Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Many UAE residents are trying to dive into the currency market. They are looking for ways to trade forex using the Dirham (AED) and other global currencies like the USD, GBP, EUR, and more. If you are among such traders, you first need to understand the currency market. Learn how it works and the elements that influence the currency prices for solid trading plans. You must also identify the best forex brokers in Dubai that suit your trading requirements.

We understand that the UAE hosts hundreds of local and international forex brokers. As a result, many forex traders do not know where to begin when searching for reliable and credible brokers. This is where we come in with our top recommendations based on our hands-on experience and thorough comparisons.

List of the Best Forex Brokers

- Pepperstone – Best With Excellent Support Service

- eToro – Beginner-friendly Forex Broker in the UAE

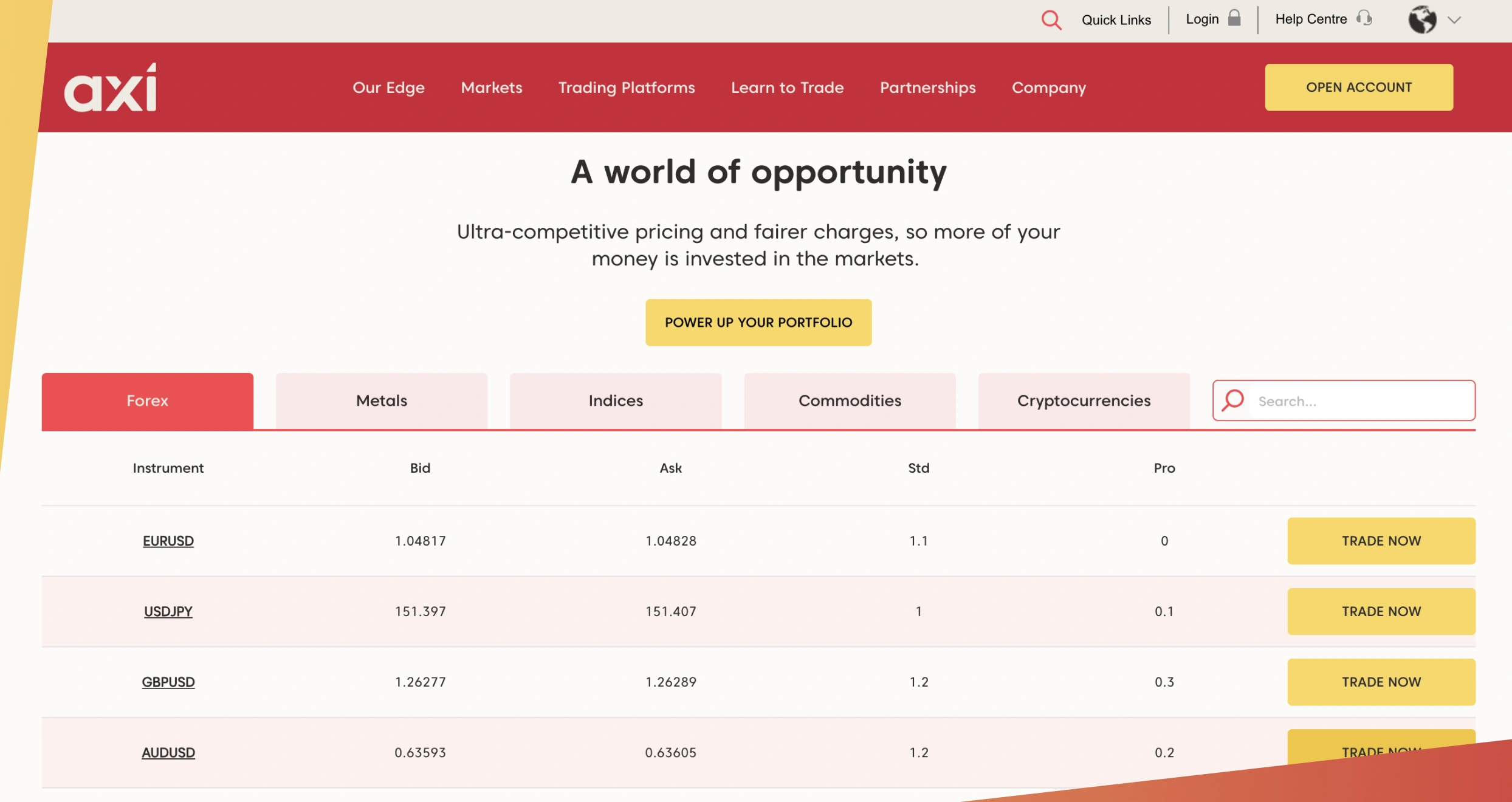

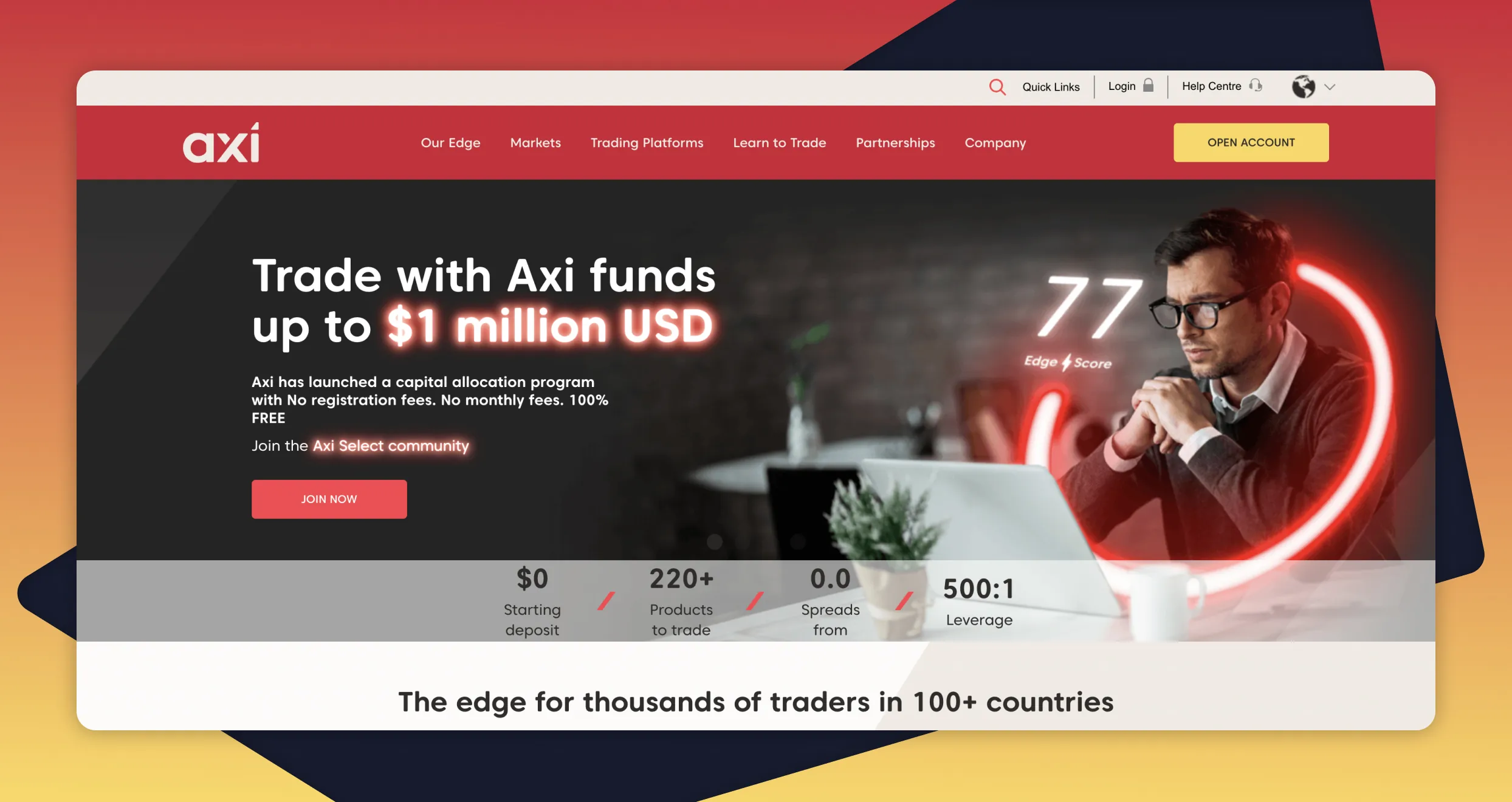

- Axi – Compatible with Expert Advisors

- FxPro – Overall Best Forex Broker in the UAE

- Forex.com – Cheapest UAE Broker for Forex Trading

- OANDA – Top Forex UAE Broker for MetaTrader Users

- Interactive Brokers – Best Forex Broker for Professional Traders

Compare Forex Brokers

As professionals with decades of experience in the financial space, we do not just pick and recommend forex brokers in the UAE. We conduct thorough market research to select the best options. We then test and compare them to shortlist those that meet our strict requirements.

Note that we remain unbiased in the research process, and our recommendations are strictly based on broker features and performance. We also factor in user recommendations from Google Play, the App Store, and Trustpilot. Below, we share our comparison table highlighting the elements that made us consider the forex brokers in the UAE we recommend on this page.

