Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

I believe in AI’s amazing potential, especially where trading is involved. I’ve been harnessing the power of AI-powered trading software for a while now, and the results are something I can brag about. Since I switched to AI stock trading platforms, my profits have skyrocketed by an impressive margin. I’d like you to enjoy the same.

Today, I will introduce you to 5 AI-powered platforms that will change your trading career for the better. I’ve tested and used all of them, so my recommendations are based on firsthand experience. I used several factors, including licensing status, online reputation, and customer service quality, to weed out inferior solutions and identify the best tools.

Use my findings and tips to find the best AI tool for stock market India.

List of the Best AI Tools for Stock Trading

- Pepperstone – Best for Fast, Low-Cost Trading

- FP Markets – Best for Traders Who Need an All-in-One Trading Hub

- AvaTrade – Best for AI Trading Newbies

- Interactive Brokers – Best for Asset Variety

- FxPro – Best for Experienced Traders

Compare Tools Table

I know that picking the right trading tool can be easier when you have a rough idea of what to expect from each option. That is why I’ve decided to open with a brief comparison table of the best AI tools for stock trading in India before diving into detailed reviews. The table focuses on the most crucial elements that every stock trader should consider when picking the best AI tools to trade with, from licensing to money insurance.

| AI Tools in India | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Pepperstone | SEBI, ASIC, CMA, FCA, DFSA, CySEC, SCB, BaFin | $0 | From 0.0 pips | 24/5 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView,cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | No |

| FP Markets | SEBI, IIROC, FCA, ASIC, MAS, FSCA, CMA, CySEC, FSA | $100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | No |

| AvaTrade | SEBI, ASIC, MiFID, FSA, FSC, FSA, FFAJ | $100 | From 0.13% | 24/5 | MetaTrader 4, MetaTrader 5, AvaOptions, AvaTrade App, AvaSocial, DupliTrade, ZuluTrade | Credit/debit cards, E-payments, Wire transfer | Yes | No |

| Interactive Brokers | SEBI, FCM, SEC, FINRA, CFTC, NFA | $0 | From 0.1 pips | 24/5 | Trader Workstation, IBKR Global Trader, IBKR Desktop/Mobile, IBKR APIs, IBKR ForecastTrader, IMPACT | Bank wire, Direct ACH transfer, Bank account, WISE, Online Bill Pay, Check | Yes | Yes |

| FxPro | SEBI, FCA, CySEC, FSCA, SCB, FSA | $100 | From 0 pips | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | No |

Software Reviews

I’ve helped compare the best AI-based stock trading Indian tools, but the information I’ve shared isn’t enough to help you make informed decisions. You need to know more, including each service provider’s strengths and drawbacks. The reviews I’ve shared below will cover that end. I’ve focused on crucial information that I uncovered while testing and gauging each trading tool.

1. Pepperstone – Best for Fast, Low-Cost Trading

In terms of fast, low-cost trading, Pepperstone is the leader. The first thing I noticed while evaluating this software is that its users enjoy super-fast execution, with most orders executed in less than 30 milliseconds. The provider also takes pride in its ability to facilitate zero requotes or partial executions on market orders.

Cost efficiency is another factor that made me fall in love with Pepperstone. Transaction fees won’t compromise your profits since this software supports free deposits and withdrawals. Neither will high spreads and commissions give you sleepless nights. While trading share CFDs, you’ll enjoy commissions as low as 0.07% per side. You can also diversify with assets like FX pairs and leverage sharp spreads starting from 0.0 pips.

While testing Pepperstone, my experience was made more enjoyable by the impressive array of platforms offered by this service provider. I had the chance to try out everything from MT4, MT5, and TradingView to cTrader and Pepperstone’s web and mobile platforms. Finding the right platform will be easy when you trade with this broker.

Pros

- Super-fast execution speed

- Tight spreads and commissions

- Diverse platforms, including MT4, MT5, and cTrader

- No minimum deposit requirement

- No inactivity fee

Cons

- CFDs are the main offer

- Limited tradable assets compared to its peers

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. FP Markets – Best for Traders Who Need an All-in-One Trading Hub

In my opinion, FP Markets is the best AI trading software for traders who need a well-rounded, all-in-one trading hub. Get it today and secure your access to thousands of tradable securities. You’ll get the chance to trade CFDs on over 10,000 shares and stocks from diverse global markets, from Paris and London to New York and Hong Kong.

