Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

As a Canadian investor, it is crucial to consider your budget when choosing a discount broker. Trading and non-trading charges can eat into your profits, so prioritize this element during research. You must also ensure your broker offers quality investment resources and other elements that will increase your profitability.

We understand that you probably do not know how to conduct research for the best discount broker in Canada. Depending on your skill level, you may also wonder whether discount brokers are the right fit for you. Below, we share our best discount brokers that we have tested and find worthy of recommending. We will also shed light on what a discount broker is so you can decide whether it is worth investing with.

List of the Best Discount Brokers

- Interactive Brokers – Overall Best

- Saxo – Best With Numerous Investment Options

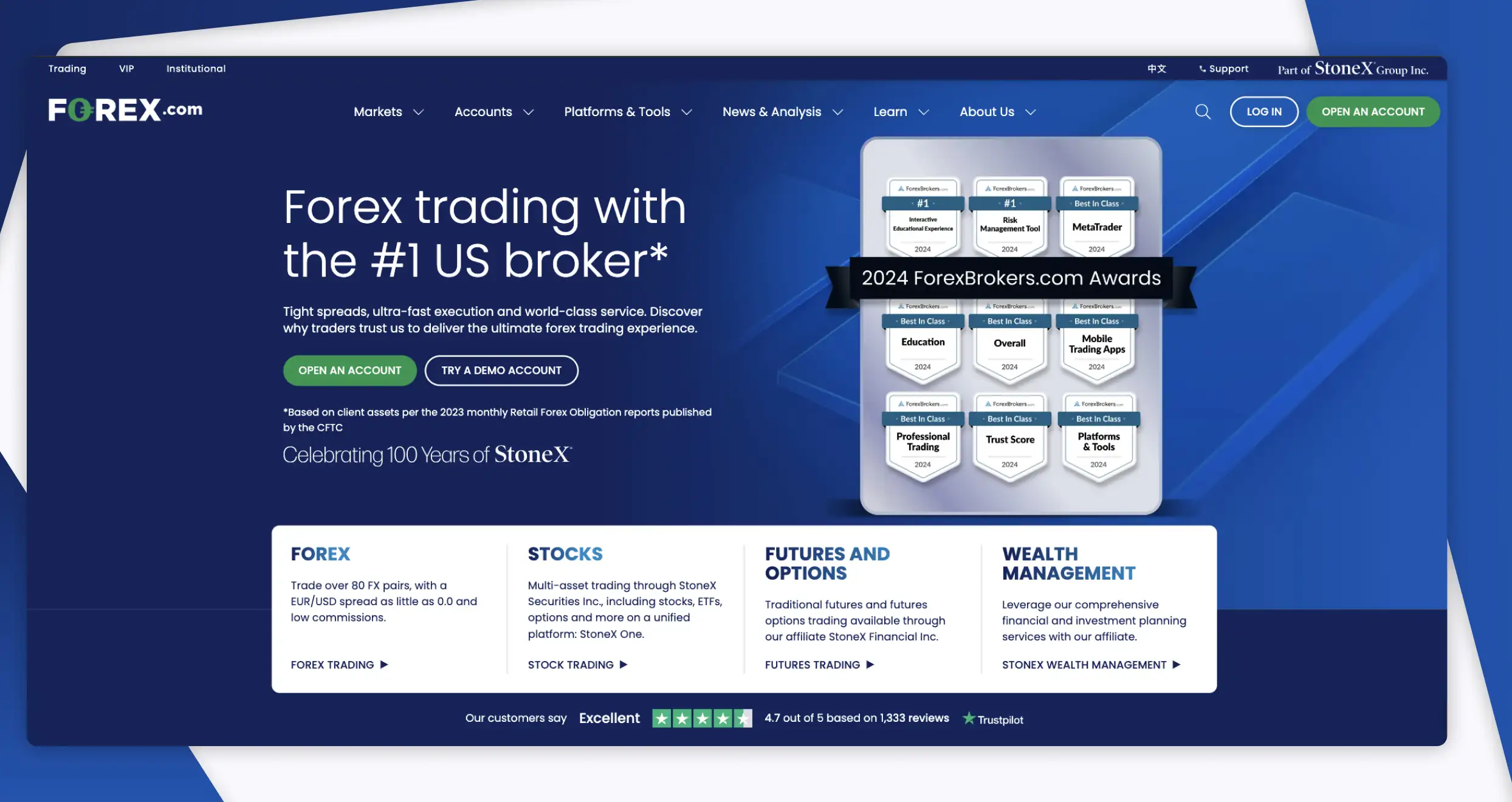

- Forex.com – Top Option For Forex Traders

- OANDA – Best With No Minimum Deposit Requirement

- XTB – One Of The Cheapest

Compare Discount Trading Platforms

Our research process for Canada’s best discount trading platforms was lengthy and overwhelming. We started by collecting hundreds of options, considering their regulatory status. We only tested those that are CIRO-regulated since they are legitimate and offer favourable trading conditions. Other elements we considered while comparing discount brokers in Canada include fees, asset offerings, support services, demo accounts, and more.

Our Canada discount brokerage comparison process did not stop here. Besides conducting multiple tests and comparisons, we visited Google Play, the App Store, and Trustpilot to sample user comments and ratings on the brokers we shortlisted. This procedure helped us understand the brokers’ strengths and weaknesses from user perspectives and create a comprehensive list without being biased.

Before making a choice, ensure you compare broker features. Our comparison table below highlights some of the key elements that might influence your decision.

| Cheapest Broker Canada | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Interactive Brokers | FCA, SEC, FINRA, ICS, CBH, ASIC, SFC, MAS | 24/5 | IBKR Desktop, IBKR Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader | Check, wire transfer, direct bank transfer (ACH) | Yes |

| Saxo | FCA, FSA, MAS, FINMA, JFSA, SFC, ASIC, AFM, FSMA | 24/5 | SaxoTraderGo, SaxoTraderPRO | Bank/wire transfer, debit card | Yes |

| Forex.com | FCA, CFTC, NFA, CIMA, CIRO, CySEC, FSA | 24/5 | MT4, MT5, TradingView | Bank transfer, Credit/debit cards, Skrill, Neteller | Yes |

| OANDA | CIRO, FCA, CFTC, ASIC, FSA | 24/5 | OANDA Platform, MT4, MT5 | Bank Transfer, Credit/debit cards, PayPal | Yes |

| XTB | FCA, FSCA, ASIC, CySEC, FSA | 24/5 | xStation 5, xStation Mobile | Neteller, Credit/debit cards, Bank transfer, Skrill, PayPal | Yes |

Brokers Overview

Choosing the right discount broker means considering various elements and ensuring they align with your trading or investment needs. Besides safety, the majority of Canadian traders consider affordability and asset offerings. However, conducting broker comparisons can be lengthy, thus leaving many traders with wrong choices. To streamline this process, our tables below highlight summaries of our top Canadian discount brokers’ fees and available securities.

