Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Online brokers have made securities trading incredibly easy. Gone are the days when trading was exclusively for professionals with access to the Australian Security Exchange’s bustling floors. Thanks to these service providers, anyone can buy and sell financial assets online.

That said, trading with a reputable online broker regulated by the Australian Securities and Investment Commission (ASIC) is crucial. Why? It guarantees you’ll enjoy fair trading practices, optimum client fund protection, access to legal recourse whenever necessary, and other vital perks.

Having said that, my colleagues and I scoured a multitude of ASIC-regulated trading platforms and handpicked 5 that are unquestionably the cream of the crop.

List of Online Trading Platforms

- eToro – Overall Best Online Trading Platform Australia

- Pepperstone – Best Trading Platform for Australian Forex Traders

- FP Markets – Best Platform for High-Leverage CFD Trading in Australia

- AvaTrade – Best Platform in Australia for Automated Trading

- FxPro – Best Platform for Advanced Traders in Australia

Compare Platforms Table

I’ll open with a comparison table of the best online trading platforms in Australia. I want you to get a broad sense of where each stands in terms of credibility based on licensing and regulatory status. Note that, besides being regulated by ASIC, the recommended providers are also licensed and supervised by authorities in other countries, like the FCA (UK), MAS (Singapore), and CySEC (Cyprus).

Additionally, my goal is to help you identify a provider that matches your expectations in terms of everything from support, software, and payment methods to the availability of demo accounts and money insurance.

Before proceeding, let me explain something important. As you’ll see from the comparison table, most of the trading platforms discussed here don’t have money insurance. But that shouldn’t be a major concern. While trading with them, your money will be protected from issues like misappropriation and insolvency by segregation and other measures.

| Best Trading Platform Australia | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| eToro | ASIC, MAS, FCA, CySEC, FSCA, ADGM, MFSA, SEC | AU$50 | From 1.0 pip | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| Pepperstone | ASIC, FCA, CMA, DFSA, CySEC, BaFin | AU$0 | From 0.0 pips | 24/7 | MT4, MT5, cTrader, TradingView, Capitalise.ai, Social Trading | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | No |

| FP Markets | ASIC, MAS, FCA, FSCA, CySEC, FSA | AU$100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Credit/debit cards, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | No |

| AvaTrade | ASIC, FCA, FSCA, CBI, CySEC, PFSA, FSA, ADGM | AU$100 | From 0.9 pips | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, AvaSocial, DupliTrade | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes | No |

| FxPro | ASIC, FCA, CySEC, FSCA, SCB | AU$100 | From 0.0 pips | 24/7 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes | No |

Platforms Reviews

Let’s dive into today’s main course: reviews of the best trading platforms in Australia. Pay attention to every crucial factor we are about to discuss, especially the providers’ main selling points and downsides. Use these details to sift through the recommended brands and identify the best trading platform(s) in Australia for you.