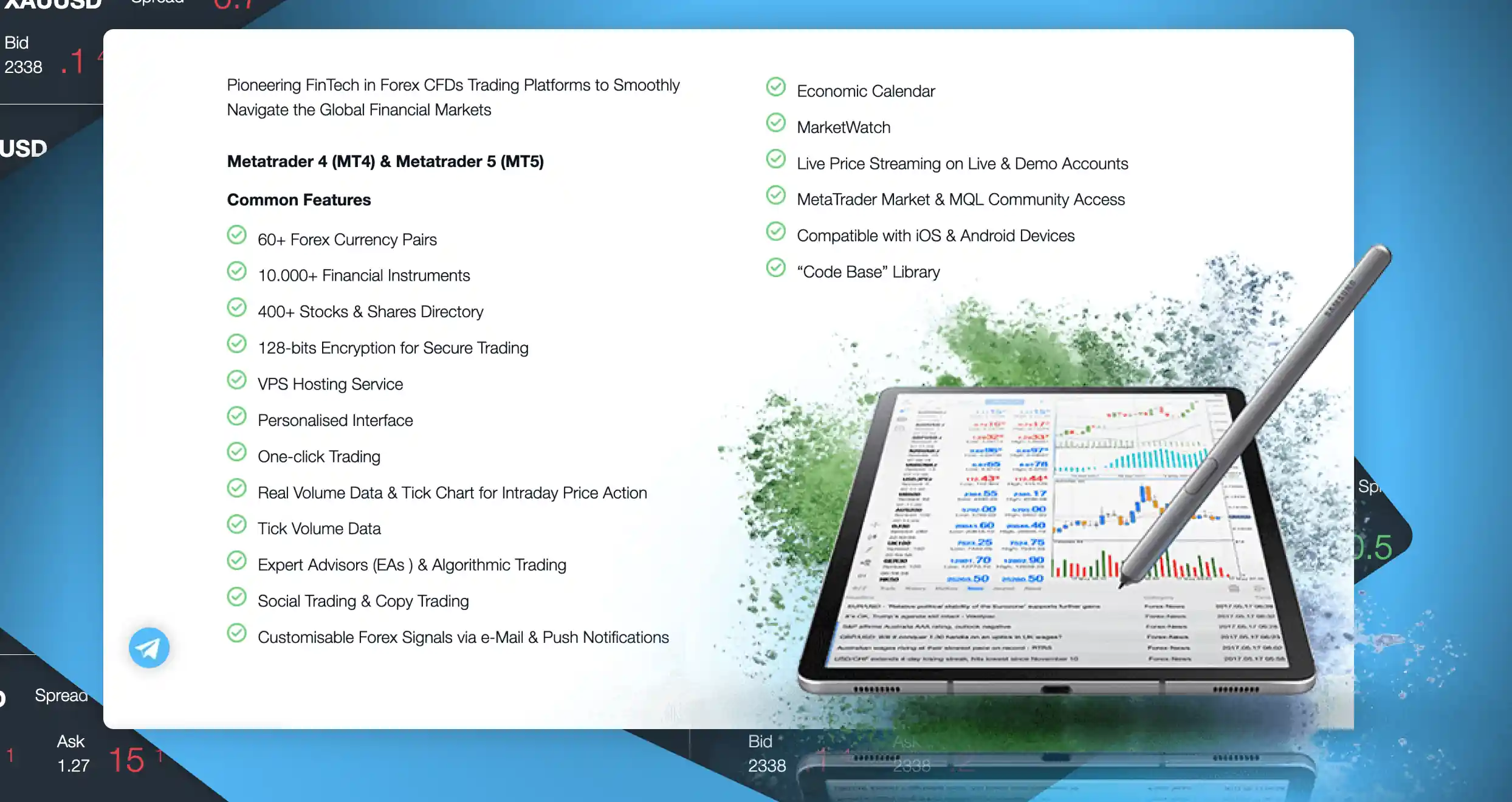

FP Markets offers 3 exceptional platforms for trading stocks and shares: Iress, MT4, and MT5. Iress comes with DMA shares and stocks CFDs. If you want uncapped access to this broker’s 10,000+ stock and share CFDs, Iress is the platform to use. On the other hand, if you are a MetaTrader enthusiast, you can choose MT4 or MT5 and get the chance to trade over 1,000 shares and stock CFDs.

