Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

India is home to millions of crypto investors and traders. Since crypto investing and trading started turning ordinary people into overnight millionaires, many Indians have become inspired to join the crypto universe. If you are in this category, note that numerous factors, including your chosen crypto exchange, will determine your chances of attaining success.

However, finding an exchange guaranteed to fuel your success isn’t as easy as it sounds since hundreds of options are available. But that shouldn’t stop you from becoming a successful trader and investor. We’ve simplified the selection process by testing available exchanges, comparing the most outstanding, and hand-picking the best of the best.

In a Nutshell

- Crypto trading and investing are legal in India. However, you should be careful since many suspicious exchanges are operating in this country.

- To avoid malicious platforms, prioritize trading and investing with exchanges that are reputable and licensed by recognized international authorities.

- Before trading or investing with any exchange, note that these activities are risky since crypto prices change constantly. Expect to incur losses at least once and learn to mitigate risk exposure.

- Our team has researched and analyzed the exchanges in India on your behalf. Based on the generated results, we’ve picked 5 that can help you turn crypto trading and investing into a lucrative endeavor. We’ve reviewed them in this guide.

List of the Best Crypto Exchanges in India

- Binance – Overall Best Crypto Exchange in India

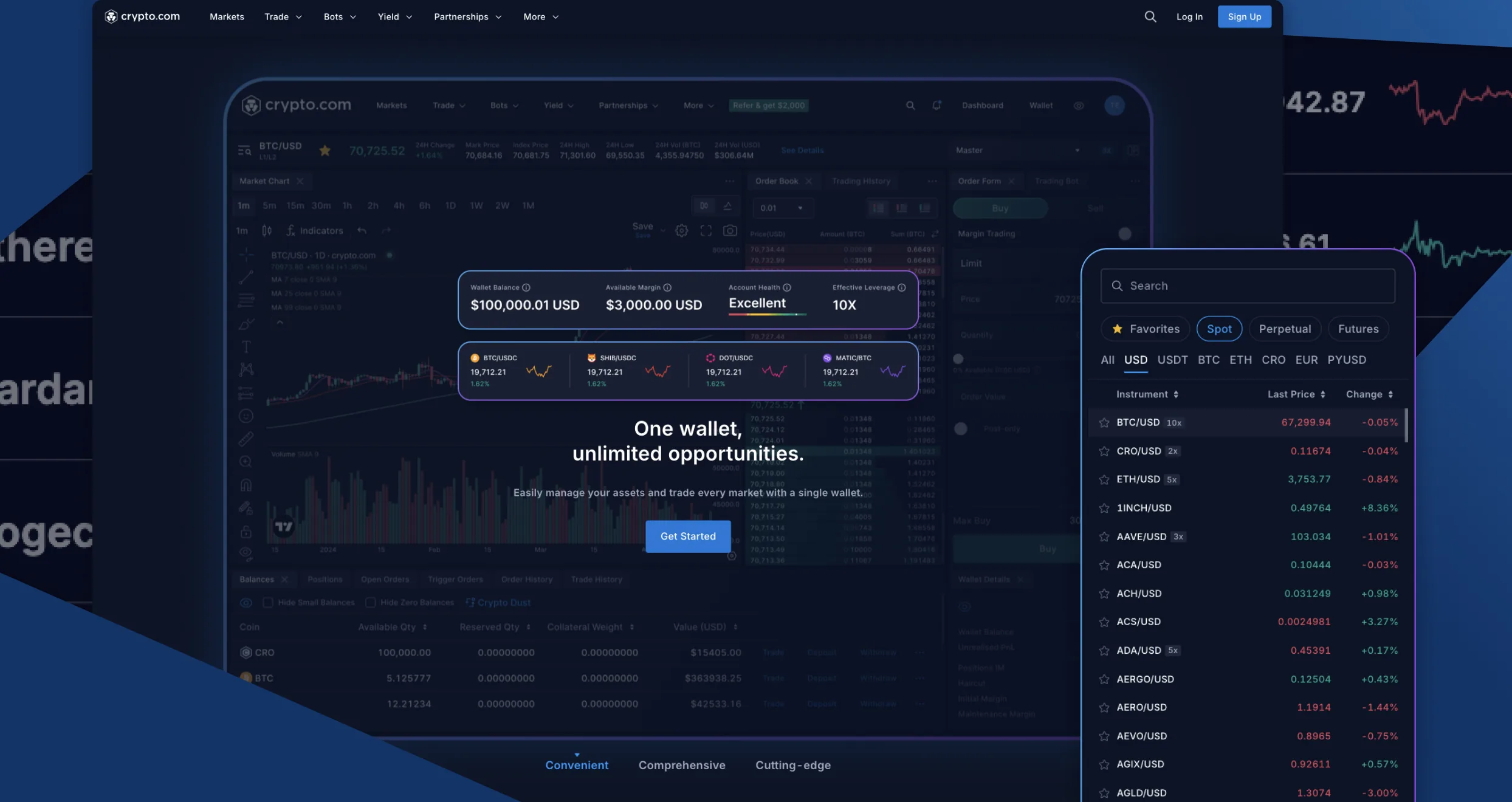

- Crypto.com – Best Exchange for Comprehensive Services

- Exodus – Best for a User-Friendly Wallet

- HTX – Best Exchange for Professional Trader

- CEX.IO – Best Exchange for Staking Crypto

Compare Cryptocurrency Exchanges

The best way to pick outstanding, exceptional crypto exchanges is through extensive research, evaluations, and comparisons. You can’t say a platform is the best without comparing it to the rest, right?

To avoid publishing inaccurate or biased information, our experts not only studied and tested the crypto exchanges in India but also compared them against each other. Finally, we picked service providers with the best of everything, from customer support to fees and charges.

Use the table below to compare the best crypto exchanges in India and pick the most fitting platform.

| Best Crypto Exchange India | Exchange Type | Support Service | Price | Supported Coins | Digital Wallet |

|---|---|---|---|---|---|

| Binance | Centralized | 24/7 | Free | 500+ | Yes |

| Crypto.com | Centralized | 24/7 | Free | 350+ | Yes |

| Exodus | Decentralized | 24/7 | Free | 300+ | Yes |

| HTX | Decentralized | 24/7 | Free | 700+ | Yes |

| CEX.IO | Decentralized | 24/7 | Free | 100+ | Yes |

Exchanges Overview

We also ranked the best crypto exchanges in India based on their charges and supported assets. Remember, most providers charge specific fees for buying, selling, and trading cryptos. And you don’t want to part with too much since it will negatively impact your returns. Not to mention, you need the right coins to invest seamlessly and mitigate risk through portfolio diversification.

Here’s a breakdown of each crypto exchange’s fees and assets.

Fees

| Best Crypto Exchange India | Fees | Minimum Deposit Requirement |

|---|---|---|

| Binance | From 0.0090%/ 0.0180% maker/ taker fees | 0.00000001 BTC |

| Crypto.com | From 0.00%/0.05% maker/taker fees | $1 |

| Exodus | No fees | None |

| HTX | From 0.0097%/0.0193% maker/taker fees | 100 USDT |

| CEX.IO | From 0.0%/ 0.1% maker/taker fees | $20 |

Assets

| Best Crypto Exchange India | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Solana |

|---|---|---|---|---|---|---|

| Binance | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes |

| Exodus | Yes | Yes | Yes | Yes | Yes | Yes |

| HTX | Yes | Yes | Yes | Yes | Yes | Yes |

| CEX.IO | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about Crypto Exchanges in India

Not all crypto exchanges in India are good. Some are associated with a lower level of reliability and trustworthiness. Others yet have been plagued by countless controversies over the years. However, the service providers reviewed here are nothing short of exceptional.