1. eToro – Beginner-Friendly Trading Platform in Australia

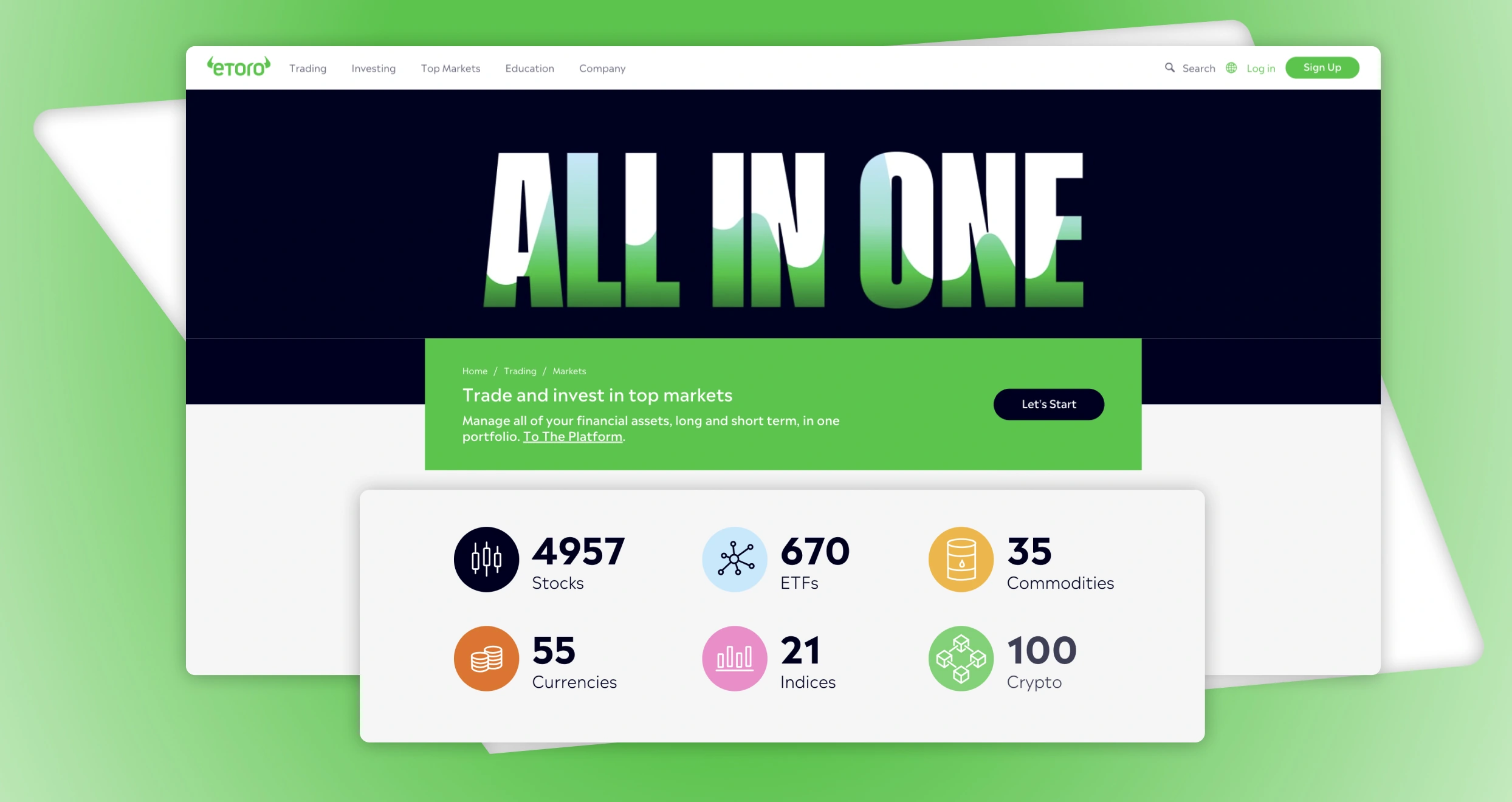

Having compared top providers in Australia, I believe without any reservations that eToro is the best of them all. Let me back my claim with a couple of solid facts. First and foremost, this platform has over 7,000 financial instruments. I’ll be honest; finding another service provider that can match this number is next to impossible.

Besides its outstanding number, I have nothing but praise for eToro’s asset collection because of its diversity. Like your average Australian trading platform, this service provider has a vast pool of CFDs on stocks, currencies, commodities, and more. But here’s what makes it truly special: the platform also has investment products you won’t find on most of its counterparts.

The investment products I discovered while exploring eToro are many and varied. The platform has over 6,000 stocks to trade from 20+ exchanges. Most of today’s favorites are available here, including stocks from popular Australian entities like the Commonwealth Bank of Australia, Yancoal Australia Ltd, and National Australia Bank Limited. Hundreds of ETFs are also available, from SPY and SPY.EXT to VEU, IXUS, BIL.

Another item I have to discuss is crypto. eToro is one of a handful of trading platforms that offer digital currencies. You can buy, trade, and sell a considerable range of crypto on the site, including Bitcoin, Ethereum, and Solana.

