Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

In India, the forex trading landscape is rapidly advancing, fueled by increasing demand and oversight from the Securities and Exchange Board of India (SEBI). As the nation embraces forex, the need for reliable forex brokers becomes paramount. This is where we come in as expert traders and researchers. We conducted extensive research involving multiple tests and comparisons and share below the best forex brokers in India. Our ultimate goal is to ensure you stay ahead in the game with insights into top-notch brokerage services, ensuring a smooth ride through the complexities of the currency market.

In a Nutshell

- The demand for forex trading in India is rising, attracting both experienced and new traders.

- Forex trading in India is overseen by SEBI and RBI, thus ensuring fair and transparent practices.

- Success in forex trading depends on choosing the right broker, considering factors like regulation, fees, and more.

- Non-resident Indians (NRIs) are increasingly contributing to the growth and diversity of the forex market in the region.

- The best Indian forex brokers should offer a variety of instruments for portfolio diversification.

- Staying informed about global economic trends is crucial for making informed trading decisions in the currency market.

List of the Best Forex Brokers in India

- FxPro – Overall Best Forex Broker

- Interactive Brokers – Best Forex Broker For Professional Traders

- Pepperstone – Best CFD Forex Broker

- FP Markets – Best MT4 Forex Broker

- AvaTrade – Top Forex Broker For Mobile Trading

- Spreadex – Beginner-Friendly Forex Broker

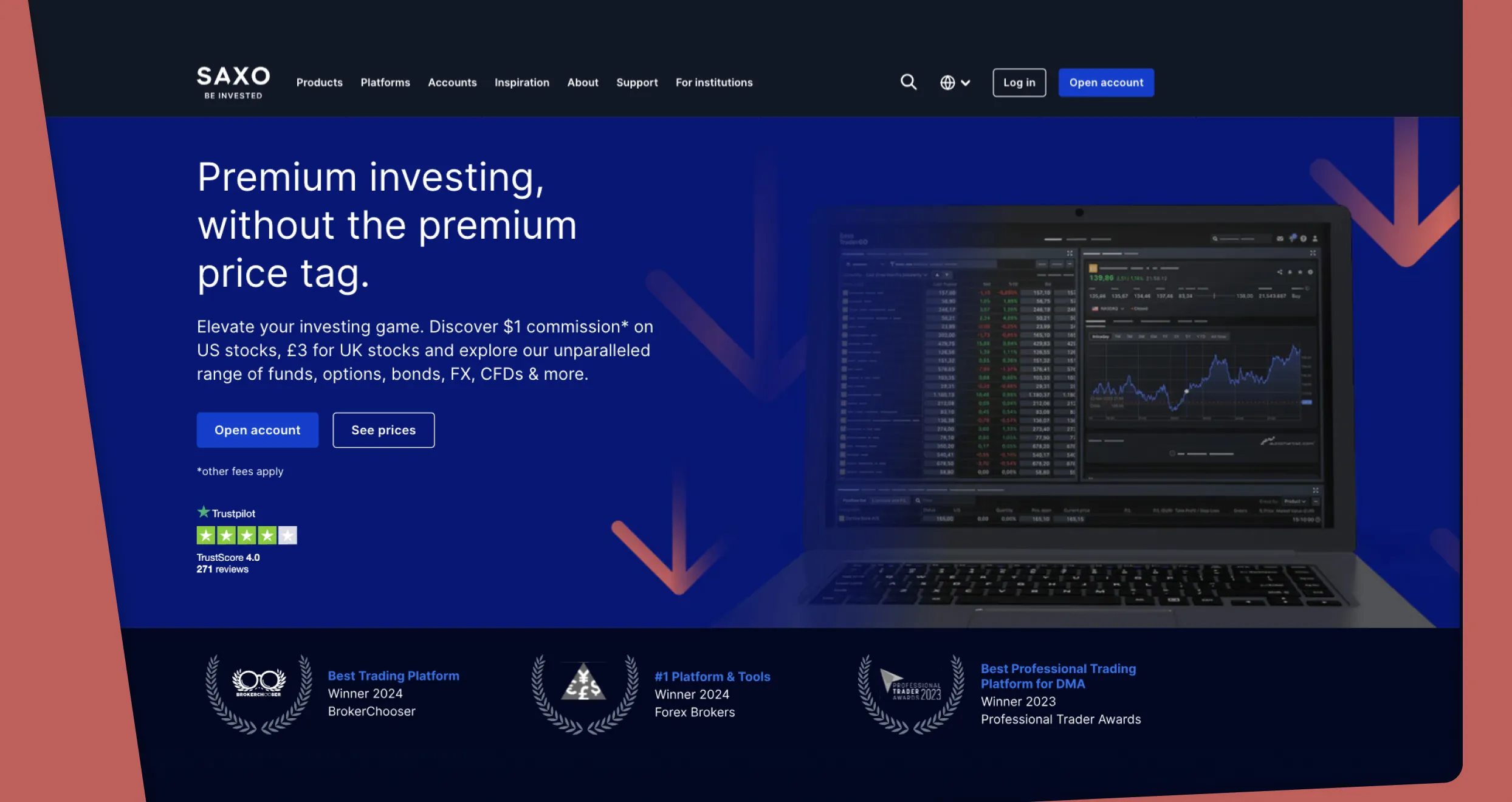

- Saxo – Leading Forex Broker With Excellent Support Service

Compare the Best Indian Forex Brokers

In our commitment to assist traders in India, we go beyond mere testing; we compare features to ensure every trader finds their optimal choice. Below, we present a comprehensive table showcasing the key features of the best forex brokers in India. We hope this guidance will help you make informed decisions that align perfectly with your trading preferences.

