Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Bitcoin prices fluctuate constantly. You can exploit this trend and earn handsome returns. But, before doing that, you must buy this crypto. That can be tricky since you have to use a good BTC app, and countless platforms are available in New Zealand, both good and bad.

That said, you can avoid unnecessary headaches by following our guide. We tested, analysed, and compared innumerable Bitcoin apps in NZ on your behalf. After days of hard work, our seasoned experts singled out 4 platforms that stand out from the crowd. We have reviewed them in this guide. You should use it to identify the best app to buy Bitcoin in New Zealand.

In a Nutshell

- BTC investing has a high return potential. However, this venture is also incredibly risky, as the price of BTC can swing wildly within a very short period.

- Before investing in BTC, learn the risks and how to mitigate them.

- Fraud and scams are common in the crypto investing scene. Vet every app for buying BTC carefully before putting up any money.

- While assessing if a BTC app is suitable, consider factors like security, supported assets, and security.

- We are here to help you find the best app to buy Bitcoin in New Zealand. Our team reviewed a long list of platforms and identified 4 noteworthy ones. These are exceptional and deserve checking out.

List of the Best Bitcoin Apps

- eToro – Best App for Staking BTC

- Kraken – Best App for Beginner BTC Investors

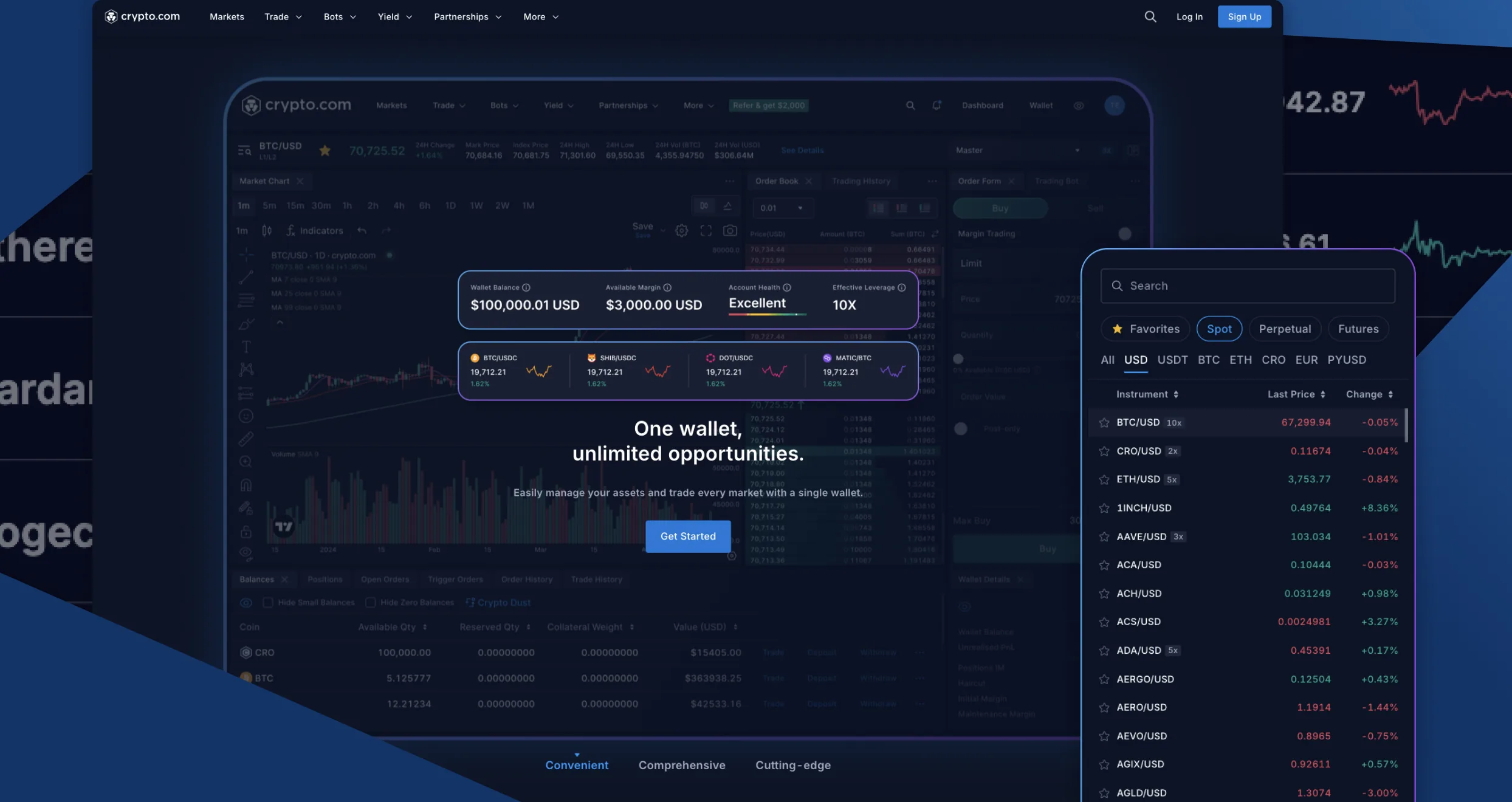

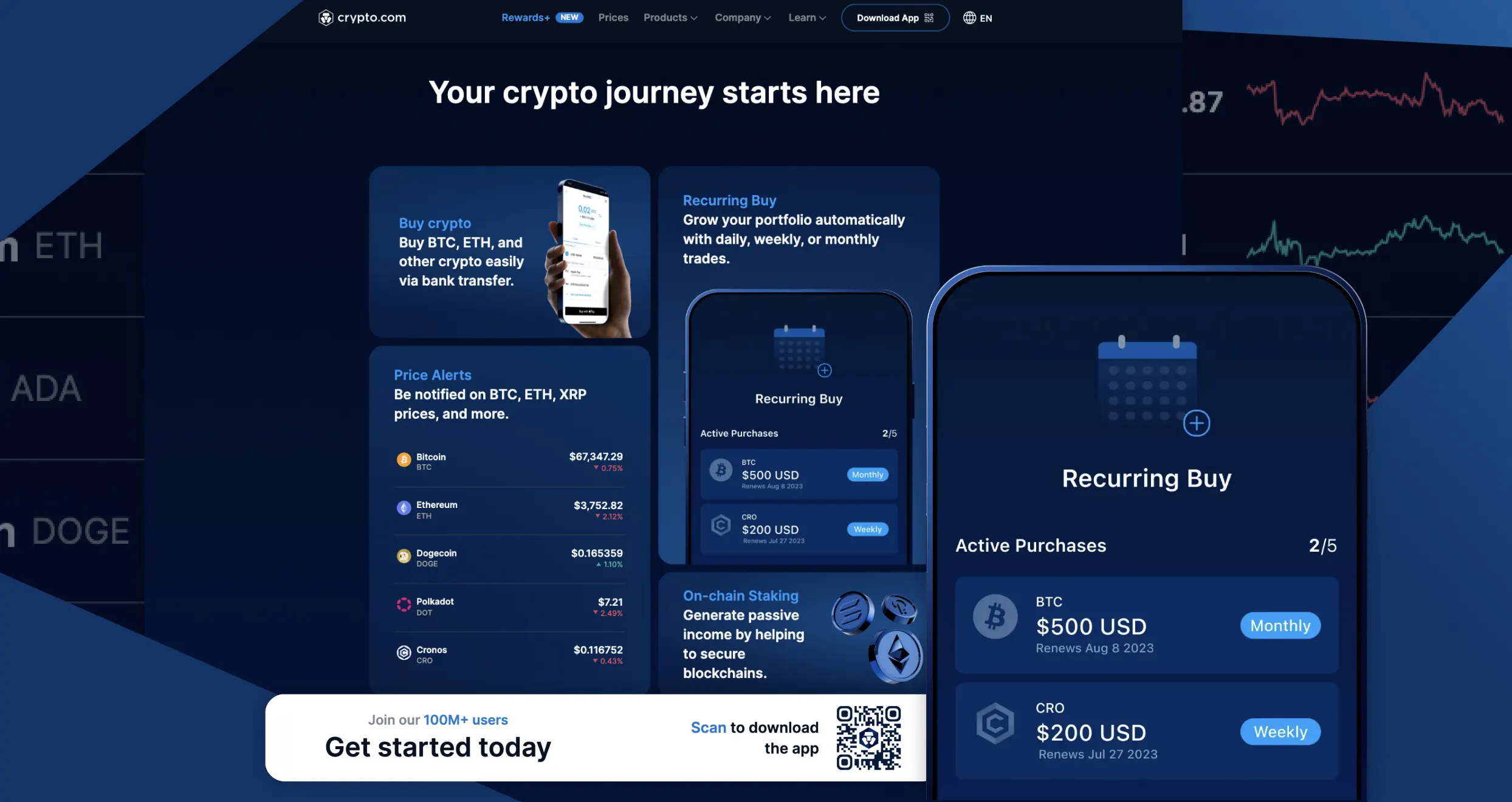

- Crypto.com – Best App for Portfolio Diversification

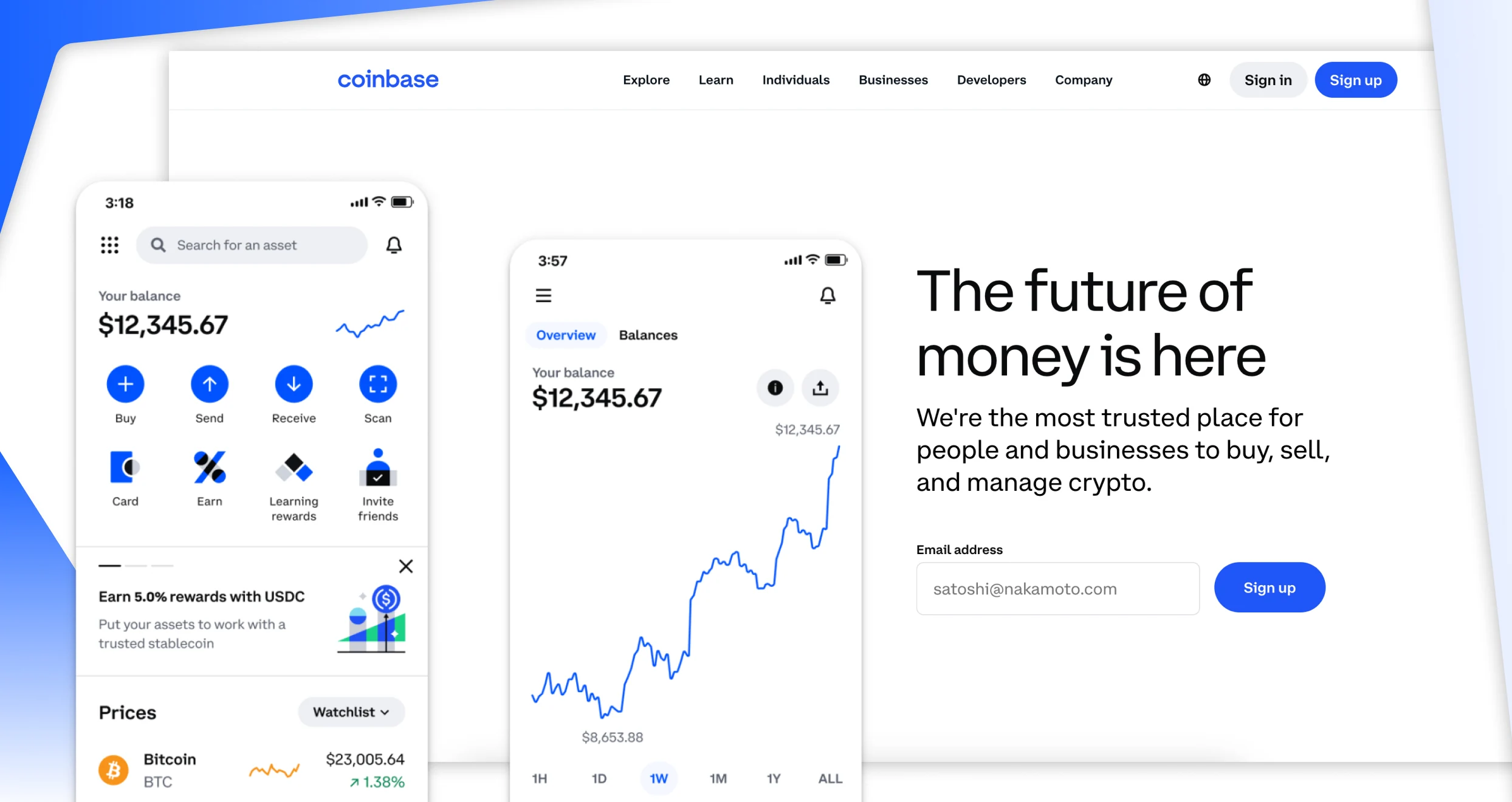

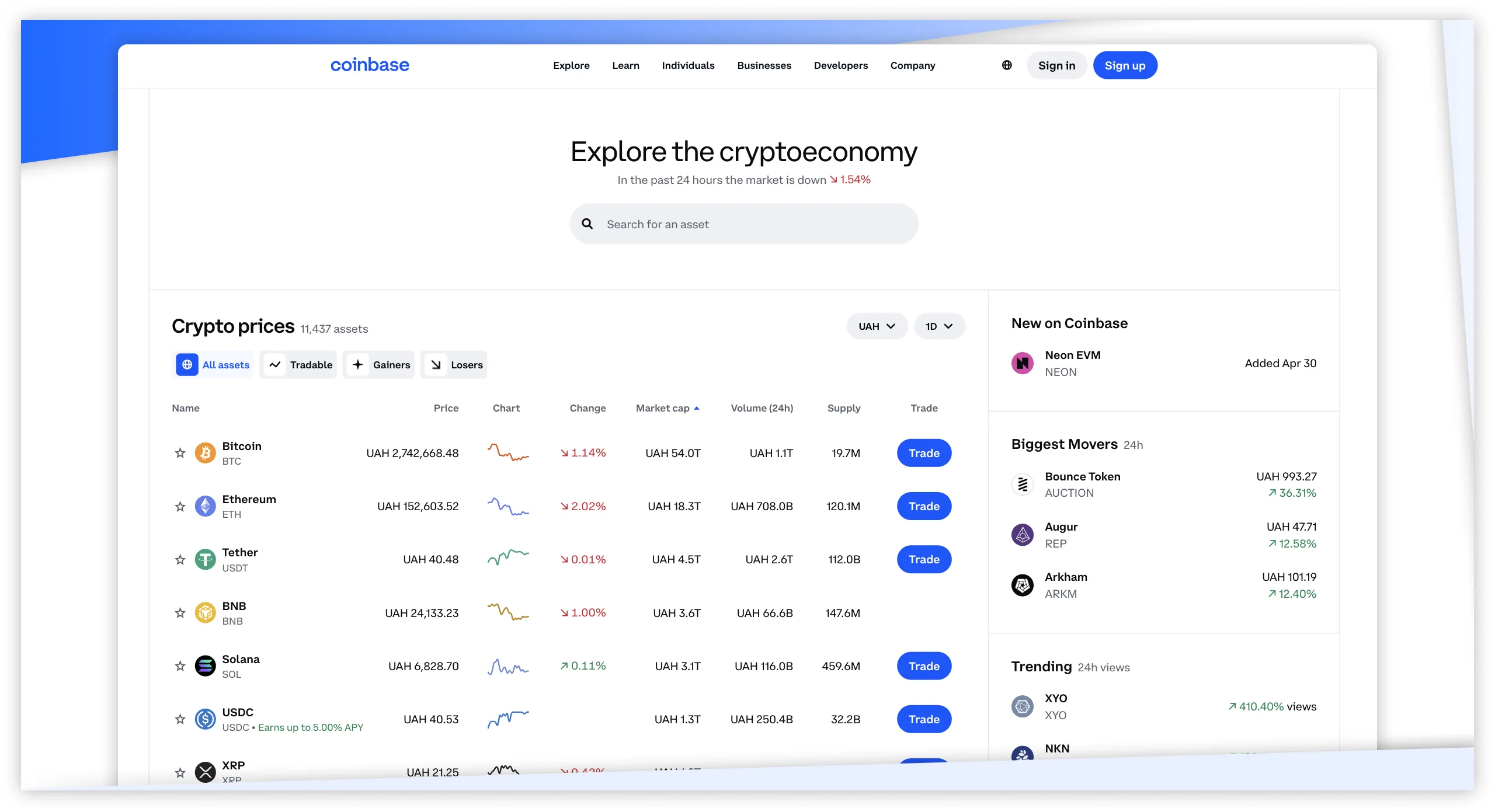

- Coinbase – Best Low-Cost App for Buying BTC

Compare Bitcoin Apps in New Zealand

Hundreds of apps allow users to invest in Bitcoin, but not all of them made it into our guide. Neither did we feature the first service provider we encountered. Our experts tested and evaluated numerous apps where New Zealanders can buy BTC. We also compared these platforms against each other and picked the most remarkable.

