Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Digital trading platforms have made investing in the financial markets incredibly easy. Today, I can use my phone or PC to browse and trade thousands of popular assets like stocks and currency pairs from the comfort of my couch. I’ve been doing that for many years, and I highly recommend you try it. The boons to be had here are pretty juicy.

But don’t dive in blindly and trade with any platform you come across. The online scene is full of shoddy and scammy providers. If you’re not careful, you’ll lose your money and much more. For your safety, trade with the best platforms in Europe, which I’m about to introduce you to. I vetted and tested them personally, so I’m 100% confident in their ability to deliver top-notch services and protect your interests.

List of the Best Trading Platforms

- eToro – Best for Beginners and Social Traders

- Pepperstone – Best for Active Traders and Scalpers

- AvaTrade – Best for Risk-Averse Traders and Hedging Enthusiasts

- FP Markets – Best for Cost-Conscious Traders and MetaTrader Enthusiasts

- Saxo – Best for Professional Traders and Institutions

Compare Platforms Table

To help you find the best online trading platform in Europe, I’ll first introduce you to a brief comparison of my recommended service providers. I’ve focused on several factors, like licensing and regulation, that will help you understand why I chose these 5 brokers. I have also covered numerous elements that will allow you to compare the recommended providers and identify the most suitable option.

| Best European Trading Platforms | License & Regulation | Minimum Deposit | Commission & Spreads | Support Service | Software | Payment Method | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|---|---|

| eToro | ESMA, ASIC, FCA, CySEC, FSCA, SFSA ADGM, MFSA, FSAS, GFSC, SEC | €50 | From 0% | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/ debit card, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes | Yes |

| Pepperstone | ESMA, ASIC, CMA, FCA, DFSA, CySEC, SCB, BaFin | €0 | From 0.0 pips | 24/7 | Pepperstone Trading Platform, MetaTrader 4, MetaTrader 5, TradingView,cTrader | Credit/debit cards, PayPal, Skrill, Neteller, Flutterwave | Yes | Yes |

| AvaTrade | ESMA, ASIC, MiFID, FSA, FSC, FSA, FFAJ | €100 | From 0.13% | 24/5 | MetaTrader 4, MetaTrader 5, AvaOptions, AvaTrade App, AvaSocial, DupliTrade, ZuluTrade | Credit/debit cards, E-payments, Wire transfer | Yes | Yes |

| FP Markets | ESMA, FCA, ASIC, MAS, FSCA, CMA, CySEC, FSA | €100 | From 0.0 pips | 24/7 | MT4, MT5, TradingView, cTrader, WebTrader, Mobile App, Copy Trading | Debit/credit card, Neteller, Skrill, Bank transfer, Google Pay, Apple Pay | Yes | Yes |

| Saxo | FSA, ASIC, FCA, IMA, MAS, SFC, JFSA | €0 | From €0.03% | 24/5 | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor | Bank transfer, credit/debit cards, Quick payment | Yes | Yes |

Platforms Reviews

Let’s explore each trading platform in detail. Please note that I have ranked each provider based on its greatest strength. That said, I’ve also covered other key aspects, including shortcomings. I want you to get a well-rounded idea of what each broker offers so you can make informed decisions. Read each review carefully and conduct additional research before committing to a specific provider.

1. eToro – Best for Beginners and Social Traders

eToro is the best trading platform for beginners in Europe. Why? First, it has a well-designed interface that’s very easy to navigate. I’ve encountered countless platforms with complicated UI, and my advice is, if you’re a newbie, avoid them. Otherwise, you’ll spend precious time learning to do basic things like open trades. This can be incredibly frustrating and unnerving.

eToro also offers many educational resources tailored for beginners. The first one is a free online academy that offers countless tutorials, guides, and courses. These materials will teach you everything from how to trade and invest to the basics of building your portfolio and reducing risk exposure.