| Best Forex Broker India | License | Software | Payment | Demo Account |

|---|---|---|---|---|

| FxPro | SEBI, FCA, CySEC, FSCA, SCB, FSCM | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Wire transfers, Credit/debit cards, PayPal, Neteller, Skrill | Yes |

| Interactive Brokers | FSA, FCA, SEBI, ASIC, FINRA, CIRO | Trader Workstation, IBKR Mobile, IBKR EventTrader, IBKR GlobalTrader, IMPACT | Bank transfers, e-wallets, credit/debit cards | Yes |

| Pepperstone | FCA, SEBI, ASIC, DFSA | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes |

| FP Markets | CySEC, ASIC, FCA, SEBI | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust FasaPay | Yes |

| AvaTradeGO | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA, SEBI | MT4, MT5, AvaTradeGO, AvaOptions, AvaSocial, DupliTrade, Capitalise.ai | Credit/debit cards, Wire transfer, Paypal, Skrill, Neteller, WebMoney | Yes |

| Spreadex | FCA, SEBI | IPHONE App, IPAD App, ANDROID App, TradingView | Bank Wire Transfer, Credit cards | No |

| Saxo | FSA, MAS, SEBI | SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer, Debit cards | Yes |

Overview of Our Recommended Forex Brokers’ Fees and Assets

As seasoned forex traders and researchers, we emphasise the significance of selecting legal forex brokers in India with suitable assets and fees. Below are concise tables outlining our recommended Indian forex brokers, detailing their fee structures and offered assets. Whether you’re an experienced or novice trader, understanding these factors is vital for informed decision-making and enhanced trading.

Fees

| Best Forex Broker India | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| FxPro | From 0.1 pips | $100 | Free | $15 one-off maintenance fee |

| Interactive Brokers | From 0.08 points | $0 | The first withdrawal per calendar month is free. Subsequent withdrawals cost $2 per withdrawal | None |

| Pepperstone | From 0.0 pips | $0 | Free | None |

| FP Markets | From 0.0 pips | $100 | Free | None |

| AvaTrade | 0.03 pips | $100 | Free | $50 quarterly |

| Spreadex | From 0.6 pips | $0 | Free | None |

| Saxo | From $0.01 | $0 | Free | $100 |

Assets

| Best Forex Broker India | Cryptocurrencies | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| FxPro | Yes | Yes | Yes | No | No |

| IBKR | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Forex Brokers

We, as experts in the currency field, present our insights into the top forex brokers in India. This comprehensive overview is designed to provide our opinions on the most reliable and effective platforms available, offering valuable guidance for traders seeking excellence in the Indian forex market.