Pros

- Over 7,000 assets for avid traders

- Allows Australians to invest in stocks, crypto, and ETFs

- With AU$10, Australians can invest in stocks and ETFs

- Extensive collection of free learning resources

- Ready-made, smart portfolios for investors

Cons

- AU$10 inactivity fee

- High spreads on forex

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

2. Pepperstone – Best Trading Platform for Australian Forex Traders

If your personal forte is in forex trading, Pepperstone is the best online trading platform in Australia for you. Here, you’ll have access to over 90 forex products, from top AUD pairs like AUD/USD, AUD, and AUD/JPY to some of the most exotic options today, like AUD/DKK, AUD/DLN, and NZD/SGD. Finding your favorites on the site will be a walk in the park.

Another aspect that makes Pepperstone the best trading platform for Australian traders is its spreads. While testing the platform, I discovered a unique account that has the lowest spreads: Razor. Its spreads for numerous currency pairs start at 0 pips, including AUD/USD, USD/CAD, and GBP/USD. The other available account is Standard, but its lowest spread is 1.0 pip.

It doesn’t matter what type of forex trader you are; Pepperstone will be a game changer. If you are a scalper, the platform’s excellent execution speed of up to 30 milliseconds will put you in the best position to make quick trades and profit from minute price changes. Pepperstone’s low costs and latency also make it ideal for day traders and swing traders. In short, this service provider is a perfect fit for everyone.

