Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Unlike ordinary trading, automated trading doesn’t require your full attention and commitment. You can execute trades based on set conditions, guidelines, and restrictions using algorithms and programs. It’s as simple as crafting your trading strategy, defining your parameters, and letting the system work its magic.

While there’s no shortage of trading platforms in the UK, finding the best automated trading platforms can be challenging. Join us today as we delve into the best auto trading platforms in the UK, checking out what they offer, where they excel, where they fall short, and more. Let’s jump right in.

In a Nutshell

- Automated trading uses pre-configured algorithms to automatically execute trades precisely without human intervention.

- Finding the right auto trading platform is difficult but crucial to succeeding in automated or copy trading.

- We took it upon ourselves to comprehensively test several trading platforms in the UK and singled out 5 with exceptional automated trading capabilities.

- Our ranking criteria included factors like regulation, security, fees, and other crucial factors to determine the cream of the crop.

- Only automated trading platforms licensed by the FCA and similar regulatory authorities are worth your trust and investment.

List of the Best Automated Trading Platforms

- Pepperstone – Overall Best Automated Trading Platform

- eToro – UK’s Best Beginner-Friendly Automated Trading Platform

- AvaTrade – Best Low-Cost Automated Trading Platform

- IG Markets – Top Auto Trading Platform for Financial Instrument Selection

- FxPro – Best Automated Trading Platform for Advanced Traders

Compare Auto Trading Platforms

Contrary to popular thought, auto trading is not a niche feature reserved for institutional traders, scalpers, and social traders. Even beginners can set up automated trades and bring home the bacon.

However, reliable auto trading alone isn’t enough to make a worthy contender for the best auto trading platform in the UK. Proper must also be affordable, with proper licenses, reasonable fees, and multiple funding options. There’s also the question of whether the platform supports certain financial instruments and the reliability of their customer support.

In light of this, we evaluated these trading platforms based on aspects that offer the most value to trades. This involved testing the platforms firsthand and combing through dozens of reviews on Trustpilot, Google Play, and other sites to get the general public’s opinion about these platforms.

Our efforts culminated in the table below, summarising and comparing the key features of the UK’s best auto-trading platforms.

| Best Automated Trading Platform UK | Licence & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | MiFID, FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin, CySEC | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| eToro | MiFID, FCA, CySEC, FSCA, ASIC, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/7 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| AvaTrade | MiFID, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| IG Markets | FCA, BaFin, MiFID, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, METI, MAFF, ASIC, CFTC, FINRA, FSA, SIPC, NFA, BMA | 24/5 | MetaTrader 4, ProRealTime, L2 Dealer, IG tastytrade Platform, Online trading platforms, Mobile trading app | Bank transfer, Credit/Debit cards | Yes |

| FxPro | FCA, CySEC, FCSA, SCB, MiFID | 24/5 | MT4, MT5, FxPro Platform, cTrader | Bank transfer, Credit/Debit cards, PayPal, Skrill, Neteller | Yes |

Platforms Overview

Different platforms have varying pricing structures and costs for the services they offer. It’s a no-brainer that traders will opt for an affordable platform, especially with regard to transaction fees, commissions, spreads, etc. Sure, the difference in fees might seem insignificant, but over time, these costs can add up significantly and eat into your profits.

Fees aside, traders also look at what financial instruments are available to trade. Seasoned traders usually want a platform with multiple tradable assets. That way, they can diversify their portfolio to boost profitability across different markets and hedge against possible losses. Usually, the more trading instruments there are, the better the platform.

The tables below summarise how the best automated trading platforms in the UK stack up with respect to their fees and assets.

Fees

| Best Automated Trading Platform UK | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | £0 | From 0.0 pips | Free | £0 |

| eToro | £100 | From 0% | £5 withdrawal fee | £10 monthly |

| AvaTrade | £100 | From 0.13 pips | Free | £50 after every 3 consecutive months of inactivity |

| IG Markets | £0 | From 0.10 pips | Free | £12 per month after 24 consecutive months of inactivity |

| FxPro | £100 | £3.50 per lot | Free | £15 maintenance fee (one-off) and £5 monthly after 6 months of inactivity |

Assets

| Best Automated Trading Platform UK | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| IG Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | No | Yes | Yes | Yes | No |

Our Opinion about the Best Automated Trading Platforms

Many factors come into play when choosing the best automated trading platform in the UK. There’s no one-size-fits-all auto-trading platform that meets all users’ needs. This explains why some traders swear by specific platforms while others flatly reject them. The conflicting views have left many UK traders in limbo over what auto-trading platforms to settle for.

