Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Trading stocks in Canada requires a strategic plan and strategies to maximize your potential. Besides learning the market, it is crucial to choose the best stock broker with features aligning with your needs. Sadly, many traders and investors have challenges making suitable choices. The region hosts hundreds of brokers, some of which are fraudulent.

The good news is that we have listed the best stock brokers in Canada below. We conducted extensive market research and share below these brokers today. Our guide also sheds light on choosing the best broker. Plus, it explains the proper procedures to create a trading account and offers more advice on maneuvering the share market in the region.

In a Nutshell

- Stock trading involves the buying and selling of company shares, hoping to earn profits from the price difference.

- For traders looking to buy stocks in Canada, choose brokers with access to the Toronto Stock Exchange (TSX), NASDAQ, LSE, NYSE, and more.

- Canada’s stock market is dynamic, and share prices tend to change. As a trader, it is advisable to conduct market research before opening a live position.

- Choose a stock broker with features aligning with your needs. It should also allow you to trade stocks via derivatives like CFDs or indices.

- The best stock broker must be licensed and regulated by the Canadian Investment Regulatory Organization (CIRO) and the Canadian Securities Administrators (CSA). Such brokers offer a secure trading environment with favourable terms.

- Confirm the tax implications for trading stocks in Canada. You see, stock trading in the region is considered a business venture, and all the profits earned from the activity will be taxed and submitted to the Canada Revenue Agency (CRA).

- The Invezty team takes their research procedures seriously. We only recommend stock brokers that have met our stringent specifications.

List of the Best Stock Brokers in Canada

- AvaTrade – The Best Stock Broker For Mobile Traders in Canada

- XTB – Cheapest Stock Broker in Canada

- Axi – Best with no Minimum Deposit Requirement

- Interactive Brokers – Overall Best Stock Broker in Canada

- Saxo – Top Stock Broker For Professional Traders

- Forex.com – Best Stock Broker With a Wide Range of Learning Materials

Compare Canadian Stock Brokers

We spent hours in research, confirming various elements to ensure we left no stone unturned. We started by collecting over 100 stock brokers in the region. We prioritized their regulatory status, platform performance, trading tools availability, customer care, demo accounts, and more. The brokers also underwent multiple tests, and only those that met our strict criteria were shortlisted for our next procedure.

Besides testing the brokers, we visited Google Play, the App Store, and Trustpilot to analyze users’ testimonials. We combined our findings from user reviews with our test results to create this list of top stockbrokers.

See below our comparison table highlighting some of the features that made our recommended brokers stand out.

| Best Stock Broker Canada | Licence | Support Service | Software | Payment | Demo Account |

|---|---|---|---|---|---|

| AvaTrade | FCA, CySEC, ASIC, CIRO, FSCA | 24/5 | MT4, MT5, AvaSocial, DupliTrade, AvaOptions, AvaTradeGO | Bank transfers, e-wallets, Credit/debit cards | Yes |

| XTB | CIRO, FCA, CNMV, KNF | 24/5 | xStation 5, xStation Mobile | Credit/debit cards, e-wallets, bank transfers | Yes |

| Axi | FCA, ASIC, CySEC | 24/7 | MT4 | Credit/debit cards, PayPal, International bank transfer, Domestic bank transfer | Yes |

| IBKR | FSA, FCA, ASIC, FINRA, CIRO | 24/5 | Trader Workstation, IBKR Mobile, IBKR EventTrader, IBKR GlobalTrader, IMPACT | Bank transfers, e-wallets, credit/debit cards | Yes |

| Saxo | FSA, CIRO | 24/5 | SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer, Debit cards | Yes |

| Forex.com | FCA, CFTC, NFA, CIMA, CIRO, CySEC, FSA | 24/5 | MT4, MT5, TradingView | Bank transfer, Credit/debit cards, Skrill, Neteller | Yes |

Brokers Overview

Choosing the best broker for your stock trading needs is crucial to having an exciting experience and maximizing your potential. Besides security, many Canadian stock traders prioritize brokers they can afford. They also choose them based on asset offerings. This way, they can easily trade while diversifying their portfolios.

Below, we share overviews of our top stockbrokers’ fee structures and asset offerings. We hope the information will help you save time and make a suitable choice.

Fees

| Best Stock Broker Canada | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| AvaTrade | From 0.13% | C$300 | Free | C$50 quarterly |