I also recommend eToro to social traders. Join eToro today and become one of the 40 million+ people on the platform. As a member of an enormous community, you’ll have the opportunity to interact with other traders and grow your knowledge base. You’ll also be able to locate and copy some of the most successful traders today.

Lastly, I urge you to check out eToro’s asset catalog; I’m sure you’ll be impressed. This broker has a vast array of trading instruments, including 6,200+ stocks, 55+ currencies, and 40+ commodities. There’s more! Unlike most platforms that offer tradable assets exclusively, eToro’s users can invest in popular products like cryptocurrencies, and ETFs. The best is that this broker allows its customers to invest in stocks without paying any commission, making it a top choice among stock brokers.

Pros

- Simple, neat user interface

- First-rate educational resources

- Supports social and copy trading

- 7,000+ trading instruments

- Investment products like stocks

- Outstanding support service

Cons

- Higher spreads than its peers

- €10 monthly inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

2. Pepperstone – Best for Active Traders and Scalpers

Are you an active trader or a scalper? Pepperstone is the best trading platform in Europe for you. I’ve said that because, with Pepperstone, you can keep costs low. This platform has some of the best spreads and commissions today. I traded numerous forex pairs with it and enjoyed tight spreads as low as 0 pips. This perk comes with a razor Pepperstone account. If you opt for a standard account, your spreads will be higher but you’ll enjoy zero commission while trading most assets.

Pepperstone will do you a world of good if you are a scalper. While trading on this platform, you will enjoy fast execution speeds of up to 30ms. You’ll never miss critical opportunities due to extended delays. Pepperstone’s exceptional execution will ensure you enter/exit trades as fast as possible and take full advantage of quick price movements.

I also hold Pepperstone in high regard because of its impressive range of platforms. I tried the company’s proprietary platform and was impressed by its features, including one-click trading and Quick Switch, which allowed me to swap between charts quickly and seamlessly. Also, while using Pepperstone, I had uncapped access to the best third-party trading software today, including TradingView, cTrader, and MT4/MT5.

Pros

- Low spreads and commissions

- Swift order execution

- Multiple excellent platforms, including MT4 and MT5

- No minimum deposit requirement

- No inactivity fees

- 24/7 support

Cons

- Limited assets

- Mostly CFDs are available

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

3. AvaTrade – Best for Risk-Averse Traders and Hedging Enthusiasts

I noticed several features that make AvaTrade the best European trading platform for risk-averse traders and hedging enthusiasts. The first item on the list is risk management tools. I have yet to find a better tool for minimizing risk exposure than AvaProtect.

AvaProtect is a premier risk management tool that you can use after paying a small fee. It protects you against losses on a particular trade for a fixed period of time. With it, you can lock in profits and mitigate potential losses. You can use it while trading forex pairs as well as CFDs on different assets, including stocks and ETFs. This feature can cover up to €1 million.

AvaTrade clients also have access to an arsenal of free risk management tools like stop-loss and take-profit orders. If you don’t know how to leverage such tools, the broker’s learning materials will be of great help. Visit Ava Academy today to get started.

I also recommend AvaTrade due to its impressive product range. This broker allows you to hedge against risk with different instruments, including commodities, options, and indices, while trading your favorite assets.

Pros

- Free risk management tools like stop-loss

- Users can avoid losses of up to €1 million with Ava Protect

- Negative balance protection

- A reasonable range of assets

- Top-tier learning materials

- MT4 and MT5 are available

Cons

- High inactivity fees

- Most assets are CFDs

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

4. FP Markets – Best for Cost-Conscious Traders and MetaTrader Enthusiasts

The first group of people that can benefit immensely from FP Markets is cost-conscious traders. This platform has incredibly low spreads and commissions. You can either trade with its Raw account, whose spreads are as tight as 0.0 pips and low commissions, or choose the Standard account option, which has zero commissions and reasonable spreads. Either way, you will save a lot of money.

