefiting both novice and seasoned traders alike.

Choose an app with responsive customer support available through live chat, email, and phone channels. Prompt assistance is crucial for addressing queries, technical issues, or any concerns that may arise during your trading journey. Evaluate the accessibility and efficiency of customer support to ensure a seamless user experience.

To gain insights into an app’s performance, reliability, and user satisfaction, explore user reviews and recommendations. Positive feedback from fellow traders on platforms such as Google Play, the App Store, and Trustpilot provides valuable indications of the app’s credibility and the overall user experience.

Key Features of the Best Trading App In India

When choosing a trading app in India, several key features set the best apps apart from the rest. These features enhance your trading experience, provide valuable insights, and help you make informed decisions. Here are some essential features to look for in a top-notch trading app in India.

- User-Friendly Interface – A user-friendly interface is crucial for a seamless trading experience. The app should be easy to navigate, with intuitive menus and clear visuals. A well-designed interface allows traders to quickly access market data, place orders, and monitor their portfolios without any hassle.

- Advanced Charting Tools – Technical analysis is a vital aspect of trading, and having advanced charting tools at your disposal is essential. The best trading apps offer a wide range of technical indicators, drawing tools, and customisable charts to help traders identify trends, patterns, and potential trading opportunities.

- Real-Time Data and Updates – Real-time data is indispensable for making informed trading decisions. The app should provide live updates on stock prices, indices, commodities, and other financial instruments. Additionally, real-time news and market insights can help traders stay ahead of the curve and respond to market movements promptly.

- Robust Order Execution – A reliable and efficient order execution system is imperative for successful trading. The app should execute trades quickly and accurately, minimising slippage and ensuring that traders can enter and exit positions at the desired prices.

- Portfolio Management Tools – A comprehensive portfolio management suite is crucial for tracking and managing your investments. The app should offer detailed insights into your portfolio’s performance, including real-time valuations, profit and loss calculations, and historical data. This information empowers traders to make well-informed decisions and adjust their strategies as needed.

- Research and Analysis – Access to in-depth research and analysis is invaluable for traders seeking an edge in the markets. The best trading apps provide expert opinions, market reports, and fundamental data to help traders make informed investment decisions.

- Security and Regulation – The security of your funds and personal information should be a top priority. Choose a trading app with robust security measures, such as encryption, secure login protocols, and regulatory compliance.

Conclusion

Achieving success trading stock in India goes beyond mere market acumen—it hinges on selecting the right stockbroker and trading app, especially for those on the go. The best element about a trading app is that it streamlines activity tracking and facilitates informed decision-making without being tethered to a trading station. Our recommendations promise an exhilarating trading experience, but success ultimately rests on your dedication. Therefore, adhere to our guidelines for choosing a reliable stock trading app and uphold discipline in your endeavours—key ingredients for a triumphant journey in the dynamic Indian stock market.

This is a helpful overview, but I’m still unsure about which app would be best for me as a beginner. I'll need to do more research before making a decision.

Surprised eToro didn't make this list - yeah the fees are higher but the social trading features are pretty solid for beginners wanting to learn.