| XTB | From 0.1 pips | C$0 | Free | C$10 monthly |

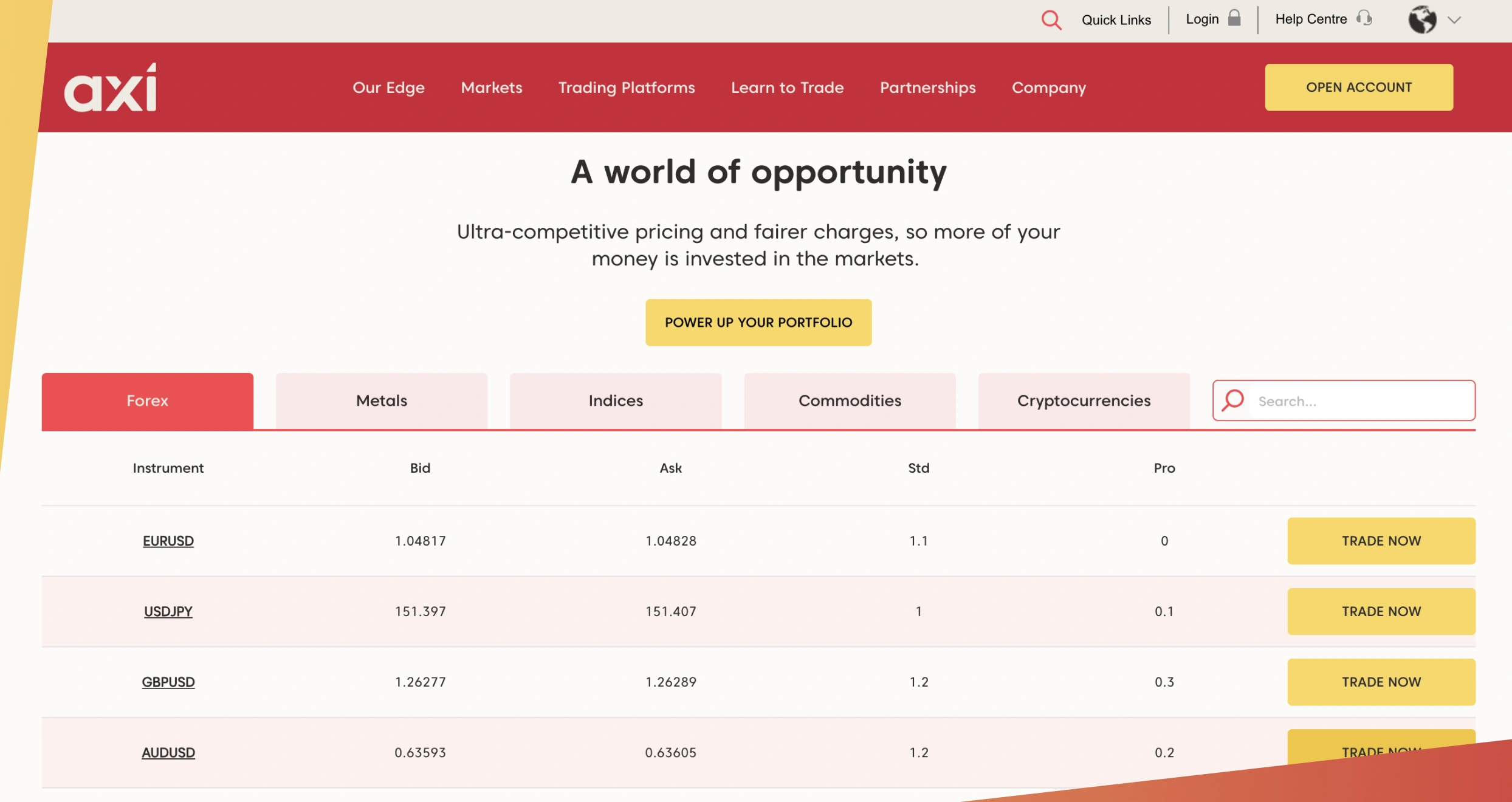

| Axi | From 0 pips* on Pro accounts | C$5 | Free | C$10 monthly |

| Interactive Brokers | From C$0.0005 per share | C$0 | Free | None |

| Saxo | From C$1 commissions | C$0 | Free | None |

| Forex.com | From 0.0 pips | C$100 | Free | C$15 monthly |

*Commission charges apply.

Assets

| Best Stock Broker Canada | Forex | Stocks | Commodities | Cryptocurrencies | ETFs | Options |

|---|---|---|---|---|---|---|

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | No |

| Axi | Yes | Yes | Yes | No | No | No |

| IBKR | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes |

| Forex.com | Yes | Yes | Yes | No | Yes | No |

Our Opinion about Stock Trading Platforms in Canada

Below, we share our overviews and opinions on the best stockbrokers in Canada. These mini-reviews are based on our hands-on experience. We aim to ensure our readers are fully informed regarding our top brokers’ features and make informed decisions.

1. AvaTrade – Top Stock Broker For Mobile Traders in Canada

Stock traders who are always on the move require a reliable trading app, and based on our experience, AvaTradeGO shines in this category. We noticed that this broker is one of the most highly rated by users on Google Play, the App Store, and Trustpilot. We also had a seamless experience with its app. All features are easily accessible and secured with passwords and face IDs. AvaTrade hosts over 1,000 stocks, including popular options like Tesla, Microsoft, Netflix, and more. The assets are available to trade as indices and CFDs.

When it comes to supporting traders, AvaTrade prides itself on hosting advanced resources on its MT4 and MT5 platforms. You can also take advantage of its social trading feature, whereby you get to interact with other global traders and mirror positions with increased profitability. For beginners, this broker offers learning materials plus a demo account to utilize as you build your skill level and confidence.

Pros

- A user-friendly and modern design stock trading app

- Features automated social and copy trading platform

- Quality trading tools on its advanced MT4 and MT5 platforms

- Reliable and responsive support service team

Cons

- Charges a $50 quarterly inactivity fee should your trading account stay dormant for over three months

