Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Budgeting manually can be challenging, especially when it comes to filling out spreadsheets for incomings and outgoings. Fortunately, the advancing technology has simplified these lengthy tasks, making it easier for individuals to effectively manage their budgeting. For instance, the onset of budgeting apps has made many individuals stay on top of their finances. Using mobile devices, these apps give users greater insights into their finances without much effort.

With a multitude of budgeting apps in the market today, choosing a suitable one can be a lengthy and overwhelming process. As professionals, we conducted the research on your behalf and rounded up the top options so far. And if this is your first time using a budgeting app, we will enlighten you on what a budgeting app is, how to choose and use one, and more. Ultimately, you should be able to decide whether budgeting apps are a great addition to your finance management.

In a Nutshell

- The best budgeting apps in the UK are listed in this guide. Each of these apps has its own unique feature, including personalised financial insights, money savings tips, and more.

- While most of our recommended budgeting apps UK have free versions, they also come with subscriptions. Therefore, choose the one you can afford for an exciting experience.

- Safety should be a priority when choosing a suitable budget app. Ensure an app is highly encrypted and regulated by the Financial Conduct Authority (FCA).

- Whether you are using an Android or iOS mobile device, the app you select must integrate and operate seamlessly on the device.

- At Invezty.com, we take market research seriously. We incur we leave no stone unturned to identify and recommend the best apps without bias

List of the Best Budget Apps

- Plum – Overall Best Budgeting App in the UK

- Emma – Best UK Budgeting App With Advanced Features

- Monzo – Top Low-Cost Budgeting App in the UK

- Snoop – Beginner-Friendly Budgeting App

- Moneyhub – Best Budgeting App for Detailed Analysis and Insights

Compare Budgeting Apps

There are hundreds of budgeting apps in the UK, meaning that identifying the best remains a major challenge for individuals. To ensure you save time and make the best decisions, we took it upon ourselves to shift through the available options. Through multiple tests and comparisons, we were able to create the list below. Some of the elements that helped us create this list include security, fees, performance, support service, and more.

Additionally, we analysed user testimonials on Google Play, the App Store, and Trustpilot. While it is essential to understand what other users say, reviewing their comments and ratings ensures we remain unbiased. As a result, we get to recommend budgeting apps solely based on their features.

That said, we have shared a comparison table below so you can fully understand the features of our top apps. Hopefully, this will help you make the best choice.

| Best Budgeting Apps UK | Regulation | Support Service | Free Plan | Money Protection |

|---|---|---|---|---|

| Plum | FCA | 24/7 | Yes | Up to £85,000 |

| Emma | FCA | 24/7 | Yes | Up to £85,000 |

| Monzo | FCA | 24/7 | Yes | Up to £85,000 |

| Snoop | FCA | 24/7 | Yes | Up to £85,000 |

| Moneyhub | FCA | 24/7 | No | Up to £85,000 |

Apps Overview

Before you start using a budget app in the UK, ensure it aligns with your financial goals. Consider features such as affordability and supported securities. Since comparing the available options based on these features can be daunting, we share tables below to help you save time and make the best choice that guarantees a worthwhile experience.

Fees

| Best Budgeting Apps UK | Minimum Deposit Requirement | Subscription Fees |

|---|---|---|

| Plum | £0 | From £2.99/month |

| Emma | £0 | From £4.99/month (£41.99/year) |

| Monzo | £0 | From £3/month |

| Snoop | £0 | £4.99/month (£31.99/year) |

| Moneyhub | £0 | £1.49/month (£14.99/year) |

Assets

| Best Budgeting Apps UK | Funds | Stocks | SIPP | Stocks and Shares ISA |

|---|---|---|---|---|

| Plum | Yes | Yes | Yes | Yes |

| Emma | No | Yes | No | No |

| Monzo | Yes | Yes | Yes | Yes |

| Snoop | No | No | No | No |

| Moneyhub | No | No | No | No |

Our Opinion about UK Budget Apps

Let’s explore below the best budgeting apps in the UK 2025. Note that we thoroughly tested them and guarantee their safety for all users. While these apps have free versions, they also have paid plans. Therefore, feel free to compare them to make the best choice for your financial needs.

