Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Thousands of Canadians are earning a living or substantiating their income with proceeds from forex trading. But thousands more are trying this venture and getting disappointed. What is causing this disparity, you may wonder? The answer includes many factors, starting with the involved brokers. Successful forex brokers trade with the best forex brokers in Canada.

By the best forex brokers, we refer to reputable service providers regulated by IIROC and other authorities in Canada and worldwide. We have listed these entities below after researching and comparing them with thousands of companies available in the Great White North.

List of the Best Forex Trading Platforms

- FP Markets – Best Forex Broker for MetaTrader Enthusiasts

- XTB – Best Forex Broker Canada for Advanced Traders

- Axi – Best With Multiple Trading Accounts

- Interactive Brokers – Best Broker for Institutional-Grade Forex Trading

- AvaTrade – Best Broker for Copy Trading and Automation Enthusiasts

- Saxo – Best Forex Broker for High-Net-Worth Individuals

Compare Canadian Forex Brokers

We used a very specific process to separate the best Canadian forex brokers from the pack. First, we checked every service provider’s regulatory status while prioritizing proper licensing and regulation. We always recommend forex brokers that are either licensed, regulated, or authorized by IIROC and other recognized authorities. Our experts will never expose readers to unregulated service providers.

After checking every broker’s licensing and regulatory status, our focus shifted to customer support and available trading software. Our experts vetted the availability of each company’s support team and researched/tested the trading software that each platform’s users have access to. Finally, we checked if the companies supported the most convenient payment methods and if they allowed new users and novices to start with demo accounts before diving into live trading.

The comparison table will help you see how the service providers we picked performed based on the factors discussed above.

| Best Forex Broker Canada | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| FP Markets | IIROC, FCA, ASIC, MAS, FSCA, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| XTB | IIROC, FCA, CySEC, FSC | 24/5 | xStation 5, xStation Mobile | Neteller, Credit/debit cards, Bank transfer, Skrill, PayPal | Yes |

