Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Around 190,000 people are actively trading forex in South Africa. Some do it as a full-time job, others consider it a side hustle. Either way, many South Africans are reaping handsomely from this activity. If you’d like to join in, there are several things you should know. First, forex trading is regulated by the Financial Sector Conduct Authority (FSCA).

The FSCA vets and supervises everything related to this venture, including the brokers that make it possible for you to trade in South Africa. Having said that, I thoroughly evaluated forex brokers in SA and rooted out shoddy providers. Then, I rated the remaining brands and hand-picked 5 highly regulated brokers that I consider ideal for South Africans who value unmatched credibility, reliability, and trustworthiness.

List of South African Forex Brokers

- XTB – Best Overall Forex Broker in South Africa

- eToro – Best Forex Broker for Copy Trading Enthusiasts in South Africa

- Pepperstone – Best Forex Broker with the Lowest Minimum Deposit in SA

- FP Markets – Best Broker for Constant Evaluation and Improvement

- FxPro – Best Forex Broker for Traders Who Prefer ZAR Deposits and Withdrawals

Compare Brokers Table

| Best Forex Brokers in South Africa | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| XTB | CySEC, FCA, IFCS, CNMV, AMF, KNF, FSCA | $0 | From 0. 00008 pips | 24/5 | XStation 5, xStation Mobile App | Bank transfers, Paysafe, PayPal, credit/debit cards | Yes | Yes |

| eToro | ASIC, MAS, FCA, CySEC, ADGM, MFSA, SEC | $2,000 | From 1.0 pips | 24/5 | eToro online trading platform, mobile app, CopyTrader | Credit/Debit cards, PayPal, eToro Money, Bank Transfer | Yes | Yes |

| Pepperstone | ASIC, FCA, DFSA, CySEC, SCB, BaFin | $0 | From 0.0 pips | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView, cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | No |

| FP Markets | FSCA, ASIC, MAS, FCA, CySEC | $100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | No |

| FxPro | FSCA, FCA, SCB, FSA | $100 | From 0.0 pips | 24/5 | FxPro Mobile App, MT5, MT4, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | No |

Brokers Reviews

I have discussed the best brokers’ strongest qualities, features, and services in detail below. I’ve started with what makes each truly outstanding, then moved on to other noteworthy aspects, including prominent pros and cons.

Before you dive in, note that, over the years, you will encounter many reputable offshore brokers that are not licensed by the FSCA. But you don’t have to avoid them provided they are credible and licensed by other respected authorities, like the FCA and ASIC. No law explicitly prohibits South Africans from trading with offshore companies licensed and regulated by recognized organizations besides the FSCA.

Also, remember to pay taxes as required by the South African Revenue Service, even when trading with offshore companies not licensed by the FSCA.

1. XTB – Best Overall Forex Broker in South Africa

XTB is licensed under the company name XTB AFRICA (PTY) LTD, registration number 2018/363888/07. Proper licensing is one of the factors that have enabled this broker to bag today’s top spot. But it’s not the only one. I’ve also ranked XTB as the overall best forex broker in South Africa for many other reasons, starting with reputation.

With a rating of 4.4/5.0 on Google Play and 4.7/5.0 on the Apple Store, XTB is definitely one of the most reputable forex brokers not only in SA but in the world. On Google Play alone, this service provider has tens of thousands of authentic positive reviews and a good history of promptly addressing negative comments.