We consider these crypto exchanges the best because they are secure and reputable. The companies have excellent ratings and reviews on established sites like Trustpilot. Additionally, they offer 24/7 support and allow their customers to invest and trade popular cryptos like Bitcoin, Ethereum, and Ripple.

Below, we’ve reviewed each of the top crypto exchanges in India in detail. Our experts have covered everything from the platform’s most remarkable attributes to noteworthy pros and cons. Use our insights to identify an exchange that meets your standards and requirements.

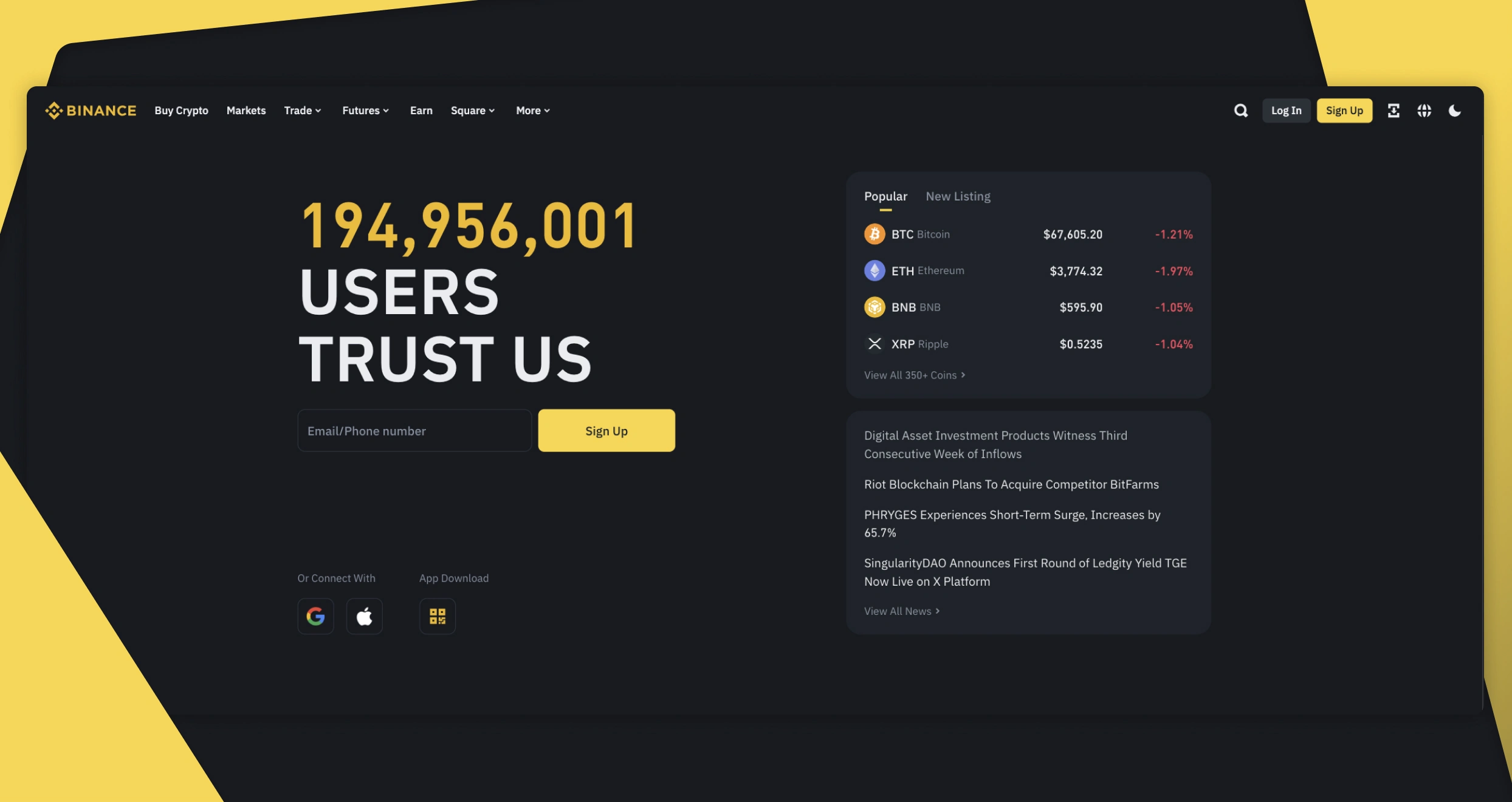

1. Binance – Overall Best Crypto Exchange in India

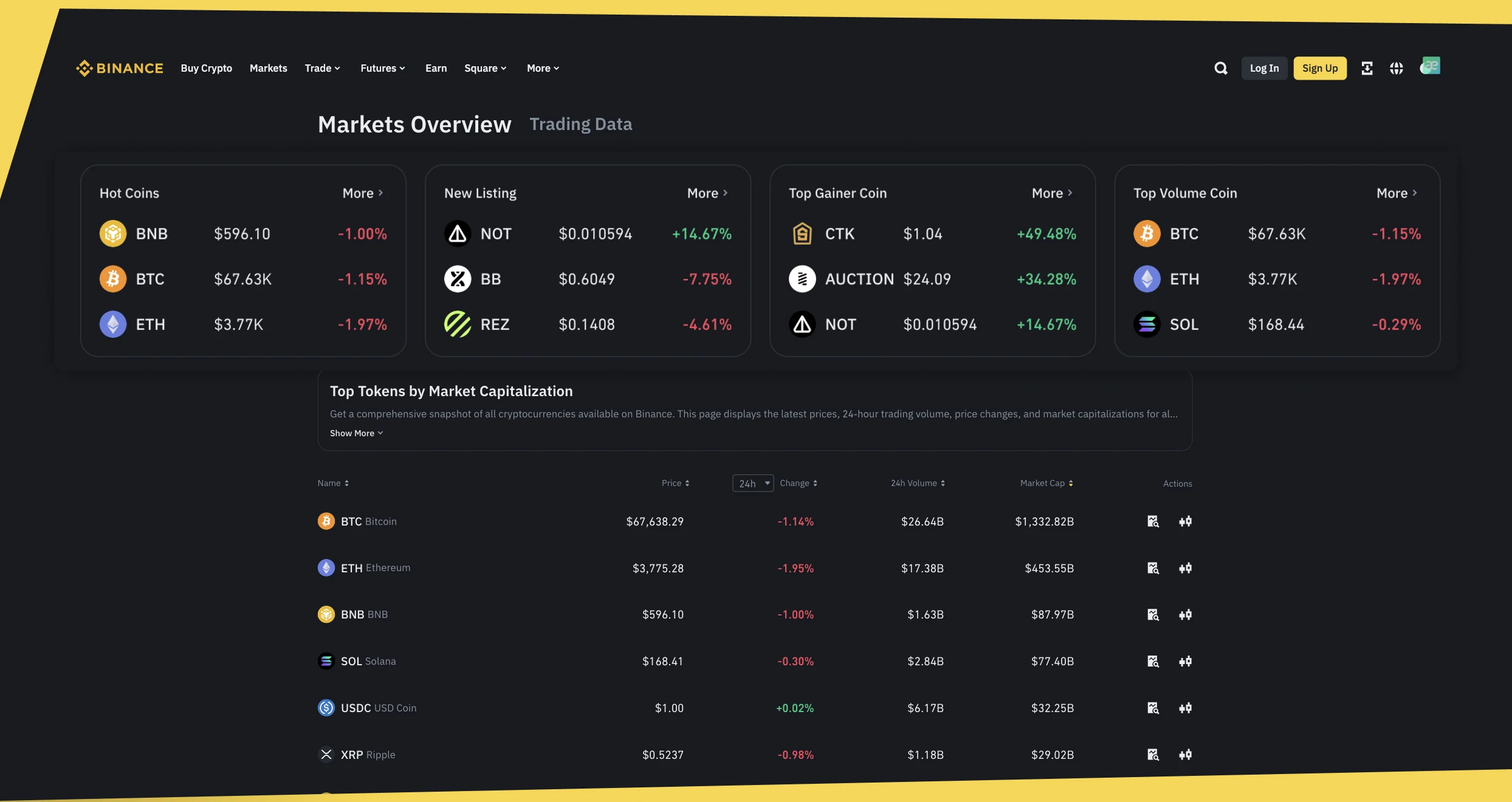

Founded in 2017, Binance boasts over 203 million global users. It’s our overall best crypto exchange in India for several reasons. For starters, it gives its users the opportunity to trade over 500 cryptocurrencies on margin, futures, and spot markets. Moreover, traders can deposit crypto to their Binance accounts without paying transaction fees.

