We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Australia is one of the regions experiencing a surge in cryptocurrency trading thanks to the advancing technology that makes online trading safe and secure. If you’re new to this space, you might be wondering how to choose a secure platform regulated by the Australian Securities and Investment Commission (ASIC) and AUSTRAC. That’s where we come in. We’ve tested and reviewed the top cryptocurrency exchanges, and we’ll guide you through the best options available. Additionally, we’ll cover how to get started and provide insights into Australia’s cryptocurrency tax regulations. By the end, you’ll be ready to make informed decisions and start your crypto journey on the right foot.

In a Nutshell

- Cryptocurrency exchanges are best suited for traders or investors looking to solely put their money into crypto tokens.

- The best cryptocurrency exchange Australia should be licensed and regulated by ASIC to guarantee a safe and secure trading environment.

- At Invezty, our experts conduct thorough tests and compare hundreds of cryptocurrency exchanges to bring you the best recommendations.

- The best Australian crypto exchange must align with your trading requirements. We will guide you on how to identify a suitable option.

- The cryptocurrency market is highly volatile. Always conduct thorough research on any digital token and apply the right strategies to maximize your profit potential.

List of the Best Crypto Exchanges

- Kraken – Overall Best Crypto Exchange in Australia

- eToro – Best Cryptocurrency Exchange With Diverse Asset Offerings in Australia

- Plus500* – Top Choice For CFD Cryptocurrency Trading in Australia

