Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Getting started with online trading might seem challenging at first, but the activity can be exciting and rewarding once you understand how it works. However, understand that the venture carries risks, and profits are not guaranteed. You may earn profits today and losses the next day.

The good news is that there are ways to maximize your potential trading in India. You need a reliable and credible broker with features guaranteeing an exciting experience. Since we are experts in online trading and understand how challenging it can be to identify the best trading platform in India, we did all the legwork. Our guide lists our top trading platforms based on multiple tests and comparisons. We will also guide you on how to set up an account and more.

In a Nutshell

- Online trading in India has proven lucrative. However, to maximize your experience and potential, you need a solid plan and strategy.

- Having the best trading platform in India will give you the peace of mind to trade securely. Simply ensure it is licensed and regulated by SEBI or the RBI.

- Besides considering a platform’s regulatory status, ensure it features elements suitable for your trading requirements.

- Extensively learn about the asset you want to trade. Understand the factors affecting its prices to make informed decisions.

- Always apply risk management controls like stop-loss or take-profit orders in your trade. You do not want to risk incurring massive losses in case a trade works against you.

- Note that online trading in India is considered a business venture. Therefore, all profits from the activity will be subject to capital gains tax.

List of the Best Trading Platforms in India

- Pepperstone – Overall Best Trading Platform

- OANDA – Best Trading Platform for Beginners

- Interactive Brokers – Best Platform for Day Trading

- AvaTrade – Best Platform for Mobile Traders

- FxPro – Best Trading Platform for Experienced Traders

Compare Trading Platforms in India

Our dedication to unveiling the best trading platforms led us to conduct intensive research that took hundreds of hours. As trading experts who have been in the business for decades, we know too well the perils of depending on the wrong broker. Therefore, we tested and compared as many trading platforms in India as possible. We also analyzed user testimonials on Google Play, the App Store, and Trustpilot. Rest assured that our recommendations above are unbiased.

Let’s compare some of the features offered by our referenced trading platforms in India. We hope this table will help you make informed choices.

| Best Trading Platform India | License | Support Service | Software | Payment | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | FCA, ASIC, DFSA | 24/7 | TradingView, MT4, MT5, cTrader, Capitalise.ai, Social Trading | Bank transfer, Credit cards, Union Pay, PayPal, Skrill | Yes |

| OANDA | CFTC, FCA, CySEC, FSA, ASIC | 24/5 | MT4, OANDA Trade | Credit/debit cards, Bank transfer | Yes |

| Interactive Brokers | FSA, FCA, ASIC, FINRA | 24/5 | Trader Workstation, IBKR EventTrader, IBKR GlobalTrader, IMPACT | Bank Transfers, Wire Transfers, Check, Wise | Yes |

| AvaTrade | CBI, CySEC, ASIC, BVIFSC, FSA, SAFCSA, ADGM, ISA | 24/5 | MT4, MT5, AvaOptions AvaTradeGO, AvaSocial, Capitalise.ai, DupliTrade | Credit/debit cards, Wire transfer, Neteller, Paypal, Skrill, WebMoney | Yes |

| FxPro | FCA, FSCA, SCB, FSCM | 24/5 | MT4, MT5, cTrader | Credit/debit cards, Wire transfers, Skrill, PayPal, Neteller | Yes |

Platforms Overview

It is advisable to choose a trading platform in India that you can afford to effectively budget and avoid digging deep into your nest egg. The broker must also feature your preferred assets for solid strategy development to maximize your potential.

As Invezty experts, we understand how challenging it can be for traders to identify affordable platforms with their preferred offerings. That is why we did all the legwork to share the fee structures and available securities at our recommended platforms in India.

Fees

| Best Trading Platform India | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Pepperstone | From 0.0 pips | $0 | Free | None |

| OANDA | From 0.6 pips | $0 | Free | $10 monthly |

| Interactive Brokers | From 0.08% | $0 | Withdrawal fees apply | None |

| AvaTrade | 0.03 pips | $100 | Free | $50 quarterly |

| FxPro | From 0.13 pips | $100 | Free | $10 monthly after 6 inactive months |

Assets

| Best Trading Platform India | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes |

| OANDA | Yes | Yes | Yes | Yes | No |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | No |

Our Opinion about Trading Platforms in India

We thoroughly analyzed different trading platforms and rated them based on an array of vital data. Our primary focus was their fees, security measures, investment options, trading tools, demo accounts, and user experience. Below, we share our opinion on our top trading platforms in India. In these mini-reviews, you will understand each platform’s offerings, thus choosing what suits your requirements.