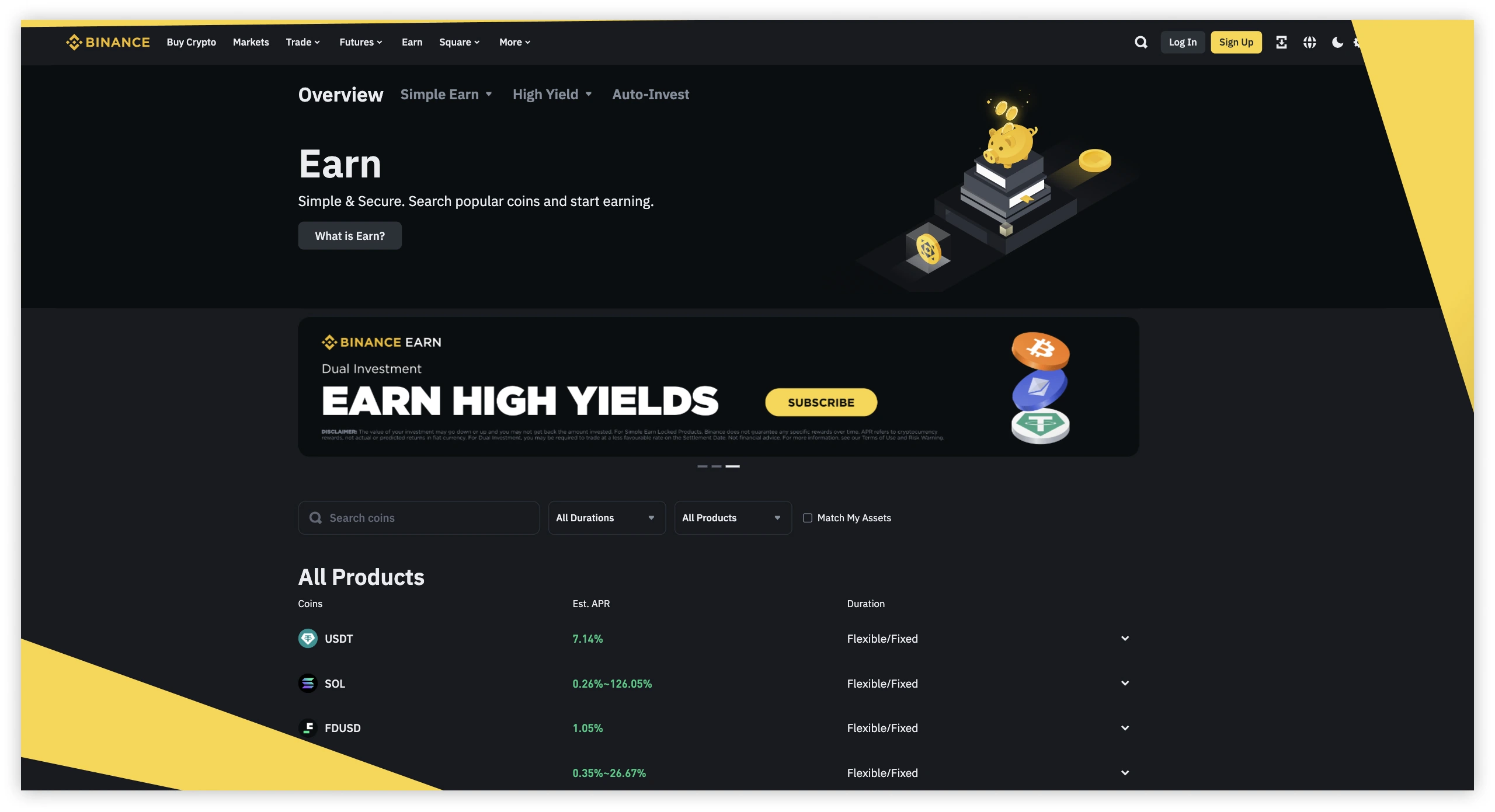

Binance also has a spectacular P2P platform that enables users to transact with their favorite payment methods and enjoy the freedom of buying and selling crypto without intermediaries. This company also hosts Binance Earn, which allows investors to grow their assets through staking, and the Binance NFT marketplace, where you can trade, loan, and stake NFTs.