- A high minimum deposit requirement of C$ 300 for Canadian clients

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

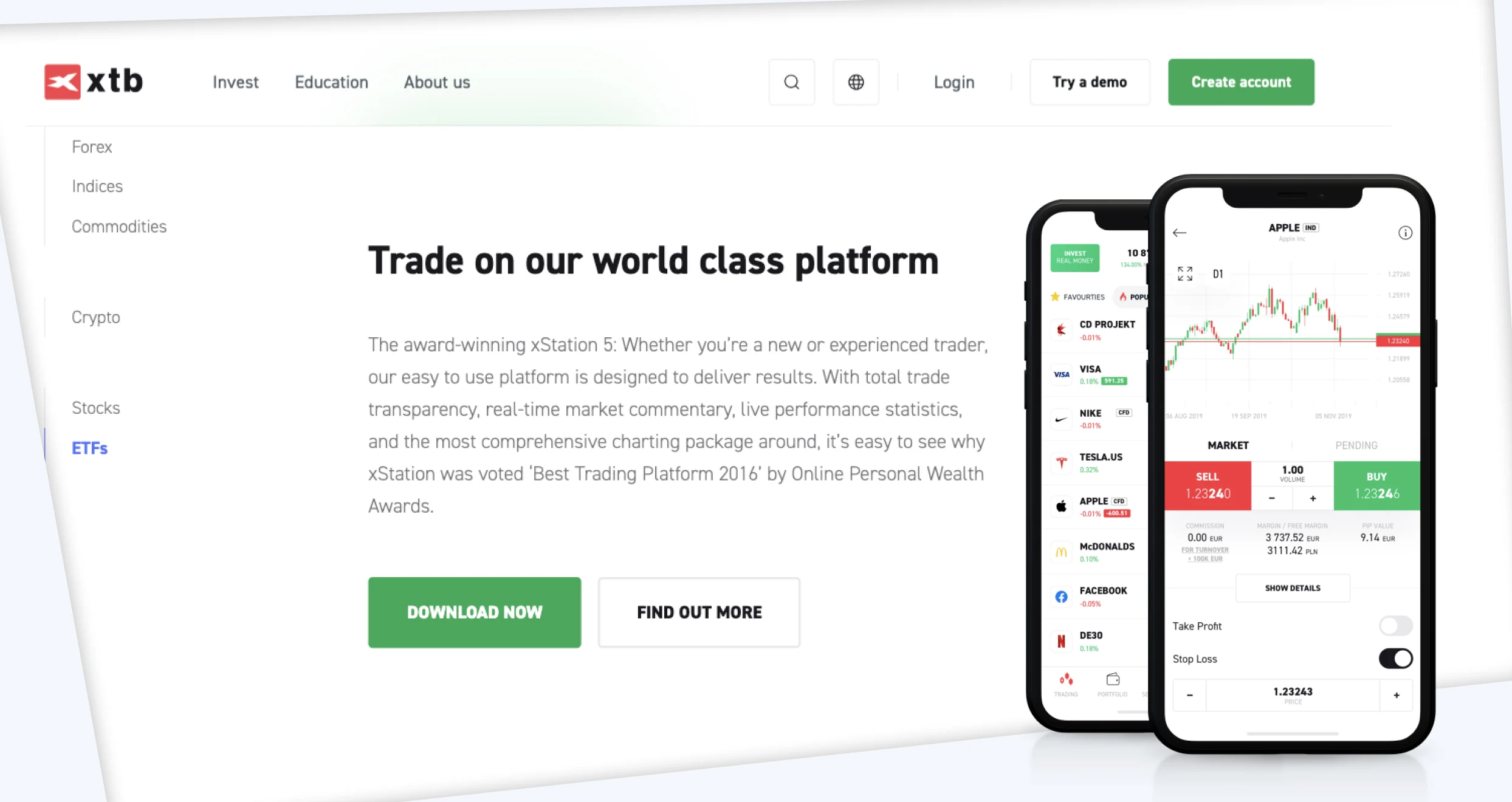

2. XTB – Cheapest Stock Broker in Canada

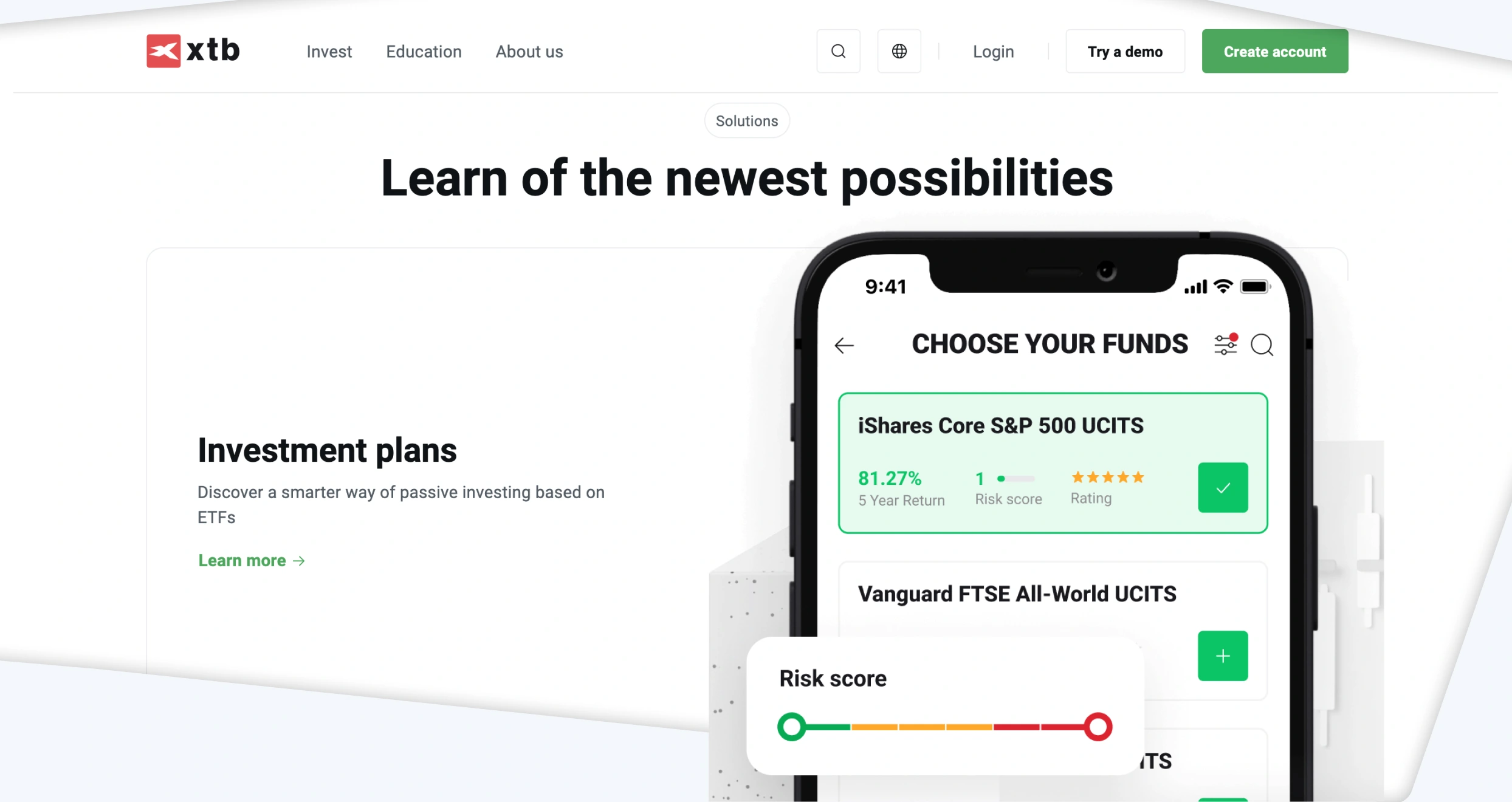

We like XTB because it has the interest of low-budget traders in Canada at heart. We explored its fee structure and noticed that there is no minimum deposit requirement or transaction costs for deposits and withdrawals. Moreover, XTB’s stock trading attracts low commissions, from C$0. We believe it is the best platform for newbies who are still skeptical of diving into stock trading with large capital.

Stock trading at XTB was seamless, and we explored over 3,600 shares listed across 16+ exchanges. What’s more interesting is that the broker lists additional asset classes, which you can take advantage of for portfolio diversification. Besides listing quality learning materials on its XTB Academy platform, the broker offers users an opportunity to earn up to 5% interest on uninvested funds. The rate goes up to 4.2% for EUR balances and 5% for USD.

Overall, XTB stands out as one of the most reliable low-budget brokers, offering a user-friendly experience for traders at any level.

Pros

- No minimum deposit requirement

- Commission-free stock trading with low spreads

- Free deposits and withdrawals

- Quality learning and market analysis tools on its xStation 5 and xStation Mobile platforms

Cons

- You can only trade stocks as CFDs

- No third-party platforms like the MT4 and MT5

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

3. Axi – Best with no Minimum Deposit Requirement

Traders who are skeptical of making large deposits should consider Axi. After thoroughly testing it, I noticed that it has no minimum deposit requirement and users can get started with as little as C$5. The best part is that deposits and withdrawals are supported via multiple payment methods, including Skrill, PayPal, bank transfers, credit/debit cards, and more.

