We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Thousands of South Africans earn a living from forex trading. If you’d like to become a full-time forex trader or add this activity to your list of side gigs, here’s some good news. There are countless forex trading apps in South Africa. They come with fantastic features and allow you to trade on the go.

That said, for the best experience, you need to trade with the best forex trading app in South Africa. Sifting through the thousands of platforms available today and choosing the most exceptional app can be difficult. But don’t worry; our team has already done the heavy lifting for you. We researched, tested, and compared most of the trading apps available in SA. After doing so, our team was able to identify 5 mention-worthy service providers.

In a Nutshell

- Forex trading can be highly profitable, but success requires trading with a reliable platform.

- If you’re a novice, immerse yourself in educational resources and practice with demo accounts. Don’t dive into forex trading without sufficient knowledge and skills.

- Trading on the go is possible in South Africa. Numerous outstanding apps regulated by the FCSA are available; you just have to pick a suitable one.

- While choosing the best forex trading app in South Africa, prioritize licensing from the FSCA. Limit your trading to platforms authorized by this regulatory body. Additional licenses from international authorities are an added advantage.

- We at Invezty.com used a team of experts to test the forex trading apps in South Africa and identify the most outstanding platforms. Our recommendations and opinions come from first-hand experience and extensive research.

List of the Best Forex Trading Apps

- Pepperstone – Best App for Trading CFDs in South Africa

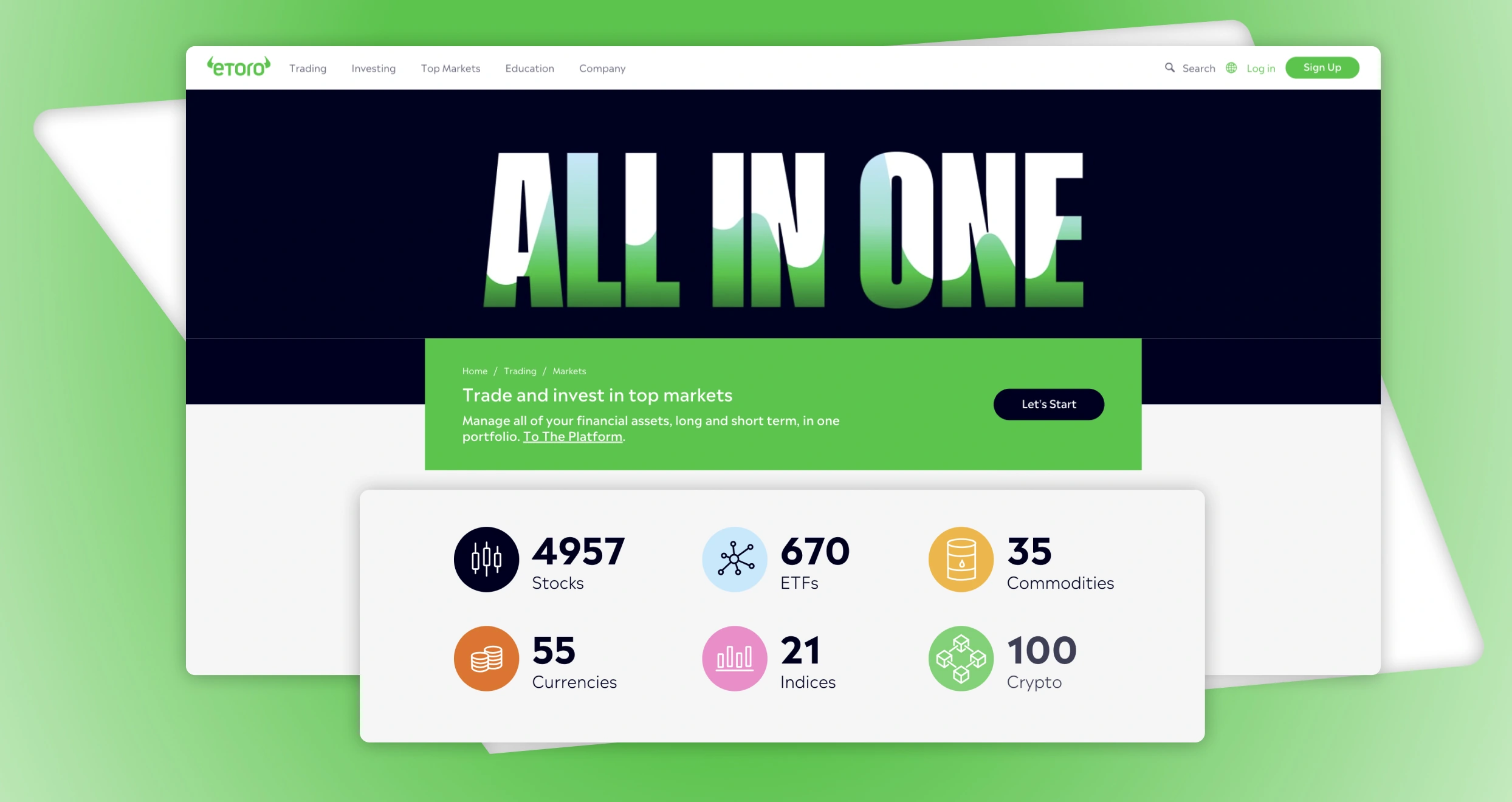

- eToro – Overall Best Forex Trading App in South Africa

- AvaTrade – Best Trading App for Beginners in SA

- FP Markets – Best Trading App for Competitive Pricing

- Plus500* – Standout Trading App for Risk Management

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Forex Trading Apps in South Africa

Our team of experts tested and evaluated the trading apps we’ve reviewed here. We conducted comprehensive assessments and compared them with other leading platforms. As a result, we can confidently recommend the five trading apps we have identified as the top choices.

While vetting and selecting the best forex trading apps in SA, our team considered a plethora of factors. They range from security and reputation to fees and customer support. Our primary objective is to publish unbiased and accurate information that you can use to find the best app for your trading goals and needs.

We also gauged the reliability of each trading app based on online reputation. Our experts reviewed hundreds of testimonials on Trustpilot, the App Store, Google Play, and numerous community forums. Then, we used the insights we gathered from reviews and the outcomes from our assessments to pick 5 of the most exceptional forex trading apps.