Fees

| Cheapest Broker Canada | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Interactive Brokers | C$0 | From 0.08% | From C$10 withdrawal fees | C$0 |

| Saxo | C$0 | From 0.03% | Free | C$0 |

| Forex.com | C$100 | From 0.0 pips | Free | C$15 monthly |

| OANDA | C$0 | From 0.1 pips | Free | C$10 monthly |

| XTB | C$0 | From 0% | Free | C$10 monthly |

Assets

| Cheapest Broker Canada | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| IBKR | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | No | Yes | Yes | Yes | Yes |

| Forex.com | Yes | Yes | Yes | Yes | Yes | Yes | No |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Expert Opinions About the Best Cheap Brokers

As professionals, we sign up for trading accounts with various Canadian discount brokers to understand their features and offerings. This way, we are assured of making the best recommendations to ensure you settle with the broker aligning with your needs. Below, we share our mini-broker reviews based on our hands-on experience. Feel free to compare these options for informed choices.

1. Interactive Brokers – Overall Best

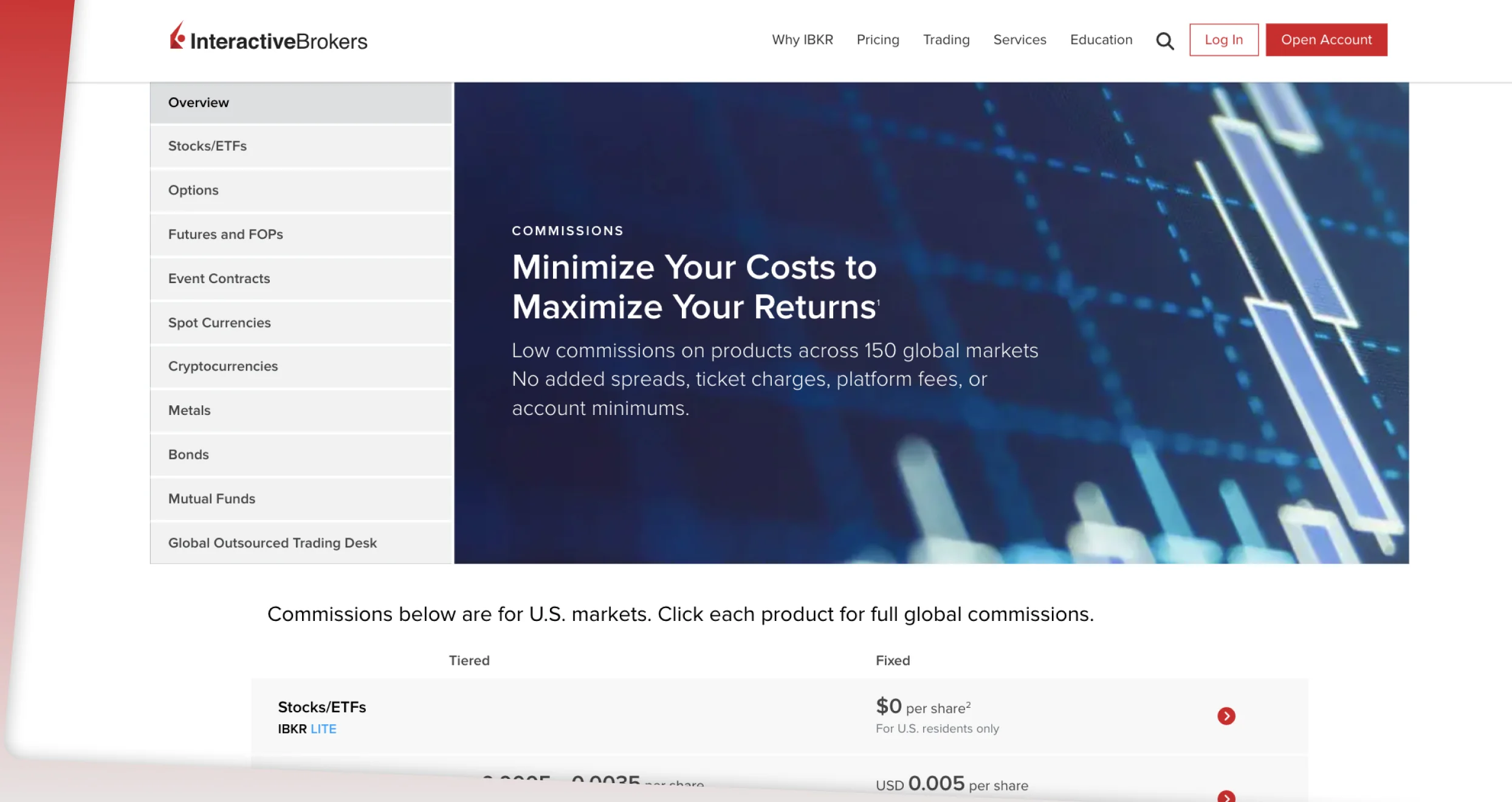

Based on our multiple tests and comparisons, Interactive Brokers (IBKR) stood out as our overall best discount broker in Canada. While signing up for investment accounts, we noticed that the broker has no minimum deposit requirement. This means that it allows users to start investing by depositing any amounts they can afford. Moreover, IBKR charges some of the lowest spreads and commissions. For instance, stock investing attracts low commissions ranging from C$0.0005 to C$0.0035 per share, and there are no transaction charges for deposits.

Another element that makes this broker excel among its competitors is its wide selection of assets. Overall, there are over 10,000 instruments to explore. Besides stocks, you can diversify your portfolio using ETFs, options, futures, bonds, mutual funds, and more. For newbies, this discount broker hosts a Free Trial account to practise trading without risking your hard-earned money. There is also an amazing Traders’ Academy platform with a wide range of educational materials for skills development.

