Claire Maumo wears multiple hats. She is a leading crypto and blockchain analyst, a market dynamics expert, and a seasoned financial planner. Her blend provides a unique combination that she leverages to offer expert analysis of economic and market dynamics. Her pieces deliver a holistic approach to the game, building your confidence and securing your financial future. Follow her for a comprehensive approach to mastering your trading journey.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Learning the stock market in New Zealand is easy, considering numerous educational online resources. However, how do you buy or trade various company stocks? With the best stock broker, it’s easy to access NZ-based shares listed on the New Zealand exchange to complete your purchase. Plus, some brokers offer access to global exchanges, thus exposing you to numerous opportunities.

If you are looking for such stock brokers, we are here for you. In this guide, we recommend the top 5 options that our experts have tested and approved based on various elements. For beginners, we will take you through the procedures for starting stock trading, and more. Our goal is to ensure our readers are satisfied and can eventually make the best decisions.

In a Nutshell

- Stock trading in New Zealand is becoming prevalent. Through reliable and credible brokers, you can explore various equities and derivatives assets listed on the New Zealand Exchange (NZX).

- The best stock broker in NZ should meet your trading or investment needs. It should be licensed and regulated by the Financial Markets Authority (FMA).

- An FMA-regulated stock broker with multiple global authorities overseeing it exposes you to numerous opportunities. You will explore global stocks listed on various exchanges, such as the NYSE, LSE, NASDAQ, and more.

- Our recommended stock brokers in New Zealand have been tested and approved by Invezty experts. We also chose them based on user testimonials.

- While having the best broker stock in New Zealand can maximise your potential, conduct thorough market analysis for solid strategies. Plus, understand the tax rules for this market for an exciting experience.

List of the Best Stock Brokers

- IG Markets – Overall Best Stock Broker in New Zealand

- Plus500* – Top CFD Stock Broker in New Zealand

- eToro – Beginner-Friendly Stock Broker in New Zealand

- AvaTrade – Top Stock Platform For Mobile Trading in New Zealand

- Saxo – Best New Zealand Stock Broker For Professional Traders

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Stock Trading Platforms in NZ

Whether you are a beginner looking to begin your ventures in the financial landscape or are a professional trader looking for a reliable option, we have your back. Our professional researchers embarked on a mission to identify and share top stock brokers so you do not have to. The research process was overwhelming and time-consuming, and so we understand why many Kiwi investors end up with the wrong choices.

We started by testing as many FMA-regulated stock brokers as we could. We evaluated and compared their features to shortlist only those that met our stringent requirements. Some of the features we looked into include security, product offerings, charges, and more.

Our research did not stop here. We proceeded to Google Play, the App Store, and Trustpilot to analyse as many user ratings and reviews as possible. We combined our findings and test results to create this list of the top stock brokers in New Zealand.

That being said, see our table below highlighting the features that made our NZ stock brokers and platforms stand out. Use it to make a suitable choice.

| Best Stock Broker New Zealand | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| IG Markets | FCA, CySEC, SCA, DFSA, FMA | 24/5 | MetaTrader 4, IG trading platform, ProRealTime, Web platform, Trading apps, L2 Dealer | Debit card, Bank transfer, PayPal, HK FPS | Yes |

| Plus500* CFD service. Your capital is at risk | FMA, FSCA, CySEC (#250/14), FCA, ASIC, MAS, FMA | 24/7 | Plus500 Invest, Plus500 CFD, Plus500 Futures | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| eToro | FMA, FCA, CySEC, FSCA, ASIC, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| AvaTrade | FMA, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

| Saxo | FCA, SCA, DFSA, FMA | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank Wire Transfer, Debit cards | Yes |

Brokers Overview

The best stock trading broker in New Zealand offers an exciting experience. You can select a suitable choice based on various elements, including those outlined in our comparison table above. Most NZ traders and investors also prioritise affordability and asset offerings in a broker. This way, they can plan their activities and commit to a broker, knowing all their needs are catered for.

That being said, utilise the tables below to compare and select a stockbroker you can afford and lists your preferred securities.

Fees

| Best Stock Broker New Zealand | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| IG Markets | $0 | From 2 cents on US shares | Free | None |

| Plus500* | $100 | From 0% | Free | $10 monthly after three months of inactivity |

| eToro | $1,000 | From 0% | $5 withdrawal fee | $10 monthly |

| AvaTrade | $100 | From 0.13% | Free | $50 after every 3 consecutive months of inactivity |

| Saxo | $0 | From $1 on US equities | Free | None |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Assets

| Best Stock Broker New Zealand | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| IG Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Our Opinion about the Best Stock Brokers

At Invezty.com, we extensively test brokers and trading platforms before making recommendations. We sign up for demo accounts on the brokers’ official websites to understand all their features and performance.

Below, we share our opinion on the best stockbrokers in New Zealand. These mini-reviews are based on our hands-on experience and findings. By thoroughly comparing them, we believe you will find a platform that suits your stock trading or investment needs.