We understand how frustrating it can be rummaging through the multiple user reviews with opposing views. So, instead of relying on them, you can check out what our team of financial and technical experts has to say about the said platforms. Here are our professional opinions about the best automated trading platforms in the UK.

1. Pepperstone – Overall Best Automated Trading Platform

Pepperstone is the UK’s best automated trading platform. The platform is no stranger to experienced traders and enjoys a considerable following worldwide of about 400,000 users. Pepperstone takes the crown because of its range of platforms that support automated trading, including TradingView, MT4, MT5, and cTrader. All these platforms support over 1200 trading instruments and are compatible with both algorithm and copy trading.

Algo traders can code efficiently using MQL4 and MQL5 on MT4 and MT5, respectively. They can also use cTrader automated and code with C# on cTrader and Pine Script on TradingView. Copy traders, on the other hand, can utilise MQL5 Signal Service and Duplitrade to automatically copy trades to MetaTrader platforms and cTrader, respectively.

Considering its licenses from authoritative bodies like the FCA, Pepperstone is a trusted platform with a solid reputation among the trading community. It’s also among the most affordable platforms in the UK. Pepperstone doesn’t charge a minimum deposit and has spreads as low as 0.0. Moreover, the platform doesn’t charge an inactivity fee even after months of inactivity.

However, it’s worth noting that Pepperstone is far from perfect. While undoubtedly a titan in automated trading, it leaves much to be desired in terms of its educational material. Given how copy trading goes hand-in-hand with learning, this hurts the platform’s overall usefulness but isn’t enough to topple it from the top spot.

Pros

- Supports automated trading across multiple platforms

- Huge selection of tradable assets with over 1200 instruments at your disposal

- Less expensive in terms of spreads and commissions compared to its peers

- Multi-award-winning platform with a solid reputation in the trading community

- Regulation from top regulatory bodies in seven financial jurisdictions, including FCA, ASIC, and BaFiN

- Versatile platform compatible with numerous third-party integrations

Cons

- Limited educational materials compared to its competitors

- Razor account has lower spreads than the standard one

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – UK’s Best Beginner-Friendly Automated Trading Platform

Beginner traders can have a field day with automated trading. Automated trading allows newbies the luxury of hands-free investing by copying the trades of more advanced traders. eToro supports automated trading on its proprietary platform called CopyTrader. This platform allows beginners to copy the trades of more experienced traders effortlessly and increase their chances of profitability.

eToro has a clear, well-organized user interface that users can easily navigate and copy trades. Besides the straightforward interface, the platform provides a step-by-step guide for newbies to start their trading journey, including instructions on how to copy trades successfully. It also helps that eToro sits at par with some of the UK’s most affordable trading platforms, removing barriers for newcomers with little to invest in trading.

Furthermore, eToro enjoys a thriving community of traders where beginners can get in touch with and get inspiration from more experienced traders. It also has an excellent social trading feature where new traders can choose from a wide selection of traders from whom to copy their trades. Beginners can filter traders based on parameters like risk level and number of copiers.

We also vouch for eToro’s beginner friendliness, given its robust security measures to protect users’ funds. The platform uses 2FA and SSL encryption to ensure beginners can ensure a safe repository for users’ assets and personal information.

Pros

- Easy-to-use interface makes it ideal for beginners

- eToro has a large social trading community that creates a conducive environment for learning

- Wealth of educational materials and learning resources on eToro Academy

- Minimum deposit requirements are lower compared to some of its competitors

- Industry-leading security features for ultimate protection from hackers, like 2FA and SSL encryption

Cons

- Charges a £5 withdrawal fee

- Monthly inactivity fee of £10 after 24 consecutive months of dormancy

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. AvaTrade – Best Low-Cost Automated Trading Platform

Earlier, we discussed how the cost of trading is essential when picking an auto-trading platform. If you’re looking to save as much money as possible on your automated trading, then AvaTrade fits the bill perfectly. The platform has comparatively low spreads and commissions. It also doesn’t charge you for deposits and withdrawals.

