We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

I have been trading Australian stocks for decades, and I’m more than happy. Australia’s strong economy makes stock trading incredibly lucrative. I also enhance profitability and dodge enormous losses by diversifying my portfolio with stocks from other countries as well as other securities, including precious commodities and ETFs.

If you’re interested in trading stocks in Australia, here’s my advice: DO IT! You will reap handsomely, provided you make the right moves. For starters, sign up with the most credible and reliable service provider you can find. My guide will help you find the best stock broker in Australia by introducing you to 5 industry leaders.

List of the Best Stock Brokers

- eToro – Overall Best Stock Broker in AU

- Pepperstone – Best Stock Broker for Algorithmic Traders

- FP Markets – Best Broker for Customizable Trading Enthusiasts

- AvaTrade – Best Broker for Risk-Conscious Stock Traders

- Saxo – Best Stock Broker for High-Net-Worth Individuals

Compare Platforms Table

There are several factors that I always consider while choosing the best brokers to use.

The first and most crucial is licensing and regulation. I trade with fully licensed and regulated brokers because I know that’s the easiest way to ensure my assets are safe. I also check minimum deposits, spreads, and commissions to avoid high costs that are guaranteed to slice my profits by significant margins. Finally, I always compare brokers based on customer service quality, insurance, and supported payment methods.

You should use the same factors to identify credible and reliable stockbrokers in Australia. Moreover, if you’re a beginner, check if every viable service provider offers a demo account for practicing before opening a live account. The following table should get you started.

| Best Crypto Exchange Canada | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| eToro | FCA, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | $50 | From 0% | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit card, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| Pepperstone | ASIC, CMA, FCA, DFSA, CySEC, SCB, BaFin | $0 | From 0.0 pips | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView,cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | No |

| FP Markets | FCA, ASIC, MAS, FSCA, CMA, CySEC, FSA | $100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Debit/credit card, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | No |

| AvaTrade | ASIC, MiFID, FSA, FSC, FSA, FFAJ | $100 | From 0.13% | 24/5 | MetaTrader 4, MetaTrader 5, AvaOptions, AvaTrade App, AvaSocial, DupliTrade, ZuluTrade | Credit/debit cards, E-payments, Wire transfer | Yes | No |

| SAXO | FSA, ASIC, FCA, IMA, MAS, SFC, JFSA | $0 | From $0.03% | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank transfer, credit/debit cards, Quick payment | Yes | Yes |

Platforms Reviews

Let’s review what makes each stockbroker I’ve listed here outstanding. Please note that I’ve made it easier for you to pick the best online stock broker Ain ustralia specifically for you by listing each service provider’s biggest strength. I have also covered the most noteworthy drawbacks I discovered to ensure you have all the information you need to make the best decisions.