What’s more, you’ll get the chance to avoid several fees that are common in other platforms when trading with FP Markets. Deposits and withdrawals are free here, so you don’t have to worry about losing a chunk of your capital or returns to transaction costs. Plus, your account can stay dormant for a long time without accumulating inactivity fees.

I also consider FP Markets a godsend for MetaTrader enthusiasts. Why? This forex broker gives its users full access to both MT4 and MT5. The best part is that, with an FP Markets account, you can access these platforms from most devices, including your Windows/Mac PC or Android/IOS mobile phone. While doing so, you’ll have ample opportunity to take your experience to the next level with cTrader and TradingView.

Finally, FP Markets offers over 10,000 tradable instruments. Very few brokers can compete with this enormous number. Most of the assets available here are stock and share CFDs. However, forex pairs and CFDs on metals, bonds, indices, and many other securities are also available.

Pros

- Tight spreads and commissions

- Free deposits and withdrawals

- No inactivity fee

- MT4/MT5, TradingView, and cTrader are available

- 24/7 instant support

- Over 10,000 financial instruments

Cons

- Most assets are CFDs

- Few learning resources

The outstanding perks of using FP Markets include free deposits or withdrawals. This broker goes above and beyond by covering all internal bank fees arising from international transfers. Moreover, you can start your journey with a free demo account before switching to a live account. Keep in mind that FP Markets’ minimum deposit requirement is $100.

The other commendable thing is this broker has reduced non-trading costs and charges. Take inactivity fees as an example. Unlike many of its peers, FP Markets doesn’t penalize dormant accounts. So, you can stay logged out of your account for as long as you like without fretting over accumulating fees.

That said, we encountered numerous other FP Markets fees and costs. Although you can open a Standard account, which comes with 0 commissions, you’ll still face variable spreads, starting from 1.0 pips. On the other hand, IRESS, FP Markets’ sophisticated premium platform, has commissions that vary depending on geographical location. IressTrader/ViewPoint also has a mandated $60 fee. Luckily, there are free alternatives like MT4 and MT5, which have no platform fees.