| Best Forex Broker UAE | License | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA, CySEC, BaFin, SCB, CMA | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Credit Cards, Bank Transfer, PayPal | Yes |

| eToro | ASIC, CySEC, FCA, CBUAE, SCA | 24/5 | eToro investing platform, Multi-asset platform, Copy Trader | Debit card, Bank transfer, Neteller, Skrill, eToro Money, Online Banking | Yes |

| Axi | FCA, ASIC, CySEC | 24/7 | MT4 | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer | Yes |

| FxPro | FSCA, FCA, SCA, CBUAE | 24/5 | cTrader, WebTrader, MT4, MT5 | Bank transfer, broker to broker, Skrill, Neteller, PayPal, Visa, Maestro, Mastercard | Yes |

| Forex.com | DFSA, SCA, CFTC, NFA, FCA | 24/5 | Advanced Trading Platform, Web Trading, Mobile Trading, MT5, TradingView | Bank transfer, wire transfer, Visa, Mastercard, Skrill, Neteller | Yes |

| OANDA | FCA, CySEC, FSA, CBUAE, SCA | 24/5 | MT4, MT5 | Credit/debit cards and Wire transfer | Yes |

| Interactive Brokers | CBUAE, SCA, CySEC, FSA, FCA, ASIC, FINRA | 24/5 | Trader Workstation, IBKR Mobile, IBKR EventTrader, IBKR GlobalTrader, IMPACT | Bank Transfer, Wire Transfer | Yes |

Brokers Overview

UAE traders must choose forex brokers with features suitable for their trading needs. Some of the elements to prioritize include the applicable fees and asset offerings. If you find it challenging to understand and compare these elements on forex UAE brokers, we hope our tables below will help you. They summarize the asset offerings and applicable fees you should expect when trading forex with our recommended brokers above.