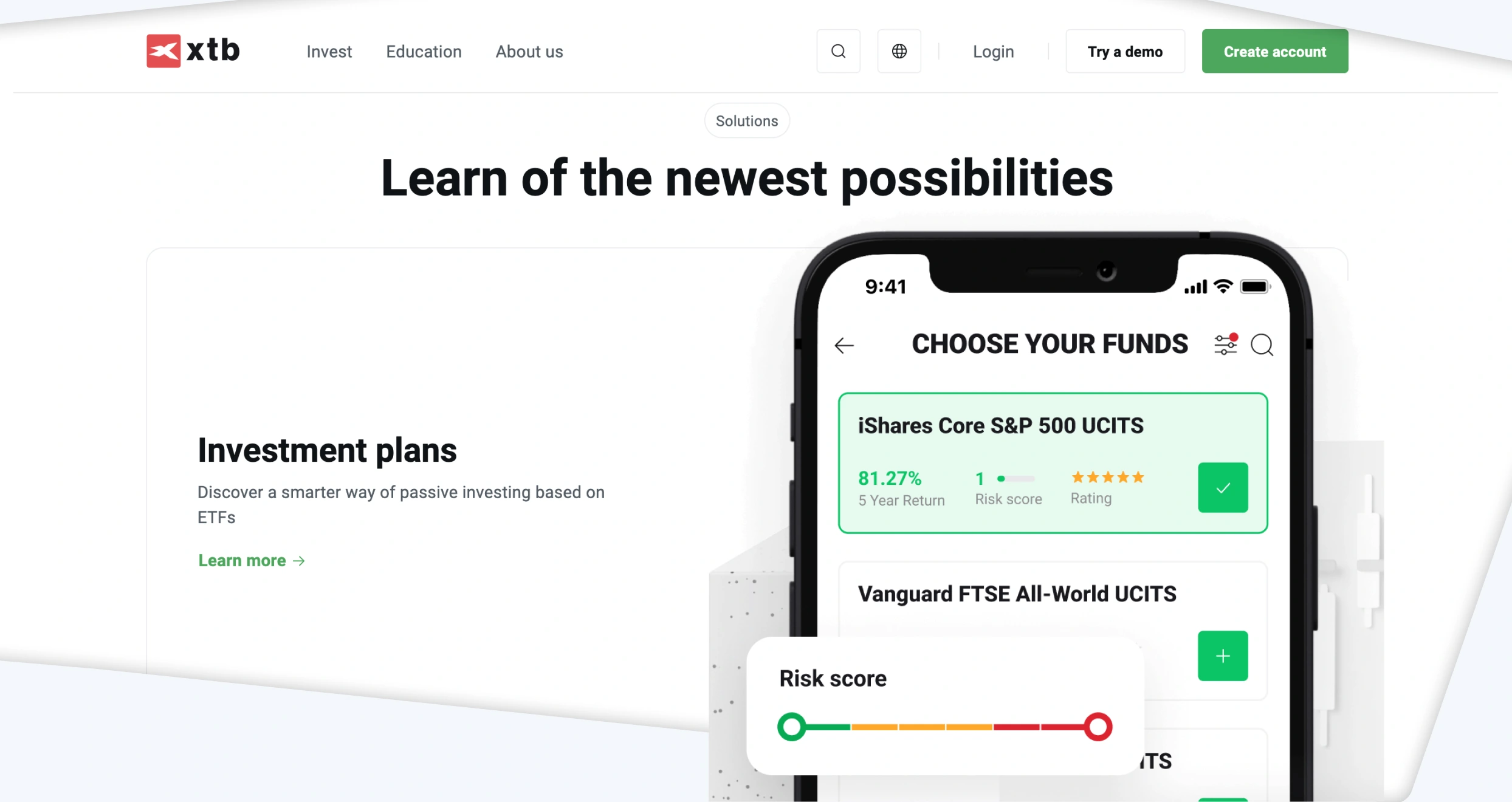

There are plenty of financial assets on the XTB platform. You can trade over 71 currency pairs here, including ZAR pairs like EUR/ZAR, ZAR/JPY, and GBP/ZAR. Furthermore, you can diversify with CFDs on stocks, indices, commodities, and other popular assets. Your costs will remain relatively low since you’ll be trading assets with low spreads from 0.00008 pips.