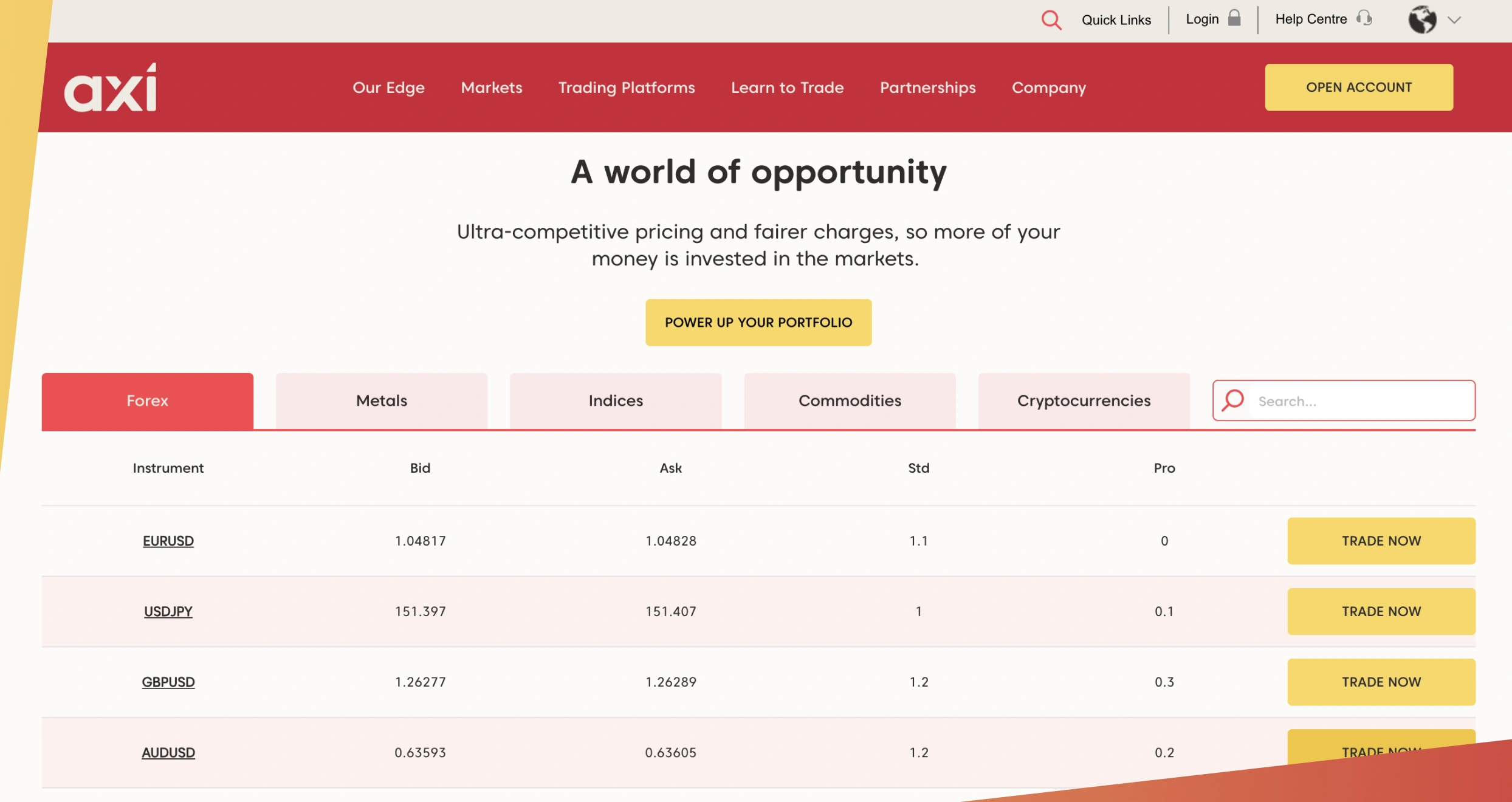

| Axi | FCA, CySEC, ASIC | 24/7 | MT4 | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer | Yes |

| Interactive Brokers | IIROC, FCM, SEC, FINRA, CFTC, NFA | 24/5 | Trader Workstation, IBKR Global Trader, IBKR Desktop/Mobile, IBKR APIs, IBKR ForecastTrader, IMPACT | Online banking, Wise, Online BPAY | Yes |

| AvaTrade | IIROC, FCA, ASIC, FSCA, CBI, CySEC, PFSA, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Saxo | IIROC, FSA, ASIC, FCA, IMA, MAS, SFC, JFSA | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank transfer, credit/debit cards, Quick payment | Yes |

Brokers Overview

We don’t want your trading experience to be ruined by either high costs or limited access to your favourite assets. For that reason, our experts went the extra mile and researched every forex broker’s fee and asset. The service providers we’ve picked have reasonable fees and offer most of the financial instruments preferred by Canadian forex brokers. Use the tables below to compare our recommended platform and isolate a broker that meets your preferences.

Fees

| Best Forex Broker Canada | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| FP Markets | C$100 | From 0.0 pips | Free | C$0 |

| XTB | C$0 | From 0.00008 pips | Free | C$10 |

| Axi | C$5 | From 0 pips* on Pro accounts | Free | C$10 monthly |

| Interactive Brokers | C$0 | From 0.1 pips | Free | C$0 |

| AvaTrade | C$100 | From 0.13 pips | Free | C$50 after every 3 consecutive months of inactivity |

| Saxo | C$0 | From 0.6 pips | Free | C$0 |

*Commission charges apply.

Assets

| Best Forex Broker Canada | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Axi | Yes | Yes | No | Yes | Yes | No | No |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Expert Opinions About the Best Forex Brokers

We learned a lot while researching and evaluating the best forex brokers in Canada. You’ll find some of our noteworthy findings below. That said, since there’s so much information regarding each of the recommended brokers and there’s only so much we could fit into a single guide, we strongly urge you to conduct independent research before signing up with any broker.

1. FP Markets – Best Forex Broker for MetaTrader Enthusiasts

FP Markets offers both MT4 and MT5 for Windows, WebTrader, Mac, iOS, and Android, making it the best broker for MetaTrader enthusiasts. The hosted MT4 platform comes with numerous excellent features, from customizable interface and one-click trading to Expert Advisors and live price streaming. You’ll find most of what’s MT4 on MT5, and then some, including expanded order types, extended timeframes, and a built-in economic calendar.

In addition to offering MT4 and MT5, FP Markets has super-tight spreads. Start trading popular pairs like USD/CAD, GBP/CAD, and AUD/USD and exploit low spreads from 0.0 pips. You’ll also get the opportunity to increase potential returns with up to 500:1 leverage. Over 70 currency pairs are provided on the platform, so finding your favorite instruments should be easy.

Forex pairs aren’t the only financial instruments available here. The broker offers over 10,000 CFDs on shares, commodities, indices, and metals. Moreover, its customers have access to a variety of trading tools, starting with the new TradeMedic. You can use it to generate hyper-personalized reports that will help you take your forex trading career to the next level.