Besides being pocket-friendly, AvaTrade is also a superb automated trading platform that allows auto trading via DupliTrade and AvaSocial. The latter is Avatrade’s proprietary social trading platform. It not only allows users to copy automated trades but is also a platform to connect with other traders and learn from AvaTrade’s growing community. Beginners can find mentors who can steer them on the road to trading proficiency.

AvaTrade also shines on security matters with 256-bit SSL encryption and an Embedded True-Site identity assurance seal, which verifies the site’s authenticity to new users. What’s more, the platform separates clients’ funds from its AvaTrade business funds and is a trusted platform with proper regulation.

Pros

- Affordable automated trading platform with low commissions and no deposit/withdrawal fees

- AvaSocial is a top-tier social trading platform ideal for beginners and expert traders looking to polish their skills.

- A seamless user interface allows smooth automated trading through DupliTrade and AvaSocial.

- Excellent platform for learning, complete with courses, tutorials, blog posts, etc.

- Loaded with advanced research tools to boost your automated trading

Cons

- High inactivity fees of £50 per month charged quarterly

- Unclear pricing structure

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

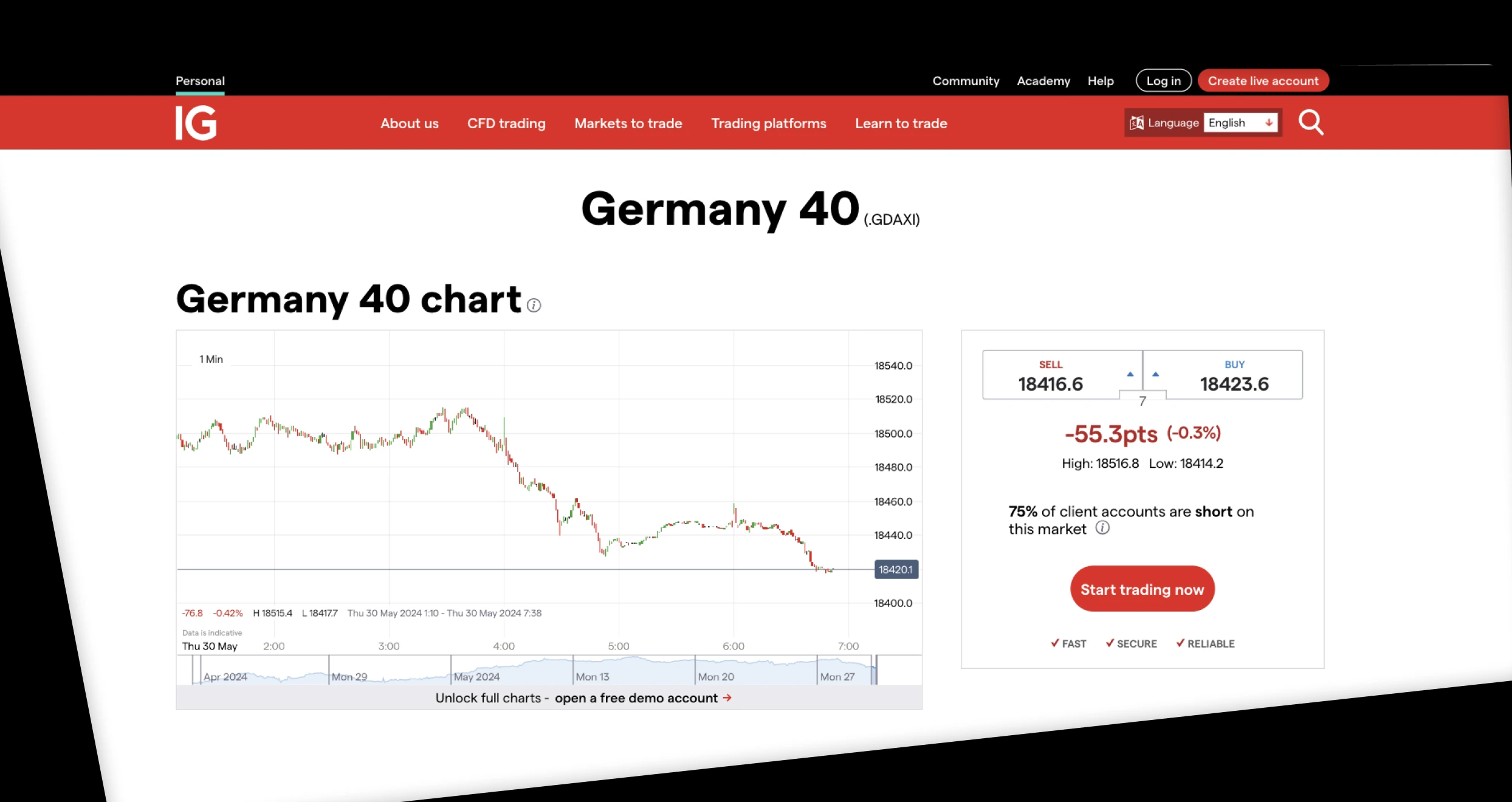

4. IG Markets – Top Auto Trading Platform for Financial Instrument Selection

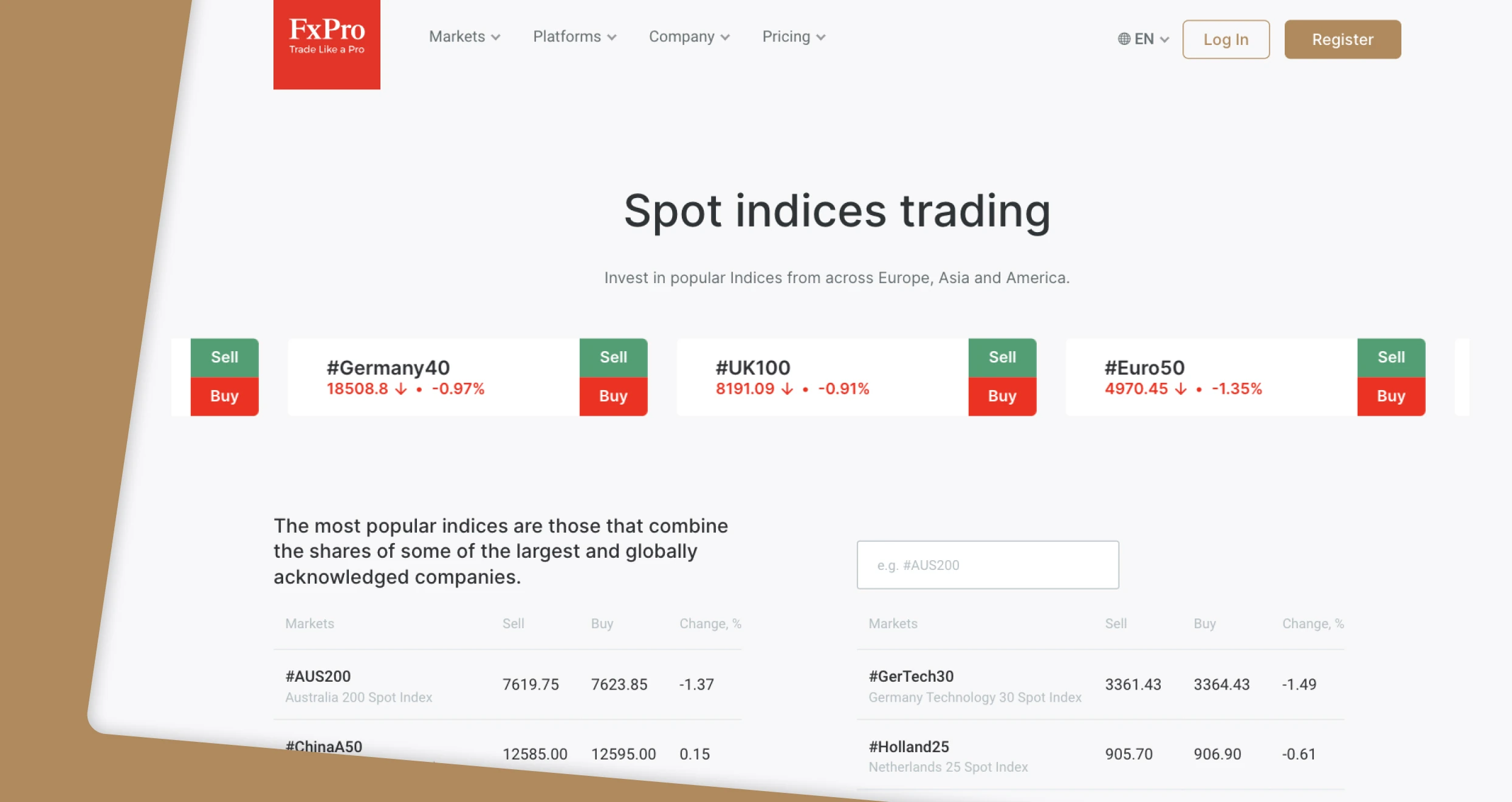

As mentioned earlier, a wide range of tradable assets gives traders more ways to expand and diversify their portfolios and more options for risk management. IG Markets has cemented its spot among the best auto-trading platforms due to its large selection of financial instruments.