1. IG Markets – Overall Best Stock Broker in New Zealand

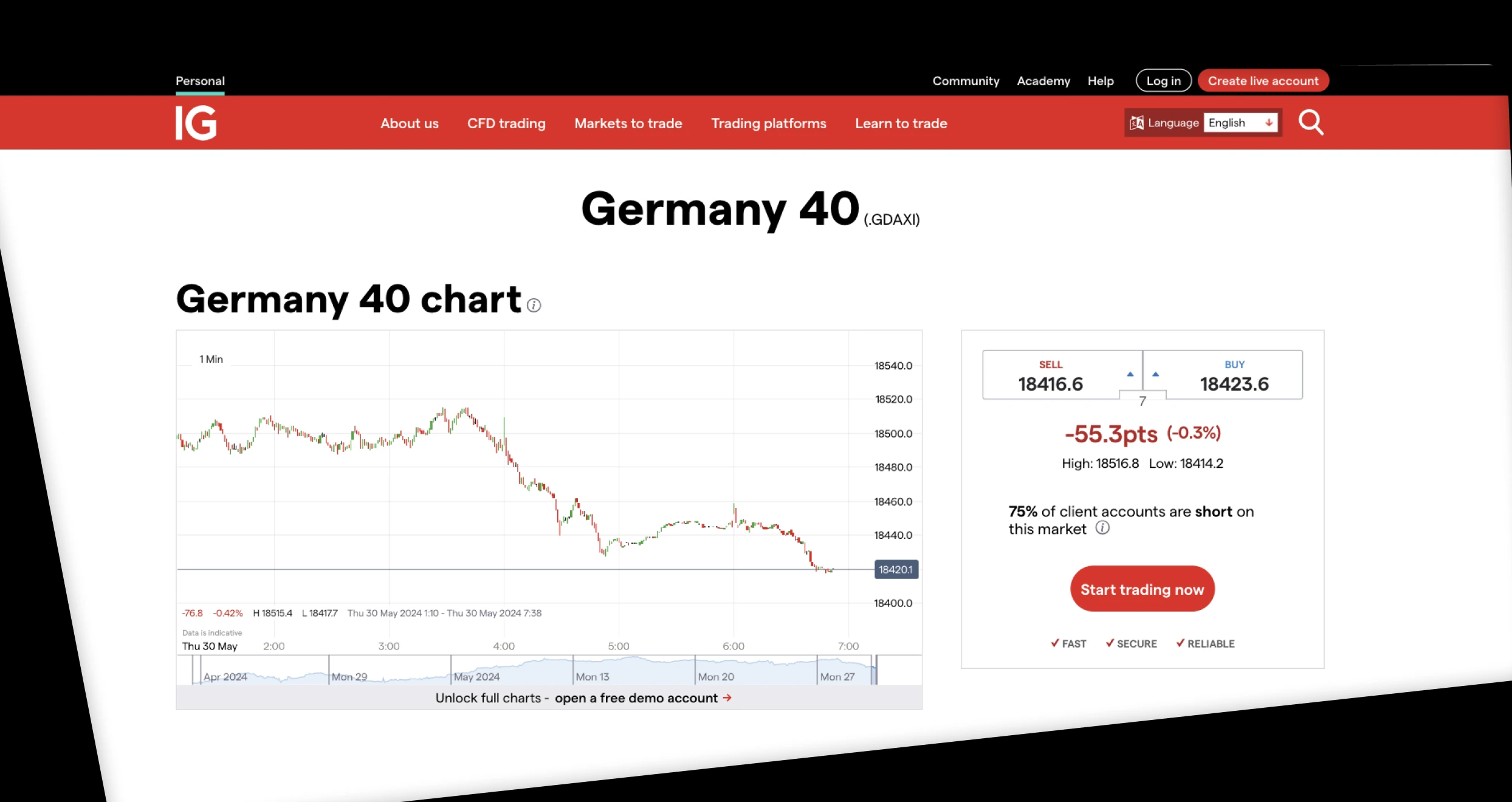

We tested many stock brokers in New Zealand, but IG Markets stood out as the best overall. From our analysis, we find the broker suitable for both newbies and professional stock traders since it has a user-friendly and modern design platform. Moreover, IG Markets hosts quality learning resources to help newbies boost their skills. There is also a social trading platform that allows you to interact with other global traders and mirror potentially profitable trades from expert traders.

For professional traders, IG Markets offers advanced resources on its MT4, L-2 Dealer, Web, and ProRealTime platforms. Trading stocks with the broker allows you to explore over 13,000 Asia, US, and international stocks, such as Tesla, Microsoft, Netflix, Google, and more. When it comes to stock trading fees, IG Markets charges low commissions, starting from 2 cents per US share and 0.25% on Hong Kong shares. And for those looking to diversify their portfolios, IG Market offers additional asset securities. These include forex, commodities, cryptocurrencies, indices, ETFs, and more.

Pros

- Features automated trading on its MT4 and ProRealTime platforms

- No minimum deposit requirement

- Has an IG Community platform for social and copy trading

- Offers an opportunity to explore global stocks listed on various exchanges

Cons

- You can only trade shares as CFDs

- New Zealand share trading charges are high, starting from NZ$7

IG Markets’ fees vary depending on the asset you are trading. The broker has come a long way and tries to accommodate both low-budget and high-budget traders. We noticed that the broker doesn’t have a minimum deposit requirement. This allows you to trade with any amount you can afford.