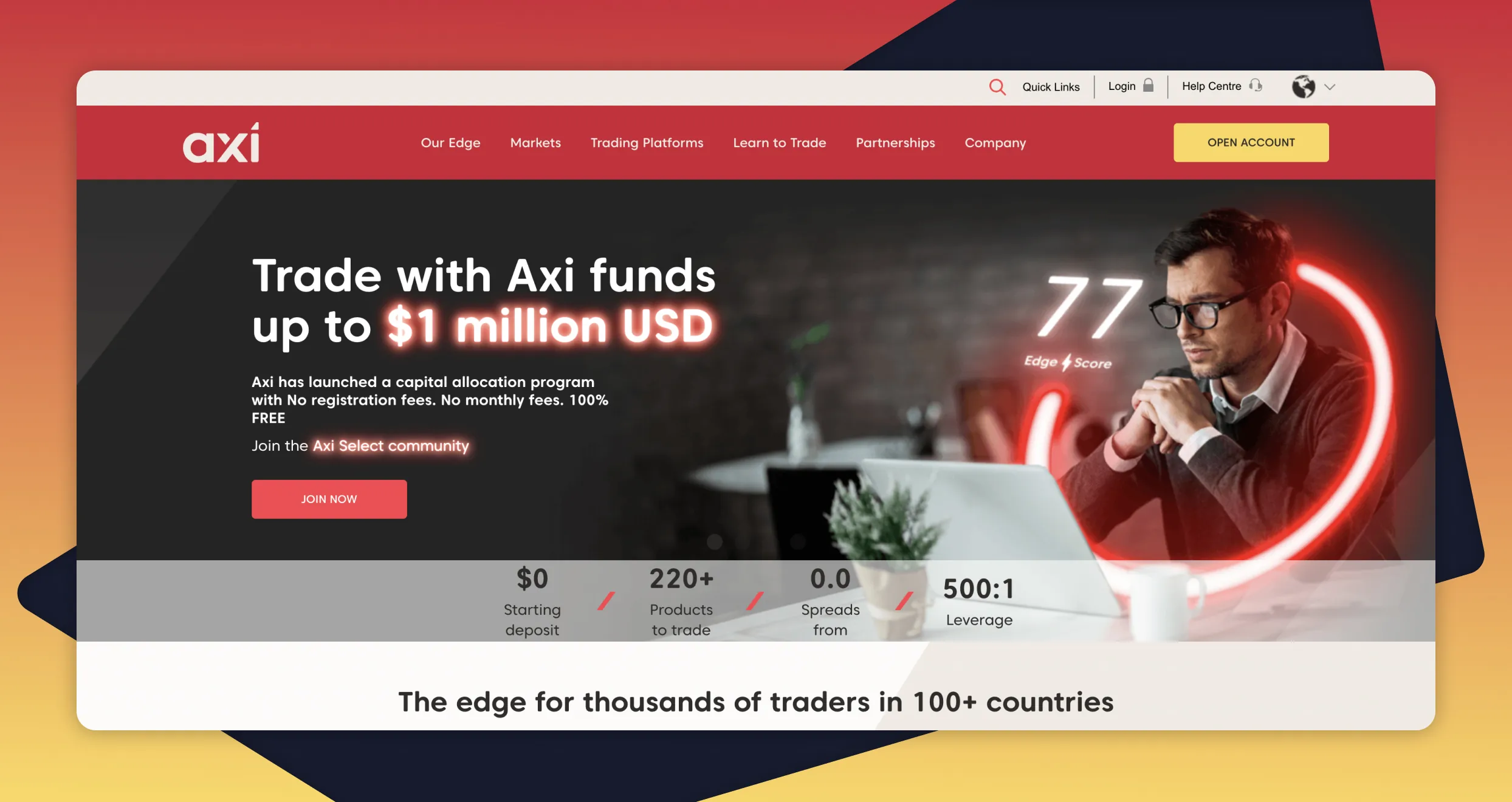

My tests discovered that Axi offers access to some of the most popular global stocks. There are over 100 options from the UK, the US, and European countries. It also lists some of the latest IPOs, which you get to trade commission-free. And if you are into trading portfolio diversification, additional asset classes are at your disposal. These include forex, commodities, indices, cryptos, and more. Axi hosts three accounts to suit all types of traders. There are the Standard, Pro, and Elite, all with quality trading tools. I love that it features copy trading, allowing users to follow the most professional traders and mirror their positions to maximize their profitability. And if you want to manage larger positions with a small capital, this broker has an Axi Select funding program, with generous funding up to C$1 million.

Pros

- Lists over 100 stocks and IPOs to trade as CFDs

- Has an “Axi Select” feature that allows you to manage larger positions with a small capital

- Free deposits and withdrawals across multiple payment methods

- Commission-free stock trades with low spreads

- Offers access to advanced trading tools, including Autochartist, TradingCentral, and MT4 Forex VPS hosting

Cons

- Supports only CFD trades

- The Elite account has a high minimum deposit requirement of C$25,000

Promoted by AxiTrader Ltd. CFDs carry a high risk of investment loss. Not available to AU, NZ, EU & UK residents. Spreads and other fees apply.

The Axi Select program is only available to clients of AxiTrader Limited. CFDs carry a high risk of investment loss. In dealings with you, AxiTrader acts as a principal counterparty to all of your positions. AxiSelect is not available to residents of AU, NZ, EU, and the UK. For more information, please refer to the AxiSelect Terms of Service.

The Axi Copy Trading App is provided in partnership with London & Eastern LLP.

4. Interactive Brokers – Overall Best Stock Broker in Canada

Interactive Brokers (IBKR) features amazing trading tools that we believe will give all types of stock traders and investors an exciting experience. While trading with it, we loved its user-friendly interface, especially on the GlobalTrader app. Plus, the broker has no minimum deposit requirement, and stock trading attracts low commissions from C$0.0005 per share.

We like that IBKR lists over 10,000 global stocks across 90+ markets. We invested in popular companies like Tesla, Microsoft, NVIDIA, Google, and more. When it comes to market analysis tools, IBKR hosts plenty of options on its IBKR Desktop, IBKR Mobile, and IBKR Trader Workstation (TWS) platforms. Beginners also have an opportunity to advance their skills using this broker’s learning materials on its IBKR Campus. You will then gauge your skill level on its Free Trial account before transitioning to live trading.

Pros

- Allows users to buy and sell global stocks, even in fractions

- Low stock trading commissions on its IB SmartRouting platform

- Quality trading tools on its powerful IBKR Mobile platform

- Offers traders an opportunity to earn interest of up to USD 4.83% on their instantly available cash

