Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Dubai is a digital hub that is now home to countless crypto companies and enthusiasts. The city has a favorable climate for fans of cryptos, with numerous regulatory bodies, zero personal income tax for traders, and many other perks. If you’re an Emirati living in this city, you’ve more than enough reason to try as many crypto-related endeavors as possible, starting with crypto trading.

Before diving in, note that the crypto exchange you trade with will influence your degree of success or failure. You can only enjoy optimum results when using the most reliable and credible crypto-trading platforms. We’ve listed 5 of them below after vetting and gauging countless service providers using crucial factors like reputation, security, and charges.

In a Nutshell

- The crypto exchange you use will determine your success or failure as a trader.

- Tens of exchanges are open to Emiratis, but only some are credible and reliable.

- To enjoy optimum protection, fair practices, and fewer complications, you should trade exclusively with credible and reliable exchanges.

- Our team tested the crypto exchanges in Dubai and isolated the top five based on reputation, reliability, and security.

List of the Best Crypto Exchanges

- Binance – Best for Advanced Crypto Trading Features

- eToro – Best Crypto Exchange for Social Traders

- Crypto.com – Best for Crypto Payment Integration

- Exodus – Most User-friendly Crypto Exchange

- HTX – Best Exchange for Token Variety

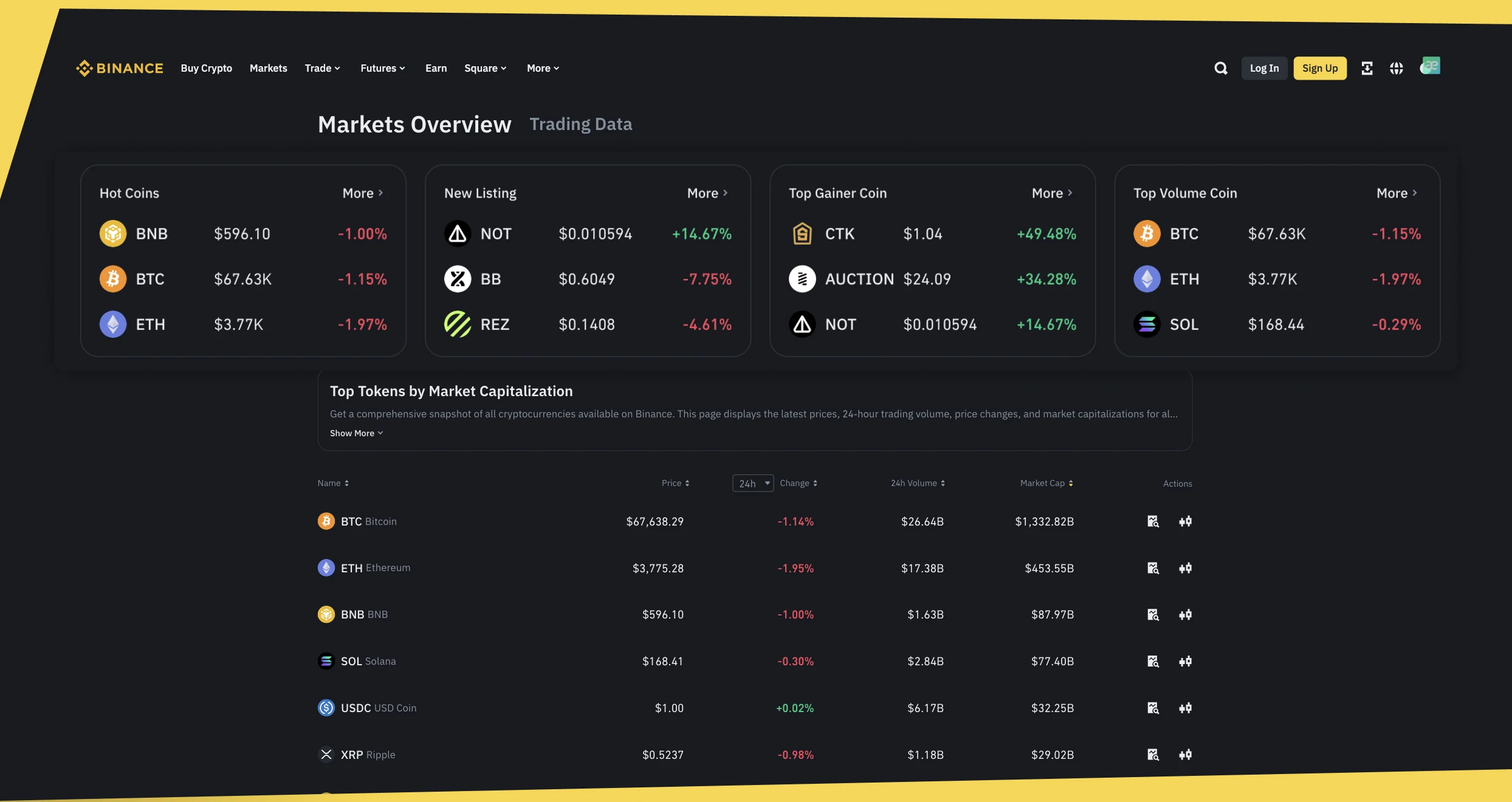

Compare Crypto Exchanges

When searching for the best crypto exchange to use, you must be guided by a plethora of factors. They range from each platform’s key strength and number of supported coins to the availability of a proprietary digital wallet and well-rounded customer support service. Let’s compare the best Dubai crypto exchanges based on the most important factors.

| Name of Exchange | Type of Exchange | Support Service | Supported Coins and Tokens | Digital Wallet |

|---|---|---|---|---|

| Binance | Centralized | 24/7 | 350+ | Yes |

| eToro | Centralized | 24/5 | 30+ | Yes |

| Crypto.com | Centralized | 24/7 | 700+ | Yes |

| Exodus | Decentralized | 24/7 | 270+ | Yes |

| HTX | Decentralized | 24/7 | 700+ | Yes |

Exchanges Overview

Without an exchange that has your favorite assets and reasonable fees, your crypto trading escapades will be a nightmare. You’ll have to contend with coins and tokens that you’re not used to. Worse yet, your returns will diminish significantly courtesy of ungodly costs and charges. You need to check if every exchange has your favorite crypto and whether its fees and charges are reasonable before signing up to avoid such problems.

Considering the above, the two tables we’ve included below outline the fees charged and the assets supported by each of the recommended crypto exchanges in Dubai.