Regarding spreads and commissions, IG Markets imposes some of the lowest fees. For instance, you will explore the currency market with spreads from 0.6 pips. Major indices also attract spreads from 0.8 points and 0.1 points on commodities.

Unfortunately, IG Markets’ share trading fees are high compared to its counterparts. For instance, you will incur 2 cents per US share and 0.18% on Hong Kong shares. The good news is that the broker allows free deposits and withdrawals. Its inactivity fee of $12 monthly also applies after 24 consecutive months.

2. Plus500 – Top CFD Stock Broker in New Zealand

For stock investors and traders looking to explore the CFD share market, Plus500 is here for you. We believe this broker excels in this category due to its attractive features for CFD trading. For instance, the NZ broker lists over 2,000 shares, including popular options like Meta, Tesla, Microsoft, Alphabet, and more. We also like the fact that CFD share trading is commission-free*, and Kiwi traders will incur only low spreads from 0.0 pips. With a fast trade execution speed, a user-friendly platform, and quality learning resources, Plus500 is worth committing to.

Although Plus500 does not host third-party platforms like the MT4/5 for professional clients, it still features quality and advanced trading tools on its proprietary platform. It is regulated in New Zealand by the FMA and has other global oversights from CySEC, FCA, ASIC, and more. When it comes to additional asset classes, Plus500 hosts a variety of options for portfolio diversification. These include forex (CFDs), commodities (CFDs), ETFs (CFDs), indices (CFDs), and more. You can get started with as little as $100 while enjoying free transactions.

*other fees may apply

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- Low spreads from 0.0 pips

- Free deposits and withdrawals

- Quality learning materials and a dedicated support service team

- A user-friendly and intuitive design platform, perfect for newbies

Cons

- Its $10 monthly inactivity fee kicks in after only three months

- Plus500 does not support buying and taking full ownership of the featured assets