- Low margin rates from as little as USD 5.83% to USD 6.83%

Cons

- No third-party platforms like MT4 and MT5

- Newbies might find the desktop platform challenging to navigate

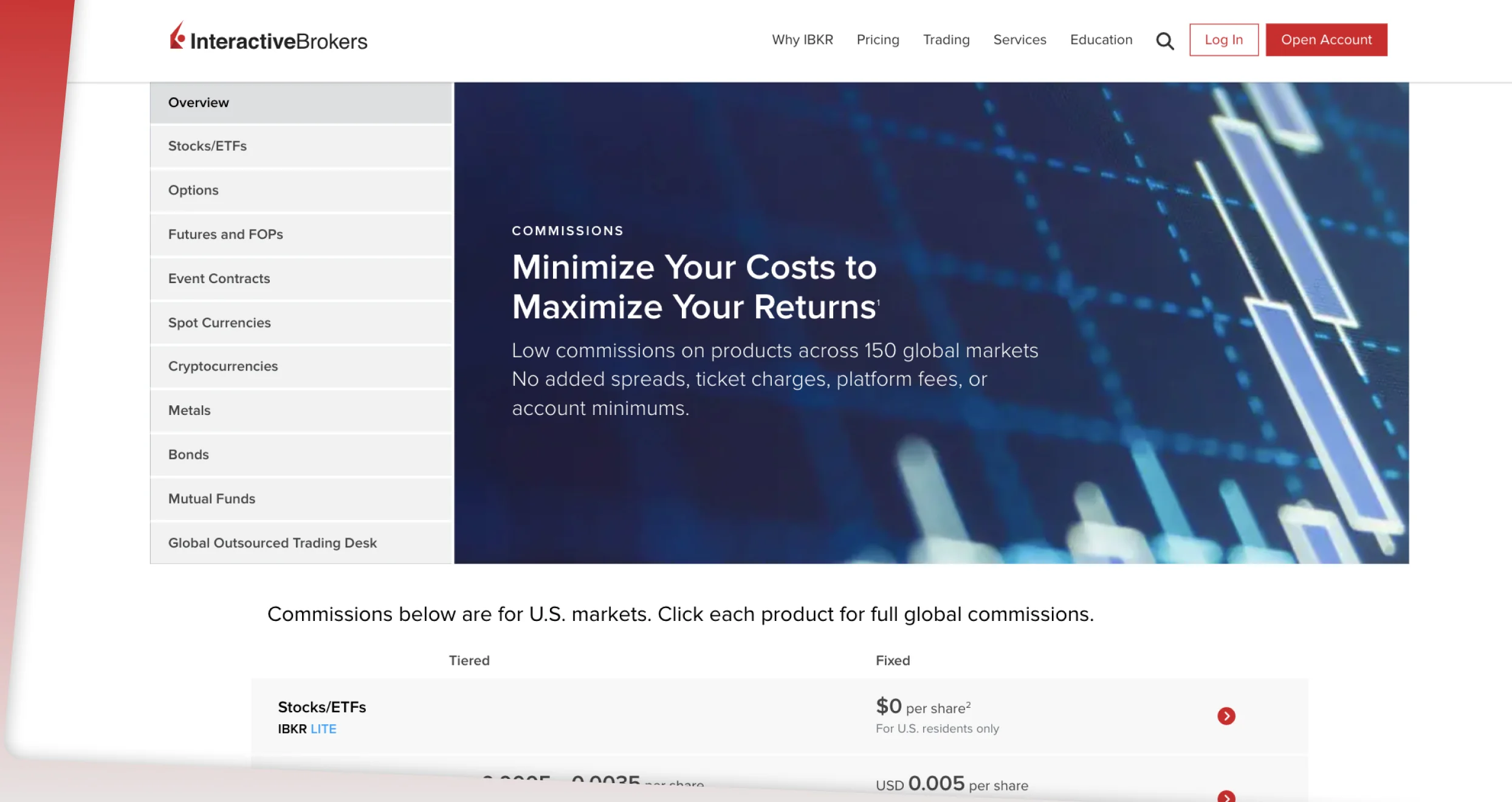

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

5. Saxo – Top Stock Broker For Professional Traders

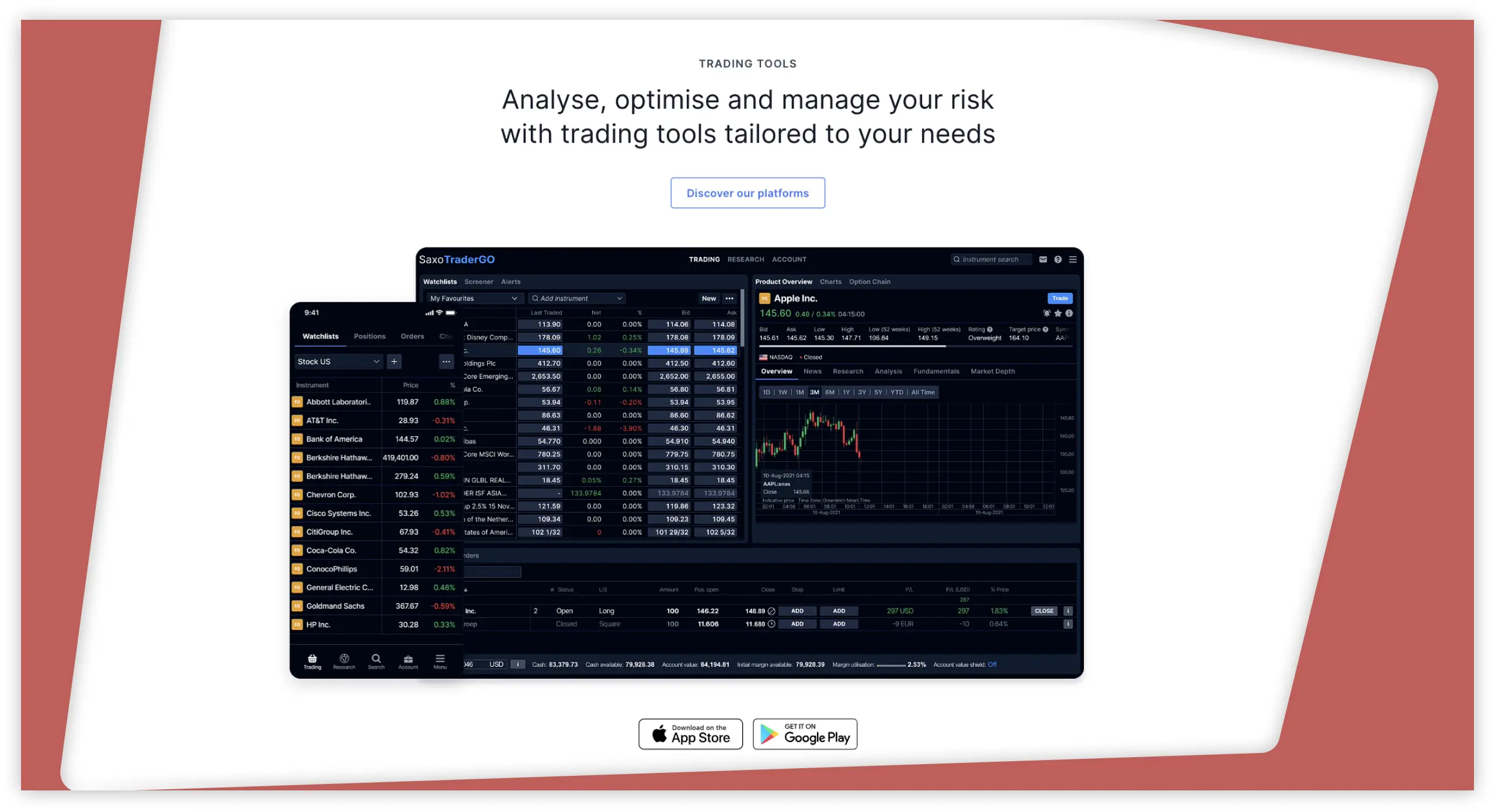

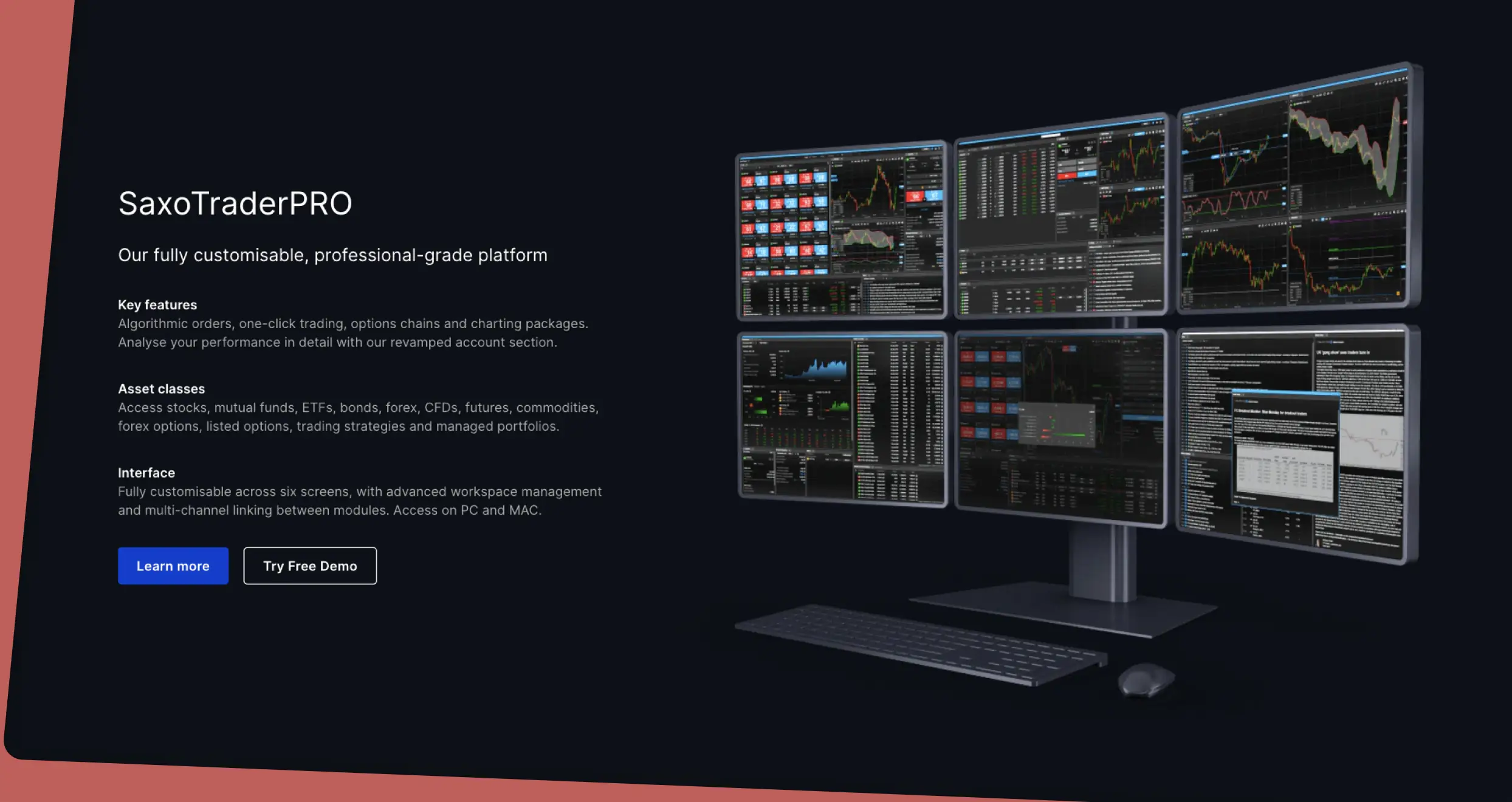

Saxo has proven reliable for traders looking for advanced resources. Although it does not partner with third-party platforms like cTrader and MT5, its SaxoTraderPRO and SaxoInvestors platforms feature some of the best resources for technical and fundamental analysis. We also noticed that the stock broker is user-friendly, and getting started does not require a minimum deposit.

Regarding stock offerings, this best stockbroker in Canada lists over 23,500 options from 50+ global markets. The best part is that you can buy the shares with as little as C$1. Plus, it supports fractional share purchases and CFD trading for those who are not willing to buy the assets and take full ownership. Other features we like at Saxo include offering users an opportunity to earn interest on loans, additional assets, quality learning tools, and more.