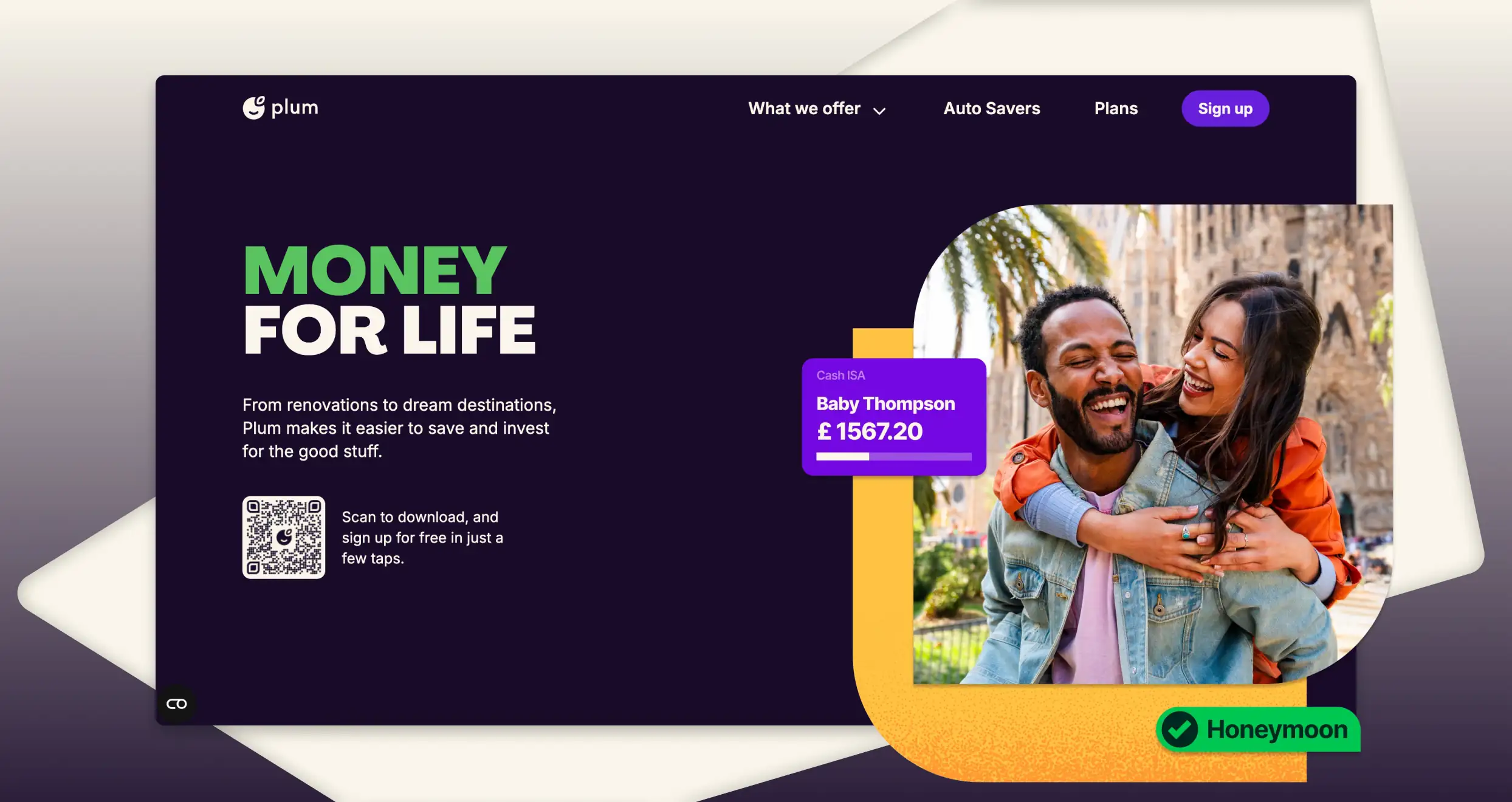

1. Plum – Overall Best Budgeting App in the UK

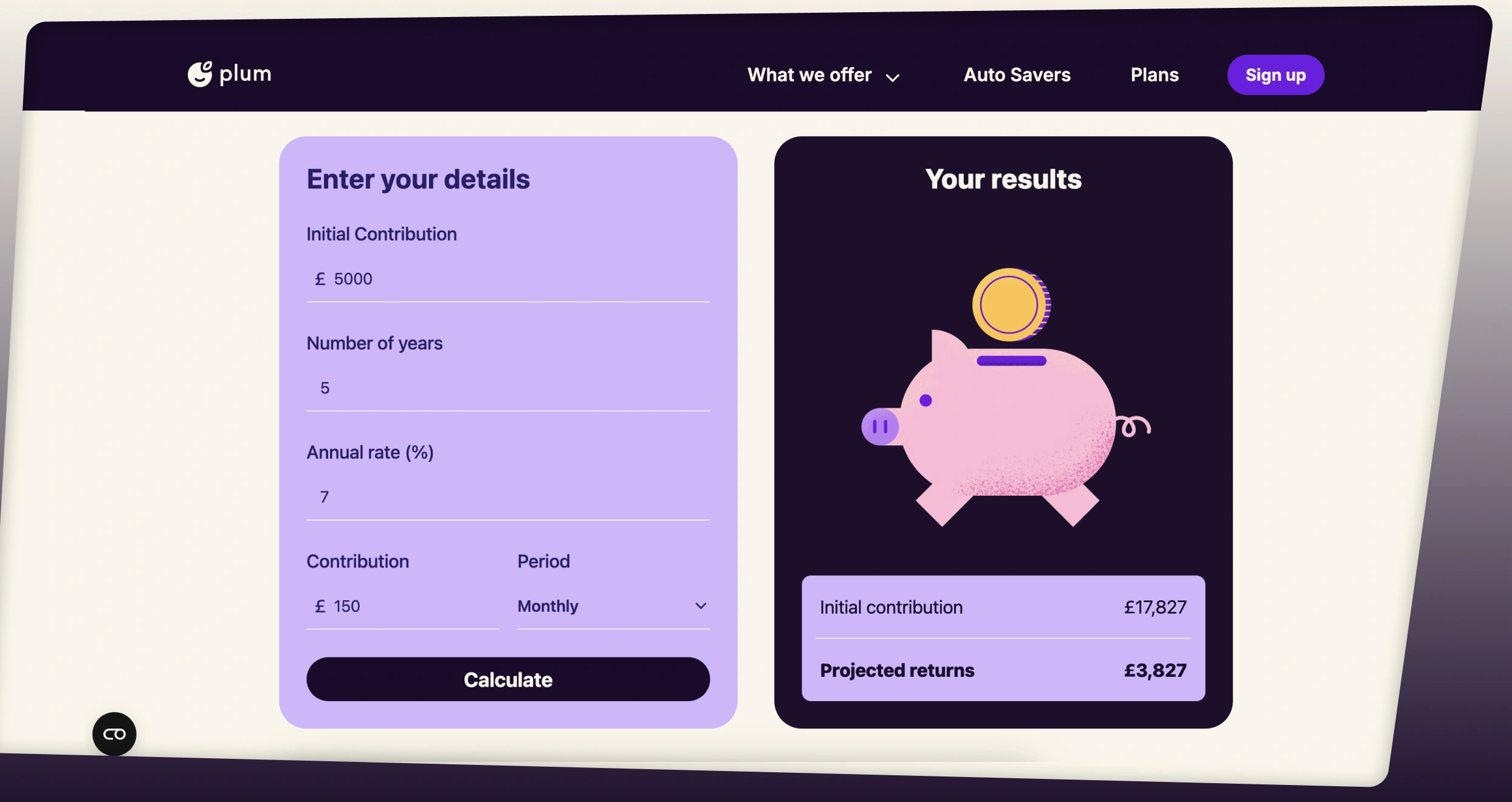

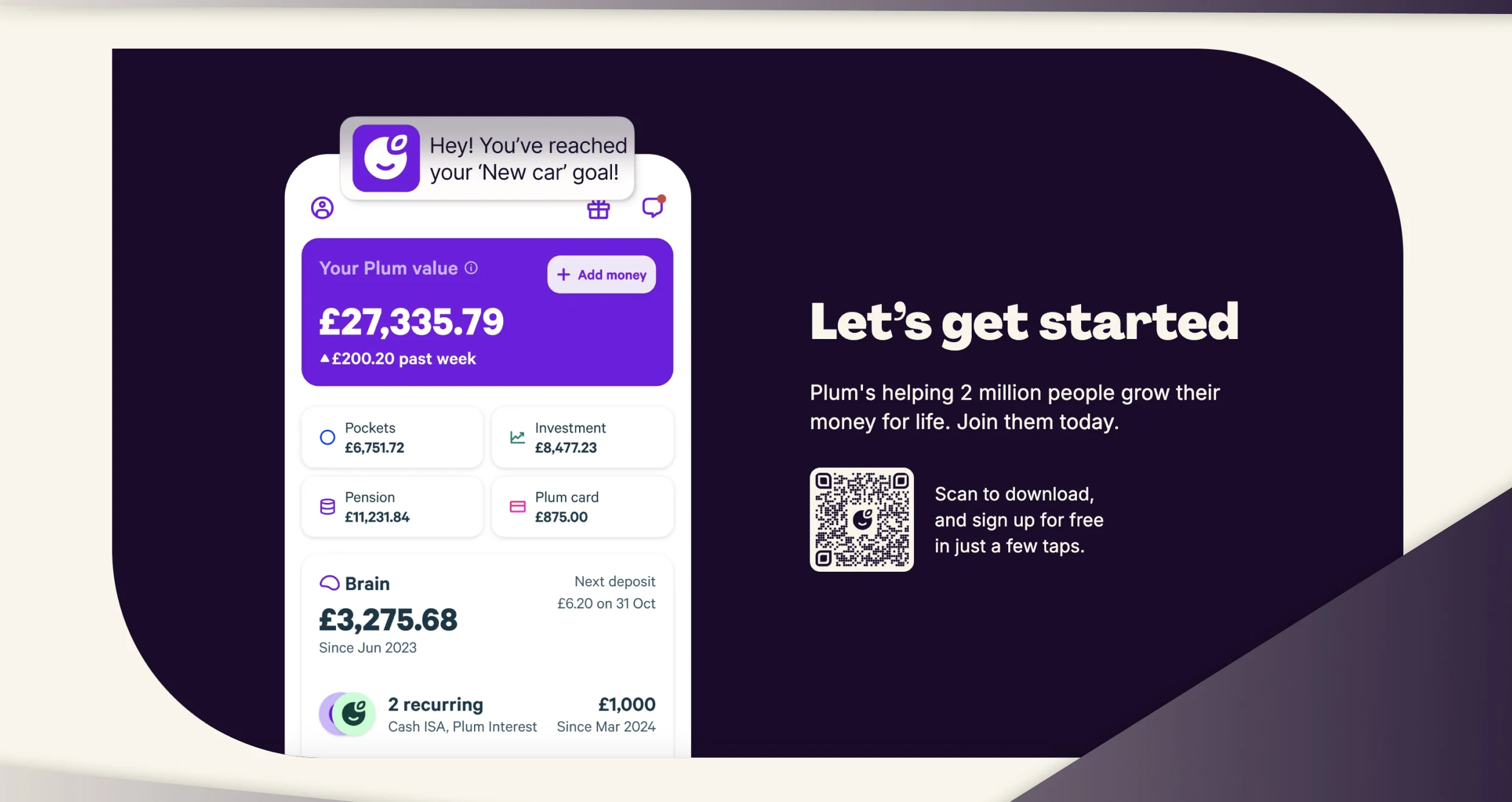

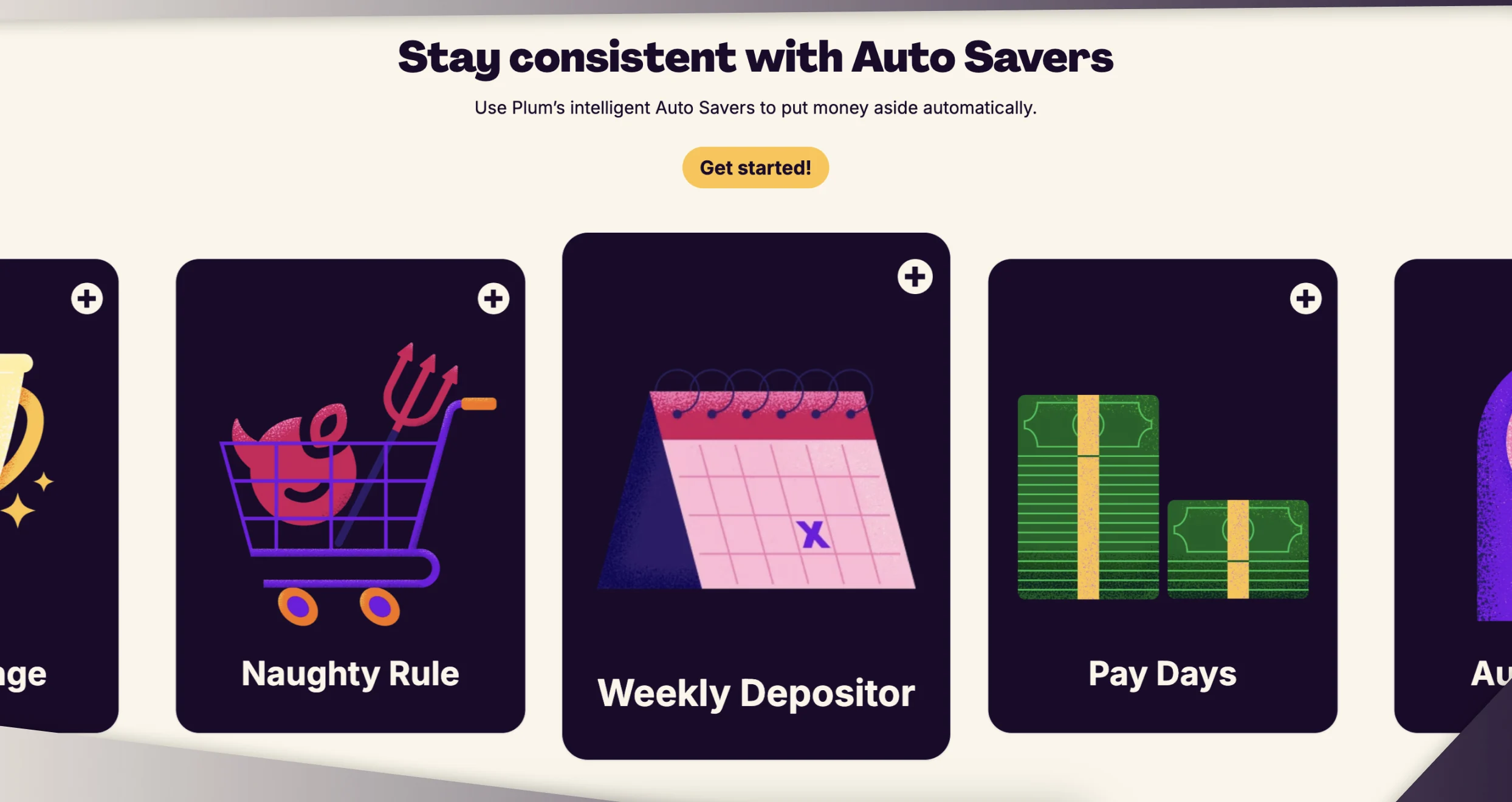

Among the hundreds of budgeting apps in the UK we tested, Plum stood out as the overall best due to its incredible features. For instance, while using the app, we noticed that it has a simple and user-friendly interface, which can excite both newbies and experts in the financial landscape. We also like its automated savings feature, whereby it automatically calculates an affordable amount to regularly set aside. This, of course, is based on your income and spending patterns. On top of that, this app is customisable, allowing users to set specific targets and work towards them. These can be setting an emergency fund, saving for a vacation, and more.

We also discovered an AI assistant at the Plum budgeting app. The chatbot is very interactive and offers personalised recommendations and insights based on the user’s financial data. While using it, we were able to identify the best areas for savings, get the best recommendations on budgeting, and additional financial advice. As a result, we were able to understand where all our income was going. That being said, explore Plum’s features on its free version to decide whether it fits your requirements. You will then subscribe to its Pro or Premium plans and unlock advanced features to gain better control over your finances.

