Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Stock brokers are in plenty in Europe. They all promise exceptional experiences to European traders, but we know very few can deliver. And those few brokers are the ones you should be interacting with. But how can you identify them when so many service providers are up and running today? Well, you don’t have to worry about fishing them out from the crowd since we’ve done that for you.

We sent our experts on one crucial mission: to compare European stock brokers and isolate 5 that deserve your money and attention. After many days of research and evaluation, our gurus singled out what we needed based on qualities like security, charges, and reliability. Use our insights and opinions based on first-hand experience to find a stock broker that’ll fuel your rise to success.

In a Nutshell

- Finding a good stock broker in Europe, where hundreds of service providers are available, is daunting.

- Our experts have made this task easier for you by vetting European stock brokers and cherry-picking 5 providers that deserve mentioning.

- While searching for the best European stock brokers, we considered licensing, fees, customer support, and many other indispensable elements. You should follow suit.

- For safety and security purposes, prioritise trading with a platform regulated by the FCA, CySEC, and other authoritative bodies in Europe.

- Trading is risky. Ensure you have sufficient knowledge and learn how to manage your risk exposure before putting your hard-earned cash on the line.

List of the Best Stock Brokers

- eToro – Best Overall Stock Broker in Europe

- FP Markets – Best Stock Broker for Trading Stock CFDs

- Pepperstone – Best Stock Broker for Professionals

- AvaTrade – Best Stock Broker for Beginners

- XTB – The Best Stock Broker for Low Trading Costs

Compare Stock Trading Platforms in Europe

Stocks are a popular investment vehicle in Europe, and brokers are capitalizing on this trend. Today, many brokerage firms allow Europeans to trade stocks and stock CFDs. We researched these entities and picked the most reliable ones. Then, our team tested these entities and selected 5 that were truly outstanding. While isolating the best from the rest, we considered factors like regulation, platform performance, and fees.

Besides researching and testing European stock trading platforms, we also factored in user reviews and testimonials while choosing the brokers to include in our guide. We got ratings and feedback from Trustpilot, the App Store, and Google Play. They helped us understand other people’s opinions and experience interacting with different European stock brokers.

Here is a comparison table highlighting the elements we considered while picking the best stock trading platform in Europe.

| Best Stock Broker Europe | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| eToro | FCA, CySEC, FSCA, ASIC, SFSA ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| FP Markets | FCA, FSCA, ASIC, CMA, CySEC, FSA | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes |

| Pepperstone | FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin, | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| AvaTrade | FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | |

| XTB | FSCA, ASIC, CySEC, FSA, FCA | 24/5 | xStation 5, xStation Mobile | Neteller, Credit/debit cards, Bank transfer, Skrill, PayPal | Yes |

Brokers Overview

As traders, we prefer brokers with affordable fees because we know that high costs erode our profits. We also prioritise trading platforms that offer the financial instruments we need. The chances are high that you will do the same. That is why our experts also checked fees and assets while selecting the best stockbroker in Europe.

This comparison table will give you a sneak peek into what to expect from the stock brokers reviewed here.

Fees

| Best Stock Broker Europe | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| eToro | £100 | From 0% | £5 withdrawal fee | £10 monthly |

| FP Markets | £100 | From 0.0 pips | Free | £0 |

| Pepperstone | £0 | From 0.0 pips | Free | £0 |

| AvaTrade | £100 | From 0.13 pips | Free | £50 after every 3 consecutive months of inactivity |

| XTB | £0 | From 0% | Free | £10 monthly |

Assets

| Best Stock Broker Europe | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes | Yes | No |

Our Opinion about European Stock Trading Platforms

The best European stockbrokers suit traders who value security and safety. NCAs like the FCA regulate them, which means their operations are monitored closely. The integrity and reliability of these platforms are unquestionable. But we want you to make your own decision after checking out what we discovered while exploring these service providers.

Not that we compiled the following reviews after days of research and analysis. Our insights come from first-hand experience and are unbiased. We don’t favour any stock brokers. Our primary objective is to inform and equip you with the insights you need to find the best stock trading platform in Europe and avoid shoddy companies.

1. eToro – Best Overall Stock Broker in Europe

We consider eToro the best stockbroker for Europeans for multiple solid reasons. First and foremost, unlike many trading platforms that offer share CFDs exclusively, eToro allows investing in real stocks and fractional shares. These come from some of the most successful companies in the world, from Microsoft and Meta to Nike and Starbucks.