Pros

- 90+ major pairs, minors, crosses, exotics, and NDF

- Minimum spreads start at 0 pips

- High execution speeds of up to 30ms

- Top-tier platforms, including MT4 and MT5

- No inactivity fee

- 24/7 customer support

Cons

- High minimum and average spreads on Standard

- Supports CFD trading only

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

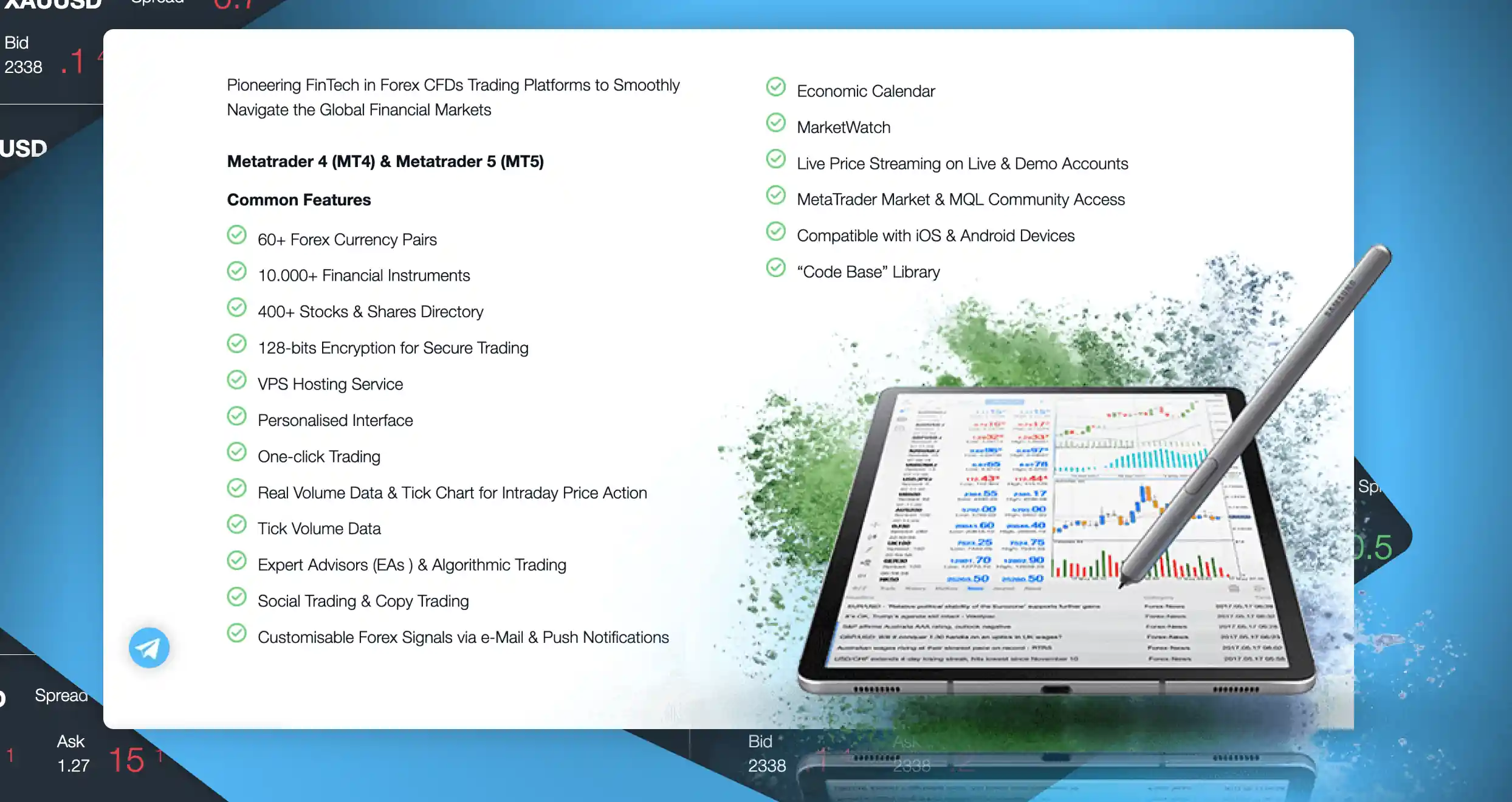

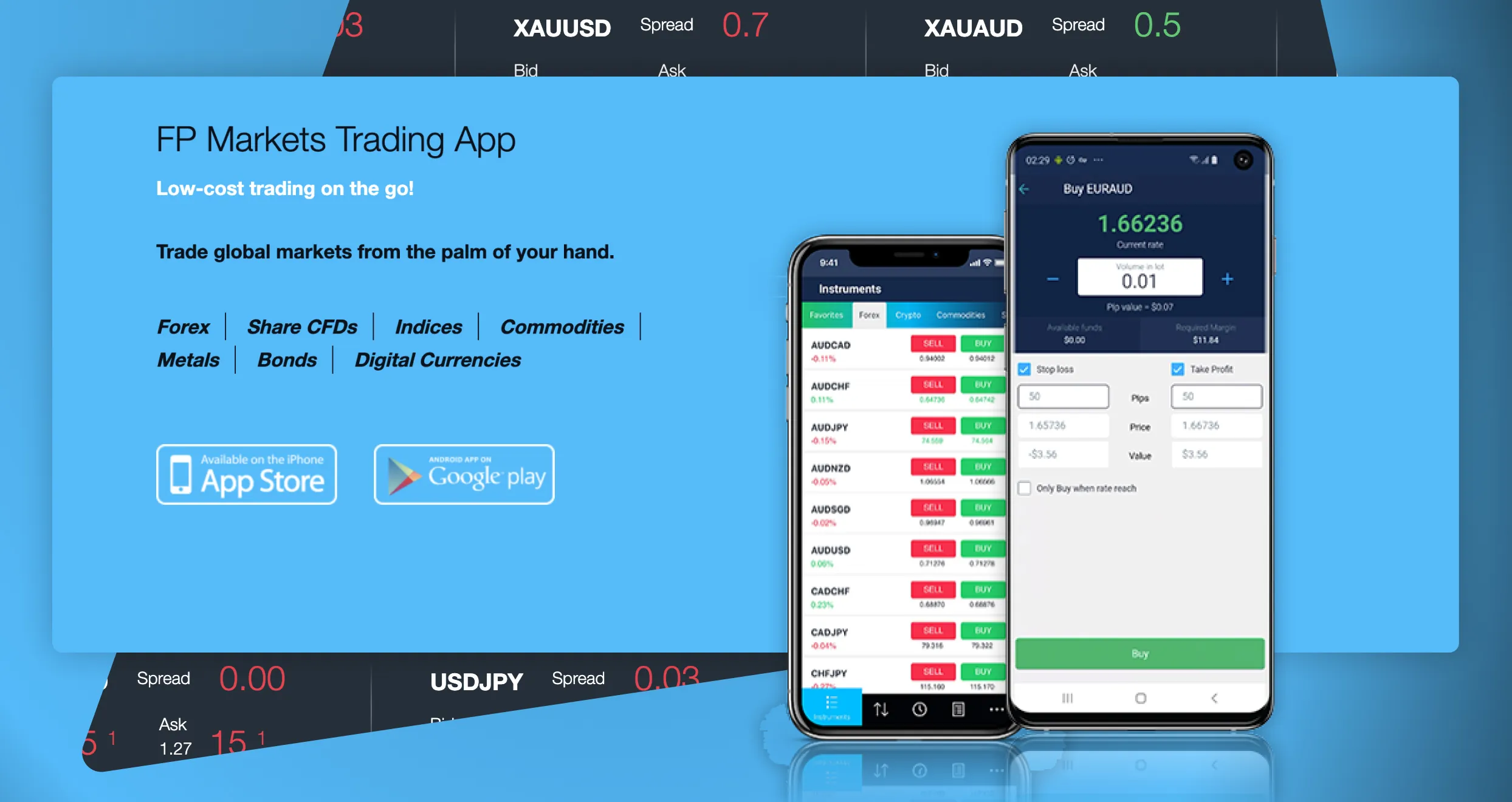

3. FP Markets – Best Platform for High-Leverage CFD Trading in Australia

Suppose you’d like to maximize market exposure and potential earnings with high leverage. In that case, the best trading platform for you should be FP Markets, especially if you are a seasoned pro. Open a professional account with it today and start using leverage as high as 1:500 to get to the next level.

Before signing up on FP Markets, let me familiarize you with a few key concepts. First, the 1:500 leverage is only for CFDs on gold and major/minor currency pairs. Other securities have lower ratios. For instance, the maximum leverage for CFDs on commodities and major/minor indices are 1:100 and 1:200, respectively. Also, the maximum leverage for retail traders is 30:1, as required by the product intervention order that ASIC introduced on 29th March 2021.

I can’t fail to point out FP Markets’ product selection. This service provider offers CFDs on over 10,000 financial securities, from forex, commodities, and shares to metals, bonds, and ETFs. You can trade them from any of the platforms available on the site, from MT4, MT5, and TradingView to cTrader and WebTrader.

