Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

It doesn’t matter if you are a seasoned pro or a green noob; your success in the forex market will depend on the broker you choose to work with. If you sign up with an unreliable service provider, you won’t last long in this fast-paced world of online forex trading. If you don’t get scammed and lose your investment, you will face numerous challenges that will spell your undoing, like extra-slow order execution and manipulated prices.

I’d like to see you start off on the right foot, achieve as much success as you can dream of, and avoid common hiccups associated with unreliable forex brokers. And I won’t do anything complicated; far from it. I’ll simply increase your odds of becoming a successful trader by introducing you to the best forex brokers in Singapore.

List of the Best Brokers for Forex Trading

- Pepperstone – Best Overall

- AvaTrade – Best for Beginners

- Plus500 – Top for CFD* Traders

- eToro – Best for Portfolio Diversification

- FP Markets – Best Broker for Professional Forex Traders

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Brokers Table

I’ll kick things off with a short comparison of the best brokers for forex in Singapore. It will help you compare the service providers I’ve recommended in this guide based on key factors like licensing, costs, and money insurance right off the bat. Seeing the differences side by side should simplify the entire process of pinpointing a broker that matches your needs and requirements.

| Best European Trading Platforms | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Pepperstone | MAS, FCA, ASIC, CMA, DFSA, CySEC, SCB, BaFin | $0 | From 0.0 pips | 24/7 | Pepperstone Trading Platform, MT4, MT5, TradingView, cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | Yes |

| AvaTrade | MAS, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | $100 | From 0.9 pips | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, AvaSocial, DupliTrade | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes | Yes |

| Plus500 | MAS, FSCA, CySEC (#250/14), FCA, ASIC | $100 | From 1.2 pips | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes | Yes |

| eToro | MAS, FCA, ASIC, CySEC, FSCA, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | $50 | From 1.0 pip | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| FP Markets | MAS, FCA, ASIC, FSCA, CMA, CySEC, FSA | $100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | Yes |

Apps Reviews

Let’s review each app and what it offers in detail. Besides the comparison table above, I’ve tried to simplify your work by specifying where every provider excels the most. So, finding a broker that’s best for you, whether you are a beginner, professional, or any other category of trader, shouldn’t consume too much of your time and energy.

Here are detailed overviews of the best trading platforms in Singapore.

1. Pepperstone – Best Overall

Today’s top choice is Pepperstone, a broker trusted by hundreds of thousands of forex traders globally. The first factor that makes Pepperstone my number one is its low spreads. Numerous forex pairs have tight minimum spreads from 0.0 pips, such as GBP/USD, USD/CHF, and EUR/USD. If you prefer other pairs, plenty are available, and they have friendly minimum spreads, such as USD/CAD (0.1 pips), NZD/USD (0.2 pips), and GBP/CAD (0.1 pips).

Pepperstone doesn’t offer forex pairs alone. I discovered over 1,000 assets while testing the platform, including CFDs on shares, crypto, and currency indices. I also found out that this broker has friendly commissions, especially on share CFDs. The commissions per side for Australian, UK, and German share CFDs are 0.07%, 0.10%, and 0.10%, respectively.

I also vetted and tested Pepperstone’s trading platforms, I was blown away. Unlike many of its peers, this broker doesn’t restrict its clients to proprietary software alone. It also allows its traders to capitalize on the amazing features offered by top-tier third-party tools like TradingView, cTrader, and MT4/5.

Pepperstone is one of a handful of platforms I tested with a live account for one simple reason: it has no minimum deposit requirement. So I got the opportunity to sign up, fund my account with a few dollars, and use the money to test this provider’s mettle.

Pros

- Minimum spreads start at 0.0 pips

- Respectable variety of financial instruments

- No minimum deposit

- No fees for dormant accounts

- Multiple outstanding platforms, including MT4 and MT5

Cons

- The asset volume could be bigger

- CFDs make up a major chunk of available assets

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. AvaTrade – Best for Beginners

My first year in forex trading wasn’t smooth or easy. I incurred significant losses, primarily due to a poor understanding of key aspects like strategizing and managing risk. Avoid the same issue by studying these and other core concepts before trading currency pairs. AvaTrade will help you learn the essentials and acquire sufficient knowledge.