1. Pepperstone – Overall Best Trading Platform

Pepperstone is a well-established online trading platform with a strong presence in India. We chose this Australian-based broker as our best trading platform in India for its robust trading infrastructure that offers one of the fastest order executions. Pepperstone boasts a wide array of tools, including lightning-fast execution, social trading, built-in indicators, customizable charting and indicators, expert advisors, and more. All these are available on its multiple platforms, namely MT4, MT5, cTrader, and TradingView.

Regarding asset offerings, this platform hosts over 1200 CFD options across various asset classes. These include forex, shares, commodities, ETFs, and more. We also find it to be one of the most affordable platforms, as it does not charge commissions. Instead, traders incur low spreads, starting from 0.0 pips. What’s more, there is no minimum deposit requirement or inactivity charges. From our analysis, this platform accommodates all, whether newbies or expert traders.

Pros

- Licensed and regulated by SEBI and other global authorities

- No minimum deposit requirement

- A comprehensive suite of tools and educational resources

- Features social trading, which is ideal for traders with limited time for market analysis

Cons

- Limited asset offerings compared to its peers

- Offers only CFD assets

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. OANDA – Best Trading Platform for Beginners

OANDA takes the crown as our best trading platform in India for beginners. During our tests, one factor that stood out was the clean and user-friendly interface. It’s also hard not to be awed by the customizable dashboard, advanced charting tools, and consistent mobile app experience. With 65+ technical indicators and drawing tools, analyzing market trends cannot be easier. OANDA also has highly responsive 24/5 customer support, ensuring traders can easily get help when needed.

We also like this platform’s selection of learning materials and an FAQ page with answers to commonly asked questions. You can get started using its demo account, which is a risk-free environment for testing OANDA’s performance and gauging your skill level. OANDA is also one of the cheapest trading platforms, with spreads from 0.6 pips on major currency pairs. This, together with its no minimum deposit requirement, allows beginners to get started in the financial space without worrying about overspending.

Pros

- No minimum deposit requirement

- A user-friendly and intuitive design platform

- Compatible with desktop and mobile devices

- Low trading fees on its featured securities

Cons

- Limited asset offerings compared to its peers

- No buying and taking full ownership of the featured securities

When testing OANDA, we opened a live account and funded it. We didn’t encounter any OANDA minimum deposit requirements, which was a good thing. That allowed us to start with a few dollars. While preparing to fund our account, we noticed that this broker doesn’t charge deposit fees for cash transfers, credit cards, and debit cards. The same applies to e-wallets like Neteller, Skrill, and Wise. But withdrawals aren’t entirely free.

OANDA allows traders to make one free withdrawal per month to their debit or credit cards. Anyone who exceeds this threshold has to pay. The exact fees vary depending on account currency. On the other hand, all bank-related withdrawals incur charges. The fees you’ll pay while using a bank to withdraw funds from OANDA depend on the number of bank withdrawal transactions you’ve made in that calendar month and account currency.

We also noticed that OANDA has overtime financing charges. If you keep a position open after a trading day has ended, OANDA assumes you’ve held it overnight and either credits or charges your account. Visit OANDA’s Financing Costs page to learn more.

Lastly, OANDA charges a $10 monthly inactivity fee on accounts that have been dormant for 12 or more months. If OANDA deems your account legible for inactivity fees, the broker will levy it until you terminate the account, resume trading, or deplete your account balance.