There are two more platforms on FP Markets that I should mention: Iress Viewpoint and Mottai. Both are robust solutions tailored for advanced traders. They are equipped with a bevy of powerful features, from module linking to customizable order tickets.

Pros

- Up to 1:500 leverage on Pro

- Hosts MT4, MT5, cTrader and TradingView

- Advanced traders can use Iress or Mottai

- No inactivity fee

- Spreads start at 0 pips

- 10,000 tradable financial instruments

Cons

- Low leverage for retail traders

- Offers CFDs exclusively

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

4. AvaTrade – Best Platform in Australia for Automated Trading

While vetting AvaTrade, I discovered several elements that make it ideal for Australians who prefer automated trading. The first one is Duplitrade, and MT4 and MT5-compatible software you can use to automatically follow and copy signals and strategies from more experienced traders.

In addition to Duplitrade, AvaTrade offers AvaSocial. This is a platform that gives you the opportunity to connect with a broad community of experts and copy the most outstanding gurus. You just have to sign up and choose the best expert to copy based on past performance and other key stats.

Not to forget, this broker offers algorithmic trading on MT5, which is one of the trading platforms you’ll have access to after signing up. With algorithmic trading, you can use algorithms to turn a specific trade model or idea into an actual strategy.

If you’re not yet fully acquainted with automated trading, don’t worry. You can learn everything you need to know about this concept and more from AvaAcademy. This is a free virtual institution that gives noobs uncapped access to hundreds of expert-crafted trading courses, guides, and other materials.