Here’s a summary of our top 5 trading apps in South Africa and their attributes.

| Best Forex Trading App South Africa | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FSCA, FCA, ASIC, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| eToro | FSCA, FCA, CySEC, ASIC, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| AvaTrade | FSCA, CBI, CySEC, PFSA, ASIC, B.V.I, FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, AvaSocial, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| FP Markets | FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| Plus500* CFD service. Your capital is at risk | FSCA, CySEC (#250/14), FCA, ASIC, FMA, MAS | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

Apps Overview

Having been in the trading industry for decades, we know that fees and assets can undermine or elevate your trading experience. Finding an app with affordable fees and your preferred assets will fuel your success.

Before signing up with any forex trading app in South Africa, go through the tables below. They outline the fees and assets associated with each of the platforms.

Fees

| Best Forex Trading App South Africa | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| eToro | $2,000 | From 1 pip | $5 withdrawal fee | $10 monthly |

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of inactivity |

| FP Markets | $100 | From 0.0 pips | Free | $0 |

| Plus500* | $100 | From 0.0 pips | Free | $10 monthly after three months of inactivity |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Assets

| Best Forex Trading App South Africa | Stocks | Forex | Cryptocurrencies | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Our Opinion about the Best Forex Trading Apps

Below is a comprehensive review of the best forex trading apps in the Rainbow Nation. All our opinions come from personal experience. We signed up with these apps and put each through rigorous tests and evaluation. Select any of these recommended products to elevate your trading and investment activities to new heights.

1. Pepperstone – Best App for Trading CFDs in South Africa

If you trade forex CFD assets and are searching for the perfect app for your endeavors, check out Pepperstone. This app gives you unmatched access to 1,200+ CFDs across diverse assets, including FX pairs and currency indices. Moreover, it allows you to fund your trading account with what you can afford and start trading without being burdened by transaction fees.

We recommend trading forex CFDs with Pepperstone because this app is reliable and works like a dream. Our experts tested it, and its performance is applaudable. If that isn’t enough, the broker offers numerous popular platforms, such as TradingView, MT4, MT5, cTrader, and the Pepperstone Trading Platform.

Pepperstone has dedicated apps for Android and IOS users.

