Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

I’m a big fan of trading apps because they enable me to trade anytime, anywhere. With my favourite apps, I can easily log into my trading account and open, monitor, and close positions, whether I’m commuting to work, relaxing at home, or going on a road trip. All I need is my smartphone and data; I no longer need my PC to trade and earn returns.

You should try trading with mobile-friendly apps today. But before you run into your official app store and download the first app you encounter, I’d like to point this out: both good and bad trading apps are available in the UK. I highly recommend vetting every app before signing up. Better yet, increase your odds of dodging shoddy providers by trading with either of the top-tier apps I’ve recommended below.

List of the Best Trading Apps

- Pepperstone – Best App for Leverage Trading

- eToro – Best App for Crypto Enthusiasts

- FP Markets – Best App for CFD Traders

- Saxo – Best Trading App for Investors

- FxPro – Best App for Forex Traders

Compare Apps Table

First, let me highlight key factors that convinced me to choose the 5 apps I’ve recommended here. That includes licensing and regulation, which I consider the most critical element when it comes to vetting every service provider’s legitimacy and credibility. The other factors, like minimum deposit and spreads, will help you compare the recommended apps and spot the most promising from the get-go.

| Best European Trading Platforms | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, CMA, DFSA, CySEC, SCB, BaFin | £0 | From 0.0 pips | 24/7 | FCA, ASIC, CySEC, FSCA, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | Yes |

| eToro | FCA, ASIC, CySEC, FSCA, SFSA ADGM, MFSA, FSAS, GFSC, SEC | £50 | From 0% commission | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| FP Markets | FCA, ASIC, MAS, FSCA, CMA, CySEC, FSA | £100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | No |

| Saxo | FCA, FSA, ASIC, IMA, MAS, SFC, JFSA | £0 | From £0.03% | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank transfer, credit/debit cards, Quick payment | Yes | Yes |

| FxPro | FCA, CySEC, FSCA, SCB, FSA | £100 | From 0 pips | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | Yes |

Apps Reviews

I have reviewed the 5 best trading apps in the UK in excruciating detail below. I have also denoted each service provider’s greatest strengths and drawbacks to make isolating the right app easier. That said, I couldn’t explain every single feature in this guide. To ensure you have all the information you need to make sound decisions, please visit each viable prospect’s official site and digest every crucial information before signing up.

1. Pepperstone – Best App for Leverage Trading

If you’d like to control large positions and get juicy returns, but your capital is limited, don’t fret. Just sign up with Pepperstone today. You’ll get the opportunity to increase potential profits with leverage of up to 1:200 while trading forex pairs and other assets. In other words, this broker allows you to multiply potential profits by up to 200x.

Does the 1:200 leverage seem lower? Worry not. If you are experienced and your trading portfolio and cash deposits exceed £500,000, you can get access to up to 1:500 leverage by opening a professional Pepperstone account. You’ll get many other boons besides sky-high leverage, including discounted commissions and up to £1,000 in referral bonuses.

I also urge cost-conscious Brits to check out what Pepperstone has to offer. If you’re one of these people, you’ll love Pepperstone’s £0 minimum deposit requirement and cost-free transactions. I’m sure you’ll also be impressed by this app’s low spreads and commissions, starting from 0 pips for low-volatility currency pairs like GPB/USD and EUR/USD.

Pros

- Up to 1:500 leverage

- No minimum deposit requirement

- Free deposits and withdrawals

- Tight spreads and commissions

- Supports cTrader, TradingView, and MT4/5

- Available on iOS and Android

Cons

- Limited financial instruments compare to its peers

- Scanty learning materials

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – Best App for Crypto Enthusiasts

Some traders like investing in crypto assets, and rightly so. Cryptocurrencies are incredibly volatile and subject to extreme price charges. If you know what you are doing, you can exploit that and reap high returns, sometimes multiple times a day. That said, if you’d like to augment profits from your trading escapades with juicy returns from crypto investing, I strongly recommend joining eToro.