Pros

- Allow Canadian traders to buy, sell, and trade stocks as CFDs

- Quality learning and market research tools

- No minimum deposit requirement for Canadian traders

- A wide range of stocks and additional securities to explore

Cons

- Stock trading fee is higher compared to its peers

- No third-party platforms like the MT4 and MT5

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

6. Forex.com – Top Stock Broker With a Wide Range of Learning Materials

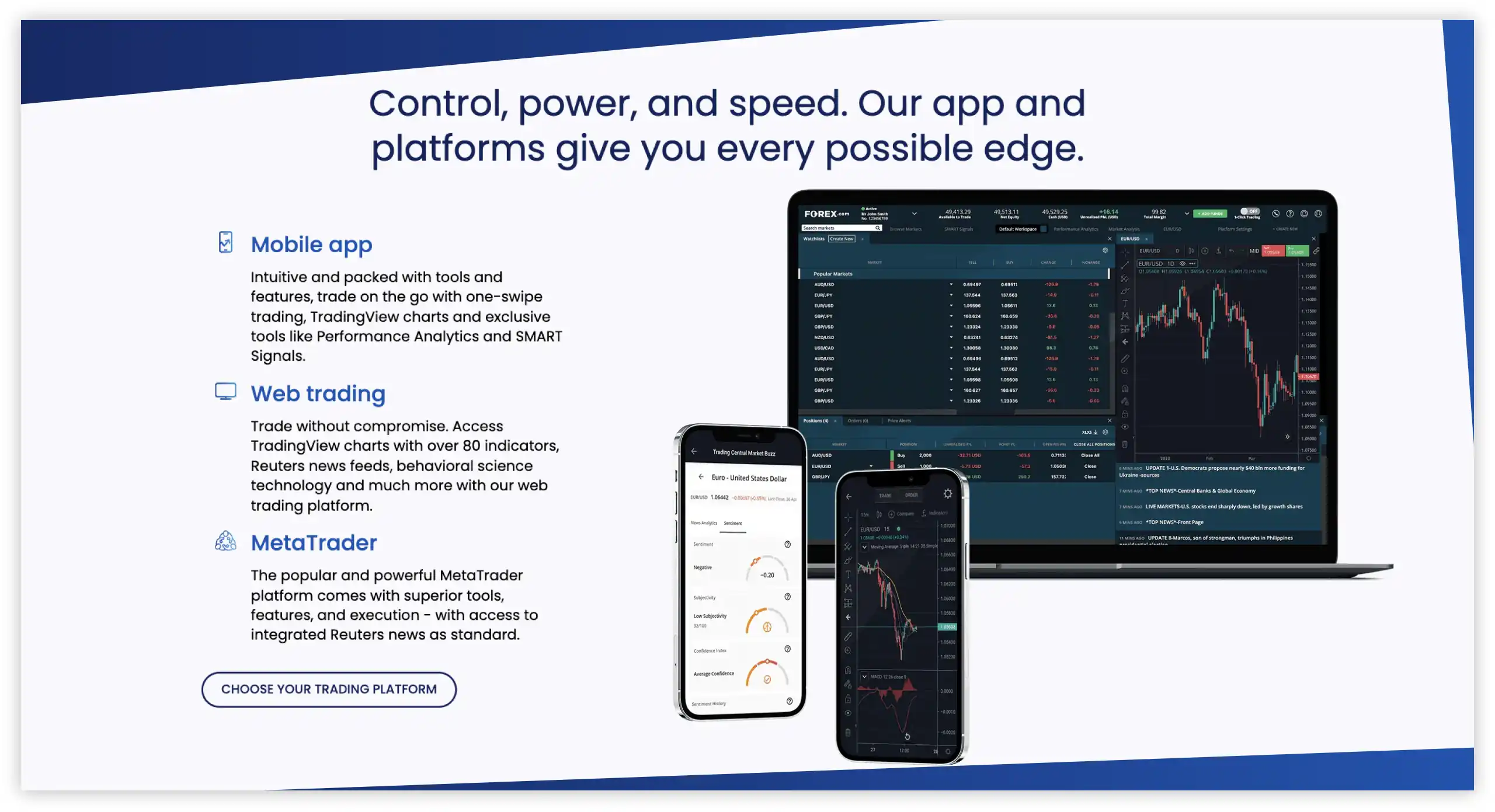

Whether you are a beginner or an intermediate stock trader looking to advance your skills, Forex.com can be an excellent choice for you. We discovered plenty of learning tools, including guides, articles, videos, webinars, seminars, and more. Plus, the broker has an efficient and responsive support service team to cater to your needs in case you need personalized assistance. It also has a virtually funded demo account to gauge your skill level before transitioning to live trading.

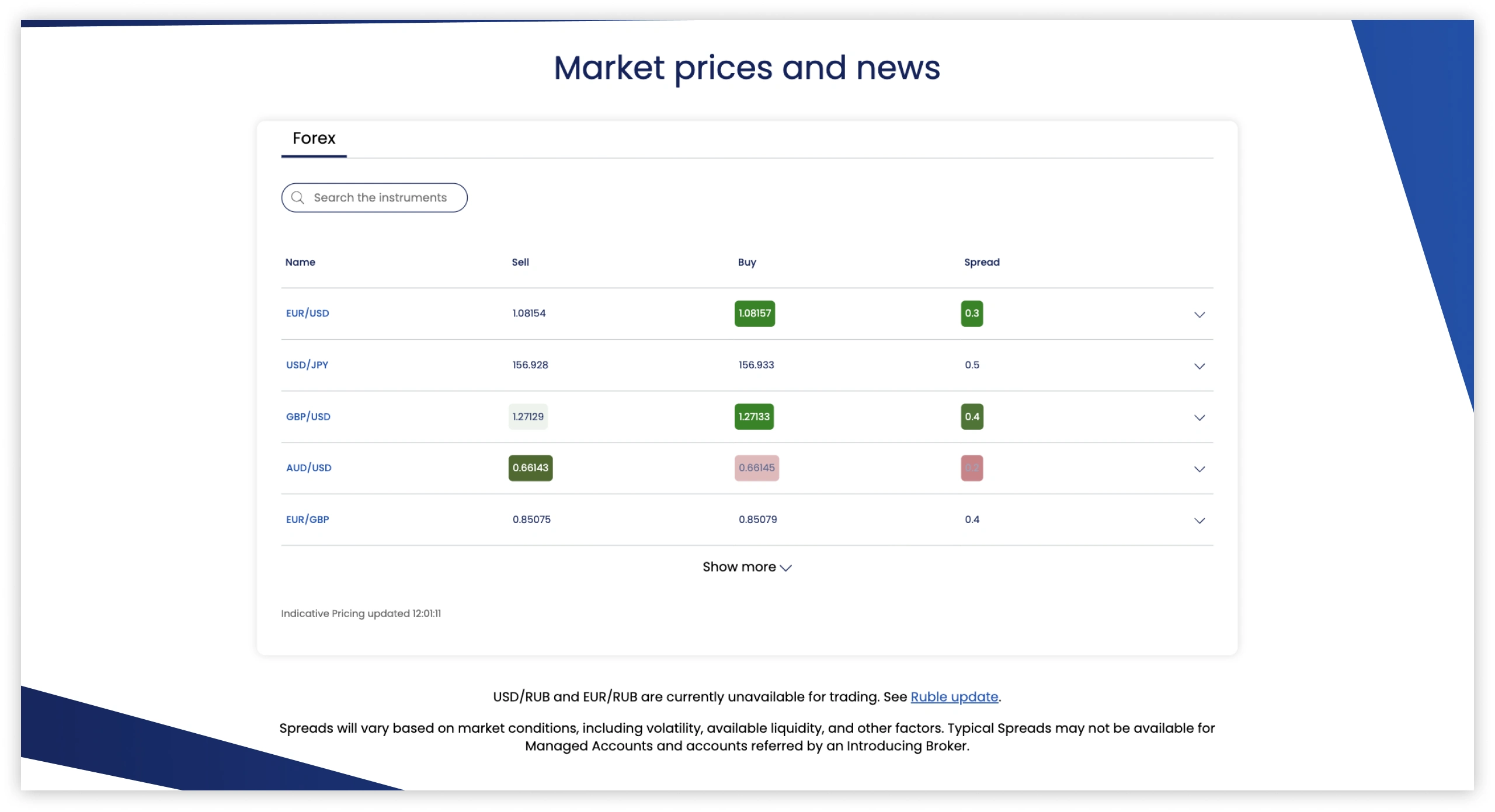

Note that creating an account with Forex.com is a straightforward procedure, and you only need C$100 as the minimum deposit. You will enjoy over 2,500 stocks for CFD and index trading, allowing you to discover the best trading method for your skill level. For traders looking to diversify their stock trading portfolios, Forex.com hosts additional asset classes to choose from. Furthermore, it is a top broker for forex trading and offers access to its MT5 and TradingView platforms, known to host quality indicators, chart types, timeframes, and more.

✔Zero fees for card deposits and card withdrawals

✔A broad range of trading platforms, including MT4 and 5

Pros

- Hosts a virtually funded demo account for beginners to get started with

- Quality learning materials on its Academy platform

- Low minimum deposit requirement of C$100 for Canadian traders

- Advanced trading platforms, including TradingView and the MT5

Cons

- You can only trade stocks as CFDs

- Limited stock offerings compared to its peers

The best decision you can take as a trader is to join a platform with friendly, transparent fees. Luckily, Forex.com values transparency and cost-friendliness. We tested this broker using Standard and RAW Spread accounts. Here’s what we found out.

First, you must fund your account before trading live with this broker. When doing that, keep in mind that Forex.com’s minimum deposit is $100. Therefore, your first deposit should be $100 or higher. But don’t worry about deposit charges. Forex.com charges zero fees for incoming deposits from bank transfers and debit cards.