Fees

| Name of Exchange | Fees | Minimum Deposit Requirement |

|---|---|---|

| Binance | From 0.0110% / 0.0230% maker/taker fees | None |

| eToro | 1% fee for buying/selling crypto, 2% crypto asset transfer fee | $100 |

| Crypto.com | 5% liquidation fee (subject to change), | $1 |

| Exodus | From 0/0.50% maker/taker fees | None |

| HTX | From 0.0097%/0.0193% maker/taker fees | 100 USDT |

Assets

| Name of Exchange | Bitcoin | Ethereum | Litecoin | Ripple | Tether | Solana |

|---|---|---|---|---|---|---|

| Binance | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto.com | Yes | Yes | Yes | Yes | Yes | Yes |

| Exodus | Yes | Yes | Yes | Yes | Yes | Yes |

| HTX | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about the Best Crypto Exchanges

The exchanges we’ve listed and are about to review are the best in Dubai for many reasons. To begin with, they are credible, reliable, and secure. In addition, these companies have the friendliest fees, world-class support, easy-to-use platforms, and many other positive attributes. Read on to discover what each of the recommended service providers offers.

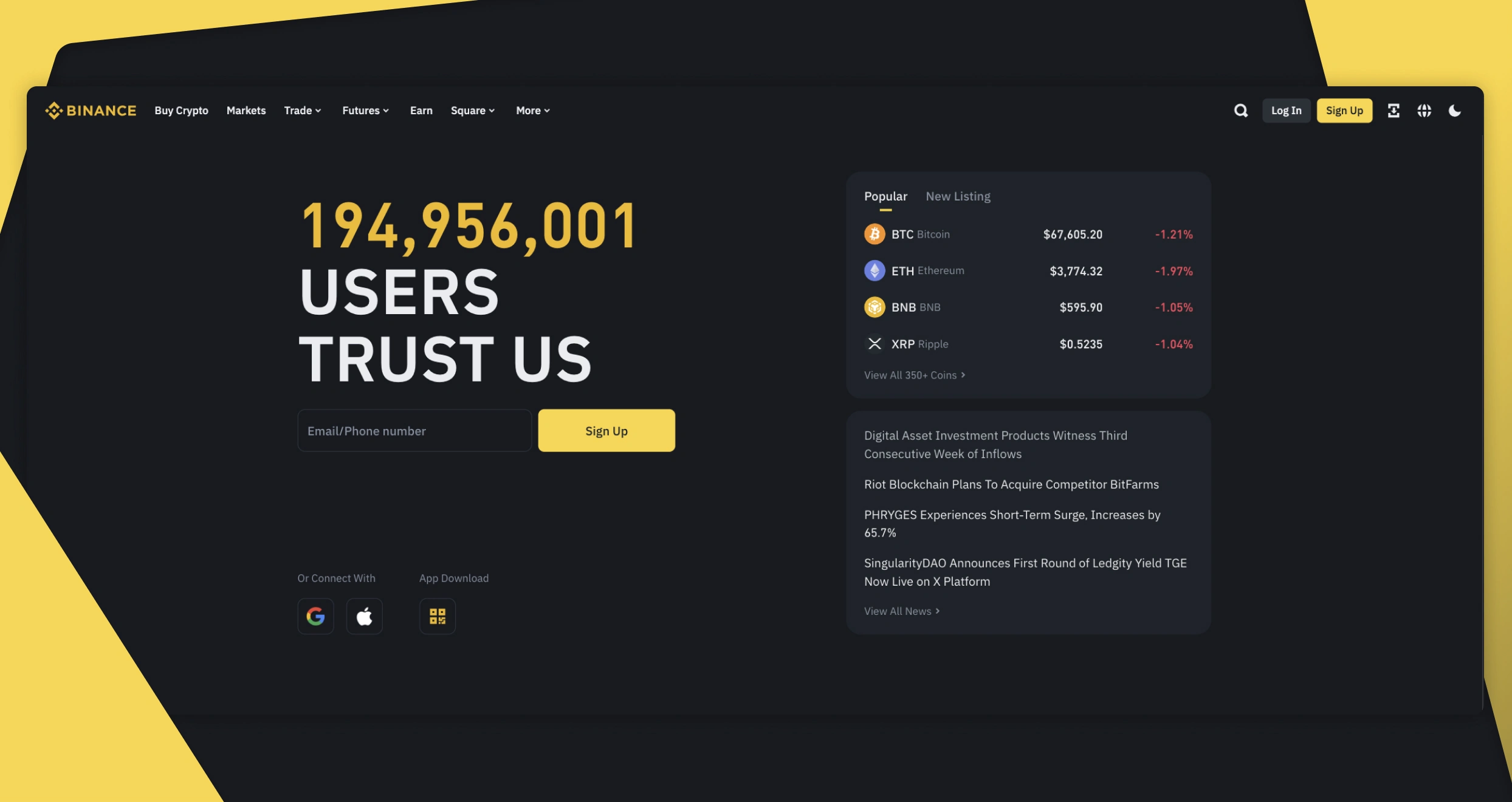

1. Binance – Best for Advanced Crypto Trading Features

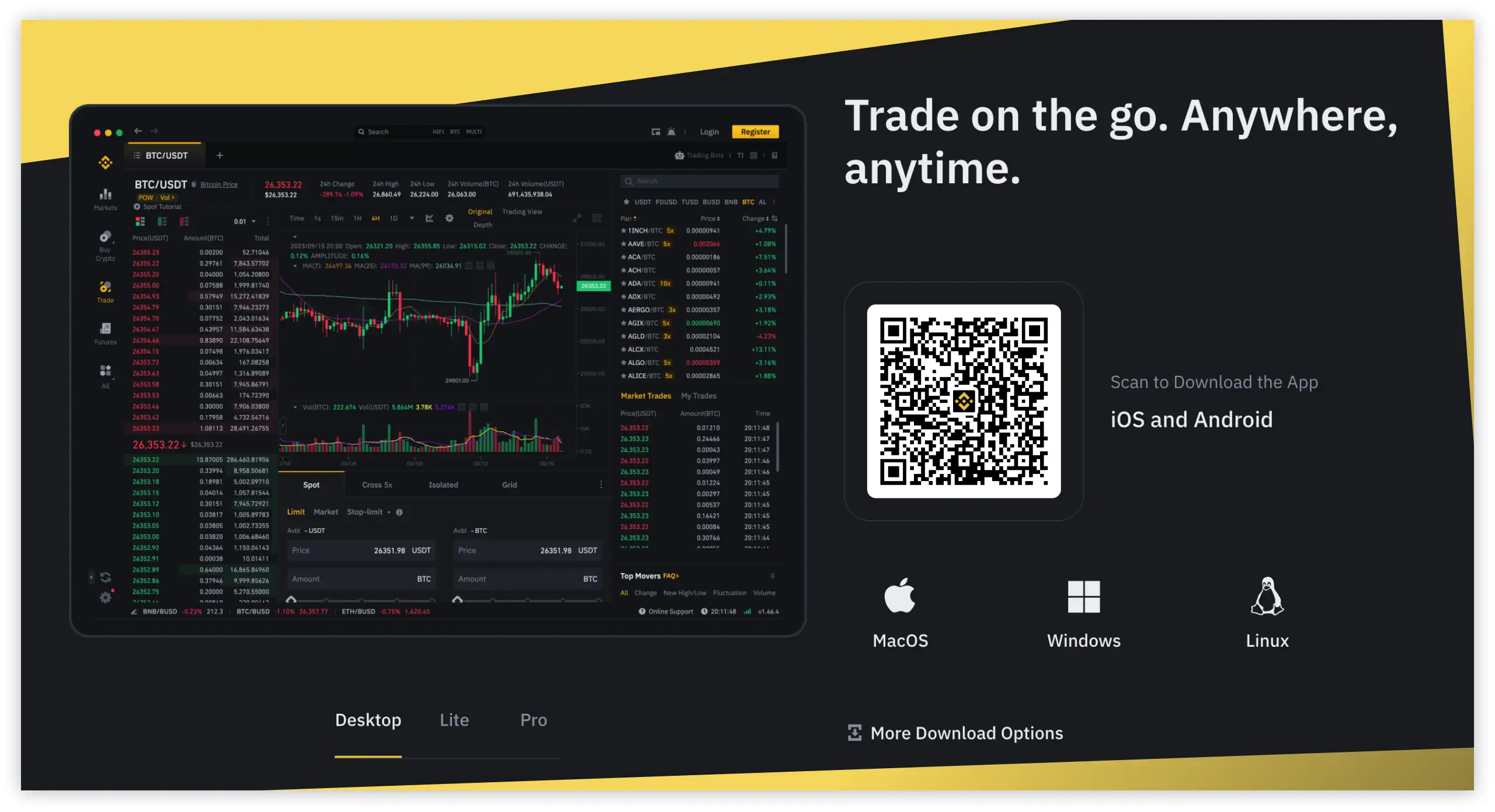