I discovered many other assets offered on FP Markets besides CFDs on stocks and shares, including forex pairs, commodities, and ETFs. What I like most about this service provider is that its spreads start at a measly 0.0, and traders can maximize potential profits with up to 500:1 leverage. Plus, the company offers 24/7 support, guaranteeing prompt, professional assistance and issue resolution.

Pros

- 10,000+ stocks and share CFDs

- Thousands of instruments for diversification

- 24/7 support

- Spreads starting from 0.0 pips

- Robust platforms like MT4 and MT5

- No inactivity fee

Cons

- Iress minimum deposit is $1000

- Focuses on CFDs

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

3. AvaTrade – Best for AI Trading Newbies

Every seasoned AI trader was once a newbie, including yours truly. I understand the complexities and challenges that noobs face and how discouraging they can be. I’m also familiar with the risks that newbies face when trading with AI-powered software, from overreliance on automated tools to poor risk management. To avoid such issues, I urge all beginners to use the resources offered by AvaTrade to hone their skills and knowledge.

One of AvaTrade’s resources you can use to transition to a better trader and mitigate risk exposure is AvaAcademy. If you know little to nothing about AI stock trading, start there. The platform’s courses, quizzes, and lessons will help you master the fundamentals and gain indispensable knowledge. Don’t trade with insufficient knowledge because it’s one of the reasons why 95% of traders fail.

Once you acquire sufficient knowledge, trading will be a breeze. AvaTrade has a clean, easy-to-navigate interface, so you won’t be overwhelmed by unnecessary clutter and complex features. But don’t dive into live trading directly; use a demo account to take your skills to the next level. While doing so, you can use AvaTrade’s copy trading features to make a few bucks.