1. FxPro – Overall Best Forex Broker

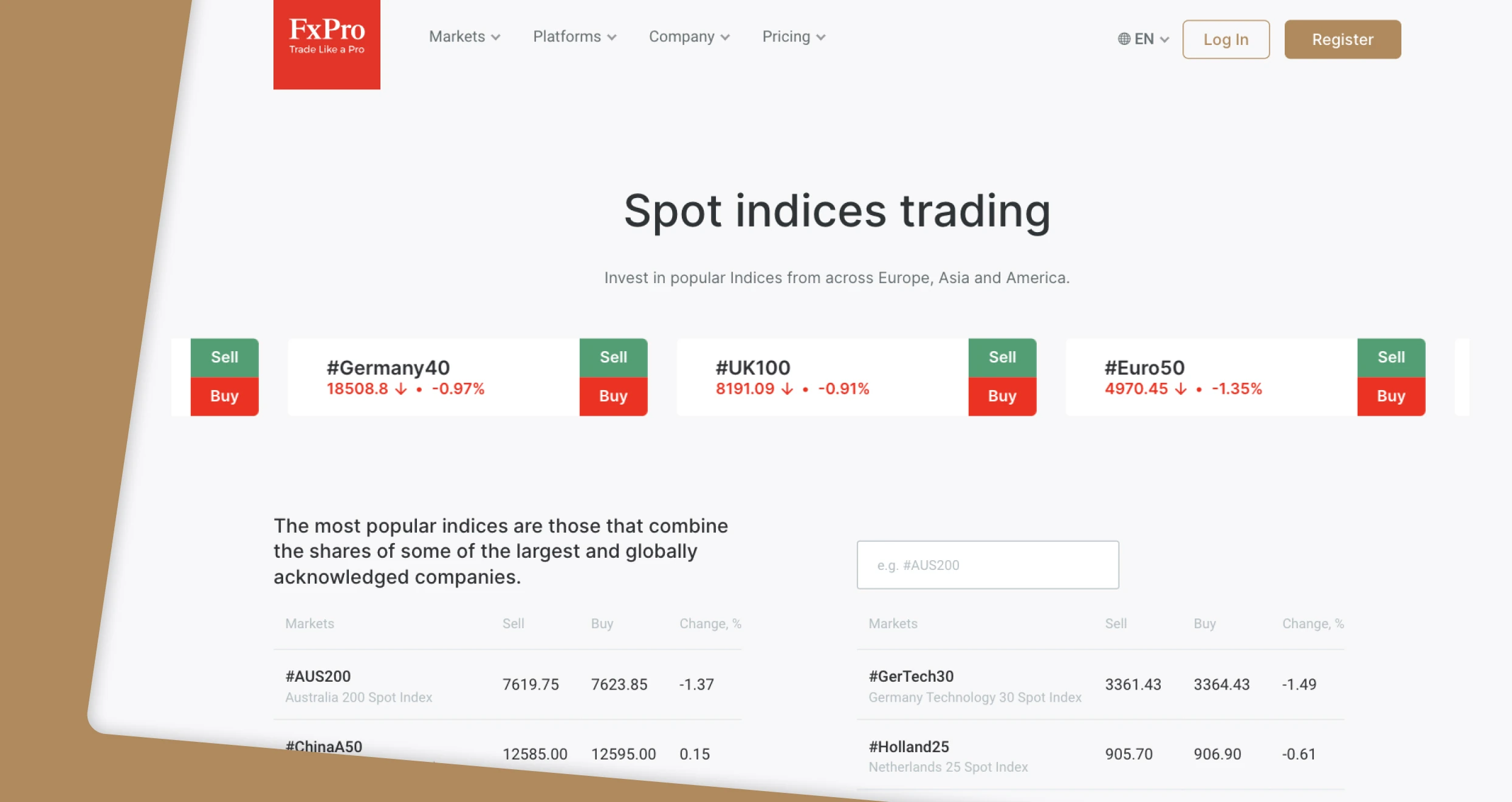

Following extensive testing and analysis, FxPro emerges as the overall best forex broker in India. Its user-friendly platform, featuring over 70 currency pairs, from major to exotic, stood out during our evaluation. FxPro’s lightning-fast order execution enhances time-sensitive trading, and the absence of transaction charges, coupled with a modest starting requirement of $100, makes it accessible to a wide range of users.

Beyond forex, we like FxPro’s inclusion of additional assets like shares, futures, spot indices, metals, and more, which facilitates robust portfolio diversification. With the support of MT4, MT5, and cTrader, FxPro seamlessly accommodates advanced forex traders. We also tested the broker’s 24/5 support service and got reliable assistance that kept us trading for a more extended period. Compared to its peers, FxPro receives a commendable 4.3-star rating from us.

Pros

- Over 70 currency pairs to trade

- Low spreads from 0.6 pips on major currency pairs

- Quality learning and research tools

- Reliable and responsive support service

Cons

- Only forex and CFD assets are supported

- Its price is a bit higher compared to some of its peers

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

2. Interactive Brokers – Best Forex Broker For Professional Traders

From our perspective, Interactive Brokers (IBKR) stands out as the ultimate platform for professional traders in India. Its user-friendly interface, coupled with a straightforward account opening procedure and no minimum deposit requirement, makes it easier for expert traders to start exploring the currency market. We also like that IBKR supports free transactions and allows its users to earn interest of up to USD 4.83% on available cash. This leads us to conclude that the broker prioritises transparency and financial benefits for professional traders in India.

Besides the web platform, the IBKR GlobalTrader mobile app offers direct access to interbank quotes and lists 100+ currency pairs to trade with tight spreads. The streamlined activities we experienced with this app make us recommend it to newbies. With thousands of tradable assets, including stocks, commodities, options, futures, bonds, and ETFs, IBKR provides a comprehensive collection for portfolio diversification. Plus, the broker’s BestX platform, equipped with advanced technologies, solidifies IBKR’s position as the top choice for professional traders in India, thus earning a 5-star rating from our analysis.

Pros

- No minimum deposit requirement

- Features thousands of securities for portfolio diversification

- Its GlobalTrader app is user-friendly with a modern design

- Allows its users to earn high interest rates of up to 4.83 on instantly available cash