Binance is the best crypto exchange for seasoned traders who need advanced trading features. Trusted by over 200 million people worldwide, Binance is one of today’s most prominent and friendliest service providers. Join it and trade seamlessly from your web browser, PC, or Android/IOS mobile gadget.

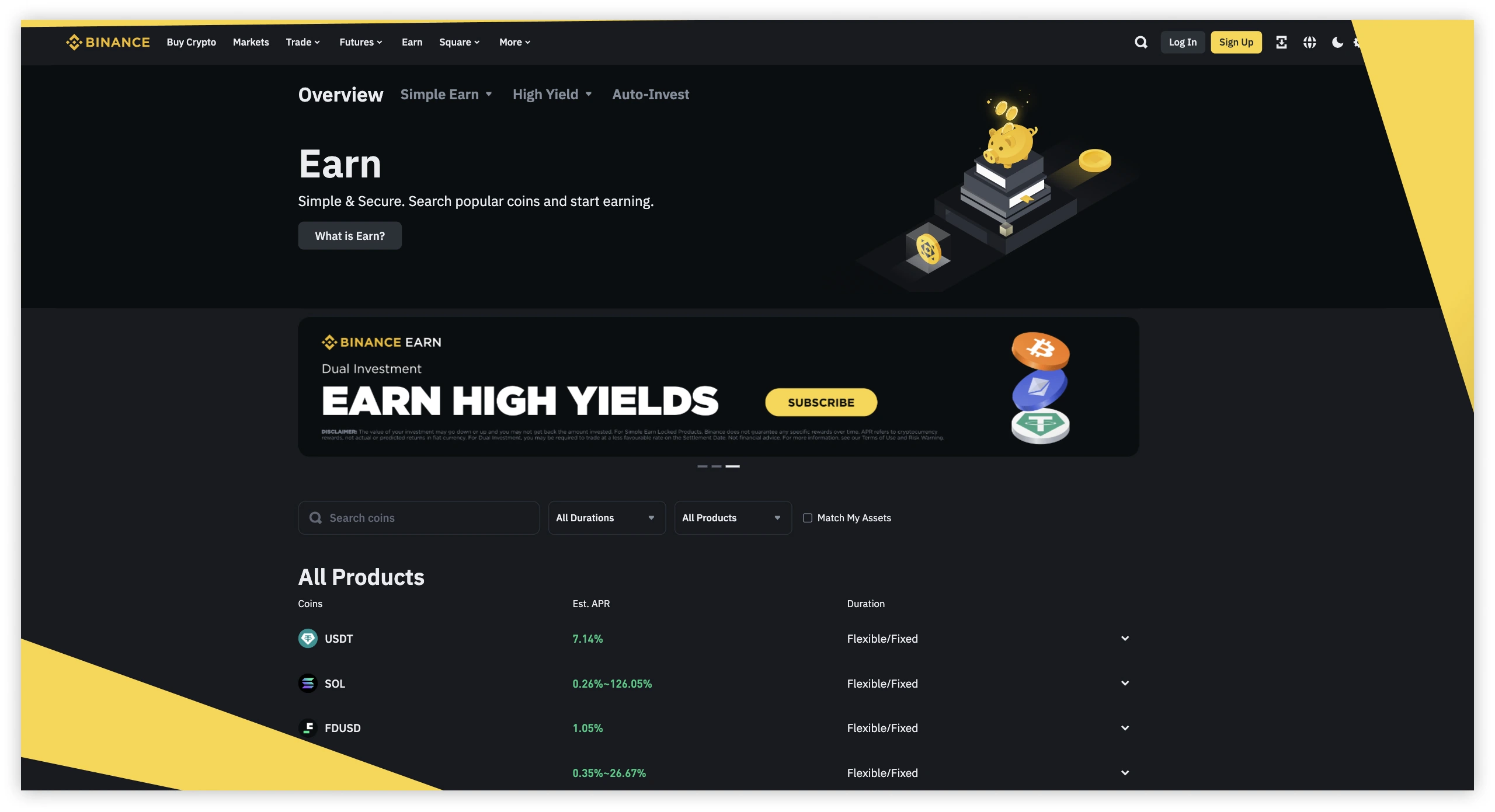

As a Binance user, you can trade over 350 crypto assets on margin, futures, and spot markets. You can also buy/sell cryptocurrencies on Binance P2P and enjoy a plethora of perks, from unmatched security to super-friendly costs. Not to forget, you can stake idle assets with Binance Earn and reap what the name suggests – juicy earnings.

Binance has countless comprehensive trading tools. With this exchange, you can take your crypto trading experience to the next level with TradingView’s supercharged analytical and charting tools. You can also leverage the full power of advanced order types like one-cancels-the-other (OCO), trailing stop order, and one-triggers-the-other (OTO).

If high fees are causing you major concerns, it’s time to smile. With this exchange, you can enjoy maker/taker fees as low as 0.011%/0.023%. What’s more, this company doesn’t charge any cryptocurrency deposit fees.