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

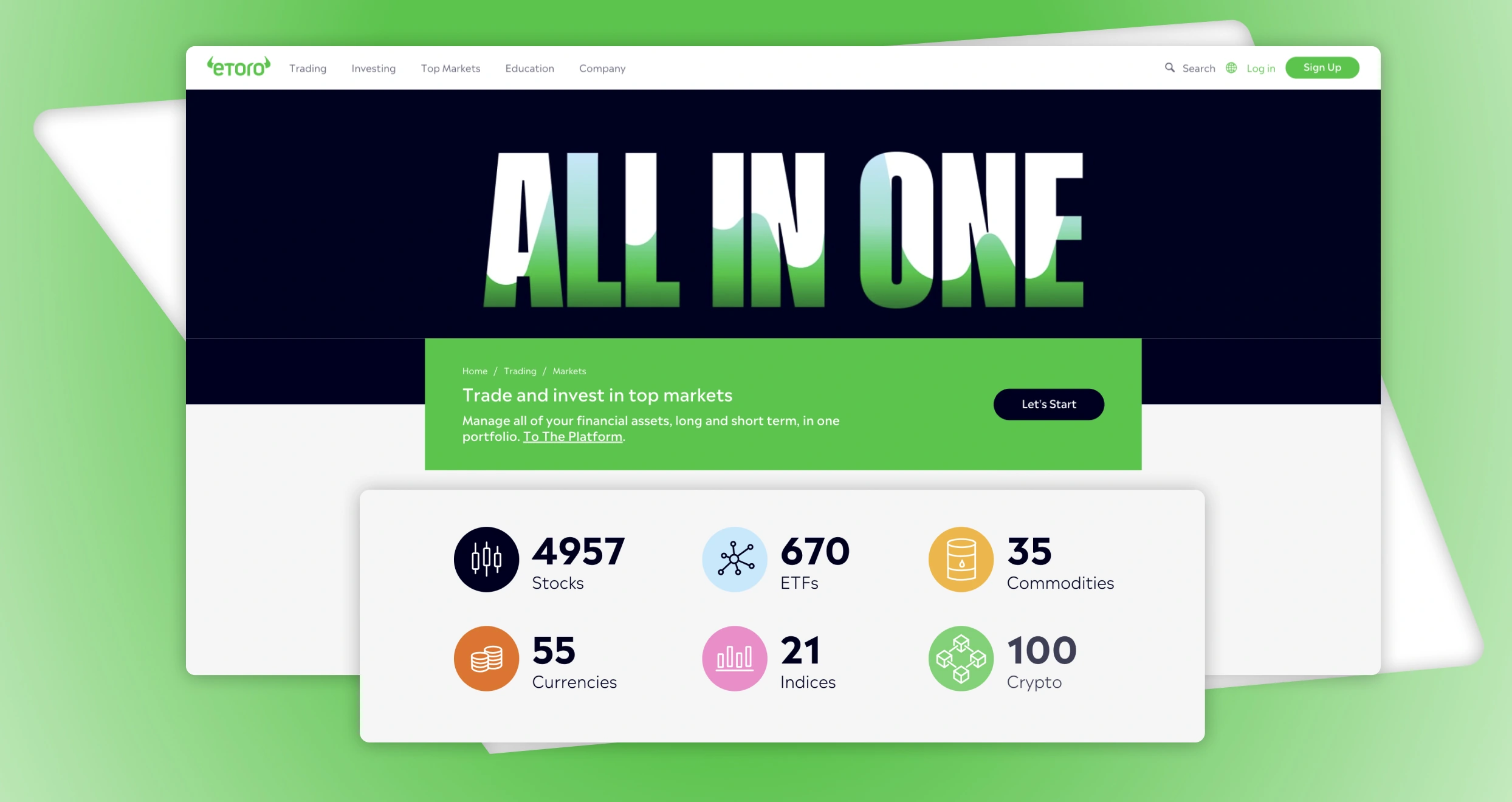

3. eToro – Beginner-Friendly Stock Broker in New Zealand

Exploring the share market with eToro was seamless, thus leading us to primarily recommend it to newbies. The broker has a user-friendly and customisable platform, allowing beginners to invest in the stock market for a more extended period. Plus, eToro hosts an extensive selection of learning materials, which newbies will find helpful in boosting their skills. And when you are ready to gauge your skill, a demo account is at your disposal with $100,000 in virtual funds.

eToro has a high minimum deposit requirement of $1,000 for Kiwi stock traders and investors. It also charges spreads for share trading, and users will incur withdrawal charges. The good news is that stock trading is commission-free, and you get to deposit funds in your account free of charge. You will explore over 4,500 stocks from 20+ global exchanges as CFDs, indices, or buying and taking full ownership. For those who like social trading, eToro gives you an opportunity to interact with other global stock investors and copy expert positions with increased profitability.

Pros

- Opportunity to trade real stocks commission-free

- Hosts an award-winning social trading platform that can be beneficial to newbies

- Numerous learning materials and a demo account

- A user-friendly and intuitive design platform for desktop and mobile devices

Cons

- High minimum deposit requirement for New Zealand stock investors

- Charges a $5 withdrawal fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

4. AvaTrade – Top Stock Platform For Mobile Trading in New Zealand

We discovered that AvaTrade is one of the NZ stockbrokers with an excellent reputation from users on Google Play, the App Store, and Trustpilot. This led us to recommend it primarily for traders who prefer mobile trading. Our experience with its AvaTradeGO app was seamless, as we found it user-friendly and navigable. Getting started was also straightforward, with a minimum deposit requirement of only $100.

Stock trading at AvaTrade exposes you to over 600 stocks, including popular options like Tesla, Meta, Netflix, and more. Although the asset offerings are limited compared to its peers, and you can only explore them as CFDs, AvaTradeGO is among the most affordable mobile apps. Plus, the app hosts diverse platforms, including MT4, AvaSocial, MT5, ZuluTrade, and DupliTrade, each with its own unique features. Learning has also been simplified with the availability of numerous educational materials.