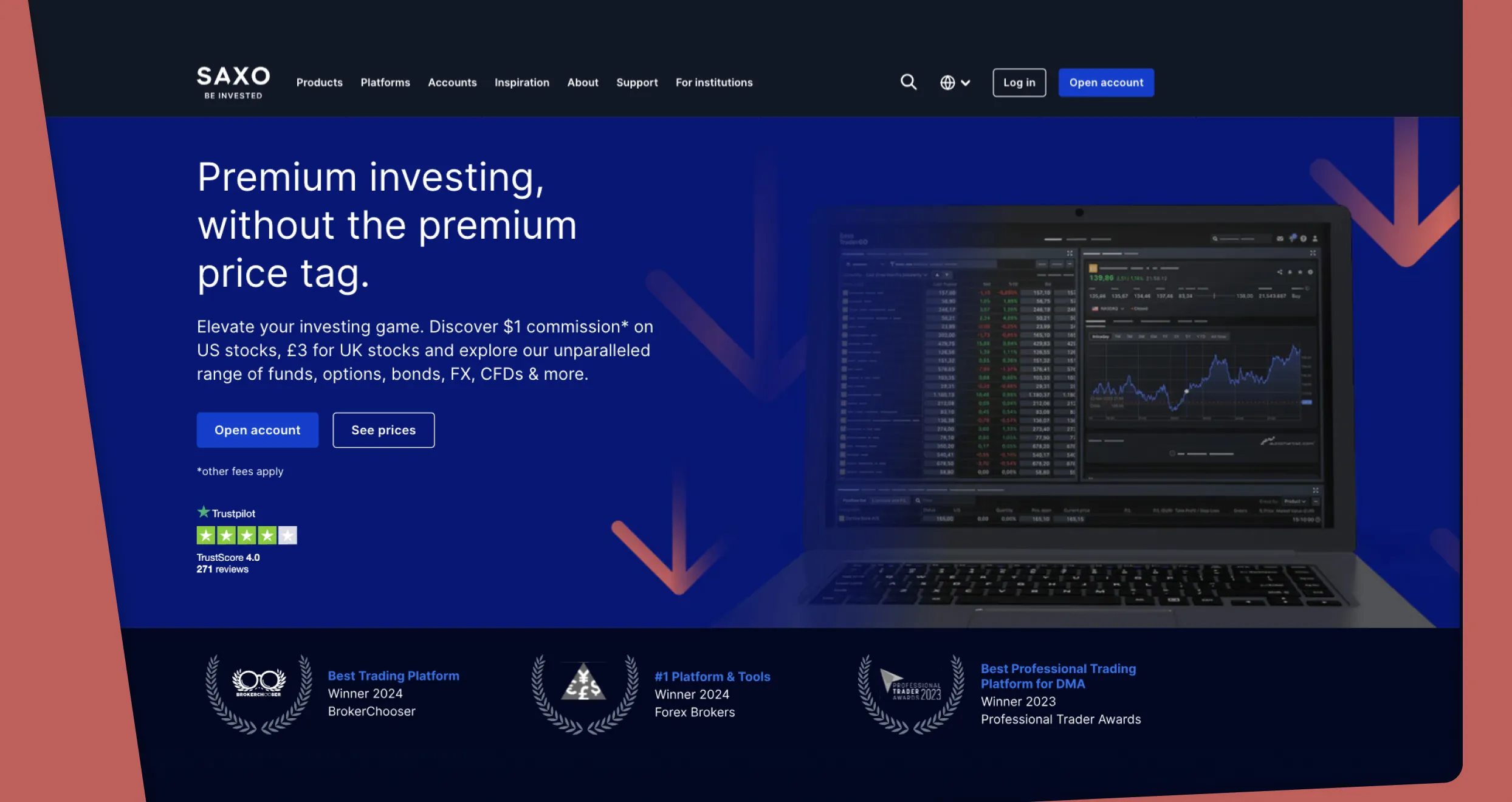

5. Saxo – Best for Professional Traders and Institutions

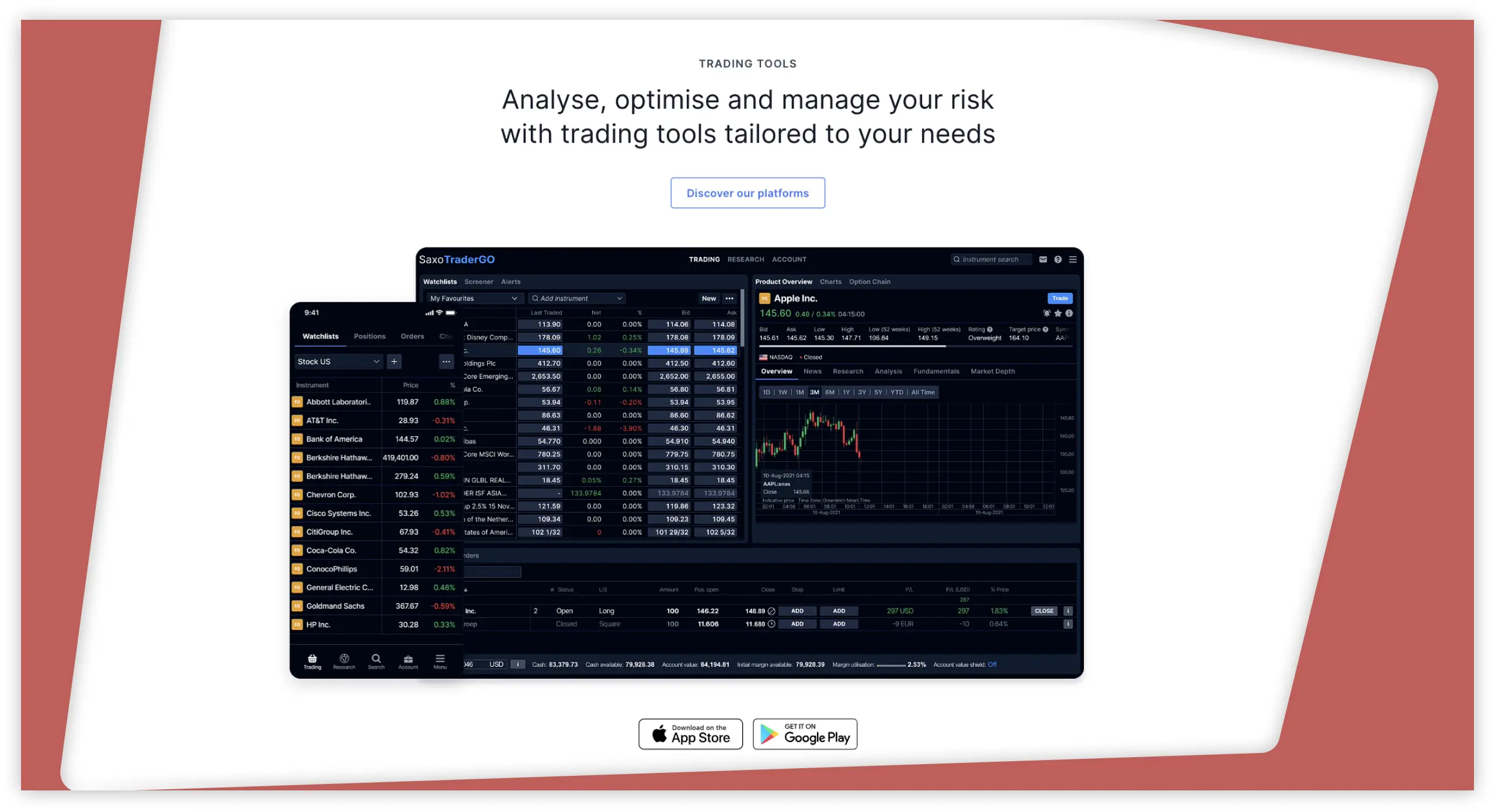

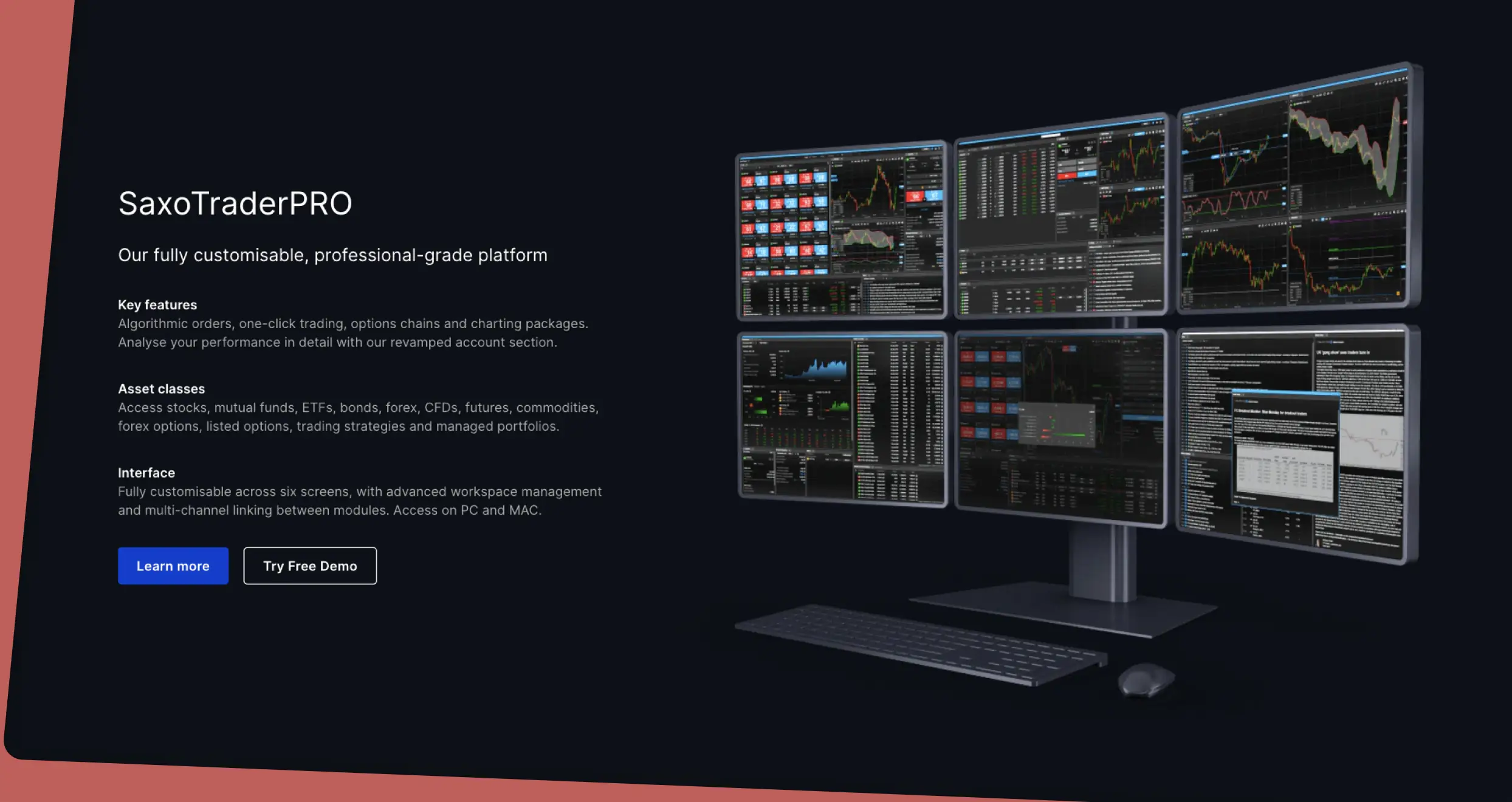

Suppose you are a professional or institutional trader. In that case, I strongly suggest committing to Saxo. This broker has 2 powerful platforms that will be a blessing to you. The first one is SaxoTraderPRO, which has been engineered exclusively for advanced trading. It has numerous features that made my day, from support for up to six screens and algo orders that are integrated into the trade ticket.

