Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

The most successful traders didn’t rise to the top overnight. They toiled hard for success and spent countless days learning, practising, and honing their skills. If you want to benefit from online trading, follow suit. Start by identifying a good paper trading app that can help you build a strong foundation and shoot for the stars.

We want you to spend as much time as possible mastering trading and sharpening your skills. That is why our experts have researched and vetted the paper trading apps in India on your behalf. You don’t have to waste valuable time evaluating the innumerable service providers. All you have to do is use our guide to pick the best app for paper trading in India.

In a Nutshell

- Paper trading gives you the opportunity to test a trading app, improve your skills, and refine your strategies in a risk-free environment.

- If you go online today, you will be bombarded by endless paper trading apps. But not all are outstanding.

- For the best experience, you must choose paper trading apps carefully and factor in crucial aspects like supported software and expiry duration.

- Also, prioritise opening demo accounts with brokers that have positive attributes, especially proper licensing, reasonable fees, and diverse financial instruments.

- Avoid trading apps that don’t adhere to mandates set by authorities like the RBI and SEBI.

- Our experts tested and compared the paper trading apps in India. We’ve reviewed our top 5 picks in this unbiased and informative guide.

List of the Best Paper Trading Apps in India

- FP Markets – Overall Best Paper Trading App

- Pepperstone – Best Paper Trading App for Indian Forex Traders

- AvaTrade – Best Paper Trading App for Beginners

- Interactive Brokers – Best Paper Trading App for Advanced Trades

- FxPro – Best for Multi-Platform Paper Trading

Compare Paper Trading Apps in India

Many brokers have paper trading platforms, otherwise known as demo accounts. But not all of them are outstanding. We want you to interact with only the best apps. That is why our experts tested every reputable broker’s paper trading account. Then, we compared our experiences and picked 5 of the best.

We also know that you are highly likely to transition to trading live with a broker that offers outstanding paper trading capabilities. When that time comes, we want you to enjoy all the perks you need to succeed, from top-notch security to affordable fees. That is why we also chose the best paper trading apps based on what their live trading accounts have to offer. We considered numerous factors, including licensing, support, and supported software.

Here is what the best paper trading apps in India offer to both demo account holders and live traders.

| Best Paper Trading App India | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| FP Markets | RBI, FCA, FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| Pepperstone | RBI, FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/5 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| AvaTrade | RBI, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Interactive Brokers | RBI, SEC, FCA, FINRA, ICS, CBH, ASIC, SFC, MAS | 24/5 | IBKR Desktop, IBKR Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader | Check, wire transfer, direct bank transfer (ACH) | Yes |

| FxPro | RBI, FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes |

Apps Overview

At Invezty.com, we have your best interests at heart. We don’t want you to grapple with cost-related issues like ungodly or hidden fees. Our wish is to see you trading with an affordable account that will catalyze your prosperity. We also want you to find the best paper trading app in India that has your preferred financial instruments. For these reasons, we factored in fees and assets while choosing the best apps.

The tables below outline the fees and assets of each of the best paper trading apps in India. Use them to pick a broker best suited to your needs.

Fees

| Best Paper Trading App India | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| FP Markets | $100 | From 0.0 pips | Free | $0 |

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| AvaTrade | $100 | From 0.13 pips | Free | $50 after every 3 consecutive months of inactivity |

| Interactive Brokers | $0 | From 0.08% | From $10 withdrawal fees | $0 |

| FxPro | $100 | From 0.6 pts | Free | $10 monthly |

Assets

| Best Paper Trading App India | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| IBKR | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Opinion about Paper Trading Apps in India

The service providers featured in this guide are the best in India since they offer exceptional paper trading apps. Moreover, they have outstanding qualities that make them ideal for live trading, from reasonable fees and proper licensing to top-tier security features. Therefore, you can use their demo accounts to enhance your trading skills and then transition to live trading. You won’t need to look for different service providers.

Note that we tested these service providers with both demo and live accounts. Our opinions and insights stem from first-hand experience and many hours of research.

1. FP Markets – Overall Best Paper Trading App

FP Markets is our overall best paper trading app in India. We’ve awarded this rank to FP Markets since it allows users to open a demo account and receive $100,000 in virtual funds. The demo simulates real-time trading conditions, giving you the perfect opportunity to practice in an ideal environment without risking your hard-earned cash.

We were also impressed by FP Markets since it supports outstanding trading platforms, from MT4 and MT5 to cTrader and Iress. But here’s the best part. You can use demo mode to test any of these platforms before making a financial commitment. And if you use your FP Markets paper trading account regularly, it won’t expire. That said, you shouldn’t let it remain idle for more than 30 days because it will expire automatically, and you won’t be able to reactivate it.