While comparing service providers, we considered several factors, including the ones outlined in the comparison table below.

| Best Bitcoin App NZ | App Type | Support Service | Supported Coins | Digital Wallet | Price |

|---|---|---|---|---|---|

| eToro | Decentralised | 24/5 | 100+ | Yes | Free |

| Kraken | Centralised | 24/7 | 240+ | Yes | Free |

| Crypto.com | Centralised | 24/7 | 350+ | Yes | Free |

| Coinbase | Centralised | 24/7 | 260+ | Yes | Free |

Apps Overview

A Bitcoin app may require users to cover different costs, including deposit, network, and conversion fees. Moreover, some service providers have account maintenance and inactivity fees. Since high or unexpected costs undermine profitability, we checked every app’s fees before including the platform in our guide. We also considered offered assets besides BTC since they are indispensable in portfolio diversification and risk mitigation.

Check what we discovered in the comparison table below.

Fees

| Best Bitcoin App NZ | Fees | Minimum Deposit Requirement |

|---|---|---|

| eToro | 1% fee for buying BTC | $1,000 |

| Kraken | From 0% | $10 |

| Crypto.com | From 0.4% of the total purchase | $20 |

| Coinbase | From 1% transaction fees | None |

Assets

| Best BTC App NZ | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Solana |

|---|---|---|---|---|---|---|

| eToro | Yes | Yes | Yes | Yes | Yes | Yes |

| Kraken | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes |

| Coinbase | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion About New Zealand Bitcoin Apps

We thoroughly researched and evaluated the best Bitcoin apps in New Zealand. Every platform included in our guide deserves it. We picked the 4 apps reviewed below because they have most of the qualities we were searching for, including top-tier security, a broad range of assets, and a user-friendly interface.

Here are our opinions and reviews of the best Bitcoin apps in NZ. Use them to find a platform best suited to your trading needs and requirements.

1. eToro – Best BTC App for Portfolio Diversification

We’ve used eToro for several years, and it never disappoints. As a Bitcoin enthusiast, you can open an account with this broker and buy your favourite crypto within a few minutes. The platform allows investors like you to purchase Bitcoin using different payment methods, from credit and debit cards to PayPal and Neteller.

What’s more, eToro offers you unlimited options for portfolio diversification. For starters, you can invest in diverse altcoins, including Ethereum, Litecoin, and Bitcoin Cash. You can also hedge against the risks associated with cryptos by purchasing stocks from thriving companies like Apple, Meta, and Microsoft. We can’t forget that eToro lets users stake crypto and earn juicy rewards.

The eToro app is compatible with Android and IOS devices.