Cons

- Its desktop platform can be challenging for newbies to navigate

- Support service is only available 24/5

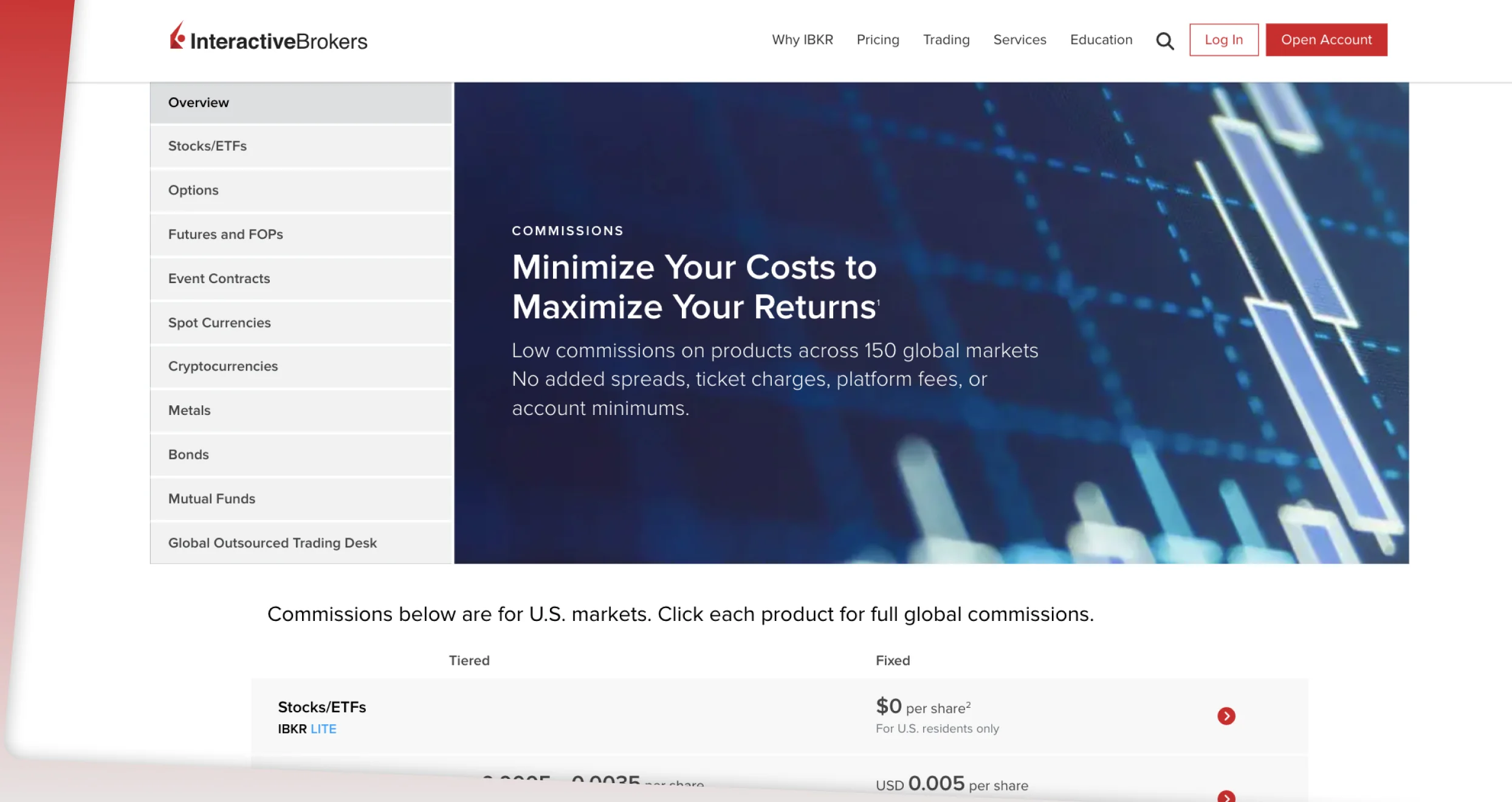

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

3. Pepperstone – Best CFD Forex Broker

We also tested Pepperstone, and it emerges as the optimal CFD forex broker in India, offering a diverse and personalised trading experience. Compatible with TradingView, MT4, MT5, and cTrader platforms, this broker ensures flexibility for CFD forex traders. With it, you will have access to 90+ currency pairs and a suite of an additional 1200+ CFDs covering shares, commodities, ETFs, and indices for portfolio diversification. The broker has a recommended $200 minimum deposit requirement for Indian traders and low spreads starting from 0.0 pips.

We noticed that Pepperstone boasts a 1:500 leverage for professional forex traders and regulation across multiple jurisdictions. This provides a secure trading environment and an opportunity to apply high leverage on your trades, which can bring about massive profits if a trade works out in your favor. The inclusion of social and copy trading on platforms like Myfxbook, MetaTrader Signals, and DupliTrade further enhances the user experience. Comparing it with other forex brokers in India, Pepperstone earns a commendable 4.7-star rating from us.

Pros

- Low trading fees with spreads from 0.0 pips

- A user-friendly and modern design platform

- Features social trading whereby you get to interact with other traders and mirror potentially profitable positions

- Free deposits and withdrawals

Cons

- Limited asset offerings compared to its peers

- Does not allow buying and taking full ownership of the assets

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

4. FP Markets – Best MT4 Forex Broker

From our multiple tests and comparisons, FP Markets emerges as India’s top MT4 forex broker. This is primarily because the platform is equipped with customisable interfaces, one-click trading, and expert advisors, which, in our opinion, further enhance the forex trading experience. Besides MT4, you can also trade forex on MT5, Iress, and TradingView platforms. Our experience with this broker was one of the best, with a low minimum deposit requirement of $100.

Beyond forex, FP Markets provides access to an additional 10,000+ CFD assets, facilitating robust portfolio diversification across indices, commodities, cryptocurrencies, bonds, and ETFs. With spreads as low as 0.0 pips and 70+ currency pairs, the platform is definitely worth trying if you are looking to explore the currency market. Based on our analysis, we give this broker a 5-star rating.