Pros

- No minimum deposit requirement

- Zero inactivity fees

- Low commissions starting from C$0

- Cost-free deposits

- Wide variety of trading and investment products

- Free, world-class educational resources

Cons

- Higher fees for wire withdrawals

- No third-party trading software

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

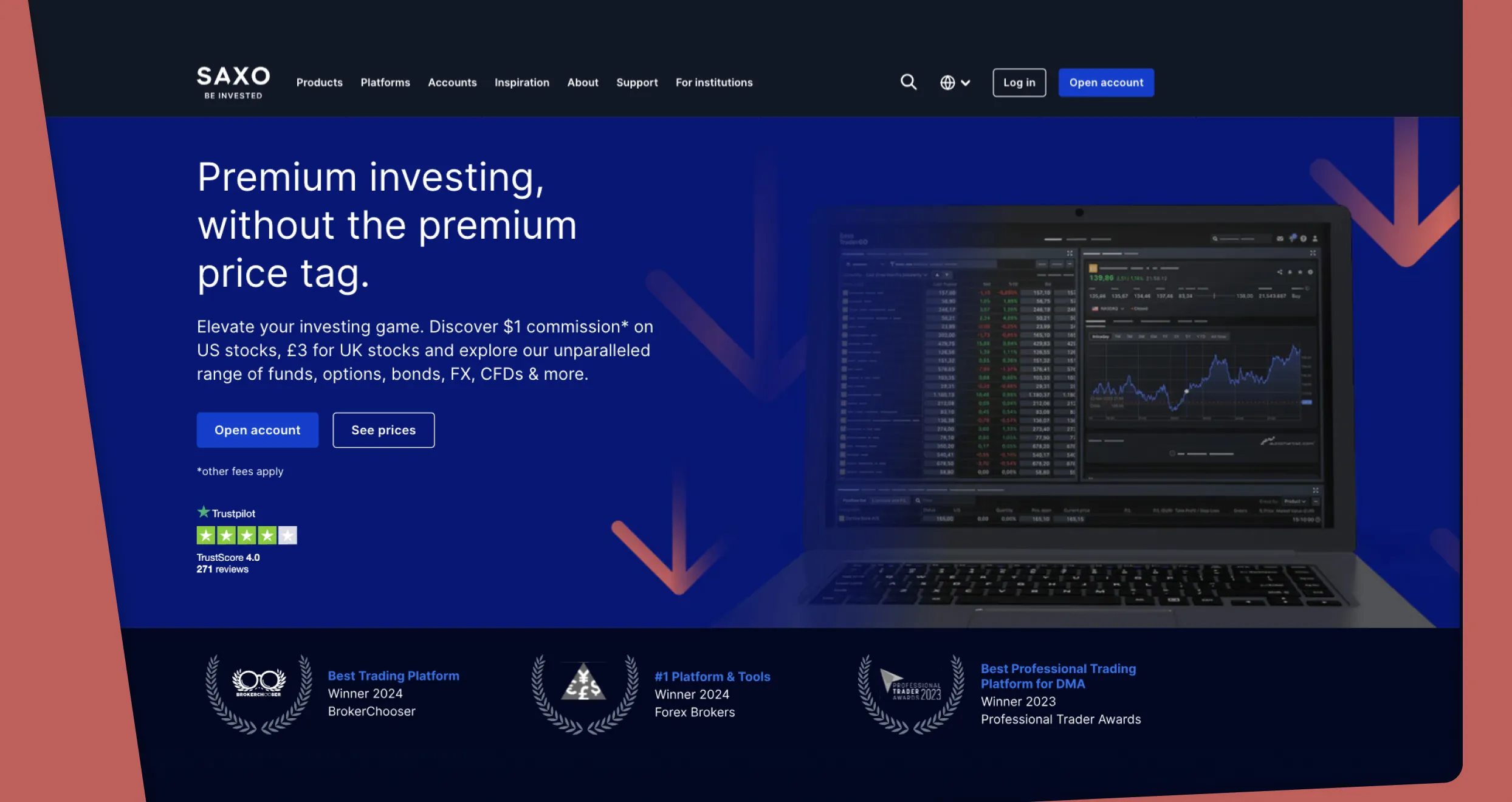

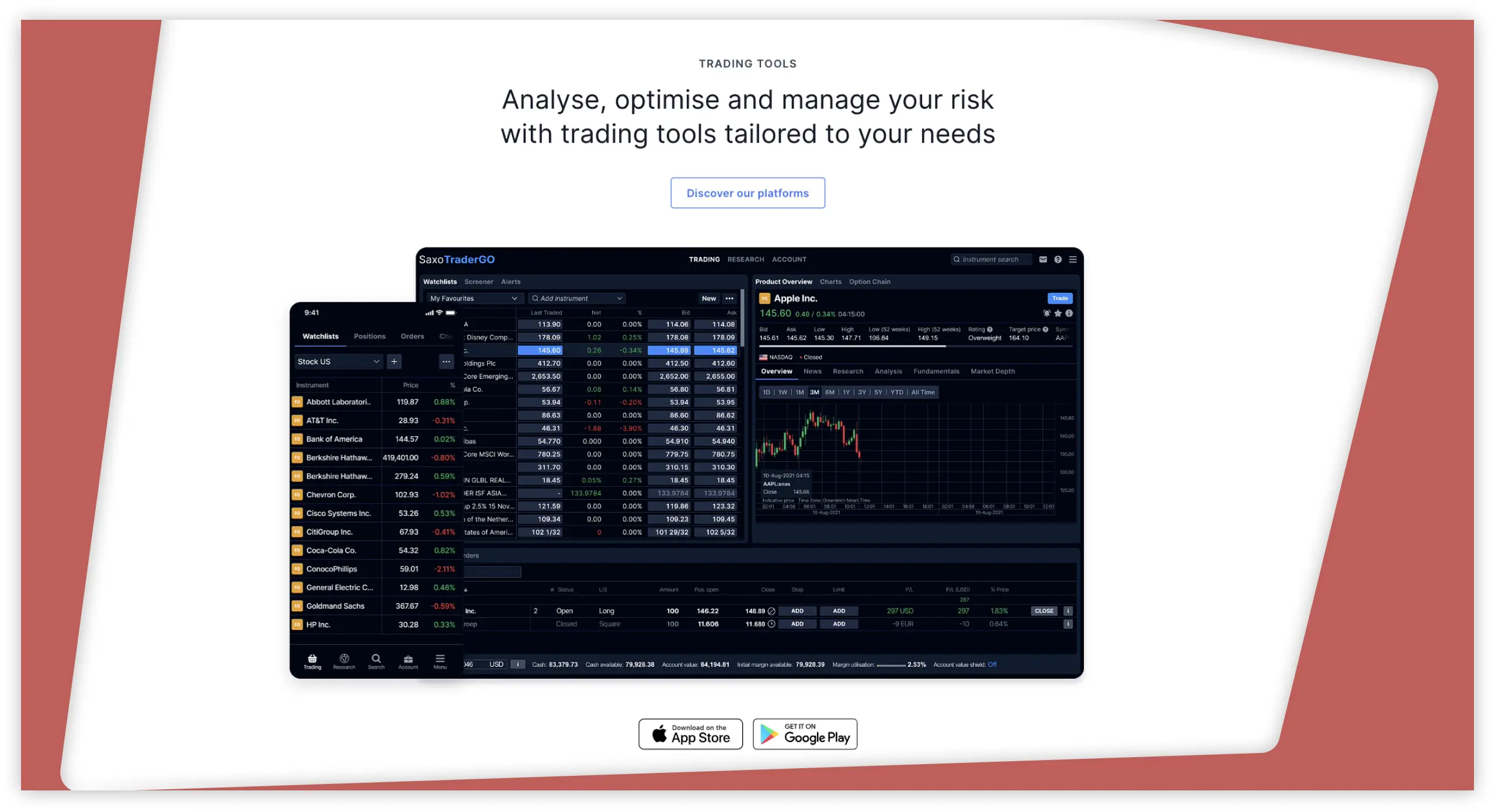

2. Saxo – Best With Numerous Investment Options