Pros

- Exceptional educational resources

- Clean, newbie-friendly user interface

- Supports copy trading

- Beginners get to practice with AI

- Helpful support agents

Cons

- High inactivity fees

- Fewer financial instruments

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

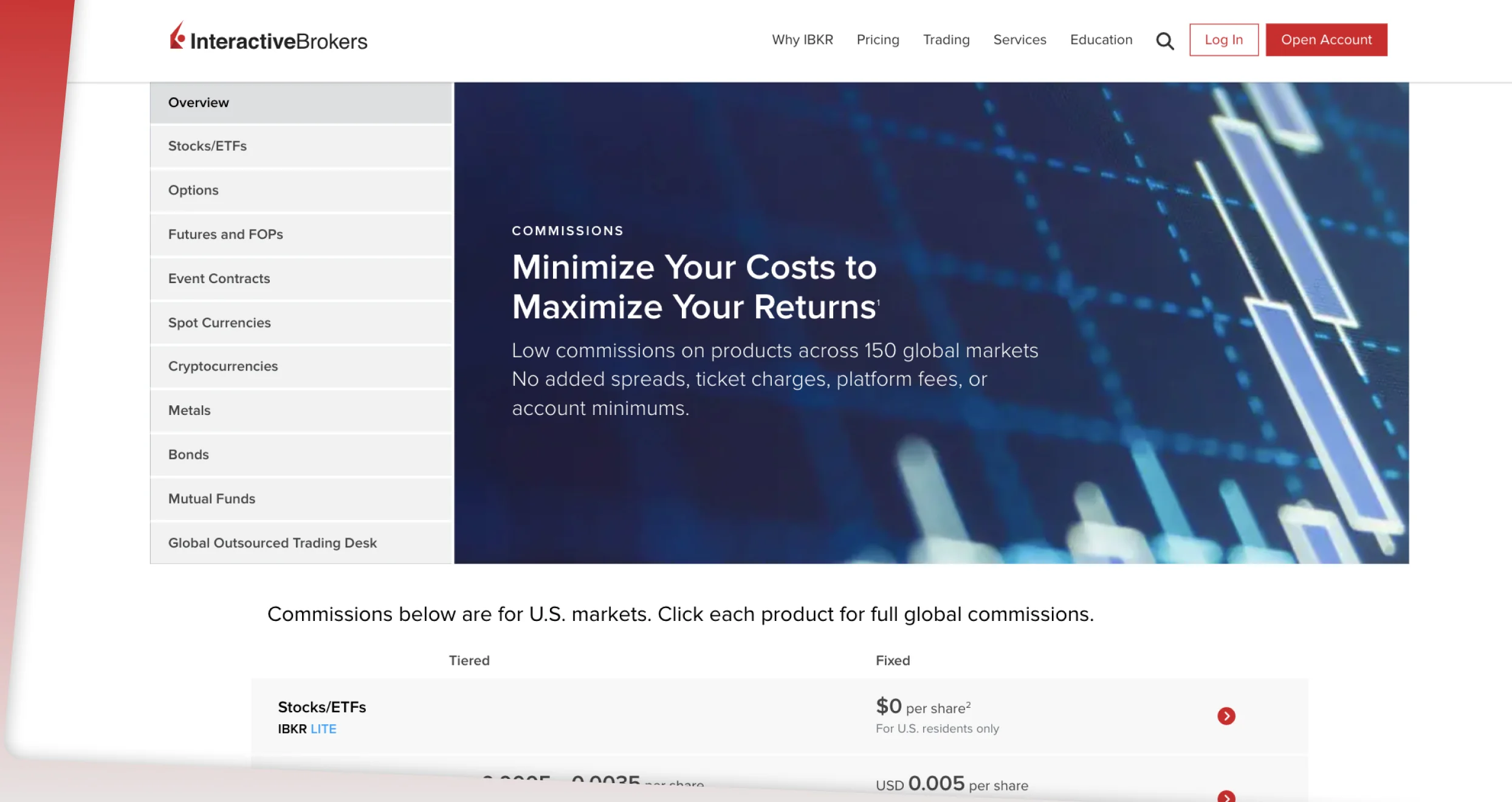

4. Interactive Brokers – Best for Asset Variety

Several aspects caught my eye while I was evaluating Interactive Brokers, starting with asset variety. As a stocks enthusiast, this software offers you the golden opportunity to trade stocks from varied regions, including APAC and EMEA. While trading your favorite stocks with this provider, you’ll enjoy commissions as low as $0.

Interactive Brokers helps traders mitigate losses through optimum portfolio diversification by providing many more assets besides stocks. I discovered everything from ETFs, futures, and options to spot currencies, bonds, and US spot gold while vetting this formidable provider.

The best part is that most available products are optimized to facilitate the lowest costs possible. For instance, bonds have no markups or built-in spreads, while ETFs have $0 commission, and the spreads for spot currencies are as low as 0.1 pips.

Assets aside, I was impressed by the IBKR Campus. This is a vast platform that has numerous essential elements for the modern trader, including an online trading academy. The academy’s courses and lessons are tailored to help you expand your trading knowledge base and get to the next level.

Pros

- No minimum deposit for new signees

- Competitive spreads and commissions

- Wide variety of instruments

- No inactivity fees

- Impressive range of educational resources

Cons

- The interface is not beginner-friendly

- Limited client support over the weekend.