Pros

- Top-tier security features

- Responsive support agents

- Reasonable fees

- Supports hundreds of crypto assets

- Robust trading feature

- Free crypto and blockchain academy

Cons

- Higher fees for regular users

- No phone support

We signed up for investment accounts at Binance, and there were no registration charges. The exchange also does not have a minimum deposit requirement, thus allowing us to get started with any amount of money we could afford.

We analyzed Binance’s fee structure and concluded that it is among the most affordable cryptocurrency exchanges we have tested. Its maker and taker fees are low, but this depends on the trading volume and Binance Coin balance. Simply put, higher-volume trades are subject to low trading fees.

Regarding transactions, Binance does not charge deposit fees for cryptocurrency deposits. However, investors will incur withdrawal charges depending on the crypto token they use to transact.

You can also transact using fiat currencies at Binance. While some currencies do not attract deposit fees, others do. For instance, you will pay a 0.65% deposit fee when you make deposits using the AED currency via online banking. Withdrawal charges on fiat currency transactions also apply depending on the currency you transact with.

2. eToro – Best Crypto Exchange for Social Traders

If you are still honing your crypto trading skills and would like to reduce risk exposure, eToro has a solution for you: social trading. It lets you copy the moves made by more experienced and profitable crypto traders on the platform. Before copying any specific individual, you can assess their portfolios, performance, and stats, which helps you make informed decisions and avoid copying questionable entities.

You’ll never run out of people to follow and copy since millions of traders use this platform. Besides copying others, you can discuss important topics and source wisdom from other eToro users, courtesy of its thriving, professional, and friendly community. eToro also issues critical news feeds that help you stay informed on market trends, sentiment, and recent developments.

We also urge beginners to start their crypto trading careers with this respected exchange for one more reason: quality education. Here, you’ll have all the materials and resources you need to master crypto trading, from beginner’s guides to free lessons, tutorials, and courses. After acquiring education, you can jump into trading without any hassles since the platform is optimized for beginners and has a highly user-friendly design and layout.

Pros

- Extensive support for social trading

- Localized customer support

- User-friendly platform interface

- Transparent fees

- Strong regulation

Cons

- Limited asset offering

- Higher withdrawal fees than its peers

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

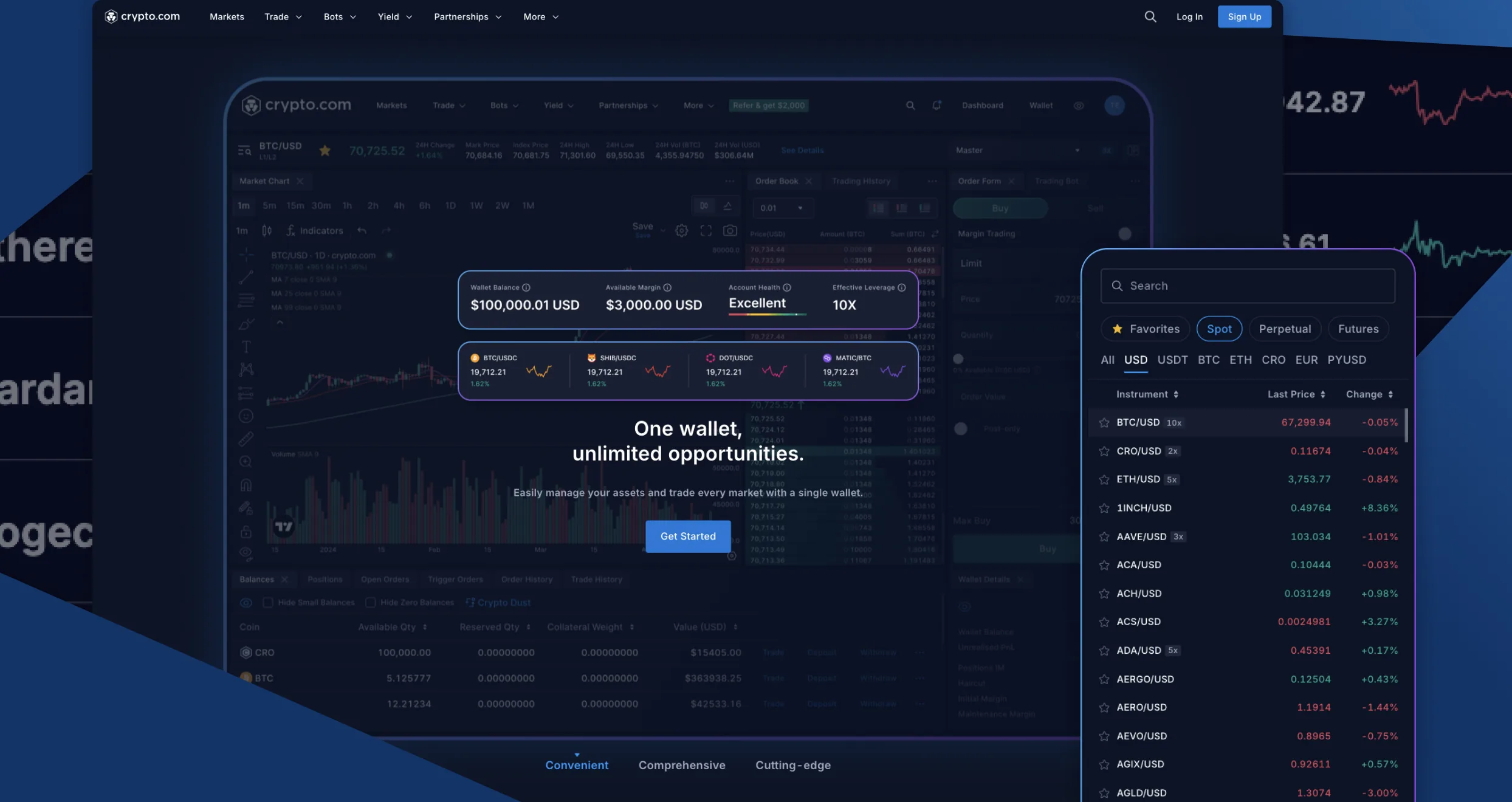

3. Crypto.com – Best for Crypto Payment Integration

Paying merchants with crypto is the key to enjoying lower fees, enhanced security, and faster transactions. The good news is that Crypto.com is dedicated to ensuring you reap these and many other perks of paying with crypto. This company offers one of the most outstanding payment features today: Crypto.com Pay.

With Crypto.com Pay, you can spend your crypto assets anywhere, from coffee shops and electronics stores to fashion shops and restaurants. Over 300,000 shops allow their customers to pay with crypto using this feature. What’s more, while shopping with Crypto.com Pay, you can get up to 10% cash-back rewards and save juicy amounts of money in the long run.