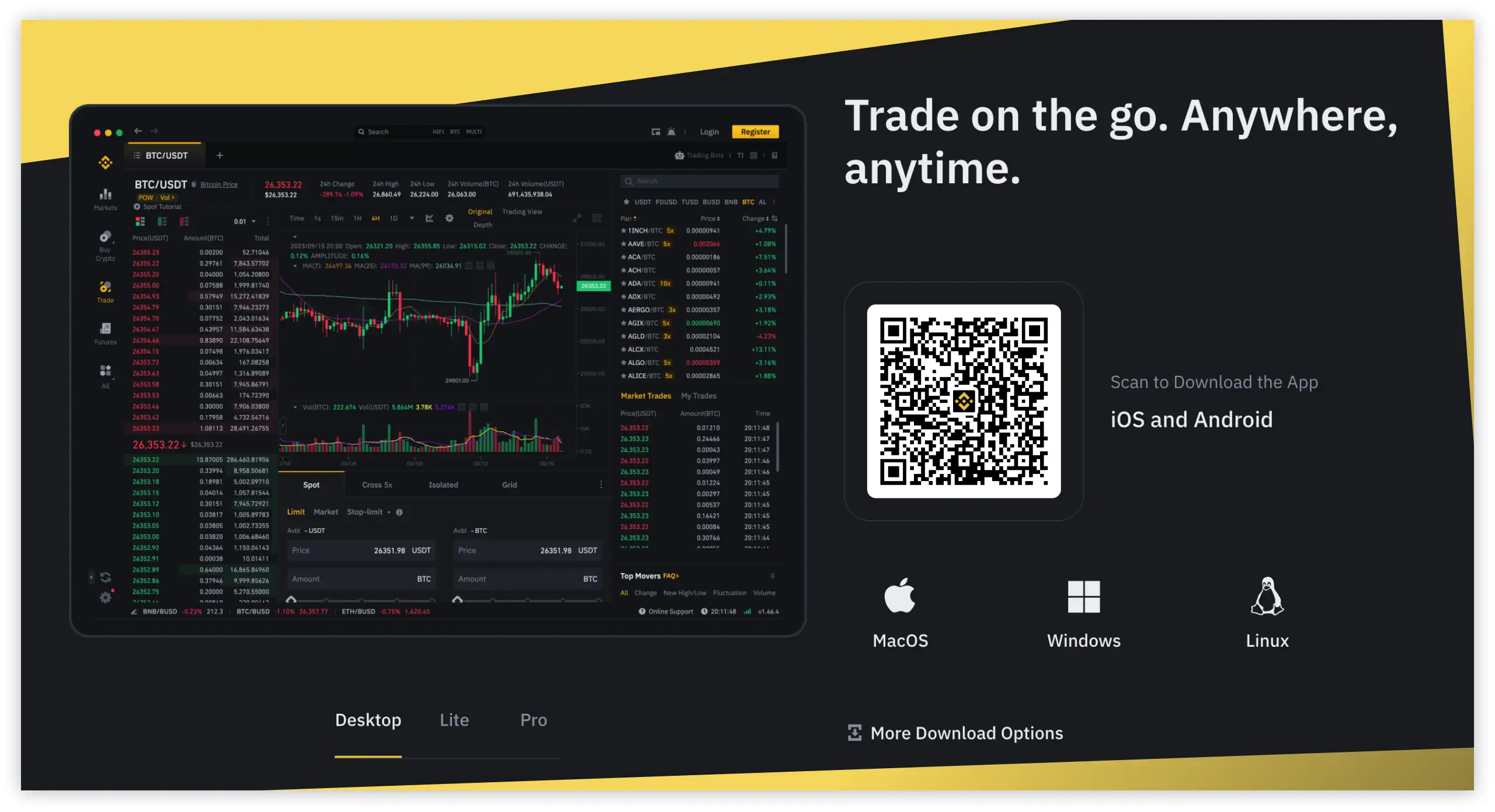

The Binance exchange is designed for optimum user-friendliness. Every type of investor can use it seamlessly, from newbies to professionals. You can access this platform from your browser or use a dedicated Binance app for PC, IOS, or Android.

Pros

- Registered with the Financial Intelligence Unit (FIU)

- Offers a dedicated app for desktop, Android, and IOS devices

- Optimizes security with 2FA and other protocols

- Zero deposit fees

- Secure P2P with countless supported payment methods and millions of users

Cons

- High maker and taker fees for regular users

- All withdrawals from the Binance account incur transaction fees

We signed up for investment accounts at Binance, and there were no registration charges. The exchange also does not have a minimum deposit requirement, thus allowing us to get started with any amount of money we could afford.

We analyzed Binance’s fee structure and concluded that it is among the most affordable cryptocurrency exchanges we have tested. Its maker and taker fees are low, but this depends on the trading volume and Binance Coin balance. Simply put, higher-volume trades are subject to low trading fees.

Regarding transactions, Binance does not charge deposit fees for cryptocurrency deposits. However, investors will incur withdrawal charges depending on the crypto token they use to transact.

You can also transact using fiat currencies at Binance. While some currencies do not attract deposit fees, others do. For instance, you will pay a 0.65% deposit fee when you make deposits using the AED currency via online banking. Withdrawal charges on fiat currency transactions also apply depending on the currency you transact with.

2. Crypto.com – Best Exchange for Comprehensive Services

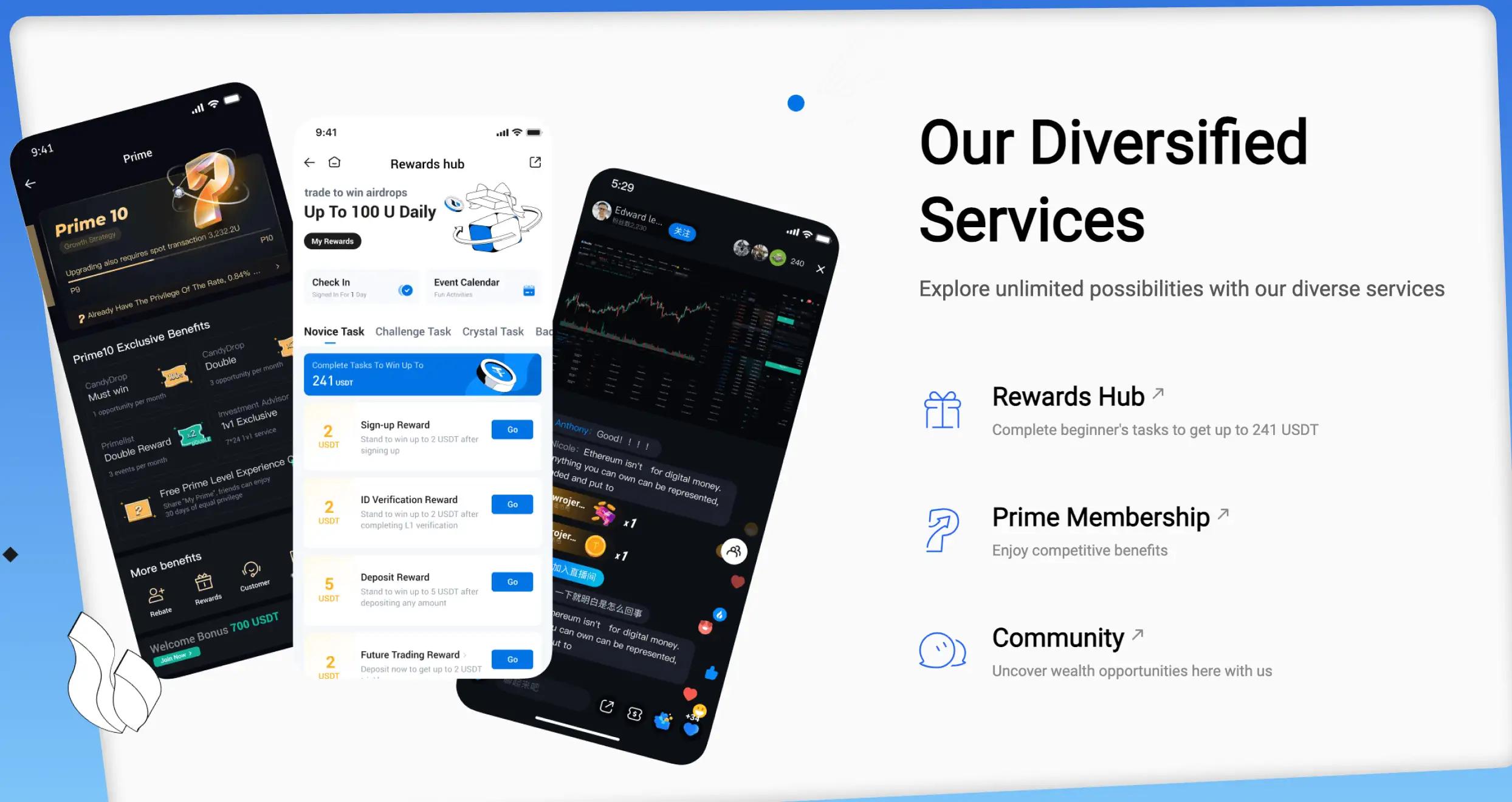

Crypto.com is a popular exchange headquartered in Singapore. It offers diverse services, which has enabled it to feature in our review. With this platform, you can purchase, sell, or trade over 350 cryptocurrencies alongside over 100 million fellow traders and investors. You can join Crypto.com’s Crypto Earn platform and earn up to $250 on your investments.

We also rank this exchange among the best in India due to its remarkable wallet. The Crypto.com non-custodial digital wallet is secure and exquisitely designed. With it, you can secure hundreds of different tokens, earn rebates on multiple assets, and explore popular dApps conveniently.

Not to mention, Crypto.com offers lending services. You can take out up to 3 loans simultaneously against your assets. Borrowing a loan from Crypto.com saves you from selling your assets whenever you’re short on cash.