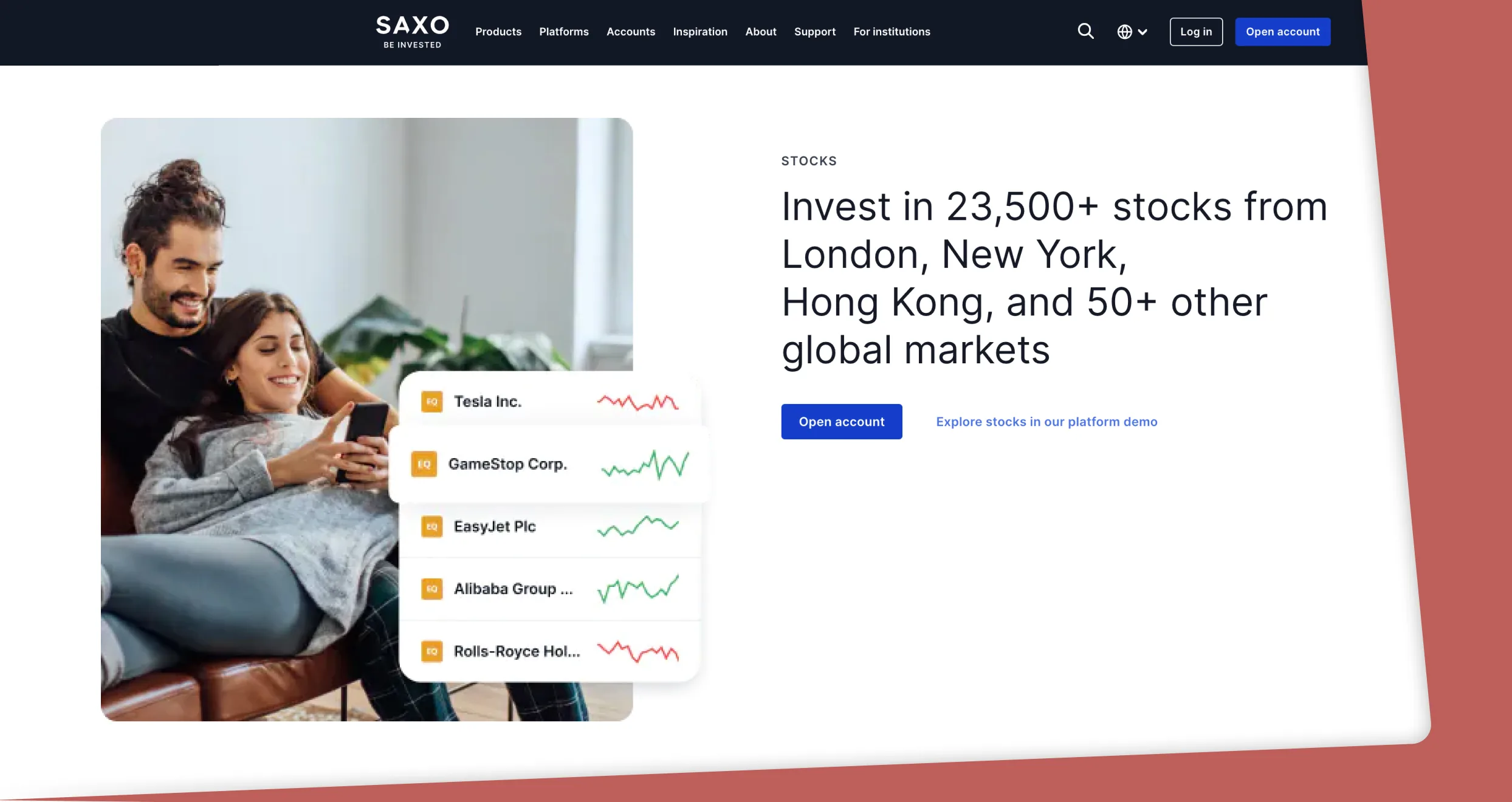

Finding a discount broker with many investment options in Canada is not easy, but Saxo delivers in this category. Based on our analysis, Saxo lists over 71,000 trading and investing securities, including shares, ETFs, bonds, commodities, and more. We discovered over 23,500 global stocks for investments across 25+ countries. The best part is that commissions from stock investment start from only C$1, and you can lend your already purchased stock for extra potential revenue.