After practising with a demo account, you can open a live FP Markets account and get access to over 1,200 tradeable instruments, including currency pairs and CFDs.

Pros

- It comes with $100,000 in virtual money

- No expiration date for an active demo account

- Supports advanced platforms like MT4 and MT5

- Low spreads for live traders

- Live accounts attract zero deposit, withdrawal, and inactivity fees

Cons

- Limited financial instruments compared to other industry leaders

- The Iress platform has a $1000 minimum deposit requirement

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

2. Pepperstone – Best Paper Trading App for Indian Forex Traders

Based on our experience, Pepperstone is the best paper trading app in India for forex enthusiasts. We opened a Pepperstone demo account and received $50,000 in virtual funds. The best part is that we were able to test most of the platforms that this broker offers with demo accounts. Pepperstone hosts myriad advanced platforms, including TradingView, cTrader, and MT4/5.

Also, if you are a forex enthusiast, we encourage you to practice with Pepperstone since you can do it for as long as you like. Please note that most of the platforms hosted on Pepperstone have demo accounts that expire after 30 days, including MT4 and MT5. But if you have a live account that you’ve funded, you can ask Pepperstone to tweak your demo account and make it perpetual.

Pepperstone allows you to trade over 90 FX major, minor, and exotic pairs. Once you switch to a live account with Pepperstone, you’ll enjoy many perks, including no deposit requirements, free transactions, and zero inactivity fees.

Pros

- Allows users to request no-expiry demo accounts

- Hosts exceptional platforms like MT4, MT5 and cTrader

- No minimum deposit requirement

- Free deposits and withdrawals

- Zero account inactivity fees

Cons

- Demo accounts not backed by live, funded accounts expire within 30 days

- Fewer tradeable products compared to its peers

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

3. AvaTrade – Best Paper Trading App for Beginners

For many reasons, we consider AvaTrade the best paper trading platform in India for beginners. First, it allows mobile traders to open demo accounts using the AvaTradeGo mobile app. The app has an elegant yet simplified interface that anyone, especially novices, can navigate seamlessly. Moreover, AvaTrade allows new users to test the available platforms in demo mode, including MT4, MT5, and WebTrader.

An AvaTrade demo account comes with virtual money worth $10,000. Before diving into the real thing, you can use these funds to test the broker’s features and functionalities. And, although your demo account is supposed to last 21 days, you can request an extension before the expiry date.

As a beginner, you can also use AvaTrade’s demo account to trade over 1,000 financial instruments and familiarise yourself with indispensable tools like stop-loss, take-profit, and the legendary AvaProtect. When you’re ready, you can trade live with this broker and reap numerous perks, including free deposits and withdrawals.

Pros

- Simple interface, perfect for beginners

- Users can request extensions on demo accounts

- Hosts outstanding platforms like MT4 and MT5

- Rich educational materials

- Supports social and copy trading

Cons

- Without extensions, demo accounts expire after a mere 21 days

- Limited financial instruments compared to its peers

- High inactivity fees for dormant live accounts

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

4. Interactive Brokers – Best Paper Trading App for Advanced Traders in India

After reviewing numerous service providers, we recommend Interactive Brokers to advanced traders searching for a suitable paper trading app in India. Upon signing up with this broker, you’ll get the opportunity to open a free trial account loaded with $1,000,000 in virtual money.

You can use your free trial account to explore and analyze all the trading platforms offered by Interactive Brokers, from IBKR Mobile to IBKR Desktop and TWS. This account also allows you to test your skills and strategies with different financial instruments, including FX currencies, stocks, and futures. And since this is a risk-free environment, you can make as many mistakes as possible and learn from them without worrying about financial losses.

Not to forget, an Interactive Brokers free trial account comes with diverse superior trading tools for advanced traders. They range from Market Scanner and Probability Lab to the IB Risk Navigator and Option Strategy Lab.