Unlike most brokers in the UK, eToro doesn’t offer CFDs on crypto exclusively. This app also allows its users to buy, hold, and sell real cryptocurrencies. The crypto assets you’ll have access to after opening an eToro account range from Solana, Ethereum, and Bitcoin to TRUMP, HBAR, and AVAX. You only have to pay a reasonable 1% fee while buying and selling these assets.

But how will your trading experience be on eToro? In one word: sensational. While investing in crypto, you’ll have unlimited access to over 7,000 tradable assets, including currencies, commodities, and ETFs. What’s more, you can invest in other products besides popular cryptocurrencies, such as thousands of stocks from established companies like META, Amazon, and Alibaba.

Pros

- Users can buy and sell popular crypto assets

- Over 7,000 tradable securities

- Investors can diversify with stocks

- Reasonable trading and investment charges

- Top-rate learning resources

- Available on Android and IOS

Cons

- £5 fee for withdrawing money from your investment account to an external account

- £10 monthly inactivity fee that kicks in after 12 months

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

3. FP Markets – Best App for CFD Traders

Most of the best UK trading apps have CFDs on popular assets like stocks, commodities, and ETFs. But when it comes to the actual numbers, FP Markets is the uncontested king of the hill. I’ve said that because this service provider offers over 10,000 CFDS on everything from indices and ETFs to metals and commodities. This is one of the largest catalogues I have ever seen.

While trading with FP Markets, you will enjoy some of the lowest spreads and commissions today. Trade popular shares and minimize costs with sharp spreads starting from 0 pips. You can diversify with many low-commission assets, such as stock CFDs, whose commissions are as low as 0.06%. The good news is that you don’t need a large sum of money to start trading with this app and enjoy said perks; £100 is enough to get you started.

FP Markets’ other commendable attribute is its array of trading platforms. After signing up with this app, I had unlimited access to some of my favourite software, including MT4 and MT5. I also had ample opportunity to leverage exceptional charting tools like cTrader and TradingView. I’m pretty sure I’ll use this app in the near future. And if I don’t get a chance to do that, I can rest easy knowing I won’t have to cover any dormancy charges because FP Markets has zero inactivity fees.