Pros

- MT4, MT5 are available

- Powerful trading tools like TradeMedic and Autochartist

- Traders also have access to cTrader and TradingView

- Tight spreads from 0 pips

- Over 10,000 financial instruments

- No inactivity fees

Cons

- Most assets are CFDs

- Scanty educational materials for newbies

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

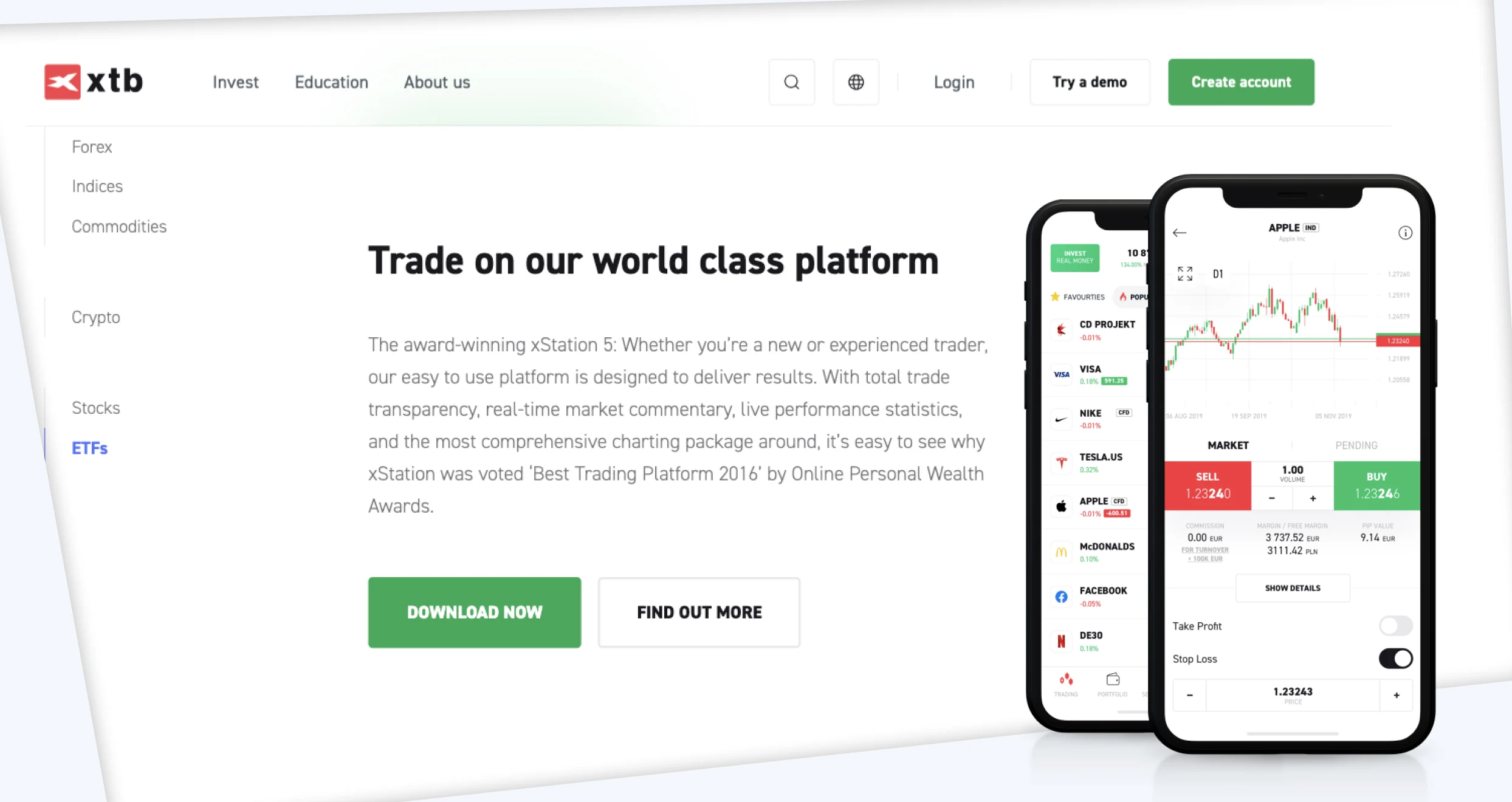

2. XTB – Best Forex Broker Canada for Advanced Traders

If you have extensive knowledge, skills, and experience, consider trading with XTB. The broker offers a powerful platform called xStation 5, which is equipped with multiple exceptional features, including 3 modules dubbed Chart Window, Market Watch, and Terminal.

Chart Window allows you to view, add, and deselect diverse analytical tools, including widgets and charts. It also comes with numerous unique tabs that give you a clearer picture of financial markets, like top movers, market news, and stock screeners. The second model is Market Watch, which allows you to open/manage trades, observe market prices/depth, and choose custom markets to watch. Last on the list is the Terminal module, where you manage open trades, cash operations, etc.

XTB has a comprehensive asset range that is ideal for advanced traders. 70+ forex pairs are available on the platform, with low spreads starting from 0.00008 pips. You can diversify your portfolio with thousands of different assets while trading currency pairs with this forex broker in Canada, including 3,000+ assets, 400+ ETFs, and 2,300+ CFDs on commodities and indices.

Also, as an advanced forex trader trading with XTB, you’ll have the chance to invest in shares from companies like Tesla and Apple for just C$10. The best part is that this broker’s customers enjoy up to 0% commission for monthly turnovers of up to C$100,000.

Pros

- Advanced trading tools and resources

- Thousands of tradable assets

- Investing in stocks and ETFs is supported

- No minimum deposit

- Tight spreads from 0.00008 pips

Cons

- Doesn’t host third-party platforms

- C$10 monthly inactivity fee

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

3. Axi – Best With Multiple Trading Accounts

It is important to find a forex broker that offers a trading account suitable for your skill level. At Axi, you do not need to worry, as it hosts multiple trading accounts for all types of traders. For instance, I traded on its demo account, which comes with C$50,000 virtual funds. I was able to explore the supported assets risk-free and test Axi’s performance before making a commitment.

Besides the demo account, Axi has a Standard account, which I find suitable for new retail traders. With commission-free trades and no minimum deposit requirement, simply sign up for a trading account using your personal details and make a deposit as low as C$5 to get started. The same applies to its Pro account, whereby you can start trading with as little as C$5. The only difference is that the Pro account charges commission and has advanced features for professional traders.