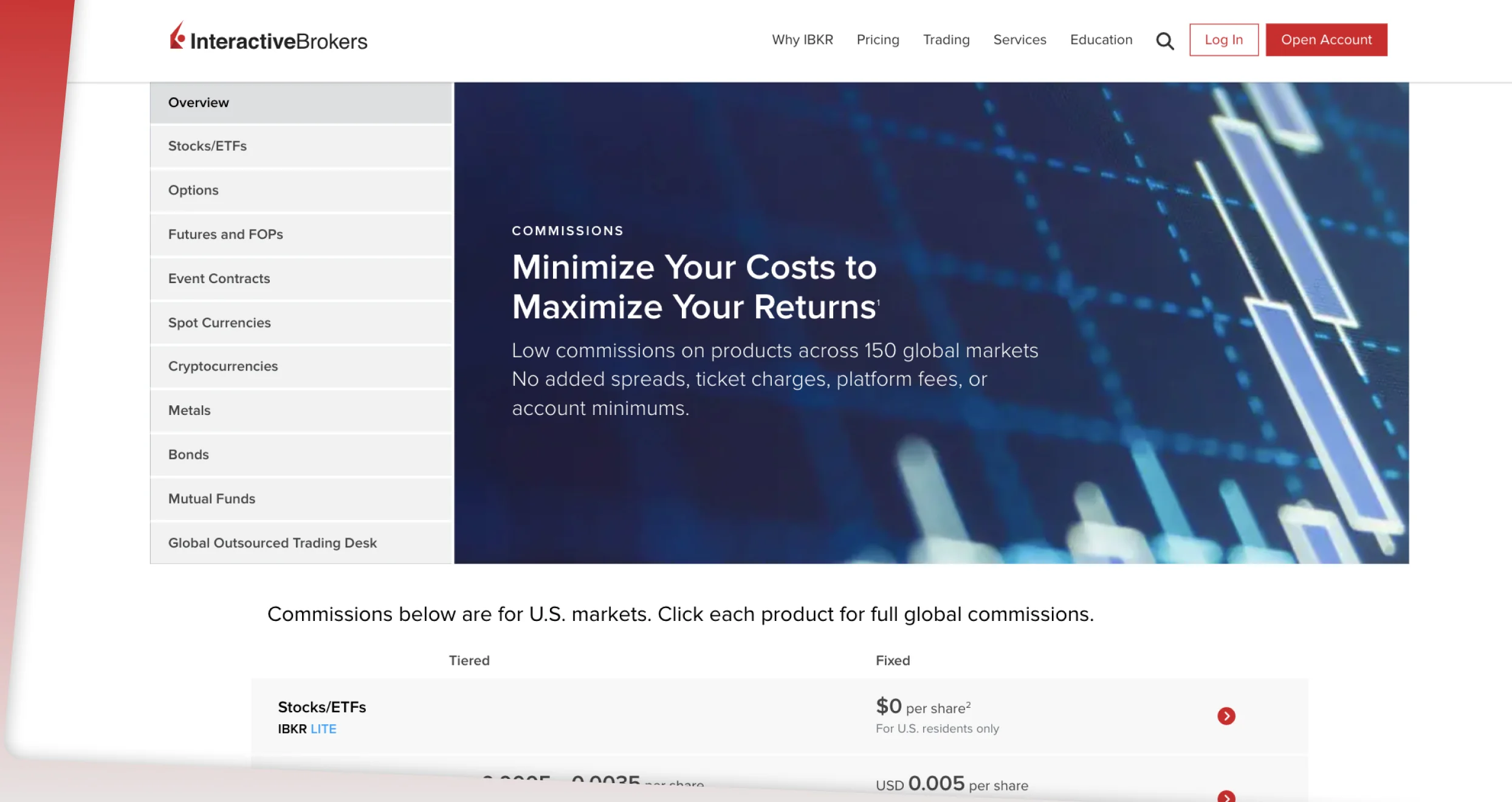

3. Interactive Brokers – Best Platform for Active Traders

If you are an active or high-frequency trader, we recommend choosing a trading platform that offers exceptional services at low fees. Interactive Brokers (IBKR) excels as one of the best platforms for day traders because it has no minimum deposit requirement or inactivity fees. The platform also charges low trading fees, making it easier for active traders to manage multiple trades within a day. From our analysis, this platform lists over 10,000 instruments, including forex, shares, commodities, futures, and more.

Additionally, we like that IBKR has a fast trade execution speed. You’ll also benefit from a range of quality trading resources on its IBKR Mobile, IBKR Desktop, and TWS platforms. For beginners, this platform has a Free Trial account loaded with $1,000,000 in virtual money. Feel free to use it to understand IBKR’s features and gauge your skill level before trading using real funds.

Pros

- No minimum deposit requirements for retail traders

- Cost-free deposits

- Packed with excellent educational tools and materials

- Commissions as low as 0.08% for stocks and ETFs

- A wide range of learning and market analysis tools

Cons

- The desktop platform can be challenging for newbies to navigate

- No third-party platforms like MT4 and MT5

We find IBKR to be one of the most affordable brokers in the financial landscape. For starters, the broker has no minimum deposit requirement. This makes it easier for traders to start trading or investing with any amount they can afford.