- Coinbase – Best Cryptocurrency Exchange For Newbies in Australia

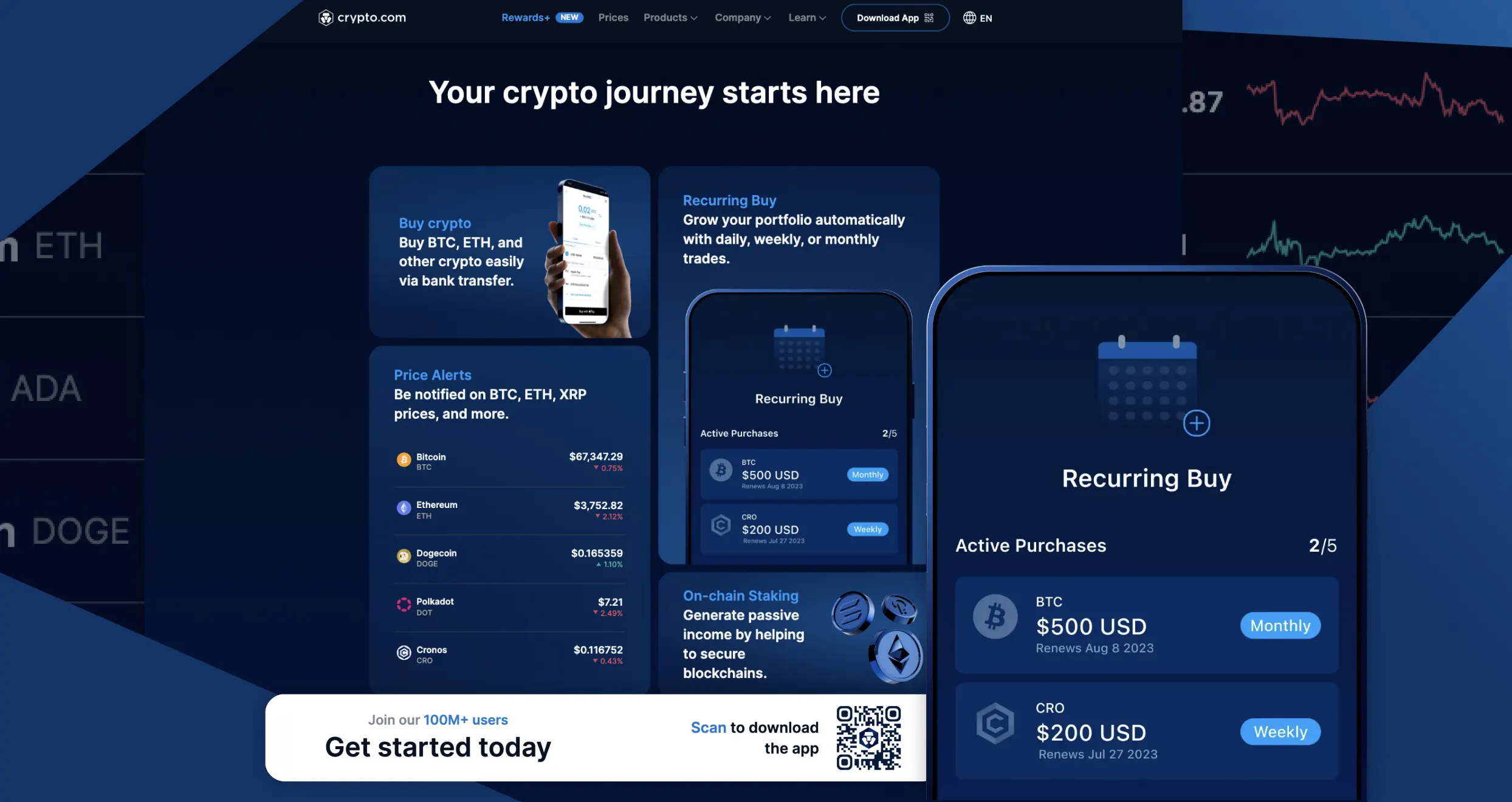

- Crypto.com – Cheapest Crypto Exchange in Australia

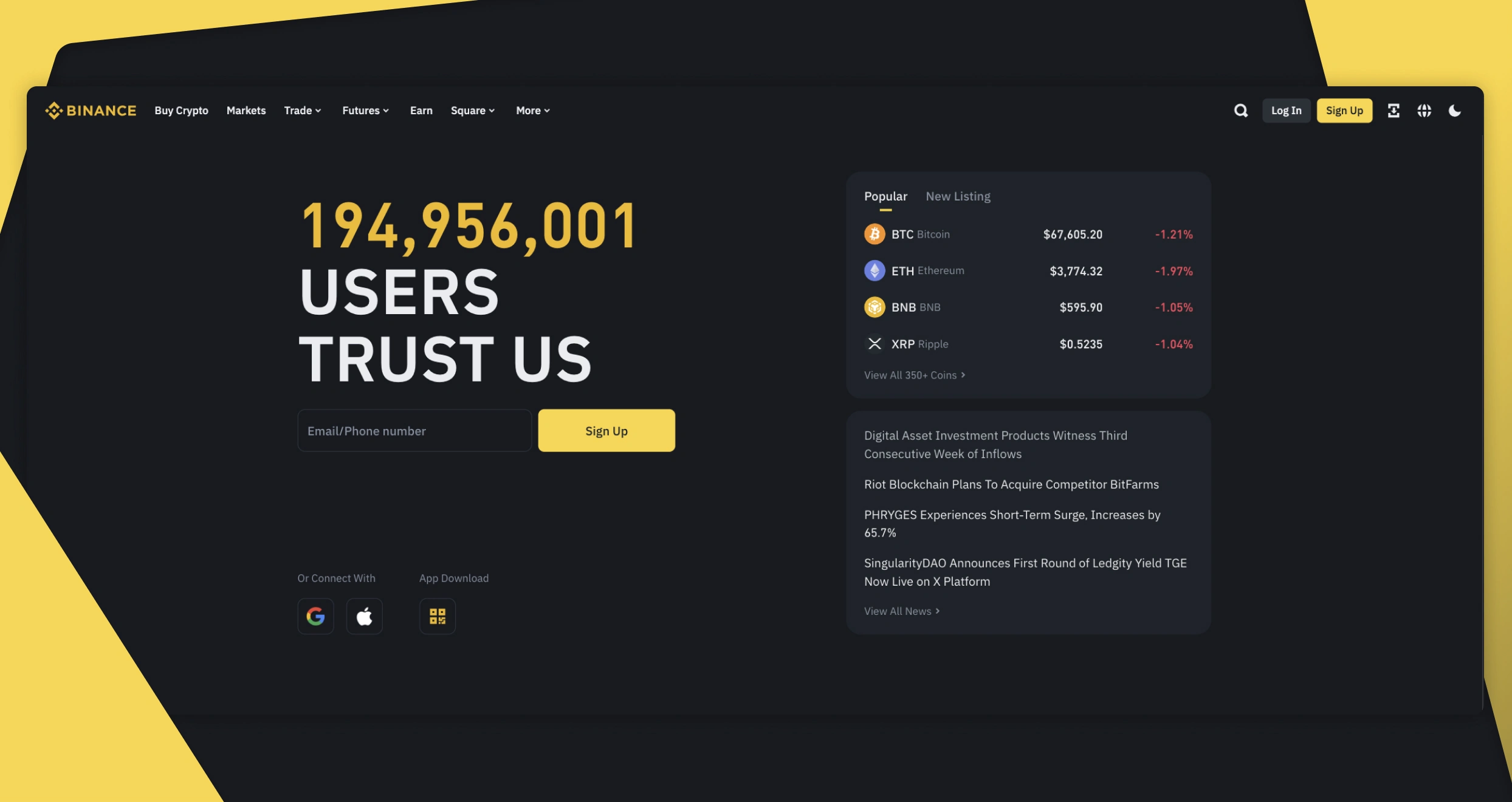

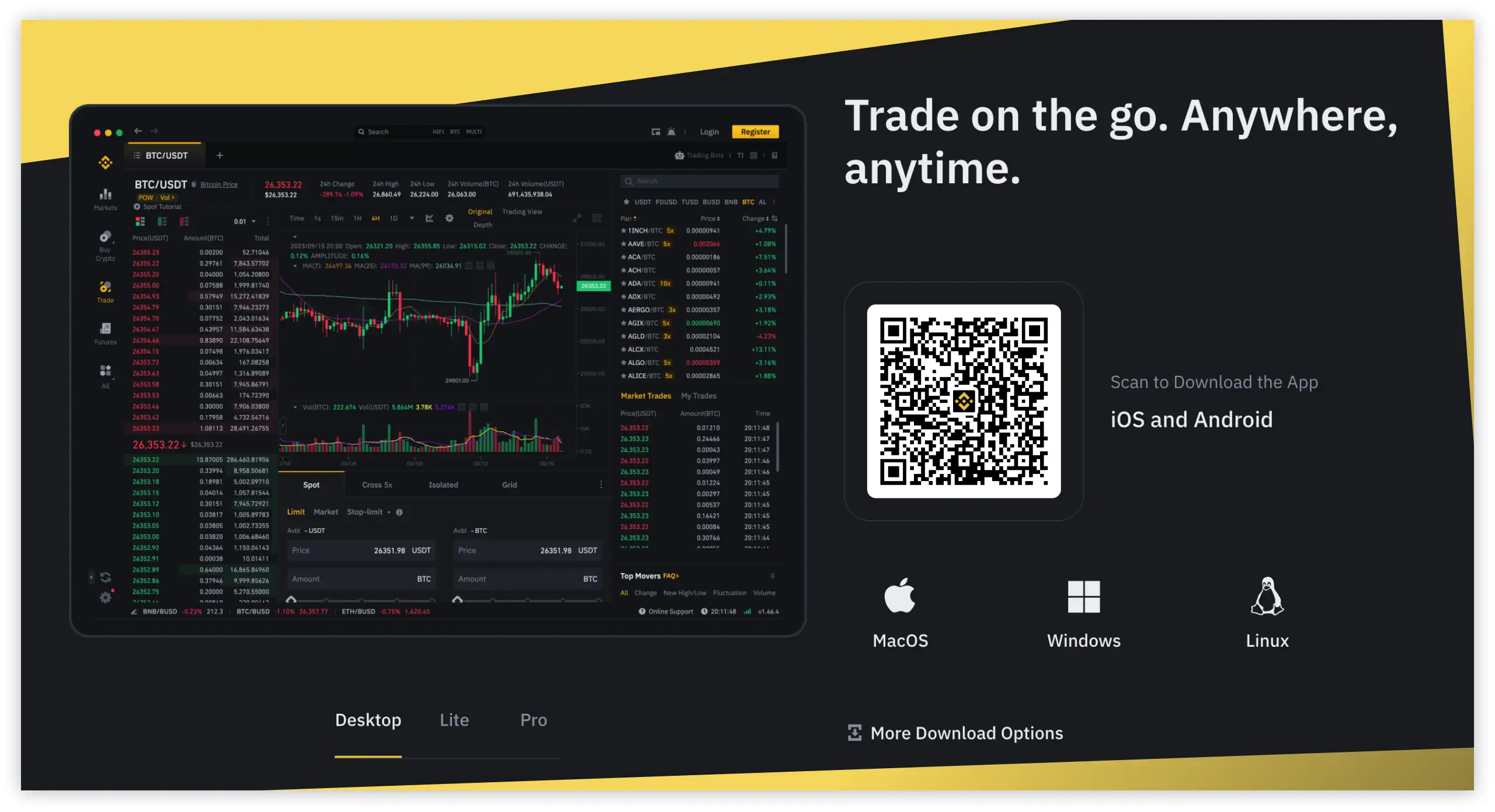

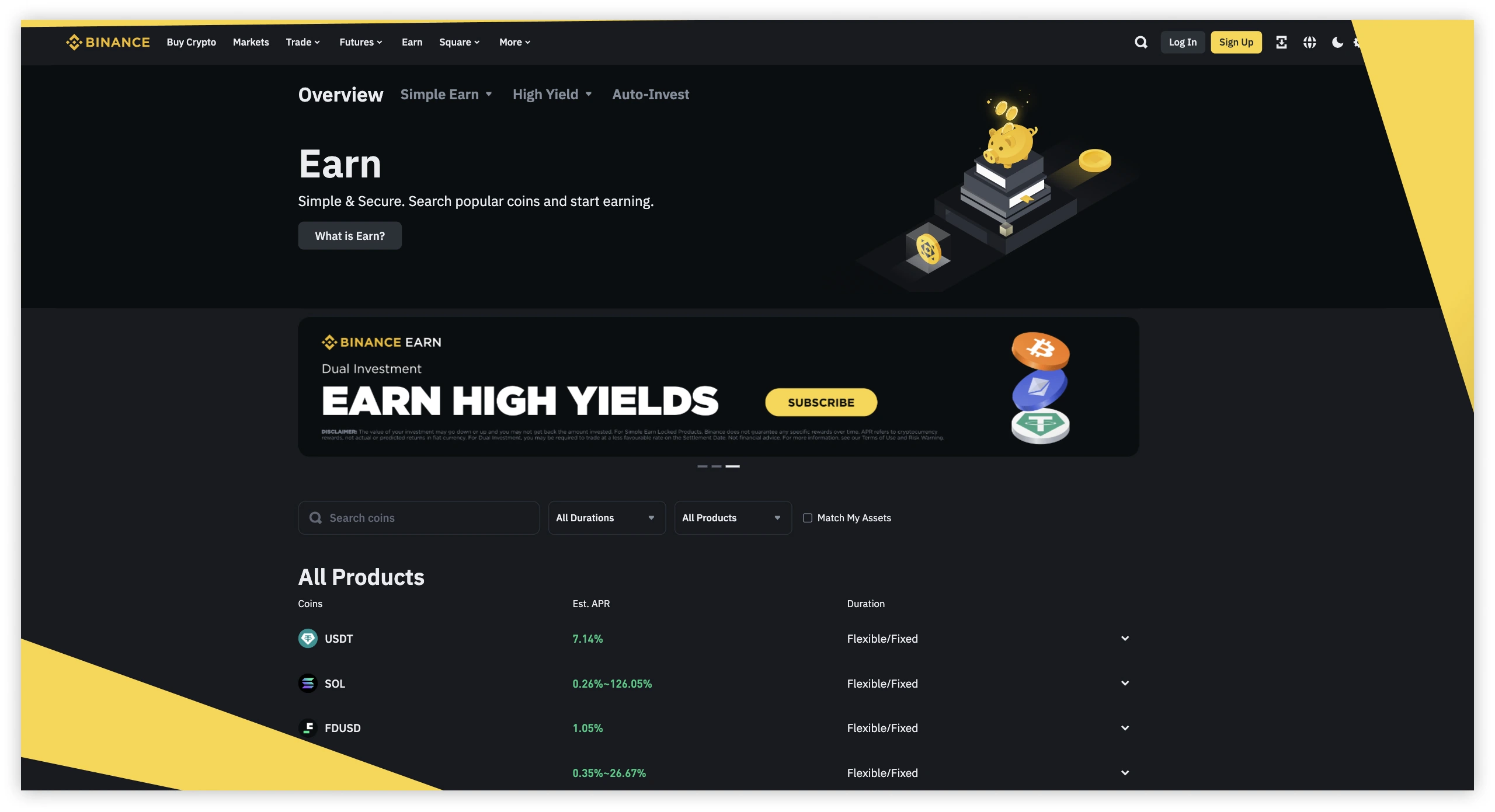

- Binance – Best Cryptocurrency Exchange With Numerous Digital Tokens

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

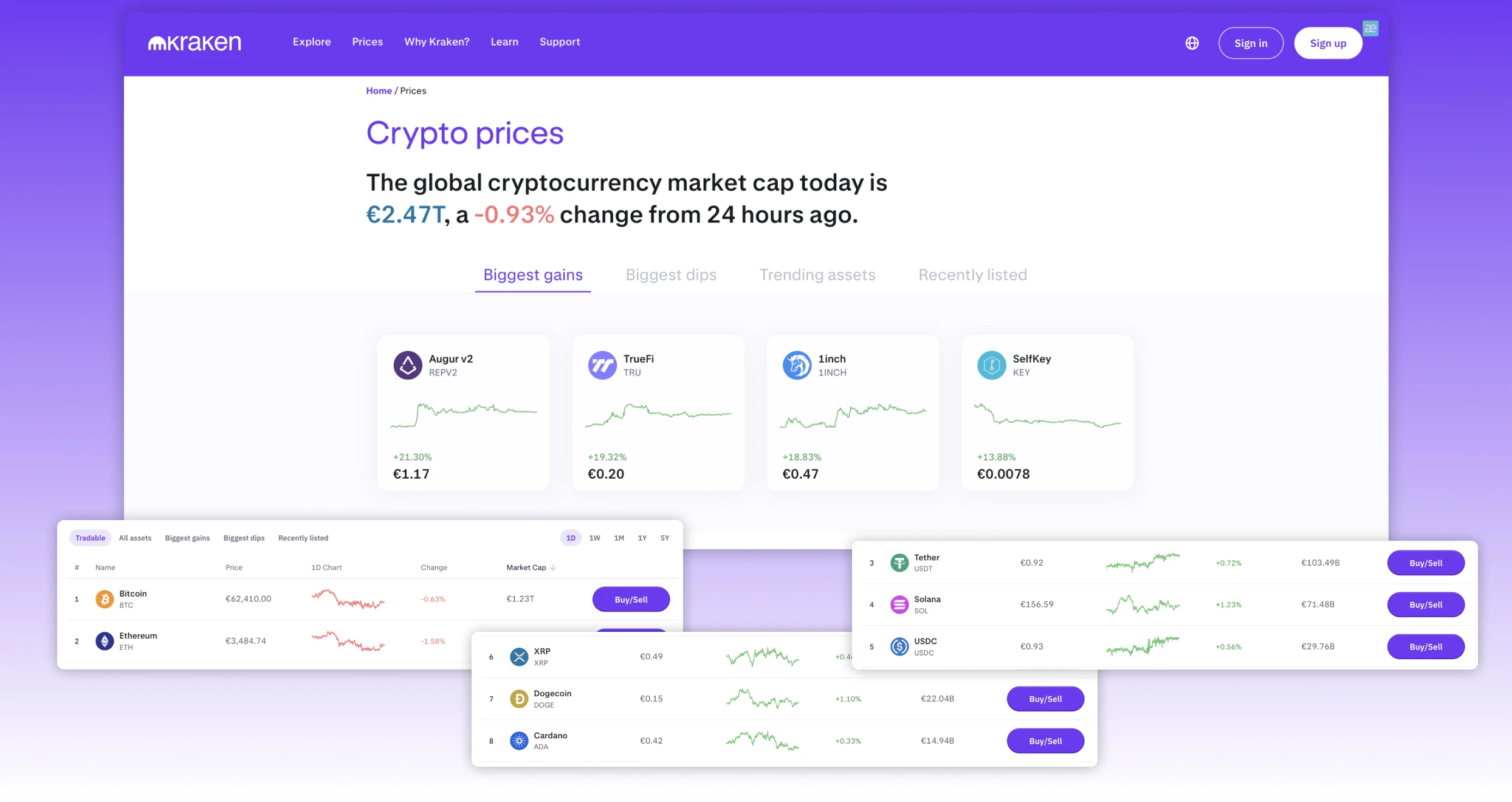

Compare the Best Australian Crypto Exchanges

As mentioned earlier, we thoroughly test and compare numerous cryptocurrency exchanges in Australia to compile our recommendations. We evaluate various features, outlined in the table below, to help you make informed decisions and ensure a smooth, enjoyable trading experience.

| Best Crypto Platform AU | Exchange Type | Support Service | Price | Supported Coins | Digital Wallet |

|---|---|---|---|---|---|

| Kraken | Centralised | Email, Phone, Live Chat | Free | 200+ | Yes |

| eToro | Decentralised | Phone, Email, Live Chat | Free | +30 | Yes |

| Plus500* CFD Service. Your capital is at risk | CFD broker | Phone, Email, Live Chat | Free | +20 | No |

| Coinbase | Centralised | Phone, Email, Twitter | Free | +200 | Yes |

| Crypto.com | Decentralised | Phone, Email, Live Chat | Free | +250 | Yes |

| Binance | Centralised | Phone, Email, Live Chat | Free | +400 | Yes |

Brief Overview of Our Recommended Cryptocurrency Exchanges’ Fees and Assets

Successful cryptocurrency trading requires careful planning to enhance your experience. It’s important to choose an exchange that is both affordable and offers the right assets for your trading strategies. To help you get started, we have prepared tables below highlighting the fee structure and available assets on our top-recommended cryptocurrency exchanges in Australia.