Last is the Elite account with a high minimum deposit requirement of C$25,000. Its fees are lower than those of the Standard and Pro accounts. It also has premium features, including exclusive market analysis, indicators and a complimentary MT4 Forex VPS hosting service. All these accounts offer access to over 70 currency pairs, copy trading, and high leverage limits of up to 1000:1.

Pros

- You can access the Standard and Pro accounts with as little as C$5

- Free deposits and withdrawals across multiple methods

- A user-friendly trading platform with fast trade execution speed

- Quality trading and learning material on all account types

- Compatible with the MT4 platform, which is perfect for forex trading

- Compatible with Expert Advisors

Cons

- You can only trade the supported assets as CFDs

- High account balance requirement on the Elite account

Promoted by AxiTrader Ltd. CFDs carry a high risk of investment loss. Not available to AU, NZ, EU & UK residents. Spreads and other fees apply.

The Axi Copy Trading App is provided in partnership with London & Eastern LLP.

The Axi Select program is only available to clients of AxiTrader Limited. In dealings with you, AxiTrader acts as a principal counterparty to all of your positions. AxiSelect is not available to residents of AU, NZ, EU, and the UK. For more information, please refer to the AxiSelect Terms of Service.

Demo accounts operate in a simulated market environment. Performance in a demo account may differ from your real trading account. Past performance is not indicative of future results.

4. Interactive Brokers – Best Broker for Institutional-Grade Forex Trading

Institutional-grade traders need forex brokers that offer robust infrastructure, exceptional execution technology, and excellent support for large-volume trades. That’s exactly what Interactive Brokers offers. Join this service provider, which is trusted by over 2.6 million individual and institutional-grade clients, for the best experiences.

As an institutional-grade trader, you’ll get access to Trader Workstation, a platform that’s engineered for the most active investors and traders. It gives you easy access to all the tools you need to thrive, from comprehensive trading tools to robust order management functionalities. While using this platform, you’ll receive uncapped real-time access to extensive research data and market news from veritable sources like Dow Jones and Reuters.

Furthermore, while using TWS, you’ll get access to 100+ algos and order types. These are designed to help you do everything, from leveraging the best prices and limiting risk exposure to exploiting speedy executions and simplifying the entire trading process.

IBKR serves diverse institutional-grade clients, from registered investment advisors, prop traders, and hedge funds to introducing brokers, small businesses, and family offices. You can access this broker’s services via the web, mobile, or desktop.