The other aspect that makes eToro the best overall is affordability. This stockbroker doesn’t charge commissions for trades and investments involving stocks. What’s more, it has a reasonable minimum deposit and free deposits.

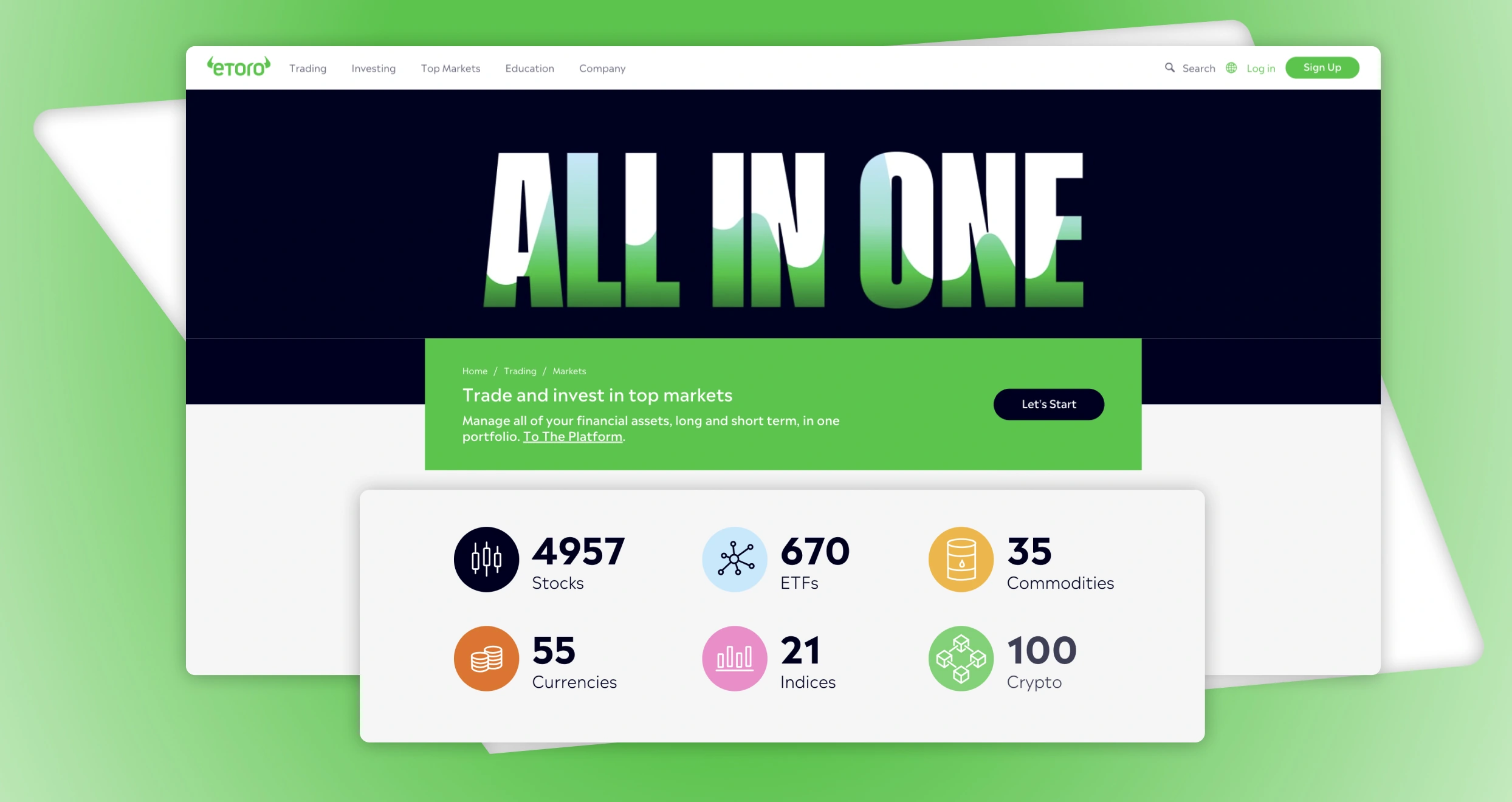

When it comes to supporting diversification, eToro provides many juicy options. They range from investing in crypto and ETFs to trading CFDs on currency pairs, indices, and commodities. There are over 5,000 instruments on eToro, so you’ll be spoilt for choice.