Pros

- Zero makers fees for high-volume traders

- Free deposits and reasonable withdrawal fees

- Allows investors to borrow against their assets

- Juicy returns for staking enthusiasts

Cons

- $45 fee for USD withdrawals

- No P2P trading platform

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

3. Exodus – Best for a User-Friendly Wallet

Exodus is an infamous crypto wallet that offers integrated exchange services. With this wallet, you can enjoy most of the services associated with conventional crypto exchanges. For starters, you can buy digital assets like Bitcoin with different fiat currencies. You can also swap and stake cryptos or explore Web3 apps and manage NFTs.

Currently, Exodus supports 50+ networks and hundreds of assets. You will download a dedicated Exodus app for your Android or IOS mobile device. This wallet is also compatible with Windows, Linux, and Mac operating systems, meaning you can use it on your desktop. Not to forget, Exodus is about to launch a dedicated desktop app that will be incredibly beneficial to PC users.

If you don’t want to download the app, you can add an Exodus wallet extension to your browser, provided it’s Brave or Chrome.

Pros

- Excellent wallet with crypto exchange services

- Offers an exceptional app for IOS and Android devices

- No transaction fees

- Allows users to access many services without signing up

- Integrates seamlessly with the Trezor hardware wallet

Cons

- Limited features and capabilities compared to conventional crypto exchanges

- Exodus is a hot wallet and vulnerable to cyber criminals

Exodus is among the digital wallets that have no fees for downloading and setting up accounts. From our exploitation, the wallet does not charge any fees when you receive and store cryptocurrencies. However, expect to incur network or gas fees when you send cryptocurrencies. The best part is that this Exodus wallet fee can be customized, although this option is limited to Bitcoin, Ethereum, and ERC20 transactions.

Cryptocurrency sending charges vary based on the blockchain network you use. Therefore, always understand applicable charges to plan accordingly. Exodus automatically checks all addresses to ensure seamless transactions with no errors.