Pros

- Over 70 currency pairs to trade

- Low minimum deposit requirement with free transactions

- High leverage limit of 1:500 for professional forex traders

- Features a social trading platform that allows users to connect, share various trading ideas, and copy potentially profitable positions

Cons

- FP Markets does not allow Indian traders to buy and take full ownership of the listed stocks. You can only trade them as CFDs

- You will incur commissions on the Raw Account tailored for professional forex traders

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

5. AvaTrade – Top Forex Broker For Mobile Trading

Among the forex trading brokers in India, we believe AvaTrade is the best choice for mobile trading. This is because we noticed that the AvaTradeGO app is one of the most highly rated forex trading apps on Google Play, the App Store, and Trustpilot. We also downloaded the app on our mobile devices, and our experience highlighted the app’s seamless trades and modern design. With access to over 60 currency pairs and an additional 1,250+ assets, AvaTrade facilitates extensive portfolio diversification.

AvaTrade goes beyond with platforms like AvaSocial, DupliTrade, and ZuluTrade for enhanced social and copy trading. The inclusion of MT4 and MT5 platforms further solidifies the broker’s commitment to providing a versatile and user-friendly trading experience. From our analysis and positive experiences, we confidently assert AvaTrade’s position as India’s top forex broker for mobile trading. Therefore, we give it a 5-star rating.

Pros

- Over 60 currency pairs to trade

- Low minimum deposit requirement of $100

- Commission-free trades with low spreads

- Quality learning and research materials

Cons

- Limited asset offerings compared to its peers

- High minimum deposit requirement to access the DupliTrade platform

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

6. Spreadex – Beginner-Friendly Forex Broker

After thorough testing and exploration, Spreadex emerged as a beginner-friendly forex broker in India. With no minimum deposit requirement, it champions accessibility for newcomers, allowing them to begin trading with any affordable amount. Speculating on over 60 currency pairs, including EUR/USD from 0.6 pts and GBP/USD from 0.9 pts, Spreadex offers competitive spreads.

Our experience revealed that Spreadex’s user-friendly and customisable platform ensures a seamless journey for beginners, enhanced by advanced and automated technical analysis tools. The diverse array of an additional 10,000+ CFD assets caters to traders seeking portfolio diversification. We were also impressed by the broker’s quality learning resources and responsive customer support via email, phone, and live chat. That is why we believe it deserves a solid 4.5-star rating.

Pros

- A user-friendly and modern design trading app

- No minimum deposit requirement

- Low trading fees

- Allows social trading

Cons

- Limited research resources compared to its peers

- No negative balance protection for Indian traders

From our assessment of Spreadex’s fees, we concluded that this broker offers one of the most cost-friendly platforms. Why? For starters, Spreadex has $0 minimum deposit requirements. That means you can deposit whatever you can afford and start trading immediately. Moreover, while funding your account, you won’t have to pay any deposit fees – it’s free! The same applies to withdrawals.

That is exceptional news since Spreadex supports myriad payment methods, from debit and credit cards to Apple Pay and Easy Bank Transfer. You can use these options without fretting over any charges undermining your profits.

We also recommend Spreadex because this broker doesn’t penalize dormant accounts. Your Spreadex trading account can remain inactive for an extended period without attracting inactivity fees, which separates this company from its peers.

Spreadex offers exceptional rates on spreads. This broker’s spreads start from 0.6 pips for CFD trading. This trading broker should be your go-to if you want lower overall trading costs and improved profit margins.

That said, Spreadex charges overnight funding for shares rolling positions. If you keep a position open through the close of the relevant exchange, Spreadex will keep it open for the following day’s trading. But that will attract a funding adjustment. The fees you’ll incur at any given time will be a combination of the Adjusted ARR and Spreadex’s charges. However, holding futures overnight won’t attract any charges.