Pros

- 10,000 CFDs on stocks, commodities, and more

- Low spreads and commissions

- No inactivity fees

- Supports TradingView, cTrader, and MT4/5

24/7 support - Available on Android and IOS

Cons

- Iress has a £1,000 minimum deposit requirement

- Only CFDs and currency pairs are available

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

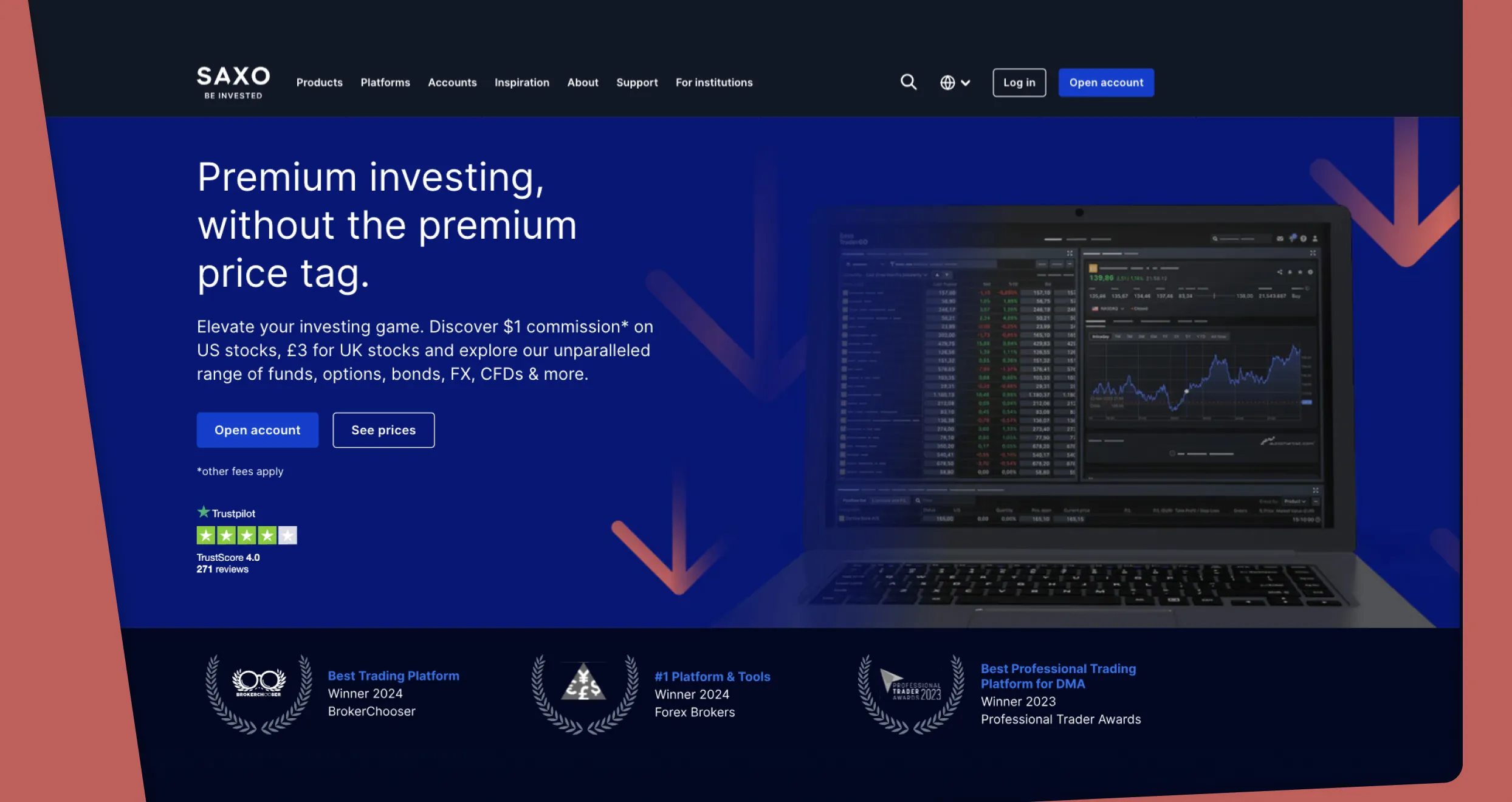

