Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

In an era where technology reshapes investment landscapes, choosing the right broker for stock trading and investing in India is pivotal for success. However, how do you identify a suitable choice amongst thousands of options? Fret not, for this guide simplifies your research process by listing the top 5 stock brokers in India we have identified through thorough research, incorporating user feedback and expert evaluations. Here, you will discover the distinctive features of each broker, gain insights into their effective utilisation, and unravel the criteria for selecting the ideal option. Our goal is to ensure you elevate your investment experience with the best choices tailored to the nuances of the Indian market.

In a Nutshell

- The top stock brokers in India should be licensed and regulated by the Securities and Exchange Board of India (SEBI) and other global financial authorities. This ensures you invest in a secure environment.

- The best stock broker in India should have access to the local stock exchanges, including the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE).

- Stock investors and traders must also ensure that the broker for stock investment lists global stocks from tier-one global exchanges, including NASDAQ, NYSE, LSE, and more.

- Besides investing, the best stock broker should allow derivatives trading via CFD or indices.

- Traders and investors must prioritise their trading and investment needs when selecting a stock broker in India.

- Stock investment and trading in India are considered business activities. Therefore, all profits earned from this venture are taxed.

List of the Best Stock Brokers in India

- Saxo – Overall Best Stock Broker

- FP Markets – Best CFD Stock Broker

- AvaTrade – Best Broker For Penny Stocks

- IC Markets – Best Stock Broker With Automated Features

- Pepperstone – Best MT5 Stock Broker

Compare the Best Indian Stock Brokers

Comparing stock brokers in India was not easy, as the process was lengthy and overwhelming. The good news is that we were able to come up with the list above, highlighting the best options in the region. Here is a table showing some of the key elements we looked into to ensure you get the best of the best. You can also use the table to identify a suitable option for your stock investment needs.

| Best Stock Broker India | Licence | Support Service | Software | Payment | Demo Account |

|---|---|---|---|---|---|

| Saxo | FSA, MAS, SEBI | 24/5 | SaxoTraderGO, SaxoTraderPRO | Bank Wire Transfer, Debit cards | Yes |

| FP Markets | CySEC, ASIC, FCA, SEBI | 24/7 | MT4, MT5, cTrader, Iress | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust FasaPay | Yes |

| AvaTradeGO | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA, SEBI | 24/5 | Credit/debit cards, Bank transfer, PayPal, Neteller, Skrill, PayTrust, FasaPay | Credit/debit cards, Wire transfer, Paypal, Skrill, Neteller, WebMoney | Yes |

| IC Markets | ASIC, CySEC, SEBI, FSA, SCB | 24/7 | MetaTrader 4, MetaTrader 5, cTrader, IC Social, ZULU Trade | Bank/wire transfer, Paypal, credit card, Skrill, Neteller, UnionPay, Bpay, FasaPay, Poli | Yes |

| Pepperstone | FCA, SEBI, ASIC, DFSA | 24/7 | MT4, MT5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit cards, Bank transfer, PayPal, Neteller, Skrill, Union Pay | Yes |

Summary of Fees and Assets Offered by Our Recommended Stock Brokers

As professional stock traders and investors, we understand the importance of investing with a stockbroker suitable for your trading requirements. This means that you should confirm a broker’s features, including the available assets and its fee structure, to plan accordingly. To simplify your broker comparison process, we have prepared tables below highlighting the fees and assets offered by our recommended stockbrokers in India.

Fees

| Best Stock Broker India | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Saxo | From $0.01 | $0 | Free | $100 |

| FP Markets | From 0.0 pips | $100 | Free | None |

| AvaTrade | 0.03 pips | $100 | Free | $50 quarterly |

| IC Markets | From 0.0 pips | $200 | Free | None |

| Pepperstone | From 0.0 pips | $0 | Free | None |

Assets

| Best Stock Broker India | Cryptocurrencies | Forex | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Saxo | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | No |

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

| IC Markets | Yes | Yes | Yes | No | No |

| Pepperstone | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best Stock Brokers in India

As professional researchers, we always conduct multiple tests and compare hundreds of stockbrokers to ensure our readers get the best recommendations. The tests involved checking and verifying various metrics per our experts’ specifications, including security, asset availability, platform performance, and more. We then combine our test results with user testimonials on various platforms to ensure we are not biased with our final options.