Pros

- A highly secured budgeting app with Financial Services Compensation Scheme (FSCS) protection

- Pays an interest of up to 4.59% AER with an Interest Pocket

- Offers ISAs and no-cost savings accounts

- A user-friendly and modern design budgeting app

Cons

- Has a variable fee structure based on investment options available

- Automated investing is only supported on the premium plan

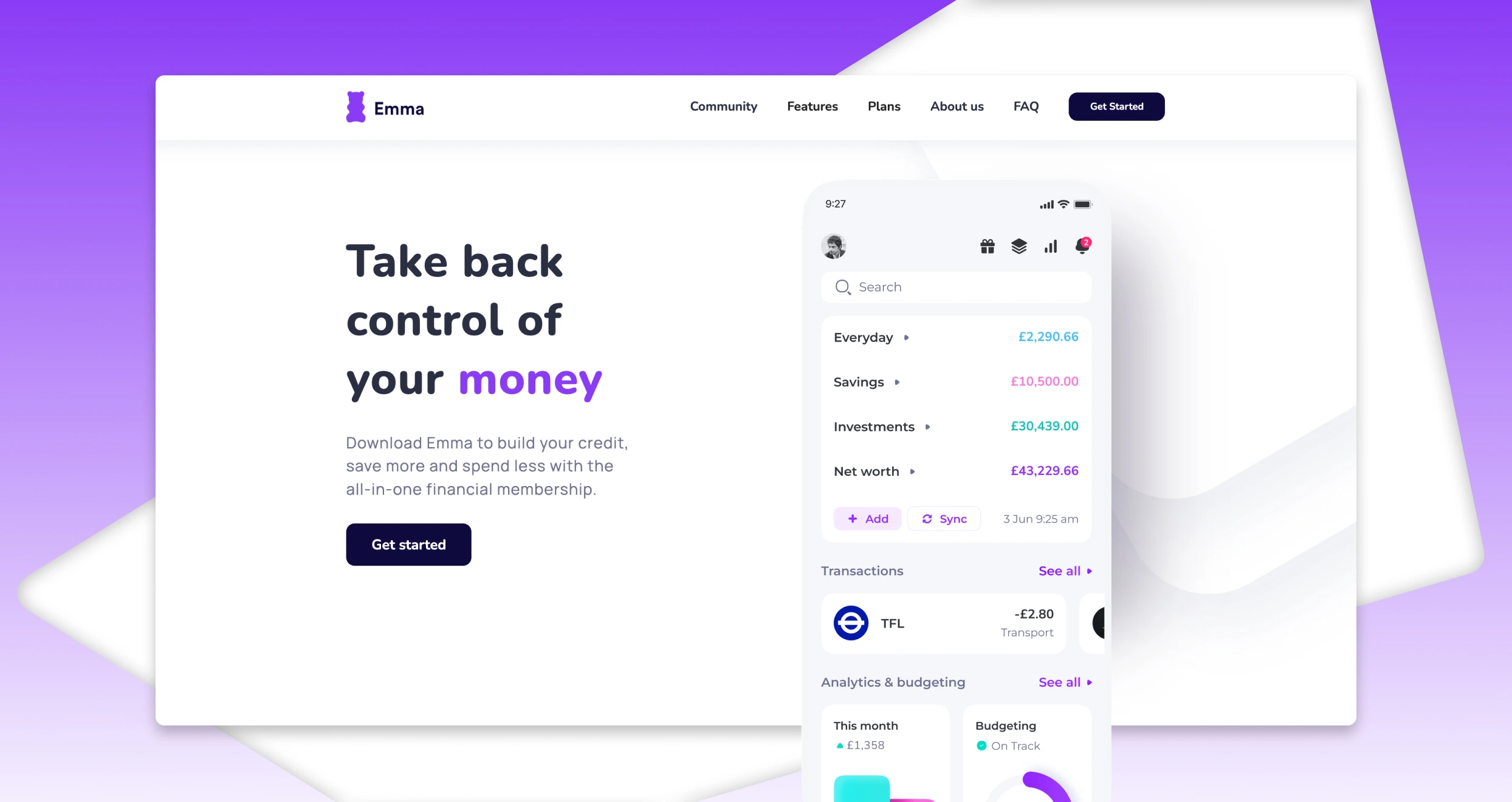

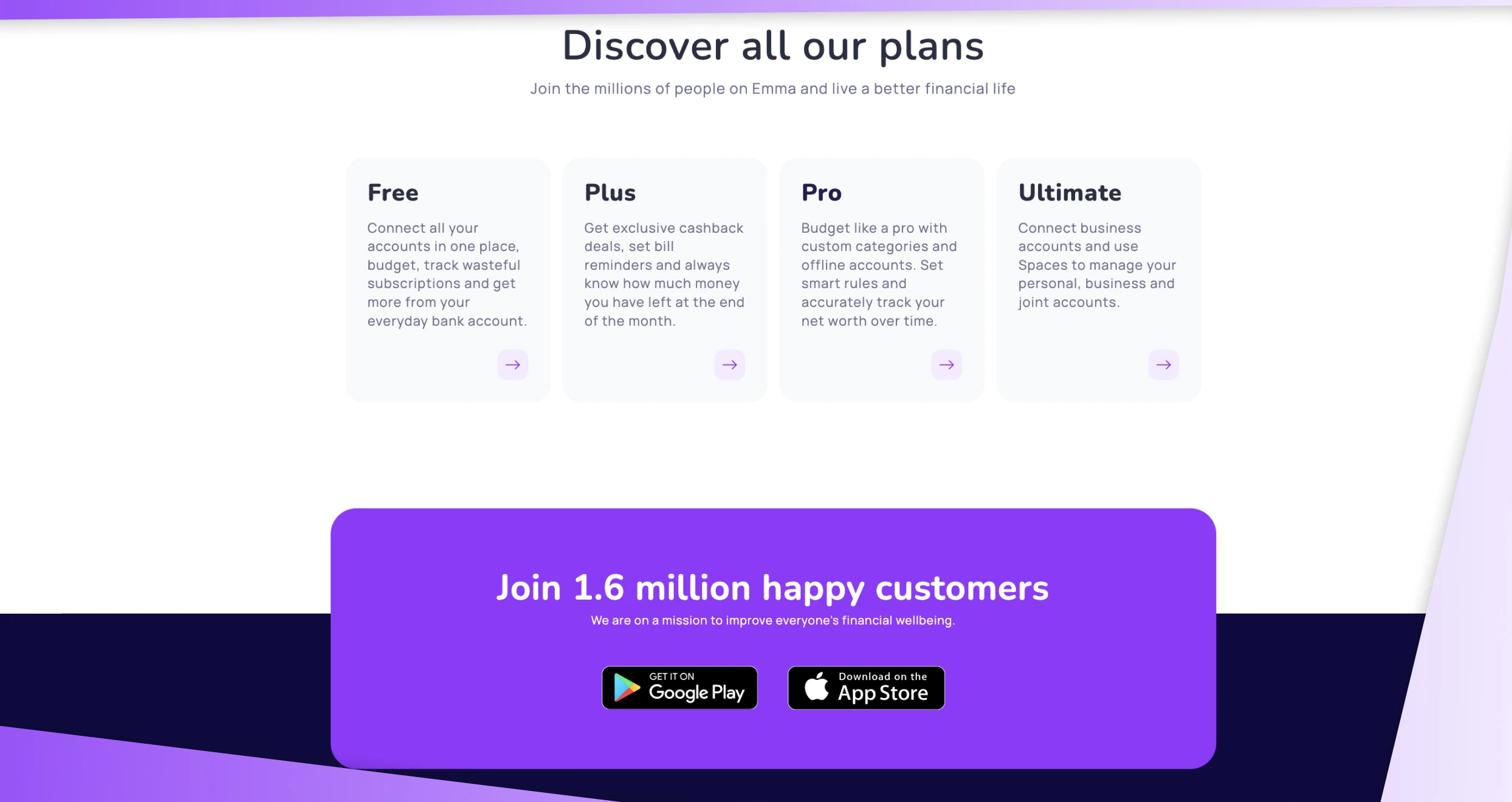

2. Emma – Best UK Budgeting App With Advanced Features

Emma is another budgeting app we had the best experience with. Besides being user-friendly, we like that it has some of the best-advanced features that streamline users’ expense tracking. With this app, it’s easy to connect to multiple bank accounts, credit cards, and cryptocurrencies. As a result, you get a comprehensive overview of your finances using a single platform. Emma is also customisable, meaning users can adjust the features based on their preferences and track their expenses for a more extended period.

Another element that makes Emma stand out is its budgeting tools, which help users set spending limits. Furthermore, it features insightful reporting and notifications. These ensure you stay on top of your finances by always keeping you informed of your upcoming expenditures. Overall, over 1.6 million users are enjoying Emma’s features, which proves it is safe and available for all types of individuals. You can try Emma’s free version before deciding whether it is suitable for you.