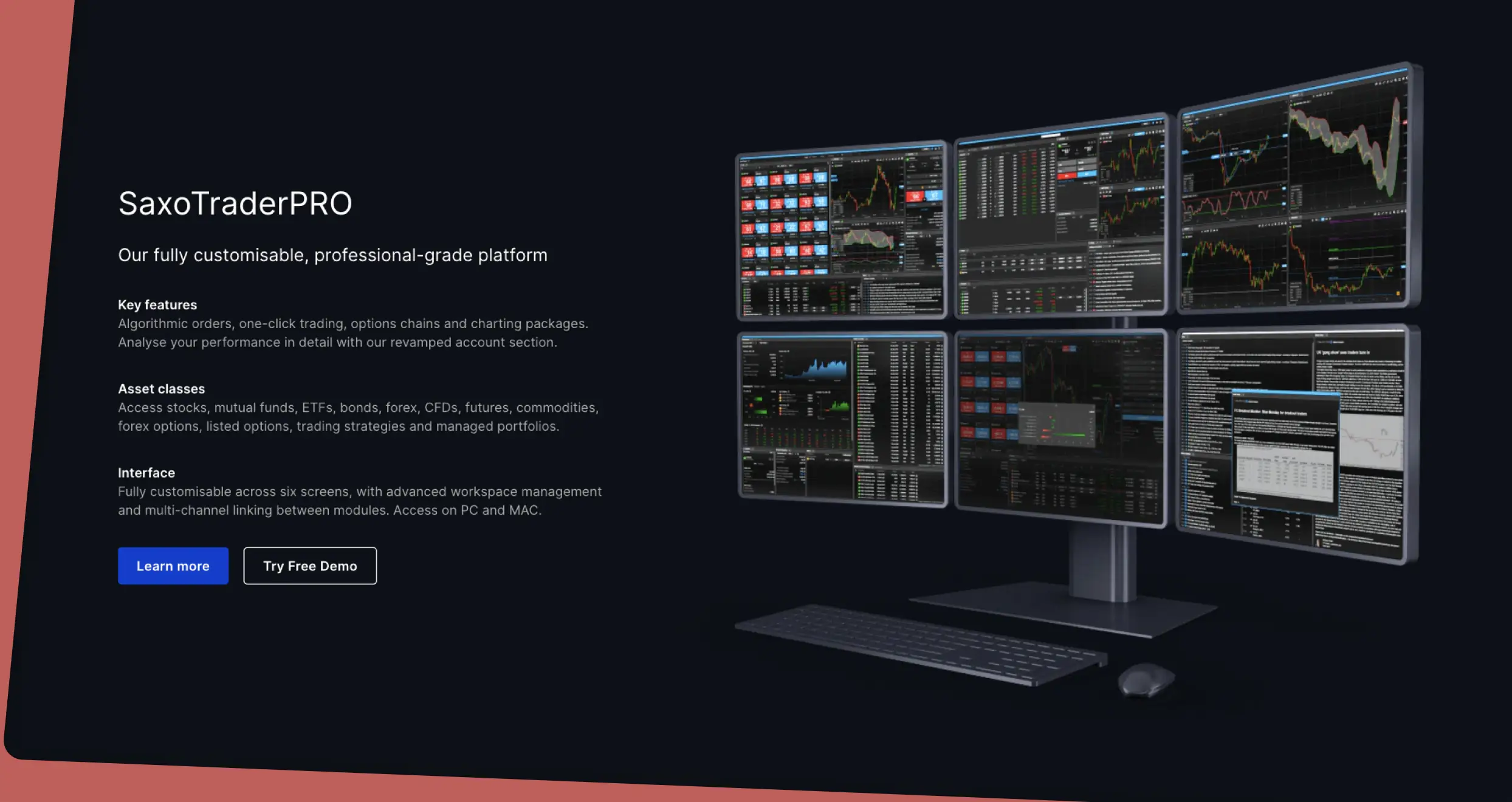

We like that Saxo hosts amazing platforms for all types of investors and traders. Depending on your preference and requirements, you can choose between SaxoTraderGO, SaxoTraderPro, and SaxoInvestor. Getting started is streamlined, and expect no minimum deposit requirement. Once you set up your account, deposit any amount you can afford, which, of course, does not attract a deposit fee. Other elements that make this broker stand out are quality learning tools and an amazing support team you can contact via phone, email, and live chat.

Pros

- Offers over 71,000 financial instruments

- No minimum deposit requirement

- Tight spreads and commissions

- Powerful trading tools are available

- Users have access to 24-hour expert support service

- Zero inactivity fees

Cons

- High custody fees for classic accounts

- Higher currency conversion fees than its peers

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

3. Forex.com – Top Option For Forex Traders

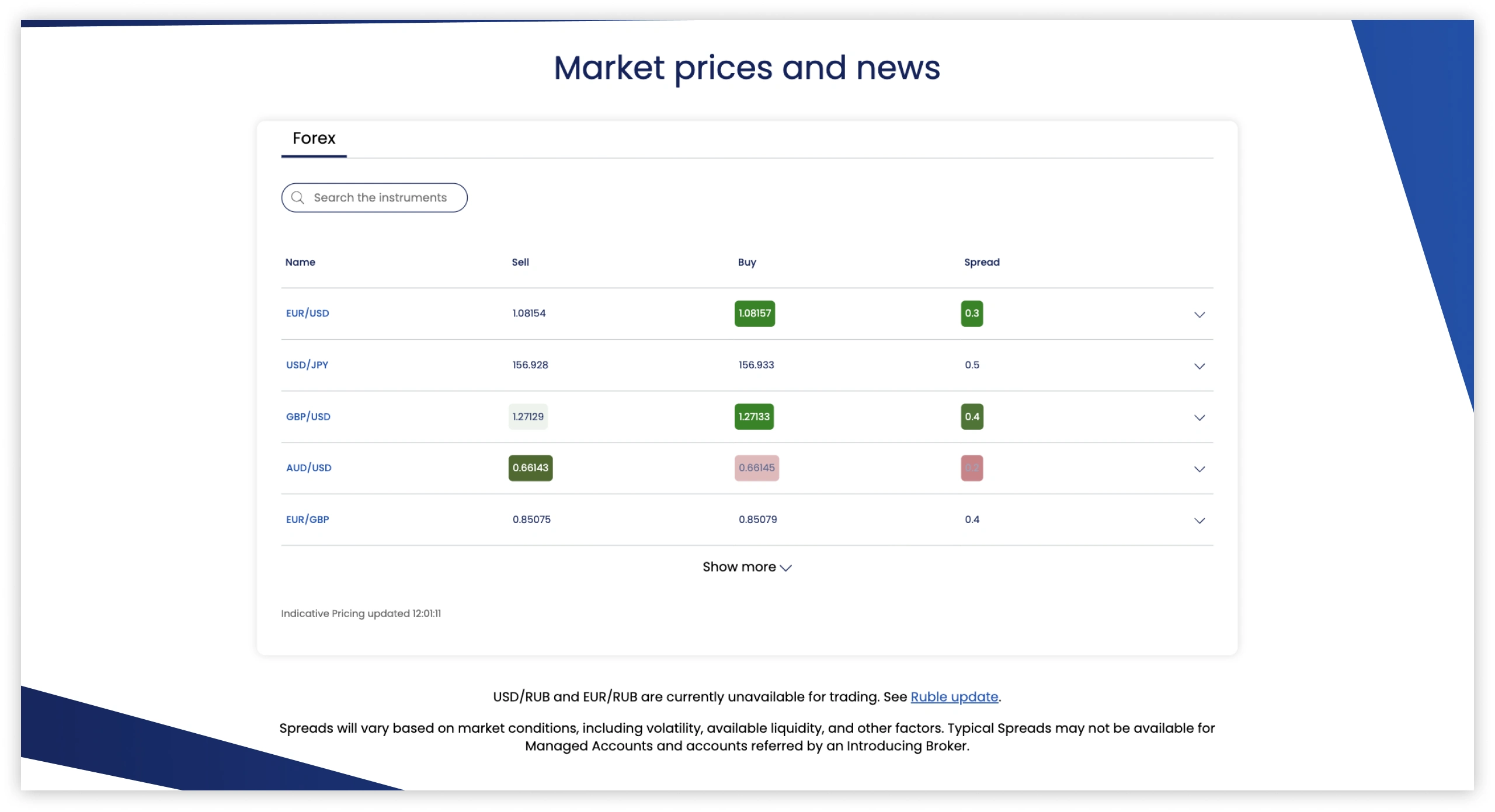

If you are into forex trading but prefer a discount broker to trade with, try Forex.com. This broker gave us one of the best experiences, especially when it came to exploring its user-friendly and modern design platform. Getting started is streamlined, and you only need to deposit at least C$100 to access its unique tools and services. For forex trading, we discovered over 80 currency pairs and incurred low spreads from 0.0 pips. There are also an additional 4500+ securities for your portfolio diversification. These include shares, indices, ETFs, and commodities, which also attract low trading fees.