1. eToro – Overall Best Stock Broker in AU

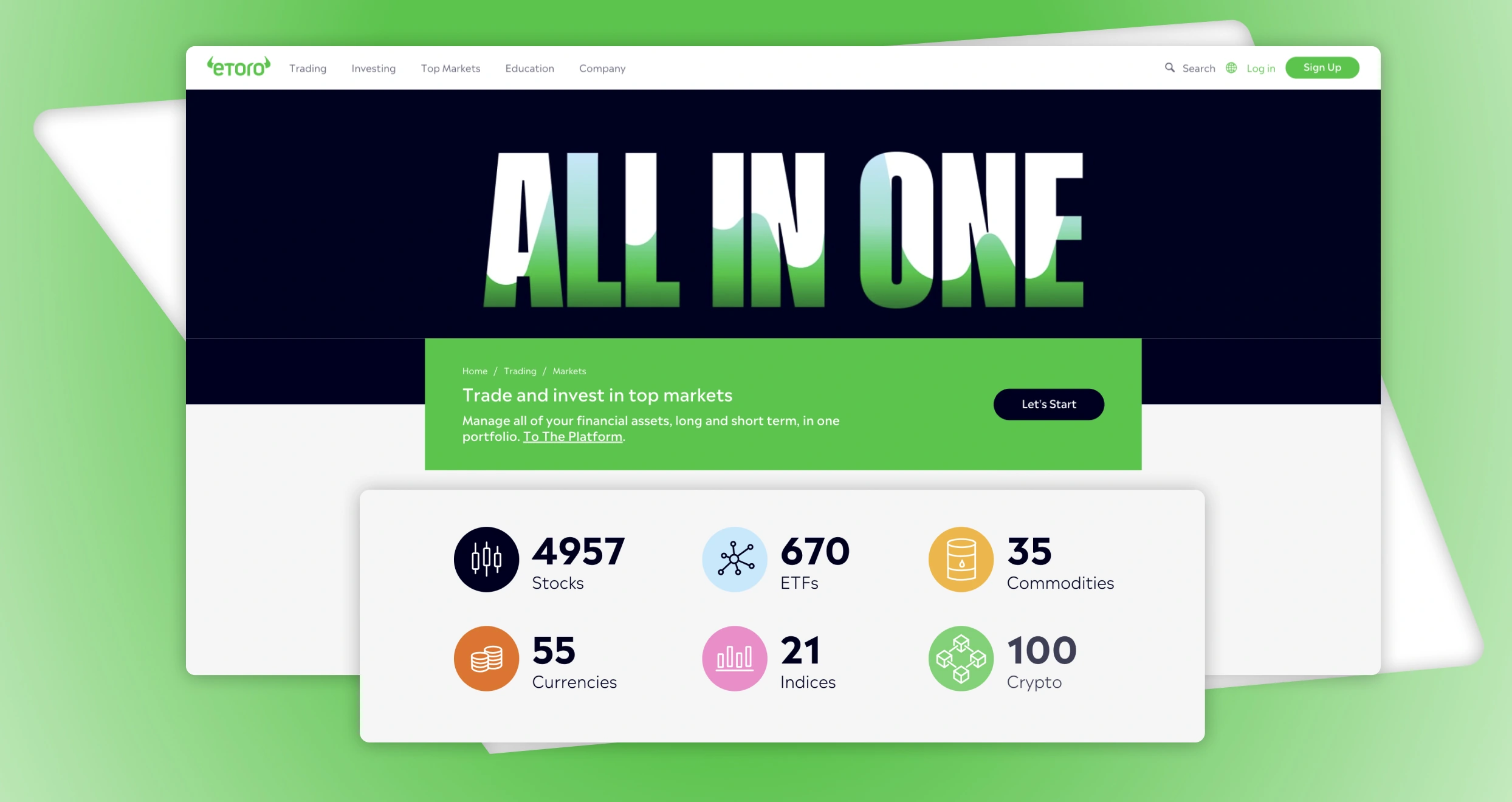

I’ve handed the crown for the overall best stock trading platform in Australia to eToro for very good reasons. eToro has a user-friendly interface designed to accommodate traders of different levels. Beginners will find its simplicity rewarding and fulfilling. On the other hand, everyone from newbies to seasoned traders can benefit from the UI’s intuitive features, including a dashboard that consolidates all sorts of assets, from stocks to ETFs.

When it comes to assets, eToro’s catalog is unparalleled. This broker is my personal favorite since it offers over 6,000 stocks from over 20 exchanges. I have yet to meet a service provider with a better offering. Moreover, unlike its peers, eToro doesn’t focus only on CFDs. The company also offered investable company stocks and shares.

You can trade and invest in thousands of other assets on eToro, including commodities, forex pairs, and indices. This broker has a reasonable minimum deposit, so opening and funding a new account won’t be a problem. Plus, it has plenty of free online educational materials that can help you acquire more knowledge, whether you’re a novice or an experienced trader.

I also tried eToro’s social trading feature and was impressed. Thanks to this broker, I’ve joined an immense community of millions of traders like myself. The community is always a godsend when I need vital tips and advice from gurus.

Pros

- Thousands of assets, including 6,000+stocks

- Reasonable minimum deposit requirement

- Free educational materials

- Commission-free trading is available

- Supports social trading

Cons

- $5 fee for withdrawing from the investment platform to an external account

- $10 monthly inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

2. Pepperstone – Best Stock Broker for Algorithmic Traders

When it comes to algorithmic trading, Pepperstone wins. This broker offers numerous indispensable elements. For starters, it allows users to purchase or develop custom EAs that can automatically execute trades without human intervention.

Moreover, Pepperstone offers several indispensable platforms for algorithmic traders, including MT4, MT5, and cTrader. I also highly recommend this company’s web platform and mobile app. They all have intuitive, easy-to-navigate interfaces, making them suitable for newbies, novices, and experts.

Most brokers I encountered had stringent minimum deposit requirements, but Pepperstone is different. To ensure traders aren’t constrained by their financial situations, this broker allows its users to fund their accounts with whatever they can afford.

Pepperstone clients get better deals than many other traders when it comes to spreads and commissions. I traded Australian shares with this broker and was impressed by the low commissions of up to 0.07% per side. I also checked out other assets and discovered their spreads are as low as 0 pips, including popular forex pairs.