When it comes to trading, Crypto.com supports over 700 of the most popular cryptocurrencies today. Different cards are available, from Midnight Blue to Prime. Higher card tiers come with a plethora of enticing offers, from up to $1 million CRO lockup and up to 8% CRO rewards on everyday spending to priority support and a private account manager feature.

Pros

- Supports 700+ coins and tokens

- Seamless payment gateway for merchants and consumers

- A proprietary crypto visa card is available

- Competitive fees

- Enticing cashback rewards

Cons

- Its ecosystem may be overwhelming to beginners

- Complex fee structure

We were impressed by Crypto.com fees, which we believe are among the lowest in the industry. For instance, there are no deposit fees when transacting with cryptocurrencies. However, you will pay withdrawal charges, the amount of which depends on the token you are transferring.

Creating an investment account at this exchange is free, and there is no minimum deposit requirement. This means that users can start trading or investing in cryptos with as little as $1. We find Crypto.com a suitable option for low-budget traders.

When it comes to trading and investment costs, expect to incur maker and taker fees. For those venturing into spot and derivatives market, expect to incur trading fees from 0.075% and 0.034%, respectively. For CRO stakers, Crypto.com guarantees 0% maker fees if you stake at least 50,000 CROs. Those who stake at least 100,000 CRO will enjoy negative maker fees across all tiers.

Our exploration of this exchange revealed that trading fees are charged based on the cryptocurrency you trade or invest in. Therefore, we advise you to always confirm an asset’s fees and ensure they fit your budget before you open a position. Fortunately, Crypto.com is transparent with its charges. What you see is what you will incur.

Besides the charges above, expect to incur a $5 inactivity fees. This applies if your trading or investment account remains dormant for a period exceeding 12 months.

4. Exodus – Most User-friendly Crypto Exchange

In matters concerning user-friendliness and simplicity, Exodus is the ultimate winner. Fundamentally, this is a wallet that comes with an integrated exchange. In other words, it’s a crypto wallet that lets you swap, buy, and sell crypto easily. If you want to dodge complications that often arise from using independent wallets and exchanges, like forgotten passwords, Exodus is the solution to choose.

Exodus has a simplified, intuitive interface that’s ideal for both novices and seasoned crypto traders. You don’t need extensive knowledge to use it today. What’s more, there’s no KYC requirement for basic users, making it the best choice for traders whose priority is unmatched privacy and anonymity. Not to forget, this is a decentralized wallet that lets you control everything from your assets to your private keys.

The wallet supports millions of assets and allows users to buy crypto with Apple/Google Pay, credit/debit cards, and bank accounts. It also supports staking and offers competitive rewards on multiple assets, such as Cardano, Cosmos, and Solana. The platform has a calculator that helps users estimate their rewards before staking assets.

Pros

- Non-custodial wallet with built-in exchange

- Clean, intuitive user interface

- Integrates with Trevor hardware wallets

- Responsive support agents

- No KYC for basic users

Cons

- Limited support channels

- Scant advanced trading tools

Exodus is among the digital wallets that have no fees for downloading and setting up accounts. From our exploitation, the wallet does not charge any fees when you receive and store cryptocurrencies. However, expect to incur network or gas fees when you send cryptocurrencies. The best part is that this Exodus wallet fee can be customized, although this option is limited to Bitcoin, Ethereum, and ERC20 transactions.

Cryptocurrency sending charges vary based on the blockchain network you use. Therefore, always understand applicable charges to plan accordingly. Exodus automatically checks all addresses to ensure seamless transactions with no errors.