7. Saxo – Leading Forex Broker With Excellent Support Service

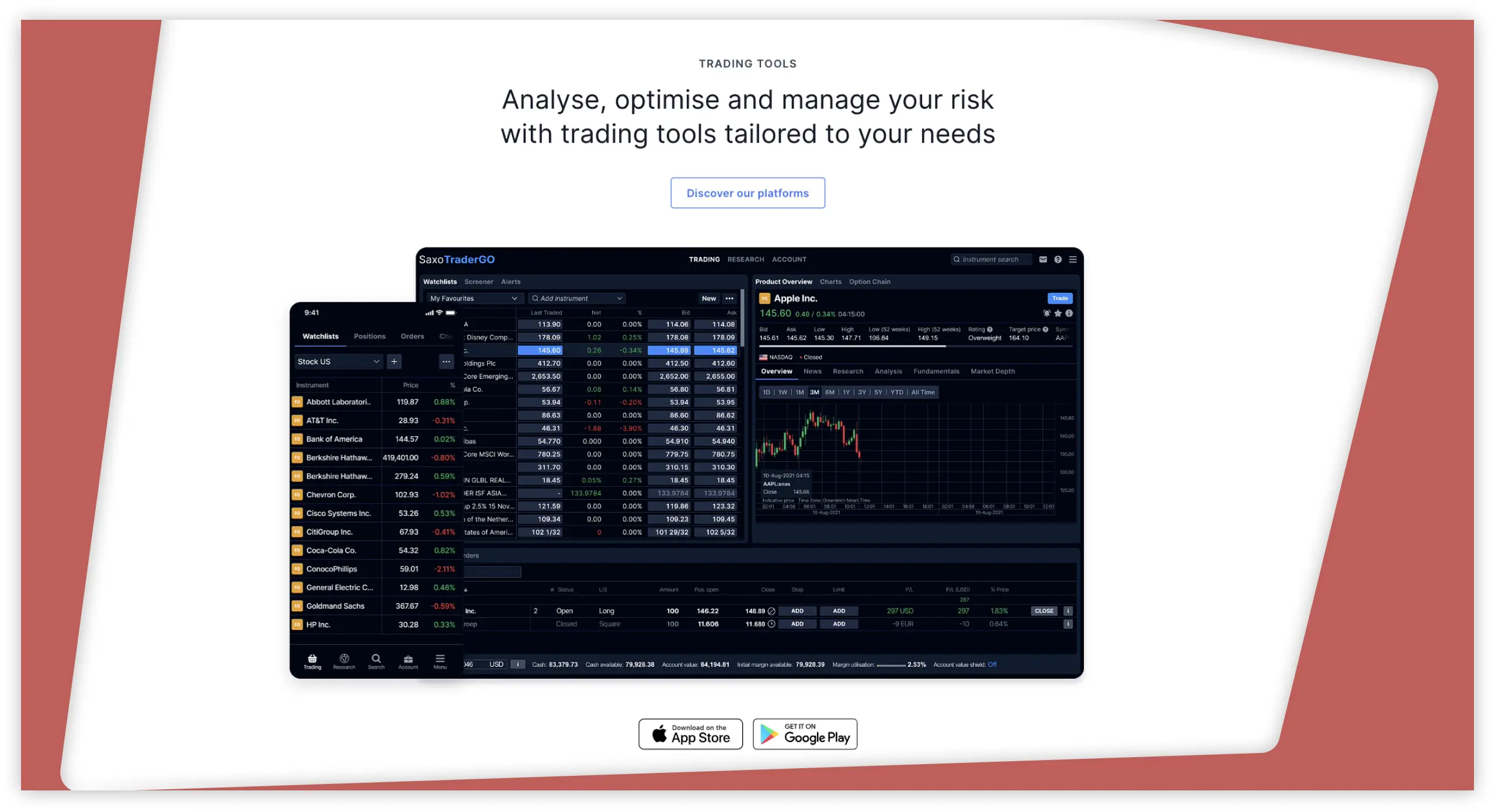

We tested Saxo’s 24/5 responsiveness and were very impressed with the team. We not only received relevant solutions to our concerns and issues, but the team also conducted follow-ups to ensure we were delighted and enjoying our trading experience. The broker offers access to 185+ forex pairs, crypto, spot metals, and an additional 71,000+ securities for portfolio diversification. With no minimum deposit requirement on its classic account, Saxo ensures accessibility for all users.