Pros

- Supports crypto staking

- Offers thousands of non-crypto assets for portfolio diversification

- User-friendly interface

- Free and instant deposits

Cons

- New Zealanders must deposit a minimum of $1,000

- Higher crypto transfer fee compared to its peers

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

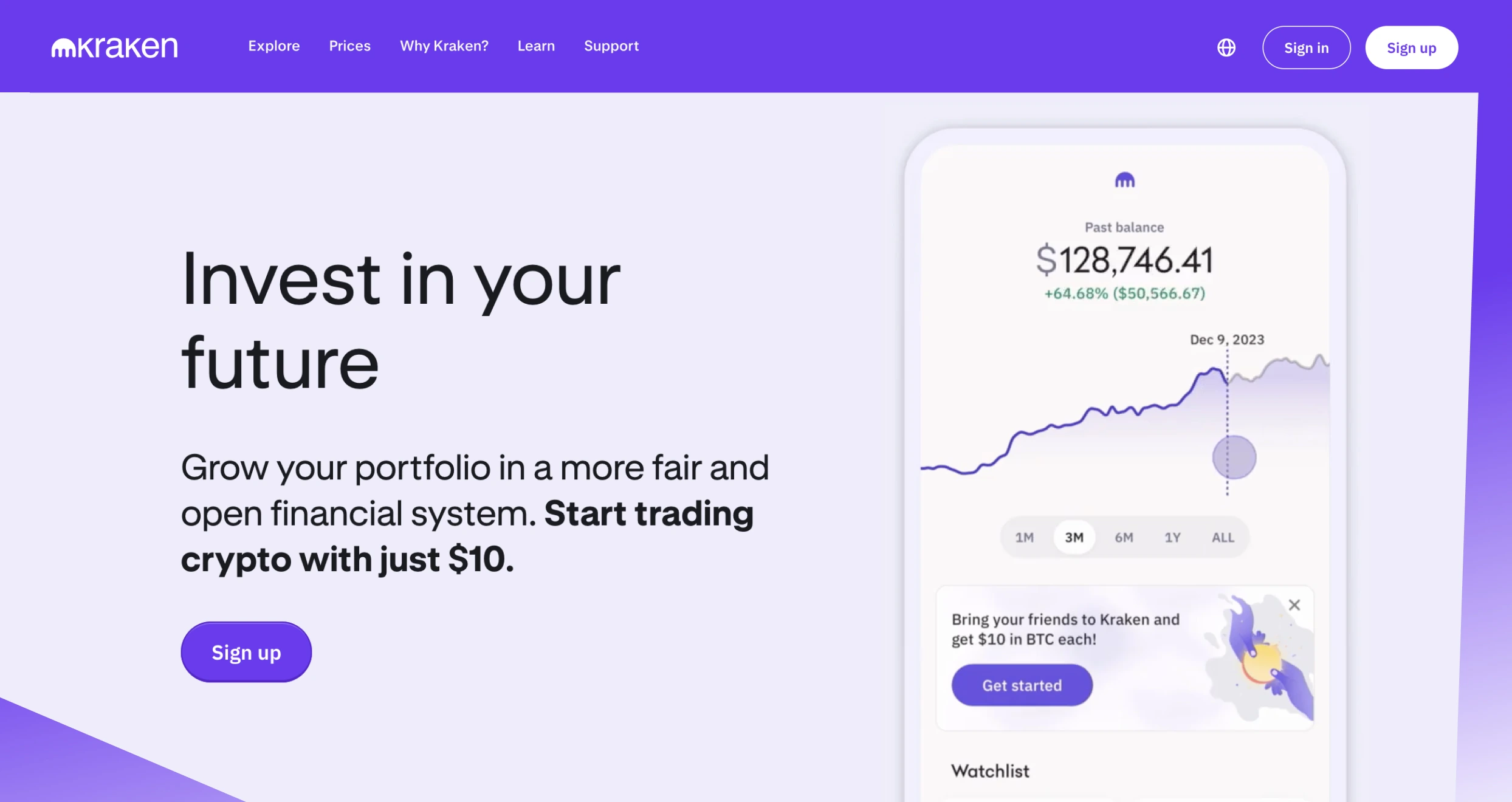

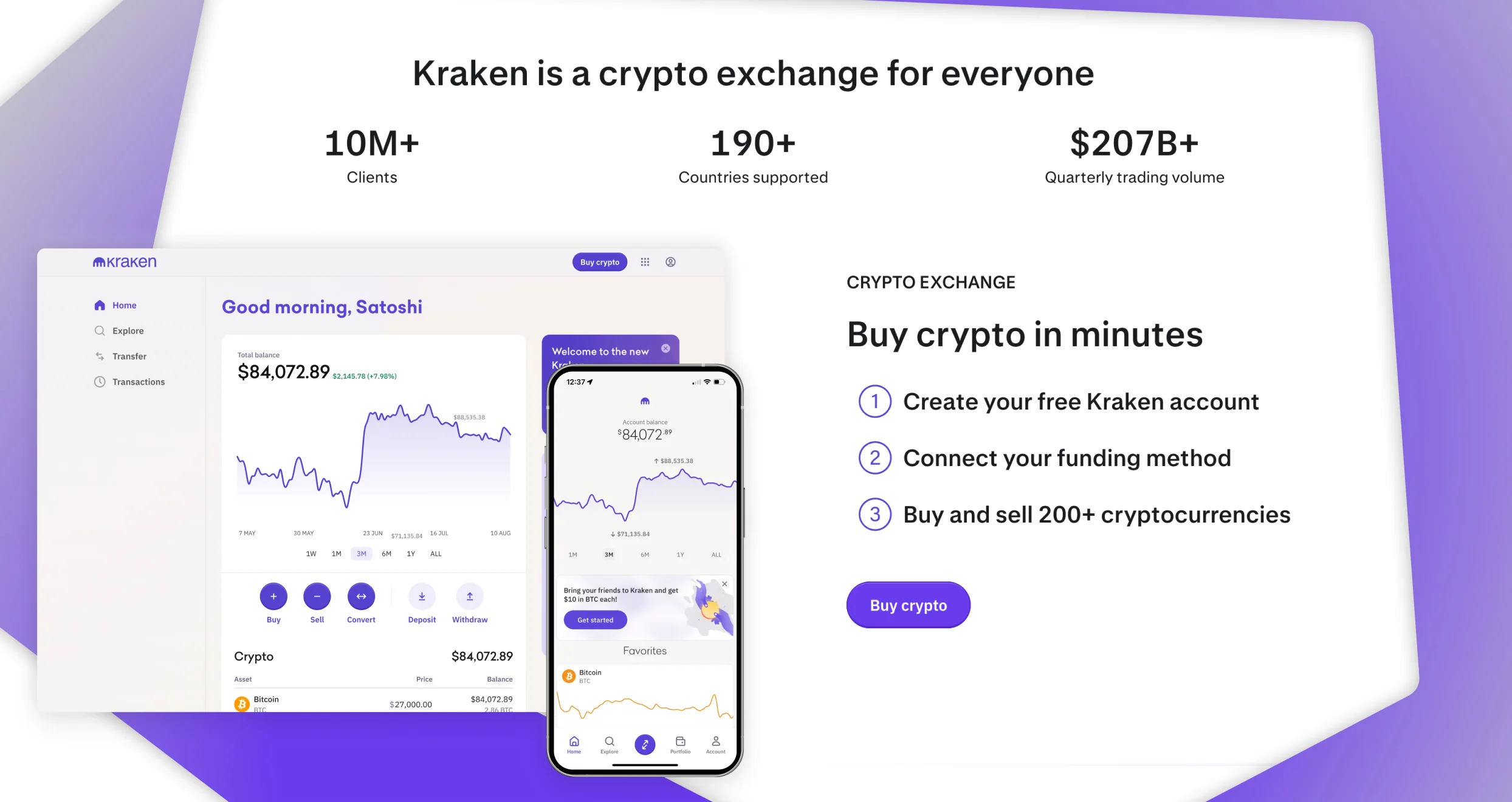

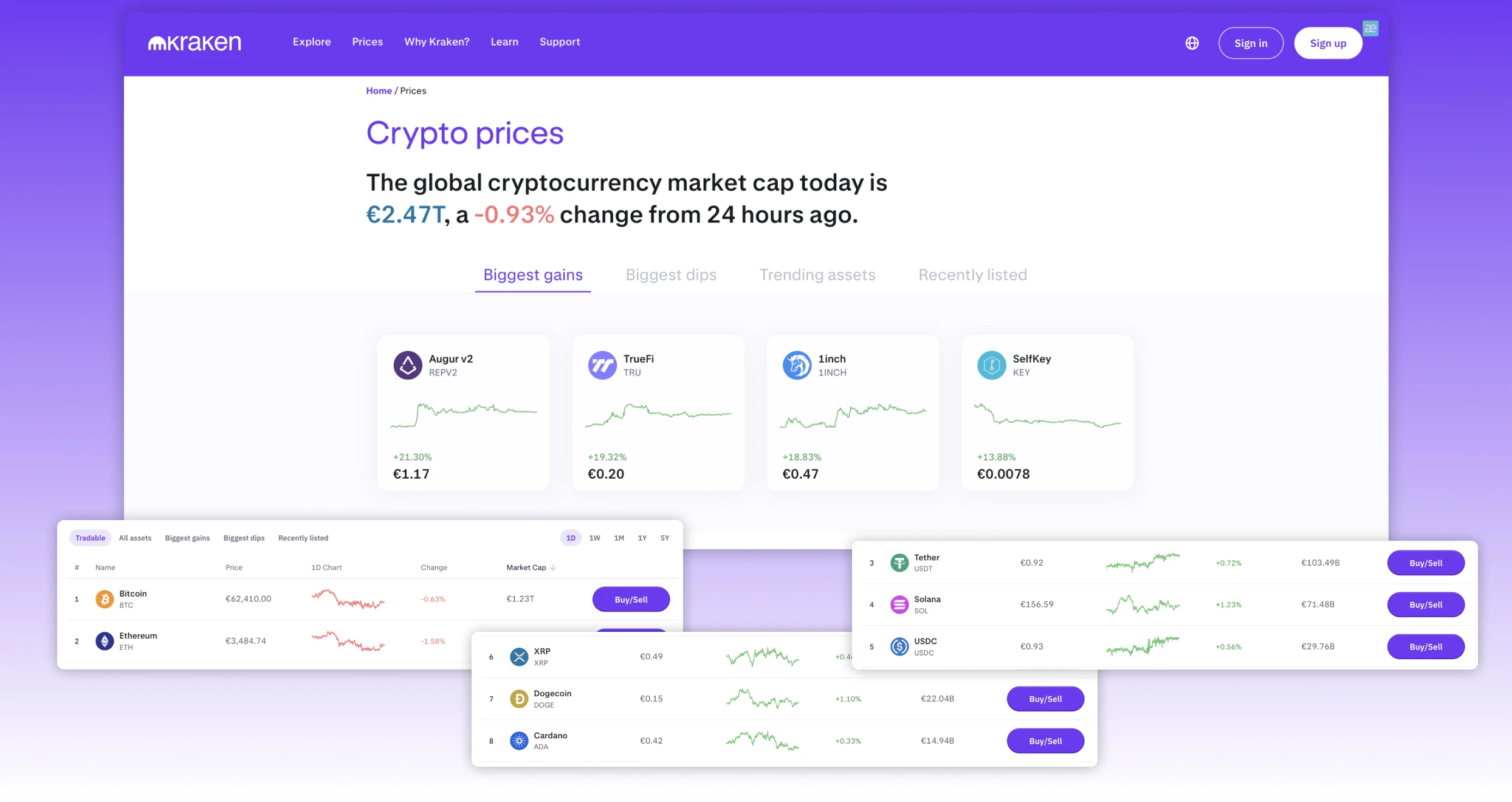

2. Kraken – Best App for Beginner BTC Investors

There are numerous aspects to love about Kraken, with the app’s beginner-friendliness at the top of the list. It’s professionally designed and tailored to make navigation easy, even for newbies. That is one of the reasons why over 10 million people use it.

Moreover, using the Kraken app is extremely easy. You just have to download it, create your account, and connect a funding method to start buying BTC. We also consider Kraken the best app for beginners since it allows users to start with as little as $10. And that is a good thing. We always advise newbies to start with low capital because crypto investing is risky and can lead to significant losses.

The Kraken app is compatible with Android, iOS, and desktop devices.