Fees

| Best Forex Broker UAE | Minimum Deposit Requirement | Commission/Spreads | Deposits/Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | None | Free |

| eToro | $100 | Spreads from 0.15% | $5 withdrawal | $10 monthly |

| Axi | $5 | From 0 pips* on Pro accounts | Free | $10 monthly |

| FxPro | $100 | From 0.0 pips | Free | $10 monthly |

| Forex.com | $100 | From 0.7 pips | Free | $15 monthly |

| OANDA | $0 | From 0.6 pips | Free | $10 monthly |

| IBKR | $0 | From 1/10 pips | Free | None |

*Commission charges apply.

Assets

| Best Forex Broker UAE | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Axi | Yes | Yes | No | Yes | Yes | No | No |

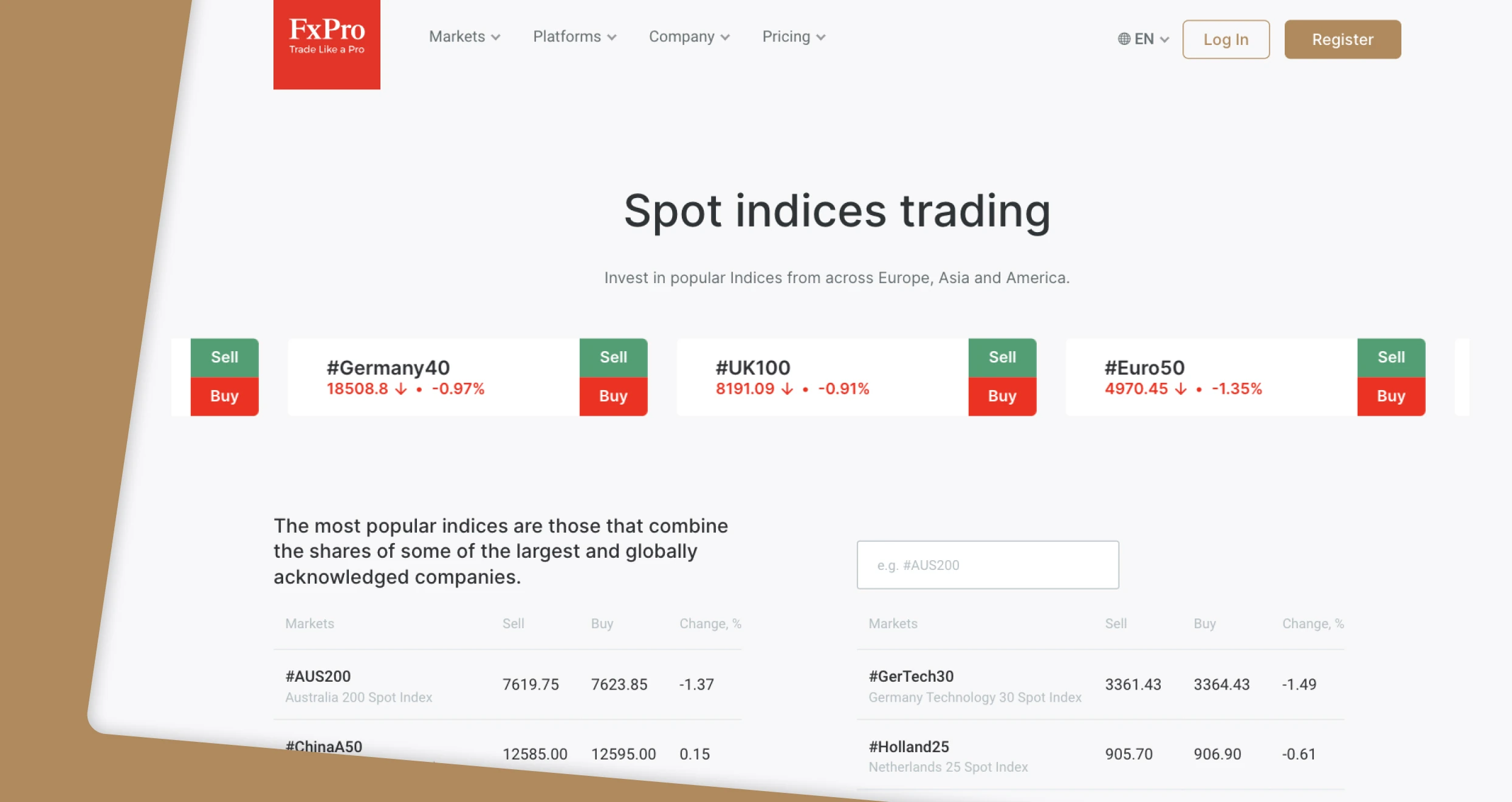

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Forex.com | Yes | Yes | Yes | Yes | Yes | No | No |

| OANDA | Yes | Yes | Yes | Yes | Yes | Yes | No |

| IBKR | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Our Opinion about the Best UAE Forex Brokers

1. Pepperstone – Best With Excellent Support Service

We tested Pepperstone, and like that it has one of the most reliable support services. We contacted the team via phone, email, and live chat and were impressed by their professionals’ response rate. Plus, all our concerns were catered for in time without affecting our open positions. We also like the broker’s FAQ page, which has comprehensive answers to some of the common questions traders ask. You can rely on Pepperstone for the best support possible, especially if you are a newbie trying to navigate the currency landscape.

Overall, this broker lists over 90 currency pairs. For traders who like to diversify their portfolios you can rely on the Pepperstone app for an additional 2,400+ asset classes, including shares, ETFs, indices, commodities, and more. And the best part is that you can trade forex on its advanced MT4 platform with quality resources. If you prefer other third-party platforms with quality resources, the broker hosts cTrader, MT5, and TradingView. All you have to do is choose what aligns with your skill level and requirements.