The platform offers the whole crescendo of financial instruments. We’re talking about everything from stocks and forex to thematics and IPOs. It boasts over 19,000 trading assets from markets across the globe.

With IG Markets, you can automate your trades on two platforms, ProRealTime and MetaTrader 4, or use native APIs. ProRealTime offers a fully customisable experience and is great for experienced traders. MT4 is suited for beginners and experts alike, while native APIs are reserved for traders with a background in computer programming and can write their own codes.

New traders can also benefit immensely from IG Markets’s abundance of learning materials. IG Academy has everything beginners need to get up to speed with the key concepts and fine details of trading. The online courses are comprehensive and systematic, with interactive lessons and complementary videos and graphics to boost learning. Users can also join live seminars and webinars hosted by industry experts to gain knowledge and ask pressing questions.

Pros

- Tens of thousands of financial instruments to choose from

- No minimum deposit requirement

- No inactivity fee

- Zero deposit and withdrawal processing fee

- Top-tier support service

Cons

- Hosts limited third-party trading platforms

- Higher minimum spreads and commissions than its peers

IG Markets’ fees vary depending on the asset you are trading. The broker has come a long way and tries to accommodate both low-budget and high-budget traders. We noticed that the broker doesn’t have a minimum deposit requirement. This allows you to trade with any amount you can afford.