Pros

- Real stocks are offered with 0% commission

- Free deposits and average minimum deposit requirements

- Good educational materials

- Allows copying of top investors

- Excellent user interface

Cons

- High eToro club eligibility requirements

- £10 inactivity fee

- £5 fee for every withdrawal

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

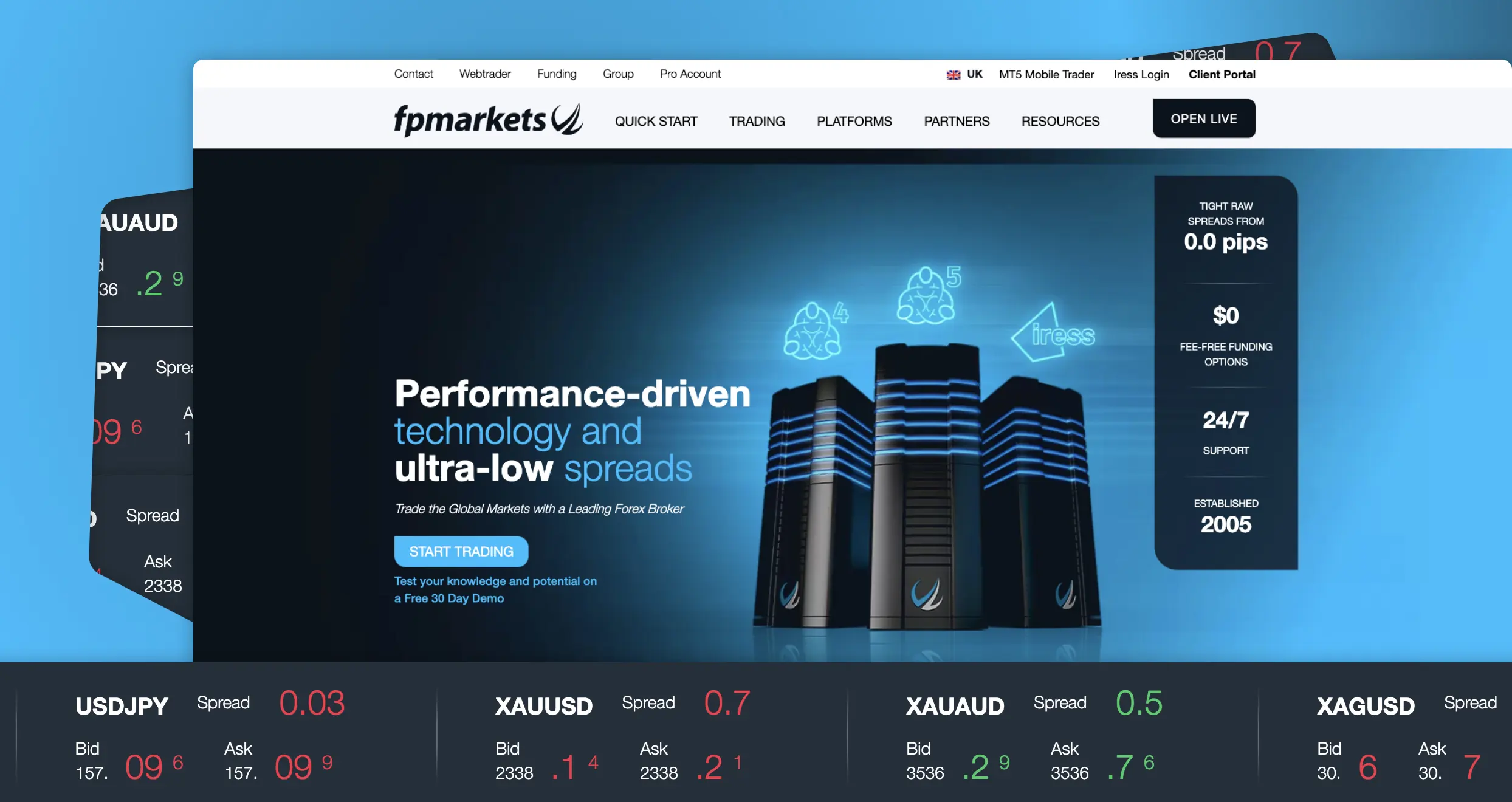