Visit the AvaTrade official homepage and head straight to the “Academy” part of the website. Then, “Trading Courses” and click “Forex Trading Courses” on the dropdown menu. Since you’re interested in the forex market, start here and familiarize yourself with every key concept, from how to get started to the best strategies to use. Afterward, transition to other markets’ courses and absorb all crucial information; it’ll come in handy during diversification.

After educating yourself with the materials on AvaAcademy, go back to the broker’s official site and open a demo account. You will receive $10,000 in virtual money, which you should use to test your knowledge and strategies in a risk-free environment. Also, with your demo account, you can test the available platforms, including MT4, MT5, and WebTrader, without risking real money.

Pros

- An impeccable assortment of educational materials

- Newbie-friendly UI

- Supports demo trading with $10,000 virtual money

- Multilingual, prompt support

- Supports trading with MT4 and MT5

Cons

- A smaller selection of assets compared to other top providers

- $50 inactivity fee after 3 months of inactivity

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

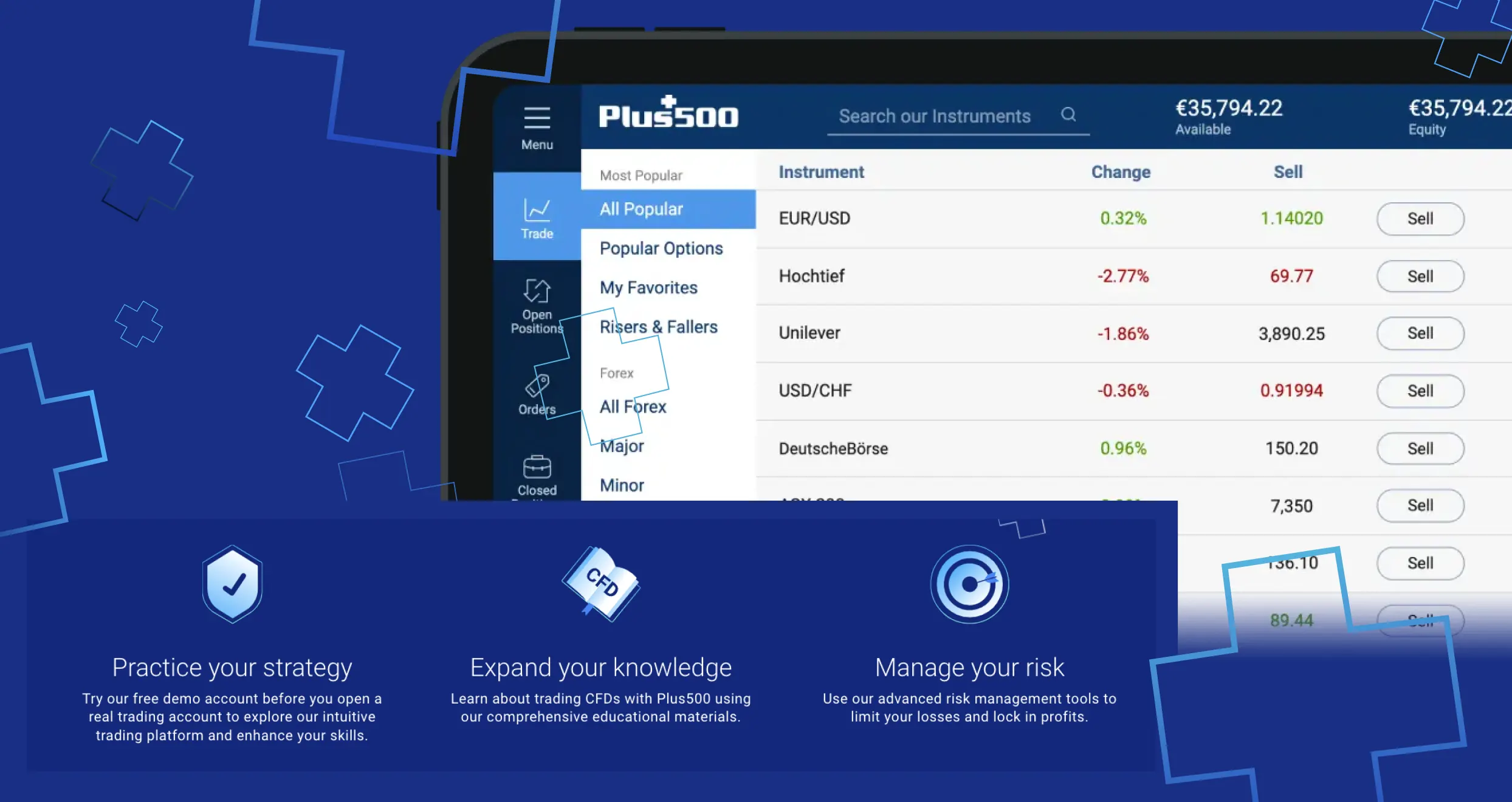

3. Plus500 – Top for CFD Traders

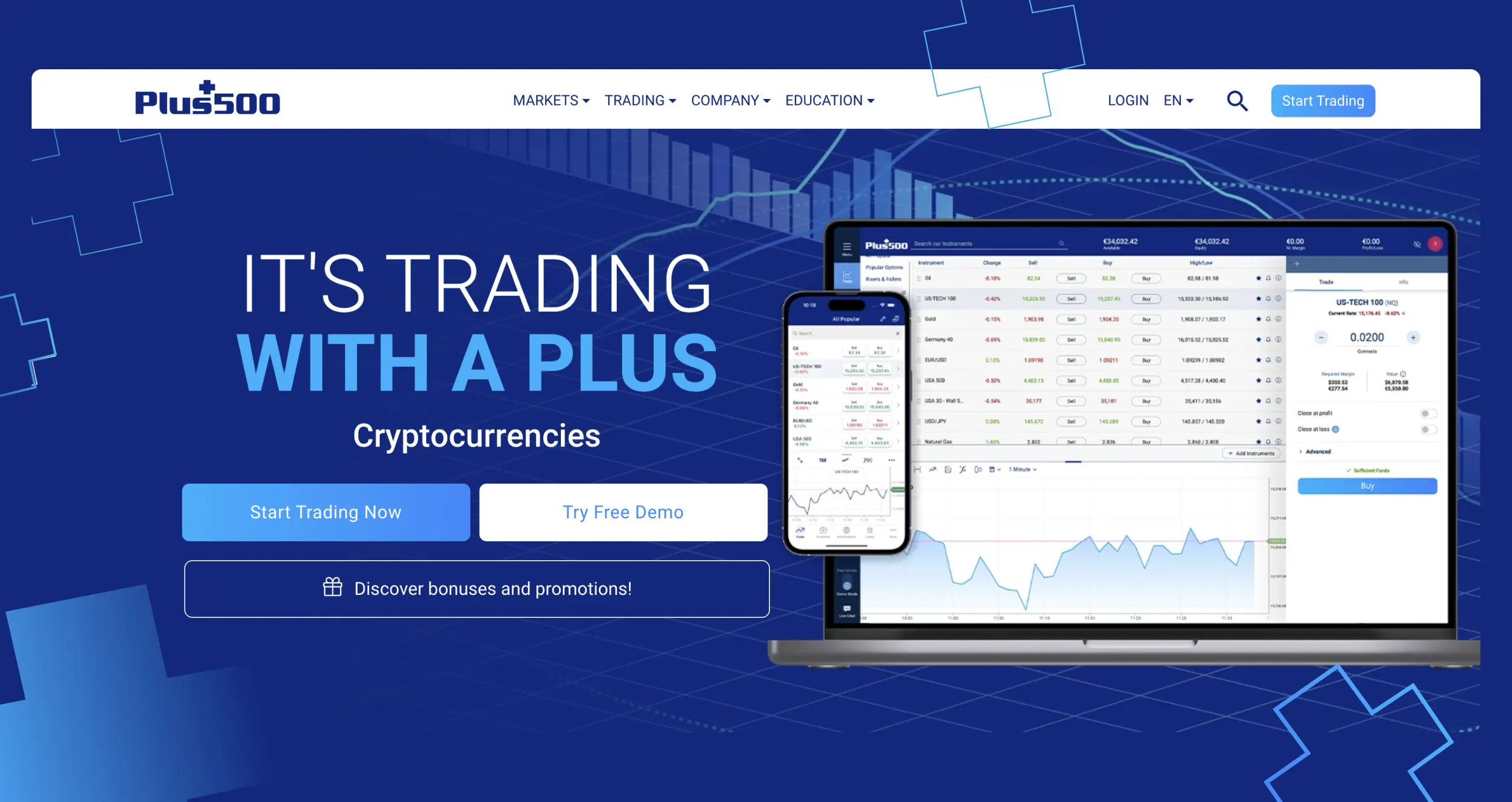

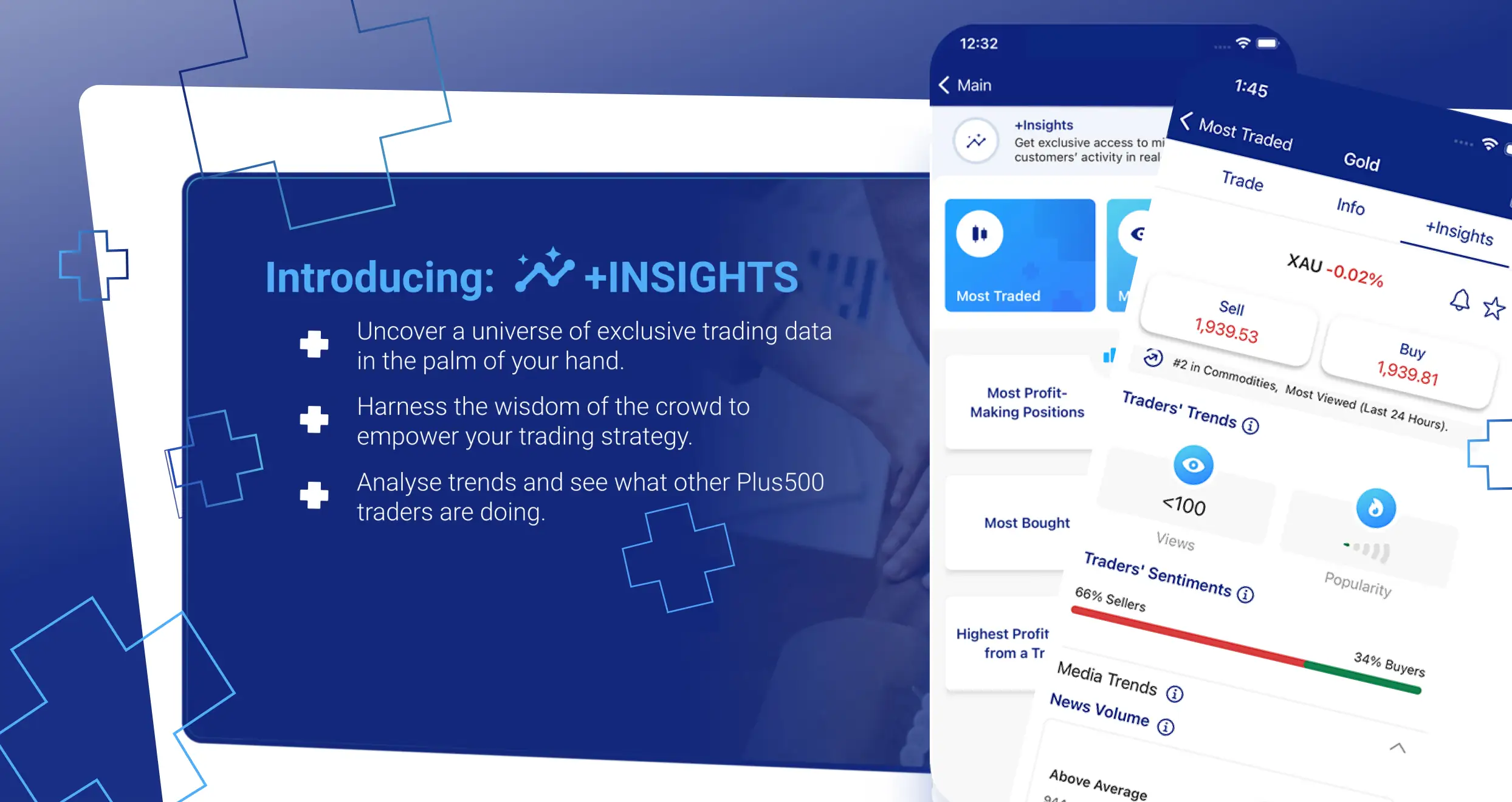

Plus500 has one proprietary platform that makes it top for CFD traders in Singapore: Plus500 CFD. I consider it a godsend for CFD enthusiasts because its users have access to CFDs on over 2,800 assets, from crypto, indices, and shares to ETFs, commodities, and options. Go through the list, find your preferred assets, and start trading.