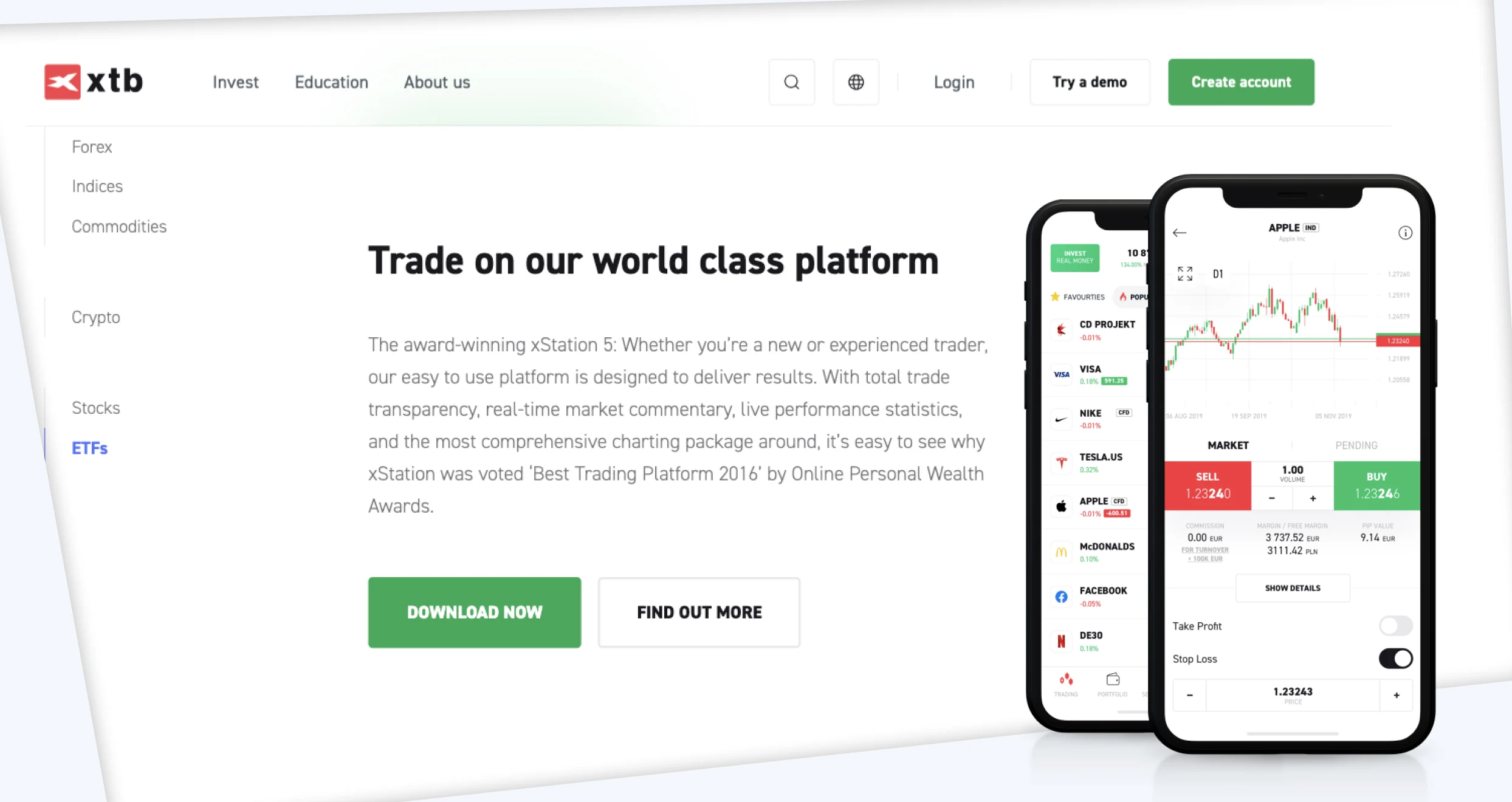

I’m also a big fan of XTB because this broker supports both experts and newbies. If you’re a pro, you’ll benefit greatly from this broker’s powerful proprietary platform, which has everything from superior charting tools to support for pending orders. If you’re a noob, XTB has a learning hub loaded with countless educational materials tailored just for you.

Pros

- No minimum deposit

- Low spreads from 0.00008 pips

- 71+ currency pairs, including ZAR pairs

- Rich learning hub

- Vast selection of CFDs for diversification

- Powerful proprietary trading software

Cons

- $10 monthly inactivity fee

- Only proprietary trading systems are available

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

2. eToro – Best Forex Broker for Copy Trading Enthusiasts in South Africa

If you don’t have extensive experience or enough time to analyze markets and make individual trades, you can simply leverage eToro’s copy trading feature. It’s designed to make it possible for you to automatically copy trades made by any guru of your choosing. The broker has a list of top traders; you just have to pick the best one, and you will trade and invest every time they do.

Speaking of trading and investing, eToro has an impressive pool of financial products. As a forex enthusiast, you can trade 55+ currencies with this broker, including USD/ZAR and JPY/ZAR. While juggling your favorite pairs, hedging against immense losses will be easy, courtesy of CFDs on thousands of financial instruments, from over 6,000 stocks to 45 commodities.