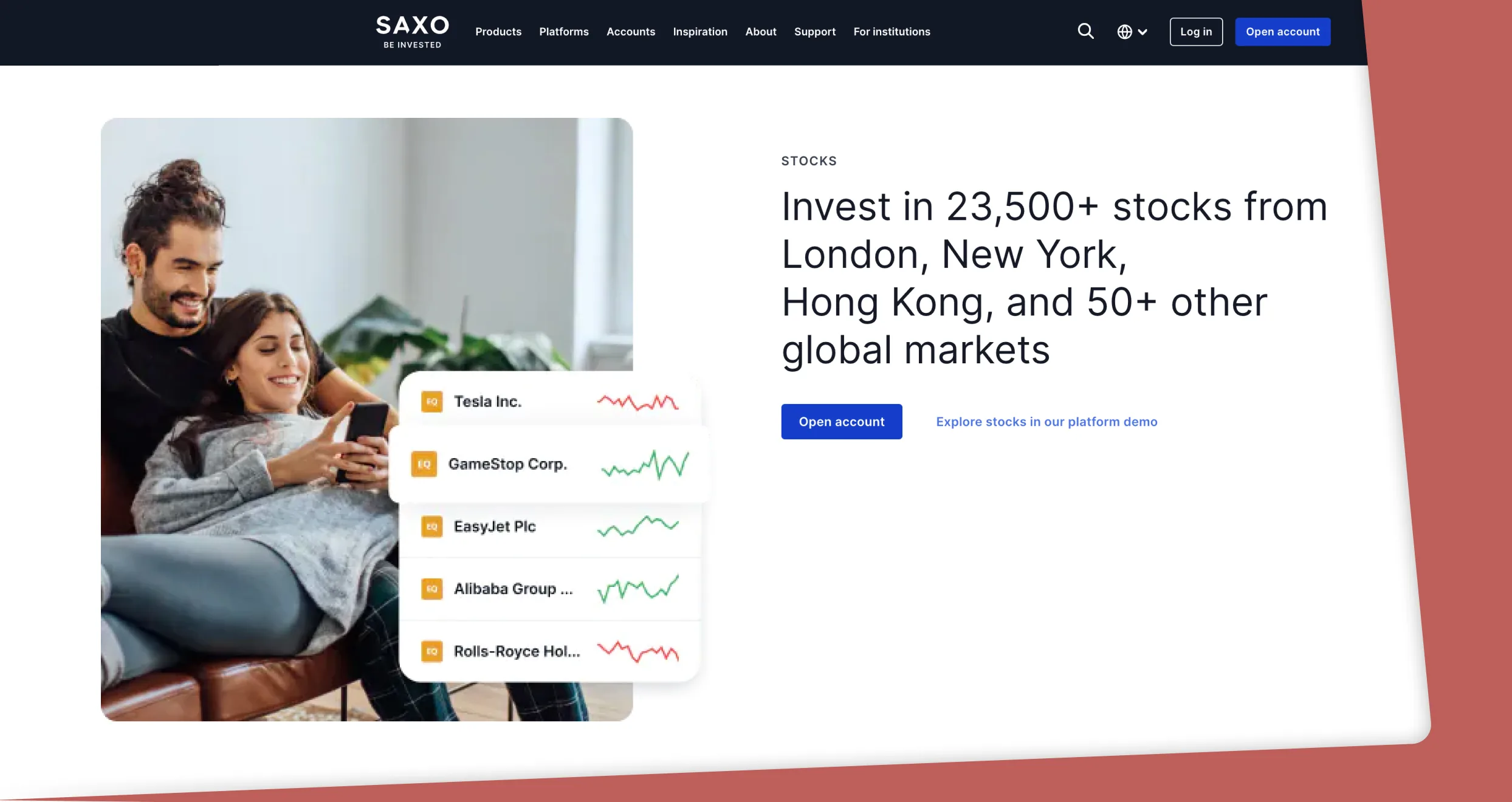

The other exceptional platform offered by this service provider is SaxoInvestor. As the name suggests, this solution is for investors. With it, you can invest in diverse assets directly from your mobile phone, PC, or tablet. The assets you’ll have access to on this platform range from stocks to bonds and mutual funds. It also stands out as a top European broker for ETF investments.

If you are an institutional trader and investor, Saxo offers you the chance to join its platform and get access to over 71,000 financial instruments. Everything conceivable is available here, from cash products like stocks, mutual funds, and bonds to leveraged products like forex pairs, forex options, futures, and commodities. Get in touch with any of the broker’s sales experts to learn more.

Pros

- Powerful platforms for trading and investing

- Thousands of tradable instruments

- Investment products like bonds and stocks are available

- World-class support

- Sophisticated risk management tools

- Zero inactivity fees

Cons

- No third-party platforms

- SaxoTraderPRO is not available on Android/IOS

We love Saxo because not only is this broker popular, but it also prioritizes transparency. The official trading site outlines every fee or cost you might incur while trading with it. Here’s a summary.

Saxo charges commissions on some assets. Investing in mutual funds is commission-free. However, financial instruments like stocks, futures, and ETFs attract commissions starting from $1. Others, like listed options and bonds, have commissions starting from $0.75 and $0.05%, respectively.

If you trade an asset in a currency different from your account’s base denomination, Saxo will charge you currency conversion fees. The good news is this fee doesn’t apply to marginal collateral and can never exceed +/- 0.25%.

Saxo also charges financing rates on margin products. Suppose you get funding from this broker and use it to open a position in a margin product and hold it overnight. Saxo will levy financing charges, which will factor in commercial product markup or markdown and this broker’s bid or offer financing rates.