Pros

- Robust trading tools and infrastructure

- 10+ different institutional accounts are available

- Wide range of educational resources

- Low spreads and commissions

- No minimum deposit requirement

- No inactivity fees

Cons

- Only proprietary platforms are offered

- It can be overwhelming for novices

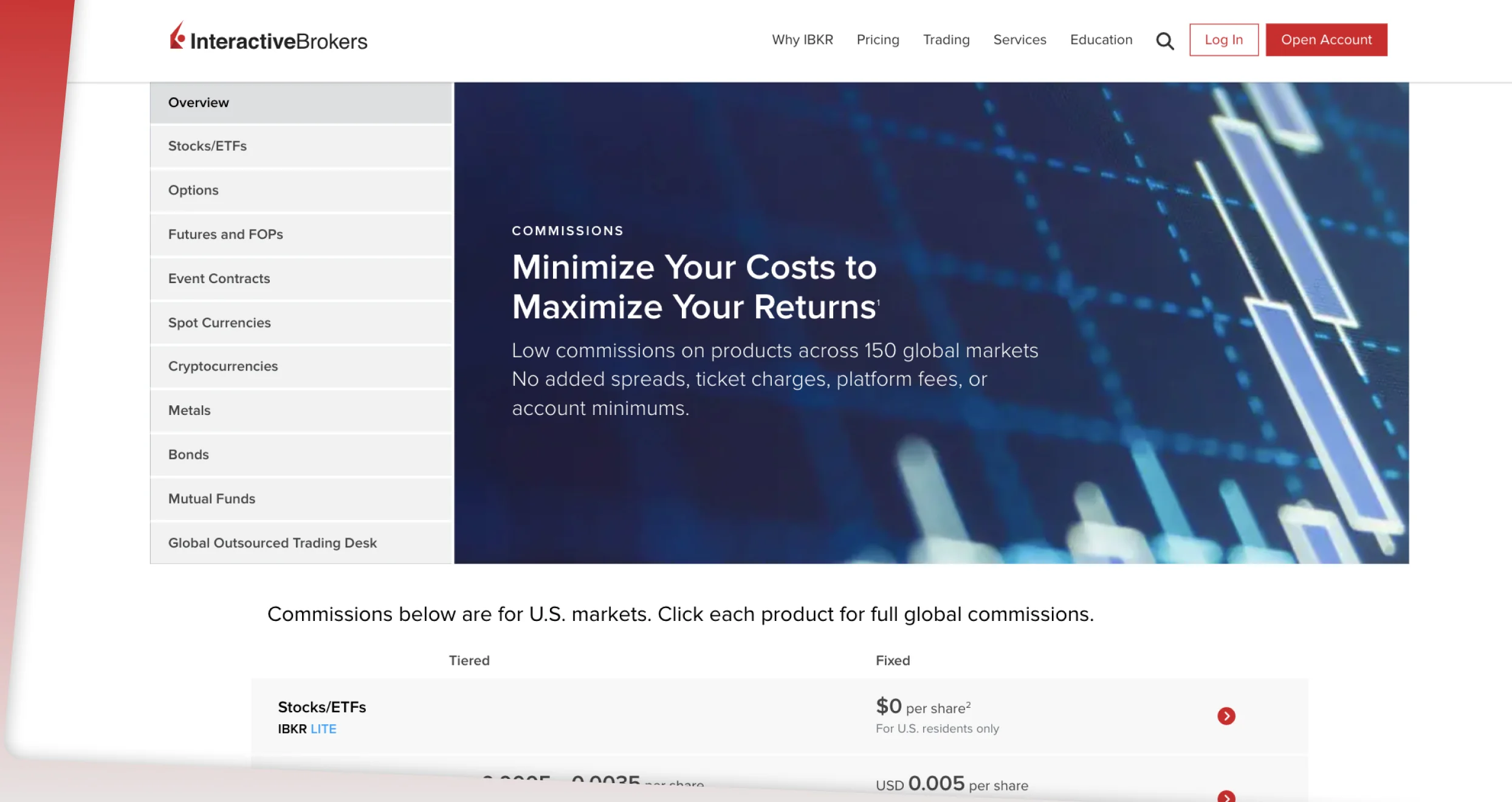

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

5. AvaTrade – Best Broker for Copy Trading and Automation Enthusiasts

AvaTrade is your one-stop shop for copy trading and automation features and functionalities. This broker offers AvaSocial, an app that allows forex enthusiasts to connect with peers, copy expert traders, and conquer the market. Novices can elevate their careers by learning from experts and replicating the strategies of profitable forex traders with this app.

This broker’s clients also have access to Duplitrade, a platform tailored to simplify automated trading. When using it, you’ll get ample opportunity to automatically duplicate expert traders’ actions directly into your forex trading account. This is the right solution for automated trading enthusiasts who prioritize having access to a rich portfolio and a vast selection of trading strategies developed by masterful forex traders.

Besides Duplitrade and AvaSocial, AvaTrade users have access to MT4 and MT5. You can use these powerful solutions to trade over 60 currency pairs while diversifying your portfolio with additional instruments like CFDs on stock, cryptocurrencies, and commodities. If you have yet to master trading and its intricacies, AvaTrade’s free online academy has lessons and courses that will help you elevate your knowledge and gain crucial skills.