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

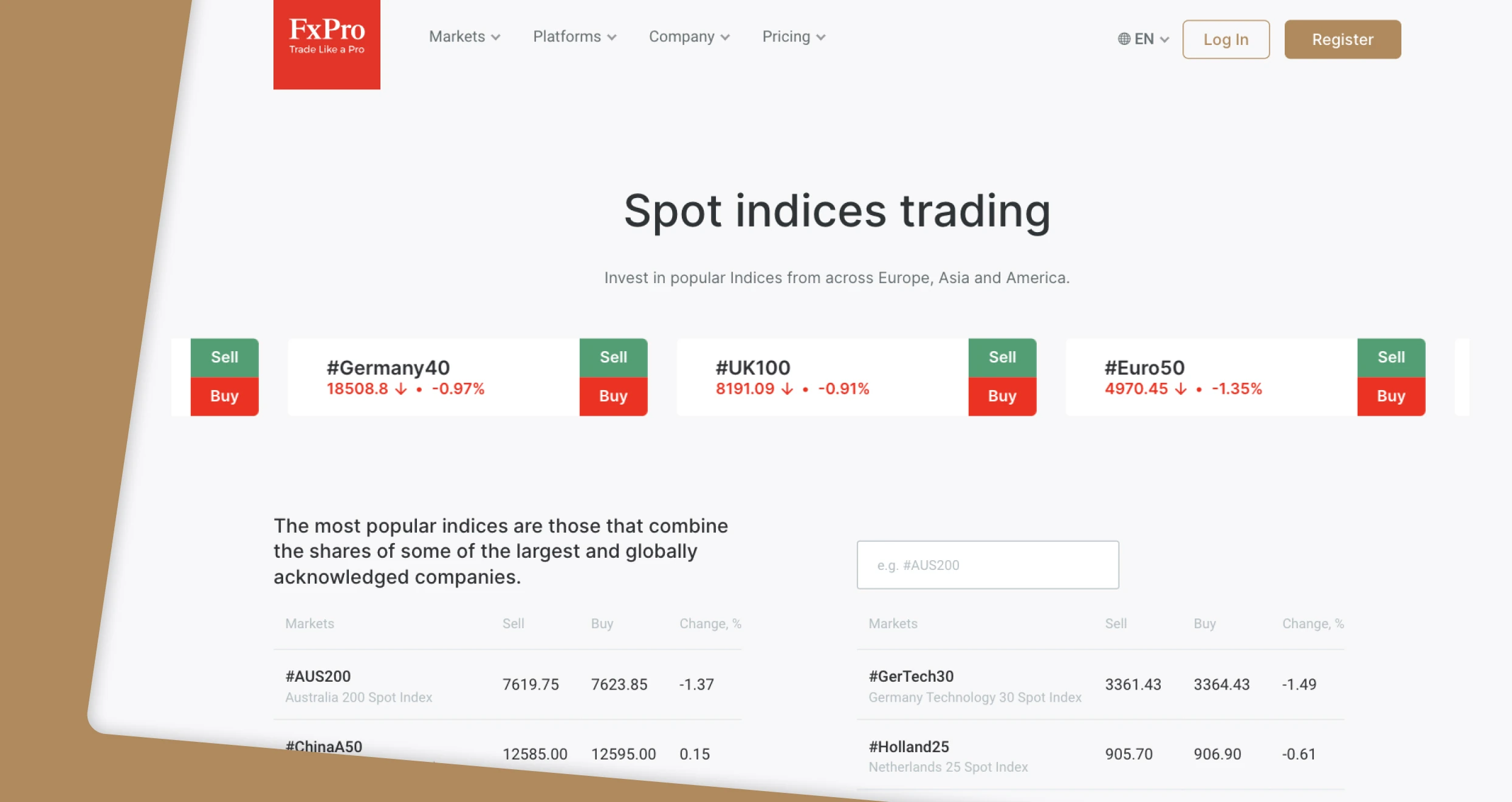

5. FxPro – Best for Experienced Traders

I strongly recommend FxPro to experienced traders and investors. If you are in this bracket, signing up with this service provider will put you in the best position to leverage the most powerful trading platforms today, including MT4, MT5, and cTrader. Not to forget, this broker has 2 top-notch proprietary trading platforms: FxPro WebTrader and FxPro Mobile App.

Additionally, FxPro gives experienced traders with adequate knowledge to pick and trade with accounts that are best suited to their needs.

If your top priorities are low spreads and ultra-fast execution, a Standard MT4/5 account will serve you well. On the other hand, if your strategy demands razor-sharp spreads, you can opt for a Raw+ MT4/5 account, which comes with as low as 0.0 pips. Finally, FxPro has an Elite account option that has all Raw+ features and additional boons like cash rebates starting from $1.50 per lot.