Fees

| Best Crypto Platform AU | Fees | Minimum Deposit Requirement |

|---|---|---|

| Kraken | Fee ranges from 1 pip | $10 |

| eToro | Yes | $50 |

| Plus500* | From 0.0 pips | $100 |

| Coinbase | 1% on all swaps | None |

| Crypto.com | From $5 to $50 for a single transaction | None |

| Binance | From 0.1% | $0 |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Supported Assets

| Best Crypto Exchange AU | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Dogecoin | Solana |

|---|---|---|---|---|---|---|---|

| Kraken | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* | Yes | Yes | Yes | Yes | No | No | Yes |

| Coinbase | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Binance | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Our Opinion & Overview of the Best Crypto Exchanges

At Invezty, we believe thorough research is essential. That’s why our team has tested and compared numerous cryptocurrency exchanges. To ensure unbiased results, we also reviewed user testimonials from Google Play, the App Store, and Trustpilot. Below, we share our insights and an overview of the best crypto exchanges in Australia based on our comprehensive research.

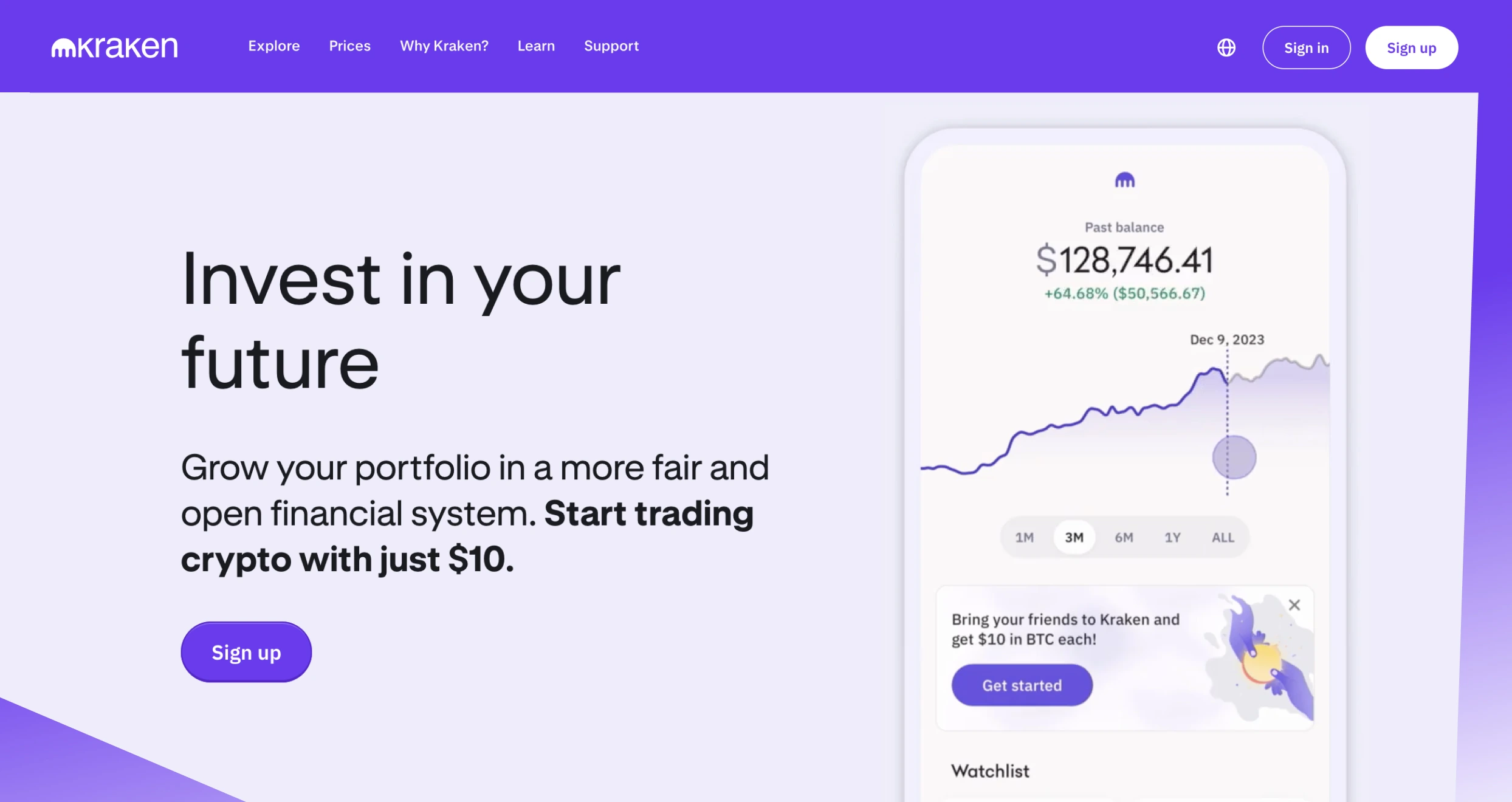

1. Kraken – Overall Best Crypto Exchange in Australia

We tested numerous cryptocurrency exchanges in Australia, and Kraken emerged as our top pick. It caters to all types of cryptocurrency traders with over 10 million global clients and increased security measures, Kraken is dedicated to providing a secure trading environment. The exchange’s platform is user-friendly, and you can start trading with as little as $10.