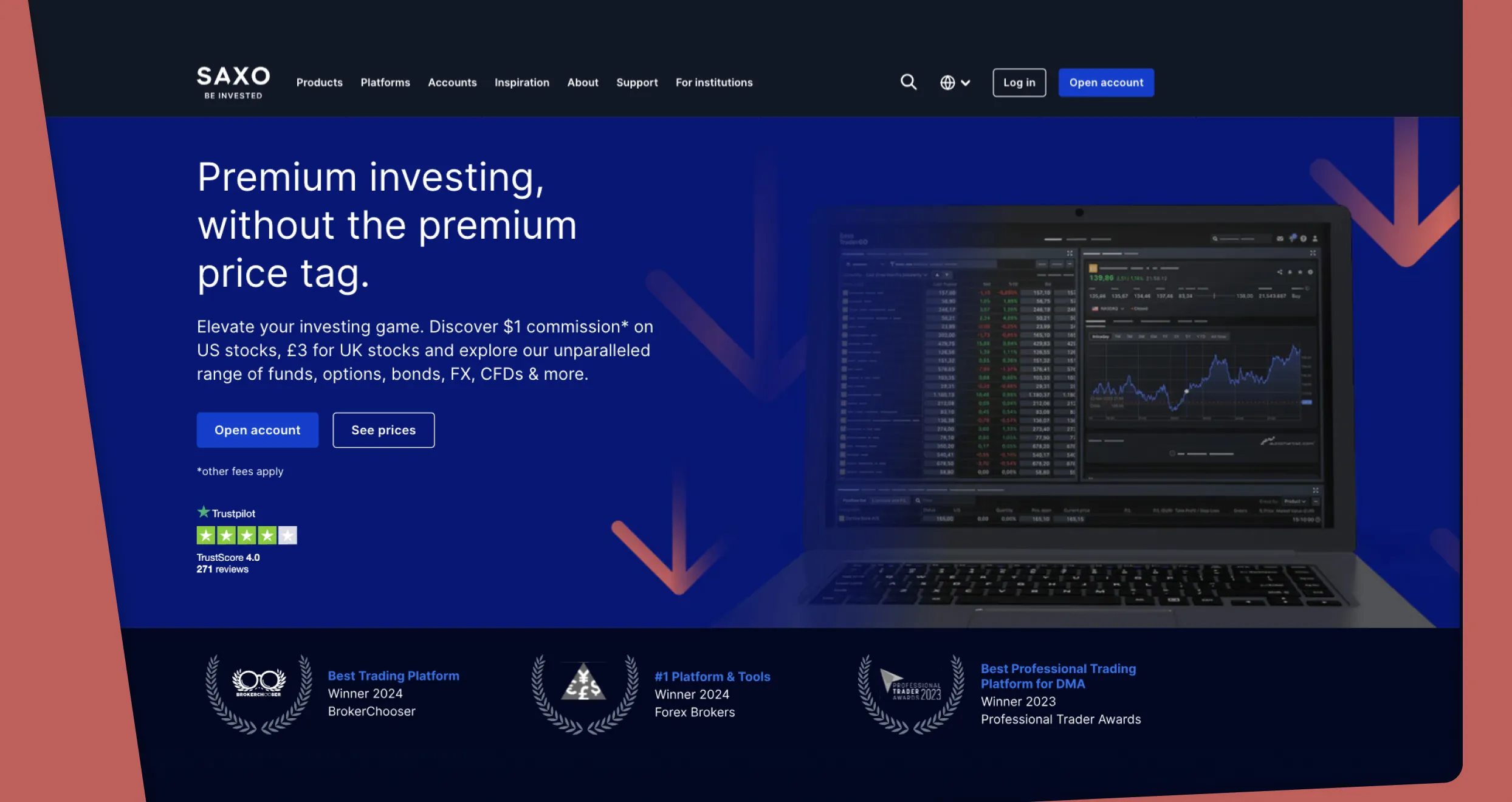

1. Saxo – Overall Best Stock Broker

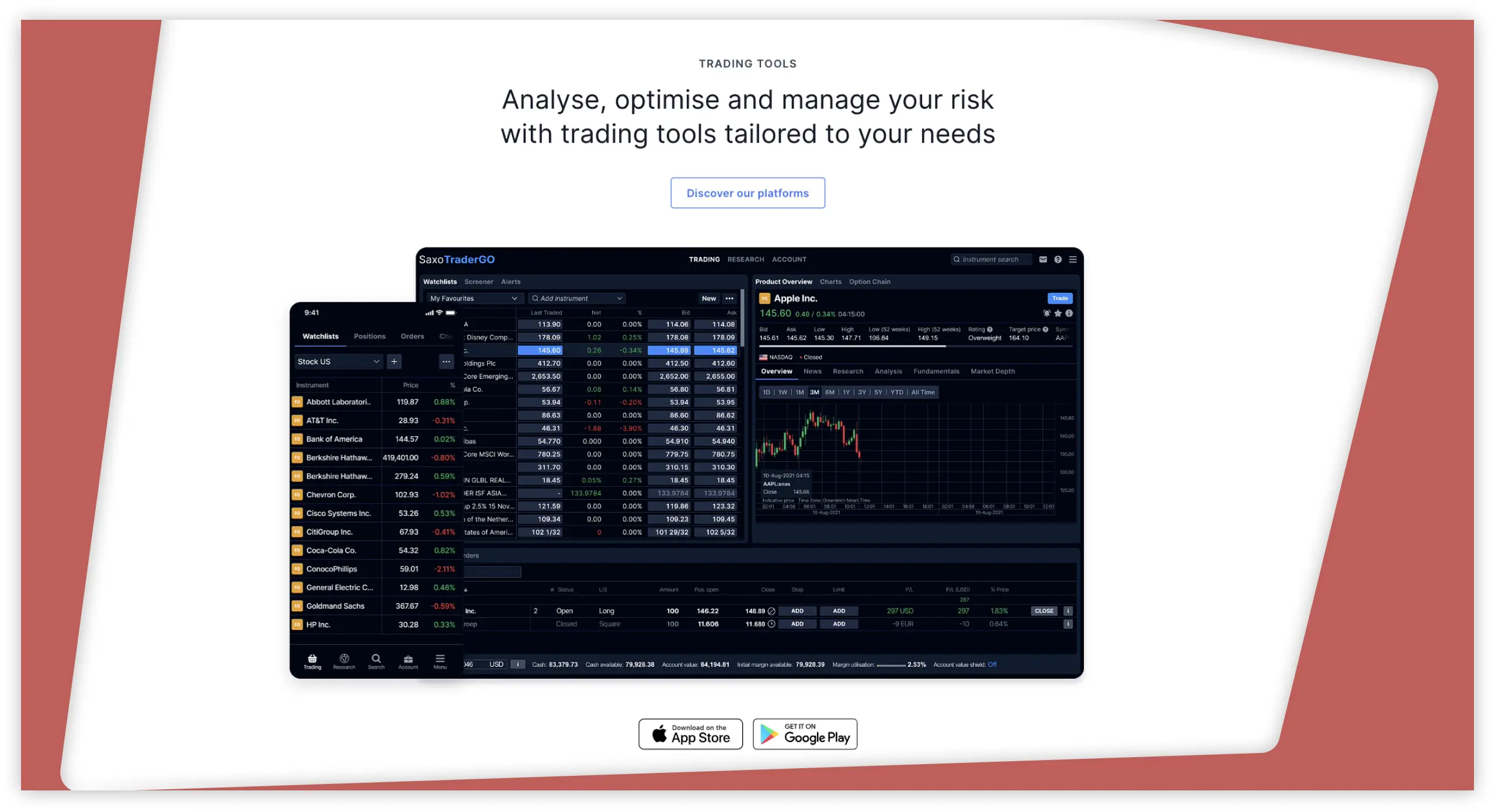

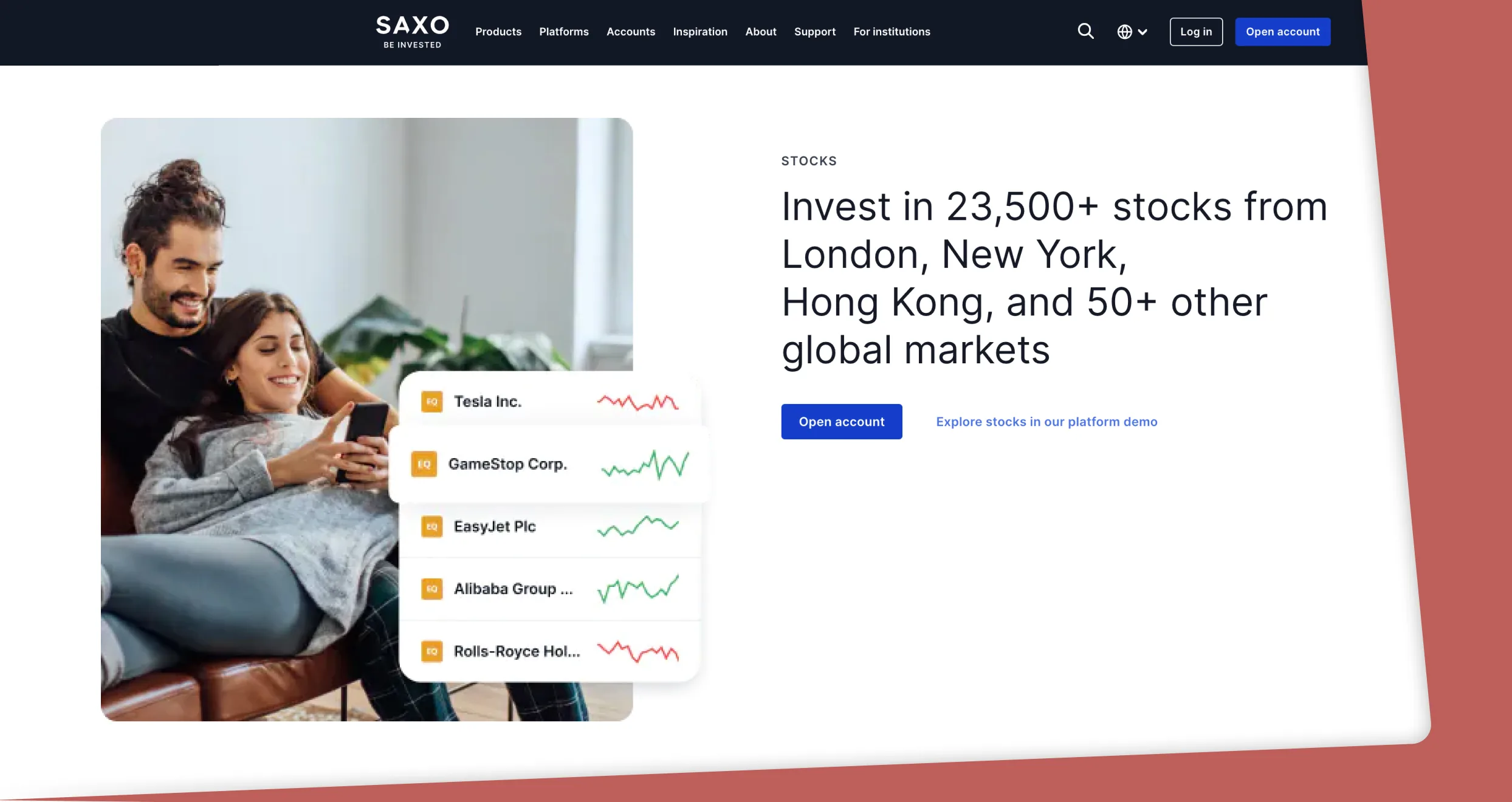

Following extensive research on India’s best stockbrokers, Saxo has secured its place as the overall best. From our user perspective, the broker’s platform impresses us with its remarkable user-friendliness and seamless navigation. With access to over 23,500 stocks across 50+ global markets and competitive commissions as low as £0.01 per share, Saxo facilitates effective portfolio diversification, a crucial strategy in India’s dynamic market.