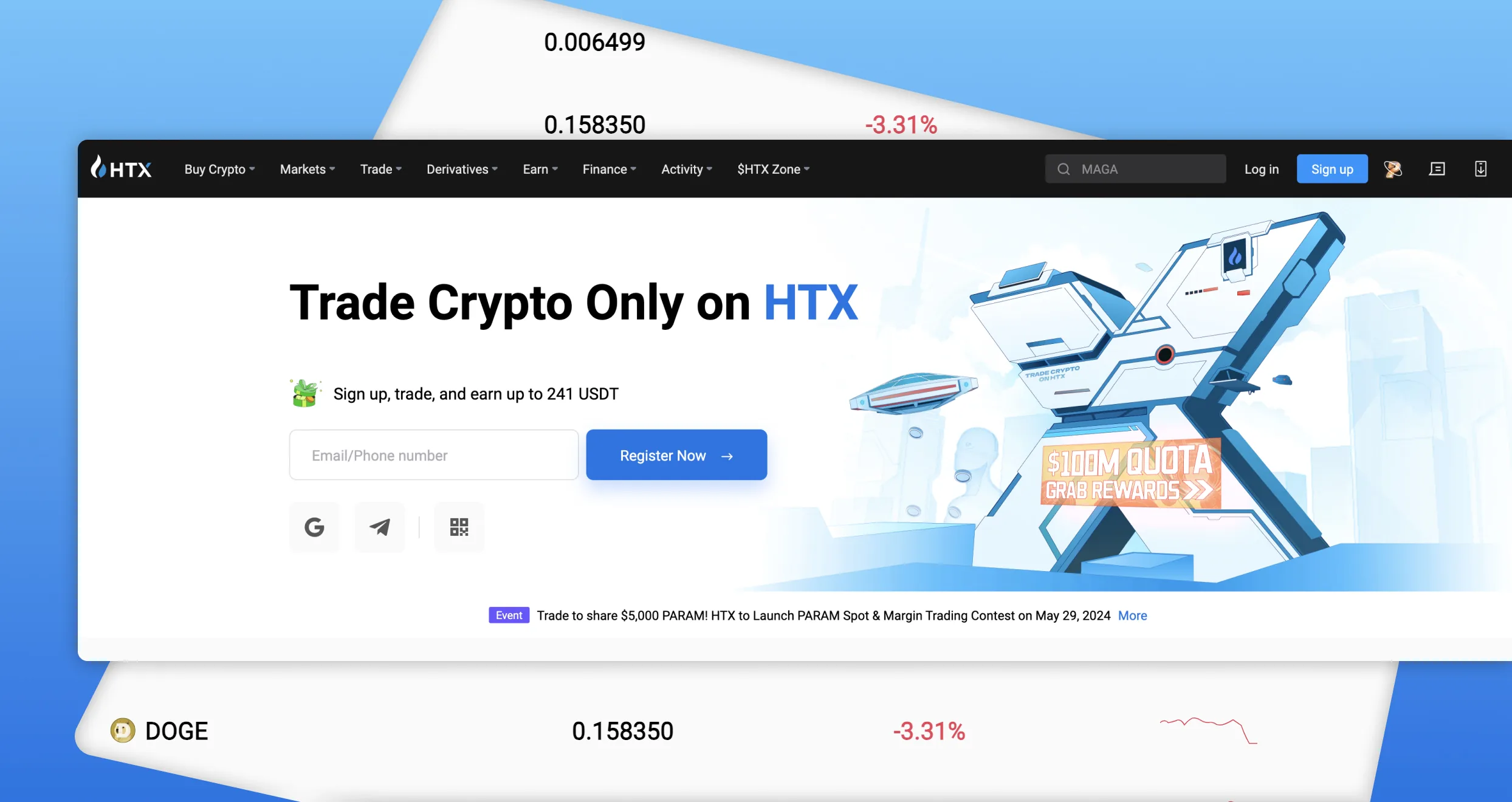

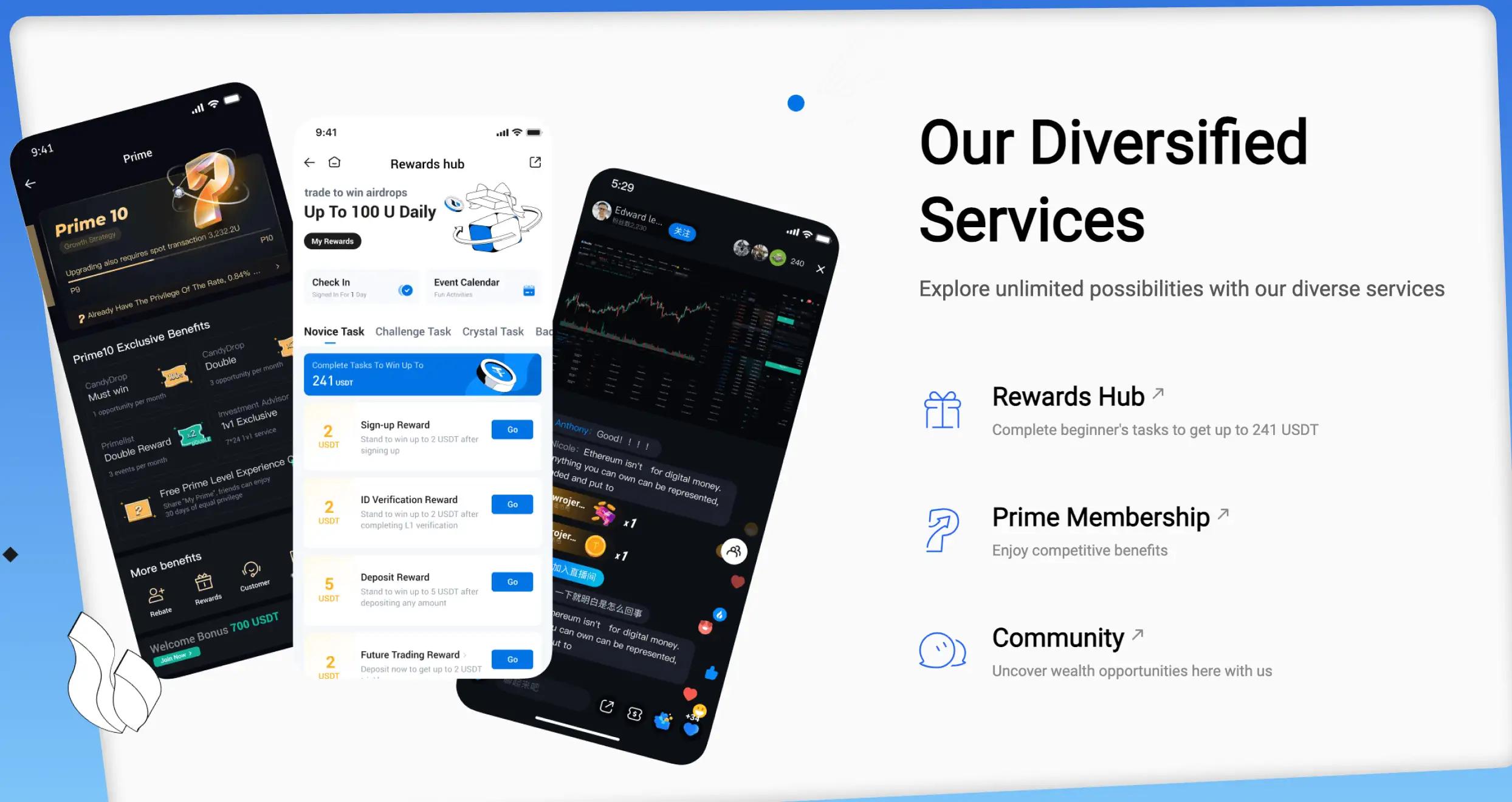

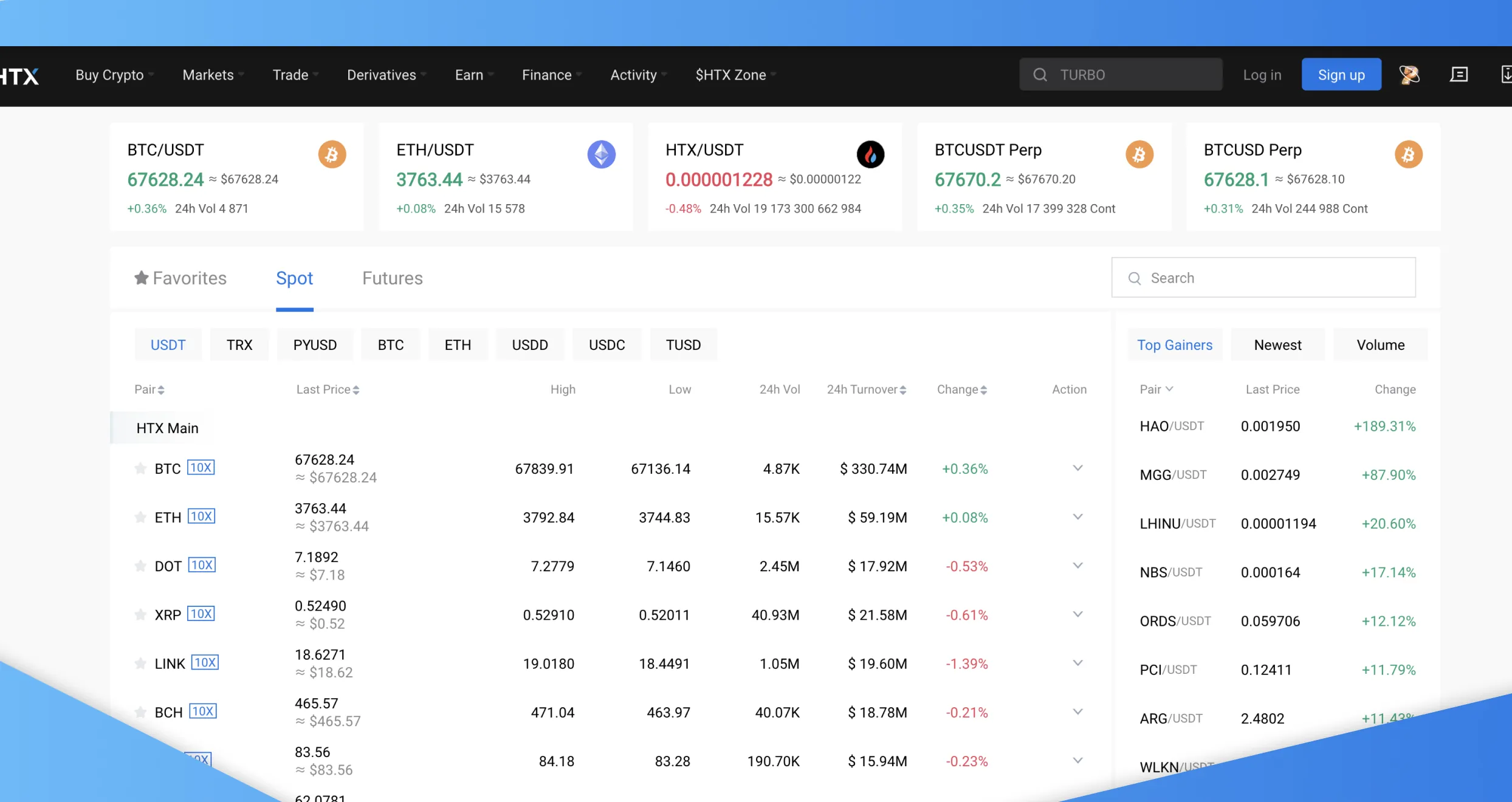

5. HTX – Best Exchange for Token Variety

HTX supports more cryptocurrencies than most of the other exchanges available in Dubai. This company’s list of accepted assets has over 700 coins, and it’s still growing. And to ensure its users always have access to the latest innovation, the exchange is dedicated to continuously adding the latest credible projects in the crypto space.

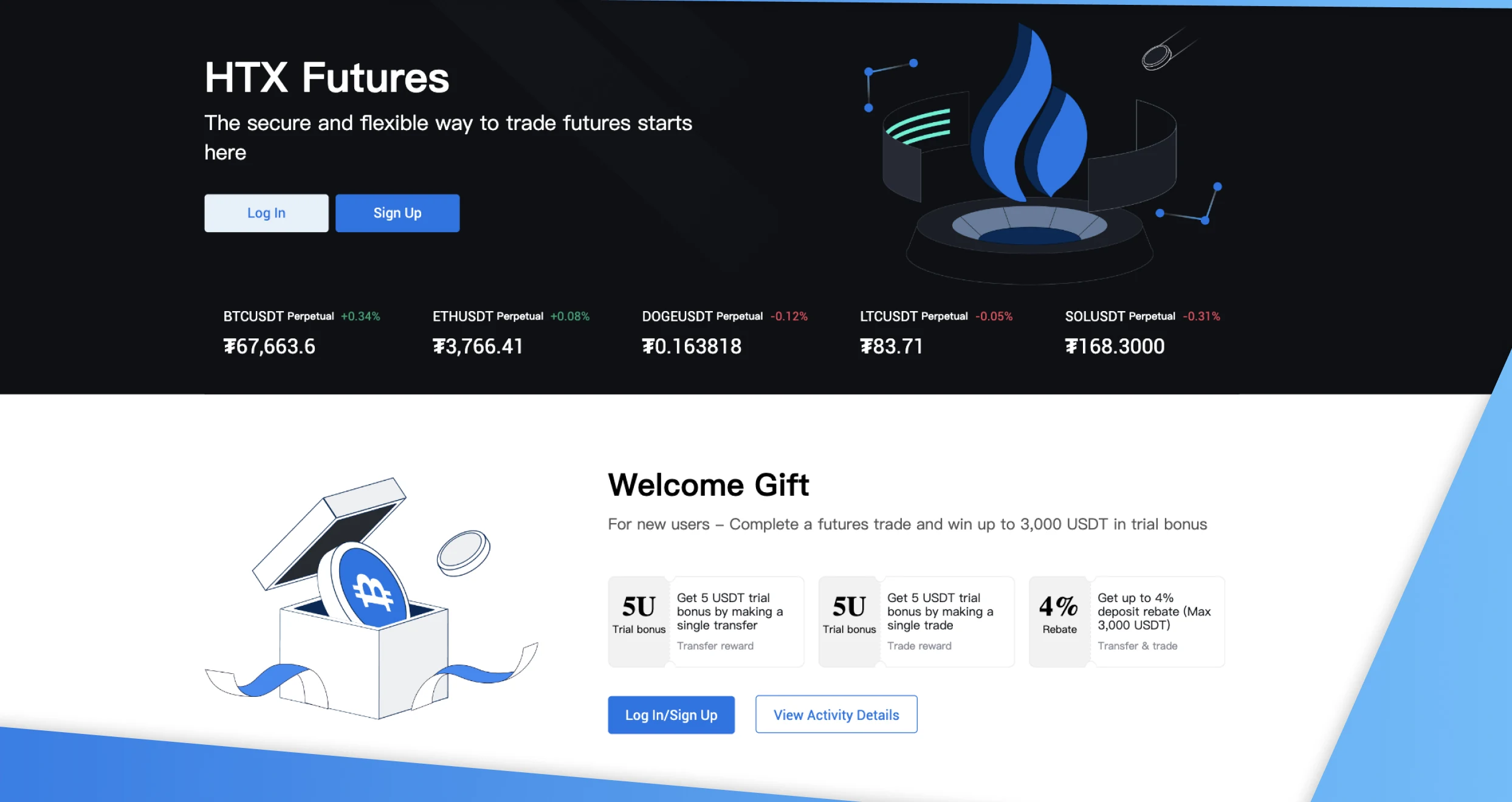

You’ll find a variety of trading options on HTX, from spot to futures trading. And while you’re trading your favorite cryptocurrencies, you can stake idle assets and earn positive returns with HTX’s industry-leading APYS. This is one of the easiest ways to scale up your portfolio and make some cash on the side without breaking a sweat.

We also rate HTX highly because the platform offers crypto loans that you can borrow anytime and pay within up to 90 days. Not to forget, the exchange has a lively community where crypto enthusiasts share recent discoveries, trends, and news. Here, you’ll find information about new projects and get the opportunity to invest before prices shoot the roof.