Pros

- Low minimum deposit requirement

- A highly rated AvaTradeGo app on Google Play, the App Store, and Trustpilot

- Low stock trading spreads from 0.13%

- Features automated trading on the MT5 platform

Cons

- High inactivity fee of $50 quarterly after only three months

- Low stock asset offerings compared to its peers

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

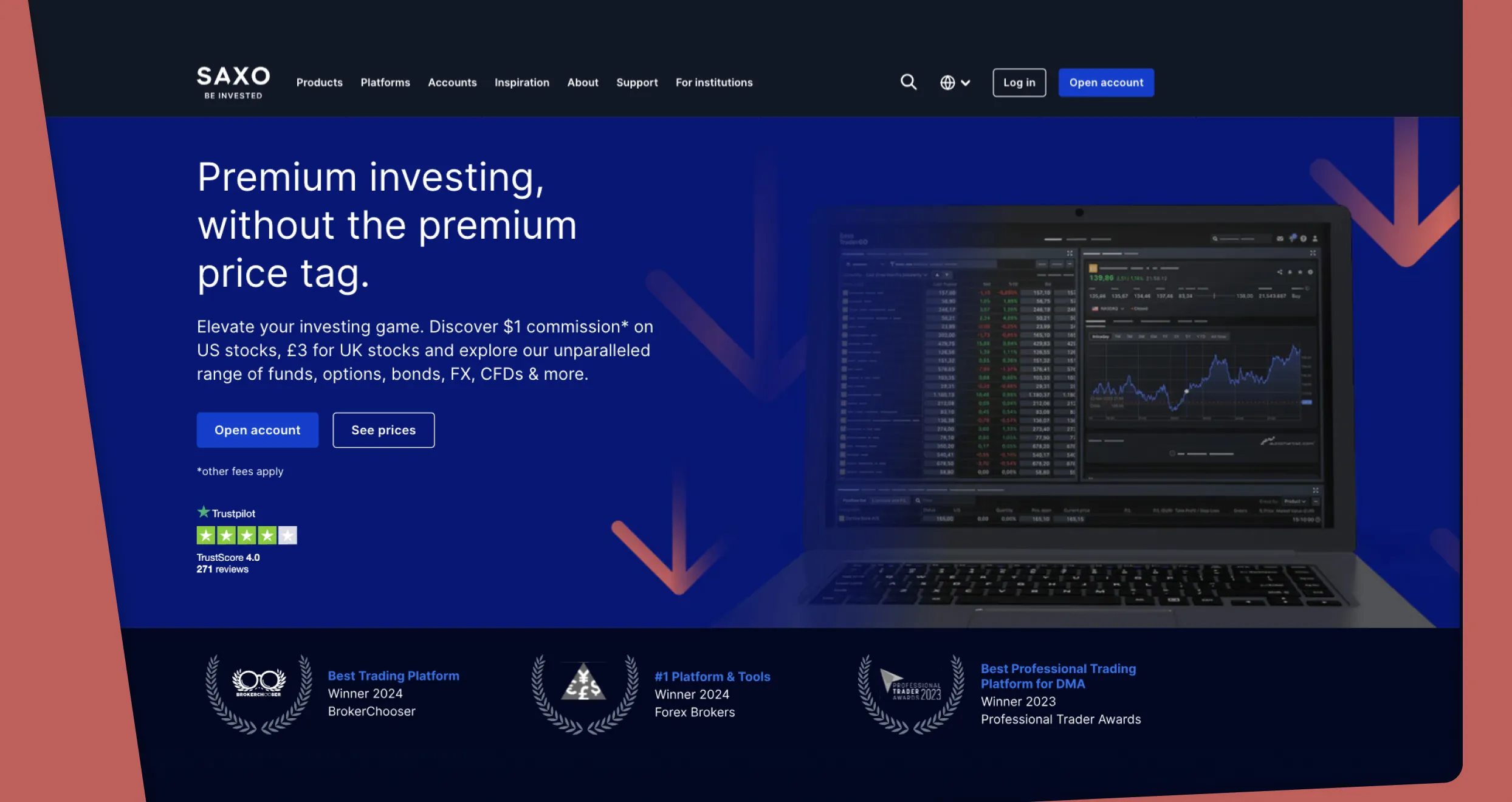

5. Saxo – Best New Zealand Stock Broker For Professional Traders

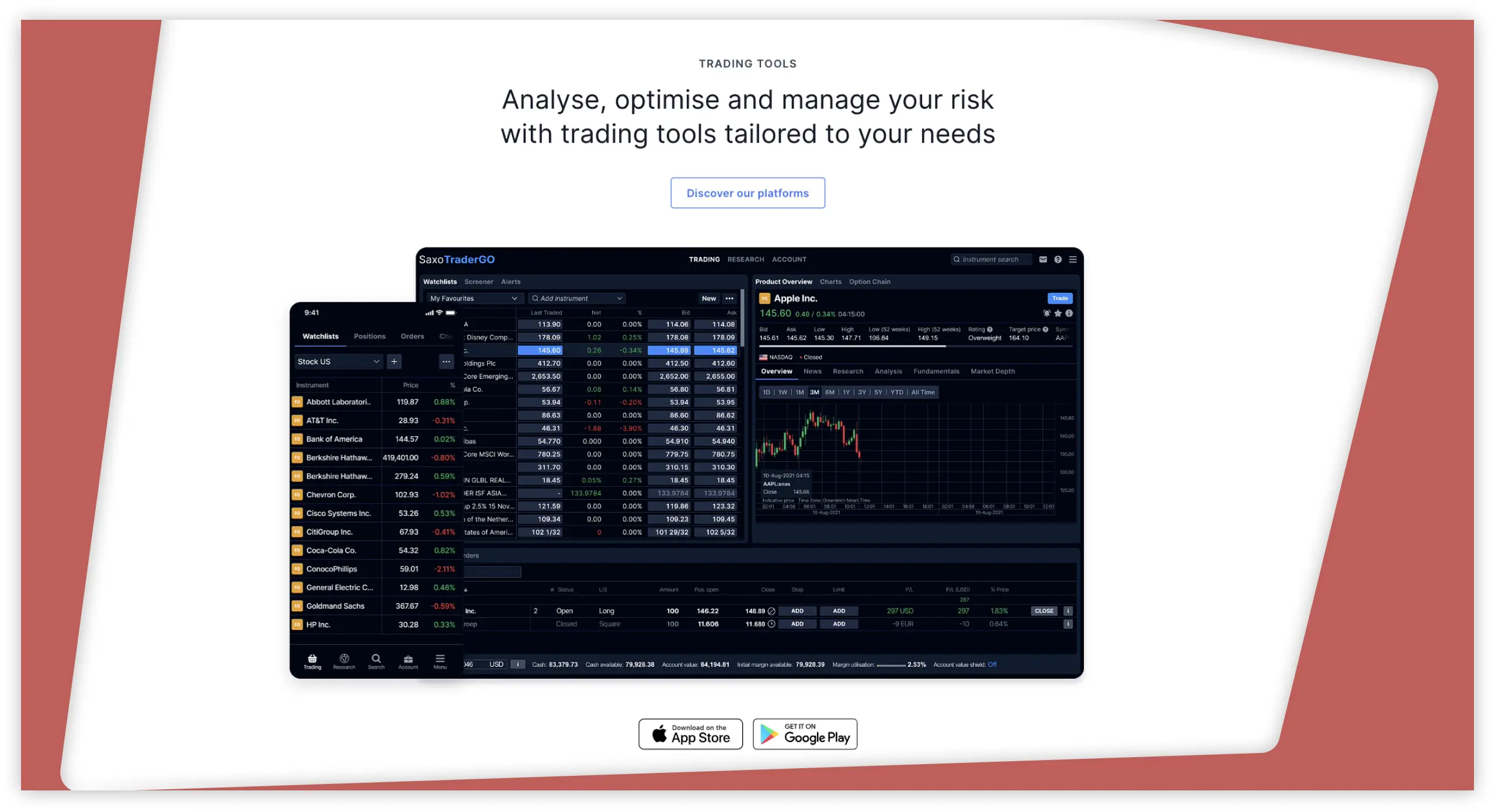