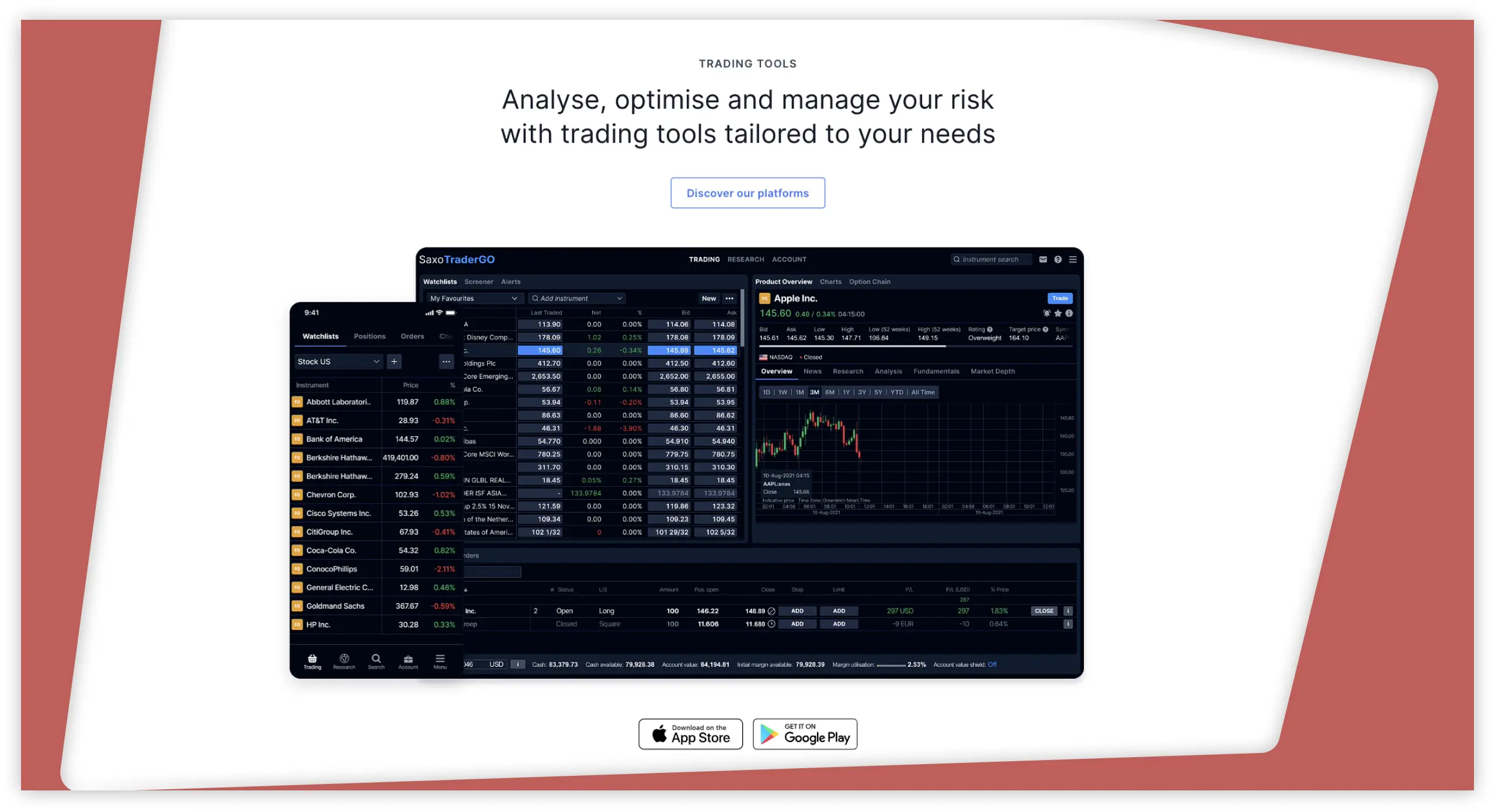

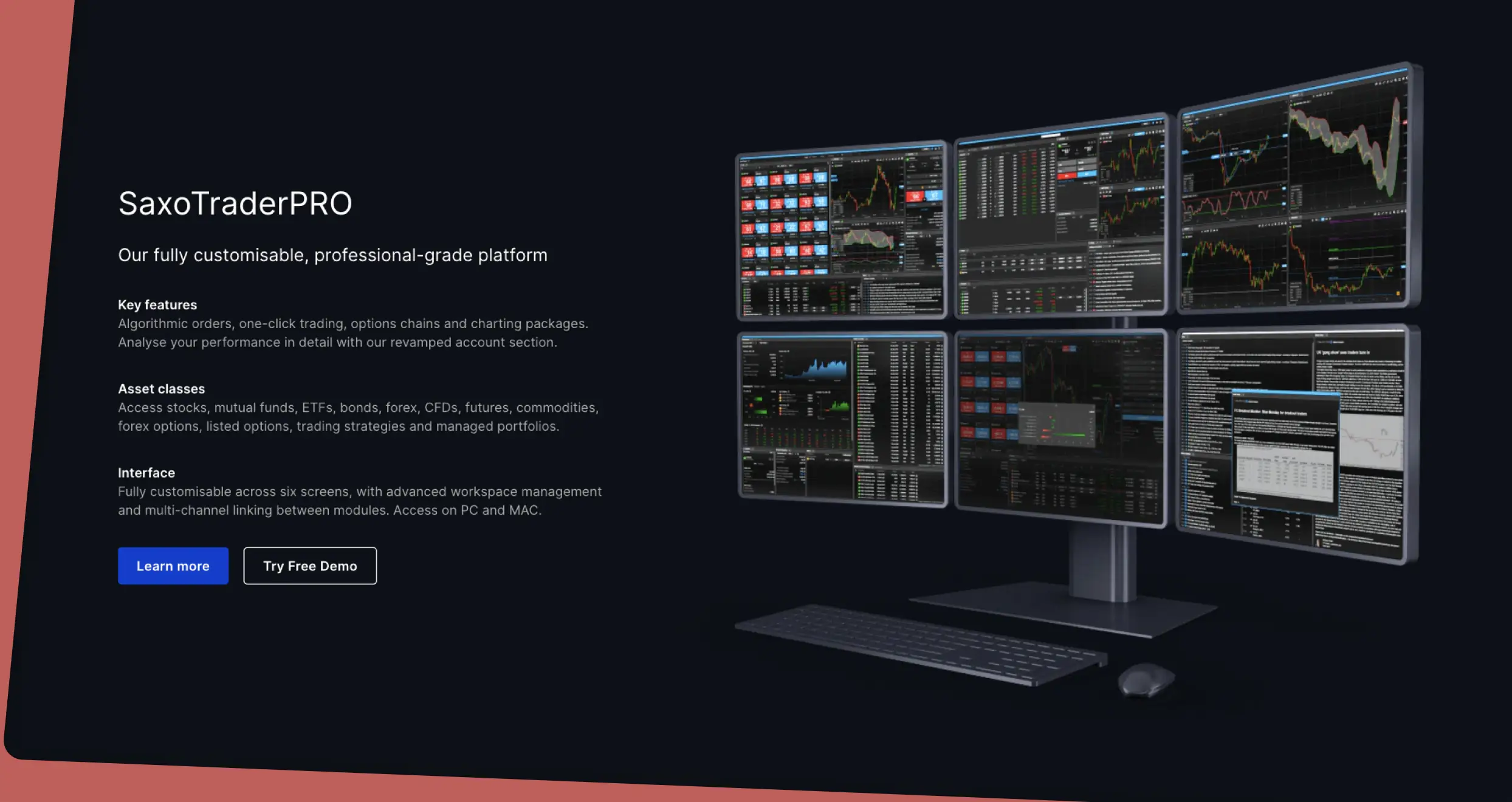

4. Saxo – Best Trading App for Investors

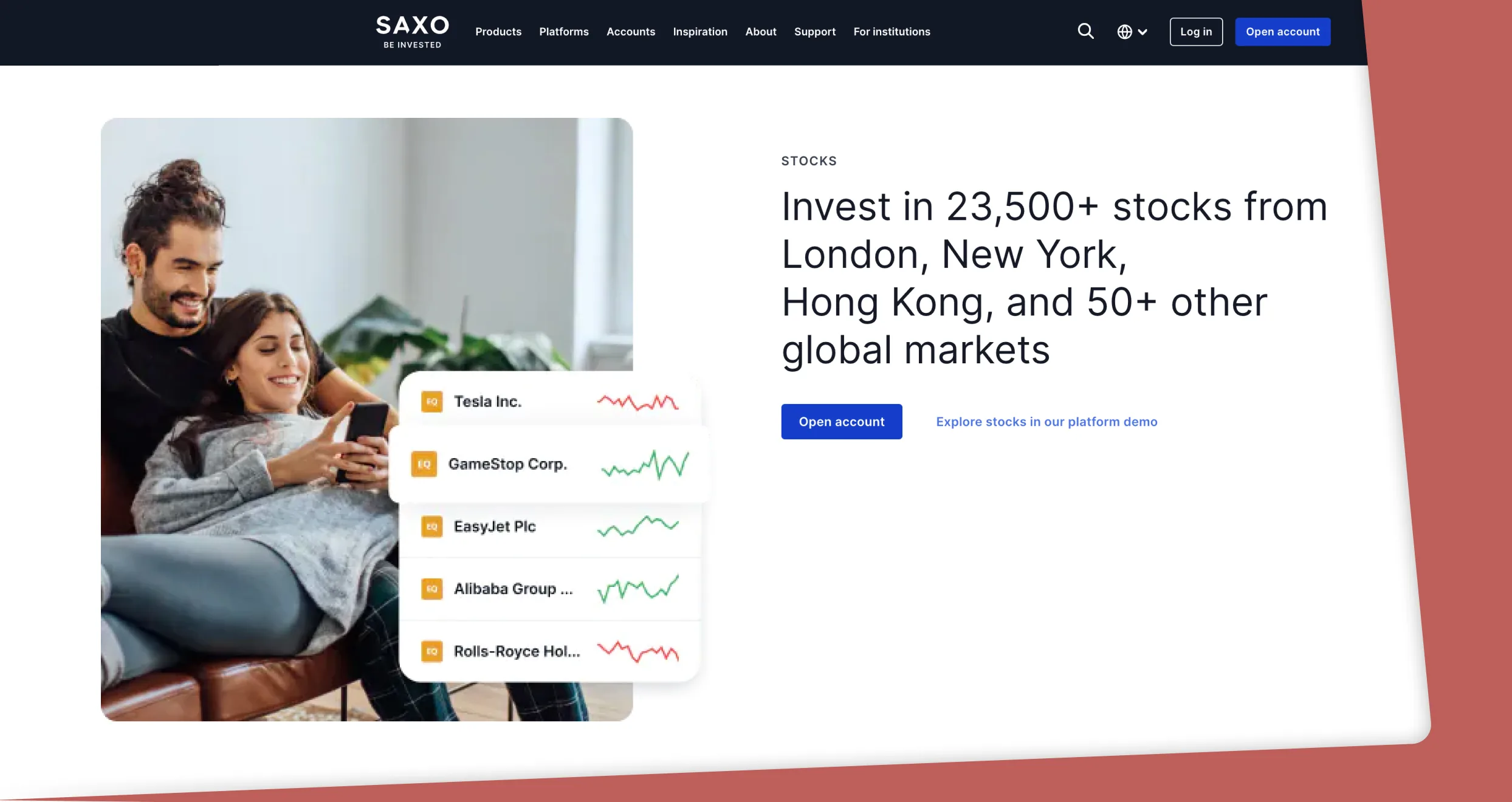

Saxo is the best provider for traders interested in investing. This company offers a unique platform called SaxoInvestor, which you can access from your phone. It’s our gateway to countless investment products, including 23,000 stocks from over 50 global markets and over 7,400 ETFs from major sectors like healthcare and tech.

Are you impressed? Wait, there’s more! SaxoInvestor also gives you the opportunity to invest your money in over 6000 funds and over 5,200 corporate and government bonds. If you think there must be a catch somewhere, let me assure you that there isn’t. You can buy your favourite assets for as little as £1 and enjoy the low commissions in the industry.

While investing with SaxoInvestor, you will have unlimited access to thousands of tradable assets. That includes CFDs on over 8,600 financial instruments like indices, stocks, and commodities. What’s more, if you get the Platinum or VIP status, you will enjoy super-low spreads and commissions.