Pros

- Users can copy master traders with DupliTrade and AvaSocial

- Supports algorithmic trading through MT4 and MT5

- Unparalleled collection of educational resources

- Top-tier risk management tools, like Guardian Angel

- Excellent support service

Cons

- AU$2,000 minimum deposit requirement for DupliTrade

- Limited tradable instruments

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

5. FxPro – Best Platform for Advanced Traders in Australia

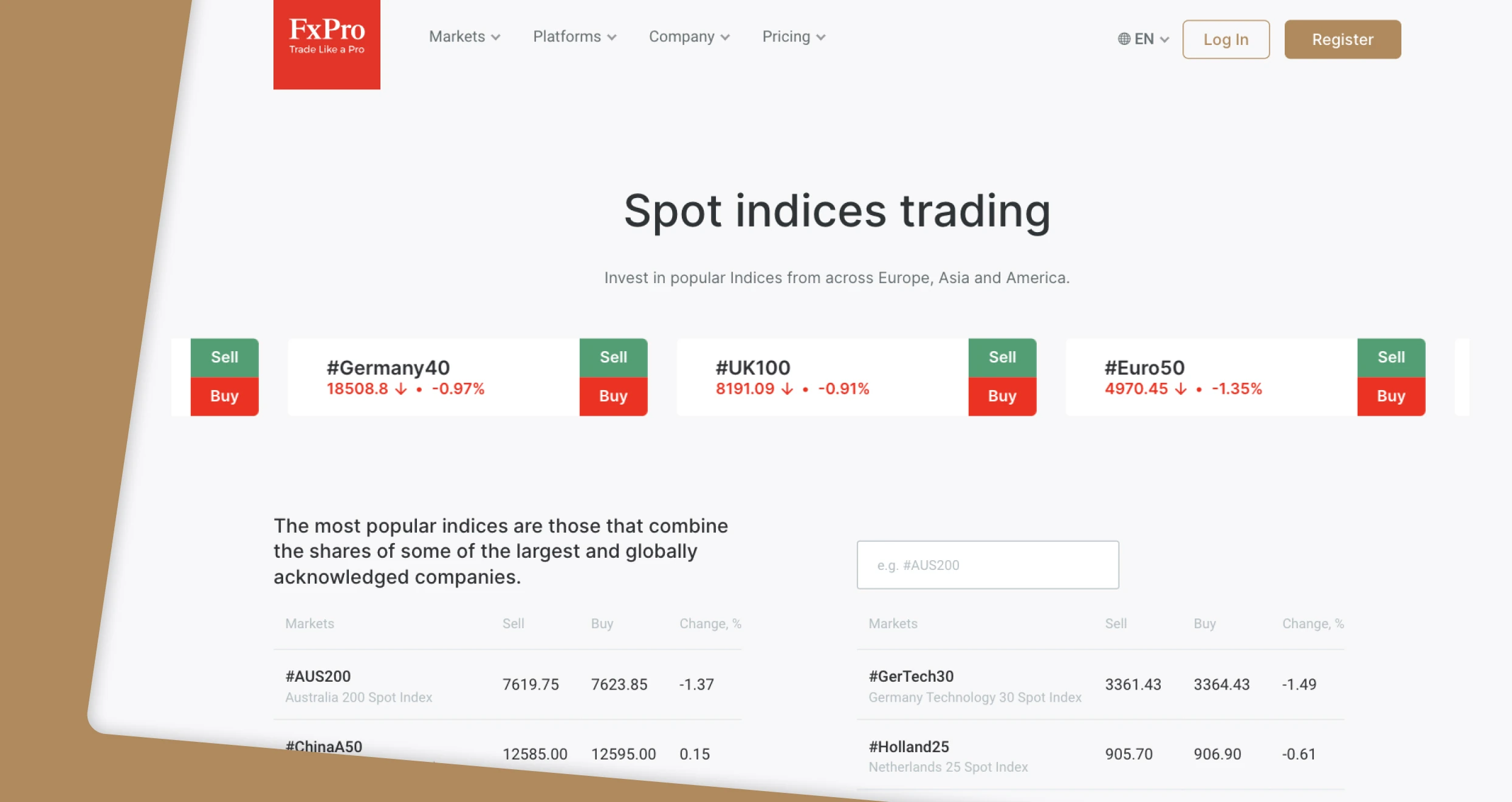

I urge all advanced traders in Australia to check out FxPro. If you’re at this level, you’ll love the variety of platforms that this broker’s clients have access to. The list has multiple robust solutions, starting with MT4 and MT5. These have premier features tailored for pros like you, from customizable interfaces to robust algorithmic capabilities.

cTrader will also be at your disposal once you sign with FxPro. This is another platform that’s designed for advanced traders like you. It has myriad top-tier features you can take full advantage of, including Level 2 DoM, detachable charts, and trailing stop.