Pros

- Provides personalised insights into your spending

- Monthly savings reminders for consistent saving

- Tracks both cryptocurrency and traditional bank balances

- A user-friendly, modern design, and customisable budgeting app

Cons

- Some banks are not supported, especially on the Emma Free and Plus plans

- There are no detailed spending habit comparisons

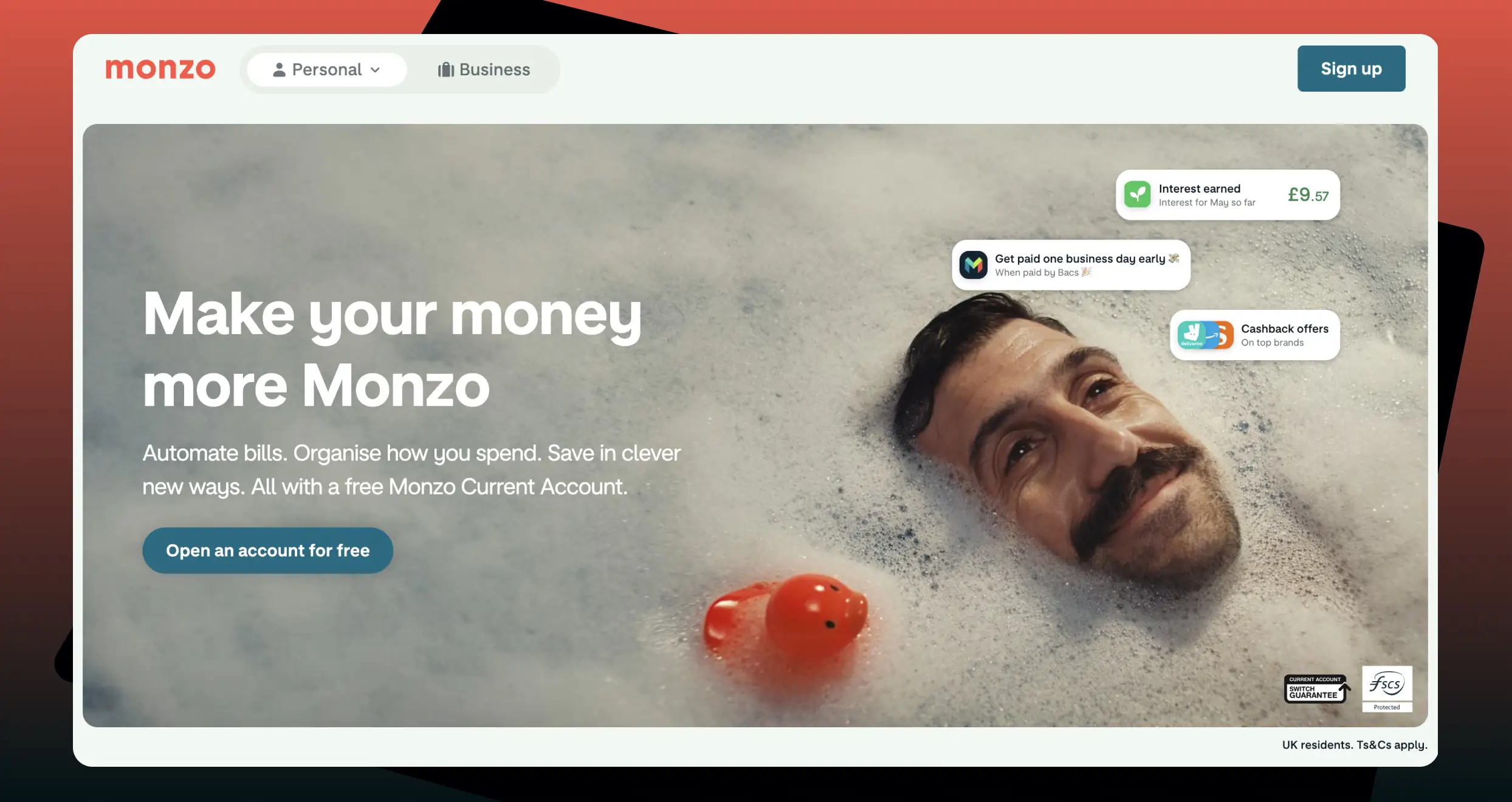

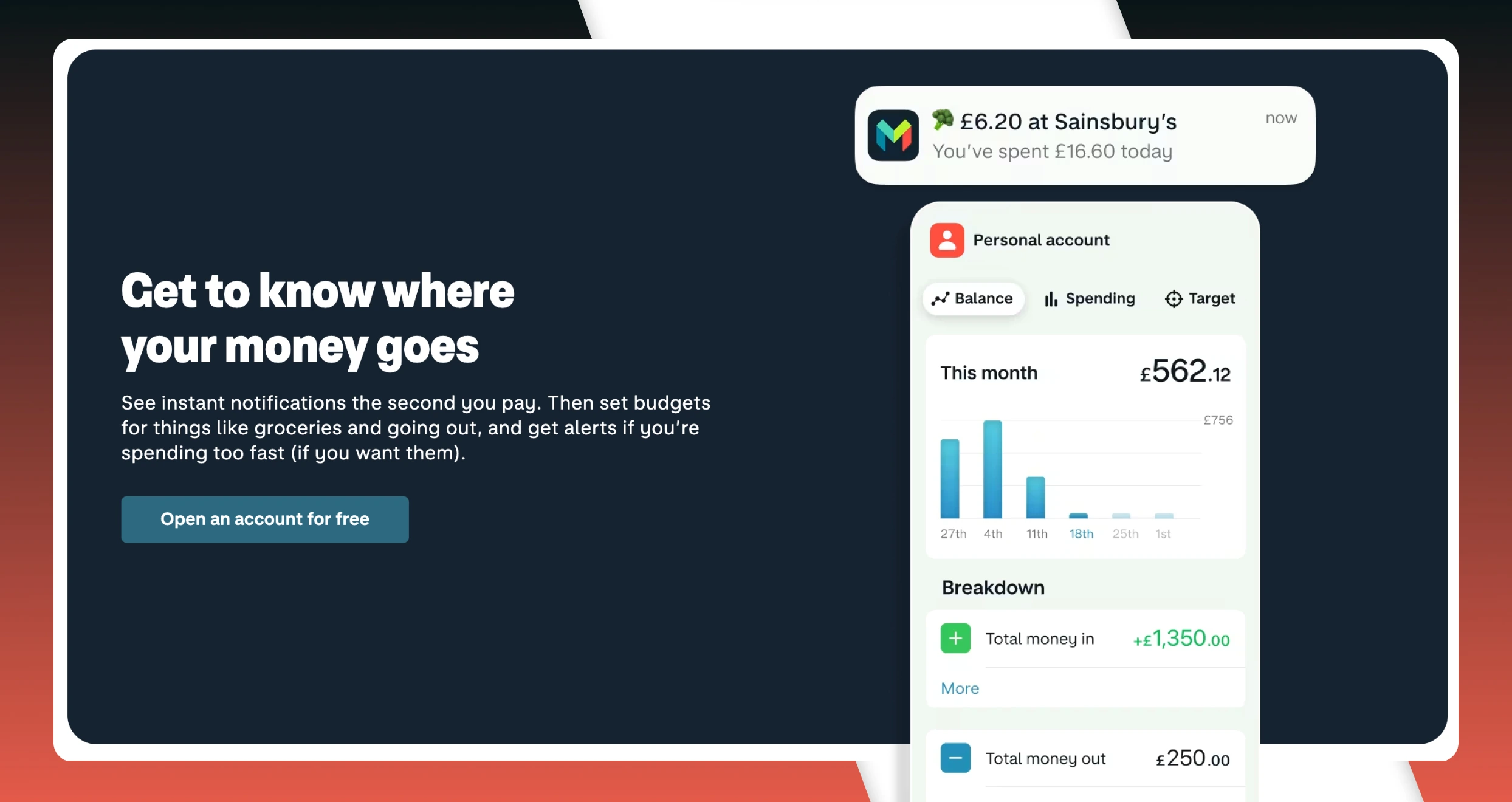

3. Monzo – Top Low-Cost Budgeting App in the UK

If you are looking for a low-cost budding app in the UK, Monzo is a considerable choice. According to our analysis, there are many free budgeting apps UK. However, Monzo stands out because of its low-cost plans, allowing low-budget individuals to effectively budget and manage their finances. For instance, Monzo’s free plan comes with a 3.85% AER interest on instant access savings. Here, there is no minimum deposit requirement, and you can make withdrawals anytime you see fit.

Additionally, Monzo’s paid plans start at £3 monthly, which is low compared to most of its peers. There are also other plans, namely Perks and Max, which come with numerous advanced features at low cost. We like that the tool sends instant notifications every time you make a purchase, allowing you to effectively track your expenses. Cashback deals are also available and you get an opportunity to earn £5 for any referrals.