Pros

- Supports automated trading through platforms like MT4 and MT5

- Fast, reliable execution speed

- 24/7 multilingual customer support

- Razor-sharp spreads of up to 0.0 pips

- Zero inactivity fees

- No minimum deposit requirement

Cons

- Less financial assets than its peers

- Only stock CFDs are available

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

3. FP Markets – Best Broker for Customizable Trading Enthusiasts

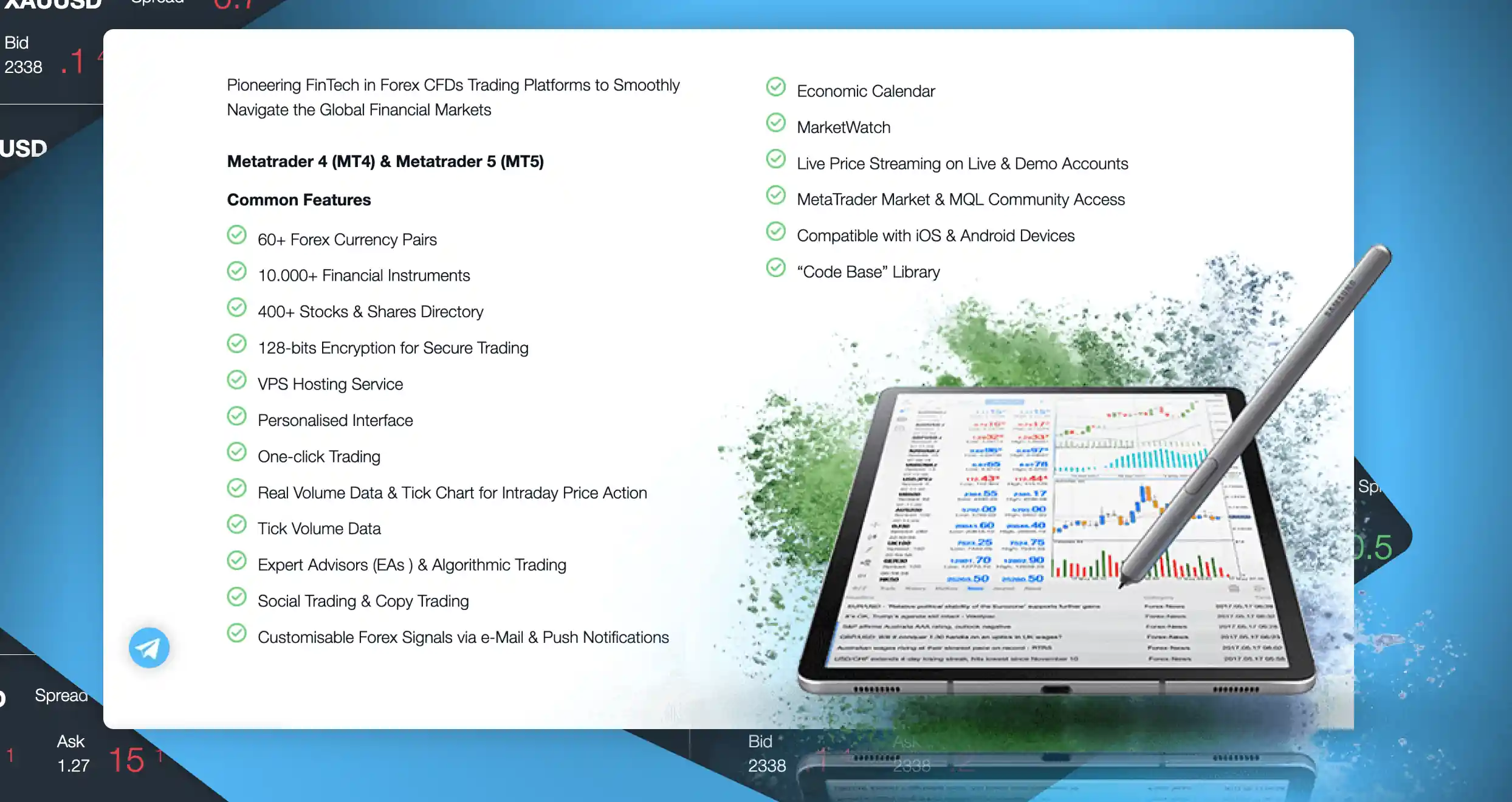

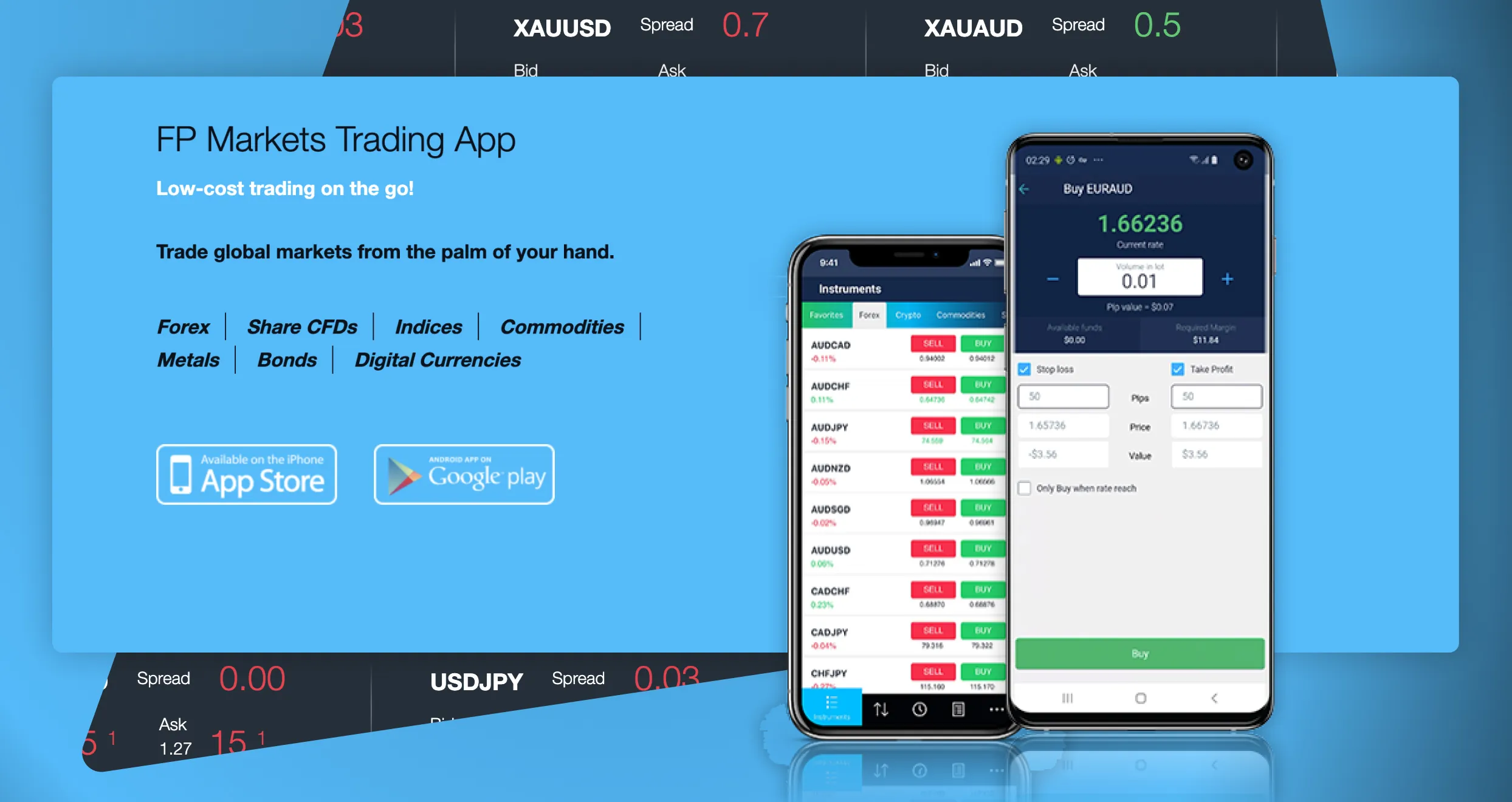

If customization is the key to your success, trade with FP Markets. This broker offers highly customizable platforms like MT4 and MT5. Choose any of them and get the opportunity to customize your preferred platform to suit your trading style and strategy. The best part is that you can access MT4 and MT5 from your phone, tablet, or PC. Other noteworthy platforms hosted here include TradingView and cTrader.