If you are cash-strapped but would still like to chase the big bucks, you can do it on Plus500. The platform supports leverage trading, which allows you to trade with “borrowed funds” and take a shot at bigger returns. For instance, courtesy of its 1:100 leverage, you can chase profits accessible to people who’ve invested $10,000 while you’ve only risked $100.

But I strongly advise trading with leverage only if you know what you’re doing. Why? Leverage also increases your risk of losing all your capital within the blink of an eye. If this is your first rodeo, visit Plus500’s trading academy and familiarize yourself with the basics of leverage trading.

Lastly, I vouch for trading CFDs with Plus500 because of the broker’s support service. The company’s support team is available 24/7 and is always ready to address concerns in over 30 languages, including English, Mandarin, Spanish, and Arabic.

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- CDFs on nearly 3,000 assets

- Free deposits and withdrawals

- Flexible leverage options

- 24/7 support in 30+ languages

- World-class educational resources

Cons

- Only offers the Plus500 CFD trading platform

- $10 monthly inactivity fee after three months of inactivity

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

4. eToro – Best for Portfolio Diversification

As a forex trading guru, I highly recommend eToro to traders who want to step up their diversification game, especially with investment products. Before discussing this aspect, note that eToro has a vast collection of tradable securities, including 55+ currency pairs like USD/JPY and EUR/USD. In addition, its clients have access to thousands of CFDs on stocks, commodities, and indices.

If you like trading as well as investing in real assets, you won’t find a broker that’ll support your endeavors better than eToro. I say that confidently with the knowledge that, besides the tradable instruments I’ve mentioned, this broker allows its clients to invest in thousands of investment products. The best part is that investors can acquire assets for as little as $10.

Open an eToro account today and choose stocks to buy/sell from a list of over 6,000 assets from at least 20 exchanges. You buy fractional or whole shares, depending on your budget. And don’t stick to stocks and shares alone. eToro has over 100 crypto assets you can invest in, from Bitcoin and Dash to Litecoin, Ethereum, and Dogecoin.