2. FP Markets – Best Stock Broker for Trading Stock CFDs

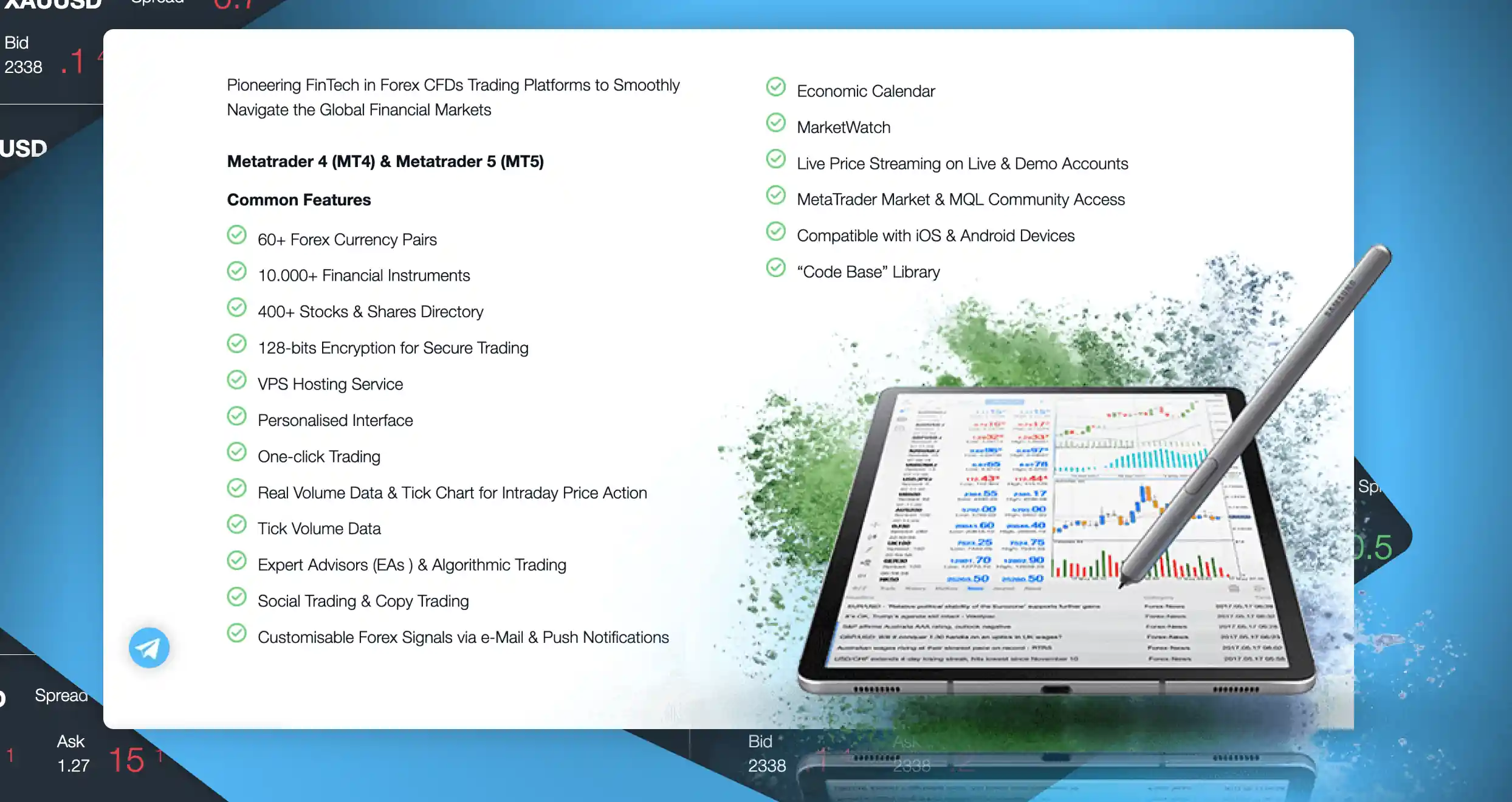

If you’d like to reap returns from interacting with stocks without owning the underlying asset, trading share CFDs should be the way to go. But don’t do it with any broker; try FP Markets. This service provider offers over 10,000 tradable CFDs on different assets, including stocks and shares from 4 continents.