We also like that Forex.com hosts multiple platforms for Canadian clients. Besides the web, we like trading on its mobile app, which is easy to navigate. On top of that, there are the TradingView, MT4, and MT5 platforms with unique features for an exciting experience. You can test Forex.com using its demo account to decide whether it fits your requirements. And if you feel like you need any clarifications, feel free to contact its support team, which we believe is efficient and professional in handling clients’ issues.

✔Zero fees for card deposits and card withdrawals

✔A broad range of trading platforms, including MT4 and 5

Pros

- Hosts a virtually funded demo account for beginners to get started with

- Quality learning materials on its Academy platform

- Low minimum deposit requirement of C$100 for Canadian traders

- Advanced trading platforms, including TradingView and the MT5

- List numerous currency pairs to choose from

Cons

- You can only trade its assets as CFDs and forex

- High stock trading fees compared to its peers

The best decision you can take as a trader is to join a platform with friendly, transparent fees. Luckily, Forex.com values transparency and cost-friendliness. We tested this broker using Standard and RAW Spread accounts. Here’s what we found out.

First, you must fund your account before trading live with this broker. When doing that, keep in mind that Forex.com’s minimum deposit is $100. Therefore, your first deposit should be $100 or higher. But don’t worry about deposit charges. Forex.com charges zero fees for incoming deposits from bank transfers and debit cards.

The other costs and charges you will incur while trading with Forex.com depend on your preferred account. The costs associated with standard accounts are included in the bid/ask spread. A Standard account’s spreads start from 0.8 pips. Additionally, this account will only require you to pay commissions if you invest in equities. But the good news is that Standard account owners can earn cash rebates on cryptos, equities, FX, and other assets.

If you go with a Forex.com Raw Spread account, you will enjoy commissions as low as $5 per $100k you trade. This account also allows you to lower your trading costs with cash rebates of up to $50 for every $1 million you trade. Furthermore, with it, you can trade FX majors and enjoy tight spreads starting from 0.0.

Commissions and rebates aside, Forex.com levies rollover fees for positions held overnight. The exact rollover rates vary depending on factors like the prevailing market conditions. Furthermore, this broker requires dormant account owners to cover a $15 monthly inactivity fee. The last fee kicks in after an account has remained inactive for 12 months.

4. OANDA – Best With No Minimum Deposit Requirement

While many of the best discount brokers in Canada do not have minimum deposit requirements, OANDA stands out in this category for various reasons. From our analysis, getting started with this broker is straightforward, and account creation takes minutes to complete. Moreover, OANDA does not charge deposit fees, and it hosts fully automated platforms for desktop and mobile trading. We also like that it offers users an opportunity to enjoy advanced resources on MT4 and TradingView platforms, thus boosting their experiences.

When it comes to asset offerings, we explored a wide range of CFD assets, including indices, forex, commodities, metals, and bonds. This makes it easier for users to try new markets and discover the best options for their portfolio diversification. OANDA hosts a demo account, which we encourage you to test it out with before making a commitment. Plus, take advantage of its learning resources to boost your skill level.

Pros

- No minimum deposit requirement for Canadian clients

- A user-friendly and modern-design platform for desktop and mobile trading

- Fast trade execution speed

- Quality learning materials

- Features an Elite Trader program with premium tools and content

Cons

- Limited asset offerings compared to its peers

- No buying and taking ownership of the featured securities

When testing OANDA, we opened a live account and funded it. We didn’t encounter any OANDA minimum deposit requirements, which was a good thing. That allowed us to start with a few dollars. While preparing to fund our account, we noticed that this broker doesn’t charge deposit fees for cash transfers, credit cards, and debit cards. The same applies to e-wallets like Neteller, Skrill, and Wise. But withdrawals aren’t entirely free.

OANDA allows traders to make one free withdrawal per month to their debit or credit cards. Anyone who exceeds this threshold has to pay. The exact fees vary depending on account currency. On the other hand, all bank-related withdrawals incur charges. The fees you’ll pay while using a bank to withdraw funds from OANDA depend on the number of bank withdrawal transactions you’ve made in that calendar month and account currency.

We also noticed that OANDA has overtime financing charges. If you keep a position open after a trading day has ended, OANDA assumes you’ve held it overnight and either credits or charges your account. Visit OANDA’s Financing Costs page to learn more.

Lastly, OANDA charges a $10 monthly inactivity fee on accounts that have been dormant for 12 or more months. If OANDA deems your account legible for inactivity fees, the broker will levy it until you terminate the account, resume trading, or deplete your account balance.