Pros

- A user-friendly and modern design app

- Highly secured and regulated by the FCA

- No minimum deposit requirement

- Offers cashback deals and an opportunity to earn £5 for every referral

Cons

- Limited features on its free plan

- Requires a monthly fee to connect to other banks and credit cards

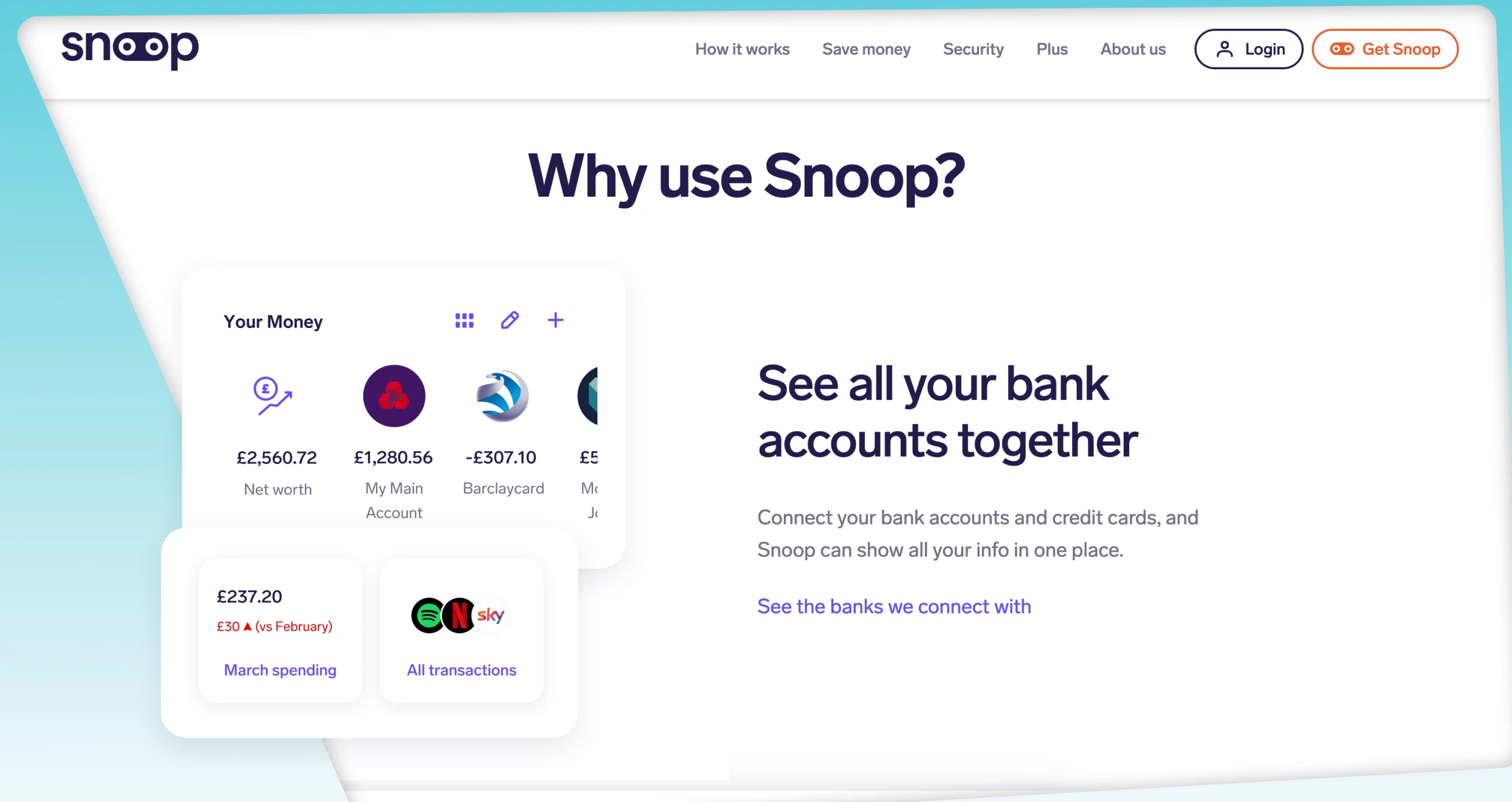

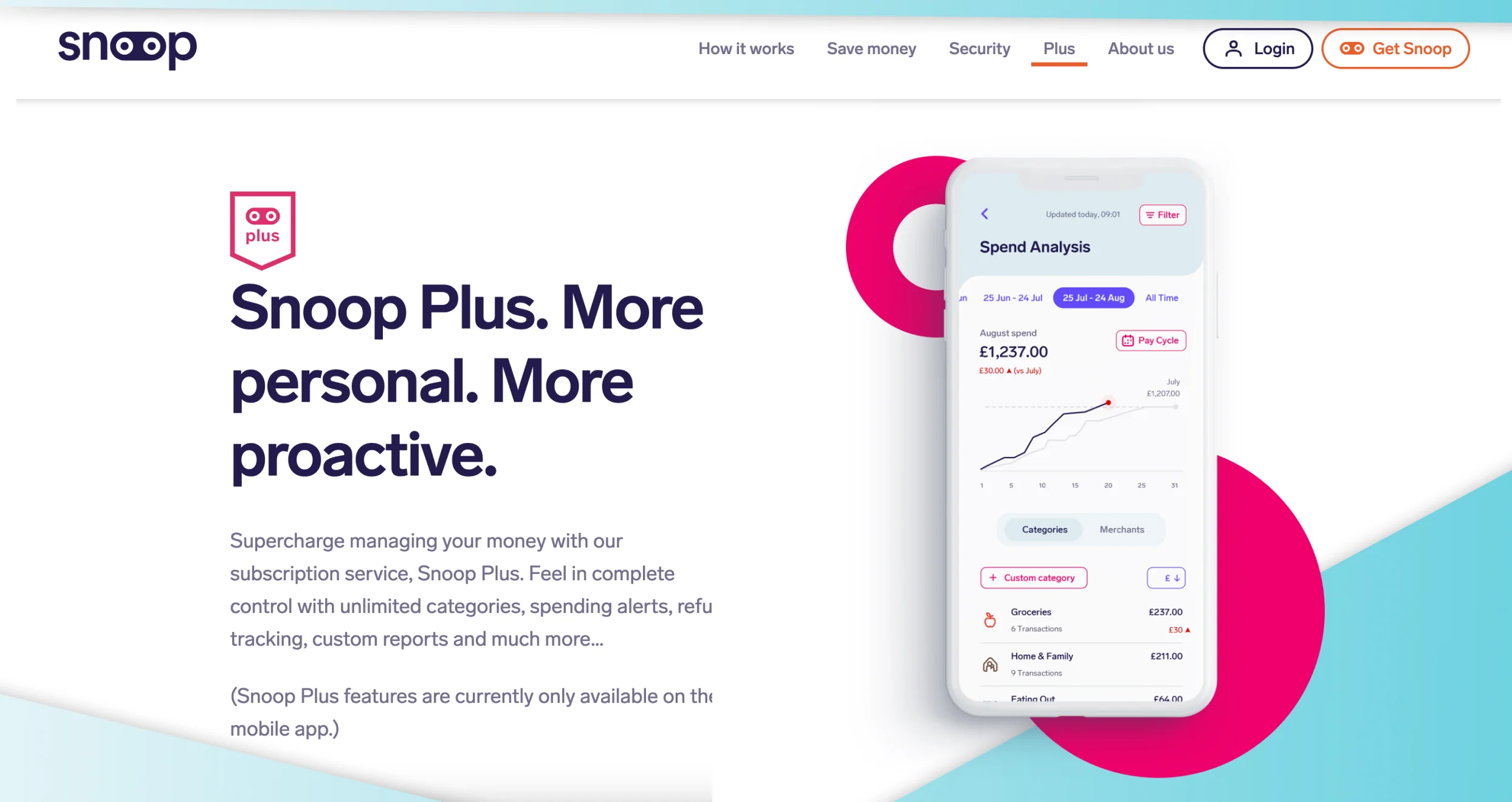

4. Snoop – Beginner-Friendly Budgeting App

Newbies to budgeting apps should consider Snoop. We tested this app, and it is among the most user-friendly in the market. We also like its automatic transaction categorisation and analysis. This helps newbies easily track their expenses and make smarter decisions. Moreover, Snoop enables secure connection with banks, allowing users to view their finances and transactions from a single dashboard. You will then decide where to save in the future.

Besides expense tracking, Snoop offers personalised money savings recommendations, which we believe every newbie needs. From your spending data, the app will suggest better alternatives. You will also receive notifications on subscription renewals or changes. We noticed that the app has bill reminders, which you can set up to never miss a due date or incur a bank penalty fine. We can conclude that Snoop is a reliable budgeting app, especially for individuals who are not looking for interest savings or investment accounts.

Pros

- A user-friendly and customisable budgeting app

- Allow users to connect all their bank accounts and credit cards together

- Offers expense budgeting advice and recommendations

- Offers weekly and monthly spending summaries

Cons

- There are no interest-earning and investment accounts

- Custom spending report is only available on its Plus plan