Kraken offers over 200 assets, including Bitcoin, Ethereum, Litecoin, Ripple, Dogecoin, and Cardano. This variety allows you to diversify your investments and reduce the risk of focusing on a single token. By offering multiple transaction options, low trading fees, 24/7 support service, and more, Kraken earns our 5-star rating.

Pros

- Up to 24% rewards annually for staking your assets with Kraken

- Low spreads on non-instant buys

- High liquidity across various markets

- Availability of popular cryptocurrencies

Cons

- No personal wallet service

- Many elements are featured, and this can challenge newbies to use

Based on our experience, Kraken is one of the most affordable cryptocurrency exchanges. We signed up for trading and investment accounts and incurred no registration fees. Plus, the exchange’s minimum deposit requirement is $10, which we believe is among the lowest in the financial investment industry.

When it comes to instant buy and sell services, Kraken imposes spreads, which are included in an asset’s price. The spreads may vary, depending on the payment method and platform you use. For instance, the exchange applies a 3% fee for converting balances less than the minimum order size using the “Convert small balances” feature.

For investors using the Kraken Pro platform, expect a maker-taker fee schedule. This comes with volume incentives based on investors’ activities in the past 30 days. On average, you will incur a 0.25% maker fee and a 0.40% taker fee for transactions between $0 and $10,000. Overall, Kraken Pro fees are charged on a per-trade basis.

When it comes to transactions, Kraken supports a variety of deposit methods. Most deposits are free, but expect to incur withdrawal charges, depending on the payment method you transat with. You may also pay a currency conversion fee. This of course will depend on the fiat currency you are converting to.

2. eToro – Best Cryptocurrency Exchange With Diverse Asset Offerings in Australia

eToro is another best crypto exchange in Australia that impressed us with its wide range of features. It has a minimum deposit requirement of only $50, with no deposit charges. Although withdrawal charges of $5 apply, the transactions are seamless with supported payment methods, including debit/credit cards, e-wallets, and bank transfers. The exchange is trusted by millions of clients globally and is licensed by the Australian Securities and Investment Commission (ASIC).

eToro offers over 60 cryptocurrencies for Australian traders, including Bitcoin, Ethereum, Litecoin, and others. Besides cryptos, the exchange allows users to diversify their portfolios across other asset classes like forex, commodities, stocks, and more. One standout feature of eToro is the CopyTrader tool, which lets you follow and replicate the trades of experienced traders. With these robust offerings, we give eToro a 5-star rating.