Pros

- User-friendly app with advanced functionalities

- No minimum deposit requirement

- Razor-sharp spreads starting from 0.0 pips on major currency pairs

- Zero deposit, withdrawal, and inactivity fees

- Superb educational tools and materials

Cons

- Focuses primarily on CFD assets

- No desktop app

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – Overall Best Forex Trading App in South Africa

Our overall best forex trading app in South Africa is eToro. We highly recommend this platform because, first, it gives its users the opportunity to trade and invest in various assets. With it, you can trade 55+ currency pairs, including USD/CHF, EUR/ USD, and USD/ JPY. What’s more, eToro allows you to dapple in CFD fx trading.

But what we love most about this app is its investment offering. Unlike most trading platforms today, the eToro app allows you to diversify your portfolio with real stocks from companies like Apple, Microsoft, and Tesla. Plus, the platform supports buying, staking, and selling digital assets like Bitcoin, Ethereum, and Solana. The eToro app is compatible with Android and IOS devices. It’s user-friendly and perfect for experienced and novice traders alike.

Pros

- Easy to download, set up, and use

- Offers over 55 currency pairs alongside CFDs on these instruments

- Allows users to invest in other assets, including shares and cryptos

- Supports copy trading

- Reasonable trading fees and commissions as low as 0% on real stocks

Cons

- A high minimum deposit requirement of $2,000 for South African clients

- $10 monthly inactivity fee

- No desktop app

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. AvaTrade – Best Trading App for Beginners in SA

AvaTrade is, hands down, the best trading app for South African trading novices. Our confidence in this broker is unwavering due to the AvaTrade Education Center for South African Traders. This program offers everything that a budding forex trader needs to enter the trading universe and make a splash. We skimmed through some of the educational articles published here and were impressed by their thoroughness.

We also consider the AvaTrade app ideal for beginners since it’s user-friendly and easy to use. Moreover, it comes with a demo account that lets you practice and test your knowledge of the forex market with virtual funds. That is incredibly beneficial since your odds of making catastrophic mistakes and losing money are significantly higher when you’re a novice forex trader. By starting with virtual funds, you can improve your skills and strategies without incurring hefty financial losses.

You can trade with AvaTrade’s app using an iPhone or Android smartphone.

Pros

- A world-class educational center with rich articles and materials

- Free demo account for testing your knowledge and skills

- User-friendly interface that’s easy to navigate

- Reasonable spreads starting from 0.13 pips on major currency pairs

- Free deposits and withdrawals

Cons

- Charges $10 monthly inactivity fees

- Offers around 1250 instruments, which is a significantly lower number compared to what industry leaders offer

- No desktop app

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

4. FP Markets – Best Trading App for Competitive Pricing

FP Markets stands out for its extensive product offerings. This broker supports 10,000+ tradeable instruments, including over 70 forex pairs, making it an ideal choice for South African traders who prioritize competitive pricing. We’ve tested and traded with countless platforms, but FP Markets takes the cake when it comes to affordability and pocket-friendliness.

With FP Markets, you can trade with spreads starting as low as 0.0 pips. Additionally, there are no fees for deposits, withdrawals, or inactivity. This platform also offers copy trading, allowing you to replicate the strategies of top-performing traders, thereby minimizing losses and enhancing profitability. FP Markets supports forex trading across multiple advanced platforms, including MT4, MT5, TradingView, and cTrader. FP Market’s trading app is compatible with most IOS and Android mobile devices.