Pros

- Simplified, beginner-friendly user interface

- Users can deposit as little as $10

- Low fees, especially for high-volume traders

- Offers 24/7 live customer support

- Provides extensive educational resources on its Learn Center

Cons

- Higher fees for low-volume crypto traders

- Limited supported payment methods

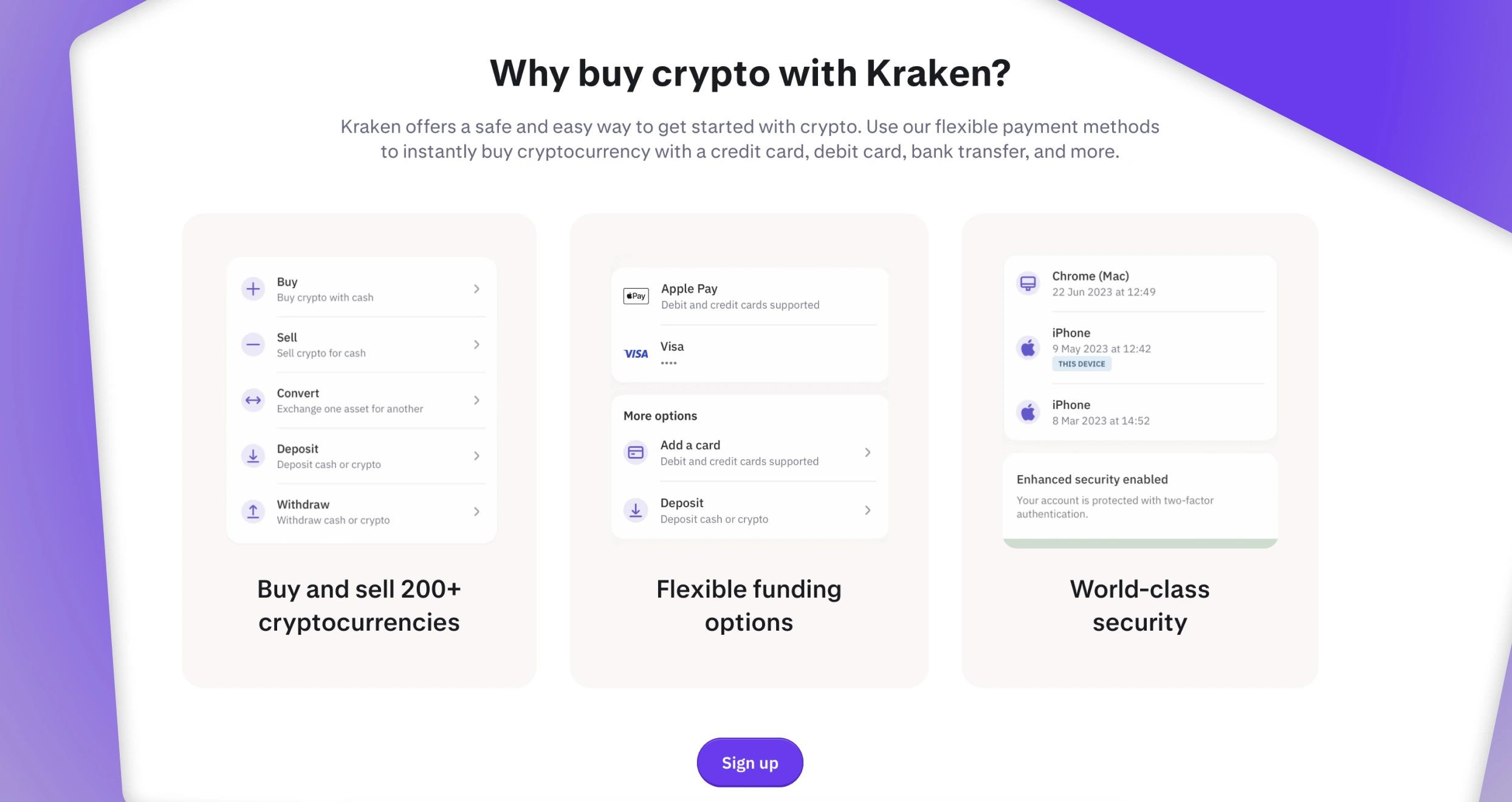

Based on our experience, Kraken is one of the most affordable cryptocurrency exchanges. We signed up for trading and investment accounts and incurred no registration fees. Plus, the exchange’s minimum deposit requirement is $10, which we believe is among the lowest in the financial investment industry.

When it comes to instant buy and sell services, Kraken imposes spreads, which are included in an asset’s price. The spreads may vary, depending on the payment method and platform you use. For instance, the exchange applies a 3% fee for converting balances less than the minimum order size using the “Convert small balances” feature.

For investors using the Kraken Pro platform, expect a maker-taker fee schedule. This comes with volume incentives based on investors’ activities in the past 30 days. On average, you will incur a 0.25% maker fee and a 0.40% taker fee for transactions between $0 and $10,000. Overall, Kraken Pro fees are charged on a per-trade basis.

When it comes to transactions, Kraken supports a variety of deposit methods. Most deposits are free, but expect to incur withdrawal charges, depending on the payment method you transat with. You may also pay a currency conversion fee. This of course will depend on the fiat currency you are converting to.

3. Crypto.com – Best App for Paying with BTC

In the modern era, you can buy different goods with Bitcoin, from cars and accessories to real estate and electronics. You can also pay for flights, hotel bookings, gaming services, and more. The best part is that tens of thousands of merchants accept Bitcoin payments worldwide.

We highly recommend Crypto.com to savvy individuals who prefer making Bitcoin payments. This crypto exchange offers Crypto.com Pay, a platform that allows users to shop with popular digital assets like Bitcoin. Moreover, if you are a merchant, you can use this service to accept BTC payments from millions of people from different corners of the globe.

Crypto.com Pay also allows users to send BTC to other people for free. You can access the Crypto.com Pay app from your Android or IOS mobile device.

Pros

- Low minimum deposit

- Enables users to make BTC payments

- Low fees for Bitcoin purchases

- Offers a crypto card for crypto payments

- Allows user to borrow funds against their crypto assets

Cons

- It can be overwhelming to novices

- Tailored primarily for mobile users

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

4. Coinbase – Best Low-Cost App for BTC Investors

If you are working with a limited budget, we strongly urge you to use Coinbase to purchase BTC. With this app, you can buy as little as $2 worth of Bitcoin. Moreover, it has no fixed minimum deposit requirement, so you can load your account with any amount you can afford. You can also use supported payment methods like bank transfers to fund your account at no additional cost.

We also hold Coinbase in high regard because the app offers juicy rewards to new account holders. For instance, if you register with this platform and purchase BTC, you may get an incentive of up to $200 in crypto.

You can do more than purchase Bitcoin on Coinbase. For starters, you can trade and stake different cryptocurrencies. Staking digital assets on this app comes with UP TO 9% annual percentage yield (API). Moreover, Coinbase charges zero staking and unstaking fees.

Pros

- No predefined minimum deposit requirement

- Reasonable, transparent fees

- Intuitive and user-friendly interface

- Excellent customer support is available 24/7

- Juicy crypto staking yields

Cons

- Limited payment methods compared to its peers

- Cashing out with wire and bank account can take a couple of days

Opening and maintaining a Coinbase account is free. You can fund your account and withdraw money using a variety of payment methods, including wire transfers, debit/credit cards, and digital wallets like Apple Pay.

While using FIAT, you may have to pay deposit and withdrawal fees depending on your chosen payment method. ACH transactions are free. But alternatives like wire transfers attract $10 and $25 deposit and withdrawal fees, respectively. That said, you can buy as little as $2 of crypto using a card or funds in your account.