Pros

- Over 60 crypto tokens to choose from

- Low minimum deposit requirement for Australian clients

- Quality learning and research materials

- Additional 3,000+ assets for portfolio diversification

Cons

- Withdrawal fees apply

- Limited cryptocurrency offerings compared to most exchanges we have explored

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

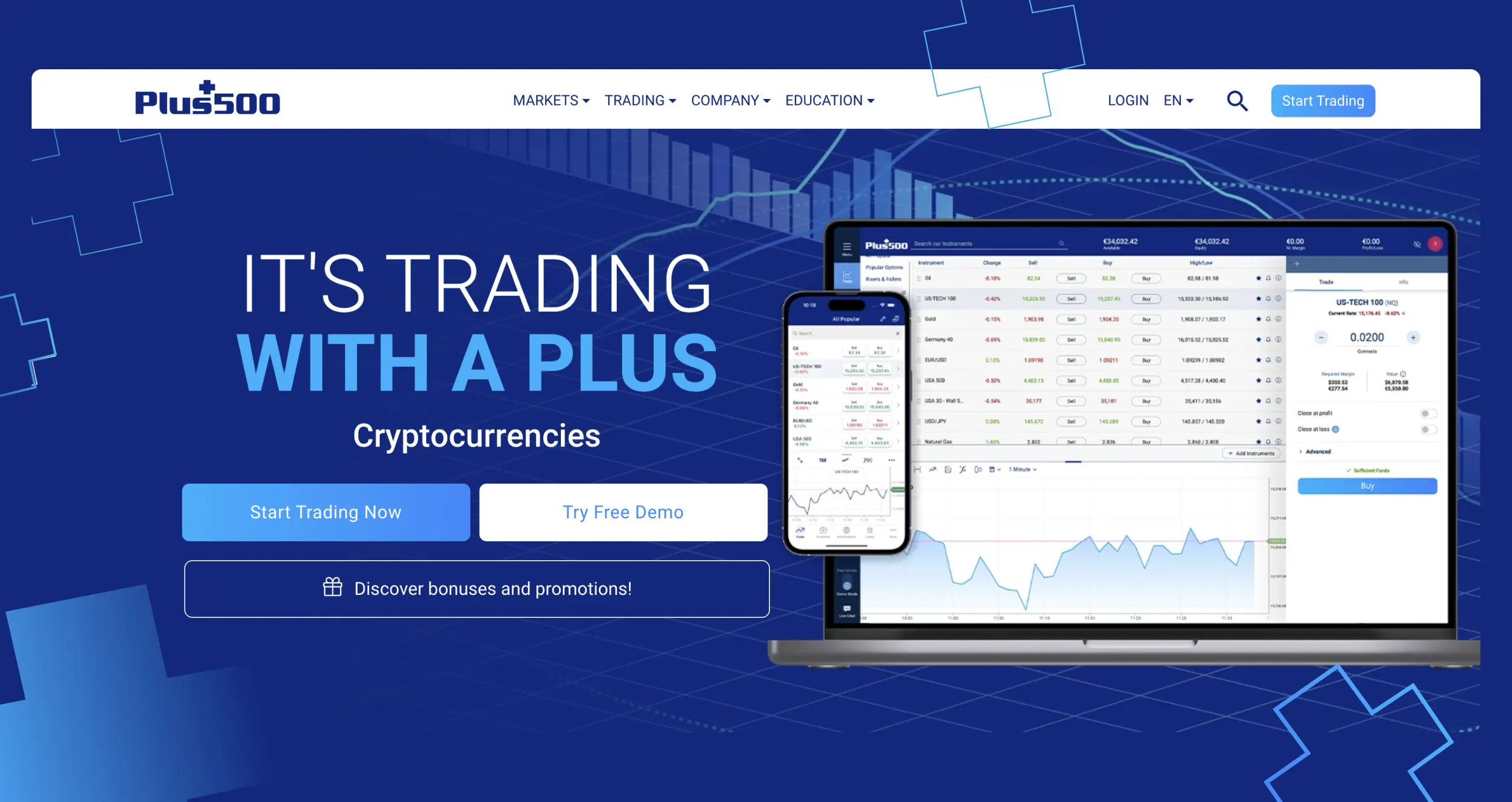

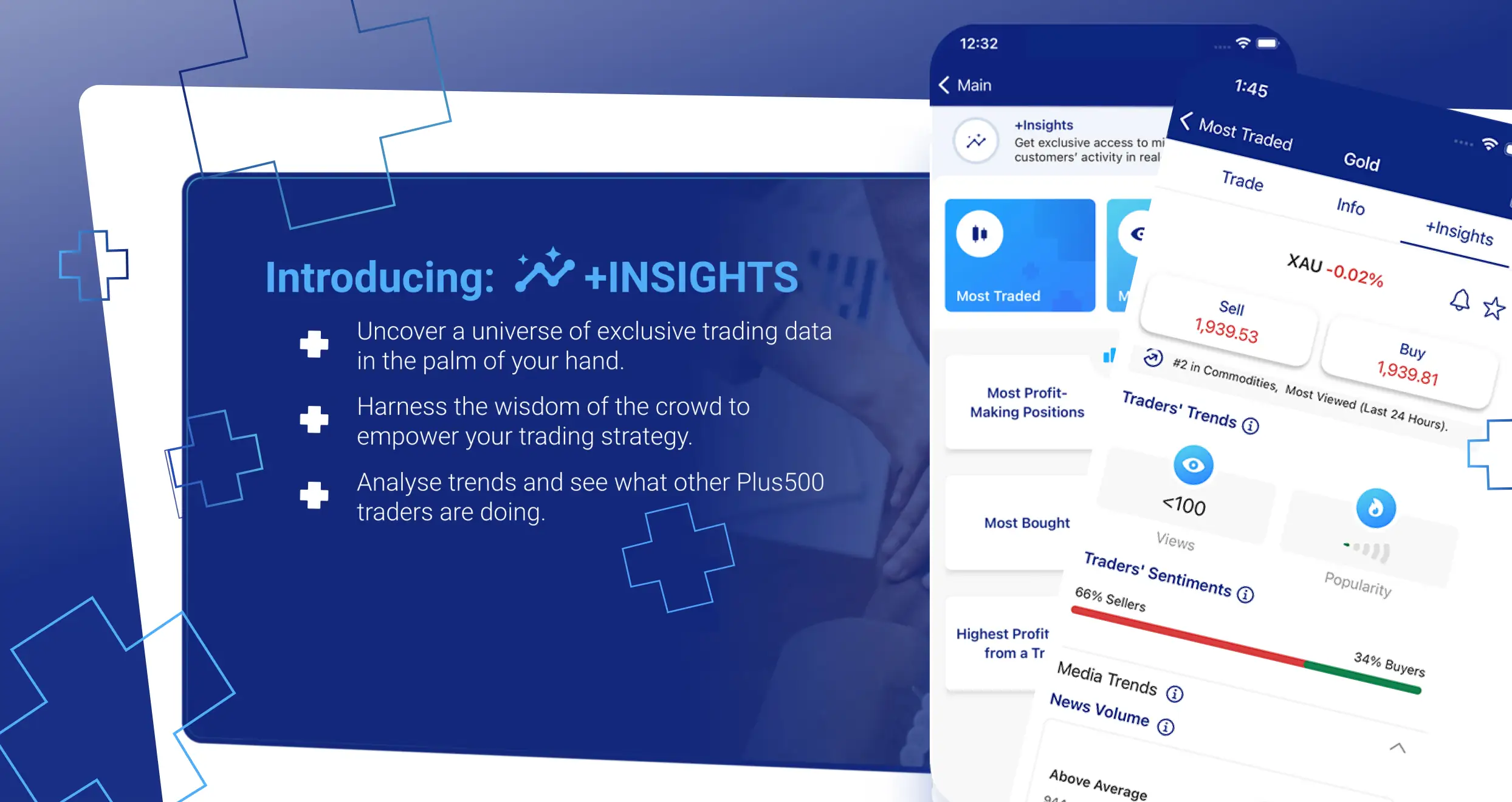

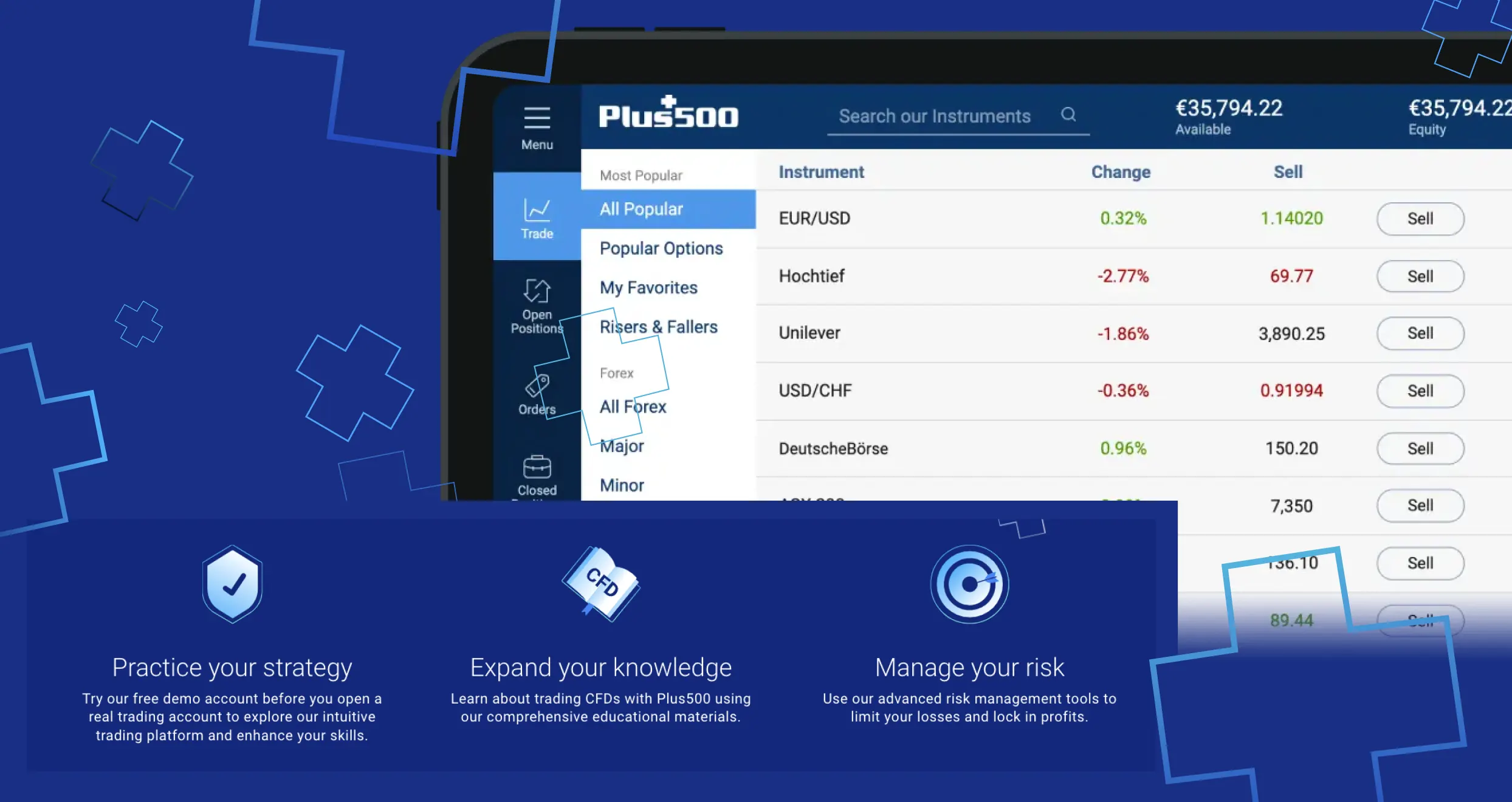

3. Plus500 – Top Choice For CFD Cryptocurrency Trading in Australia

Having extensively tested various platforms, we found Plus500 to be one of the top choices for CFD cryptocurrency trading in Australia. With access to 10+ CFD cryptocurrencies like Bitcoin, Ethereum, and Cardano, it offers a diverse range of investment options. Moreover, Plus500 provides a wide range of additional securities, including forex and stocks (CFDs), making it ideal for portfolio diversification.

We appreciate that Plus500 offers crypto trades with low spreads* starting from 0.0 pips. Minimum deposit requirement for Australian traders is $100. The platform also offers 24/7 support via phone, email, and live chat, as well as quality learning resources for skill development. Based on our experience, this CFD broker in Australia stands out for its user-friendly interface, thus receiving a 4.5-star rating from us.