Regarding spreads and commissions, IG Markets imposes some of the lowest fees. For instance, you will explore the currency market with spreads from 0.6 pips. Major indices also attract spreads from 0.8 points and 0.1 points on commodities.

Unfortunately, IG Markets’ share trading fees are high compared to its counterparts. For instance, you will incur 2 cents per US share and 0.18% on Hong Kong shares. The good news is that the broker allows free deposits and withdrawals. Its inactivity fee of $12 monthly also applies after 24 consecutive months.

5. FxPro – Best Automated Trading Platform for Advanced Traders

Hitting your stride as a trader requires plenty of hard work and commitment. Once you reach an advanced level, you’ll need a platform that can handle the complex requirements of advanced trading. This means everything from advanced charting tools to extensive algo trading capabilities like Expert Advisors (EAs).

We found FxPro to be the best automated trading platform for advanced traders in the UK. Its extensive offering of trading platforms supporting automated trading makes it the top choice for high-level traders. FxPro offers automated trading through MetaTrader 4, MetaTrader 5, and cTrader. cTrader, for instance, has over 55 indicators that seasoned traders can use to make well-informed trading decisions.

Auto trading aside, FxPro has an intuitive interface that’s a breeze to navigate. It also provides high-quality and detailed in-house research and analysis of trading markets and offers an extensive range of tradable markets for expert traders to expand their portfolios.