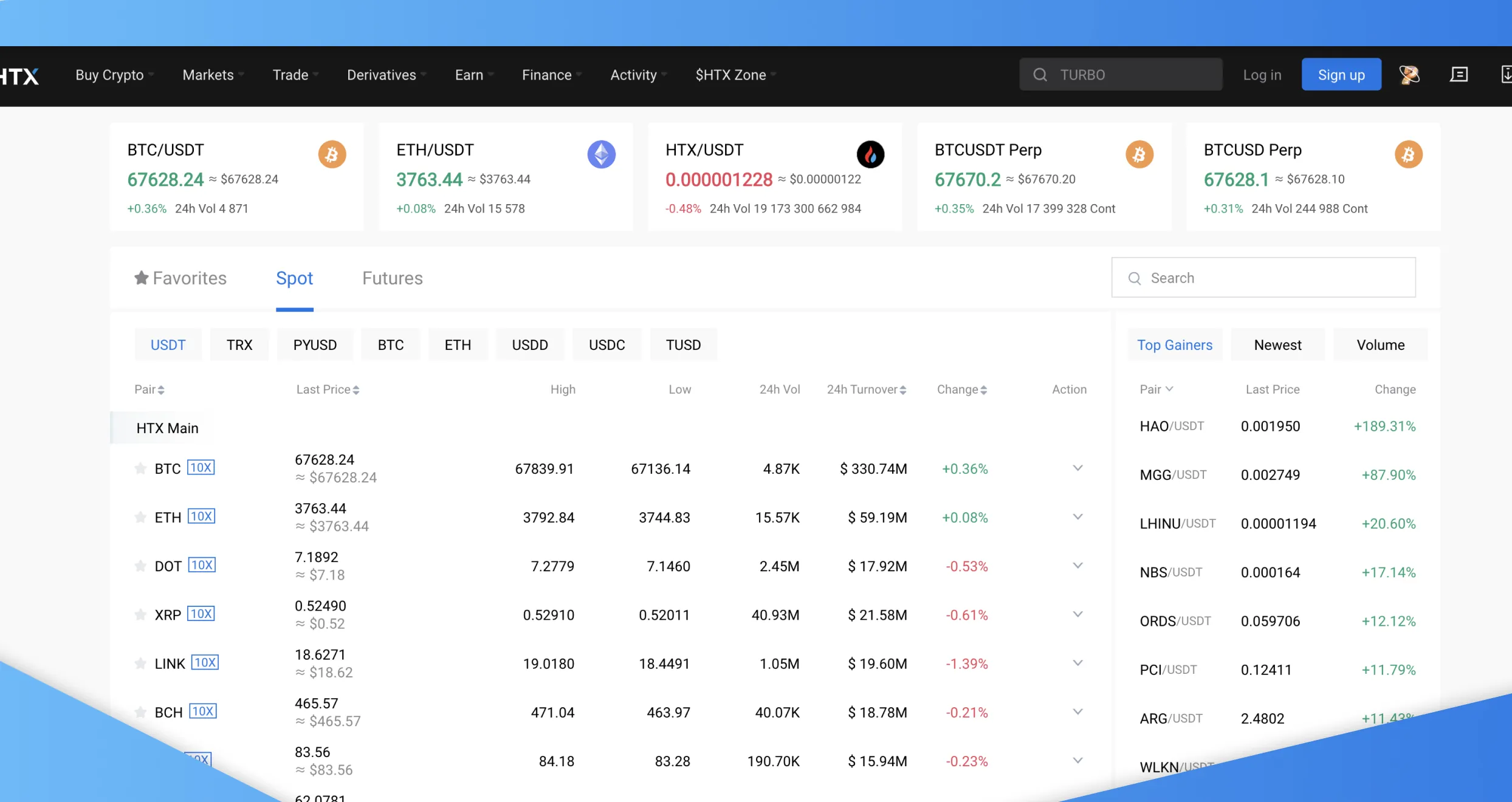

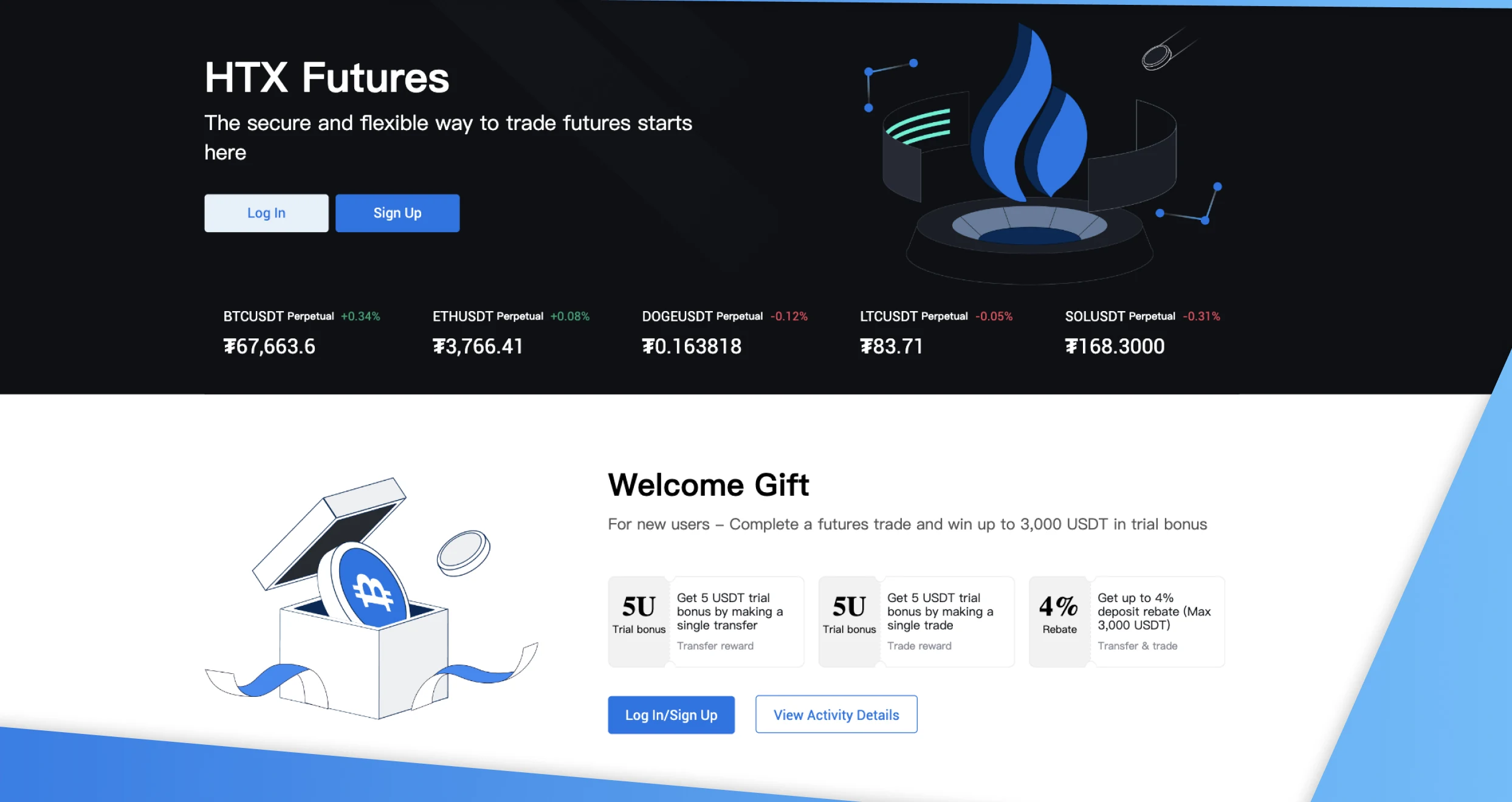

4. HTX – Best Exchange for Professional Trader

HTX is a versatile crypto exchange platform designed for professionals. Founded in 2013, this company accepts traders and investors from 100+ countries, including India. It’s ideal for professionals since it guarantees high liquidity and smooth order execution. Recently, this exchange recorded an average trading volume of $60.5 billion, making it one of the global exchanges with the highest liquidity.

As a seasoned pro, you can seamlessly buy cryptos with a Visa card or any other supported payment method straight from the platform. You can also purchase or sell assets on HTX’s P2P platform with zero-commission fees. Or, if you are a high-net individual, you can use this company’s OTC Desk to buy or sell assets.

Also, HTX hosts trading bots that professionals can use to take their game to the next level. They range from Optimus to Trace Holder and Cyberbot.

Pros

- High liquidity, especially for OTC desk users

- Diverse trading options, including spot, margin, and automated

- Active community for professionals to follow hot trends and news

- Quick crypto loans available

- Allows investors to earn passive income from staking

Cons

- Higher fees for average traders

- Not suitable for beginners

Since unplanned-for charges can increase your trading costs and reduce your profits, we decided to evaluate HTX’s fees and inform you accordingly. That way, you can prepare beforehand and avoid nasty surprises.

From our evaluation, we realized a few things. First, you can use this exchange’s P2P platform and enjoy zero transaction fees. You can enjoy the same perk when using an AdvCash wallet to deposit and withdraw RUB (Russian Ruble). Additionally, people using RUB to buy crypto on HTX incur zero transaction charges.

This exchange charges 0.02% and 0.05% transaction fees for makers and takers, respectively. These fees are for USDT-margined trading. The actual amount that makers and takers pay while trading with HTX depends on numerous factors, including the filled quantity, transaction prices, and contact face value.

And if your situation requires you to use HTX’s OTC Desk, you can start smiling now. That is because this platform doesn’t have any transaction fees. Everything you’ll pay while using it is included in the “all-inclusive” price you’ll see.

But before you fund your HTX account and start trading, you should know a few additional things. For starters, this exchange’s minimum deposit is 100 USDT. If you send a lesser amount to the exchange, it won’t be credited to your account. You’ll have to deposit more USDT to the address you used before until your deposit amount hits or exceeds this threshold.