* other fees may apply

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- A user-friendly and intuitive design interface

- Low minimum deposit requirement

- Reliable and responsive 24/7 support service

Cons

- Inactivity fee of $10 monthly kicks in after only 3 months

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

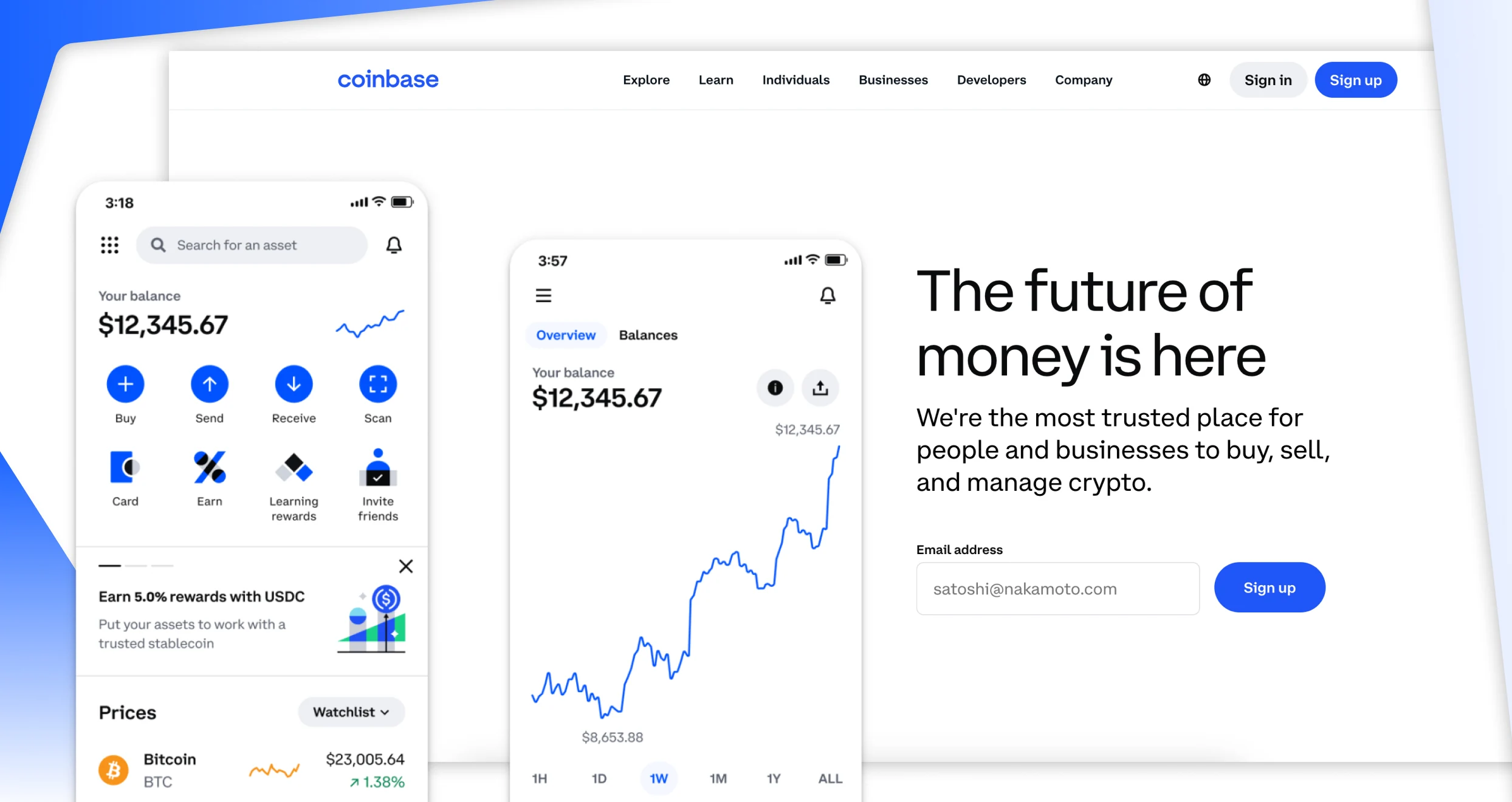

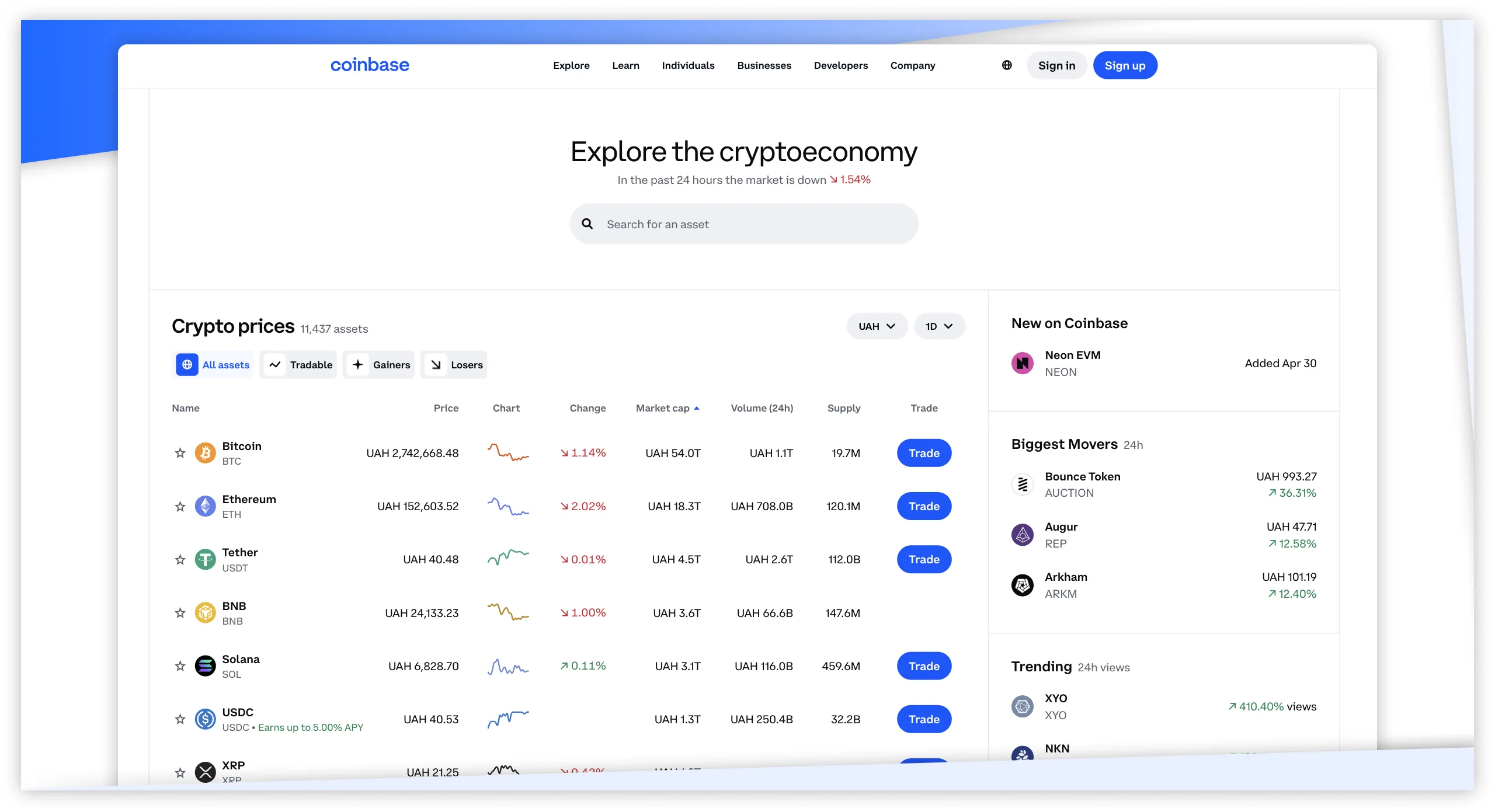

4. Coinbase – Best Cryptocurrency Exchange For Newbies in Australia

For beginners looking to enter the world of cryptocurrency trading in Australia, Coinbase is an excellent option. In our tests, we found it to be one of the safest crypto exchanges for buying, selling, and managing your crypto tokens. With a user-friendly interface and easy account setup that comes with zero fees, Coinbase allows newcomers to get started without incurring extra costs.

Coinbase offers access to over 200 crypto tokens, including Bitcoin, Litecoin, and Ethereum. Beginners can feel confident in the security of their assets, as Coinbase provides a self-custody wallet and operates under ASIC regulation. Additionally, the platform is available via Android and iOS mobile apps, making it easy to manage investments on the go. Based on our comparison with other exchanges, we give Coinbase a 4.6-star rating.

Pros

- User-friendly platform

- In-built centralised crypto wallet backed up by an insurance policy

- Wide array of crypto assets offered

- Offers an opportunity to earn cryptocurrencies by buying and holding assets

Cons

- The exchange controls the private keys to users’ wallets, meaning users do not have complete control over their cryptocurrency holdings.

- You get to pay more for lower balances

Opening and maintaining a Coinbase account is free. You can fund your account and withdraw money using a variety of payment methods, including wire transfers, debit/credit cards, and digital wallets like Apple Pay.

While using FIAT, you may have to pay deposit and withdrawal fees depending on your chosen payment method. ACH transactions are free. But alternatives like wire transfers attract $10 and $25 deposit and withdrawal fees, respectively. That said, you can buy as little as $2 of crypto using a card or funds in your account.

Expect to pay specific fees when you purchase, convert, or sell crypto on Coinbase. Your charges will depend on numerous factors, including the order size, your preferred payment method, and market conditions. For instance, if you place an order at a stipulated market price and it is fulfilled immediately, this exchange will charge you anywhere from 0.05% to 0.60%.

If you place standard buy and sell orders on Coinbase, the platform will include a spread in the specified price. You will also encounter a spread when converting one crypto asset to another. To avoid spreads, join Coinbase Advanced, which is an advanced platform for seasoned traders.