5. Moneyhub – Best Budgeting App for Detailed Analysis and Insights

We find Moneyhub to be a comprehensive and simple budgeting app for UK individuals. We were primarily drawn to its spending analysis feature, which we believe will help users stay on top of their finances. Moreover, Moneyhub offers a seamless connection to multiple bank accounts, allowing you to view all your finances from a single dashboard. As a result, you will learn more about your spending habits and make the best decisions that improve your overall financial health.

While testing Moneyhub, we also like that it sorts expenses by different categories. This means users will understand where every pound goes regardless of the budgeting method they prefer. Plus, it offers advice and tips to help you make the best savings decisions. Simply put, this app ensures you avoid overspending through its detailed analysis and insights.

Pros

- Creates a spending overview to ensure you remain financially disciplined

- Its Plus plan is affordable and has numerous advanced features for an exciting experience

- A user-friendly and modern design app for Android and iOS mobile devices

- Employs robust security measures and is regulated by the FCA

Cons

- No free plan

- No investment options

What is a Budgeting App?

Now that you have met the top budgeting apps in the UK, you probably wonder what they are all about. Well, if you are a beginner with these tools, note that a budgeting app is software that helps you track your finances using a mobile device. With a budgeting app, it is easy to monitor the incoming and outgoing funds on your account. As a result, you will understand where you overspend and make the necessary changes to achieve your financial goals.