Pros

- Over 7,000 tradable instruments

- Users can invest in over 6,000 stocks

- Simple to use exchange for crypto trading and investing

- Lower minimum deposit requirement for Singaporeans

- Friendly, knowledgeable support representatives

Cons

- $10 monthly inactivity fee

- Higher spreads than its peers

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

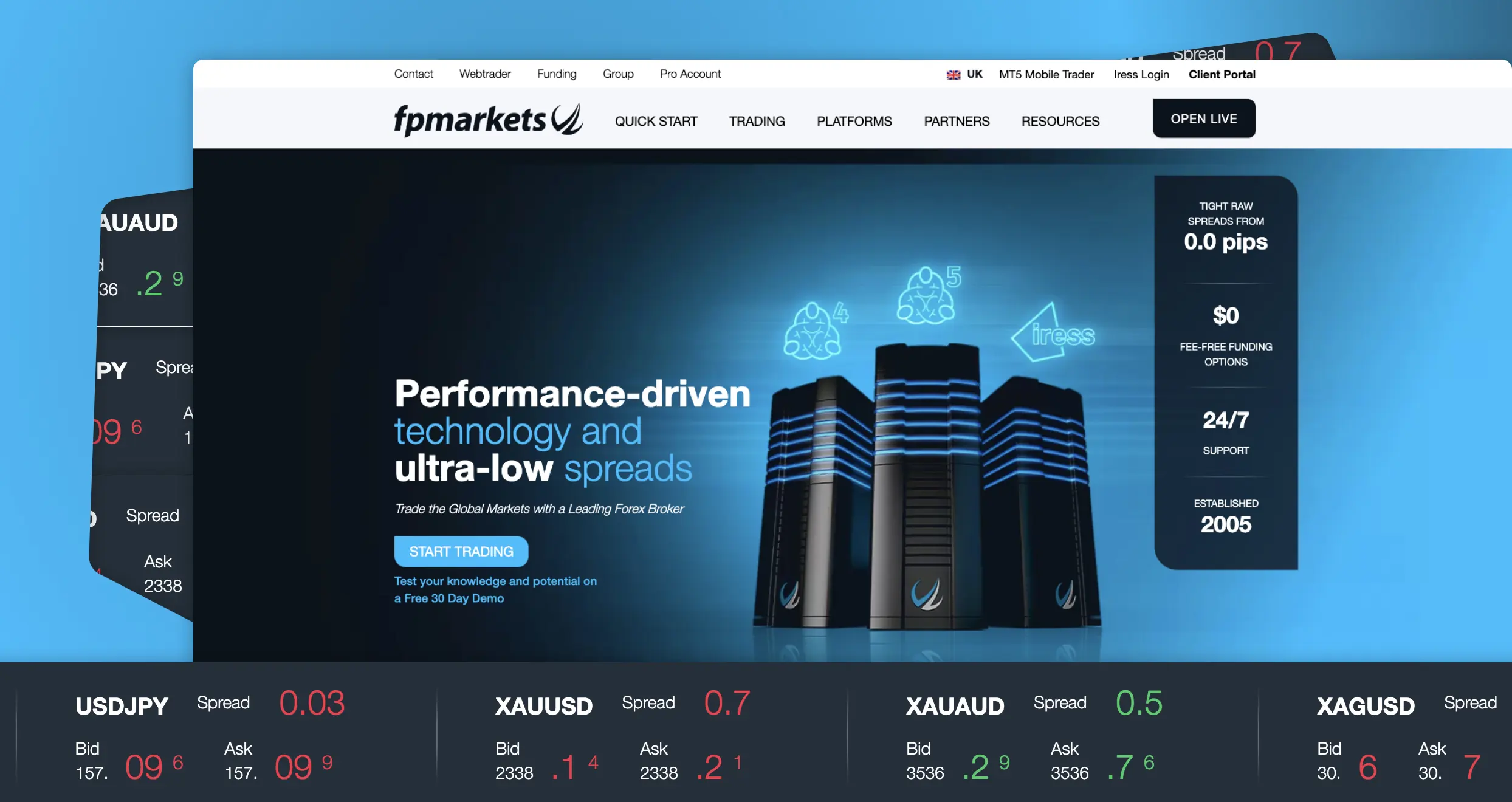

5. FP Markets – Best Broker for Professional Forex Traders

Pro to pro: if you want access to tools and services that fit professional trading the best, choose FP Markets. That is more so if you are an avid CFD trader. This broker has a Pro Account offering specially tailored for professionals, which I’m sure you will love.

The FP Markets Pro Account boasts an assortment of special boons and features that standard accounts don’t have. The first one is higher leverage options of up to 1:500. Generally, average traders only get leverage of up to 1:30. Sweet, right? In addition, Pro Account holders enjoy negative balance protection, dedicated support, and unparalleled referral incentives.

That aside, I vouch for FP Markets because it’s one of the cost-friendliest brokers in Singapore. Sign up, top your account with a supported payment method like a Visa credit/debit card, and enjoy zero deposit fees. After topping up your account, you can trade multiple assets with low spreads and commissions, including major currency pairs.

I can’t sign off without mentioning FP Markets’ asset collection. This platform has over 10,000 CFD products you can trade today. They are spread across a wide variety of instruments, from shares, ETFs, and bonds to commodities, digital currencies, and indices.

Pros

- Higher leverage, dedicated account manager, and other boons on Pro

- Tight spreads from 0 pips

- Over 10,000 tradable CFD assets

- Free deposits and withdrawals

- Multiple exceptional platforms, including cTrader, MT4, and MT5

- No inactivity fees

Cons

- Most of the 10,000+ products are CFDs

- Needs more educational tools and materials

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

How to Choose a Forex Trading Platform

While searching for the best forex trading platforms in Singapore, I came across over 100 service providers that claim to be the best in the region. Of course, their claims didn’t hold water; I was able to dismantle their false assertions easily based on the following factors, which you should always consider when vetting every broker before opening a new account:

In my expert opinion, the first thing you should check when evaluating a forex broker’s suitability is licensing and regulation. A multi-regulated broker follows strict rules and standards tailored to protect you against issues like financial fraud and data theft. That is why I urge you to prioritize trading with a service provider that obeys regulations set by MAS and other authorities.