Depending on your jurisdiction, you may stake crypto on Coinbase at no additional costs. However, the exchange will deduct a commission based on your accrued rewards and the involved asset. The standard commission for ADA, SOL, DOT, ATOM, XTZ, and MATIC is 35%. Eligible Coinbase One members can enjoy a commission of 26.3% for the same assets. On the other hand, ETH attracts a 25% commission.

Lastly, Coinbase charges asset recovery fees. If you send an unsupported asset to your Coinbase account, you may try to recover it. If it’s eligible for recovery, the exchange will charge a network fee. If the recovery is over $100, expect to pay a 5% fee. But if it’s less than $100, you won’t have to pay a dime.

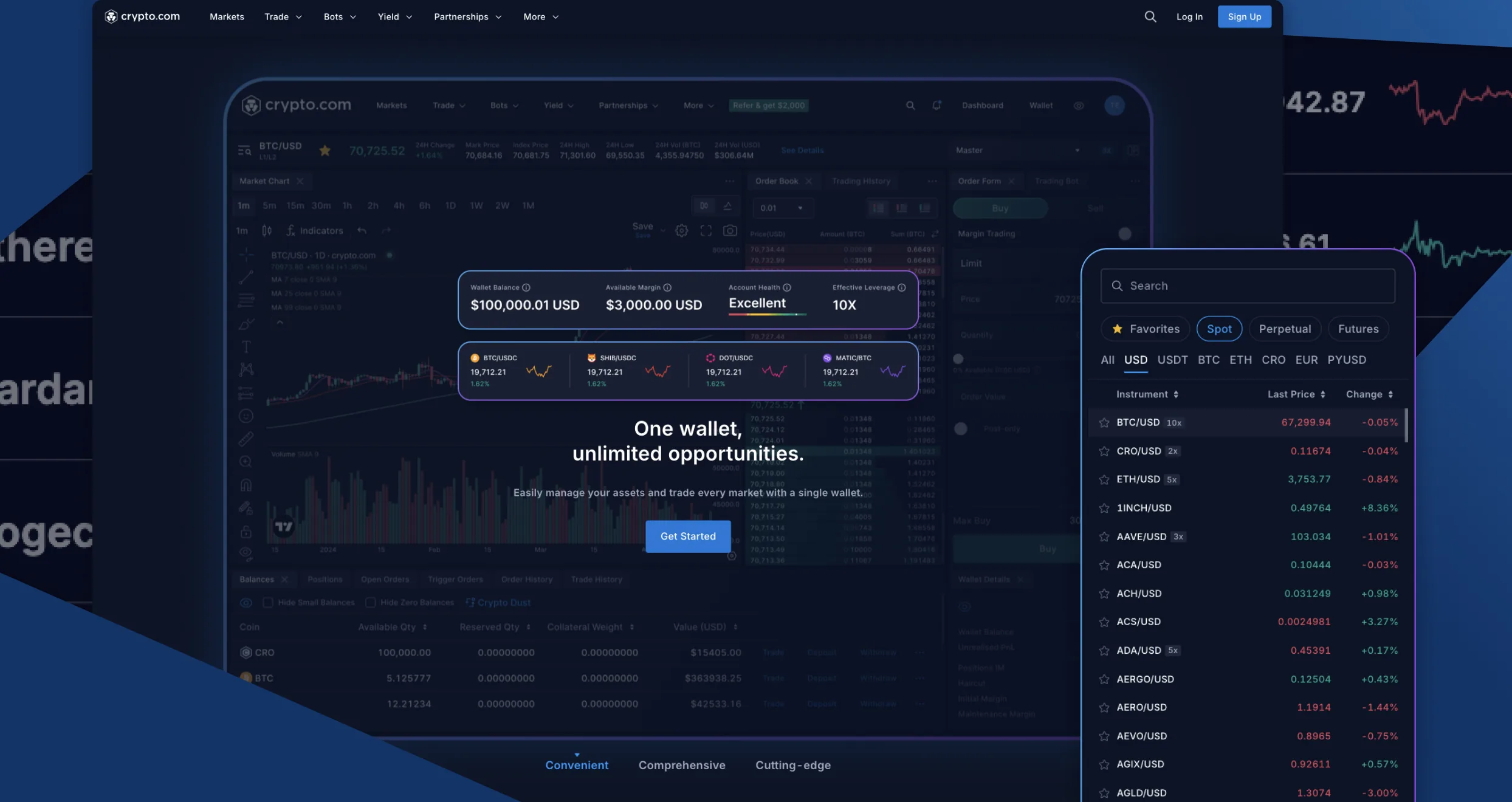

5. Crypto.com – Cheapest Crypto Exchange in Australia

Crypto.com is one of the ASIC-licensed crypto exchanges we have had the best experience with, and we highly recommend it for traders and investors on a budget. Setting up an account is free, and you can start with as little as $2. With over 250 crypto tokens available, you can trade popular options like Bitcoin and Ethereum as well as emerging tokens like Dogecoin and Shiba Inu.

One standout feature about this Australian crypto exchange is its Visa Card, which allows users to earn up to 5% cash back on their spending. The platform also offers a highly secure in-built wallet, giving you the choice between hardware and software options for added security. Based on our analysis, we give Crypto.com a 4-star rating.

Pros

- Low trading fees

- Compatible with desktop and mobile devices

- In-built DeFi wallet, giving you total control of your assets

- Wide range of cryptocurrencies offered

Cons

- You get to pay more for low trading volumes

- Withdrawing cryptos to external address attracts a fee

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

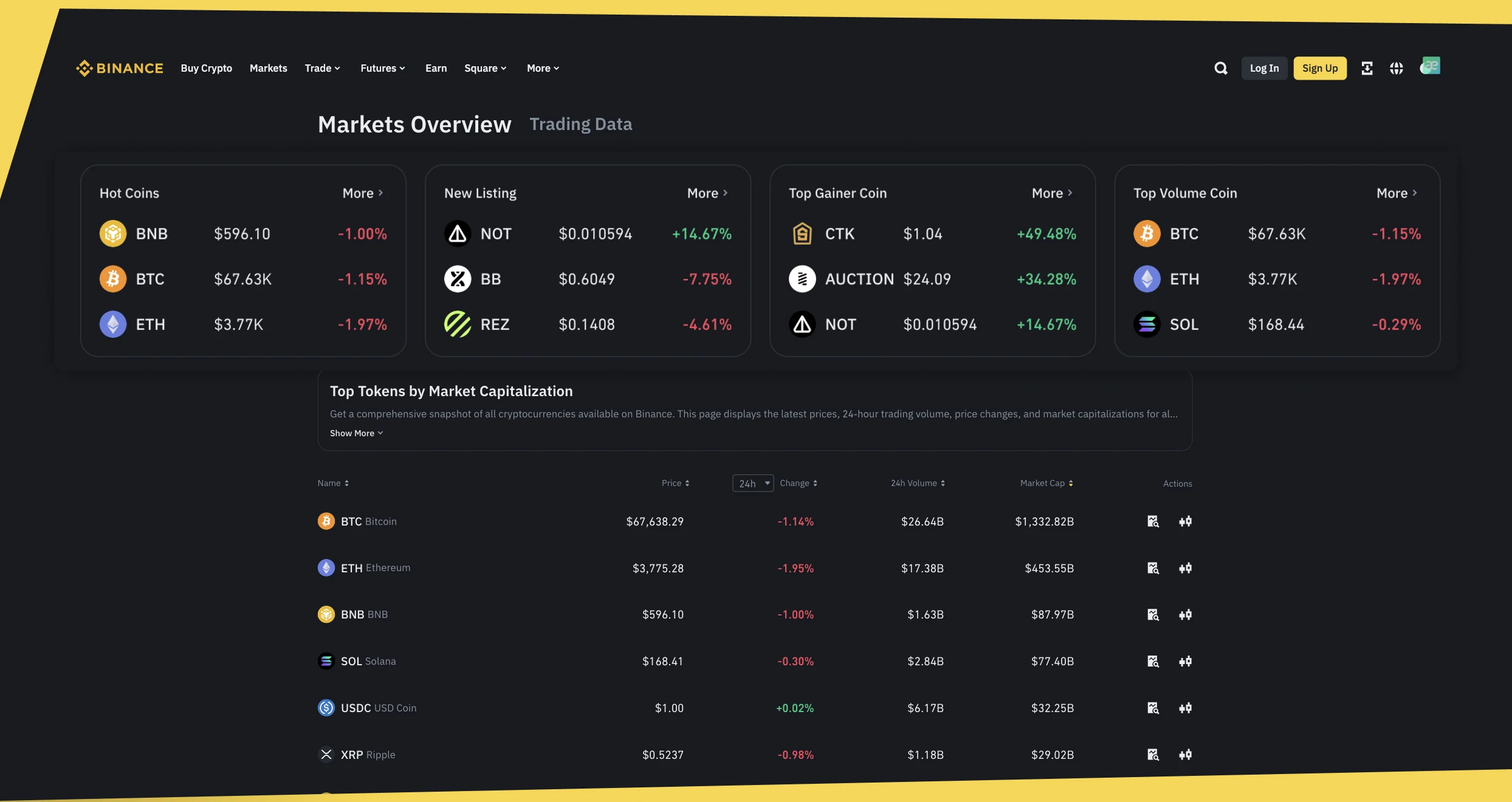

6. Binance – Best Cryptocurrency Exchange With Numerous Digital Tokens

After thoroughly testing Binance, we found it to be the best cryptocurrency exchange for those seeking a wide range of digital tokens. With over 600 cryptocurrencies available, Binance offers diverse investment opportunities for both new and experienced traders. Its integrated wallet provides an added layer of security, allowing users to explore multiple profit avenues with confidence.