As an investor, you may also incur annual custody fees if your account holds stock, bond, or ETF/ETC positions. The exact will vary depending on your account. Classic, Platinum, and VIP accounts attract up to 0.15%, 0.12%, and 0.09%, respectively.

If you open a Classic Saxo account, expect to pay $50 whenever you request online reports to be emailed to you. On the other hand, as a Classic or Platinum account holder, you can pay $200 and add an instrument to your platform.

But here’s some good news: online deposits and withdrawals are free on the Saxo trading platform. Furthermore, this broker charges zero inactivity fees and has no minimum deposit requirement.

How to Choose a Trading Platform

Finding the best European trading platforms is not as straightforward as looking for providers with the juiciest promises. You also have to pay attention to critical factors like the ones I’ve discussed below to avoid countless complications, including unexpected costs and scams.

Before opening an account, check if every platform is regulated by ESMA. It should also be regulated by other reputable authorities, including CySEC and ASIC, for optimum security and integrity. A broker regulated by multiple authorities complies with strict standards designed to protect you from issues like fraud, identity theft, and manipulated outcomes.

You should carefully vet every platform’s fees and charges, especially if you plan to trade frequently. First, check if the provider has a reasonable minimum deposit requirement. Secondly, confirm if there are any fees you’ll pay while funding your account and cashing out. Most importantly, spend as much time as possible assessing spreads and commissions. Don’t ignore elements like inactivity, account management, and overnight funding charges.

I never sign up with a platform that doesn’t support my favorite assets because it’s pointless and a wastage of time. Before filling out the registration form, check if the broker supports the instruments you want to trade and diversify your portfolio with. If you are interested in investing, check if the platform in context offers investment products.

Avoid unnecessary complications by signing up with a broker that offers easy-to-use proprietary platforms. Each should come with a clean interface and helpful navigation features. If you’ve decided to use a specific third-party software, like MT4 or MT5, check if the service provider supports it before handing in your sign-up form.

Do you plan to trade every day of the week or just weekdays? Use your answer to find a platform that guarantees you’ll get expert help when you need it most. If you plan to trade from Monday to Friday, a broker with 24/7 support should suffice. However, if your trading and investment activities will carry on into the weekend, I recommend signing up with a platform with 24/7 professional support.

After checking everything I have stipulated here, assess every trading platform’s reputation before completing registration. Most popular providers have thousands of reviews on sites like Trustpilot, so gauging your chosen platform’s reputation should be easy. If the broker has been operating for years and a majority of its reviews are positive, proceed to registration. If not, I advise you to be very cautious and find a better alternative if possible.

How We Test

We tested each platform extensively before preparing this guide. Our testing process was thorough and detailed. Its primary objective was to enable us to test the most important functions, including security, ease of use, and customer support quality. The insights we’ve shared here are grounded in first-hand experience, not hearsay.

That said, I encourage you to do exactly what we did. First, test your chosen platform in demo mode before opening and funding your live account. If you encounter any issues, especially where usability is involved, find a different provider.

Conclusion

I’ll conclude with this invaluable piece of advice: If you are new to trading and investing, don’t open a live account and start trading right away. I strongly advise against that because ignorance is a trader’s worst enemy and can lead to costly mistakes. Eliminate it by educating yourself now. Use the free materials offered by brokers like AvaTrade; don’t pay a dime unless you have to.

Afterward, open a demo account with any of the service providers I’ve covered here and practice religiously. Don’t stop practicing until you are skilled, disciplined, and good enough to make the right decisions and earn consistent returns.

It’s great that they focus on key factors like security, fees, and customer support. I’m interested in Pepperstone because of its low fees and no minimum deposit.

One thing I'd add is that anyone considering these platforms should definitely test them with small amounts first. I made the mistake of going all-in with my first broker choice and learned some expensive lessons about their specific quirks and fee structures.