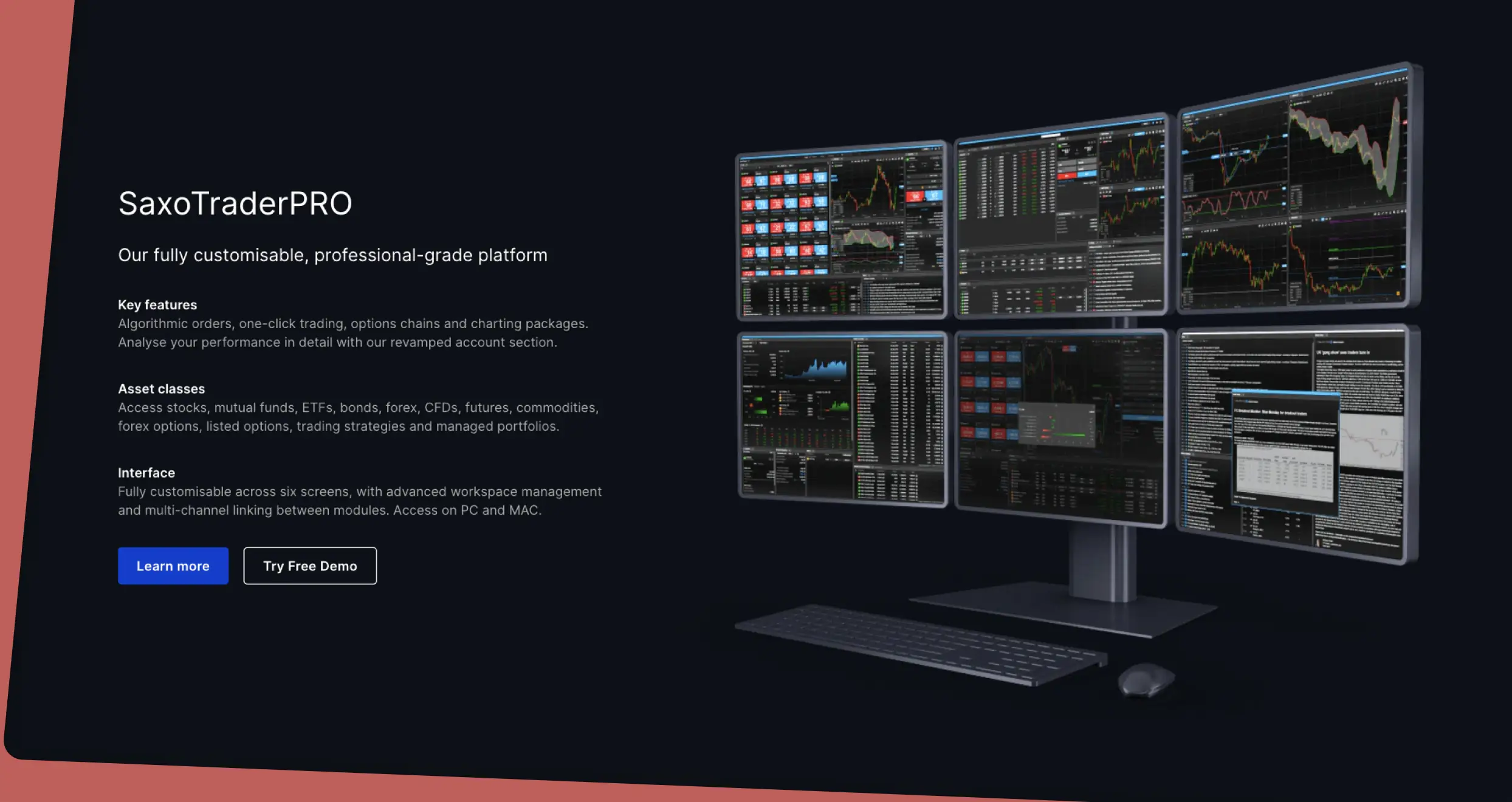

We like the platform’s commitment to third-party research and expert portfolio management services, which we believe enhances the users’ experience. While the £2,000 minimum deposit requirement on the professional may pose a hurdle, Saxo compensates with access to over 70,000 additional assets and versatile trading options via desktop and SaxoTraderGO app for Android and iOS. Beginners will also get started with no minimum deposit requirement on its standard account. From our comparisons, Saxo deserves a 4.1-star rating.

Pros

- Plenty of research resources

- Numerous penny stocks to explore

- A user-friendly and customisable trading platform

- Low commission

Cons

- High minimum deposit requirement on the professional account

- Does not support the MetaTrader platforms

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

2. FP Markets – Best CFD Stock Broker

In our quest to identify India’s premier stock brokers, FP Markets has emerged as the preeminent CFD stock broker, offering an unparalleled user experience. From our user perspective, FP Markets impresses with its straightforward account opening procedures, demanding only a minimum deposit of £100 and featuring zero transaction charges — an enticing proposition for Indian stock traders.