Pros

- Free trial offers superior tools for advanced traders

- No minimum deposit requirements for retail traders

- Cost-free deposits

- Packed with excellent educational tools and materials

- Commissions as low as 0.08% for stocks and ETFs

Cons

- High withdrawal fees compared to its peers

- No third-party platforms like MT4 and MT5

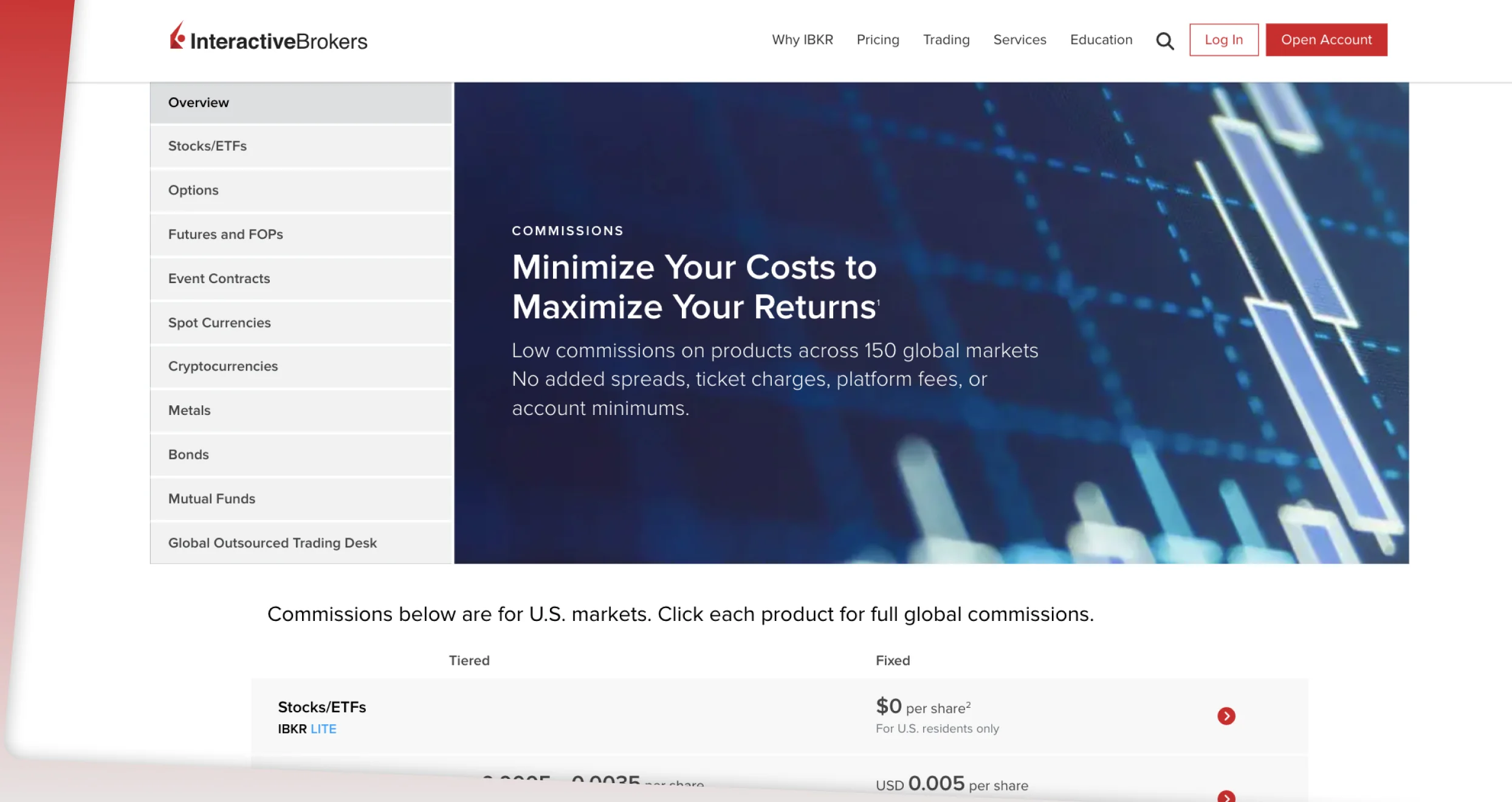

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

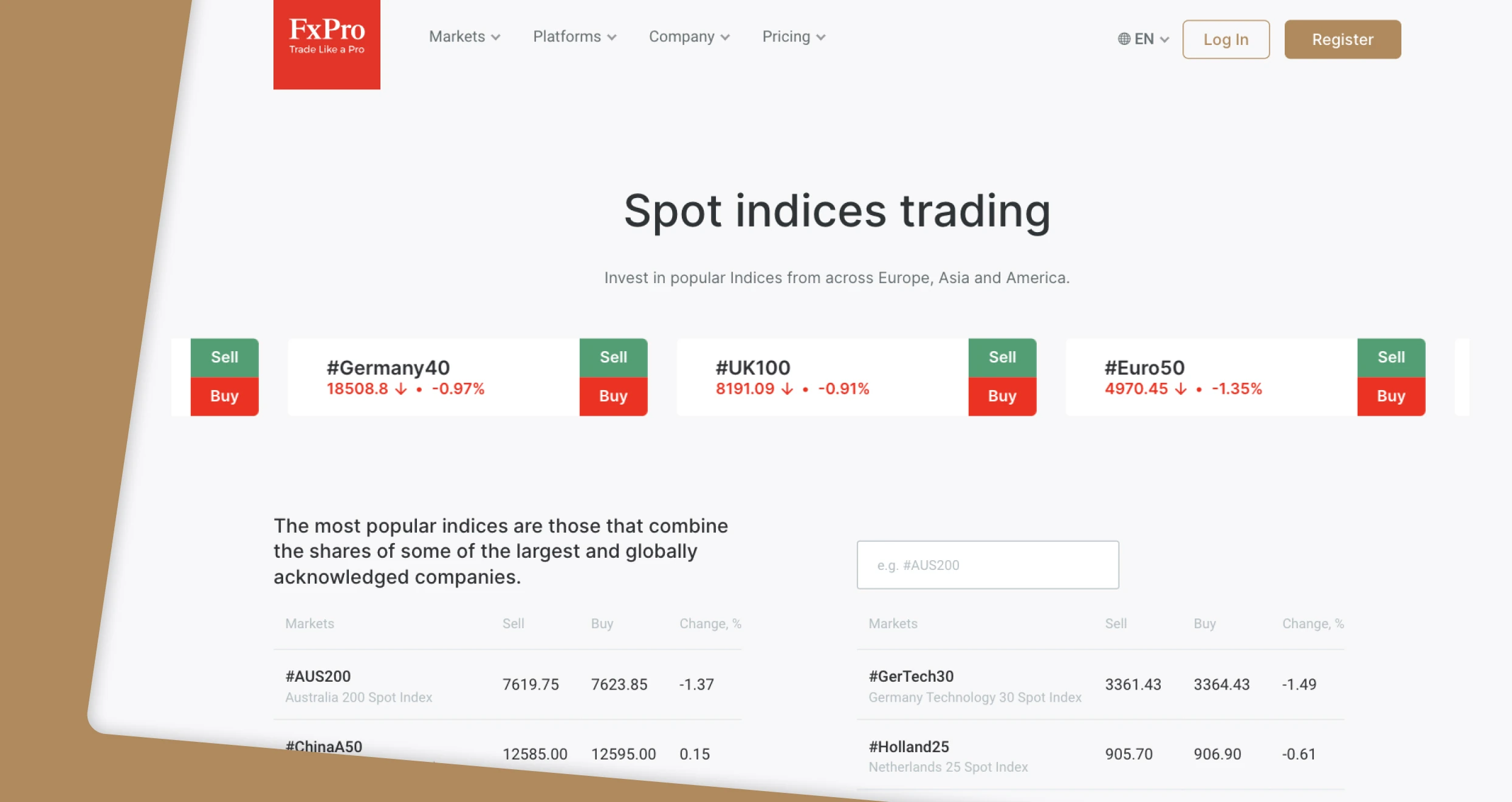

5. FxPro – Best for Multi-Platform Paper Trading

Modern traders hold several advanced trading platforms in high regard. These include MetaTrader 4, MetaTrader 5, and cTrader. The good news is that FxPro hosts all of these solutions. Moreover, it offers proprietary software like FxPro WebTrader and the FxPro Mobile App. To make things better, you can test all of these platforms for free with demo accounts.

FxPro’s demo accounts come with up to $10,000 in virtual funds. They also last for 180 days, meaning you’ll have ample time to familiarise yourself with every trading platform, test your strategies, and practice consistently. What’s more, if you like trading on the go, you can open a demo account from FxPro’s mobile app and then switch to live trading later.

We also recommend FxPro’s demo accounts since they allow users to top up. If you deplete your virtual funds prematurely, you can add up to $500,000 from FxPro Direct. When the time is right, you can just switch to a live FxPro account and trade CFDs on different assets, including currency pairs, commodities, and cryptocurrencies.

Pros

- Hosts excellent platforms like MT4, MT5, and cTrader

- Demo accounts last for a whopping 180 days

- Users can top up their demo accounts if they get depleted

- Free deposits and withdrawals for live traders

Cons

- Limited product range compared to its peers

- $10 monthly inactivity fee for dormant live accounts

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Paper Trading in India

In India, online trading is legal and highly regulated by numerous authorities, including the RBI and SEBI. These organizations strive to protect your interests as a trader and ensure brokers maintain optimum integrity. The paper trading apps we’ve listed here adhere to strict mandates set by these governing authorities.