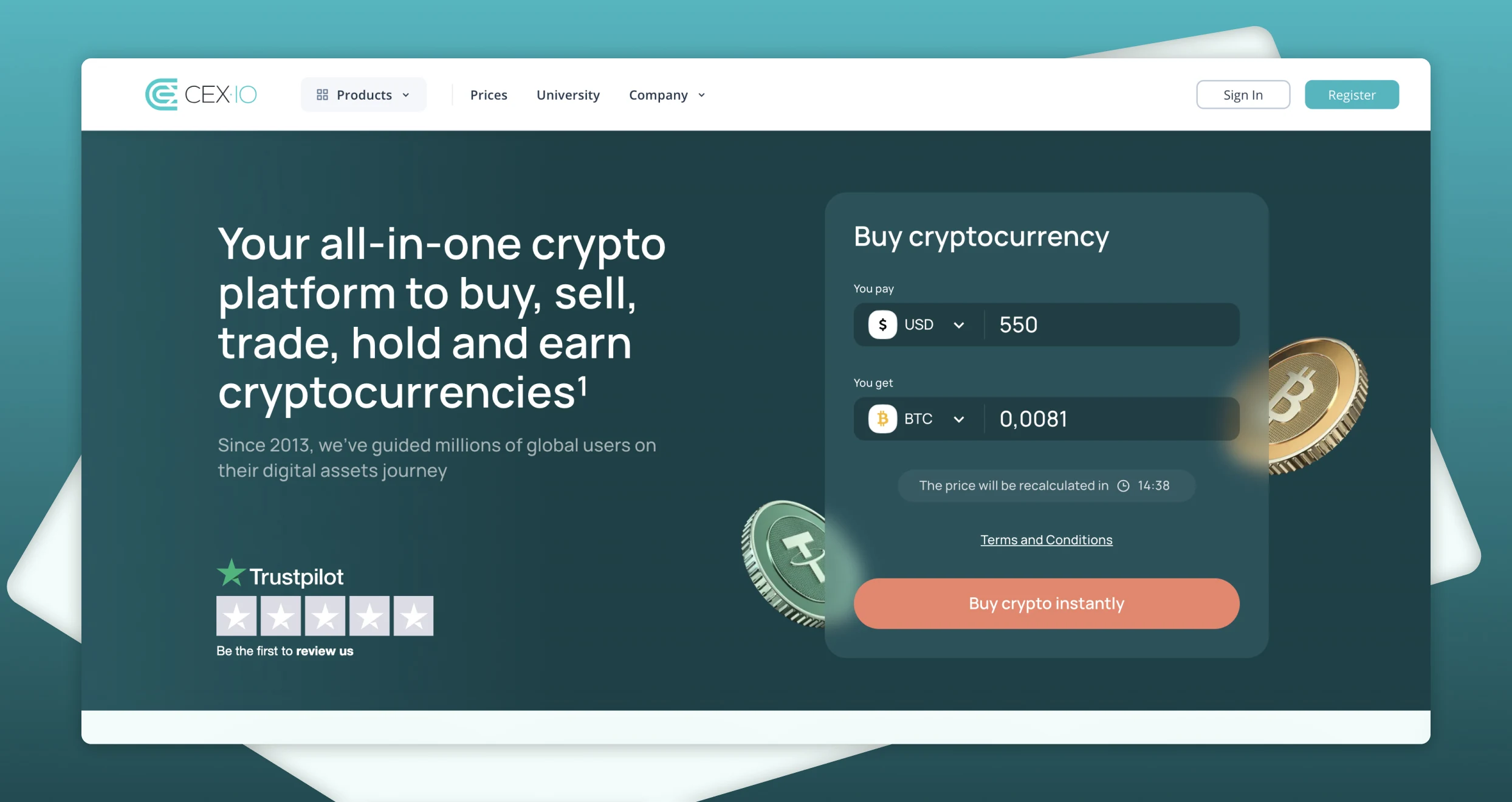

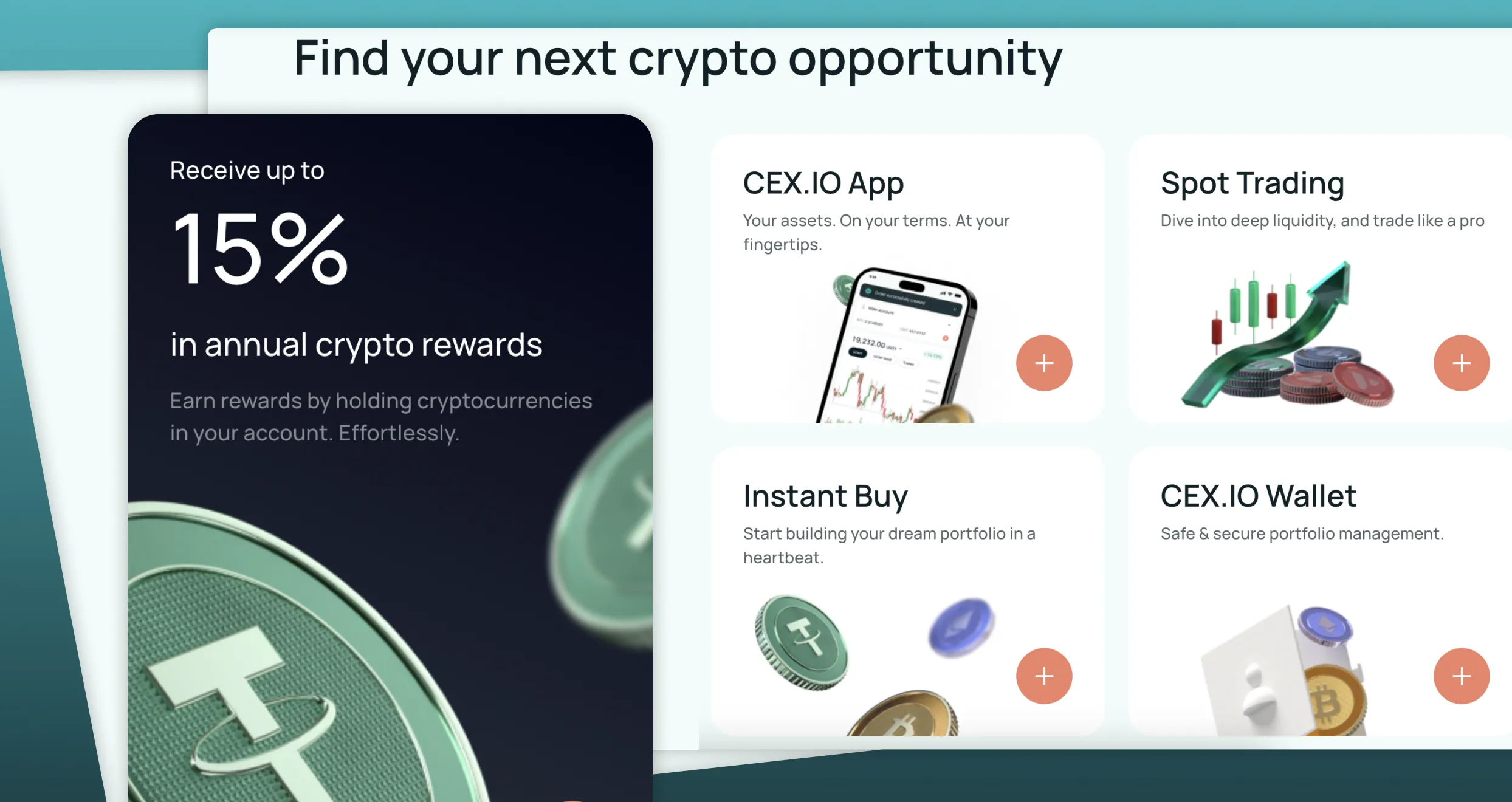

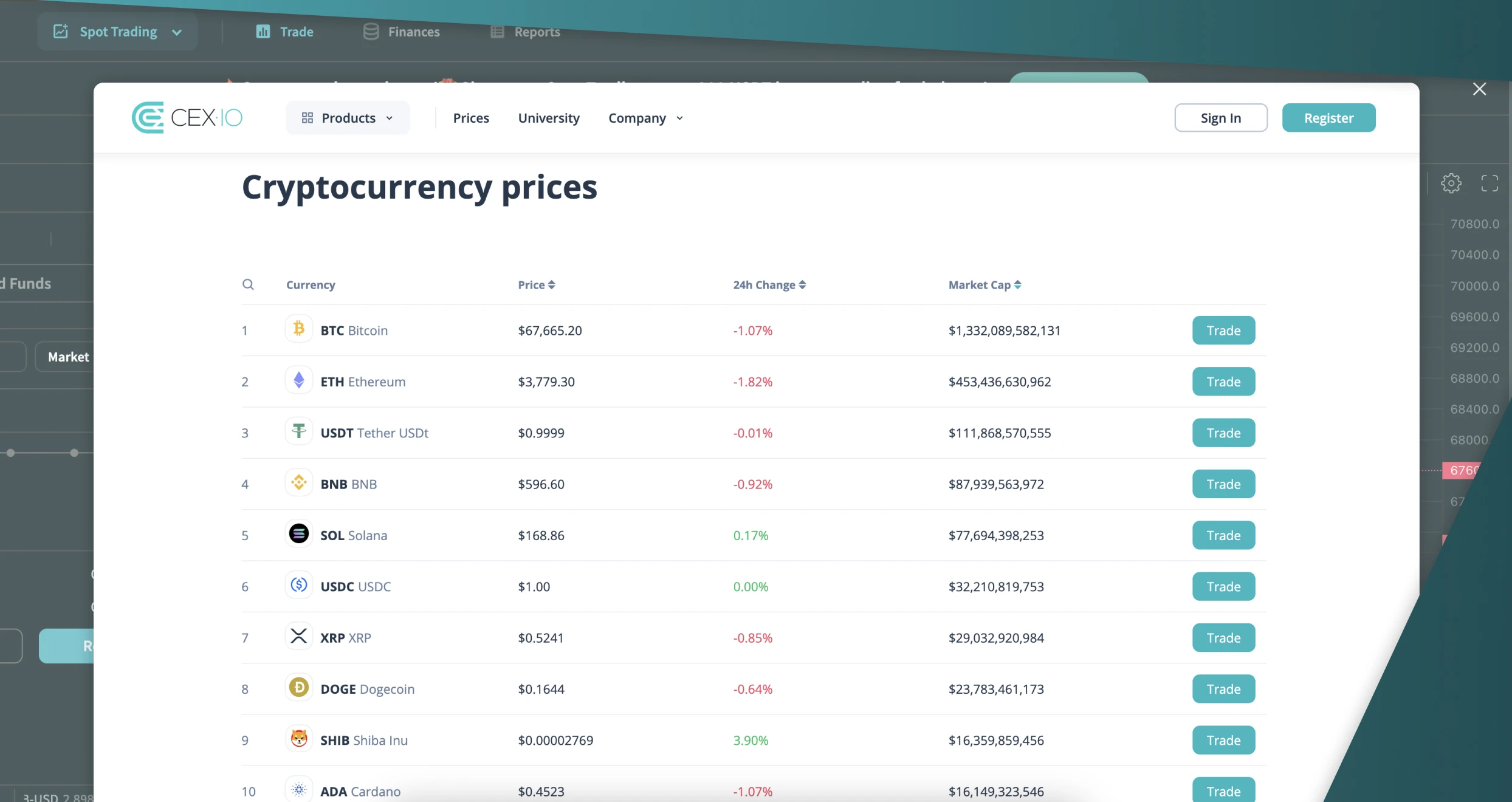

5. CEX.IO – Best Exchange for Staking Crypto

Crypto staking makes earning a passive income from idle assets possible. It’s like depositing money in a high-yield savings account and reaping returns. If you’d like to stake crypto assets and earn returns, use the CEX.IO exchange.