Pros

- No minimum deposit requirement

- Low forex trading fees starting from 0.0 pips

- Lists more than 90 currency pairs

- A reliable support service and comprehensive FAQ page to cater to your needs

Cons

- Only CFD trading supported for UAE clients

- The MT4v platform lacks some features like advanced stop loss and take profit levels

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – Beginner-Friendly Forex Broker in the UAE

Beginner traders in the UAE will have an exciting experience with eToro. While exploring its platform, we noticed that the web and mobile versions are user-friendly and have modern designs. Moreover, eToro hosts a plethora of learning materials, from guides and articles to webinars and seminars. We also discovered a $100,000 virtually funded demo account, which we believe will help you discover your potential in a risk-free environment.

eToro hosts an award-winning CopyTrader platform, which we highly recommend to beginners. Here, you will follow global traders and mirror potentially profitable trades from the experts. The best part is that copy trading at eToro is free. You only need a minimum amount of $200 to copy a trader. When it comes to forex trading, we traded over 55 currencies at favorable fees from 1 pip on major currency pairs. For those looking for portfolio diversification, eToro hosts an additional 5,000+ asset classes, namely stocks, commodities, indices, and more. Additionally, it provides an intuitive exchange for cryptocurrencies.

Pros

- Low minimum deposit requirement of $100

- Extensive selection of learning materials

- Hosts an award-winning CopyTrader platform

- Quality market analysis resources for beginners and professional traders

Cons

- High forex trading fees compared to its peers

- No third-party platforms like the MT4 and MT5

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. Axi – Compatible with Expert Advisors

Are you looking for a forex broker that allows you to custom build your own Expert Advisors for trading signals? Well, Axi is the place to be. The broker does not have its own in-built automated functions but supports this feature across all trading accounts. All you have to do is open your MT4 platform and select the EA feature on the MQL4 folder to start customizing your automated function.

Besides the EAs, I discovered other features that will ensure you have an exciting automated trading experience. For instance, the broker features Forex VPS hosting that keeps you connected to the internet even while your device is closed. Additionally, there are Autochartist and Trading Central functions that scan the market 24/7 to provide you with reliable technical analysis.

When it comes to currency trading, Axi lists over 70 currency pairs, including major, minor, and exotic. Forex trading here is commission-free with low spreads on Pro accounts starting from 0.0 pips. For those into trading portfolio diversification, Axi lists additional asset classes to consider. These include shares, commodities, cryptocurrencies, and more. Other features I find worth sharing include copy trading and the Axi Select funding program.

Pros

- C$5 minimum deposit requirement

- Quality learning and market analysis tools

- Allows users to customize their own EAs for automated trading

- A user-friendly platform for both desktop and mobile devices

- High leverage limit of 1000:1 on all account types

- Has an “Axi Select” feature that allows you to manage larger positions with a small capital

Cons

- There is no buying and taking ownership of the supported assets

- No alternative third-party trading platforms besides the MT4

4. FxPro – Overall Best Forex Broker in the UAE

We tested hundreds of UAE offshore forex brokers, and FxPro stood out as our overall best in this category. One thing that caught our attention was its ability to host various forex trading platforms. We traded forex on its WebTrader, cTrader, MT4, and MT5 platforms. All these platforms are user-friendly and allow users to open positions with trade sizes from 0.01 micro lots.

Forex trading exposes you to over 70 currency pairs, all of which you can trade as CFDs. We like the fact that currency trading attracts low fees, starting from 0.0 pips on major currency pairs. Moreover, users have an opportunity to diversify their portfolios using additional 2,100+ assets, including shares, commodities, futures, cryptocurrencies, indices, and more. With quality research tools and learning resources on its “Knowledge Hub” platform, we find FxPro suitable for both new and professional UAE forex traders.

Pros

- Free deposits and withdrawals via multiple payment methods like bank transfers, Skrill, Neteller, and more

- Although it has a recommended minimum deposit requirement of $1,000, you can get started with as little as $100