While trading the markets with FxPro, you will have ample opportunity to lower costs with super-low spreads. All you have to do is open a Raw+ or Elite account. Do that today to get your hands on tight spreads from 0 pips on multiple major FX pairs. You will also enjoy significantly lower spreads for CFDs on Bitcoin and gold compared to Standard users, starting from 15 USD.

If you believe in your capabilities and have an extensive track record, you can increase your income with FxPro’s PAMM (Percentage Allocation Money Management) program. It primarily involves managing pooled accounts with funds from investors seeking high returns.

Pros

- Supports MT4, MT4, and cTrader

- Low spreads from 0 pips

- Orders are executed <11 milliseconds

- Skilled pros can increase income by managing pooled accounts

- Excellent multilingual support service

Cons

- AU$10 inactivity service

- Only CFDs are available

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

How to Choose a Trading Platform

Many traders have failed to reap the juicy fruits of online trading because they didn’t choose the right platform. Some settled for inferior providers and encountered numerous issues that catalyzed their failure, including slow execution and high slippage. Others fell for shady sites and got scammed from the get-go. Avoid their unfortunate fate by vetting every platform thoroughly before committing.

While vetting trading platforms in Australia, check the following:

Valid licensing and regulatory status are the first indicators of a good trading platform. While vetting each service provider, check if it’s licensed by ASIC in Australia and other tier-1 authorities, like the FCA, FINMA, and BaFin.

A broker licensed and regulated by such authorities is more likely to protect your funds with segregated accounts and facilitate a conducive trading environment through fair practices. Avoid platforms with no sign of valid licensing because they might be fly-by-night sites that will disappear with your hard-earned funds.

Protect your data and funds from cybercriminals by signing up with a secure platform. Several aspects can help you determine if a particular trading site is secure, including available security protocols and measures. The safest platform should have top-notch data encryption and account protection features.

Besides checking if a platform has the best security features, investigate the company’s history of hacks and breaches. Steer clear of service providers with a long history of successful cyberattacks because they are more likely to expose you to hefty financial losses, identity theft, and other issues.

The assets that will be at your disposal in the future will be determined by market access. While vetting different trading platforms, go through each service provider’s list of financial instruments. Prioritize platforms that have a considerable pool of your favorite assets.

Remember to check the available assets’ spreads and commissions. This will determine your costs and profitability in the long run. If you are a leverage trader, assess the leverage options for each market and whether they suit your needs.

The platforms you have access to can make or break your trading career. Before committing by funding a new account, vet the broker’s platforms. Most service providers allow new signees to test available solutions with demo accounts, so this should be easy.

While assessing and testing a broker’s platforms, pay attention to user-friendliness and how seamless everything is. Also, check the features and functionalities that come with each platform.

Good support might seem like a triviality until you need it. When trouble knocks at your proverbial door, you will need quick and reliable support to fix the issue at hand, stave off increased stress, and avoid losing a truckload of money.

Before signing up, check your chosen trading platform’s support status. 24/5 support should be sufficient in most cases. But if you plan to interact with international markets or crypto, 24/7 support is the better option.

How We Test

We assessed and tested a great number of trading platforms while searching for the most ideal options for Australians. While performing this crucial task, my colleagues and I checked several factors, from regulation, security, and ease of account setup to user testimonials, support service, and fees & commissions.

We eliminated the shoddiest platform as we worked through the list of trading sites in Australia. Then, our team rated the remaining service providers and picked 5 that garnered the highest. These are the ones we’ve recommended here.

And we never rely on guesswork or hearsay; our experts are always thorough, unbiased, and factual. Our only goal is to guide you towards the most credible and reliable trading sites in Australia. That is why we take extensive research and uncompromised accuracy very seriously.

Conclusion

Your degree of success or failure as a trader will be determined by numerous factors, including the platform you use. You’ll need a reliable and trustworthy service provider to conquer the markets and join the list of the most successful online traders in Australia. Pick from my recommended list and get going today!

Remember to pay your taxes diligently. The Australian Tax Office (ATO) will require you to pay income taxes if you are an active retail trader. On the other hand, if you trade occasionally as an individual, you’ll only need to pay capital gains tax.

Online brokers have definitely made trading more accessible. It's great to see that there are so many ASIC-regulated platforms to choose from