The cherry on the sundae is eToro offers real stocks and ETFs. This is something extremely special since most trading platforms in SA have nothing besides CFDs. After opening and topping up your account, you can buy whole stock units if your budget allows it or opt for fractional shares that cost as little as $10. You can also invest in over 300 popular ETFs.

Lastly, eToro allows you to invest in digital assets, from Bitcoin, the Crypto King, to fresh alternatives like Orca, Injective, and Solana. You can stake the cryptocurrencies you buy on the platform and earn juicy monthly rewards.

Pros

- CFDs on 7,000+ assets, including 55 currencies

- Investment products, including 6,000+ stocks

- Extensive range of educational materials

- Supports copy trading and investing

- Crypto staking rewards

- Newbies can start with ready-made investment portfolios

Cons

- SA’s minimum deposit requirement is $2,000

- $10 monthly inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. Pepperstone – Best Forex Broker with the Lowest Minimum Deposit in SA

If your main priority is trading forex in South Africa with a broker with the lowest minimum deposit requirement, check out Pepperstone. This service provider has no set threshold, so you can start with any amount you choose, depending on your preferences and financial situation. If your budget is limited, this should be a godsend.

Open a Pepperstone account today, fund it with a small deposit, and unlock a universe of diverse financial instruments. This broker offers everything a low-budget SA forex trader can ask for, from over 90 currency pairs to commodity, stock, and crypto CFDs.

I love the forex pairs offered by Pepperstone for multiple reasons. First and foremost, my favorite local options are available, such as EUR/ZAR, ZAR/JPY, and USD/ZAR. And while trading them, I can diversify with pairs that have tight minimum spreads starting from 0.0 pips, like AUD/USD, USD/CHF, and GBP/USD.

Another aspect that has made Pepperstone a permanent fixture on my list of favorite brokers is trading platforms. Most of the systems I love are supported by this service provider, from charting powerhouses like TradingView and MT5 to the most user-friendly software today: cTrader and MT4.