- Low forex trading fees

- Lists over 70 currency pairs

Cons

- Limited asset offerings compared to its peers

- Copy trading is only offered through the cTrader platform

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

5. Forex.com – Cheapest UAE Broker For Forex Trading

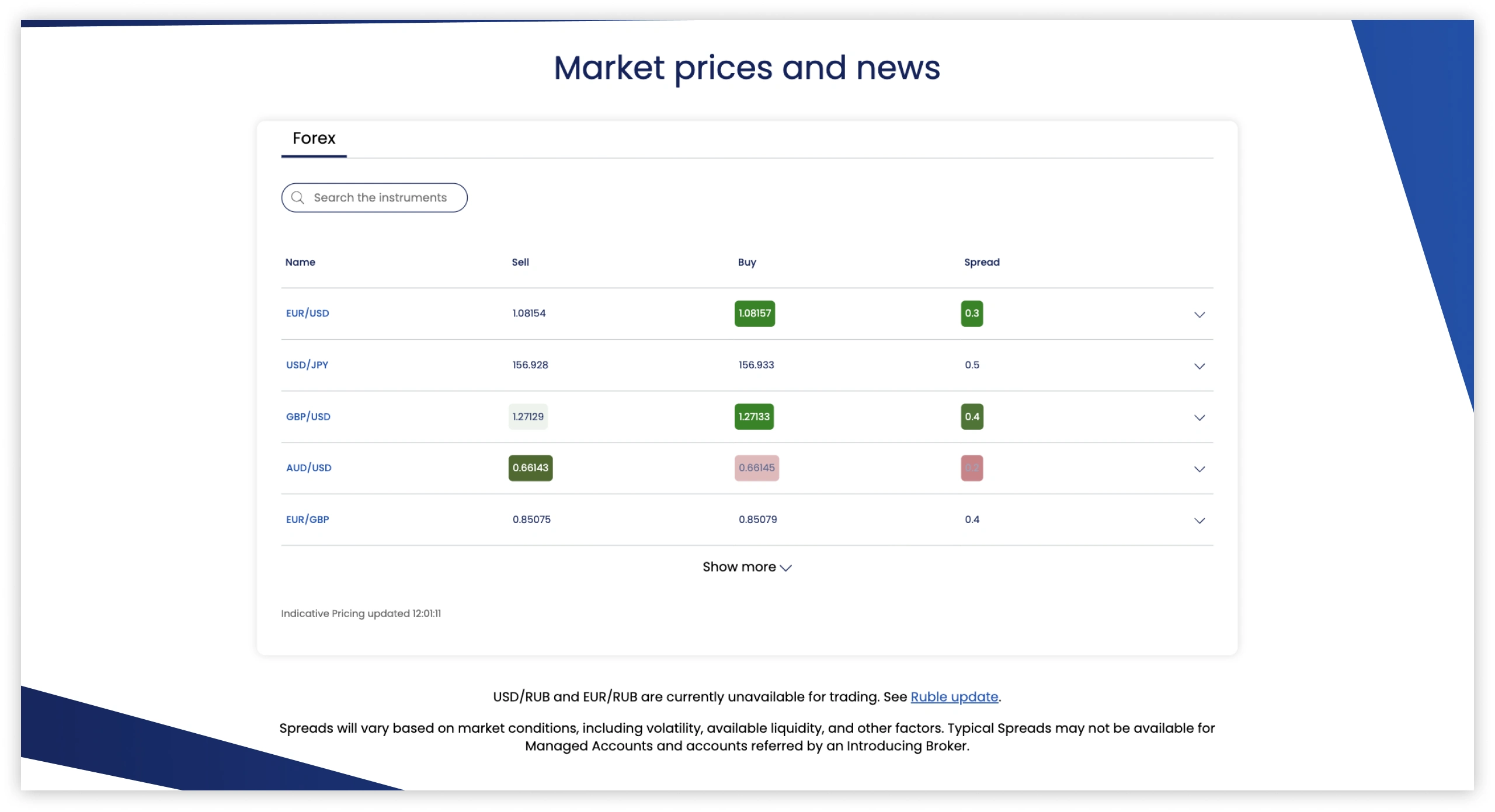

We believe Forex.com is the cheapest forex broker in the UAE because of its low spreads, which start from 0.7 pips on major currency pairs. Plus, we got started by depositing funds from $100 per its minimum deposit requirement. When it comes to transactions, Forex.com does not impose deposit or withdrawal fees. Its inactivity fee of $15 monthly also kicks in after 12 months, which we believe is a longer duration compared to most of its peers.