The stock CFDs on FP Markets come from popular global markets like Frankfurt, New York, and Hong Kong. They are provided by companies in different sectors, including aviation, Big Tech, and pharmaceuticals. You can trade them from 2 unique platforms: MT5 and Iress.

That aside, we also recommend trading stock and share CFDs with FP Markets since this broker offers sharp spreads from 0.0 pips, free transactions, and zero inactivity fees.

Pros

- A broad selection of CFDs on stocks and shares

- Super-low commissions starting from 0.06% for stock traders

- Free deposits and withdrawals

- No inactivity fees

- 24/7 customer support

Cons

- Iress accounts require a £1000 minimum balance

- Iress traders pay a £60 monthly fee

- Only hosts CFDs on stocks and shares

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

3. Pepperstone – Best Stock Broker for Professional

Pepperstone is ideal for professionals who need advanced platforms. This broker lets its customers trade stock CFDs on global shares, including the UK, Germany, AU, and the US. The best part is that you can trade shares CFDs and enjoy commissions as low as 0.07% on shares from Australian companies.

As a professional, you can make good use of Pepperstone’s broad range of trading platforms, which range from cTrader and TradingView to MT4 and MT5. These have outstanding features that can enhance your trading experience, including advanced analysis and charting tools.

Not to forget, Pepperstone offers traders like yourself the opportunity to open a professional trading account. With it, you enjoy lower margins and can earn cash rebates from the supported Active Trader program. A pro account also has numerous features unavailable in a standard account, including a dedicated relationship manager.

Pros

- Low commissions starting from 0.07%

- No minimum deposit requirement

- Free deposits and withdrawals

- Zero inactivity fees

- 24/5 dedicated support for professional traders

Cons

- High eligibility requirements for professional accounts

- Offers share CFDs only

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

4. AvaTrade – Best Stock Broker for Beginners

AvaTrade is the best stock trading platform in Europe for newbies. We love it because it gives budding traders uncapped access to its trademark trading program, Ava Academy. This program has free courses and materials that you can use to learn how to trade stocks and unleash your full potential. Plus, at the end of each course, you get to test your knowledge with quizzes.

Not to forget, AvaTrade allows newbies to practice whatever they’ve learned from its free courses with a real-time trading simulator. It comes with virtual money worth £10,000 and lasts for 60 days. As a newbie, the best part is that you can open a new demo account with AvaTrade if the existing one expires before you master trading.

When you’re ready to trade live, visit AvaTrade’s official site or use the broker’s app to invest in stock CFDs. You will get access to major exchanges like the NYSE and enjoy flexible leverages of up to 5:1.