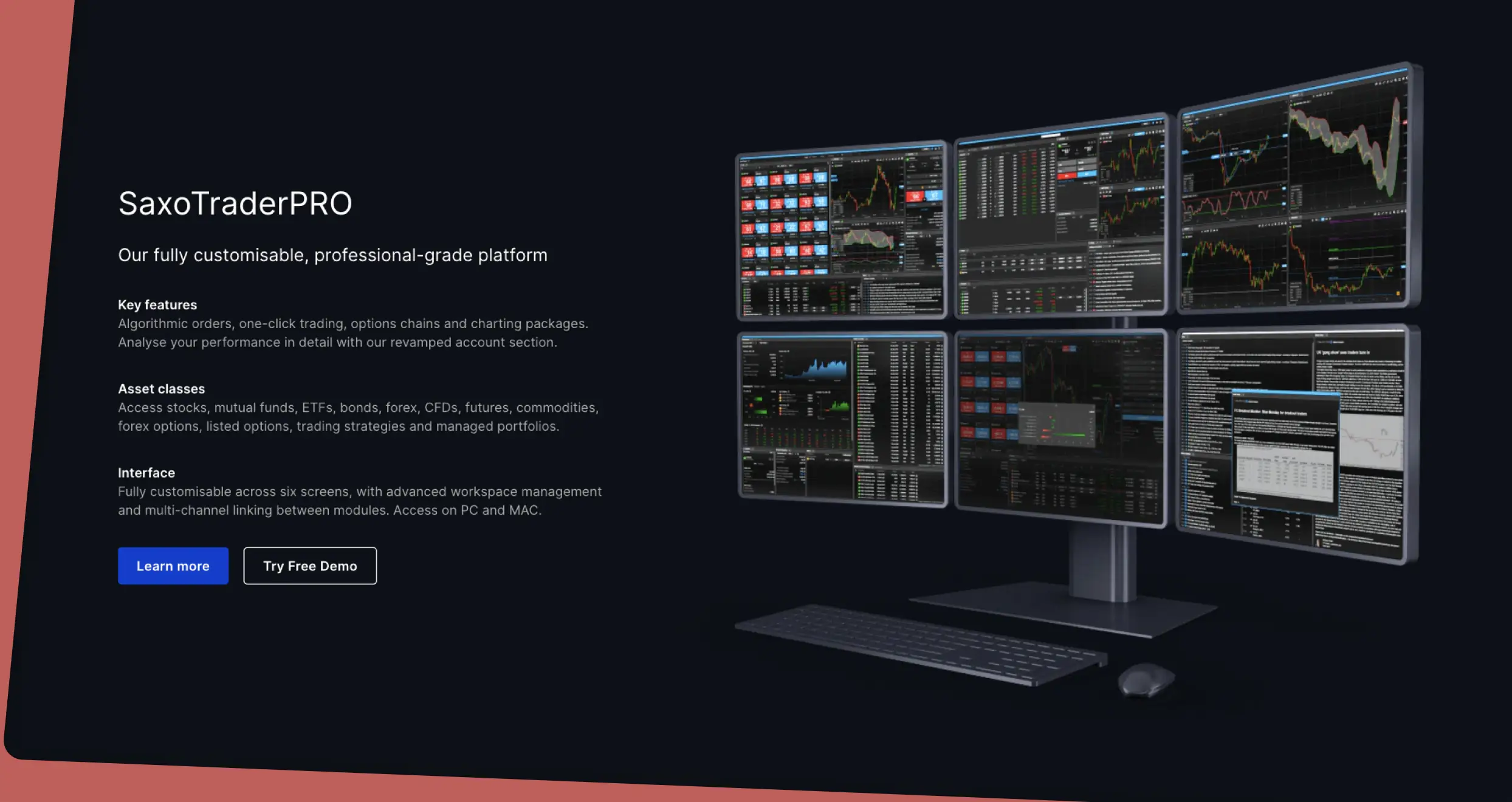

Besides the beginner-friendly web platform, we like the broker’s SaxoTraderPRO platform, which is tailored for professionals. From our experience, the platform is fully customisable and compatible with iOS and Windows devices, thus delivering an unparalleled user experience. The inclusion of algorithmic orders and advanced trading resources also appeals to seasoned traders. Saxo’s unique offering of earning interest on uninvested funds adds a distinctive dimension. Comparing it to peers, we give it a 4.4-star rating.

Pros

- Lists over 185 currency pairs to trade

- Excellent research tools for market analysis

- A responsive and efficient support service with relevant solutions

- Over 71,000 additional securities for portfolio diversification

Cons

- Has an inactivity fee of $100, which kicks in after 6 months

- Limited learning tools compared to its peers

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

How to Start Trading Forex in India?

Trading forex in India demands a strategic approach, and once you have mastered the essential steps, initiation becomes straightforward. If you are looking to dive into the currency market, we take you through the proper procedures for getting started below.

The first thing you must do to seamlessly trade forex is to choose a suitable forex broker with features aligning with your trading requirements. Besides conducting research, you can compare our recommendations above by considering the elements we will share below. Also, confirm a broker’s terms and conditions and install its app on your mobile device to always track your activities even while on the move.

Once you have selected your best forex broker, click on any of the links we have shared on this page to quickly access its website and begin the account registration. On the site, click the “Register” or “Sign Up” button to begin this procedure. Most brokers will require you to share your personal details, including your name, email, phone number, location, and more. Remember, an account verification procedure is awaiting, so always provide accurate details to avoid inconveniences in the future.

With your personal details accepted, you are not off the hook yet. This is because most SEBI-regulated forex brokers in India will require you to verify your details to fully activate your account. This is a standard procedure set by the financial authority to ensure the Indian financial space is secure for users and free from imposters. Therefore, you will upload copies of your documents, such as your ID card or passport, for identity verification and a recent utility bill or bank statement to verify your location.

It might take up to 48 hours for your trading account to be fully activated, after which your broker will send an email notification. At this point, you can make a deposit per the broker’s minimum deposit requirement. The good news is that most SEBI-regulated forex brokers in India, including our recommended ones above, accept payments via multiple options, whether credit/debit cards, e-wallets, or bank transfers.

Once your broker accepts your deposited funds, you will automatically be redirected to its platform where available currencies are listed. Feel free to choose your preferred currency pairs and create a solid strategy before opening a position. You should also consider implementing risk management controls such as stop-loss and take-profit orders to mitigate massive losses in case a trade doesn’t work out as planned. For beginners, take advantage of a broker’s demo account to be familiar with the currency market before you begin trading with real funds.

How to Choose the Right Forex Brokers in India

Trading forex in India with the right app will not only give you an exciting experience but will also increase your chances of executing profitable trades. Whether you research the best broker or choose from our recommendations list, below are the factors to consider to identify the best for your needs.

Verify a broker’s compliance with the Indian regulatory body, the Securities and Exchange Board of India (SEBI). Ensure it adheres to the legal framework, fostering a secure and trustworthy trading environment. Remember, there are numerous fraudsters in the Indian market, and you do not want to fall victim to them and lose your hard-earned money.

Explore the diversity of account types offered by a forex broker in India. Assess whether the broker caters to varying trading styles, risk appetites, and initial investment levels. The flexibility in account options is vital for a personalised approach. For instance, you can choose to trade forex with a demo account or live account.