Pros

- Tens of thousands of investment products

- A wide variety of tradable instruments

- Advanced tools for seasoned traders and investors

- Supports institutional trading and investing

- Premier support service

- Available on Android and IOS

Cons

- Offers proprietary platforms only

- Higher spreads than its peers

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

5. FxPro – Best App for Forex Traders

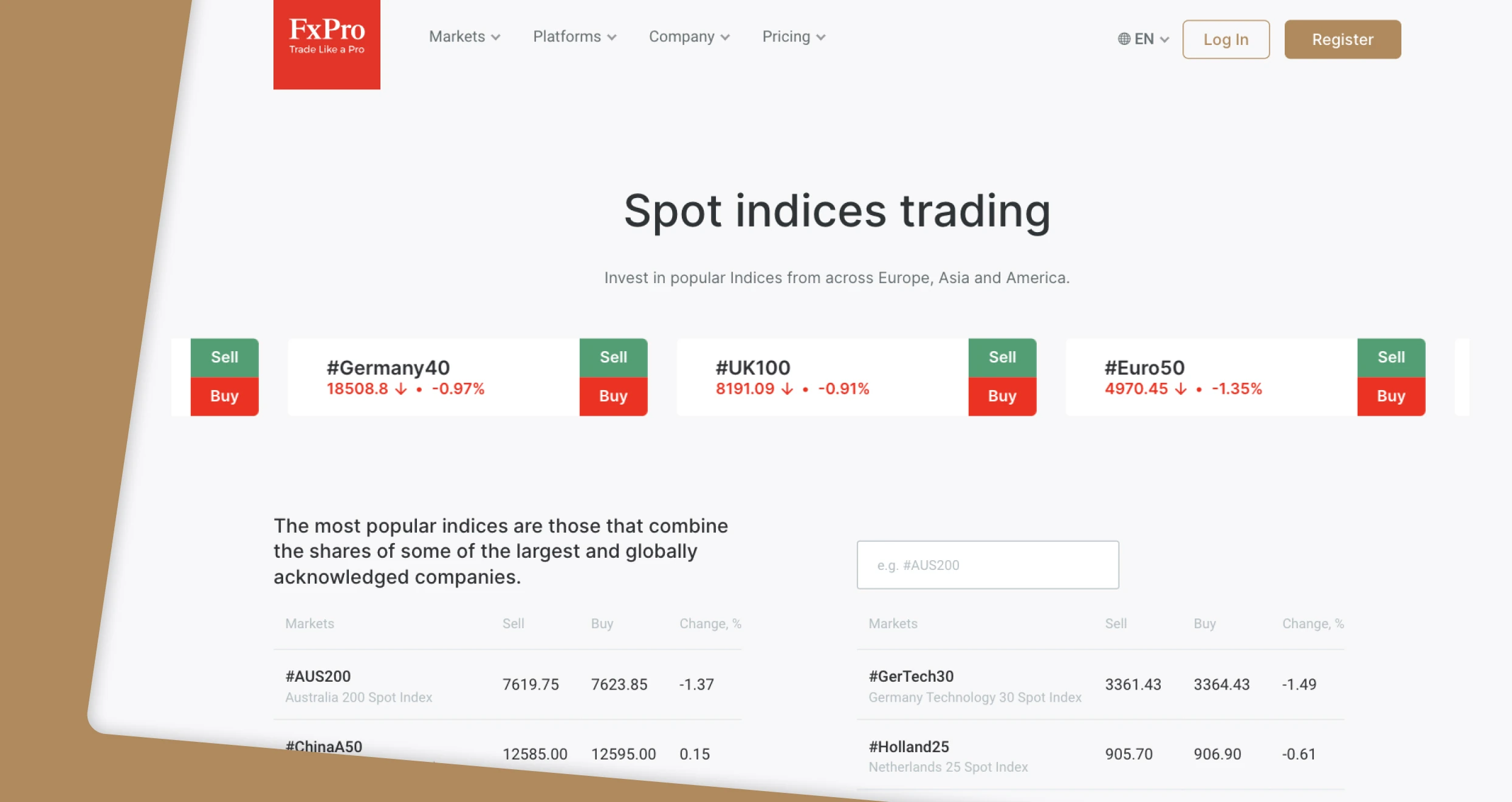

FxPro is the forex trader’s best friend. With this app, you can trade CFDs on over 70 currency pairs, including popular products like GBP/USD, EUR/USD, and EUR/GBP. You’ll also enjoy swift order execution that will enable you to leverage every opportunity and earn significant returns, especially if you’re a scalper.