Binance caters to all types of traders by offering major crypto assets along with useful trading resources. We particularly recommend Binance for newcomers due to its industry-leading low fees and support for a variety of payment methods, including credit/debit cards, e-wallets, and bank transfers. The platform’s user-friendly interface and extensive features make it accessible for beginners while providing advanced tools for seasoned traders.

Binance’s global reputation is reflected in its status as one of the largest exchanges by trading volume, backed by positive user reviews. Based on our experience, Binance is a top-tier choice for anyone looking to enter the world of cryptocurrency trading.

Pros

- User-friendly platform perfect for newbies

- Excellent collection of learning resources for skills development

- P2P platform for direct interaction with other cryptocurrency traders

- Over 600 cryptocurrencies to choose from

Cons

- Has a history of hacking

- Less regulated compared to its peers

We signed up for investment accounts at Binance, and there were no registration charges. The exchange also does not have a minimum deposit requirement, thus allowing us to get started with any amount of money we could afford.

We analyzed Binance’s fee structure and concluded that it is among the most affordable cryptocurrency exchanges we have tested. Its maker and taker fees are low, but this depends on the trading volume and Binance Coin balance. Simply put, higher-volume trades are subject to low trading fees.

Regarding transactions, Binance does not charge deposit fees for cryptocurrency deposits. However, investors will incur withdrawal charges depending on the crypto token they use to transact.

You can also transact using fiat currencies at Binance. While some currencies do not attract deposit fees, others do. For instance, you will pay a 0.65% deposit fee when you make deposits using the AED currency via online banking. Withdrawal charges on fiat currency transactions also apply depending on the currency you transact with.

ATO Tax Crypto

Understanding how taxes apply to cryptocurrencies in Australia is essential, especially with the Australian Taxation Office (ATO) overseeing the process. Here’s the deal: the ATO treats digital currencies like Bitcoin and Ethereum as assets than regular cash. This means when you trade or sell them, you are subject to capital gains tax (CGT) on the profits you earn. Calculating CGT involves subtracting what you originally paid for the crypto from what you sold it for. If your holdings are under AUD 10,000 and for personal use, you may be exempt from some taxes.

It’s crucial to keep detailed records of every transaction—whether you’re trading, mining, or staking, any profits you earn are taxable. Also, if you’re paid in cryptocurrency, that’s considered income and is subject to income tax.

It’s always a good idea to stay updated with the latest tax rules by checking the ATO’s website, as regulations can change. And don’t navigate this alone—working with a tax professional who understands cryptocurrencies can help you avoid mistakes and hefty fines.

Is Crypto Legal in Australia?

Cryptocurrencies are completely legal in Australia, reflecting the nation’s progressive approach to digital assets. Recognised as a legitimate form of financial asset, cryptocurrencies operate within a regulatory framework overseen by the Australian Securities and Investments Commission (ASIC). This regulatory body ensures that cryptocurrency exchanges adhere to anti-money laundering (AML) and counter-terrorism financing (CTF) laws, fostering a secure and compliant environment.

The Australian Taxation Office (ATO) also regulates cryptocurrencies by classifying them as taxable property. This means individuals must report crypto transactions, including capital gains and losses, in their annual tax returns, adding transparency to cryptocurrency dealings and aligning with broader financial regulations.

Beyond regulation, Australia has embraced the underlying blockchain technology, recognising its potential applications beyond cryptocurrencies. The government’s support is evident through funding for blockchain research projects, fostering an environment conducive to innovation in this space.

On the consumer protection front, efforts focus on ensuring the safety of individuals engaging in cryptocurrency transactions. The regulatory framework is designed to prevent fraudulent activities, emphasising transparency and security in the operations of cryptocurrency exchanges.

Even in the domain of Initial Coin Offerings (ICOs), Australia imposes strict regulatory oversight. Companies conducting ICOs must comply with existing securities laws, ensuring investor protection and regulatory adherence.

Overall, Australia provides a favourable legal landscape for cryptocurrencies, balancing innovation with consumer protection. As regulations continue to evolve, individuals involved in crypto transactions are encouraged to stay informed and comply with established guidelines for a secure and compliant experience.

How to Choose the Right Crypto Exchange in Australia

When trading or investing in cryptocurrencies in Australia, choosing the right crypto exchange is essential for a smooth and reliable experience. Here are the key factors to consider when selecting a platform:

Always prioritize security when evaluating crypto exchanges in Australia. Look for platforms implementing robust measures like two-factor authentication (2FA) and encryption protocols. The exchange should also be regulated by relevant regulatory authorities such as ASIC and AUSTRAC. A secure exchange safeguards your funds against potential cyber threats.

Check the range of cryptocurrencies an exchange offers. Choose a platform that aligns with your investment goals by providing access to a diverse selection of digital assets. A broader selection allows you to diversify your portfolio and explore different opportunities within the crypto market.

Evaluate the fee structure of each exchange, including trading fees, withdrawal fees, deposit fees, and other types of fees. Opt for platforms with transparent fee and competitive rates to help maximize your profits.

Consider the platform’s user interface and overall performance. A user-friendly interface makes trading easier, especially if you’re new to crypto. Also, ensure the platform offers tools for market analysis to help you build effective trading strategies.

Check if the exchange is compatible with your preferred type of crypto wallet, whether it’s an in-built, hardware, software, or mobile wallet. Some users prefer external wallets for added security, so ensure the exchange supports your choice.

Explore user reviews and recommendations from reputable sources like Google Play, the App Store, and Trustpilot. Insights from other traders can provide valuable perspectives on the reliability and performance of an exchange, helping you make an informed decision.

How to Buy Crypto with Crypto Exchange in Australia

Buying cryptocurrencies in Australia is straightforward if you follow the right steps. Below, we outline the process to help you get started with your first investment.

Start by selecting a reputable crypto exchange in Australia like the ones we have recommended in our reviews above. Research various platforms, considering factors like security, asset availability, fees, and overall reputation. Opt for an exchange that aligns with your preferences and has a strong track record in the crypto community.

Once you’ve chosen an exchange, create your account by providing necessary details like your name, email, and password. Many platforms will also require identity verification (KYC). Follow the registration process carefully and ensure that all details are accurate.

Security is critical when dealing with cryptocurrencies. Set up a reliable crypto wallet to store your assets. Some exchanges offer built-in wallets, while others recommend external wallets for added security. Enable two-factor authentication (2FA) and use strong, unique passwords to keep your wallet safe.

Next, deposit funds into your exchange account. Most platforms accept deposits in fiat currency (such as AUD). Follow the exchange’s instructions and be aware of any deposit fees. This is the step where you’ll fund your account to make your crypto purchase.

With your account funded, navigate to the exchange’s trading platform and select the cryptocurrency you wish to purchase. Specify the amount and review the transaction details. Confirm the purchase, and the crypto assets will be added to your wallet.

Remember, the cryptocurrency market is highly volatile, and all investments come with risks. Be sure to do thorough research, and if necessary, consult a financial professional before making significant investments. Only invest what you’re prepared to lose, as profits are not guaranteed in crypto markets.

Conclusion

Now that you’re familiar with the best cryptocurrency exchanges in Australia and the tax rules involved, you’re ready to make your first investment. Always conduct thorough research and market analysis on the crypto tokens you’re interested in to build effective strategies. Choose a reliable exchange, like the ones we’ve reviewed, to get started.

If you’re a beginner, start with small investments and take time to learn from your experiences. It can also be helpful to maintain a trading journal where you can track your strategies and decisions, allowing you to identify areas for improvement and refine your approach over time.

I’ve tried using eToro, and while it’s easy to use with a solid range of assets, I’m not too happy about the withdrawal fees. Plus, the crypto offerings aren’t as extensive as I expected, especially compared to other platforms like Binance. It’s decent for beginners but definitely has some drawbacks.