Pros

- Ultra-low spreads starting from 0.0 pips

- No commissions for standard MT4 and MT5 accounts

- Most payment methods support free transactions

- No inactivity fees for dormant accounts

- Support technicians are available 24/7

- Over 10,000 tradeable instruments, including 70+ popular currency pairs

- High leverages of up to 500:1 for professional clients

Cons

- A few payment methods have withdrawal fees, including Perfect Money and Skrill

- The app’s interface looks lousy and outdated

- No desktop app

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

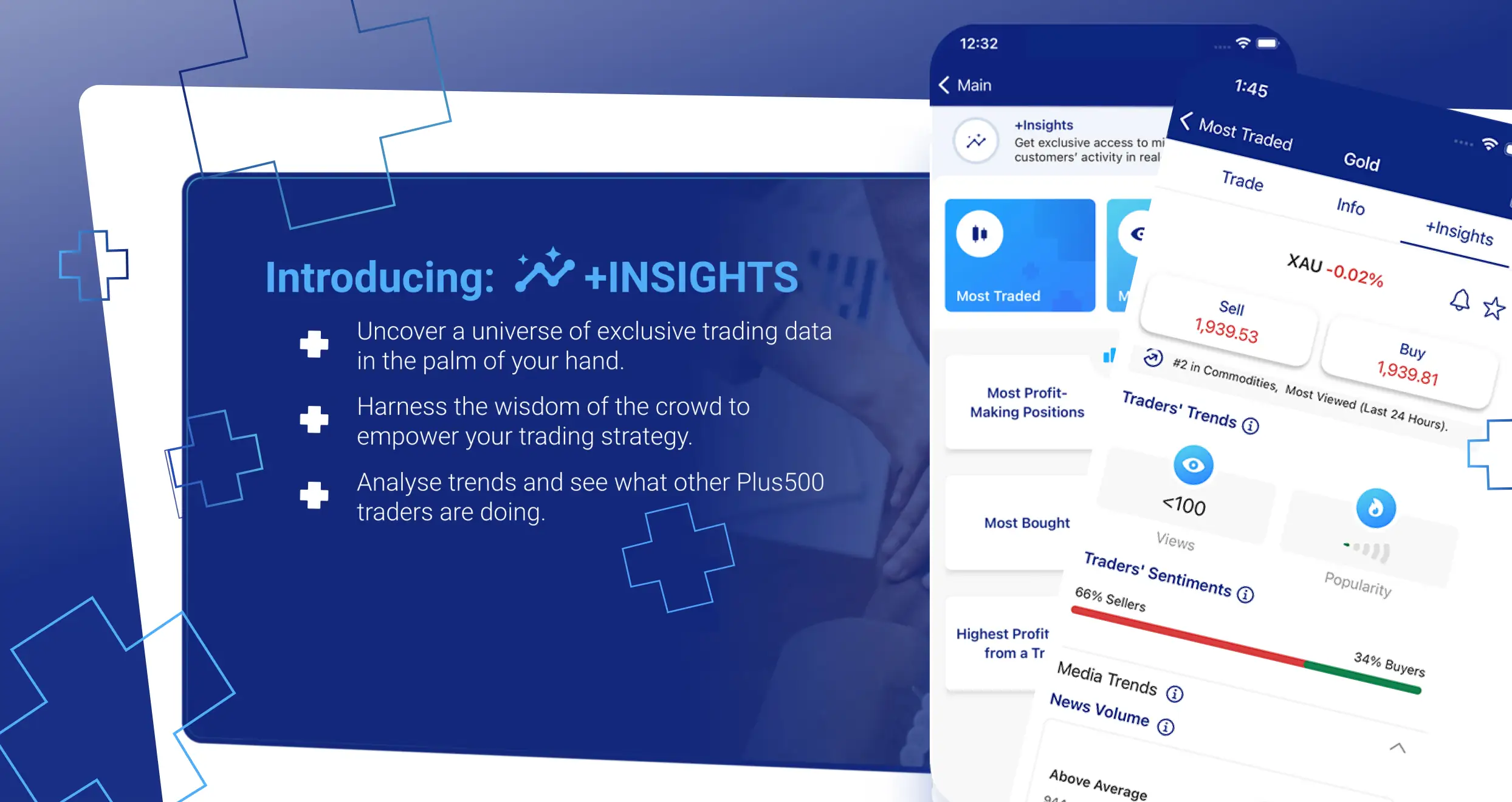

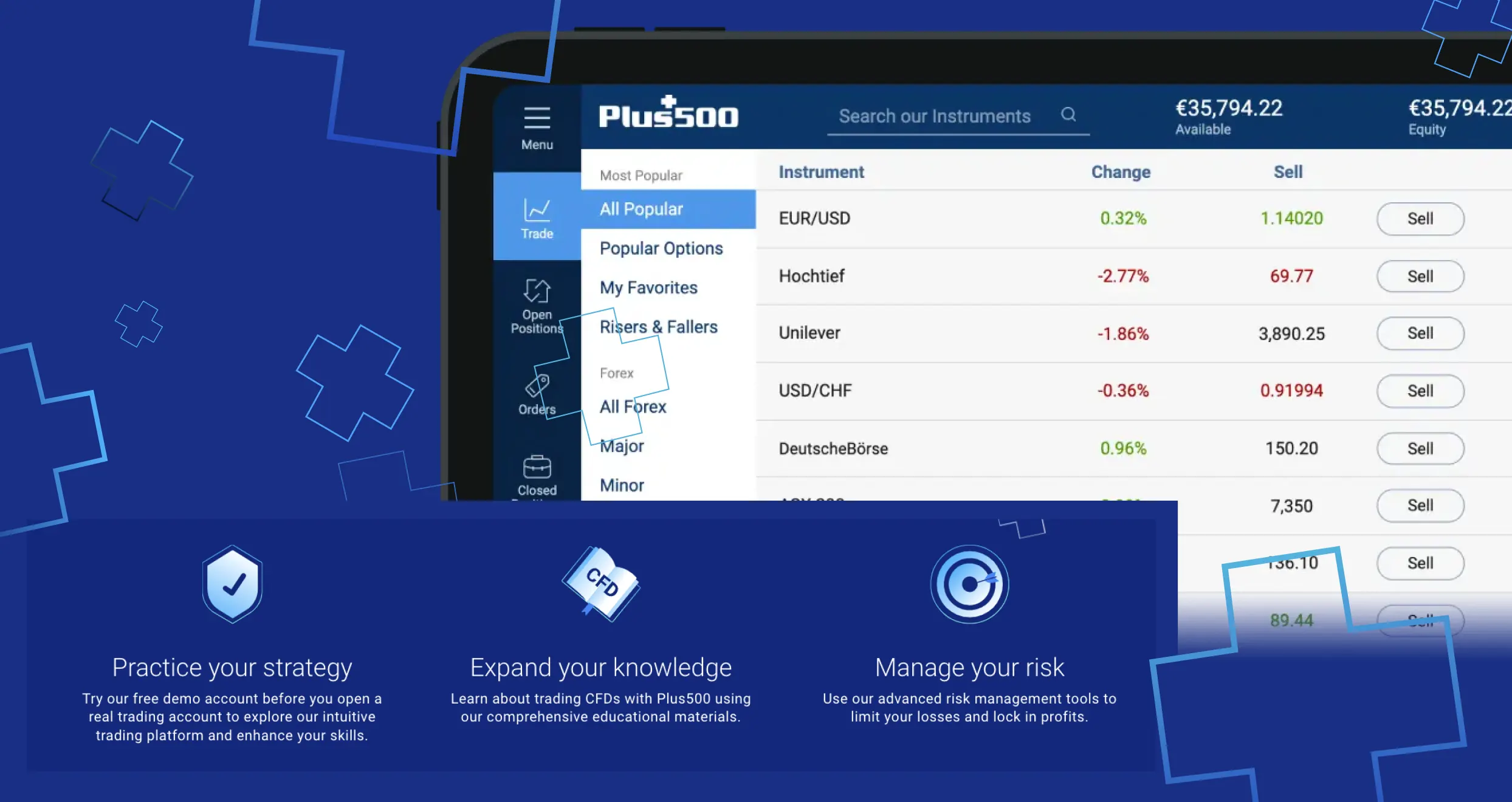

5. Plus500 – Standout Trading App for Risk Management

Trading is incredibly risky. Many people have lost fortunes while trading the forex markets. But you can nip your losses and avoid financial catastrophes through risk management. And that is Plus500’s forte.

Plus500 is an excellent app that gives users uncapped access to numerous risk management tools. The first one is Guaranteed Stop, which puts a definite limit on potential losses. With this tool, you can trade confidently, knowing that if prices go against you, you will be able to get out of your positions without suffering crippling losses. Additionally, Plus500 allows traders to add Close at Profit and Close at Loss price levels, which are indispensable in protecting profits and capping losses.

Besides being ideal for risk management, Plus500 gives you uncapped access to diverse tradeable assets, including CFDs on forex pairs. We also discovered that its app is among the most highly rated by users on Google Play, the App Store, and Trustpilot.

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- Excellent risk management tools

- User-friendly interface

- Thousands of financial instruments

- 24/7 responsive customer support

- Free deposits and withdrawals

Cons

- Inactive accounts incur a $10 monthly fee after three months of inactivity

- No call center for customer support

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

Forex Trading in South Africa

The Rainbow Nation is home to 190,000+ forex traders. The problem is some shoddy platforms have started popping up in SA, hellbent on exploiting the popularity of online forex trading. But don’t worry; the Financial Sector Conduct Authority is always there to save the day. This authority protects you from scrupulous brokers and unfair practices.