Check the broker’s fee structure, including spreads, commissions, and additional charges. Transparent and competitive pricing is crucial to any forex trader. Therefore, understand how costs may impact your overall profitability and trading strategy.

Scrutinise the available trading platforms and tools. Evaluate features such as technical analysis resources, charting capabilities, and the speed of trade execution. A robust technological infrastructure is essential for effective trading strategies. For beginners, confirm the availability of learning resources to easily improve your skills as you explore the currency market.

Having a broker with reliable customer support is crucial when trading forex in India. For this reason, prioritise brokers offering responsive and reliable support teams via accessible channels like phone, email, and live chat. Accessibility, helpfulness, and timely issue resolution contribute significantly to a positive trading experience.

Leverage the collective wisdom of the trading community when selecting the best forex broker. Seek feedback from fellow traders and consult reputable review platforms, including Trustpilot, Google Play, and the App Store. Real-world experiences provide invaluable insights into the broker’s performance, reliability, and customer satisfaction.

India Forex Trading Strategies

The diverse landscape of forex trading in India calls for a nuanced approach, and understanding various strategies can significantly impact your success in the market. Here is a closer look at some prominent trading strategies.

- Scalping

Scalping is a forex trading strategy characterised by making small profits through numerous trades. This approach involves setting entry and exit positions with minimal changes in currencies, aiming for low margins. Note that precise execution is paramount for success in scalping, which typically lasts between 1 and 60 minutes. The strategy relies heavily on being well-informed about currency trends, and traders employing this strategy often capitalise on minor price fluctuations, making quick decisions to optimise their trading positions.

- Day trading

Day trading in the Indian forex market involves executing trades within a single trading day to capitalise on intraday price fluctuations. This strategy requires time dedication, rapid decision-making, and a thorough understanding of market dynamics. Day traders aim to profit from short-term market movements and typically close positions before the trading day ends.

- Swing trading

Swing trading is a strategy that capitalises on short to medium-term price “swings” or trends. Traders employing this approach hold positions for a few days to weeks. Successful swing trading relies on technical analysis to catch price momentum within established trends. Traders often use various technical indicators and chart patterns to identify potential entry and exit points.

- Position trading

Position trading adopts a long-term approach, with traders holding positions for weeks, months, or even years to benefit from major market trends. This strategy requires a comprehensive understanding of macroeconomic factors, and traders take a less active role in day-to-day trading activities. Position traders often base their decisions on fundamental analysis and broader economic trends.

- Range trading

Range trading involves exploiting price oscillations within a defined range by identifying support and resistance levels. Traders using this strategy exhibit patience and conduct meticulous analysis of price movements within a specific range. Success in range trading is often attributed to an ability to predict and capitalise on price fluctuations within the established range.

How are Forex Brokers Regulated in India?

In India, the regulation of forex brokers is a critical aspect of ensuring a secure and transparent trading environment. The regulatory framework is primarily overseen by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Here’s an insight into how forex brokers are regulated in India:

- Reserve Bank of India (RBI)

The RBI plays a pivotal role in overseeing the foreign exchange market in India. It regulates forex trading activities and ensures compliance with foreign exchange laws and regulations. The top forex brokers in India are required to adhere to RBI guidelines to maintain the integrity and stability of the currency market.

- Securities and Exchange Board of India (SEBI)

SEBI, as the apex regulatory body for securities markets in India, also has a significant role in overseeing certain aspects of forex trading. While SEBI primarily regulates the securities market, it collaborates with the RBI to maintain a comprehensive regulatory framework for forex brokers.

Overall, forex brokers operating in India must obtain specific licenses and authorisations from the above regulatory bodies. These licenses serve as an assurance of compliance with stringent regulatory standards, including financial stability, operational transparency, and customer protection. The brokers must also adhere to the regulations outlined in India’s Foreign Exchange Management Act (FEMA). This includes managing foreign exchange transactions, reporting requirements, and ensuring that all activities align with the provisions of FEMA.

To prevent illicit financial activities, Indian forex brokers must implement robust anti-money laundering (AML) and Know Your Customer (KYC) procedures. This involves thorough verification of their clients’ identities and financial backgrounds during the account registration procedures.

Conclusion

In choosing the best forex broker in India, you have taken a significant step, but success goes beyond the broker. Learn about the currency market, conduct in-depth analysis, and formulate solid trading strategies. Most importantly, implement robust risk management to mitigate potential losses and remain open to continuous learning. Remember, as technology shapes the forex market, staying ahead is crucial. Therefore, be proactive, adapt to changes, and strive for independence and success. Your broker is a tool; your knowledge and strategies are the keys to thriving in this dynamic financial landscape.

I’ve been trading forex for a while, and I found this article really informative. It’s great to see detailed comparisons of brokers for traders in India. Personally, I’ve used Interactive Brokers, and I agree it’s fantastic for professionals, but it can feel overwhelming for beginners. For anyone starting out, Spreadex or AvaTrade might be better options

I’ve been trading with FxPro for over 8 months now, and I have to say, the platform is super intuitive. Execution is fast and I’ve never had issues with withdrawals. It’s been perfect for building confidence as a part-time trader.