With a CEX.IO account, you can hold different tokens and coins and earn up to 13% annual rewards. This exchange allows users to stake a considerable number of crypto assets, from Tron and Cardano to Polkadot and Solana.

Besides staking, CEX.IO allows investors to buy, sell, and trade crypto. This company has a debit card that enables users to spend digital assets like cash. Not to mention, you can swap cryptocurrencies quickly from CEX.IO’s digital wallet.

Pros

- High staking rewards for assets like Polkadot and Ontology

- Simple, user-friendly interface

- Offers a credit card that simplifies spending crypto

- Lower minimum deposit for payment methods like VISA and MASTERCARD

- Supports crypto trading automation with API

Cons

- Significantly higher minimum deposit requirements for S.W.I.F.T users

- Higher deposit and withdrawal fees compared to its fees

- Supports fewer digital assets compared to other industry leaders

Opening an account with CEX.IO won’t cost you a dime- it’s free of charge. That said, when funding your account, you will incur specific charges depending on your preferred payment method.

While using VISA and Mastercard, you will have to cover fees ranging from 2.99% to 3.99% and a service charge that will depend on your country of origin and service provider. The same applies to Apple Pay, Google Pay, and PayPal. On the other hand, CEX.IO requires you to pay a $2.99 deposit commission for alternative payment methods like SWIFT, domestic wire, Faster Payments, and SEPA. The other options, which include Epay, Neteller, and Skrill, charge $3 and above for deposit commissions.

Also, while funding your account, keep in mind that CEX.IO has unique minimum deposit requirements for the supported payment method. For instance, the daily minimum deposit for VISA, MasterCard, domestic wire, and Google/Apple Pay users is $20. Conversely, people who use SWIFT can’t fund their accounts with less than $300. Also, the minimum deposit for Skrill users is $35.

CEX.IO also levies withdrawals. The exact fees vary depending on payment methods. Take VISA, SWIFT, and domestic wire as an example. If you cash out from CEX.IO using VISA, you will incur a service charge (up to 3% + $1.20) and a commission of up to $3.80. On the other hand, SWIFT and domestic wire attract $2.99 deposit charges. Lastly, CEX.IO has maker and taker fees starting from 0.25% and 0.15%, respectively.

Visit CEX.IO’s Limits and Commissions page to get a detailed overview of the accepted payment methods as well as their deposit/withdrawal limits and commissions. Also, note that you can deposit and withdraw crypto from your CEX.IO account.

Crypto Trading in India

Investing in crypto is legal in India. The same applies to trading digital assets. There are no laws that prohibit Indiana from partaking in these activities. But, by and large, the Securities and Exchange Board of India (SEBI) monitors and oversees crypto exchanges in the country. So rest assured that you’ll enjoy uncapped fairness and transparency while interacting with reputable exchanges in India.

Note that SEBI mandates prohibit minors from purchasing or selling securities. That means no one below 18 can interact with a crypto exchange in India. Minors also have a hard time registering with platforms like Binance since they require applicants to go through a mandatory KYC process.

We can’t sign off without pointing this out. Although crypto trading is on the rise in India, you shouldn’t join the trend without mastering the fundamentals. For starters, learn how cryptos, exchanges, and digital wallets work. Furthermore, familiarize yourself with the risks of crypto trading and effective risk management strategies.

Most importantly, note that there are many fraudulent crypto trading platforms. To avoid them, vet every exchange carefully.

How to Choose the Right Crypto Exchange in India

Despite many fraudulent exchanges being available today, you can avoid their intentions and sign up with a company that will help you reach the next level. But finding a fitting platform isn’t as easy as going with any exchange that claims to be legit or exceptional. You have to evaluate every company you encounter based on the following factors:

There are 3 types of crypto exchanges: centralized, decentralized, and hybrid. The type of exchange that you need will determine which platform you choose. For instance, choosing HTX or CEX.IO should be wise if you seek a decentralized exchange.

A secure crypto exchange protects your assets from malicious actors and staves off significant financial losses. As such, you should check if a platform employs measures guaranteed to optimize security before trusting it with your assets. Prioritize working with exchanges that enhance the safety of your crypto with outstanding measures like 2FA and SSL encryption.

Review every crypto exchange’s costs before signing up to avoid unexpected or excessive expenses. Assess everything from transaction charges and commissions to maker and taker fees. You should also watch out for hidden costs that are likely to inflate your expenditures in the long run.

You should verify if an exchange supports your preferred cryptocurrencies to avoid disappointment in the future. Also, prioritize trading and investing with platforms that support popular assets and newer tokens since you may need to diversify with them at some point. The broader the range of supported assets, the better.

Before choosing a particular exchange, evaluate customer support services. You should trade with a company that offers multiple support channels. They will come in handy when you encounter an urgent issue. Also, to ensure you get timely assistance when trouble comes knocking, test your chosen exchange’s support quality and response time.

You can gauge an exchange’s reputation and reliability from past user feedback. But, for unbiased insights, use testimonials from Trustpilot, the App Store, and Google Play. Watch out for cooked and misleading reviews published by minions paid to tout specific companies.

How To Register an Account with a Crypto Exchange in India

Registering with a legit cryptocurrency exchange in India is a simple process that should take a couple of minutes. We know that since we signed up with all the platforms reviewed here. So, expect no significant complications. Just do the following:

Go to your preferred exchange’s official homepage. Scrutinize the site and essential elements like supported products, trading options, and support services. Ensure the company has everything you need, especially the right type of exchange and your preferred cryptocurrencies.

Click the registration button to start signing up from your browser. You can also download a mobile or desktop app and do it from there. While registering, provide all the required information, including your name, email address, and phone number.

After signing up with your personal details, most exchanges will ask you to submit verification documents to unlock all account features and privileges. You must submit clear and legible photos of your government ID and proof of address documents like bank statements. The exchange might also require you to take a selfie while holding your ID. Fulfill all requirements.

Wait for your account to be verified. Then, log in and visit the deposit section. Use one of the available payment methods to fund your account. Depending on what your crypto exchange allows, You can deposit fiat or crypto from an existing wallet. Determine what to deposit based on the platform’s minimum requirements and your trading budget.

After depositing funds or crypto, browse the supported cryptos and choose your preferred asset. You can then trade or acquire crypto, depending on your preferences. Remember to reduce risk exposure by spreading your resources across different crypto assets.

Conclusion

The best crypto exchanges in India range from Binance and HTX to Crypto.com and CEX.IO. Each of these platforms is best suited for a specific demographic. For instance, HTX’s advanced offerings make it ideal for professional traders. On the other hand, CEX.IO is a fitting option for investors who want to reap juicy returns from staking crypto. The bottom line is to pick an exchange that aligns with your needs and preferences.

You should also avoid interacting with any crypto exchange with too many flags, especially where security is concerned. If you encounter a platform that’s fallen prey to breaches one too many times, avoid it like the plague. Otherwise, malicious actors may steal your assets or personal in the future.

Got it! Overall, this article gives a good overview