Online trading is also exploding in India. And many people are making a fortune out of it, the likes of Shashikant Sharma. You can do the same, but we don’t guarantee overnight success. You have to gather sufficient knowledge, practice consistently, and stick to the most effective trading plan. Most importantly, to trade in India, you have to be 18 or older.

And remember, not all brokers have your best interests at heart. You have to dedicate enough time to finding the best paper trading app in India. Ideally, the app you choose should be so good that you’ll be compelled to open a live trading account with it when you’re ready. Today, we are going to share a few hacks you can use to find the best paper trading platform.

How to Choose the Right Paper Trading App in India

You must interact with a good app to get the most out of paper trading. However, finding a good paper trading app can be challenging since many options are available, and some are sub-par and unreliable. But don’t worry. You can filter out undesirable apps and find the best paper trading app in India by focusing on the following:

Not all apps are regulated by acknowledged authorities. You should avoid unregulated entities because they expose you to diverse issues, including identity theft, fraud, and scams. To optimise the safety of your data and resources, limit your paper and live trading activities to brokers that adhere to strict mandates set by regulators like SEBI and the FCA.

Suppose you are a newbie. In that case, you should avoid complications by finding a beginner-friendly trading app with a simplified interface. Otherwise, your experience will be suboptimal at best if you go with an app that’s plagued by issues like poor design and complex layouts. You’ll also waste valuable time familiarising yourself with the app, time you’d otherwise spend honing your trading skills.

For a comprehensive and well-rounded learning experience, you should practice with an app with a broad product range. Your chosen service provider should give you access to popular markets like forex, crypto, and stocks. If you practice with a paper trading app with diverse financial instruments, you’ll have better chances of becoming a versatile trader.

If you plan to transition from paper to live trading on the same app, check fees and commissions beforehand. These will affect your profit margins and overall trading experience. Also, keep in mind that some brokers have hidden fees. Avoid nasty surprises by looking out for them and studying your chosen service provider’s fee structure thoroughly before signing up.

Good customer support service is indispensable to traders. Before choosing any particular paper trading app, check the quality and availability of its support. That is important since you may encounter a few issues or have some questions that require expert assistance. Good customer support will ensure you receive the help you need when you need it.

How To Register an Account with a Paper Trading App in India

The paper trading apps in our guide have a simple account application process. We registered with each of them, and the entire process took a couple of minutes. The good thing is you don’t have to go through KYC until you decide to open a live account.

You can open an account with a paper trading app in India by following these steps:

Before you begin, prepare a brief list of your needs and expectations. Visit your chosen service provider’s official site and check if it provides everything, including demo accounts and your preferred features. If you’re satisfied with what you see, proceed to the next step.

Browse the platform’s homepage and look for a tab or link labelled “Paper Trading,” “Practice Account,” or “Demo Account.” Most sites use the last tag. Before clicking it, review any incorporated information while paying close attention to crucial details like account expiry. You can also download an app if that’s what you need.

Open the demo account and fill out the registration form. You just need to submit everyday details like your name, phone number, and email address. Also, you may have to verify your email and mobile number, which should take a few minutes at most. Most brokers won’t ask for your ID or proof of address until you transition to live trading, so don’t let that bother you.

Take as much time as you need to familiarise yourself with the paper trading app, its features, and the available tools. Most importantly, use your demo account to learn how to open/close positions, set up watchlists, use charts and indicators, etc. Furthermore, use the provided virtual funds to practice, test your trading techniques, experiment with different strategies, etc. Don’t stop honing your knowledge and skills until you achieve consistent profitability and become confident in your trading capabilities.

Conclusion

This guide has introduced you to several service providers that can help you test and refine your trading skills. Pick the best app and use it to transition into a formidable trader. Also, boost your knowledge with the educational material that most of these service providers offer.

As you continue to practice and enhance your capabilities, understand that paper trading doesn’t have the same emotional intensity as live trading. That is because virtual funds are involved in the former. Things can go downhill fast once real-life funds join the equation. Prepare psychologically and acknowledge that live trading is riskier and more intense. Don’t dive into it until you ascertain you’re ready.

I’d consider focusing on a platform that gives plenty of practice opportunities, like FP Markets or Pepperstone, because they seem to offer extended demo accounts and a range of platforms to explore.