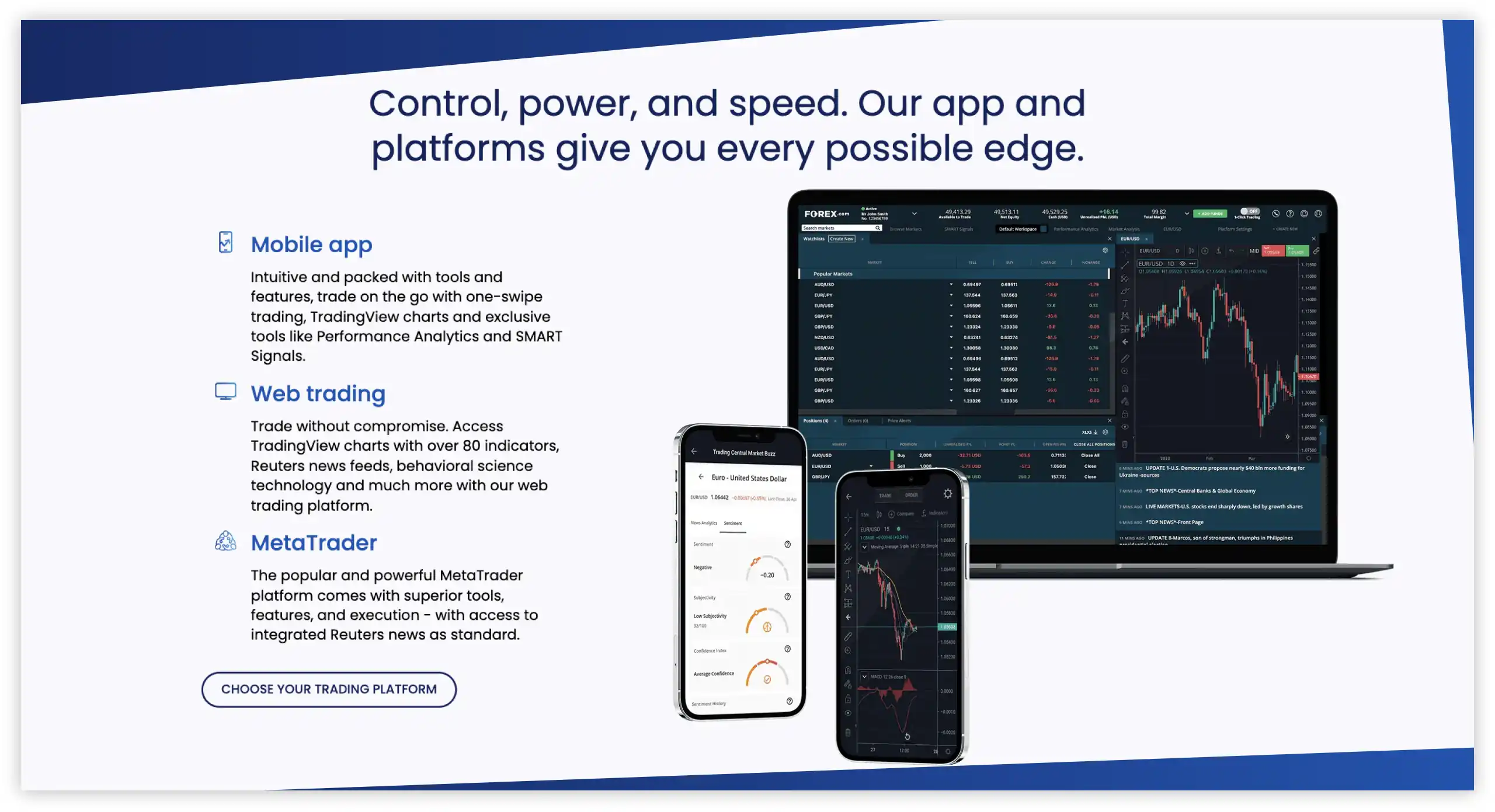

We traded over 80 currency pairs at Forex.com. For traders looking to diversify their portfolios, the broker lists additional asset classes like stocks, commodities, cryptos, indices, and more to choose from. Furthermore, expert traders can trade forex on the broker’s MT5 and TradingView platforms. They have proven to execute forex trades seamlessly on desktop and mobile devices. Other features that made us recommend Forex.com include social trading, automated trading with EAs, and more.

✔Zero fees for card deposits and card withdrawals

✔A broad range of trading platforms, including MT4 and 5

Pros

- Compatible with desktop and mobile devices

- A user-friendly and modern-design platform

- Low forex trading fees

- Lists over 80 currency pairs to choose from

Cons

- Expect to incur an inactivity fee after 12 months

- You can only trade forex and CFD instruments with Forex.com

The best decision you can take as a trader is to join a platform with friendly, transparent fees. Luckily, Forex.com values transparency and cost-friendliness. We tested this broker using Standard and RAW Spread accounts. Here’s what we found out.

First, you must fund your account before trading live with this broker. When doing that, keep in mind that Forex.com’s minimum deposit is $100. Therefore, your first deposit should be $100 or higher. But don’t worry about deposit charges. Forex.com charges zero fees for incoming deposits from bank transfers and debit cards.

The other costs and charges you will incur while trading with Forex.com depend on your preferred account. The costs associated with standard accounts are included in the bid/ask spread. A Standard account’s spreads start from 0.8 pips. Additionally, this account will only require you to pay commissions if you invest in equities. But the good news is that Standard account owners can earn cash rebates on cryptos, equities, FX, and other assets.

If you go with a Forex.com Raw Spread account, you will enjoy commissions as low as $5 per $100k you trade. This account also allows you to lower your trading costs with cash rebates of up to $50 for every $1 million you trade. Furthermore, with it, you can trade FX majors and enjoy tight spreads starting from 0.0.

Commissions and rebates aside, Forex.com levies rollover fees for positions held overnight. The exact rollover rates vary depending on factors like the prevailing market conditions. Furthermore, this broker requires dormant account owners to cover a $15 monthly inactivity fee. The last fee kicks in after an account has remained inactive for 12 months.

6. OANDA – Top Forex UAE Broker For MetaTrader Users

We tested OANDA and had one of the most amazing trading experiences. For starters, the broker has a user-friendly and modern design interface for both desktop and mobile devices. This element made us easily navigate the currency market while taking advantage of arising potentially profitable opportunities. OANDA has $0 minimum deposit requirement and does not impose any deposit or withdrawal fees. Plus, UAE traders will enjoy over 48 currency pairs.

Trading forex at OANDA attracts low fees, starting from 0.6 pips on major currency pairs. We traded forex on its MT4 and MT5 platforms and must admit that they feature quality trading tools for all types of forex traders. For instance, you will enjoy automated trading and customizable charts on these platforms. Beginners also have an opportunity to develop their skills through the numerous learning resources at OANDA.

Pros

- Has a welcome bonus of up to $888 for new UAE forex traders

- No minimum deposit requirement

- Quality technical and fundamental analysis tools on its MT4 and MT5 platforms

- Reliable and responsive 24/5 support service via phone, email, and live chat

Cons

- Limited currency pairs compared to its peers

- Additional asset classes can only be traded as CFDs. No buying and taking ownership

When testing OANDA, we opened a live account and funded it. We didn’t encounter any OANDA minimum deposit requirements, which was a good thing. That allowed us to start with a few dollars. While preparing to fund our account, we noticed that this broker doesn’t charge deposit fees for cash transfers, credit cards, and debit cards. The same applies to e-wallets like Neteller, Skrill, and Wise. But withdrawals aren’t entirely free.

OANDA allows traders to make one free withdrawal per month to their debit or credit cards. Anyone who exceeds this threshold has to pay. The exact fees vary depending on account currency. On the other hand, all bank-related withdrawals incur charges. The fees you’ll pay while using a bank to withdraw funds from OANDA depend on the number of bank withdrawal transactions you’ve made in that calendar month and account currency.

We also noticed that OANDA has overtime financing charges. If you keep a position open after a trading day has ended, OANDA assumes you’ve held it overnight and either credits or charges your account. Visit OANDA’s Financing Costs page to learn more.