FP Markets offers two main types of trading accounts: Standard and Raw. Both have outstanding features like thousands of financial instruments and up to 500:1 leverage. The most significant difference between the two is that Standard’s spreads start at 1.0 pip while Raw’s spreads are as low as 0.0 pips. Also, Standard has zero commission per lot, while Raw’s commission is $3 per side.

I interacted with FP Markets’ customer support team, and my experience was commendable. I received timely assistance from knowledgeable representatives through all available channels, including phone, email, and live chat.

FP Markets users aren’t limited by scarce assets. This exceptional broker offers over 10,000 tradable securities, including thousands of CFDs on Australian shares and indices. Experienced traders can trade these assets, and beginners can use copy trading to increase their odds of profiting.

Pros

- Offers over 10,000 CFDs on shares and other assets

- Avails professional support 24/7

- No inactivity fees

- Tight spreads and commissions

- Multiple powerful platforms, including MT4 and MT5

Cons

- Most of the available assets are CFDs

- Iress minimum deposit is $1000

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

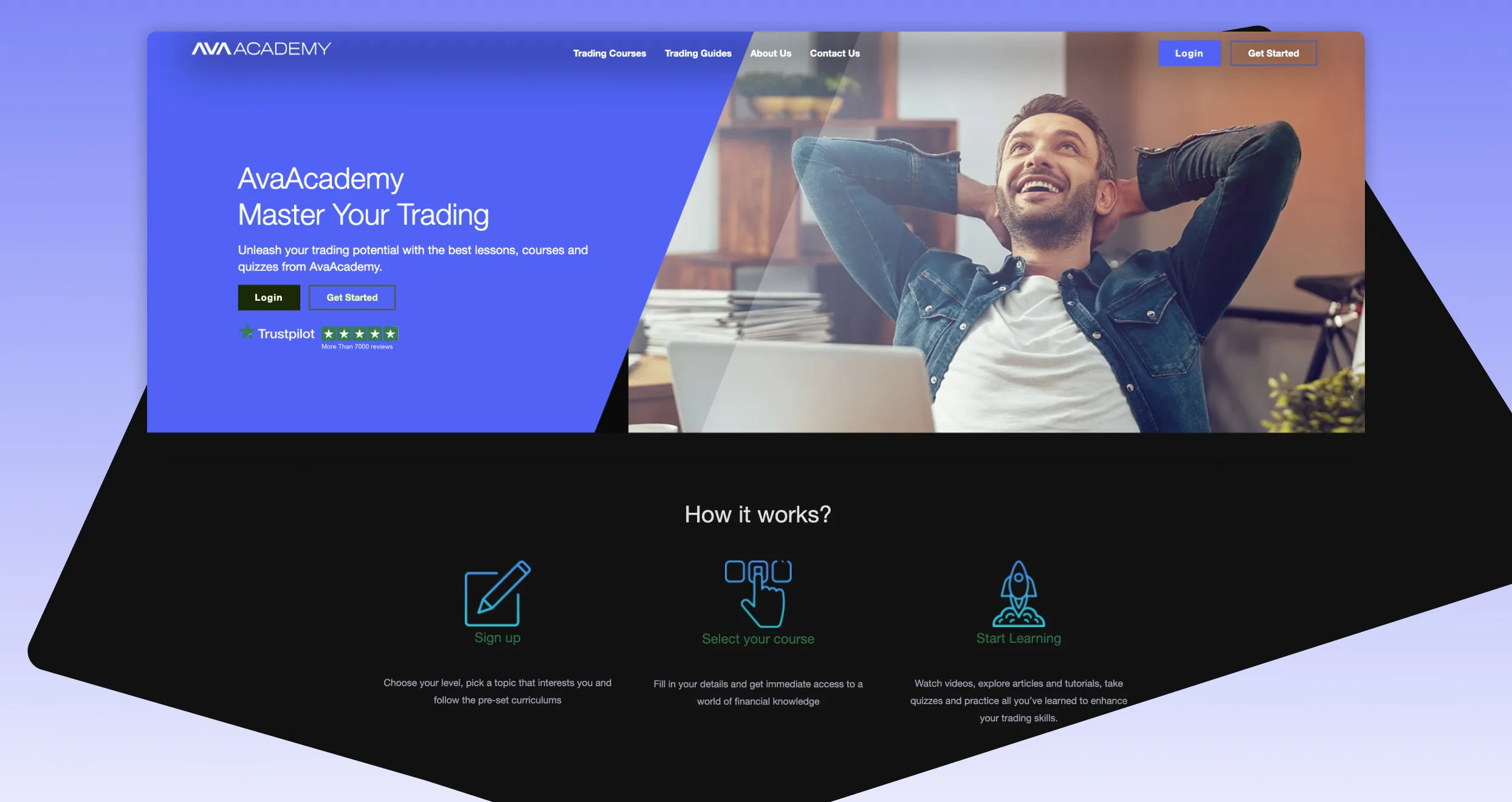

4. AvaTrade – Best Broker for Risk-Conscious Stock Traders

I urge all risk-conscious traders to check out AvaTrade. This broker has the ultimate risk management tool, AvaProtect, which gives you the opportunity to salvage some of the cash you’ve put in losing trades. With this tool, you can protect each eligible trade against losses of up to $1 million. And all you have to do to enjoy this amazing boon is cover a modest hedging fee.