FP Markets’ advanced AI trading capabilities on MT4 and MT5 platforms, including autochartist and Autotrade features, provide seamless access to profitable positions. With low trading fees, starting from 0.0 pips on major currency pairs, and Direct Market Access (DMA) features, FP Markets earns a 5-star rating. It is a top choice for Indian traders seeking sophistication and affordability in the dynamic stock market landscape.

Pros

- Low minimum deposit

- Multiple AI-powered trading platforms, including MT4 and MT5

- Over 10,000 CFD securities to choose from

- Quality learning and research materials offered

Cons

- No price plan

- Only CFD assets supported

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

3. AvaTrade – Best Broker For Penny Stocks

In our exploration of the best stockbrokers in India, AvaTrade has emerged as the standout choice for penny stock trading. From our user perspective, AvaTrade’s award-winning AvaTradeGO app offers an exceptional mobile trading experience, ensuring swift execution on Android and iOS devices. With a minimal deposit of £100, the platform provides access to a diverse range of tradable assets, making it highly appealing for Indian traders.

AvaTradeGO’s user-friendly interface, coupled with customizable features, caters to both novice and seasoned penny stock enthusiasts. The platform boasts competitive trading fees, whether utilising their proprietary platform or the MetaTrader options. Additionally, the inclusion of a social trading platform fosters skill development through interaction with fellow traders. With its comprehensive support, low trading fees, and user-friendly interface, we award the AvaTradeGO app a commendable 4.3-star rating, making it a top choice for Indian penny stock traders.