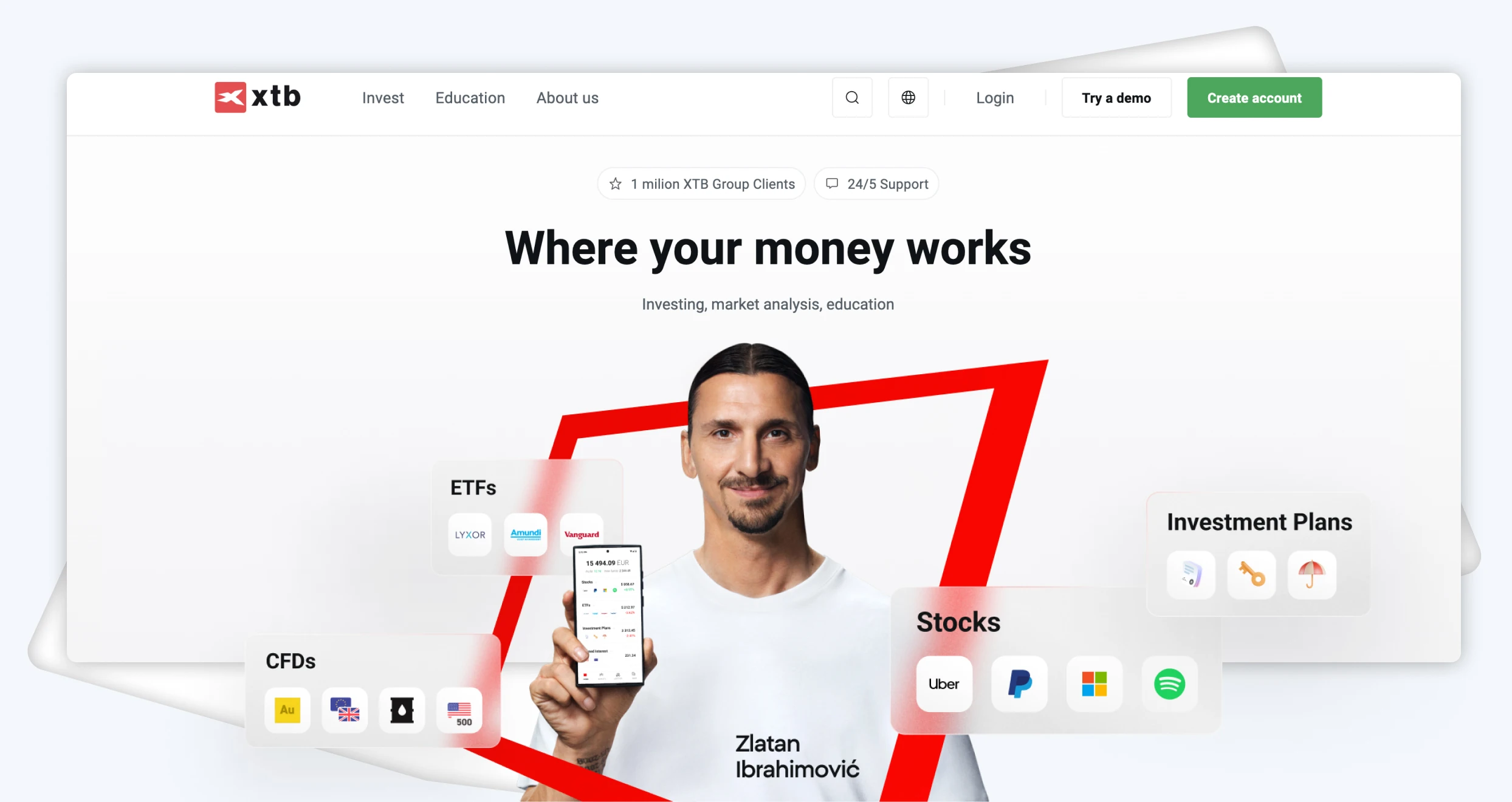

5. XTB – One Of The Cheapest

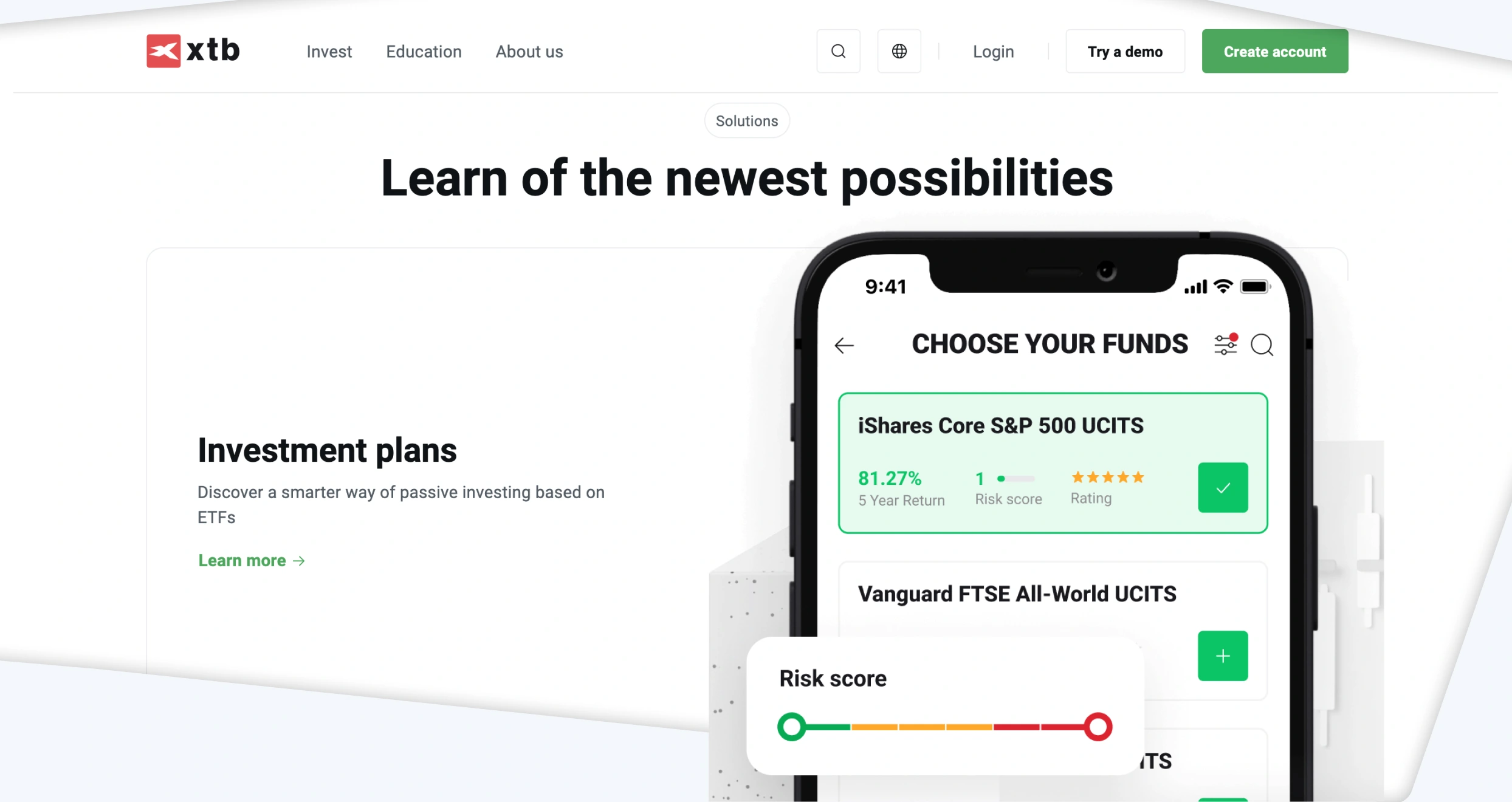

XTB has proven to be a suitable option for traders on a low budget. From our analysis, the broker has no minimum deposit requirement, and exploring assets like stocks and ETFs attracts low commissions from 0%. Some of the global stocks we invested in at XTB include Tesla, Apple, Alphabet, and more. The best part is that investing starts with as little as C$10, which we believe gives low-budget investors an opportunity to benefit from the share market. Other CFD assets we discovered for your portfolio diversification include indices, commodities, forex, and more.