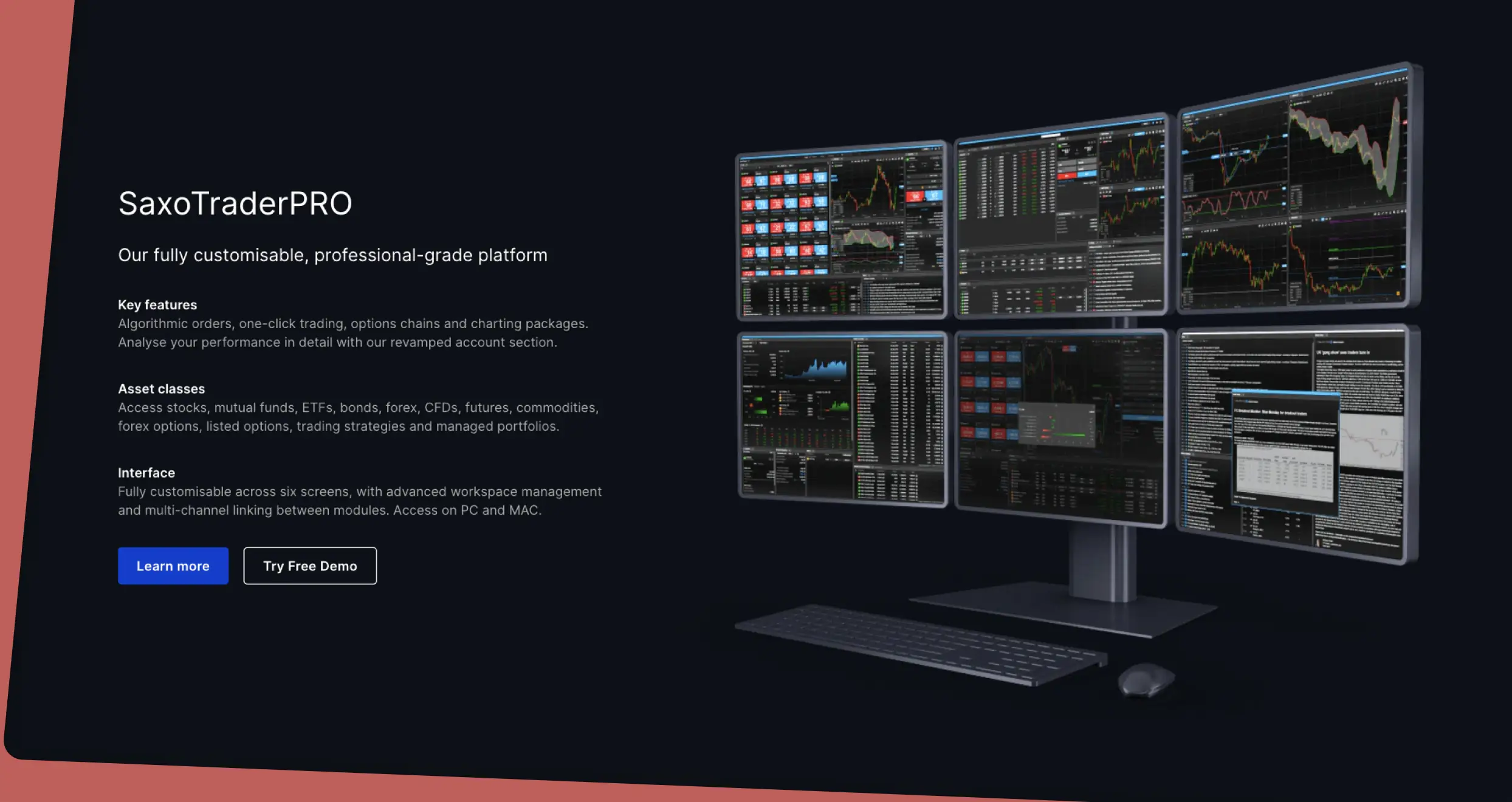

After vetting multiple stock brokers, we primarily recommend Saxo to advanced traders. As professional investors, we were glued to its SaxoTraderPro and SaxoInvestor platforms, which are tailored for advanced trading. They are fully customisable and equipped with quality resources, including high-performance charting tools, algorithmic orders, advanced trade tickets, risk management controls, and more. Saxo also allows advanced traders to trade on the go with SaxoTraderGo, a powerful, award-winning app.