Expect to pay specific fees when you purchase, convert, or sell crypto on Coinbase. Your charges will depend on numerous factors, including the order size, your preferred payment method, and market conditions. For instance, if you place an order at a stipulated market price and it is fulfilled immediately, this exchange will charge you anywhere from 0.05% to 0.60%.

If you place standard buy and sell orders on Coinbase, the platform will include a spread in the specified price. You will also encounter a spread when converting one crypto asset to another. To avoid spreads, join Coinbase Advanced, which is an advanced platform for seasoned traders.

Depending on your jurisdiction, you may stake crypto on Coinbase at no additional costs. However, the exchange will deduct a commission based on your accrued rewards and the involved asset. The standard commission for ADA, SOL, DOT, ATOM, XTZ, and MATIC is 35%. Eligible Coinbase One members can enjoy a commission of 26.3% for the same assets. On the other hand, ETH attracts a 25% commission.

Lastly, Coinbase charges asset recovery fees. If you send an unsupported asset to your Coinbase account, you may try to recover it. If it’s eligible for recovery, the exchange will charge a network fee. If the recovery is over $100, expect to pay a 5% fee. But if it’s less than $100, you won’t have to pay a dime.

Bitcoin Trading in New Zealand

BTC trading is legal in New Zealand, and anyone over 18 can participate. However, the FMA, which regulates financial markets in the country, strongly advises New Zealanders to be cautious. Why? Cryptos like Bitcoin are highly volatile and expose investors to financial losses. Moreover, scammers, fraudsters, and hackers often target crypto trading platforms.

We second the FMA and highly encourage New Zealanders to trade with reputable platforms like the ones outlined here. They are secure and trustworthy. Moreover, these companies comply with rules and regulations set by authorities like the FMA. Like the FMA, we at Invezty urge you to be cautious and trade with what you can afford to lose.

Let’s explore a few hacks you can use to identify the best BTC apps and register a new account.

How to Choose the Right App to Buy Bitcoin in NZ

Finding an exceptional BTC app and avoiding questionable platforms can be difficult since many options are available in New Zealand. That said, you should be careful since fraudulent and unscrupulous entities run some apps. If you invest with them, you will eventually lose your money or assets. To avoid that, vet each platform based on the following factors:

Generally, there are 2 types of BTC apps: centralised and decentralised. Centralised apps are run and managed by specific organisations. On the other hand, decentralised apps don’t rely on any central authority. Before registering with any app, verify its type and whether it aligns with your trading goals.

Top-notch security is indispensable in protecting your data and Bitcoin from malicious actors. That is why you should prioritise working with an app that optimises the safety and security of your assets with world-class solutions. These range from SSL encryption to biometric verification and two-factor authentication.

Picking a user-friendly app is crucial, especially if you are a beginner. You don’t want to spend too much time familiarizing yourself with the intricacies of a complicated platform. A user-friendly app reduces the learning curve and enhances the overall trading experience. It also helps you avoid making detrimental mistakes like sending BTC to the wrong address.

If you are interested in Bitcoin trading, you must register with a BTC-friendly trading app. But don’t stop there. Remember that portfolio diversification is the key to avoiding catastrophic financial losses. So, look for a platform that allows users to reduce risk exposure by investing in a broad range of altcoins and other assets.

Fees impact your investment returns. By spending less covering platform fees, you will be left with more to invest in Bitcoin and other assets. Lower costs also translate into more money in your pocket, especially where transaction charges are involved. That is why you should consider charges when choosing a good BTC app.

While evaluating different BTC apps, read user reviews on the App Store, Trustpilot, and Google Play. A reliable and trustworthy platform with admirable qualities like unmatched security, good customer support, and reasonable fees should have a good reputation. Avoid companies with too many repeated complaints and unaddressed issues.

How To Register an Account with an App to Buy Bitcoin in NZ

We had to open new accounts while exploring and evaluating the BTC apps in New Zealand. Fortunately, this process was manageable. The companies we’ve introduced you to have a straightforward registration process that newbies and pros can navigate seamlessly.

Here’s a generalised step-by-step guide to opening an account with one of the best BTC apps in NZ:

After choosing your preferred company, go to its official site. You can verify anything crucial from there, including the types of supported digital assets and mandated fees. Additionally, this is the best place to read the terms and conditions. After looking around and confirming if the company is right for you, find the dedicated app and download it.

Install the downloaded app, open it, and hit the sign-up button. Most apps will ask you to submit an active email and set a strong password. Do that and verify your email. Don’t forget to set a formidable password. Ideally, it should comprise of 12 or more characters, including uppercase/lowercase letters, numbers, and unique symbols.

Go to your account’s verification section to complete KYC. Most apps require users to complete this step before purchasing and trading BTC. You must submit valid personal information, including your name and phone number. Additionally, you have to submit documents that the company will use to verify your identity and address, like a copy of your national ID card and bank statements.

After completing KYC, wait for the company to verify your account. Then, add a payment method from the list of supported options. Remember that some service providers have varying transaction fees and minimum deposit requirements for different payment methods.

Use your chosen payment method to buy Bitcoin. You can use limit orders to acquire BTC at a predetermined price to avoid spending more than you plan to. Most importantly, keep a close eye on your investments and market trends.

Conclusion

Our guide has introduced you to outstanding BTC apps available in NZ and their properties. Use what you’ve learned to pick a platform that will help you invest in Bitcoin and benefit in the long run. If you choose one of the apps reviewed here, your investments will be secure, and you won’t waste valuable time assessing more platforms than necessary.

Investing in Bitcoin is incredibly risky, even while you’re using a reliable and trustworthy app. Research the risks associated with this venture before registering with any company and making a financial commitment.

From my experience, eToro’s been reliable, but always double-check fees and security before committing to any platform.