Pros

- No minimum deposit requirement

- 90+ FX currencies, including ZAR pairs

- Tight spreads from 0.0 pips

- Supports MT4, MT5, cTrader, and TradingView

- Customer support is available 24/7

- No inactivity fees

Cons

- Limited educational resources

- Fewer securities than its peers

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

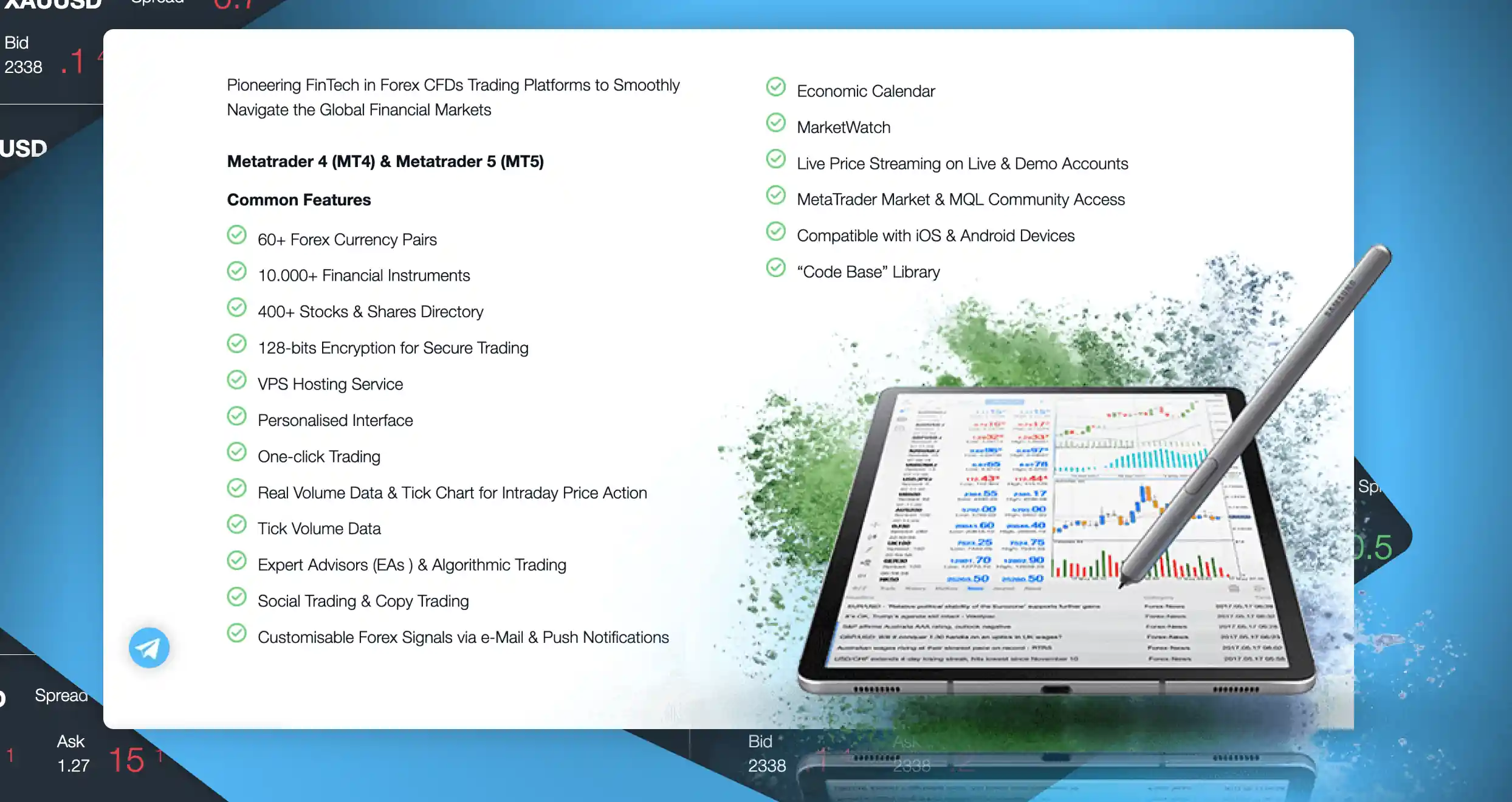

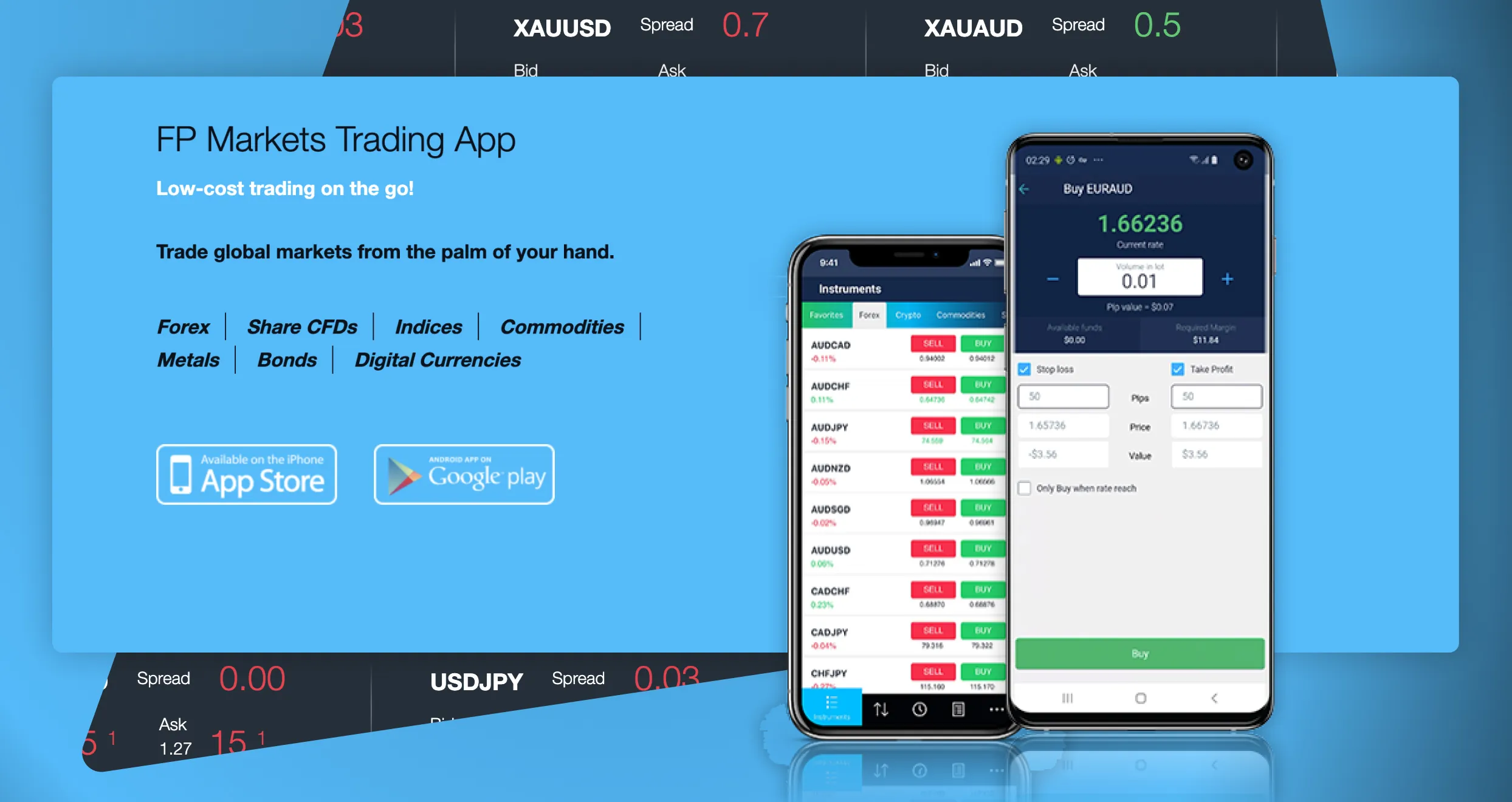

4. FP Markets – Best Forex Broker for Constant Evaluation and Improvement

If you are passionate about constant evaluation and improvement, FP Markets is the right forex broker for you. It has a unique AI-powered tool called TradeMedic that will do you a world of good. Basically, this tool helps you monitor, evaluate, and improve your performance as you trade Forex South Africa. Let’s expound on that.

Accessible to MT4 and MT5 users, TradeMedic is an analytical tool designed to generate hyper-personalized reports that help traders make better decisions. While using it, you will have access to insights that will make it easier for you to identify and fix crucial issues like overstimulation, emotional errors, and poor execution.

With TradeMedic, you can pinpoint behaviors that affect your trades, the severity of detected issues, and the best way to improve. FP Markets doesn’t offer this tool exclusively. As you may have gathered by now, it supports MT4 and MT5, which are affiliated with it. When you have no use for TradeMedic and need superior charting features, you can switch to cTrader or TradingView.

Not to forget, FP Markets has an exceptional collection of CFDs. The first category is currency pairs, with the current options totaling an impressive 70+. After opening and funding your FP Markets trading account, different pairs will be at your disposal, including EUR/ZAR and USD/ZAR. You’ll also get the opportunity to diversify with CFDS on 10,000+ stocks and other financial assets.

Pros

- AI-powered TradeMedic for enhancing your performance as a trader

- Robust trading systems, including MT4 and MT5

- Offers CFDs on 10,000+ assets

- Signal Start for traders who want to follow forex signals from reputable providers