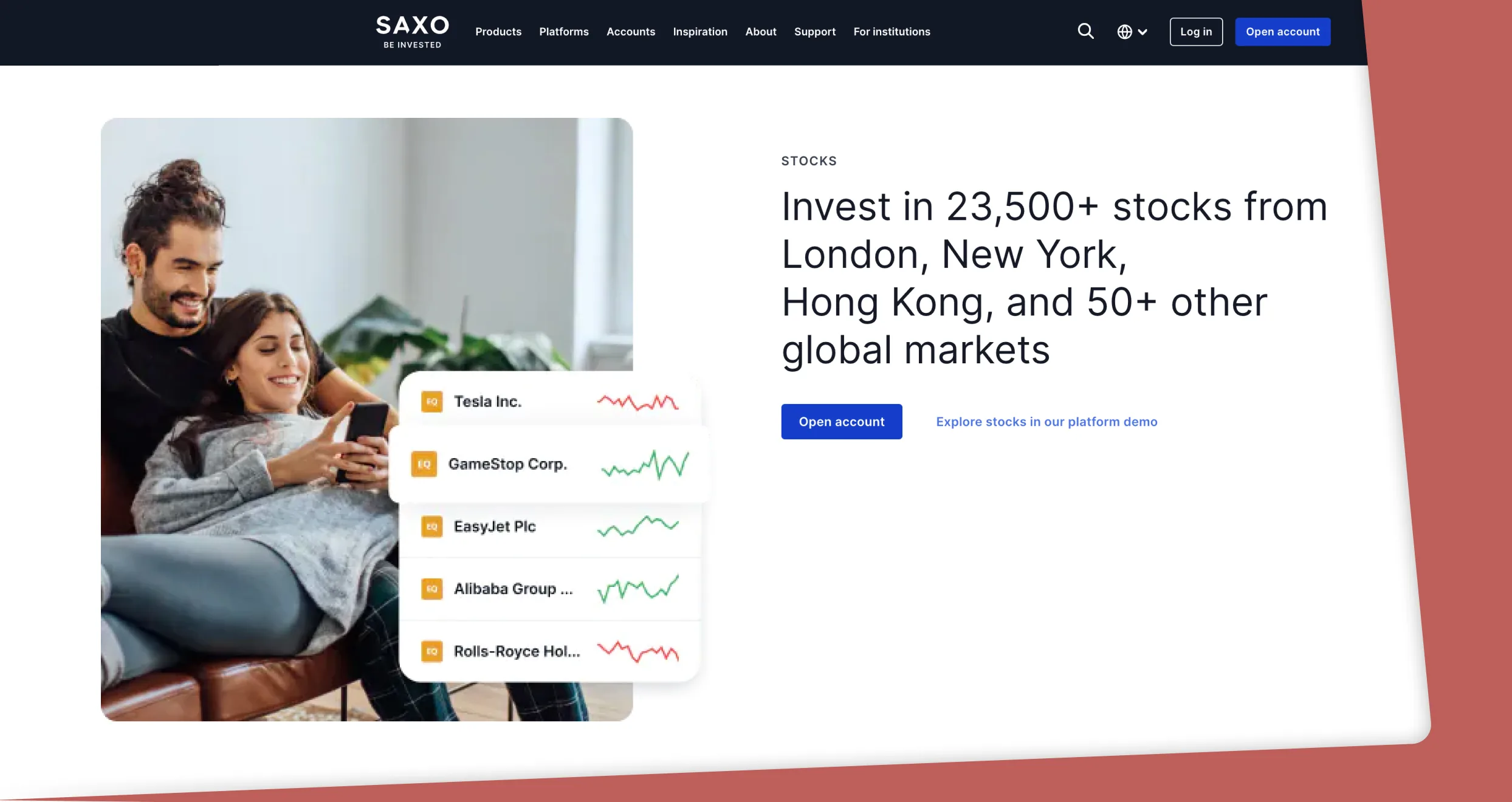

When it comes to asset offerings, this FMA-regulated broker lists over 71,000 options. Among them are over 23,500 stocks across 50+ global markets. You can buy and take full ownership of these stocks or trade them as derivatives. The best part is that stock purchases are allowed at low commissions from $1 on US equities. Note that there is no minimum deposit requirement at Saxo, and transactions are free of charge.

Pros

- Offers over 71,000 assets, including 23,500+ stocks

- Ultra-low commissions starting from $1 on US shares

- No minimum deposit requirement for NZ stock investors

- Free deposits and withdrawals

- Zero account inactivity fees

Cons

- Limited educational resources for beginners

- No third-party trading software is available

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

Stock Trading in New Zealand

Stock trading in New Zealand is legal, and any individual over 18 can engage in the activity via a brokerage firm. The region’s stock market is highly regulated by the Financial Markets Authority (FMA). This authority strives to maintain the integrity of the financial landscape, ensuring investors and traders enjoy the best conditions.

New Zealand hosts numerous stocks to explore, most of which are listed on the New Zealand Exchange (NZX). You can buy and sell such stocks using FMA-regulated brokers with access to NZX. With stock brokers, you can also trade stocks from other global exchanges like NYSE, NASDAQ, LSE, and more. Plus, Kiwi investors are free to explore the securities as derivatives like indices and CFDs.