Pros

- Top-shelf educational resources and materials

- Free deposits and withdrawals

- Allows learners to open multiple demo accounts

- Live multilingual support available 24/5

Cons

- £50 quarterly inactivity fee

- Offers stocks CFDs only

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

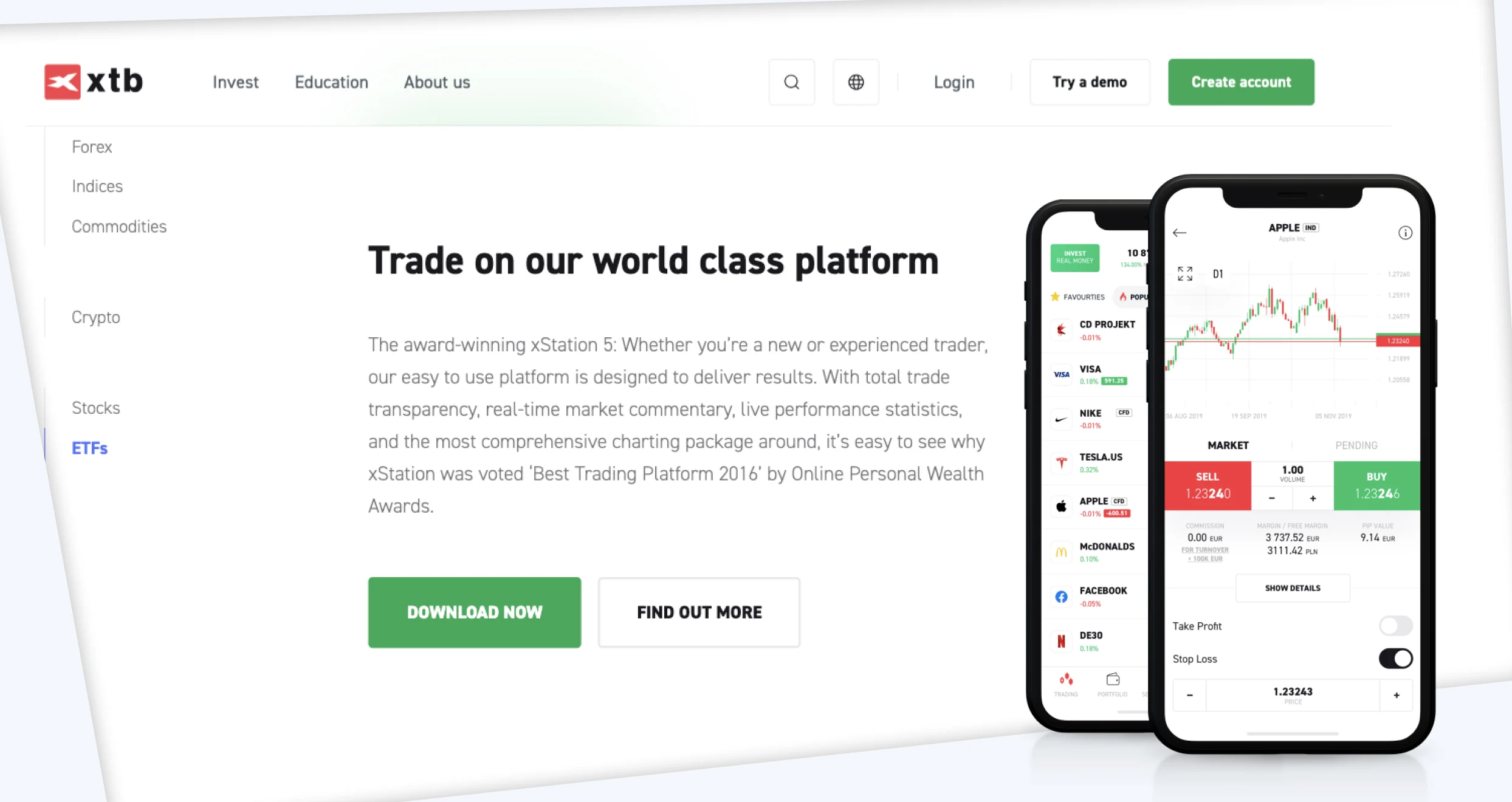

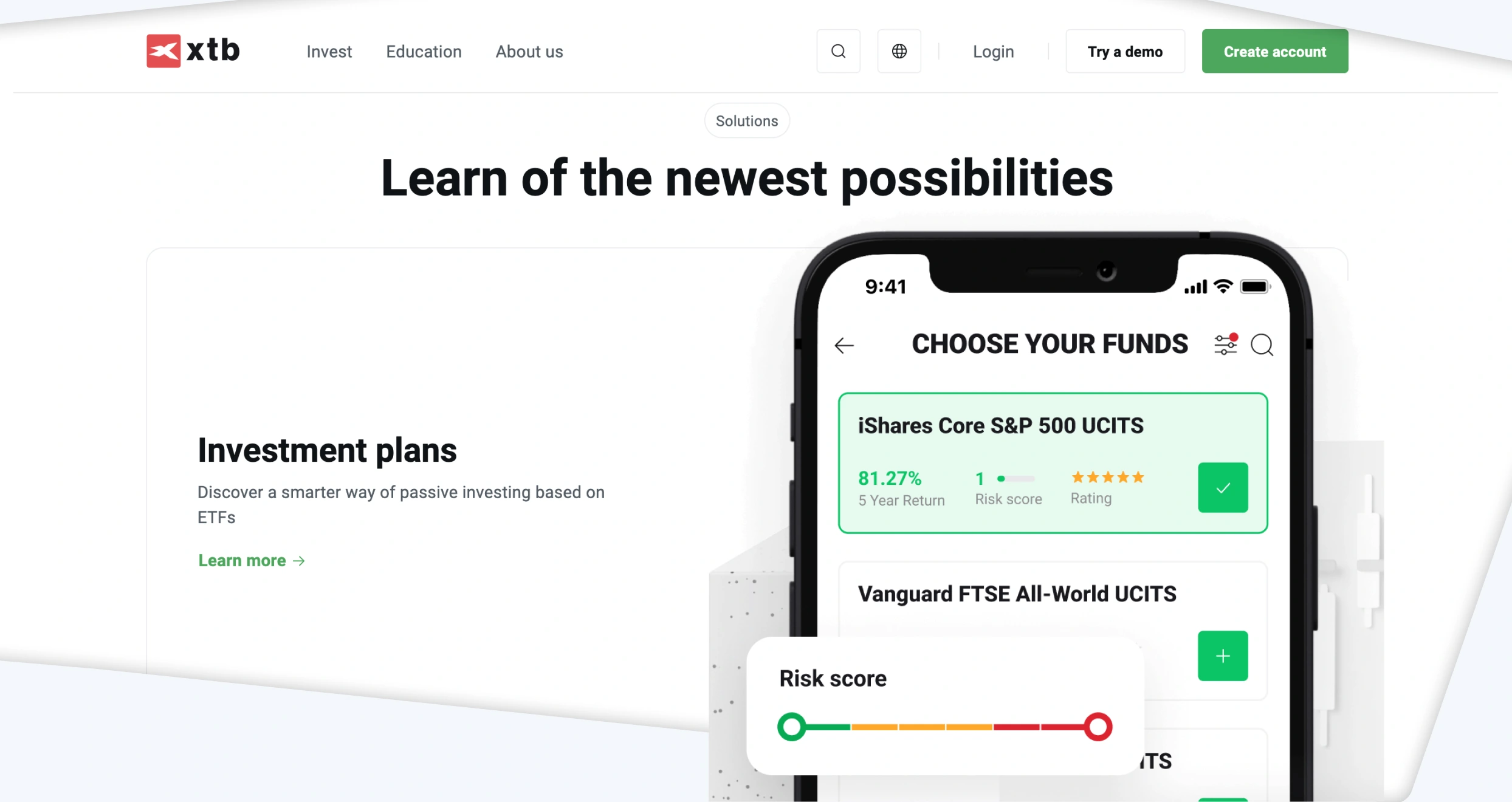

5. XTB – The Best Stock Broker for Low-Cost Trading

Reducing your trading costs is the key to maximizing your profits. Fortunately, you can lower your expenses by trading with XTB. Founded in 2002, XTB allows you to invest in real shares and enjoy 0% commission. The assets offered here are affiliated with popular companies like Lloyds Banking Group, Netflix, and Amazon.

We also recommend XTB to traders who want to lower their costs since this broker doesn’t charge any account opening or maintenance fees. Moreover, this trading platform has a zero minimum deposit requirement, meaning you can start trading with a small sum of money. Not to mention, deposits are free for all XTB clients, as well as withdrawals above £50.

Besides investing in real stocks, XTB supports stock CFD trading through xStation, XTB’s proprietary trading platform.

Pros

- No minimum deposit requirement

- 0% commission for stock traders and investors

- Supports real stocks and CFDs

- Excellent customer support

Cons

- £10 monthly inactivity fee

- Limited trading platforms and software

If you plan to open an XTB account and fund it, here’s some good news: XTB doesn’t charge any deposit fees. Moreover, you can use payment methods like bank transfers, PayPal, Skrill, and credit/debit cards. Furthermore, you can start trading with any amount within your budget since no XTB minimum deposit requirements exist. But note that if you fund your account with a digital wallet like Skrill or Neteller, you may incur some charges.

That said, there are several fees you may encounter while using the XTB online trading platform. Let’s begin with currency conversion charges. If you trade any instrument valued in a currency different from your account’s base currency, you will incur a 0.5% conversion fee. But that’s during weekdays. On weekends, the commission can go as high as 0.8%.

Regarding withdrawals, XTB charges nothing for basic transactions above $50. But those below $50 can attract an additional commission. Additionally, if your account stays dormant for over 12 months and you don’t make any cash deposits for the last 90 days, XTB will levy a $10 monthly inactivity fee. The fee will stop taking effect automatically when you start trading again.