The other costs and charges you will incur while trading with Forex.com depend on your preferred account. The costs associated with standard accounts are included in the bid/ask spread. A Standard account’s spreads start from 0.8 pips. Additionally, this account will only require you to pay commissions if you invest in equities. But the good news is that Standard account owners can earn cash rebates on cryptos, equities, FX, and other assets.

If you go with a Forex.com Raw Spread account, you will enjoy commissions as low as $5 per $100k you trade. This account also allows you to lower your trading costs with cash rebates of up to $50 for every $1 million you trade. Furthermore, with it, you can trade FX majors and enjoy tight spreads starting from 0.0.

Commissions and rebates aside, Forex.com levies rollover fees for positions held overnight. The exact rollover rates vary depending on factors like the prevailing market conditions. Furthermore, this broker requires dormant account owners to cover a $15 monthly inactivity fee. The last fee kicks in after an account has remained inactive for 12 months.

Stock Trading in Canada

Stock trading in Canada continues to gain popularity, considering it has proven lucrative. The market is dynamic, meaning that the stock’ prices tend to change depending on various factors. As a trader, it is crucial to choose a company stock you are familiar with and track its performance. This way, you can easily identify the best entry points that may bring about good profits.

Company stocks for purchases are listed on various global exchanges, including the TSX, LSE, NASDAQ, and more. You can easily access these shares via brokerage firms with access to these exchanges. The best element about using brokers for stock trading in Canada is that they support fractional share purchases. Plus, you can opt to trade them as derivatives, whereby you only speculate on the assets’ price movements and benefit from the price differences.

As we had mentioned earlier, the Canadian online space hosts many stock brokers, some of which are scrupulous. To ensure safe trading and investing, settle with a broker licensed or regulated by the Canadian Investment Regulatory Organization (CIRO) or Canadian Securities Administrators (CSA). These authorities are responsible for overseeing brokerage firms and ensuring compliance with stringent rules. They protect traders and investors from fraud and misconduct.

Overall, always be prepared with solid plans and strategies before engaging in stock trading in Canada. Plus, you must understand your tax obligations since the activity is considered a business venture and there are rules governing capital gains and dividends income. The profits you earn from stock trading must undergo tax deductions by the Canadian Securities Administrators (CSA).

How to Choose the Right Stock Broker in Canada

Whether you are a beginner or a professional stock trader, choosing the best stock trading platform in Canada is crucial. Various elements must be considered, and we share them below to ensure you save time on research.

Above all, always confirm the regulatory status of a stock broker in Canada. The region is dominated by a multitude of brokerage firms, some of which have no good intentions. They are mere scammers trying to lure innocent traders to their platforms, only for them to get scammed.

That being said, the best stock broker Canada must be licensed and regulated by the Canadian Investment Regulatory Organization (CIRO) and Canadian Securities Administrators (CSA). Such brokers secure your funds in segregated accounts and offer favourable trading conditions. You should also confirm the encryption technology of a broker and whether they provide additional security measures like two-factor authentication, passwords, and more.

Trading and non-trading fees vary with brokers, and you must choose the one you can afford for an exciting experience. Therefore, confirm your stock broker’s minimum deposit requirement, spreads/commissions, inactivity fees, financing costs, and more. This will help you easily budget for your activities, knowing you are trading stocks with funds you are comfortable losing.

The best stock trading platform Canada must host your preferred company stocks listed on various global exchanges. It is advisable to consider one with additional securities, including forex, commodities, cryptos, and more, for efficient portfolio diversification. Most importantly, confirm the supported trading methods for the featured assets. You should also be able to trade stocks as derivatives like CFDs and indices or buy them physically.

Canadian stock brokers with user-friendly platforms are worth considering since you are guaranteed a seamless experience. Plus, the broker should have a fast trade execution speed and host quality trading tools. For beginners, confirm the availability of a demo account and learning materials to ensure you get started on a good note. Trading app availability is also a crucial element to prove. You will efficiently manage your activities when you leave your trading station.

Choose a stock broker with a reliable support service team. The last thing you want is to get stuck in your activities simply because a broker’s customer care team is unable to promptly respond to your questions or concerns. You can try contacting the broker’s team and gauge their response rate. Also, its availability, whether 24/7 or five days a week, must align with your trading schedule.

Just like we did in our research process, go to Google Play, the App Store, and Trustpilot to learn what other users think about a stock broker in Canada. Sample as many comments and ratings as possible to understand the stock broker’s strengths and weaknesses from a user perspective. You should then be able to decide whether it is worth committing to.

How To Register an Account with a Stock Broker in Canada

Registering for a stock trading account in Canada may seem like an overwhelming process, especially for newbies. However, it involves simple steps that will take a few minutes to complete. This is, of course, if you use a CIRO or CSA-regulated broker. Let’s dive into these procedures and learn how to create a stock trading account with a broker in Canada.

If you have chosen a stock broker from our recommendations list above, click on any of the broker’s links we share on this page to quickly access its website. On the site, read and understand the broker’s terms of service to avoid future inconveniences. It is also advisable to download its app on your iOS or Android mobile device. This will allow you to efficiently manage your activities whenever you are on the move.

Click the “register” or “sign up” button on your broker’s website to start creating a trading account. You will share your personal details for this procedure. These include your name, email, location, source of income, and more. You must also create a unique username and password for additional security to your trading account.

It is a standard protocol for all Canadian-regulated brokers to verify traders’ and investors’ identities and locations. This procedure ensures the online trading environment remains safe and free from imposters. Therefore, your broker will verify your account after you share a copy of your ID card and a recent utility bill. They may also accept copies of driver’s licenses and bank statements if you do not have an ID or a utility bill.

Once your account is verified, your broker will email you a notification. Proceed to deposit funds per its minimum deposit requirement. The broker you trade stocks with must accept deposits using multiple methods, including bank transfers, credit/debit cards, and e-wallets. This way, you can transact with the most convenient ones that guarantee efficiency.

Your broker will confirm your deposit and automatically redirect you to its featured stocks to trade. Choose a trade size and a trading method, whether derivatives or physical purchases. You should then open a position and apply risk management controls to mitigate massive losses in case a trade fails to work in your favour.

For beginners, start stock trading with your broker’s demo account. This account is risk-free and is virtually funded to ensure you are well-prepared to take a risk in live trading.

Conclusion

Identifying a suitable stockbroker is challenging. However, our guide above will ensure you make the best choice and kickstart your ventures on a good note. As experts with decades of experience, we advise you to start slowly while building your portfolio as you become familiar with the stock market. Do not trade based on emotions, as it may lead to bad decisions. And if you are trading stocks as CFDs, understand that over 76% of traders lose money with this trading method. Therefore, conduct a thorough market analysis for solid strategies to maximize your potential.

Great info! Just remember, always do your research and stick to a plan that suits your risk level. Don’t rush into trading—take your time to learn and understand each broker before committing.