Pros

- Robust automation and copy trading features

- Simple, user-friendly interface

- MT4 and MT5 are available

- A whole universe of educational resources

- Top-shelf customer support

Cons

- Limited product selection

- High inactivity fees

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

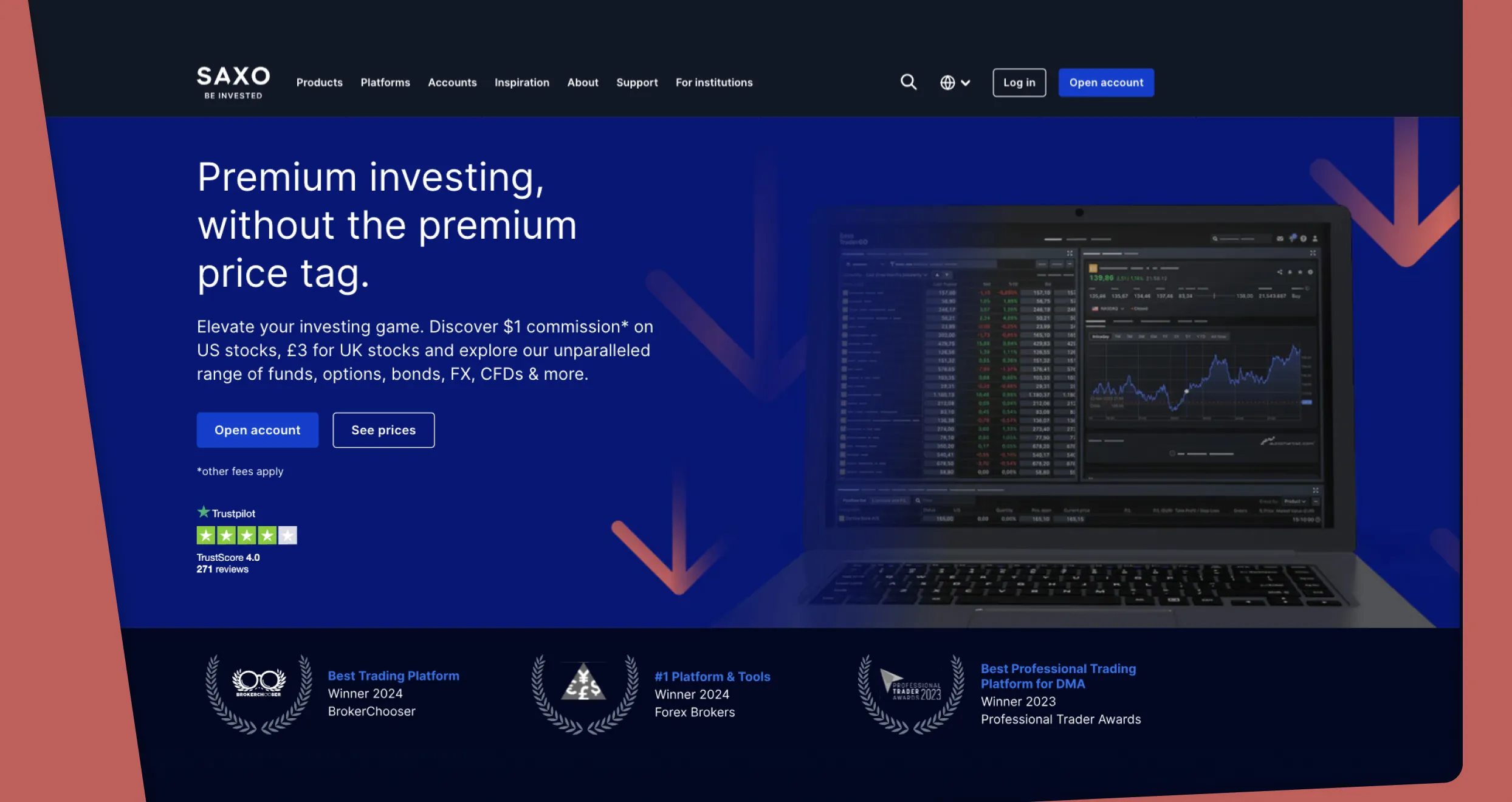

6. Saxo – Best Forex Broker for High-Net-Worth Individuals

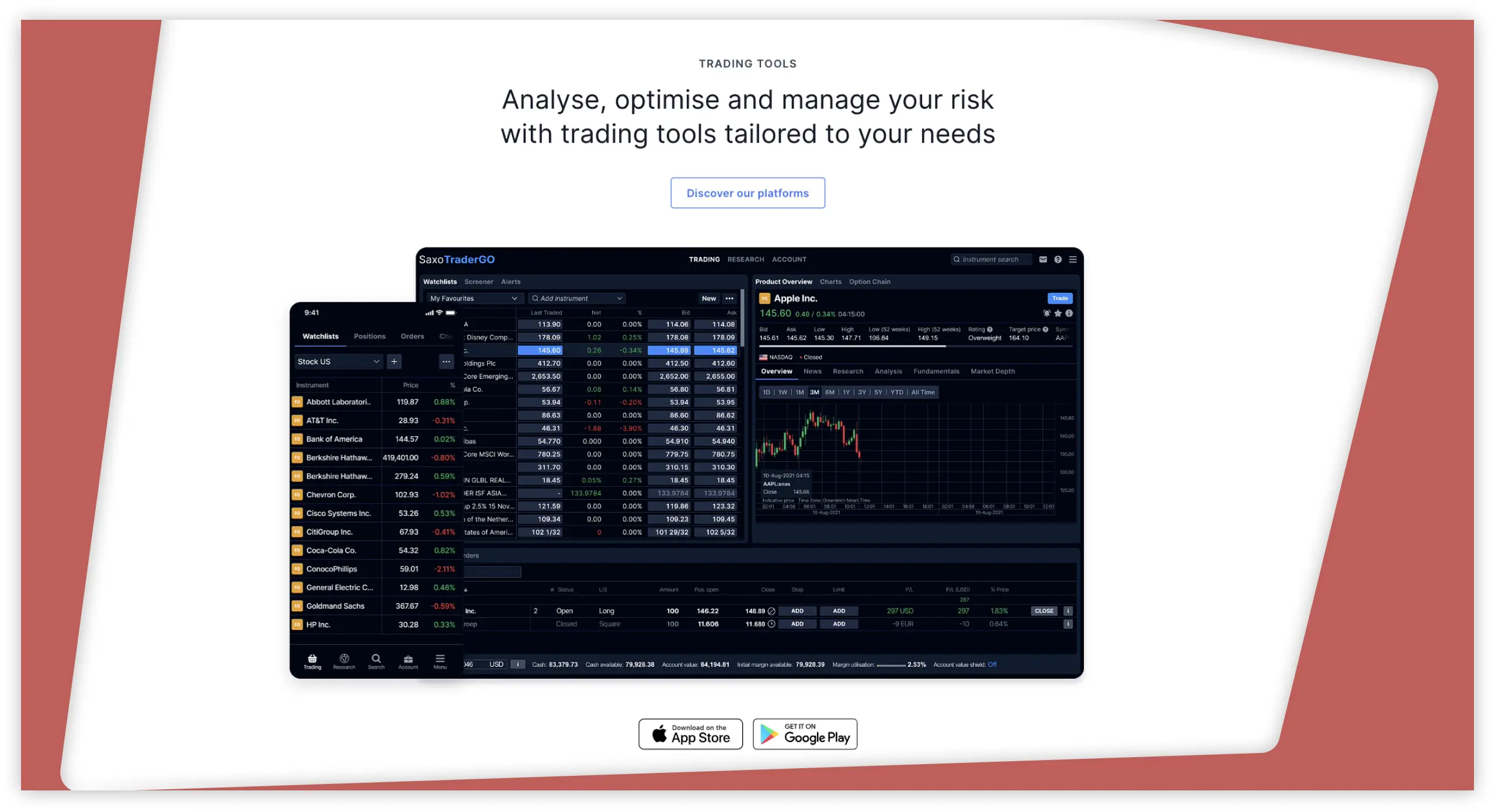

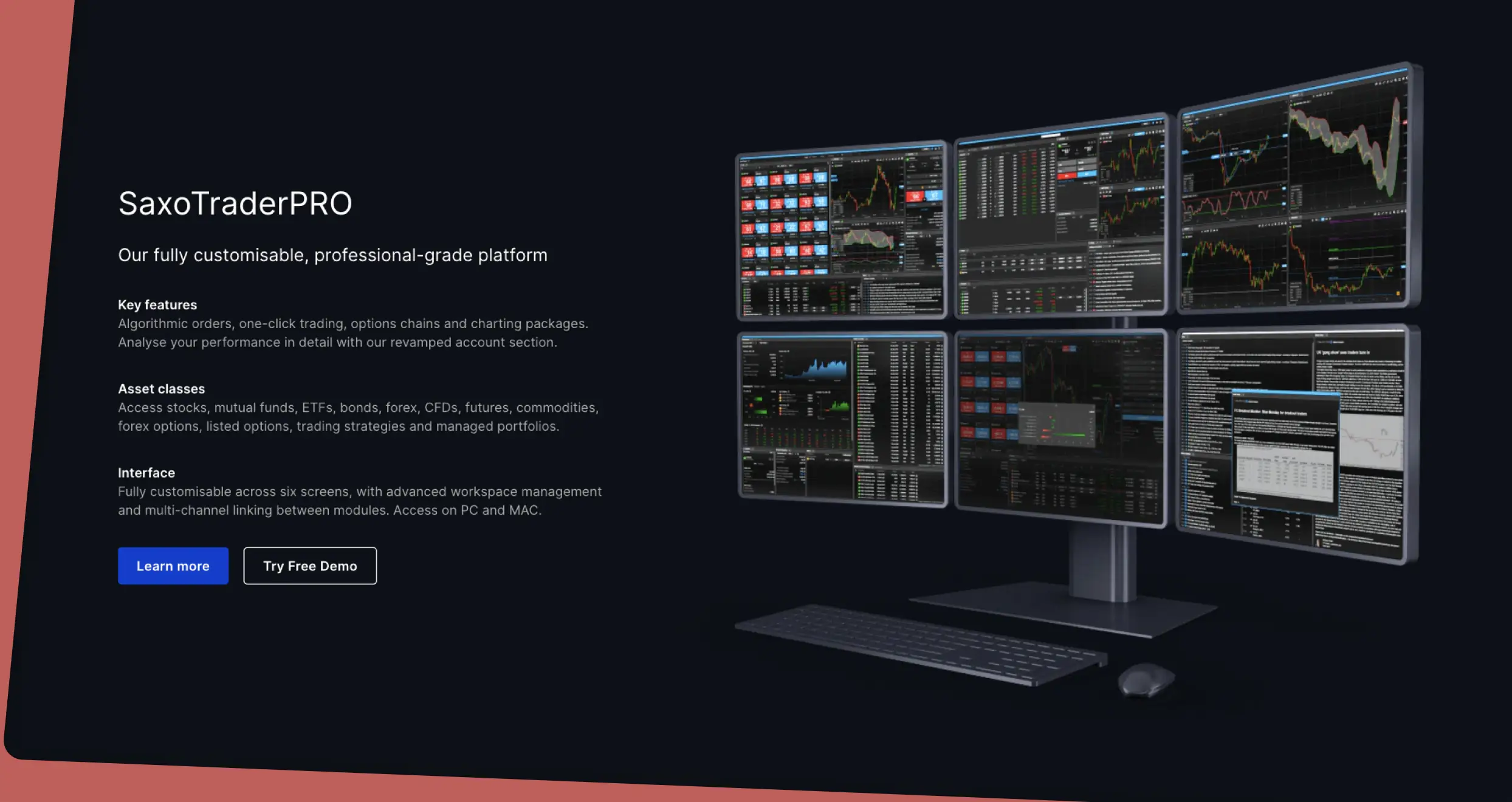

Saxo is the best forex broker for high-net-worth traders. Here, you’ll find two premium platforms that will help you trade seamlessly: SaxoTraderGo and SaxoTraderPRO. SaxoTraderGo is an award-winning mobile trading app that comes with a user-friendly interface, robust analysis tools, and advanced technical analysis tools. The other one, SaxoTraderPRO, is the one that’s better suited to high-net worth traders.

SaxoTraderPRO is a fully customizable, professional trading platform with a bunch of superior tools and features. They range from an advanced trade ticket, which is designed to facilitate optimum speed and productivity, to Depth Trader, a functionality that lets you place and manage real-time orders in relation to the Level 2 order book.

Avoiding catastrophic losses won’t be an issue when trading with SaxoTraderPRO. The platform offers a broad variety of innovative risk-management features, including stop orders, which help you protect your positions from adverse market moves, to account shield, which is designed to protect your entire account value from crippling losses.