Pros

- Good variety of robust trading platforms

- Free deposit and withdrawals

- Intricate and high-quality in-house research and analysis

- Lightning-fast order execution ensures minimal slippage

- Offers Elite MT4 and MT5 trading platforms with rebates

Cons

- £5 inactivity fee after 6 months of inactivity

- Pricing and fee structure aren’t the most competitive

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Automated Trading in the UK

Automated trading has surged in popularity in the UK. It’s no surprise that the region is home to dozens of automated trading platforms. The availability of these platforms means UK traders can take full advantage of them to use sophisticated technical analysis tools and execute profitable automated trades.

Auto trading is also attractive for UK residents with busy schedules. It allows them to trade conveniently without the hassle of constant manual oversight. Auto trading also helps traders manage their emotional biases and participate in round-the-clock markets even when sleeping.

The main oversight authority overseeing financial instrument trading in the UK is the FCA. This governing body ensures the transparency and fairness of automated trading platforms and protects traders from fraudulent activity.

How Does Automated Trading Work?

Automated trading executes trades based on predefined parameters. All traders have to do is define their entry and exit points, and trades will automatically execute once they attain the specified conditions. Auto trading can be as simple as taking profit and stop-loss orders or as complex as hundreds of coding lines powering complex trading algorithms.

How to Choose the Right Automated Trading Platform

You’ll be spoilt for choice when picking automated trading platforms in the UK. However, not all platforms may live up to your expectations. Here are a few tips for choosing the best automated trading platform:

First things first, always check the trading platform’s licenses and regulations. At the bare minimum, the trading platform should hold a license from the FCA. Platforms with licenses from ASIC, FCA, FSA, and other regulatory bodies are worth considering.

You’re much better off trading with a software/platform you’re familiar with. As such, look for a trading platform that supports your go-to software. For example, if you use MT4, then find a platform with MT4 and so on.

The lower the trading fees an automated trading platform charges, the more profit you take home. However, this doesn’t mean you should go for the cheapest platform. Fees that seem too good to be true probably are. Find a platform with trading costs that align with your budget.

Read reviews and testimonials of users before settling on an automated trading platform. That way, you can get a good idea of what to expect from the platform. Steer clear of auto trading platforms with more negative than positive reviews. They’re likely to disappoint.

Auto trading platforms with excellent customer service are invaluable when you have issues or burning questions. Check how available a platform’s customer support is and whether they offer live chat or direct lines to customer service agents.

How To Register an Account With an Auto Trading Platform

Are you looking to get started with auto trading but don’t know how to register with an auto trading platform? If so, here’s a step-by-step guide to do just that:

Enter the platform’s name on your browser’s search box and hit enter. Click on the first link after sponsored content to enter the platform’s website. Click on the “Sign Up” or “Register for an Account” button.

On clicking the “Sign Up” button, you be redirected to a registration form where you’ll enter NAP details. You may also need to provide verification documents (depending on the broker) and create a strong password for your account.

You’ll receive an email from the trading platform with a verification link. Clicking on this link verifies your account and redirects you back to the platform’s website. Note that some platforms send a verification code, which you’ll enter on the website when prompted.

Choose an appropriate deposit method and deposit funds into your account. Once you do so, the deposit will be reflected in your account balance. You can use this balance to buy financial assets and trade them.

With everything else on lock, the remaining thing for you is to pick an ideal trading software and set up your automatic trades. Remember, you can always check tutorials and guides on how to make successful automated trades.

Final Thoughts

You can make a killing with automated trading, but only if you find the best automated trading platform in the UK to facilitate your success. Still, it’s worth noting that automated trading, like regular training, is risky, and you can lose as much money as you can gain. As such, stick to your trading strategy and exercise proper risk management for the win. Do this and pick the best automated trading in the UK, and you’ll be laughing all the way to the bank.

I think automated trading can be a game-changer, especially for those looking for a more hands-off approach.

I’ve tried a couple of these platforms, and for me, eToro stands out for being super beginner-friendly with its copy trading feature. It’s a great way to get started without diving deep into all the technical stuff.