I also recommend FxPro because this service provider’s clients have access to two of the most powerful forex trading platforms today: MT4 and MT5. These come with powerful features tailored to help you get the most out of forex trading, including robust charting tools and technical indicators. If you don’t fancy MT4 and MT5, you can opt for cTrader, which comes with a beaver of advanced features like detachable charts and support for custom cBots.

Not to forget, FxPro offers each forex trader the golden opportunity to enhance potential returns with low spreads and commissions. To enjoy this boon, you only have to open a Raw+ MT4 or MT5 account. Your spreads and commissions will start from a measly 0 pips and £3.5 per side, respectively.

Pros

- Over 70 popular currency pairs

- Spreads start from 0 pips

- Supports MT4 and MT5

- Excellent support service

- Traders can use custom cBots

- Available on Android and IOS

Cons

- Higher spreads for Standard accounts

- High maintenance and inactivity fees for dormant accounts

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

How to Choose a Trading App

I’ve encountered countless traders who chose the wrong apps and suffered significant consequences, including financial losses and compromised personal information. Scary, right? But here’s the good news: you can avoid such issues by spending enough time vetting different providers before picking the best trading app in the UK. While doing so, focus on the following:

Every credible trading app in the UK is licensed and regulated by the FCA. If you come across a provider that doesn’t comply with this organization’s regulatory stipulations, don’t sign up with it. Unregulated apps are more likely to expose you to issues like fraud, data theft, and unsubstantiated account bans. Also, before signing up, check if the app offers crucial features like advanced data encryption and investor protection.

I’m familiar with the frustrations that can plague a trader when interacting with a platform with limited assets. That is why I strongly recommend limiting your trading activities to apps that boast a reasonable array of financial products. Most importantly, if you discover that a particular service provider doesn’t have your favourite securities, don’t commit; search for a better app.

While evaluating each app, check its fees and charges. Start with account opening and maintenance fees. Then, go to spreads and commissions. Lastly, research the stipulated rollover, inactivity, and transaction fees. Compare the numbers you see with those mandated by other reputable trading apps. Your goal should be to find a broker with competitive costs that will have minimum impact on your capital and returns.

See what other traders have to say about your chosen trading app before making your final decision. You just need to read reviews on Trustpilot, the App Store, and Google Play. But, if you get too many mixed reviews on these sites, you can also evaluate customer feedback on sites like REVIEWS.io or seek advice from other traders through platforms like Reddit and Facebook.

Check if the app’s representatives address concerns during your normal trading hours. You don’t want to discover that your broker’s support team is unavailable when you’re facing an urgent issue like a compromised account. If you are a weekend trader or investor, find an app with 24/7 support. I also recommend testing every available support channel to find the best option you can use in emergencies.

For more insights, check out our article on the best budgeting apps in the UK.

How We Test

Here at Invezty, providing transparent, factual information is a top priority. We never favour any service provider or base our guides on idle chatter. Before reviewing and recommending every broker, we conduct extensive research and tests. We’ve designed the entire process to be as thorough as possible and cover all indispensable aspects, from licensing and security to platform usability and speed. We used this formidable vetting procedure to pinpoint the best UK trading apps.

Conclusion

You are now familiar with the top 5 trading apps in the UK, including their most noteworthy pros and cons. This is just the beginning of what should turn into an exciting and profitable journey. Pick the most viable app while considering your needs and preferences, and get started. I strongly recommend testing each app with a demo account before taking things to the next level.

If you have any further questions, contact your chosen app’s support team and seek clarification as soon as possible. Most importantly, if you are new to trading, learn the basics before using any trading app.

Definitely going to check out some of these apps