We also recommend XTB to budget-conscious traders and investors because it supports free transactions. This means that regardless of the payment method you use, XTB will not impose any fees. And while it doesn’t host any third-party platform, its xStation 5 and xStation Mobile platforms are loaded with quality and unique resources. You can test the broker via its demo account and contact its support team should you need more clarification on its products and services.

Pros

- 0% commission for stocks and ETFs

- No minimum deposit requirement

- Free deposits and withdrawals

- Over 5,800 financial instruments supported

- Low minimum order requirements

Cons

- C$10 monthly inactivity fee

- Limited educational materials

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

What are Discount Brokers?

A discount broker is an online financial brokerage service provider that executes investment orders at rock-bottom pricing. Basically, such brokers charge low to zero commissions on investment orders. However, they do not offer investment advice or other services. We find them suitable options for professional independent investors who manage their own activities or those on a low budget.

Simply put, discount brokers in Canada offer self-service investment platforms. This means that you will conduct your own research and come up with investment ideas without the broker’s help. Besides zero or low omissions, discount brokers have the lowest or no minimum deposit requirements and are suitable for individuals with smaller portfolios.

Like full-service brokers who work with high-net-worth individuals, discount brokers are licensed and regulated by the Canadian Investment Regulatory Organization (CIRO). They must offer favourable trading conditions and adhere to the authority’s stringent rules to ensure the online financial landscape is free from imposters and money laundering activities. Since discount brokers do not offer solid support, using them puts you at a high risk of losing money. Therefore, ensure you are confident in your skill level and strategies before opening a position with a discount broker in Canada.

How to Choose the Right Discount Broker in Canada

Choosing the right discount brokers in Canada requires careful consideration. You must go out of your way and conduct thorough market research, which involves multiple tests and comparisons. You will compare various brokers based on multiple elements, including the following.

Prioritise safety when you begin your search for a reliable discount broker to avoid wasting time on illegitimate ones. Check whether the discount broker you are considering is licensed and regulated by CIRO. Remember, while Canada hosts legitimate brokers, there are also fraudulent ones. This feature ensures you do not fall victim to scammers and that the broker you select guarantees a favourable investment environment. Additionally, confirm the additional safety measures a broker imposes. These include high encryption protocols, face IDs, strong passcodes, and more.

While discount brokers in Canada charge zero to low commissions, not all will fit your budget. Compare the services rendered vs the applicable costs to settle with the best. Some of the trading and non-trading costs to confirm include commissions/spreads, minimum deposit requirements, transaction charges, inactivity fees, and more.

The best discount broker in Canada must be user-friendly and offer a modern design platform for an exciting experience. Plus, ensure it operates seamlessly on your desktop and Android/iOS mobile device. This way, it will be easier for you to alternate between desktop and mobile trading. You will efficiently manage your positions regardless of where you will be.

Additionally, a reliable discount broker should support multiple payment methods for streamlined transactions. Based on our recommendations above, you can choose to transact with debit/credit cards, e-wallets, and bank transfers.

While discount brokers are primarily tailored for stock and ETF investors, check the availability of other asset offerings like forex, commodities, cryptos, and more. This will help you to easily explore new markets and discover other interests. You can also diversify your portfolio across multiple securities, thus mitigating the risks of investing in a single asset.

Like any other investor in Canada, you will encounter challenges while exploring the financial landscape with a discount broker. For this reason, you need a broker with the right support team to ensure you solve your challenges quickly without having your open positions affected. Confirm a broker’s team responsiveness and availability, whether 24/7 or five days a week. The communication channels supported must also be convenient for you, whether by phone, email, or live chat.

After confirming the above elements, include user opinions in your analysis. Visit Google Play, the App Store, and Trustpilot to compare as many user comments and ratings as possible. It is crucial to understand a broker’s strengths and weaknesses from a user perspective for the best decisions.

How to Register an Account With a Cheap Broker

Registering an account with Canada’s discount brokers is easy. This, of course, is if you are investing with a CIRO-regulated broker. We understand that many newbies are skeptical about making the first step primarily due to not knowing how to sign up for investment accounts. Fret not, though, as our steps below will enlighten you on what to expect.

To create an investment account with a discount broker, visit its official website. We share links on this page for our recommended options so you can quickly have access. On the site, read and understand the terms of service to avoid inconveniences once fully committed and invested. You should also install its trading app on your mobile device, especially if you are always on the move.

On the broker’s homepage, click the register, join now, or sign up button to create an investment account. This procedure takes minutes to complete as long as you share accurate details. These include your name, email, phone number, age, source of income, and more. Your broker may also engage you in a questionnaire to determine favourable leverage limits. On top of that, you will be advised to create a unique username and password. This protects your account from unauthorized access.

All CIRO-regulated brokers, including our recommended options above, are required by the authority to verify users’ personal details before fully activating their investment accounts. In this procedure, you will be asked to share a copy of your government-issued ID card to verify your identity. Your broker may also accept a copy of your driver’s licence or passport. They also require proof of location, which is a copy of a recent utility bill or bank statement. Note that verification durations vary with brokers and may take up to 2 days. However, you will receive an email notification once it is complete.

With your fully activated account, make a deposit per your broker’s minimum deposit requirement. Ensure you transact using a convenient payment method, whether credit/debit card, e-wallet or bank transfer. Once your broker confirms the deposit, you will automatically be redirected to where it lists its assets for investment.

Choose the instrument you want to invest in and trade size before opening a position. We believe at this point, you are also backed up by solid strategies to maximize your potential. If you are new to investing with Canadian discount brokers, start exploring the financial market with demo accounts. Familiarise yourself with how the brokers work and gauge your skill level before investing your money.

Final Thoughts

Professional Canadian investors who are confident in their skill levels should consider discount brokers like the ones we recommend in this guide. Not only are they affordable, but they offer a secure trading environment for an exciting experience. However, it is crucial to weigh between affordability and services rendered for maximum comfort. Calculate the potential profits before opening a position so you do not incur more than the potential returns. And when you lose an investment, take a step back and re-strategize. The market can be unpredictable, so do not make decisions based on emotions. With the right approach, investing with discount brokers can be one of your best decisions.

This is a really helpful guide! I love how you break down the fees, features, and pros and cons. Definitely a great resource, especially for beginners like me who are still figuring things out.

This is exactly what I needed! I'm just starting out with investing and have been overwhelmed by all the options. Quick question though - for someone with only about $500 to start with, would you still recommend Interactive Brokers as the top choice? I noticed they have no minimum deposit but I'm wondering if their platform might be too complex for a complete beginner like me.