Note that the NZ stock market is volatile, and venturing into it requires a strategic approach. For beginners, learn how the stock market operates and select the stocks you are familiar with. Plus, understand the tax regulations on stock trading proceeds to plan accordingly. The Inland Revenue Department (IRD) considers stock investing a business venture, and any gains from selling the stocks you once purchased are subject to income tax.

How to Choose the Right Stock Trading Platform in NZ

Choosing the right stock trading platform in New Zealand will not only guarantee your fund’s safety but also an exciting experience. If this is your first time exploring this venture, or you are looking for a reliable platform, here are the key elements to consider.

This is the first and the most crucial element to look into in a platform offering stock trading services in New Zealand. With many platforms claiming to be legitimate in the region, confirming a platform’s regulatory status will ensure you do not fall victim to scammers. The best stock trading platform should be licensed and regulated by the Financial Markets Authority (FMA). Plus, it should employ additional robust security measures such as two-factor authentication, face ID, and more.

Kiwi stock traders should settle with a stock trading platform that is user-friendly and has a fast trade execution speed. It should also be customisable so you can keep trading the stock market long-term. And to efficiently conduct market analysis and advance your skills, ensure the platform you select has quality research and learning materials. Most importantly, consider a demo account availability to test the stock platform and gauge your skill level before transitioning to live trading.

You need a stock trading platform NZ that allows access to not only the local stock markets but also international ones. Access to global stock exchanges will allow you to expand your trading capabilities on different markets and increase your profit potential. Plus, consider a platform with additional asset classes like forex, commodities, cryptos, and more. It will be easier for you to explore these markets and hopefully identify more options for portfolio diversification.

The most suitable trading platform in New Zealand should have trading and non-trading charges you can afford. Having a budget will help you identify a trading platform based on this factor. Confirm a platform’s minimum deposit requirement, transaction costs, inactivity fee, overnight charges, and more to avoid surprises when already invested with a stock broker. Plus, there should be no hidden charges.

It is important to consider how you will transact on a stock trading platform in New Zealand. Choose a platform with the most efficient payment methods. Some of the most preferred ones include debit/credit cards, e-wallets, and bank transfers.

You will need customer service at some point in your trade, and if you forget to confirm this element, you might end up disappointed in that area. Note that trading issues are bound to occur, and even expert traders experience them often. So, confirm the communication channels provided and see if they work best for you. Additionally, the customer service availability should match your trading schedule.

How To Register an Account with a Stock Broker in NZ

Trading stocks with an FMA-regulated broker in New Zealand exposes you to diverse market opportunities. However, many Kiwi traders do not know the proper procedures for setting up an account with such brokers. Worry not, though, for we provide guidelines to ensure you get started on a good note.

Before visiting your broker’s website, ensure you have learnt the stock market and are familiar with how it works and the elements influencing the price movements. Take full advantage of the learning resources that your broker provides for this purpose. And when you are confident enough, visit the broker’s website to set up a trading account.

At your broker’s website, start by understanding the terms of service attached to avoid future inconveniences. Then, click the sign up, join now, or register button to create a trading account. For most FMA-regulated stock brokers like the ones we recommend, the procedures involved are similar. You will be required to share your personal details, including your name, email, phone number, date of birth, and more. Do not forget to also create a unique username and strong password for maximum safety.

The FMA has established regulations to protect the New Zealand financial landscape from imposters and money laundering activities. To achieve this, all brokers in the region must verify their clients’ personal details before fully activating their accounts.

For this reason, expect to share copies of your personal documents as proof of identity and location. These include a copy of your government-issued ID, driver’s licence, or passport and a recent utility bill or bank statement. Depending on the broker, verification may take a few hours, after which you will receive an email notification.

At this point, you are free to fund your account and access the available stocks to trade in New Zealand. For brokers like the ones we recommend, you can transact using multiple methods, including credit/debit cards, e-wallets, and bank transfers. Ensure you make the deposit with a payment method that is more convenient for you.

Once you have made the required deposit, the stock broker will allow you to access the financial markets and choose the stocks you are confident in. Whether you want to trade the stocks as physical assets or derivatives, choose the most suitable trading method based on your research and analysis. Identify the best entry and exit points and apply solid strategies that will likely increase your profit potential.

Remember, the stock market is volatile and prices constantly change based on various conditions. In this regard, always stick to your trading plan and consider applying risk management controls to mitigate massive losses.

Conclusion

Our list above presents some of the best stock trading platforms in New Zealand. If you have limited time for research, we hope you can identify a suitable option here. However, success doesn’t come with the best broker only. Dedicate time to conducting market analysis and developing solid strategies for increased profitability. Also, understand the share market and select a platform that supports your preferred trading style. For instance, if you are looking to purchase company stocks and take full ownership, choose a broker with access to the exchanges listing them. Most importantly, stick to your plan and do not make decisions based on emotions.

I’ve dabbled in different platforms, and I totally get how important it is to find the right one. IG Markets looks decent, but I personally prefer brokers with a more intuitive mobile experience