Pros

- Supports 700+ cryptocurrencies

- Crypto loans are available

- Offers airdrops and new token rewards

- Competitive trading fees

- Robust trading tools

Cons

- Might be too advanced for newbies

- The fee structure can be confusing

Since unplanned-for charges can increase your trading costs and reduce your profits, we decided to evaluate HTX’s fees and inform you accordingly. That way, you can prepare beforehand and avoid nasty surprises.

From our evaluation, we realized a few things. First, you can use this exchange’s P2P platform and enjoy zero transaction fees. You can enjoy the same perk when using an AdvCash wallet to deposit and withdraw RUB (Russian Ruble). Additionally, people using RUB to buy crypto on HTX incur zero transaction charges.

This exchange charges 0.02% and 0.05% transaction fees for makers and takers, respectively. These fees are for USDT-margined trading. The actual amount that makers and takers pay while trading with HTX depends on numerous factors, including the filled quantity, transaction prices, and contact face value.

And if your situation requires you to use HTX’s OTC Desk, you can start smiling now. That is because this platform doesn’t have any transaction fees. Everything you’ll pay while using it is included in the “all-inclusive” price you’ll see.

But before you fund your HTX account and start trading, you should know a few additional things. For starters, this exchange’s minimum deposit is 100 USDT. If you send a lesser amount to the exchange, it won’t be credited to your account. You’ll have to deposit more USDT to the address you used before until your deposit amount hits or exceeds this threshold.

Crypto Trading in Dubai

The Central Bank of the UAE has yet to recognize cryptocurrencies as legal tenders. That said, you can still trade crypto in Dubai and enjoy peace of mind, provided you use trustworthy and credible exchanges. Several entities, including the DFSA, FSRA, and SCA, regulate the best exchanges in the region. While interacting with them, your funds and assets will be safe and secure.

One of the benefits of trading crypto in Dubai is taxation. As a crypto trader in this city, you won’t be required to pay any personal income tax on your gains, trades, or holdings, which leaves more money in your purse.

How Does Crypto Trading Work?

Crypto trading, in simple terms, is the buying and selling of cryptocurrencies. If you are new to cryptocurrency trading, first learn the essentials of crypto. Countless free materials are available online, from guides to YouTube videos, so you shouldn’t fret over the cost of your education.

After educating yourself, look for a good crypto exchange. Remember that not all service providers are available in Dubai. Research each exchange’s availability in your region before committing to avoid wasting time and energy.

Note that multiple types of crypto trading are available today. You can opt for spot trading, which involves buying/selling digital assets at the current market price, or enter into a contract and agree to buy/sell crypto at a specific price in the future through futures trading. Some service providers also offer margin trading, which allows you to use borrowed funds to trade larger amounts of assets than your current account balance can allow.

Not to forget, some exchanges support p2p crypto trading. This feature allows you to buy crypto from or sell crypto to other people directly, without the intervention of the exchange or any other third party.

How to Choose the Right Crypto Exchange Work

Dedicating sufficient energy and time to finding the right crypto exchange is crucial for myriad reasons. First, hackers often target these platforms, so finding the best exchange is vital in safeguarding your assets. What’s more, service providers have different fees, supported assets, terms and conditions, etc.

To ensure you sign up with the right exchange, vet each service provider based on the following:

The best crypto exchanges have earned their users’ confidence and trust. Consequently, they have a good online reputation; the opposite is also true. Having said that, before signing up with an exchange, gauge its reputation from online user reviews and ratings. While reading reviews, look for feedback that can help you make the right decisions and avoid disasters, like multiple people complaining about account breaches.

Hackers stole crypto worth nearly 2.2 billion in 2024 alone. Don’t make their work easier in the future by signing up with an exchange that lacks world-class security. Before signing up, check if your chosen service provider employs leading protocols and measures like encryption, cold storage, and two-factor authentication.

You should also research the company’s insurance policy and how it responds to breaches. Additionally, check if the exchange has been hacked in the past. Avoid platforms with an extensive history of successful breaches and hacks.

Each exchange’s range of supported assets will determine your access to vital cryptocurrencies. To be on the safer side, sign up with a platform that allows the trading of popular digital currencies like Bitcoin, Ethereum, and Dogecoin. If you are experienced and would like to diversify your portfolio with unique altcoins, choose a service provider that supports hundreds of tokens and coins besides the most popular options.

While trading crypto, you’ll encounter common issues every now and then, like delayed withdrawals and failed login attempts. Don’t fret; it’s common. To ensure your issues are resolved promptly, you need to sign up with an exchange that offers top-quality customer support service. Ideally, the company should guarantee quick, round-the-clock assistance. It should also have a help desk with the resources needed to sort out simpler issues that don’t require professional support.

Fees can easily undermine potential profits. Remember that many exchanges have charges for deposits, withdrawals, trading, and other crucial services. Ensure more of your money remains in your pockets by signing up with a service provider with reasonable fees. Also, watch out for discounts tailored to help crypto traders reduce overall costs. Most importantly, don’t trade with companies that don’t prioritize transparent pricing and plague users with hidden charges, as evidenced by past user complaints.

How To Register an Account with a Crypto Exchange in Dubai

Setting up your crypto trading account should be easy, provided you’ve chosen the right exchange. Here’s what most service providers require new signees to do:

Start your journey on the exchange’s official site to avoid scams, malicious apps, and other issues. You can register quickly on the official site or download your preferred app and do so from there. While you’re on the site, conduct an extensive tour and check everything, from terms and conditions to fees and testimonials.

The website or app should have a clear sign-up button. Click it and provide the required information. At first, most exchanges will ask for your email and password. After sharing these details, you’ll receive an email from the company, which is supposed to allow you to verify your account. Since optimum security is the key to avoiding getting hacked and losing money and crypto, set a password with 12+ characters, including uppercase and lower-case numbers, letters, and special characters.

Some exchanges have KYC. If your chosen platform has this protocol, adhere to it. All you’ll need to do is provide personal information like your name, date of birth, ID number, and address. Additionally, upload documents that will help the exchange verify your identity, like a picture of your government-issued ID and a soft copy of a recent bank statement.

If you don’t have crypto that you can transfer to your new account, you’ll need to buy some assets. To do that, you must first fund your account. Use the fastest and most convenient funding methods, like credit or debit cards, to avoid unnecessary headaches. Check your chosen exchange’s support for each option before committing to it.

A funded account should allow you to interact with the markets. Visit the trading section, choose your preferred assets, and start trading. To avoid extreme losses, monitor your account and make adjustments whenever necessary. You should also consider storing funds and assets that you don’t plan to trade with soon in a secure personal digital wallet.

Final Thoughts

Avoid scams, constant hacks, and other complications by trading with the best crypto exchange in Dubai. We’ve listed something for everyone, from beginners to pros. Before you interact with them, note that, like other investment endeavors, crypto trading comes with certain risks, starting with considerable financial losses. Learn how to mitigate them before putting any money on the line.