You should never commit to an unregulated broker since, first, it may fail to obey segregation rules and use your money for other purposes besides your trading endeavors, like funding daily operations. If that happens and the company goes belly up at some point, you will lose your money. The worst part is that you won’t be able to seek recourse from MAS.

Before registering with a trading platform, check if it allows users like you to trade your favorite financial instruments. Furthermore, ensure you pick a broker with broad product offerings to facilitate seamless portfolio diversification.

If you don’t check a broker’s asset variety before signing up, you will increase your exposure to issues associated with access to limited financial products. That includes the inability to seamlessly adjust your trading portfolio in accordance with changing market conditions.

Go through the list of provided and hosted trading platforms before committing to a forex broker. Additionally, look for a platform that aligns with your trading strategies and guarantees unquestionable stability. If you are a fan of third-party software like MT4 and MT5, ensure the broker you choose hosts them.

Don’t forget to evaluate and test every platform that a broker puts at your disposal from the get-go. Check all crucial features and tools to ensure you don’t get shortchanged or end up with software that doesn’t match your trader level.

Like many other seasoned traders, I maximize profitability by interacting with affordable brokers. You should follow suit since high costs will erode your bottom line by a significant margin in the long run. While assessing a service provider’s affordability, check transaction costs, spreads, account maintenance fees, and other charges. They should be outlined in the broker’s fee structure.

Don’t get me wrong; I don’t advise you to focus on cheapness alone while choosing a forex broker. That is inadvisable because many shoddy providers use this factor to coax unsuspecting victims. Just ensure that every broker’s fees and charges are reasonable and match what you get in return.

Over the years, I’ve traded with different brokers and encountered countless issues, such as transaction delays and sudden account deactivation. You will face some of these problems while trading, and only helpful and knowledgeable support representatives can help you out.

Also, you may need to ask a few questions or seek clarification where ambiguous mandates are involved. Such issues require prompt, expert assistance. Before committing to any service provider, check whether its customer support team is equipped to address all valid problems and concerns in good time.

A broker’s online reputation mirrors its reliability and trustworthiness. The best providers are considered reliable and trustworthy because they’ve proven their worth over the years, and their reputation says it all. On the other hand, countless issues have made disreputable brokers what they are, from constant unaddressed customer complaints to squabbles with respected regulators.

You can assess the reputation of a forex broker through online ratings and reviews. While determining if a service provider is a perfect fit for you, visit Google Play, the App Store, and Trustpilot. On these platforms, you’ll find user feedback and testimonials regarding crucial aspects like the company’s ethics, dedication to solving customer issues, and transparency where fees are involved.

How We Test

Testing every broker before making recommendations is a cardinal rule here at Invezty. We never sleep on this, no matter how demanding the entire process is. Our maestros always evaluate and vet each service provider carefully while paying close attention to fundamental factors like licensing status, ease of use, and support speed.

To ensure our reviews are as comprehensive as possible, we test every platform offered by our chosen brokers before preparing each guide. Additionally, our reviewers read reviews on as many platforms as possible, starting with Google Play, the App Store, and Trustpilot. In short, the Invezty team never leaves a single stone unturned!

Conclusion

Mission accomplished: you are now familiar with the best forex brokers in Singapore. Before you sign up with any provider that’s earned your attention, let me remind you that trading is risky. Never dedicate all your earnings or savings to this venture. Remember, even the most profitable forex traders in history have incurred multiple losses over the years.

I strongly urge you to invest a small percentage of your income or savings in forex trading, preferably less than 10%. And before doing that, make sure you’ve covered necessities like rent, food, and utility bills. Never trade with money meant to cover living expenses because you’ll be more likely to make desperate, ill-advised decisions and lose everything.

This article is really helpful! It makes choosing a broker much easier

I totally agree with you – picking the right broker is everything. I’ve had good experiences with brokers like Pepperstone, especially with their low spreads. It really made a difference in my trades