If you are new to trading and have yet to familiarize yourself with risk management, AvaTrade’s educational resources can help. They will introduce you to everything from the importance of risk management in trading to the best strategies that can help traders mitigate losses.

Not to forget, while trading with AvaTrade, you’ll have unlimited access to MT4 and MT5. These popular third-party platforms come with diverse tools that help users manage risk and avoid devastating losses, including take-profit and stop-loss orders.

I also recommend AvaTrade’s AvaSocial and DupliTrade features. AvaSocial allows you to connect with other traders, share ideas, and win together. On the other hand, DupliTrade lets you copy other traders automatically, especially top performers.

Pros

- Traders can protect their accounts from losses of up to $1 million with AvaProtect

- Offers the best platforms for optimum risk mitigation, including MT4 and MT5

- World-class educational materials on diverse topics, including risk management

- Quick customer support service

- Beginner-friendly user interface

Cons

- High inactivity fees

- Few financial instruments compared to its peers

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

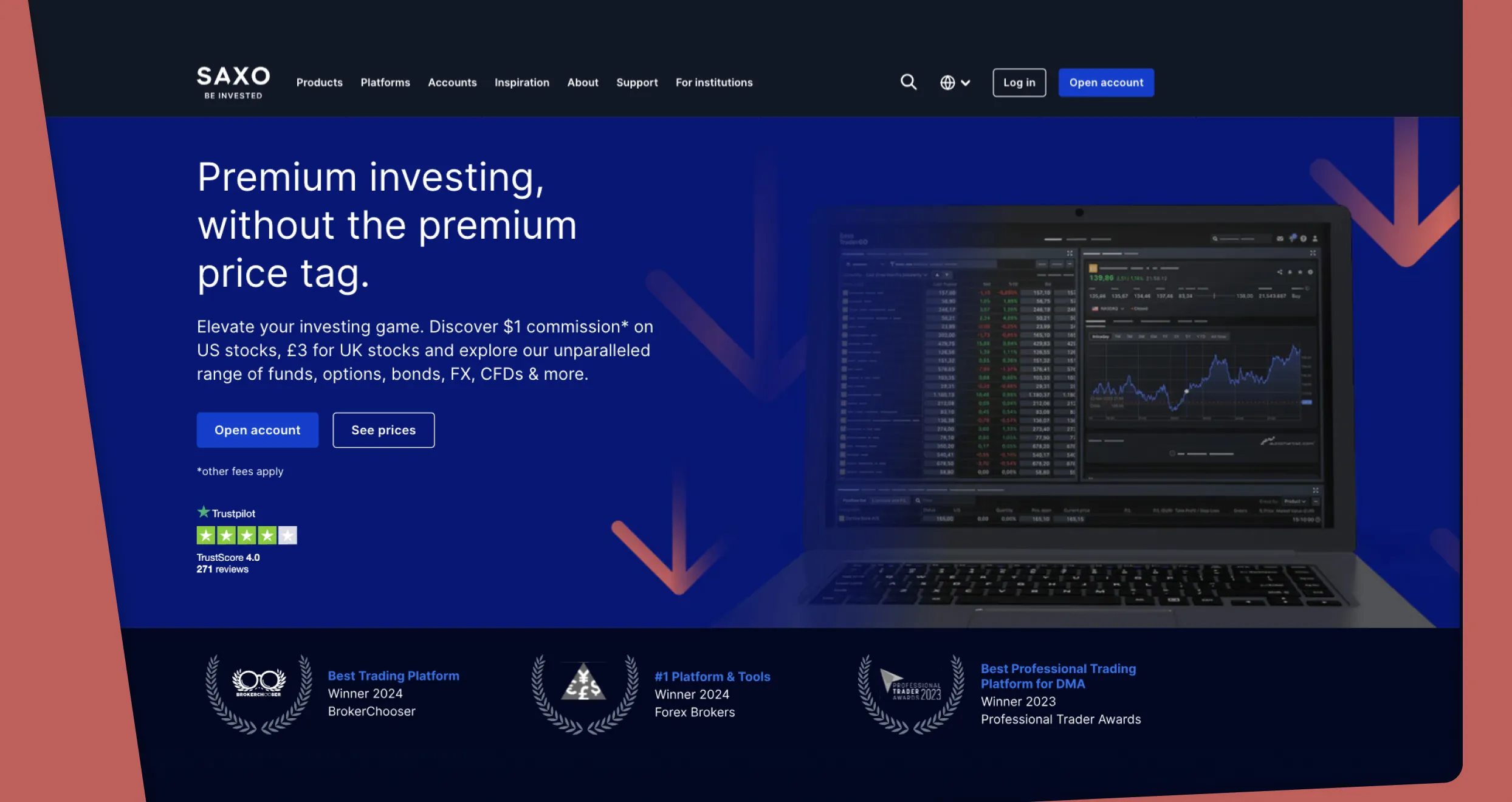

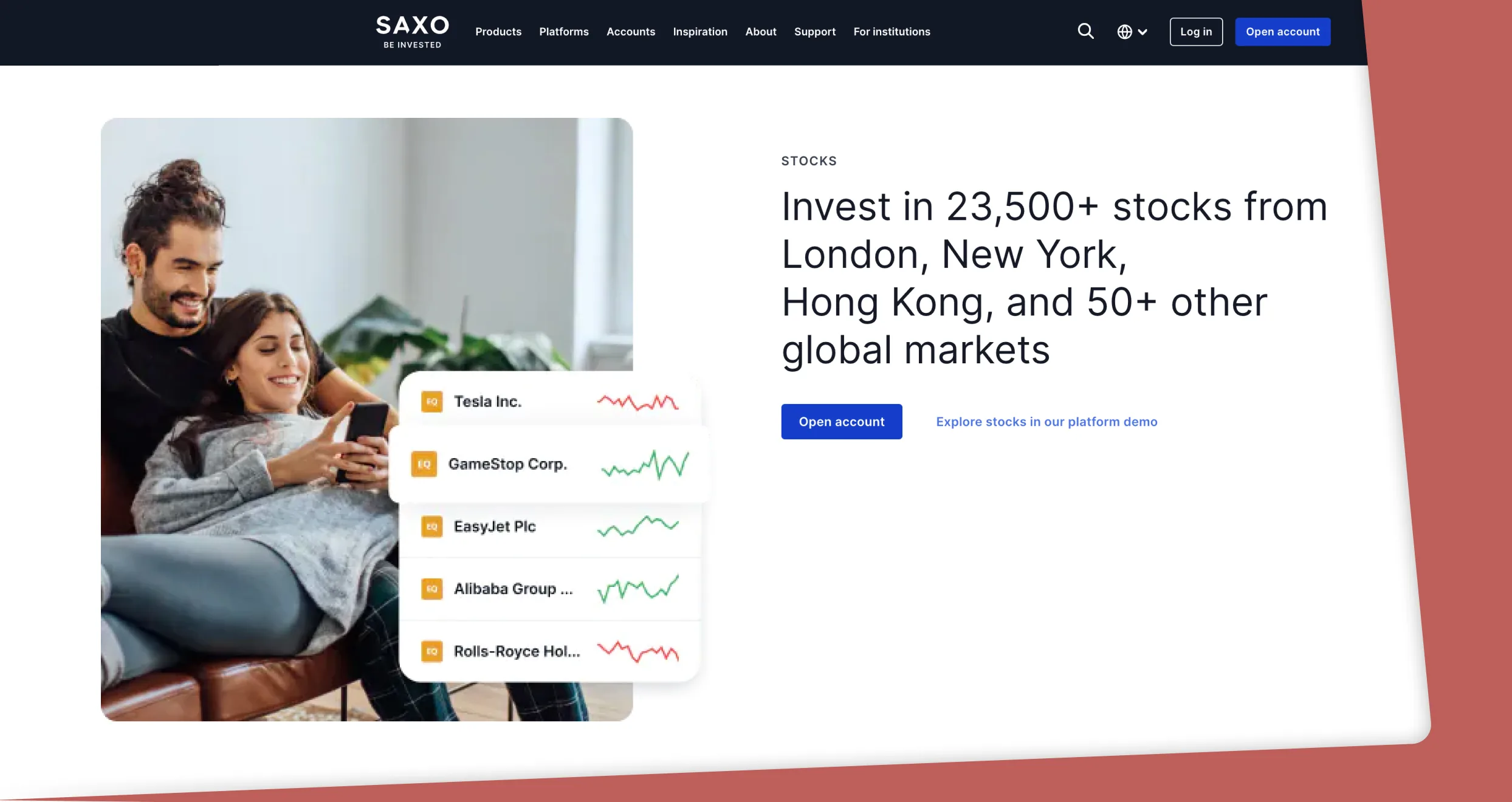

5. Saxo – Best Stock Broker for High-Net-Worth Individuals

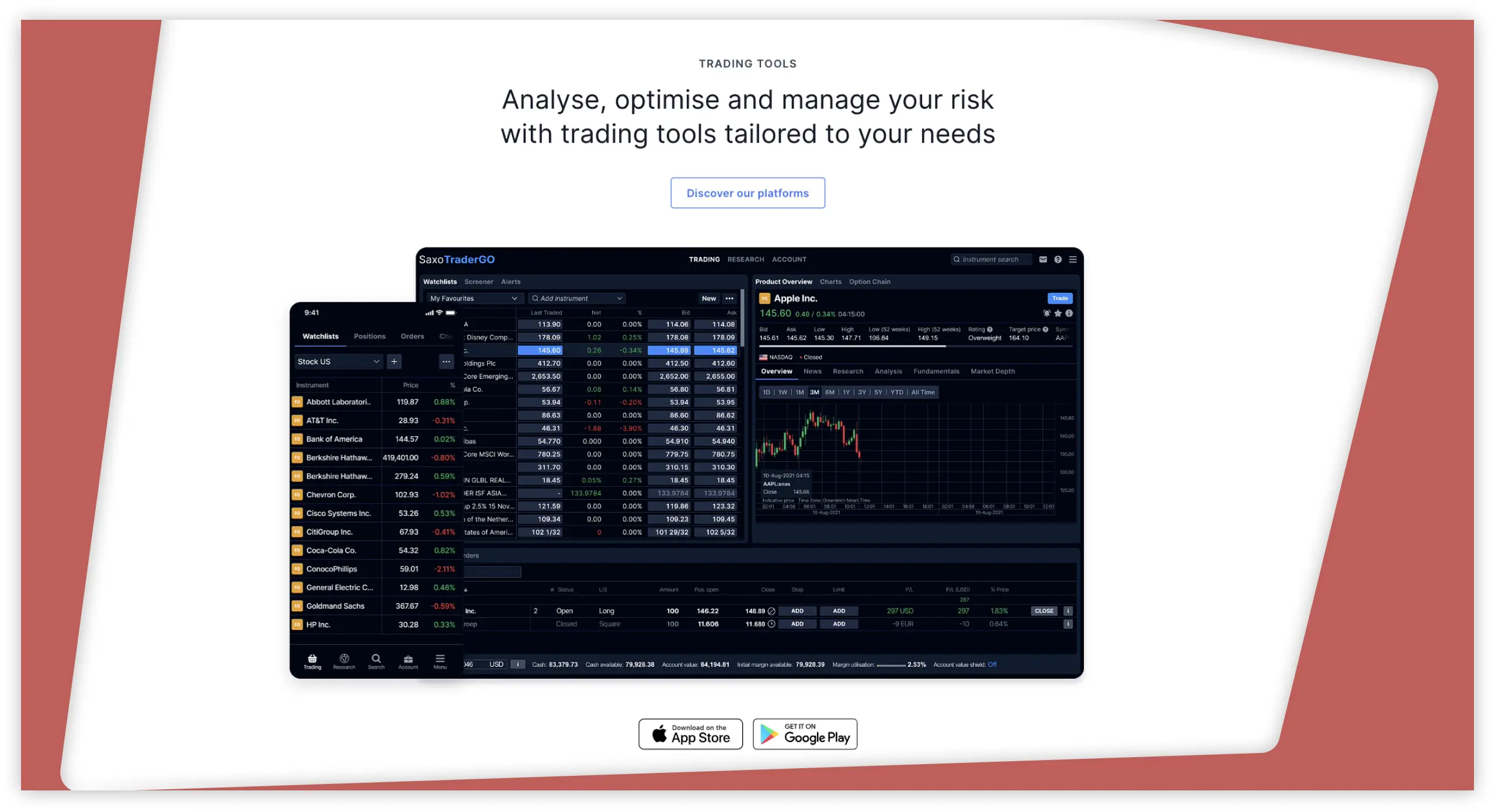

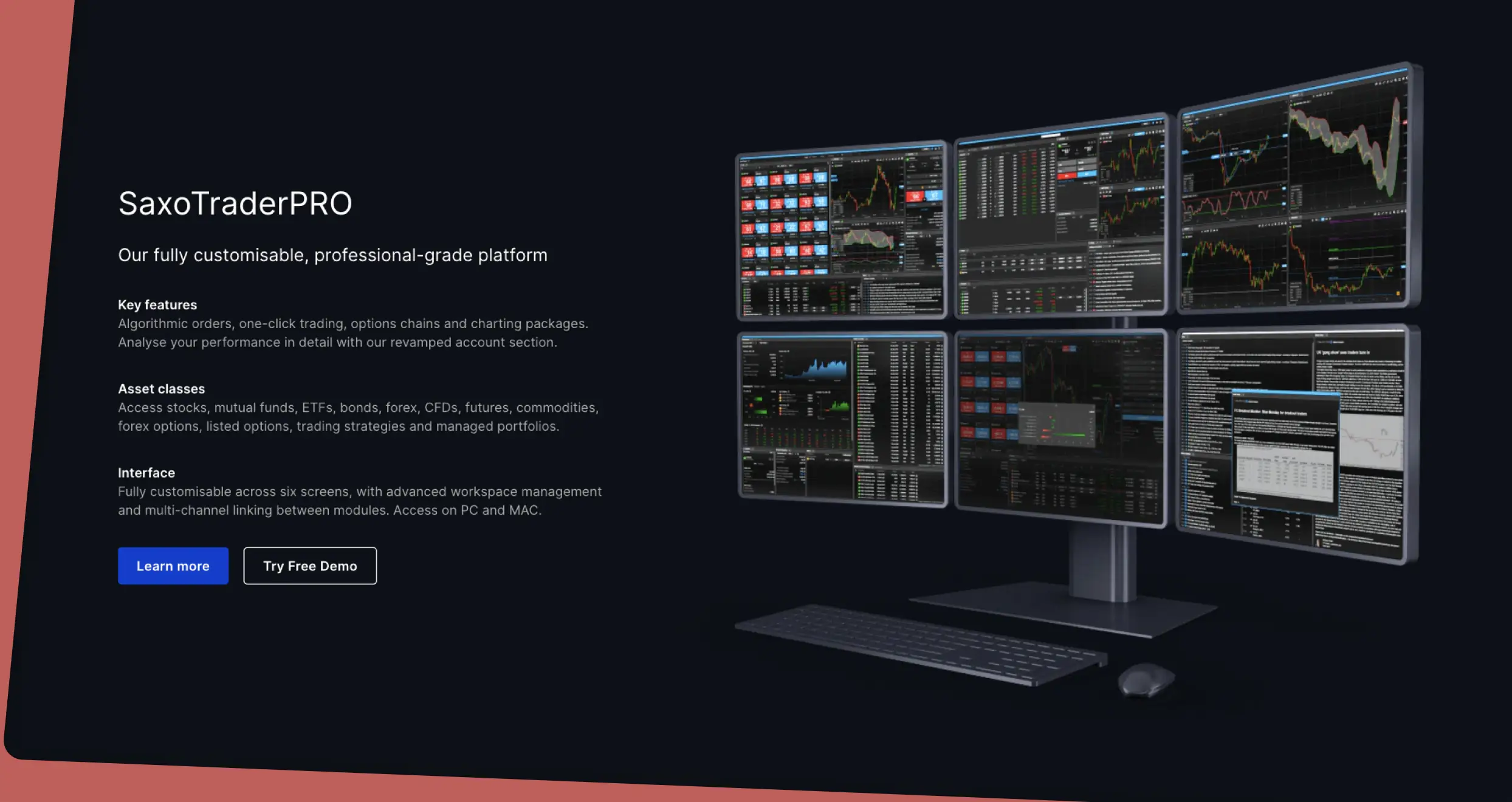

In my honest opinion, high-net-worth individuals should trade with Saxo. This broker has institutional-grade platforms perfect for such individuals, especially SaxoTraderPRO. This premium, fully customizable platform is equipped with countless high-performance trading tools, such as Depth Trader, option chain, and advanced trade ticket.