The development of budgeting apps has saved many individuals a lot of time. You no longer need to draw up a budget manually using a pen, paper, or spreadsheet. This traditional method consumes a lot of time and is prone to errors. With an app, you simply need to download and install a suitable option on your mobile device, and you are good to go. Through an open banking system, all your bank accounts and credit/debit cards will be linked in the app so you can effectively manage your finances.

Overall, thousands of budgeting apps are out there for you to choose from. As professionals with vast experience in the financial space, we advise you to thoroughly analyse them to make a secure choice. You do not want your personal and financial data to fall into the wrong hands and risk losing your hard-earned money. Any app for budgeting you choose must be regulated by the Financial Conduct Authority (FCA) to guarantee safety.

Top Budgeting Methods

Various budgeting methods are available to suit every user’s individual preferences and goals. One method may work for your friend or colleague, but it doesn’t have to work for you as well. It’s all about streamlining your activities as you work towards achieving your financial goals.

That being said, here are the top 5 budgeting methods to note.

This budgeting method enables you to allocate every pound you earn to specific categories. This means you will leave no balance at the end of the month. The best element about this method of budgeting is that it is highly effective, as all your money will have a purpose. And if you do not plan to spend all of your income, ensure you assign what’s left to a savings expense. The only pitfall we noted is that zero-budgeting can be time-consuming and requires maintaining discipline.

In this method of budgeting, you will allocate 50% of your net income to your needs like housing, utilities, food, and more. 30% will go to your wants, such as dinner dates, buying a new phone, and more. Then, you will allocate the remaining 20% to your savings and debts. The best element about this budgeting method is that it helps you create a balance between your needs and wants. You will also remain disciplined when it comes to saving for the future. While it is a straightforward and easy method to implement, the 50/30/20 rule isn’t suitable for everyone’s financial requirements.

In the envelope budget system, you allocate cash to different envelopes for various expense categories. The envelope allocation can be physically done with cash or electronically with an app or spreadsheet. Once you have made your allocation and the money in an envelope runs out, you can no longer spend more in that budget category until the upcoming month. And if you have funds left at the end of the month, you can roll them over into the same envelope next month. You also have the option to transfer the remaining funds to another budget category or envelope or save them for future use. This budgeting method promotes discipline in spending but can pose a challenge for individuals with variable incomes.

Pay yourself first budgeting ensures you prioritise savings above everything else. The first bill you pay every month is to save a predetermined amount. After paying yourself, you can now focus on paying bills and spending the balance however you please. The best thing about this method is that it helps you meet your savings goal and you can use it together with other methods we list here. The main focus with the pay yourself first budget is that you pay for the things you have to and worry less about the rest.

This type of budget focuses on aligning your budgeting with your priorities and values. This means you will allocate funds where they matter most. These may include achieving a financial objective, charitable giving, or hobbies. This type of budgeting can motivate users to focus on a main goal. However, you must be prepared to remain disciplined to maintain it.

How to Choose the Right Budget App UK

There are so many budgeting apps in the UK, thus choosing the best can be challenging. You must conduct thorough market research and combine various elements to identify the best option. These include:

Always prioritise the safety of your personal and financial data when choosing the best budget app UK. The best app should have strong security features, including two-factor authentication and encryption. Plus, confirm whether it is regulated by the FCA, considering that many fraudulent options exist waiting to take off with your hard-earned money.

Evaluate various apps’ pricing structures before choosing an option. Note that some budgeting apps are free, while others have both free and paid plans. While it is crucial to prioritise the charges you will incur, ensure it balances the value that comes with it. For instance, you may have to pay more to enjoy advanced features in a budgeting app.

It is essential to consider a budgeting app UK that allows you to efficiently categorise your spending. Whether you are looking to benefit from zero-based, pay yourself first budgeting, or more, the app must support your preferred budgeting method. This will make it easier for you to monitor where your cash is going and cut back on expenditures if need be.

Whether you are new to budgeting apps UK or looking for a reliable option, ensure you settle with one with a simple and user-friendly interface. Besides expense tracking, confirm whether the app features bill reminders, automatic categorisation, saving features, or more. Most importantly, check compatibility with Android, iOS, and web mobile devices. The best option should offer offline access and the ability to access your budgeting information while on the move.

The best budgeting app UK should automatically sync your bank accounts. It must also support integration with credit cards and other financial institutions. By prioritising this feature, it will be easier for you to enjoy your experience due to convenient and seamless expense tracking.

Always choose an app with a reliable support service. Before making a commitment, contact an app’s team and gauge its response rate and how it handles your concerns or questions. A support team with prompt responses and relevant solutions is worth committing to. Also, check the supported channels like live chat, phone, and email. Availability also matters. Whether they operate 24/7 or five days a week, simply ensure it aligns with your schedule.

While it is crucial to focus primarily on the elements above when choosing a budgeting app in the UK, consider analysing other users’ opinions. Reliable sources like Google Play, the App Store, and Trustpilot will give you access to honest opinions, whether positive or negative. As a result, it will be easier for you to narrow down your options and identify a highly regarded budgeting app.

How to Register an Account with a Budgeting App

Registering an account with the best UK budgeting app involves simple steps that take minutes to complete. If you are a newbie, here are the simple steps to follow.

Before participating in the account registration process, download your preferred budgeting app on your iOS or Android mobile device. Ensure the app is suitable for your needs and has robust security measures. Most importantly, understand its terms of service to ensure you are on the same page and you will not be inconvenienced once you are fully invested.

On your mobile device, open the app and click the sign-up or register button. You will complete the registration using your personal details, including your name, email, phone number, date of birth, and more. You will also create a username and strong password as an added layer of safety to your account. Other apps will encourage more safety measures, like using biometrics and activating two-factor authentication.

All FCA-regulated budgeting apps will ask you to verify your email. A link will be shared to your email address with a code to confirm. Others will also want you to verify your phone number through SMS codes. This procedure is straightforward, so expect your account to be activated as soon as you complete it.

It’s a no-brainer that budgeting apps allow users to link their bank accounts for efficient and automated expense tracking. In this procedure, you will share login details for your bank accounts. With a secure app, you do not need to worry about the safety of your financial details.

Once you have completed the above procedures, select your preferred budgeting method and set your goals. You can also customise your experience by setting limits, adjusting notifications, and more, to suit your preference. At this point, you are free to create budgets and track your finances or expenditures. While beginners do not need guidance to explore these apps, some have free versions or demos to help you get started.

Conclusion

Budgeting tools UK have transformed how we manage our finances. Not only can individuals save time, but they can also track their monthly expenditures and identify areas that require adjustments. Simply put, the best budgeting apps, like the ones we recommend above, will help you build a good money habit. With varying features for every user, ensure you select the best for your requirements for an exciting experience. And if you are new to using these apps, start with their free versions, as they are primarily tailored to help you understand the apps’ features risk-free.

Plum’s automated savings and Monzo’s low-cost plans caught my eye. As a trader, I wonder if apps like Emma, which track cryptocurrencies alongside traditional finances, might add extra value for managing diverse portfolios.