Pros

- Low minimum deposit requirement

- User-friendly mobile app with excellent search functions

- Social trading feature for a better experience

- Additional 2,000+ securities for portfolio diversification

Cons

- AvaTradeGO is not secured with a two-step safe login procedure

- The inactivity fee is high and kicks in only after three months

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

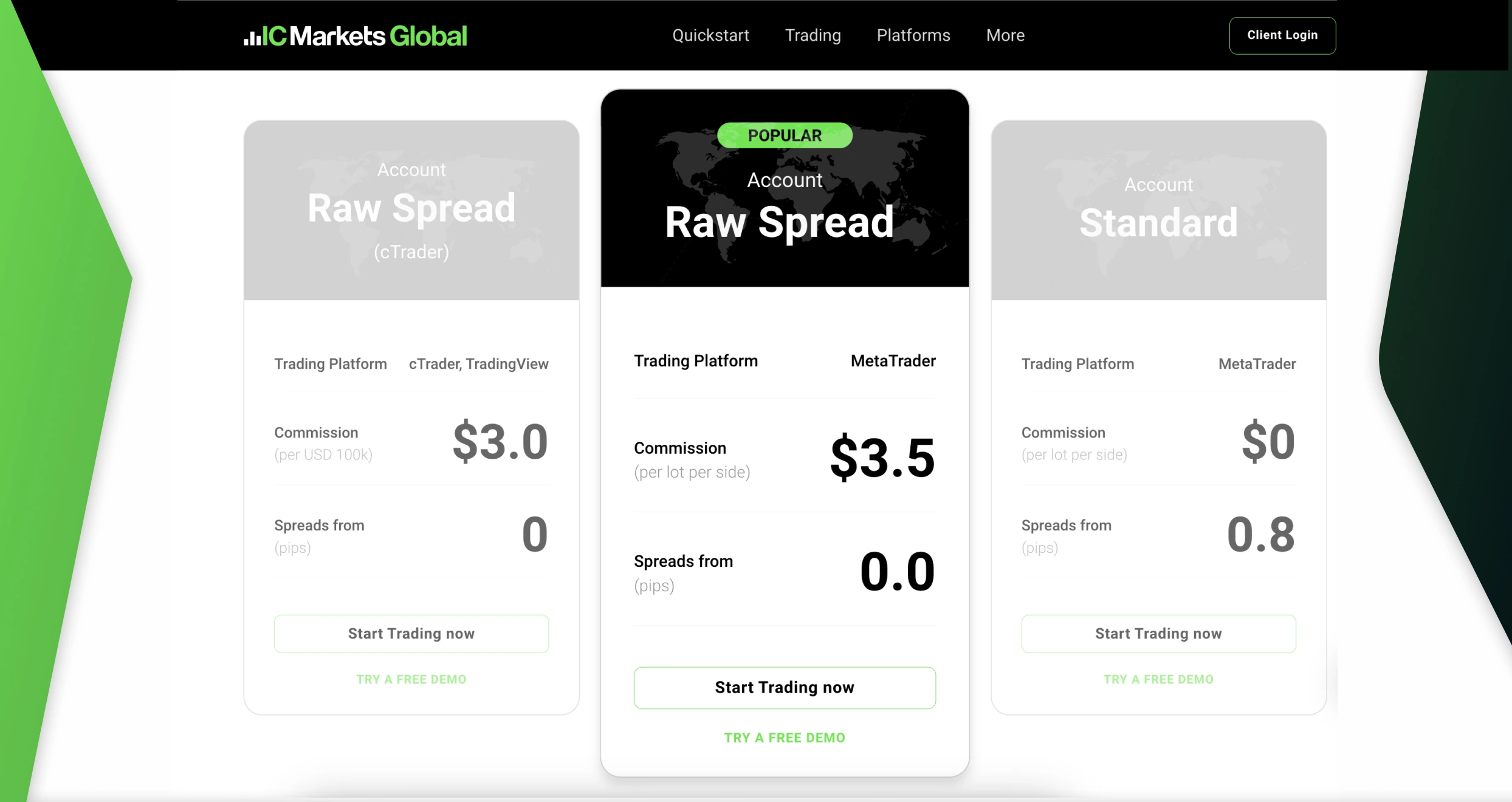

4. IC Markets – Best Stock Broker With Automated Features

In our comprehensive testing, IC Markets has emerged as the paramount choice for traders seeking automated features in the Indian market. With over +2100 large-cap stocks CFDs, the Global MetaTrader 5 platform delivers superior execution and tight pricing, ensuring an optimal trading experience. The platform’s up to 1:1000 leverage on MT5, rapid trade execution speed, and built-in automated trading capabilities, including pre-installed indicators and trading robots, impressed us.

The flexibility to install additional tools or develop custom Expert Advisors using MQL5 adds a layer of personalisation when trading on IC Markets. You can get started with as little as $200 per the broker’s minimum deposit requirement and explore a diverse range of assets, including additional options like forex, indices, commodities, futures, and more. Plus, IC Markets doesn’t charge transaction fees, and its support service is one of the most responsive. Therefore, we give the broker a 4.5-star rating.

Pros

- Free deposits and withdrawals

- Quality learning and research tools

- Offers an opportunity to enjoy copy trading on its cTrader platform

- Reliable 24/7 customer service

Cons

- Only CFD assets supported

- Limited asset offerings compared to its peers

5. Pepperstone – Best MT5 Stock Broker

In our exploration of Pepperstone, we discovered it to be the ultimate MT5 stockbroker for Indian traders. The MT5 platform, with its advanced AI trading features like Capitalise.ai on MT4, allowed us to tailor strategies effortlessly, reducing manual trading risks. Pepperstone’s stock trading app, featuring over 1,200 CFD assets, became a gateway for diversifying portfolios with cost-effective trades, making AI stock trading accessible to us and fellow Indian traders.

The enriched MT5 platform, boasting advanced charting tools and streamlined order execution, significantly enhanced our trading experience. Beyond MT5, we appreciated the flexibility to explore MT4, cTrader, and social trading, providing versatility to our strategies. With a recommended £500 minimum deposit for UK traders and a wealth of learning resources, our user experience led us to grant Pepperstone a commendable 4.4-star rating.

Pros

- A user-friendly and intuitive design AI trading platform

- cTrader, MT4, and platforms for AI trading

- Social and copy trading platforms

- Low spreads starting from 0.0 pips

Cons

- Limited CFD asset offerings compared to its peers

- High minimum deposit requirement

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

How to Start Trading Stocks in India

Before you kickstart your stock trading ventures in India, it’s crucial to lay a solid foundation of understanding the stock market. This is because knowledge is vital in creating robust trading or investment strategies that stand the test of market dynamics. If you are a new stock trader in India, we will walk you through the essential steps to kickstart your journey into stock trading. Our goal is to ensure you are well-prepared and equipped for the challenges and opportunities that lie ahead.

Begin your stock trading journey by selecting a reliable and suitable stock broker through thorough research or by choosing from our list above. Consider factors such as brokerage fees, trading platforms, research tools, customer service, and more to make the best choice. For stock traders who are always on the move, consider installing the broker’s mobile app on your mobile device for seamless activity management even while on the go.