The other Saxo Platform I recommend to high-net-worth traders is SaxoInvestor. If you’d like to maximize profits and minimize losses with investment products, this is the right solution for you. With it, you can invest in many assets, including Australian stocks, international shares, ETFs, and bonds. The cherry on top of the cake is that you can access across multiple diverse devices, including your Android or iOS phone.

Not to forget, Saxo’s account system is primarily designed to reward high-net-worth traders. There are 2 accounts you can benefit immensely from as an affluent trader: Platinum and VIP. As a Platinum user, you’ll enjoy perks like low prices slashed by up to 30% and priority support in your local language. You can also join VIP, which comes with better boons, from the lowest prices to exclusive event invitations.

Pros

- Top offerings for high-net-worth traders and investors

- Over 8,600 CFDs on stocks, indices, and other instruments

- Allows traders to invest in stocks, bonds, etc.

- Competitive spreads and commissions

- No inactivity fee

- Excellent customer support services

Cons

- Premium accounts have enormous minimum deposit requirements

- Regular traders are exposed to higher fees

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

How to Choose a Stock Broker

While searching for the best stockbroker in Australia, I encountered over 100 service providers. Some of the platforms I encountered are nothing short of shoddy and untrustworthy. They have a long list of red flags, including hidden costs, lousy regulatory compliance, and slow support service. I pity anyone who’ll be unlucky enough to trade with unreliable providers. I’d like to help you avoid such providers and reap the benefits of trading with the best tool for trading stocks in Australia.

Avoiding unreliable service providers and finding a platform that will help your trading career is easy. You just have to gauge every broker you come across based on the following:

I always prioritize trading with licensed and regulated service providers because that’s indispensable in protecting my assets. I urge you to follow suit and check if every provider complies with rules and requirements set by authorities like SEBI, the FCA, and CySEC before signing up. Also, since you’ll share sensitive information like your identity and banking details while trading, ensure the software you trade with optimizes security with solutions like data encryption and 2FA.

Online reputation mirrors each service provider’s trustworthiness and reliability. Before using a stock trading platform, check what other traders have to say about it on popular sites and forums like Trustpilot. Never choose a service provider solely based on promises to deliver because brokers are out to make money, and they’ll say whatever is needed to get your attention. Do your homework and carefully review past user ratings and testimonials.

When it comes to hassle-free trading, you need a user interface that’s easy to navigate. Otherwise, a clunky UI will affect your ability to make faster, smarter decisions and make trading a nightmare, especially if you’re a newbie. Additionally, an interface that takes forever to respond limits your ability to capitalize on opportunities promptly and increase your returns. Before you commit to any platform, check how well-organized and responsive the UI is.

Costs can accumulate and reduce profits; I learned that the hard way. To avoid what I went through in my noob years, I evaluate every software’s fees before boarding. I advise you to do the same. Don’t overlook anything or focus only on upfront costs. Dig deeper and try to identify everything, including hidden charges and premium fees. Read every company’s fine print carefully because that is where some providers hide other costs.

Concerns and issues like prolonged transaction delays are common in stock trading. When they arise, and you need professional help, the assistance you get from your service provider will matter a lot. If you get prompt assistance, your problems will be fixed, and your experience will be enjoyable. But, if the broker’s representatives fail to respond promptly or provide ineffective solutions, you’ll end up stranded, and the problem might escalate. For this reason, I advise you to test every company’s customer support team before opening your account.

Before jumping into the exciting world of stock trading, you should zero in on what you want to achieve with your chosen tool. Is it to trade full-time, multiple times a day, or will trading be an occasional endeavor? Do you want a tool that will notify you whenever there’s a new opportunity or a tool for trading exclusively? Whichever goals you may have, I recommend looking for a trading platform that aligns with them.

How We Test

The entire Invezty fraternity is committed to helping you, our readers, find the best stock trading platforms in Australia. Our job often requires us to test hundreds of service providers, which can take an impressive amount of time and effort. But as difficult as that may sound, we don’t mind; we love doing it. It’s also easier for us since we’ve been trading for many years.

Our testing process is tailored to be thorough and conclusive. It entails gauging every service provider’s suitability based on a number of crucial factors, from regulation and licensing to ease of registration and account setup. We always use demo and live accounts while testing different providers to ensure we make fully informed recommendations.

Conclusion

Stock trading is a rewarding venture, but just like other forms of trading, it exposes you to significant risk. If you don’t want to lose your hard-earned money, manage your risk exposure as best as you can. First, budget and determine how much you can risk comfortably. And before you put your money on the line, ensure you have a steady source of income and enough money to cover vital expenses.

Great guide! It’s helpful to see top brokers like eToro and Interactive Brokers listed.

One thing missing from this review is mention of CommSec - yes, they're more traditional and expensive, but for Aussie blue chips they're rock solid and you actually own the shares (not CFDs). Worth considering if you're buy-and-hold rather than day trading.