I also recommend FxPro because this software allows experienced users to create customized indicators and cBots. Such tools are indispensable since they fit your strategies and risk tolerance levels. Not to forget, FxPro users can minimize losses with a broad range of tools, from negative balance protection to limit and take-profit/ stop-loss orders.

Pros

- Excellent variety of platforms, including cTrader, MT4, and MT5

- Knowledgeable customer support team

- Tight spreads and commissions

- 2,100+ tradable instruments

- Powerful trading and risk management tools

- Simple user interface

Cons

- High inactivity fees

- Most assets are CFDs

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

How to Choose an AI Stock Trading Software

While searching for software to recommend, my colleagues and I encountered hundreds of AI stock trading platforms. However, most of these platforms had at least one noteworthy issue. For starters, some weren’t licensed, regulated, or authorized by any recognizable body, including SEBI. Others had a long history of unaddressed customer concerns and complaints, which is a major red flag.

But eventually, we found several exceptional AI tools for stock trading in India. Several factors helped us identify them, from regulatory compliance to track record. I urge you to use these factors to vet each service provider whenever you are looking for reliable trading software.

Here’s a brief breakdown of said factors:

This one is big. A good service should have verifiable licenses from SEBI, FSA, CySEC, and other reputable authorities. Otherwise, it won’t adhere to ethical trading and investor protection practices. If you can’t find proof of licensing, check if the service provider is authorized or regulated by such respected authorities. Trading with an unlicensed or unregulated broker exposes you to significant risks, including theft of data and funds, so don’t do it.

Before using trading software, check what past and present clients are saying on review sites. Can you verify the platform’s claims regarding its past performance and success rates from the reviews? If not, keep searching for a reliable service provider. This is crucial since some brokers have a habit of overpromising and under delivering. Plus, others pay people for positive reviews. Look for honest reviews that don’t show signs of bias.

As an avid trader, my primary objective is making money. I know the same applies to you. Unfortunately, fees can eat away at your profits, leading to diminished returns. Avoid this issue by gauging every service provider’s fees before signing up. And remember that some companies have costs beyond the obvious; keep an eye out for hidden charges.

If you want to stay many steps ahead of cybercriminals, choose a platform with robust security protocols. First on the list is formidable data encryption, which is indispensable in protecting sensitive information like your bank account details from malicious entities. I also encourage trading with software that lets you level up your security with multi-factor authentication, which requires anyone logging into your account to provide key credentials like an OTP code or fingerprints.

Anything can go wrong while you’re trading. For instance, you may get logged out of your account and fail to get back in. Or you may initiate a withdrawal request only for your money to fail to reflect in your bank account. Such issues demand expert intervention from your broker’s support team. To ensure you always get quick assistance when you need it most, prioritize trading with a service provider that offers prompt support through convenient channels like live chat and phone.

I always seek a trading broker with my favorite financial assets for optimum convenience. Since you are interested in stock trading, ensure the AI you choose supports this activity. Furthermore, check if the range of other assets is vast enough to allow smooth diversification and risk mitigation. In addition to stocks, the best software should allow users to trade other securities, like forex pairs, digital currencies, and futures.

How We Test

The Invezty team always tests every platform before making recommendations. This ensures we lead our readers to service providers with unquestionable reliability and credibility. Rest assured that the information I share is authoritative, factual, and based on my own experience, not hearsay.

While testing each software solution recommended here, we focused on indispensable factors ranging from licensing and regulatory status to customer support responsiveness and platform security. As always, our objective is to ensure you are trading with nothing short of the most trustworthy and credible service providers.

Conclusion

AI trading tools can enhance your trading experience and career, and I have experienced these boons firsthand. But be warned: AI is just a tool, and it is NOT foolproof. You should never trust AI-powered software blindly. Monitor your trades regularly and apply risk management tools whenever your money is on the line.

AI trading can be a game-changer, but it's not a magic money machine. I've tested a few platforms myself—some are great for fast execution, others have solid tools, but fees and usability can make or break the experience