Also, while trading on margin, you may have to pay overnight financing charges. These charges cover the costs of rolling your position to the next day. The exact fee you’ll pay at any given moment will depend on the market you are trading.

Stock Trading in Europe

Different NCAs regulate stock trading in Europe, from the FCA to CySEC and the FSC. These authoritative bodies have drawn up rules and mandates that ensure stock brokers are transparent and fair. As a trader or investor, you should interact with regulated platforms for your protection and safety.

But before you search for a regulated stockbroker, are you an adult? This question is crucial since, depending on your jurisdiction, you must be at least 18 or 21 to trade online. And you can’t circumvent this mandate legally because stock brokers will ask for an ID.

If you’re an adult, just choose a good platform from our guide and dive into stock trading and investing. You can trade stocks from different exchanges, including the NYSE, NSE, and the Shenzhen Stock Exchange. While choosing stocks to trade or invest in, factor in your financial goals, risk tolerance, and time frame. Don’t forget to research extensively.

How to Choose the Right Stock Broker in Europe

Although many stock brokers are currently serving Europeans, not all are outstanding. That is why you should pick carefully. Like our experts, you must consider the following factors when selecting the best broker to trade with:

The FCA and other regulators are here to protect traders and investors like yourself. Therefore, prioritise trading with stock brokers licensed by reputable authorities in Europe, such as the FCA and CySEC.

Before signing up with a broker, check the availability of customer support. Are representatives active during your preferred trading hours? You can get your answer by testing the support services. Just contact your broker’s team and gauge the quality and promptness of the assistance you get.

If you want to rake in maximum returns, trade with a broker with reasonable fees. Suppose you can get a service provider that offers a few cost-free services, like account opening and maintenance. That is way better since every cost you incur will ultimately reduce your profit margin.

Some brokers have proprietary and third-party platforms; others don’t. Many service providers only allow their clients to use proprietary software. Keep that in mind when selecting your broker. Check which platforms are supported and whether they match your needs and preferences. Most importantly, test the performance and reliability of the provided solutions.

Most past users give honest reviews and testimonials. Many have no hidden motives, whether it’s to sell the brokers they’re reviewing or tarnish their names. That is why reading testimonials while looking for the best trading platform is a good idea. From this type of feedback, you can identify a broker’s strengths and weaknesses quickly.

How To Register an Account with a Stock Broker in Europe

We used live accounts to test the suitability of all the stockbrokers recommended here. If opening a live account sounds daunting, we are here to tell you it’s not. Our team had an easy time registering and activating our trading accounts. We expect you to enjoy the same. But you have to follow these general steps and provide truthful information:

Visit your chosen broker’s official site and review the terms and conditions. Only proceed if everything that’s stipulated matches your objectives and expectations. If you see something shady or ambiguous, contact support and seek clarification.

Hit the registration button to sign up. Most platforms will ask for your email and password. Give an active email address so your broker can send a verification message. Also, create a strong password to ward off bad actors. Then, provide accurate information when filling out the application form with your details.

Brokers have to verify your identity and address. So, prepare to provide documents like a government-issued ID and credit card statement. Your service provider will verify your personal information with the former and use the latter to ascertain you’re where you claim to be. All documents must bear your name and personal details.

After providing the required documents, wait for your broker’s team to check them and verify your account. Then, deposit money while considering the minimum requirements and supported payment methods. Don’t forget to fund your account with an amount you can lose without risking financial peril because trading is risky.

Pick a stock or stock CFD and start trading. Use risk management tools like stop loss and take profit orders to mitigate your risk exposure. If you are a beginner, practice with a demo account before diving into live trading. Don’t trade while you’re intoxicated or in an imbalanced emotional condition since you’ll be more likely to slip up and lose your money.

Conclusion

Now that you know the best European stockbrokers, you can spend less time evaluating service providers and dedicate more to increasing your profitability. Remember, your profits in the long run will depend on your skills, knowledge, and discipline. If you are a newbie, learn to trade with a demo account. Once you are ready, maintain unwavering discipline and avoid trading without a specific goal at all costs.

I’ve had positive experiences with XTB, particularly because of their low fees and the ability to trade both real stocks and CFDs.

FP Markets should be higher on your list. Their MT5 execution is lightning fast and I've never had issues with slippage, even during earnings announcements. The 0.06% commission on stocks is reasonable when you factor in the superior execution quality.