All the apps we’ve recommended are licensed or regulated by the FSCA in South Africa. You can entrust your money with them and rest easy knowing everything will be okay. But remember that engaging with the forex market comes with significant financial risks. Risk what you can afford to lose. Most importantly, spend as much time as possible vetting and evaluating forex brokers before committing to a specific app.

How to Choose the Right Forex Trading App in SA

Choosing the best forex trading app can be challenging since thousands of options are available today, and more are popping up every other day. And if you are new to forex trading, things can be a tad harder. But that doesn’t mean finding the perfect forex trading app is impossible. All you need to do is pay attention to the following factors:

A licensed and regulated trading app guarantees the safety and security of your data and assets. Such a platform adheres to mandates put in place to protect you, like segregation of funds and implementation of state-of-the-art encryption technologies. Therefore, before using a trading app, ensure it’s backed by a reputable broker regulated by the FSCA and other recognized authorities, like FCA, CySEC, and ASIC.

Your primary goal as a forex trader is earning profits, right? High fees and exorbitant commissions can eat into your earnings. To avoid this, evaluate every trading app’s cost and charge before signing up. Opt for a platform whose fees align with your expectations. Above all, avoid brokers with numerous hidden fees because they’ll expose you to unexpected costs and transparency issues.

Not checking the available assets on a trading platform can lead to disappointment if it doesn’t offer the instruments you need. Review each app’s list of tradable instruments before signing up. Ensure your preferred assets are supported.

Traders often encounter a wide array of issues, from transaction delays to login problems. You may face such challenges in the future. When that happens, you will need professional assistance from your broker. Choose a trading platform with excellent customer support services. Also, check the availability of your preferred company’s support representatives. If you trade around the clock, opt for an app that offers 24/7 support.

While evaluating a specific trading app, you may overlook or miss some issues, potentially affecting your future trading experience. To avoid this, read online reviews and testimonials for each platform. These can help you identify specific red flags and avoid apps that are slow to resolve issues. However, be cautious, as some reviews may be biased or exaggerated. Take everything with a grain of salt, especially overly positive comments.

How To Register an Account with a Forex Trading App SA

Account registration can be intimidating, especially for beginners. This is understandable since many brokers have strict KYC policies that require applicants to fill out different forms and submit specified documents. But don’t be scared. The apps we’ve recommended here have a simple registration process and only ask for basic information like your name, address, and phone number.

Let’s explore the standard registration process for the best forex trading apps in South Africa.

First, go to your preferred broker’s official webpage. Review all offerings and check if they align with your goals and preferences. Then, look for a button for downloading their dedicated mobile app. Use the correct channel, whether it’s the App Store or Google Play, to download the app.

Install the downloaded app and open it. Click “Create a new account” or “Sign up” and start the registration process. Submit all the required information, from your legal name and physical address to your email address and phone number. Also, create your username and a strong password. Ensure your password contains letters, numbers, and unique symbols for maximum security. Make it as long as possible.

Since most trading platforms have KYC, you must submit identity and location verification documents. Depending on the broker’s mandates, you can use your government ID, passport, or driver’s license for identity verification. For proof of address, you might need your recent utility bill or bank statement. Some apps may also ask you to take a selfie.

The best apps allow users to improve security with solutions like two-factor authentication (2FA) and biometric verification. If your chosen platform supports any of these options, use them. 2FA and biometrics add an extra layer of security, making unauthorized access to your forex trading account more difficult.

After setting up your account, wait for it to be approved. Then, deposit funds using the approved payment methods. Keep all associated fees and minimum deposit requirements in mind. Finally, pick an instrument and start trading. Since trading is risky, manage your funds carefully and practice risk management. Never risk more than you can afford to lose.

Conclusion

Forex trading platforms allow you to trade currency pairs and earn returns. Forex trading can be a great source of passive income. You can also master this skill and achieve substantial returns as a full-time trader. That said, your success as a forex trader largely depends on the platform you choose. A high-quality app will offer a smooth trading experience and improve your chances of making a profit.

When choosing the best app for your forex trading needs, consider the factors discussed here, such as licensing, fees, online reputation, and support availability. Avoid platforms with a poor reputation and questionable policies.

Got it! From my experience, I’d say AvaTrade is solid for beginners, especially with its demo account and educational tools. It really helps build confidence before diving into live trading.