Additionally, trading US-listed stocks and ETFs is commission-free on its IBKR Lite account. Other trading assets also attract low commissions, thus making the broker an option for low-budget traders. For accounts with a net asset value of at least $100,000, IBKR allows you to earn interest of up to 4.83% on cash balances.

When it comes to Interactive Brokers margin rates, they are among the lowest. We compared it to others and discovered that its lowest tier has a rate of 6.83% at IBKR PRO and 7.83% at IBKR Lite. Transactions with this broker are also free. Moreover, you will not incur any inactivity fee should your account remain dormant. However, it is essential to stay active if you want to quickly become an independent and successful investor.

4. AvaTrade – Best Platform for Mobile Traders

After a thorough market analysis, we conclude that AvaTrade is the best platform for Indian traders seeking mobile trading. This is primarily because we noticed that the AvaTradeGO app is highly rated by users on Google Play, the App Store, and Trustpilot. The majority of mobile traders find the app to be user-friendly and easily navigable, thus offering an exciting experience. Plus, it is highly encrypted and secured by two-factor authentication, a strong passcode, and a face ID.

Another element we like about AvaTrade is its low minimum deposit requirement of $100 and free transactions. Spreads are also low on all its listed 1200+ CFD instruments. This attracts low-budget and active traders looking for affordable platforms with quality resources. Besides the web, AvaTrade hosts additional third-party platforms for all types of traders. These include MT4, MT5, AvaOptions, and AvaSocial. We also found AvaTrade to be the best trading platform for beginners in India. It lists quality learning materials and a virtually funded demo account to get started.