Besides the trading platforms we’ve mentioned, Saxo users can invest in diverse assets with SaxoInvestor. With this platform, you research, buy, and manage stocks, bonds, ETFs, and mutual funds from your PC, mobile phone, or tablet.

Pros

- SaxoTraderPRO has a vast arsenal of powerful functionalities

- High-net traders can invest in stocks, ETFs, etc., with SaxoInvestor

- No minimum deposit requirement

- VIP customers get better prices, priority support, and other premium perks

- Tens of thousands of tradable assets are available

- No inactivity fees

Cons

- No third-party trading software

- Steeper spreads and commissions for low-volume traders

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

Forex Trading in Canada

Every Canadian aged 18 and above is free to trade forex in Canada without risking any legal repercussions. This activity is legal and highly regulated in this country. IIROC is the primary authority charged with regulating forex brokers and trading activities in the region. That said, each province in Canada has a specific commission that imposes additional supervision and rules, with good examples ranging from the Ontario Securities Commission to the British Columbia Securities Commission.

While trading with a regulated broker in Canada, your proceeds will be subject to taxation. Your returns may be considered capital gains if you engage in occasional trading or business income if this is your primary source of income or if you trade frequently.

How to Choose the Right Forex Broker

We’ve recommended 5 forex brokers in our guide. However, thousands of companies in Canada offer the same services. The only thing we did was assess the available service providers and pick the undisputed pack leaders. That aside, we urge you to consider the following factors whenever you’re searching for the best brand to trade forex in Canada:

Trustworthy forex brokers adhere to strict rules set by IIROC, provincial authorities, and respected international bodies like the FCA. Always trade with regulated brokers because they offer uncompromised investor protection and follow strict capital adequacy and transparency standards. And if you want to be safe from solvency-related complications, trade with a broker registered with CIPF.

Since you’re after the boons of forex trading, you must sign up with a broker with a reasonable selection of currency pairs, especially your favourite instruments. But your entire portfolio can’t consist of forex pairs only. You need to diversify with other assets to avoid exposing your capital to immense losses. With that in mind, signing up with a broker that offers diverse financial instruments is healthy for your career.

Before signing up, check if your chosen broker’s minimum deposit requirements are at par with your budget limitations. If you’re working with minimal finances, go with a service provider that allows new sign-ups to start trading with a small amount, like $1. Also, to avoid hemorrhaging most of your returns, check if your chosen provider’s fees and costs are reasonable before committing.

Brokers have different proprietary platforms. Moreover, some companies also host third-party trading software. Choose a forex broker with platforms that align with your needs and trading style, both proprietary and third-party. In addition, ensure the provided tools match your trading level and expectations.

If you are at the earliest stages of your forex trading career, find a broker with simplified learning materials that cover basic topics like how to trade and minimize risk exposure. If you are a pro, commit to a service provider that offers advanced educational resources guaranteed to keep you updated on market changes and refine your skills and strategies.

Trading with a broker with reliable support is a key ingredient to success. Before signing up, check if your chosen service provider has support channels that are convenient and accessible to you. You should also test the support team’s responsiveness using your preferred channel.

How to Register an Account With a Forex Broker

Finding a reputable forex broker is one part of the equation. To trade the markets, you need a live trading account. You can easily open one through these steps:

Your chosen broker’s official site is the safest place to sign up or find links to dedicated apps. That is why we encourage you to visit it before taking any other steps. When you get there, don’t focus on signing up alone; look around. You might come across crucial information you were unaware of.

To register, click the sign-up button on the site or the mobile app. Fill out the forms that will pop up with the correct information, from your full legal name and residential address to your contact information and employment details. Faking anything at this point is an ill-advised move since the broker’s team will verify everything using your documents, which brings us to the next step.

Regulated Canadian forex brokers are KYC-compliant. So, prepare to provide copies of documents that will help your chosen service provider prove your identity, such as a copy of your ID card. For quick results, share legible, clear documents.

Some forex brokers support instant account verification, while others require signees to wait a couple of hours. Either way, once verification is complete, fund your trading account. The amount you can deposit the first time will depend on the company’s minimum deposit requirement and the capital at your disposal.

If, by any chance, you’ve done everything, including funding your account, without testing yourself in demo mode, don’t do anything else. Open a trial account and gauge your readiness to trade forex. Then go back to your live account, choose your first currency pair, and let loose. Don’t forget to hedge with multiple instruments.

Final Thoughts

Forex trading can either be a goldmine or a landmine, depending on the broker you’re trading with. A good broker offers everything you need to thrive, from uncompromised security and privacy to access to diverse markets, powerful tools, and competitive pricing. On the other hand, an unreliable service provider is likely to undermine your experience with countless issues, like slow execution and limited market access.

Choose one of the excellent brokers we’ve recommended here to enjoy unmatched forex trading experiences and succeed in the long run. But remember that your broker won’t do everything for you. A larger percentage of your odds of success will depend on your understanding of financial markets and adeptness at risk management. That is why you need to seek education and prioritize proper risk management whenever you’re trading online.

I've personally tried FP Markets and XTB, and I love their low spreads