Once you have identified your preferred stock broker, proceed to create a stock trading account on its website. If you have chosen an option from our list of stock brokers in India above, you can click any of the links we have shared on this page for quick access. On the site, use your personal details, including your name, email, phone number, location, and more, for this procedure. Simply put, follow the broker’s guidelines for a smooth account creation process.

Following the creation of your trading account, the crucial next step is account verification. This involves submitting necessary documents for KYC (Know Your Customer) compliance, a standard procedure mandated by SEBI-regulated brokers in India. Typically, users provide copies of ID cards or passports for identity verification and a recent utility bill or bank statement to confirm their location. These measures ensure the security and legality of your trading activities, maintaining compliance with regulatory standards.

Your account verification process may take up to 48 hours after which the broker will send an email notification. Once fully activated, fund your trading account by making a deposit. Most brokers offer various funding options, such as bank transfers, credit/debit cards or e-wallet payments. Adequate funds are essential for executing trades and maintaining positions in the market.

With your account funded, your broker will redirect you to its platform, where all stocks are listed for trade. Explore the offerings, conduct research, analyse market trends, and execute trades based on your strategies. For beginners, start exploring the stock market via your broker’s demo account to avoid risking real money. You can then transition into the live account once you are fully confident in your trading skills. Most importantly, ensure you apply risk management controls in your trades to mitigate massive losses, whether you are exploring CFDs or indices assets.

How to Choose the Right Stock Brokers in India

Selecting the right stockbroker in India is a pivotal decision for a successful trading journey. While we may highlight some top choices, conducting additional research is imperative to ensure alignment with your specific needs. Here are key elements to consider.

Ensure the chosen stock broker in India is licensed and regulated by SEBI (Securities and Exchange Board of India), the primary regulatory body overseeing financial markets. This provides a foundation for compliance, security, and transparency in your trading endeavours.

A user-friendly and device-compatible stock trading platform is crucial. Look for brokers offering demo accounts, allowing you to practise without financial risk. Evaluating additional features like copy trading and automated trading is crucial to enhance your trading capabilities.

Choose a stock broker providing access to both local and international stock markets. The ability to trade on global exchanges broadens your opportunities, potentially increasing profitability. Confirm the range of markets accessible through the broker’s platform before making a final decision.

Consider your budget when evaluating India’s stock brokers’ trading charges. Transparent fee structures are vital, as you will be able to easily plan your trading activities. Additionally, confirm non-trading charges, such as minimum deposit requirements, commissions/spreads, transaction costs, and more, to align with your financial plans and avoid unexpected costs.

Indian traders looking for the best stock brokers should confirm the availability of trading tools. For instance, you need the best market research and analysis resources to effectively create solid trading strategies. For beginners, opt for a stock broker with quality learning resources so you can explore the stock market while boosting your skill level.

Many stock traders in India overlook this element, whereas it is as important as the ones above. You see, having a stock broker supporting multiple payment options will help you transact with an ideal method, thus quickly resuming your trading activities. Whether you prefer debit/credit cards, e-wallets, or bank transfers, opt for a stock broker with payment methods that align with your preferences and offer convenience in your transactions.

Reliable customer service is crucial for addressing issues that may arise during your stock trading journey. Confirm the availability of communication channels and assess a broker’s support team’s responsiveness. Ensure that customer service availability aligns with your trading schedule.

Where to Buy Stocks in India

The process of buying shares in India involves engaging with SEBI-registered entities, commonly known as stock brokers, with access to various exchanges, including the NSE and BSE, where various stocks are listed. These brokers act as intermediaries between investors and the stock exchanges. They facilitate the buying and selling of stocks on behalf of investors and provide the necessary infrastructure and services to execute trades in the stock market. The best element about buying stocks with SEBI-regulated brokers is that you are guaranteed a secure environment free from fraudsters dominating the online investing space.

Conclusion

While the idea of directly purchasing shares from listed companies exists, it can be challenging in the Indian market. However, our recommended stock brokers above serve as indispensable partners in this dynamic landscape. These brokers not only simplify the stock acquisition process but also facilitate trading in derivatives. With comprehensive skill development resources and demo accounts, they empower investors in the intricacies of the Indian stock market, ensuring a confident entry into real-money transactions.

You're right—cash ISAs are just slow-moving safety nets. If inflation eats more than you earn, it's not really "saving," is it?