Pros

- Simple interface, perfect for beginners

- Users can request extensions on demo accounts

- Hosts outstanding platforms like MT4, AvaSocial, and MT5

- Rich educational materials

- Low minimum deposit requirement

Cons

- Limited financial instruments compared to its peers

- High inactivity fees for dormant live accounts

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

5. FxPro – Best Trading Platform for Experienced Traders

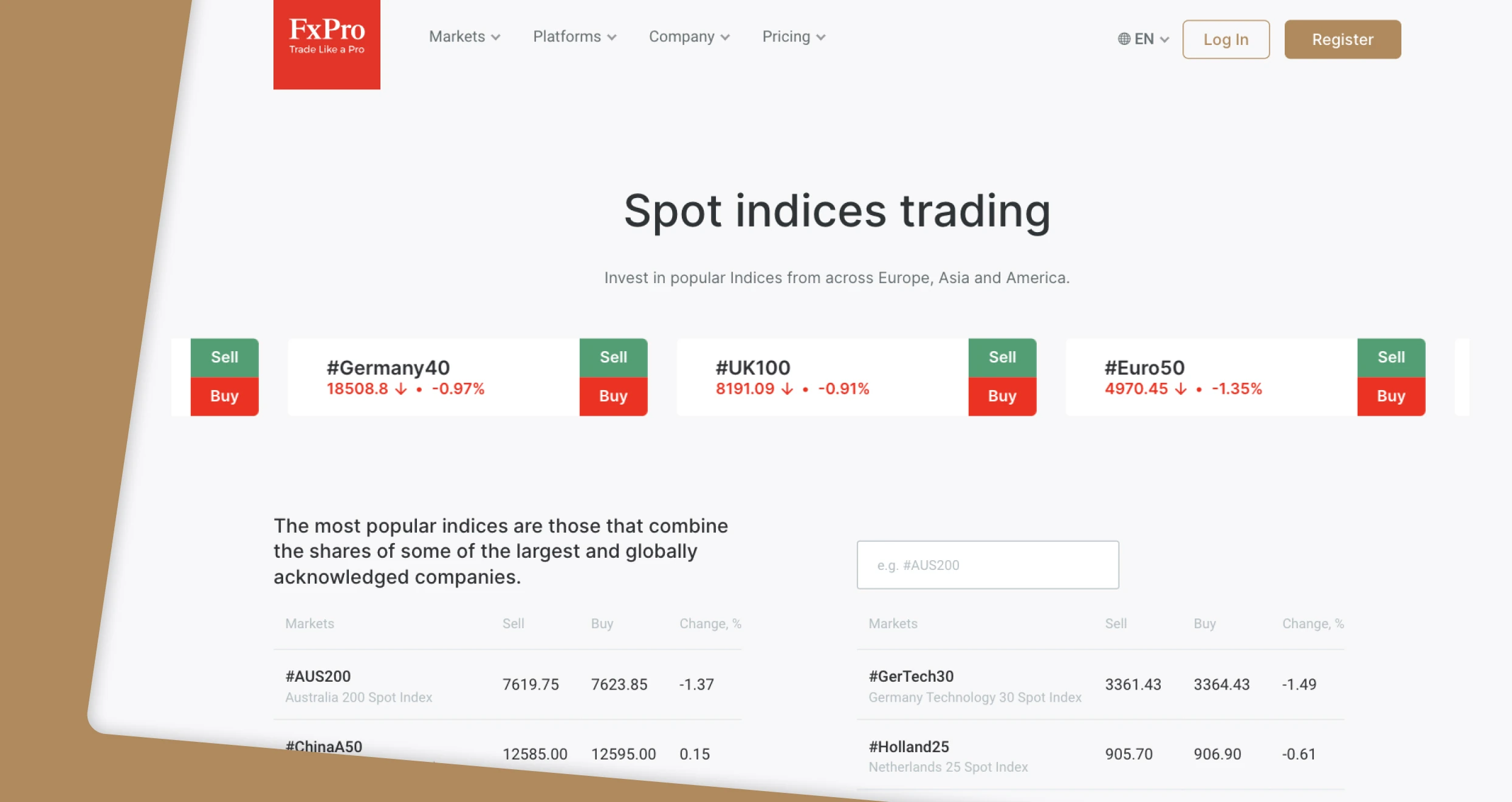

Professional traders will definitely enjoy their experience with FxPro. We like trading on this platform not only because it is user-friendly but also because of its modern design on both desktop and mobile devices. Getting started at FxPro is straightforward, with a low minimum deposit requirement of $100. Plus, the platform lists over 2100 CFD instruments across six asset classes, including shares, forex, futures, indices, metals, and energy.

Additionally, FxPro has advanced trading resources on its MT4, MT5, cTrader, and FxPro WebTrader platforms. We didn’t forget to test its support service reliability and were impressed. Their response was prompt, and we got relevant solutions that made us enjoy our experience. You can test FxPro via its $10,000 virtually funded demo account and decide whether it suits your trading requirements.

Pros

- Hosts excellent platforms like MT4, MT5, and cTrader

- Demo accounts last for a whopping 180 days

- Users can top up their demo accounts if they get depleted

- Free deposits and withdrawals for live traders

Cons

- Limited product range compared to its peers

- $10 monthly inactivity fee for dormant live accounts

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Online Trading in India

Online trading in India is legal, and any individual above 18 years can engage in this activity. India’s financial market is dynamic, and asset prices fluctuate with market conditions. As a trader, ensure you are fully prepared for such events by conducting a thorough market analysis. Moreover, trade with a trusted broker to ensure your personal data and funds are protected.

In India, the RBI (Reserve Bank of India) and SEBI (Securities and Exchange Board of India) oversee trading and investment activities in the region. These authorities strive to protect traders and investors and ensure they trade in a secure environment. With regulated brokers, your funds are highly secured in segregated accounts. Your personal data is also safe from unauthorized access.

Note that many individuals are looking for ways to start trading in India, as the activity is skyrocketing. While extensive research on your preferred assets is crucial, you must also be disciplined to maximize your potential. Don’t make decisions based on emotions, but stick to your plans. Most importantly, have a budget and trade with funds you are comfortable losing in case a trade fails to work out as expected.

While planning your trading activities, take into account the tax implications in India. From our analysis and experience, all profits from trading activities within a year are subject to tax deductions, starting from 15%. However, long-term holdings above one year are not subject to tax deductions.

How to Choose the Right Trading Platform in India

So, how do you choose the best trading platform in India that offers the best potential for enticing investment rewards? Here are the top factors to consider.

A trading platform is only as good as its security features. Reliable platforms provide a range of security features, including two-factor authentication and encryption, to keep your personal information and account safe. Moreover, the best platforms in India are licensed and regulated by the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI). This ensures your funds and personal data are secured from unauthorized access. You are also guaranteed a conducive trading environment.

Traders differ in their investment interests and preferences. We recommend revising the range of assets a trading platform offers and ensuring you can trade the precise assets that tickle your fancy. Access to a wide array of financial instruments in the global markets, such as bonds, forex, currencies, commodities, ETFs, and options, allows diversification or multi-asset trading. Diversifying your portfolio is a vital risk management strategy that ensures maximum returns by seizing opportunities across various sectors.