- Superior support available 24/7

- Conventional and Islamic trading accounts available

Cons

- $1,000 Iress minimum deposit requirement

- Supports CFD trading exclusively

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

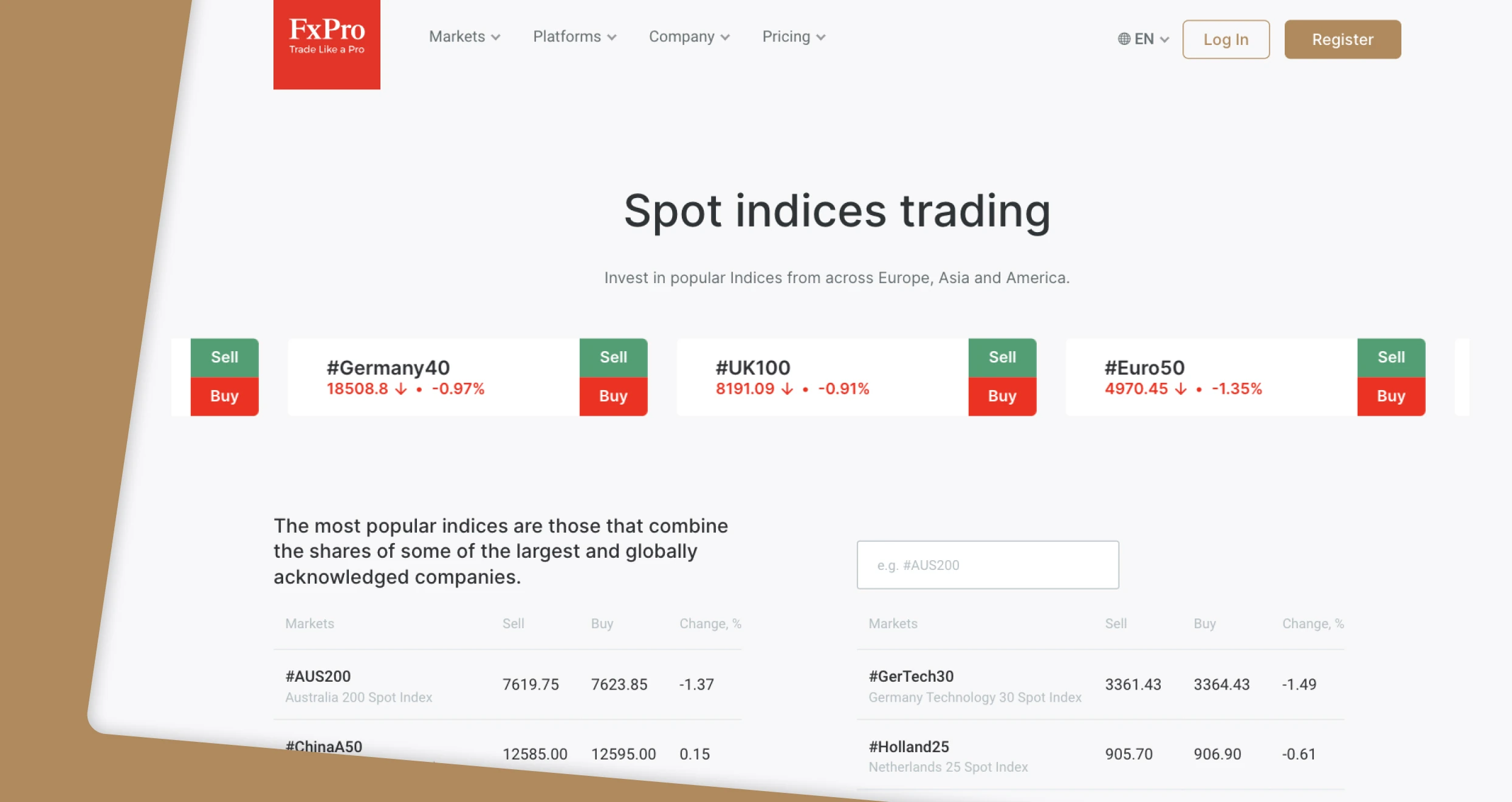

5. FxPro – Best Forex Broker for Traders Who Prefer ZAR Deposits and Withdrawals

Some South Africans trade exclusively with forex brokers that accept ZAR deposits and withdrawals, and rightly so. As a trader, you can cut down costs by a substantial margin. Here’s what I mean by that. Most brokers have currency conversion fees, which are charges for converting one currency to another.

Suppose you send R5,000 to a trading platform that doesn’t support the local South African currency. In that case, the broker will convert your money to a supported currency like the USD. While doing so, the service provider will likely charge a fee that will reduce your trading capital. You can avoid this scenario by trading forex pairs and other assets with FxPro.

While trading with FxPro, you can make ZAR deposits and withdrawals. So you won’t have to convert your money. Plus, your costs will be significantly lower since this broker offers free deposits and withdrawals. Are you eager to get started? Open an FxPro account and deposit the equivalent of $100; that’s it!

Cost-related perks aside, I strongly recommend FxPro because of the trading tools and systems its clients have access to. After signing up with this broker, you can start trading your favorite pairs with MT4 and MT5 or dial things up by leveraging the power of cTrader and TradingView.