Lastly, OANDA charges a $10 monthly inactivity fee on accounts that have been dormant for 12 or more months. If OANDA deems your account legible for inactivity fees, the broker will levy it until you terminate the account, resume trading, or deplete your account balance.

7. Interactive Brokers – Best Forex Broker For Professional Traders

Interactive Brokers (IBKR) prides itself on offering global currencies with direct access to interbank quotes. We tested the broker and discovered over 100 currency pairs, which you get to trade with spreads from 1/10 pips. Moreover, deep liquidity and real-time quotes are offered from 17 of the world’s largest forex dealers. Getting started is straightforward, with no minimum deposit requirement.

Professional traders will benefit from quality market analysis resources for technical and fundamental analysis. These trading tools are offered on advanced platforms, including IBKR Desktop, IBKR Trader Workstation (TWS), IBKR Mobile, and IBKR GlobalTrader. For beginners confident in this broker, we discovered plenty of learning materials. There is also a $10,000 virtually-funded “Free Trial” account to gauge your skill level before transitioning to live trading.

Pros

- There are a plethora of currency pairs to choose from

- A plethora of learning and market analysis tools

- Low forex trading fees

- Various trading platforms to choose from

Cons

- Its desktop platform can be challenging for new traders to navigate

- No forex trading is supported on its IBKR GlobalTrader platform

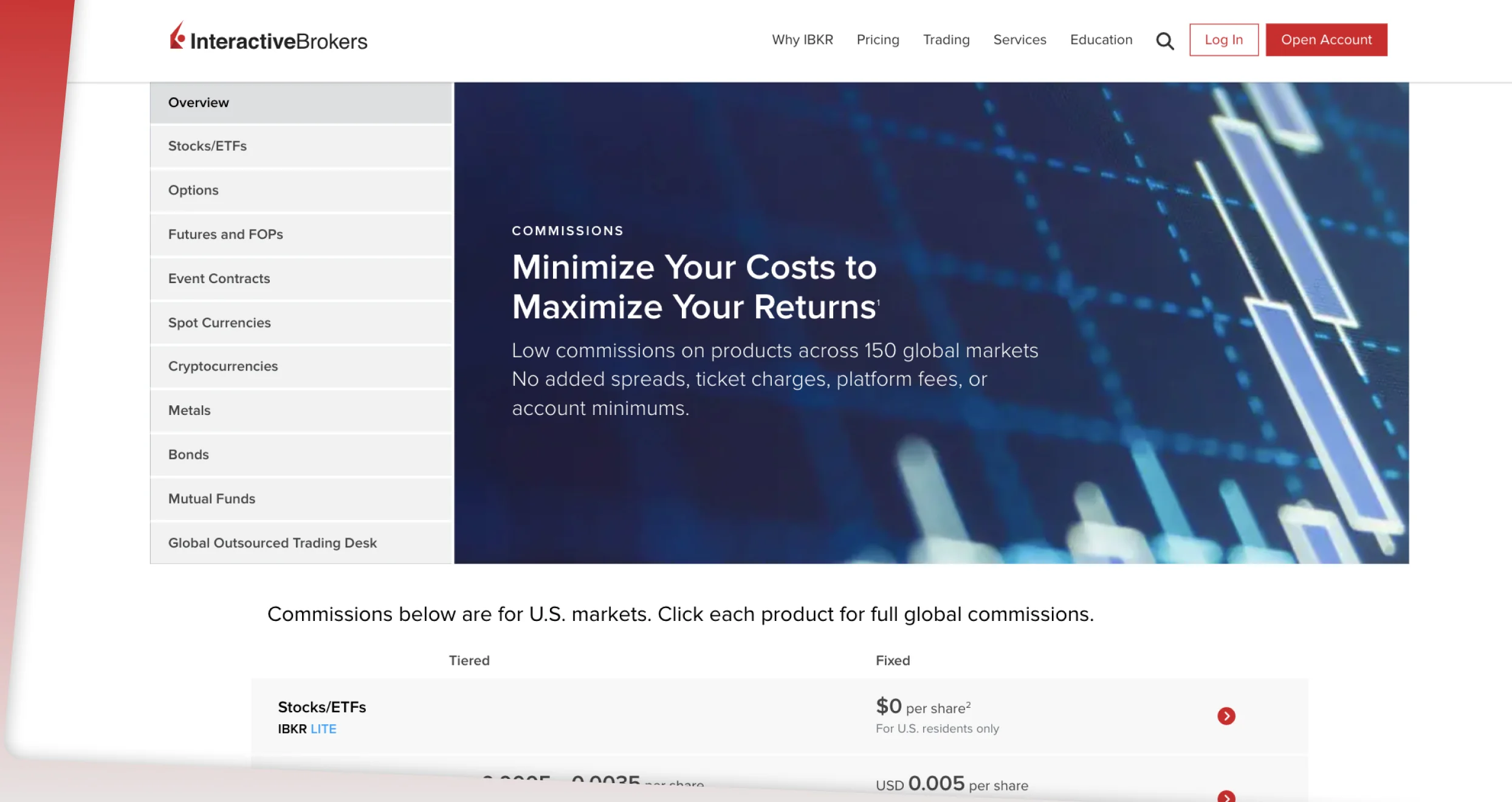

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

Forex Trading in the United Arab Emirates

Forex trading in Dubai and the whole of UAE is legal, and any trader above 18 years can engage in the activity. Brokers offering currency trading services in the region must be licensed and regulated by the local authorities. For instance, if you reside in Dubai, ensure the forex broker you use is overseen by the Dubai Financial Services Authority (DFSA). This is according to the Regulatory Law of 2004, which was enacted by the ruler of Dubai.