Given the volatility of the markets, fast and accurate trade execution can help reduce significant losses. A well-designed, feature-packed, and efficient platform is crucial in preventing missed opportunities caused by unwarranted system delays.

Most traders’ profits and overall enjoyment highly depend on their ability to make swift moves during market rallies. Market fluctuations present golden opportunities to achieve higher returns. Conversely, a slow and outdated platform can hinder your chances of capitalizing on market movements.

Staying on top of market movements is pivotal to trading success. Real-time market data and news feeds, among other vital research tools, ensure you have the information to make educated investment decisions.

Leading trading platforms provide educational resources and robust financial analysis tools. These allow users to research potential investments that align with their interests and remain abreast of market trends. Some even organize webinars catering to traders with different investment objectives and skill levels.

Another critical factor to consider when searching for the best online trading platform in India is the fee structure. Instead of focusing on finding platforms with the lowest fees, we recommend sticking to those with a transparent fee structure.

The idea is to do a detailed cost-benefit analysis. Determine the fraction of potential profits you must sacrifice and whether it’s worth it. After comparing the commissions, account maintenance fees, minimum deposit requirements, inactivity fees, and more, it is easier to narrow down your options and focus on those that suit your budget. Ensure low fees don’t translate to fewer or inferior features.

Sometimes, traders can find quick solutions by browsing the self-service content on a trading platform. However, this does not diminish the need for a proactive, reactive, highly responsive customer service team.

Reliable customer support professionals can offer invaluable assistance. They help you discover new opportunities, solve technical problems, or guide you toward making informed choices. Consider platforms that provide multiple channels for contacting the support team, such as live chat, email, and phone. Plus, confirm availability and ensure it aligns with your trading schedule.

While we advise you to confirm the above elements for suitable choices, analyze user comments and ratings on Google Play, the App Store, and Trustpilot. As a result, you will understand a platform’s strengths and weaknesses from a user perspective. Then, decide whether it is worth trading with.

How To Register an Account with a Trading Platform in India

Having the best trading platform in India is not a sure-fire way to success. You need to learn the markets and strategize accordingly for maximum potential. You can start your venture by registering for a trading account. Here are the simple steps to follow.

The first step is to visit the official website of your chosen trading platform. Understand the platform’s features and offerings to ensure you are trading on the right platform. Most importantly, install the platform’s mobile app on your mobile device. This way, you can easily manage your activities whenever you step away from your trading station.

To create a trading account, find a prominent “Create an Account” or “Sign Up” button on the top menu of the homepage. Click on it to register a trading account using your personal details. These include your name, email, phone number, source of income, and more. At this point, we believe you will have understood the platform’s terms and conditions. So, check the provided box and choose a unique username plus password for your account.

It is a standard protocol for all SEBI-regulated brokers to verify their clients’ personal details before fully activating their trading accounts. Therefore, your broker will request you to share copies of your government-issued ID or driver’s license and recent utility bill or bank statement. The goal is to verify your identity and location, which is one way of securing the online trading environment from imposters.

Once you receive an email notification, fund your trading account per the required minimum deposit. Consider the available deposit methods and settle for the most convenient option, whether credit/debit cards, e-wallets, or bank transfers. Also, check transaction charges to budget accordingly.

Your platform’s provider will confirm your deposit and automatically redirect you to its listed securities. Whether you want to buy or trade an asset as a derivative, choose what you are familiar with. Take advantage of your platform trading tools to strategize accordingly before opening a live position.

For beginners, start trading on your platform’s demo account. Once you are confident in your skills, you can open live positions and risk real money. Also, risk a small capital and increase the amount as your confidence grows.

Conclusion

Now that you have the best trading platforms in India, it is time to start exploring the financial space. If you are a beginner, do not fret, since most SEBI-regulated platforms, like the ones we recommend, have demo accounts. We encourage you to kickstart your ventures using these virtually funded accounts to acquaint yourself with online trading. It is also the best platform to gauge your skill level before switching to live trading. When you are ready to trade using real money, start with a small capital and apply risk management controls. The financial market fluctuates from time to time, and having solid plans and strategies will maximize your experience and potential.

I personally appreciate platforms like OANDA. I would recommend it to everyone

I started trading in India with a demo account on AvaTrade, and it really helped me build confidence before using real money.