Pros

- Supports ZAR deposits and withdrawals

- 2,100+ financial assets

- A bevy of platforms, including MT4 and MT5

- Low forex spreads from 0 pips

- Impressive collection of learning resources

Cons

- Higher fees for dormant accounts

- Higher spreads on Standard accounts

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

How to Choose the Right Forex Broker

According to the FSCA, fraudsters steal millions of rands from unwary South Africans every year. These criminals use a variety of tactics to fleece their victims, starting with fake platforms with manipulated prices and fly-by-night sites that shut down suddenly and disappear with client funds. To avoid losing your hard-earned money, vet every trading platform you encounter very carefully before boarding. Check the following:

Before you even entertain the thought of signing up, check if the broker in question is licensed and regulated by the right authorities. Start with FSCA licensing. Go to the official regulator’s website and check if the service provider has valid licensing. If not, visit the broker’s site and go through the list of licensing authorities.

A trustworthy broker should be licensed by the FSCA and other respected organizations. Remember, an offshore service provider may not be licensed by SA’s watchdog, but if it has valid licenses from other tier-1 authorities, there’s nothing to worry about.

Gauge every broker’s reputation using past user reviews. Where an established service provider is concerned, you should be able to find thousands of testimonials and ratings on the most popular review sites, including Google Play, the App Store, and Trustpilot.

If you encounter more complaints than compliments while evaluating a broker’s reputation, run! And beware of service providers with too many overly positive reviews that sound too good to be true.

Cheaper costs equal higher potential returns, and vice versa. Having said that, check your broker’s trading and non-trading costs before signing up. Start with trading costs, starting with spreads and commissions. I have already introduced you to South African forex brokers that offer sharp spreads of up to 0 pips, so you don’t have to deal with higher rates.

Also, evaluate non-trading costs that may arise from transaction, currency conversion, and inactivity fees. Compare the numbers for your chosen provider and its competitors to ensure you get a fair deal and don’t part with too much money.

To ensure you’re in the best position to seamlessly analyze the markets, open positions, and manage your portfolio, you have to sign up with a broker with suitable platforms. They may be proprietary systems or third-party software like MT4 and MT5. When dealing with a platform you’ve never used, test it with a demo account or the smallest capital possible before committing.

Not to forget, assess the variety of tools you’ll have access to after signing up. A good service provider should offer you access to the most critical tools, like a currency conversion calculator, an economic calendar, and stop-loss/take-profit orders.

Imagine your account password doesn’t work or your deposit is delayed for too long. Who will you complain to? Your broker’s customer support team, of course! If the company has lousy representatives, your problem won’t be solved on time and might escalate into a catastrophe. This is why you should prioritize good customer support.

Before opening your trading account, check if the broker has reliable support service and when the representatives are available. Message or call them and see how fast they respond and attend to your issue. If they take too long or are unhelpful, switch to a better broker.

How we test

The Invezty team is focused on one target: guiding you to premier brokers who will help you prosper. Our experts research, test, and vet hundreds of service providers to ensure we meet this goal and never disappoint. The process factors in a list of the most crucial functions, starting with regulatory status and ending with online ratings and testimonials. It’s a structured and thorough testing process from which we never deviate.

The tests we conduct and the process we follow enable us to recommend the best forex trading South African brokers without being biased or inconsistent. Know for certain that we’ll never lead you to a shoddy service provider. That said, we urge you to play your part and increase your odds of success by trading responsibly. Use risk management tools, keep emotions under control, and avoid over-leveraging at all costs.

Conclusion

Please note that the law in South Africa allows you to trade CFDs on forex pairs. In other words, as an individual, you can legally speculate on the price movements of different forex products, including ZAR pairs. However, the law prohibits you from engaging in direct forex trading; this venture is exclusively for authorized dealers (ADs) and authorized dealers with limited authority (ADLAs).

That is stated in unambiguous terms in a document published by the National Treasury in 2020. To avoid dire consequences, including fines and imprisonment, as an individual, stick to trading forex CFDs with one of the highly regulated forex brokers in South Africa that I’ve recommended in this guide.

AvaTrade and IG Markets caught my eye; might give them a try. Thanks for making this less overwhelming!

As someone who's traded with a few of these brokers, I'd add that while regulation is crucial, don't overlook the importance of testing their execution speed and slippage during volatile market conditions - that's where you'll really see the difference between brokers.