For traders outside Dubai, confirm whether the broker you use is licensed and regulated by the Securities and Commodities Authority (SCA) and the Central Bank of the UAE (CBUAE). These authorities oversee financial companies’ services in the UAE, ensuring traders engage in a secure environment.

Note that the UAE accepts both local and international forex brokers. While it is crucial to confirm local regulations, international brokers like the ones we recommend above are overseen by other global authorities. These include the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA), the Australian Securities and Investment Commission (ASIC), and more.

Overall, forex trading in the UAE can be lucrative, especially if you arm yourself with proper strategies. You can trade various currencies, including AED, USD, GBP, EUR, and more, using a credible broker. The best part about engaging in this activity is that all profits from forex trading are tax-free in the UAE.

How to Choose the Right Forex Broker

Choosing the right forex broker in the UAE allows you to trade in an environment suitable for your trading requirements. Above, we have listed some of the best brokers for forex trading that guarantee an exciting experience. However, should you decide to overlook our recommendations and conduct your own research, here are the essential factors to consider in identifying a suitable forex broker.

The first element you should confirm when considering a forex broker in the UAE is the security measures it employs. Settle with one that is highly encrypted and guarantees your data safety. Plus, confirm the regulatory status of a broker, especially if it is international-based. Besides being regulated in the UAE by the CBUAE, SCA, and DFSA, the broker should be licensed and overseen by other global tier-one authorities. They include the FCA, CySEC, ASIC, and more.

The best element about trading forex with regulated forex brokers in Dubai is that they adhere to stringent instructions laid down by the authorities. Your trading funds will be secured in segregated accounts only accessible to you. Moreover, you will avoid falling victim to scammers who have dominated the UAE financial space.

The best forex broker in UAE should be affordable. Check all the trading and non-trading charges and ensure they fit your trading budget. Remember, forex trading is all about taking risks. While you can earn profits, losses are inevitable. Therefore, confirm the minimum deposit requirement, commissions/spreads, transaction charges, inactivity fees, and more. The charges should fit your budget to avoid spending more than you are comfortable losing.

The best forex brokers should list the currencies you plan to trade. Plus, consider one with additional asset classes like stocks, commodities, cryptocurrencies, indices, and more. This will allow you to efficiently diversify your portfolio without seeking other brokers.

Settle for a UAE forex broker with a user-friendly and modern-design platform. The platform should also list all the necessary tools that will help you in your technical and fundamental market analysis. For beginners, confirm the availability of learning resources and demo accounts. You should be able to learn the markets and gauge your skill level in a risk-free environment before putting up your money in live trading.

Whether you are new to UAE forex trading or have been in the market for a while, expect to experience trading challenges. The broker you select should have a reliable support service team to cater to you in case of any arising issues. Test their responsiveness via phone, email, or live chat and how they handle your concerns or questions. Their availability must also align with your trading schedule, whether 24/7 or five days a week.

To ensure you make the right choice, we encourage you to analyze user testimonials on Google Play, the App Store, and Trustpilot. Sample all the positive and negative comments to understand a broker’s strengths and weaknesses. You should then be able to decide whether a broker is worth committing to.

How To Register an Account with a Forex Broker UAE

We signed up for trading accounts on our recommended forex brokers above. Overall, the process was straightforward, and it took us minutes to set up the accounts. Below, we guide you through the simple steps, ensuring you are prepared to kickstart your forex trading ventures.

Choose a forex UAE broker from our recommendations list above and visit its official website. Before you start the account registration, read and understand its terms of service. It is essential to do so to avoid future inconveniences once you are fully invested. For traders who are always on the move, install the broker’s app on your mobile device for easier activity management.

Once you complete step 1 above, click the register, sign up, or join now button to start the account registration procedure. Your broker will provide a form to fill out with your personal details. These include your name, email, location, date of birth, and more. Additionally, create a unique username and strong password for an added layer of safety to your account. Some brokers will also engage you in online trading tests to gauge your skill level and allocate the best leverage limit.

Most UAE forex-regulated brokers will engage you in account verification. This is a standard procedure that forex brokers have to ensure the online trading environment remains free from imposters. Therefore, you may be requested to share identity verification documents such as a copy of your national ID card or passport. Some brokers will request a copy of your recent utility bill or bank statement to verify your jurisdiction area.

Once your account is verified, your broker will send a notification via email. At this point, make a deposit per the broker’s minimum deposit requirement. You will then be automatically redirected to where all currencies and other assets are listed. Remember, brokers like the ones we recommend here support multiple payment methods, including debit/credit cards, e-wallets, and bank transfers. Choose the most convenient one for a quick and seamless deposit.

Select your preferred currency pairs and open a position based on your strategy. For beginners, start trading on a broker’s demo account. And when you decide to engage in live trading, start small, since the currency market can be unpredictable. Trade with capital you are comfortable losing. Most importantly, apply risk management controls to mitigate massive losses in case a forex trade doesn’t work out in your favor.

Conclusion

Forex trading in the UAE is becoming more popular, especially with more offshore brokers dominating the region. If you plan to trade Dirham and other global currencies/markets, our recommendations above will help you get started on a good note. They are not only regulated by world-renowned authorities but also highly rated by users across various platforms.

Regardless of the broker you select, success requires thorough market research and solid strategy development. Fortunately, our recommended forex brokers host resources for technical and fundamental analysis. They also feature quality learning resources to ensure newbies are fully prepared to trade forex in the UAE.

If you're just starting out, eToro’s user-friendly platform and copy trading could be a good way to dip your toes in without too much risk.