Thadeus Geodfrey is a leading voice in the financial industry. You’ll appreciate the expert ease with which he does this. He deciphers the intricate link between emotions and behavior in trading and investment. With extensive experience as a senior trading writer, Thadeus imparts his knowledge and confidence to guide your trading boat. He’ll make you conquer your fears, break barriers, and capitalize on every potential opportunity. Follow his pieces and develop your knack for trading.

We may receive compensation from our partners for placement of their products or services, which helps to maintain our site. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Trading has made countless Singaporeans, like Rayner Teo and Alex Yeo, incredibly wealthy. The good news is that any Singaporean with sufficient skills, uncompromised discipline, and enough capital can reap handsomely from this venture. But before diving in, note that your success also depends on the trading platform you use. If you trade with a lousy service provider, you’ll lower your chances of reaching your goals. Optimum success requires trading with nothing but the best platforms.

Since many lousy and disreputable trading platforms are available today, we couldn’t let you shoulder the burden of finding an excellent service provider alone. Our team decided to help out by vetting the platforms available in Singapore, comparing the most reputable, and picking 5 of the best. Now, all you have to do is read our reviews of these entities and select the best online trading platform in Singapore from the brands we’ve recommended.

In a Nutshell

- Getting juicy profits from online trading is possible in Singapore, but you need a good trading platform to attain maximum success.

- To find a reliable trading platform likely to fuel your success, you must vet service providers based on factors like reputation, fees, and support quality.

- For the safety of your funds and assets, you must also prioritize trading with a MAS-regulated trading platform in Singapore.

- Our team decided to help you find the best trading platform Singapore. We researched and compared countless service providers before preparing this guide.

- To avoid bias, we factored in crucial aspects like regulatory status, spreads, and costs while picking the best trading platforms for Singaporeans. We also considered reviews published on Google Play, the App Store, and TrustPilot.

List of the Best Trading Platforms in Singapore

- Pepperstone – Best Low-Cost Platform

- eToro – Overall Best Trading Platform

- Plus500* – Top Platform for CFD Trading

- AvaTrade – Best Platform for Beginners

- FxPro – Best Platform for Forex Traders

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Compare Trading Platforms in Singapore

Hundreds, if not thousands, of trading platforms are available today. Luckily, you don’t have to vet all of them to find the best service provider. We’ve done that on your behalf. Now, your sole responsibility is picking a fitting platform from the ones we’ve recommended. Just read our mini-reviews, find a promising service provider, and start your journey to success.

That said, to ensure you choose the best trading platform in Singapore for you, we highly encourage you to compare the recommended service providers based on multiple. Start with the most crucial, including licensing, trading software, and customer support service. The table below will help you compare the recommended platforms based on these indispensable elements.

| Best Trading Platform Singapore | License & Regulation | Support Service | Software | Payment Method | Demo Account |

|---|---|---|---|---|---|

| Pepperstone | MAS, FCA, ASIC, FSCA, DFSA, CySEC, CMA, SCB, BaFin | 24/7 | TradingView, MT4, MT5, cTrader, Pepperstone Trading Platform, Social trading | Visa, Mastercard, Bank transfer, Neteller, Skrill, PayPal | Yes |

| eToro | MAS, FCA, CySEC, FSCA, ASIC, SFSA, ADGM, MFSA, FSAS, GFSC, SEC | 24/5 | eToro investing platform and app, Multi-asset platform, Social Trading, Copy Trader, Smart Portfolios | Credit/debit cards, Bank transfer, Klarna, PayPal, Skrill, Neteller | Yes |

| Plus500* CFD service. Your capital is at risk | MAS, FCA, FMA, CySEC (#250/14), ASIC | 24/7 | Plus500 CFD | Visa, MasterCard, PayPal, Skrill, Bank transfer | Yes |

| AvaTrade | MAS, FCA, FSCA, CBI, CySEC, PFSA, ASIC, B.V.I, FSC, FSA, ADGM, ISA | 24/5 | WebTrader, AvaOptions, AvaTrade App, Mac Trading, MT4, MT5, Automated Trading | Credit/debit cards, Neteller, Skrill, Wire transfer, WebMoney | Yes |

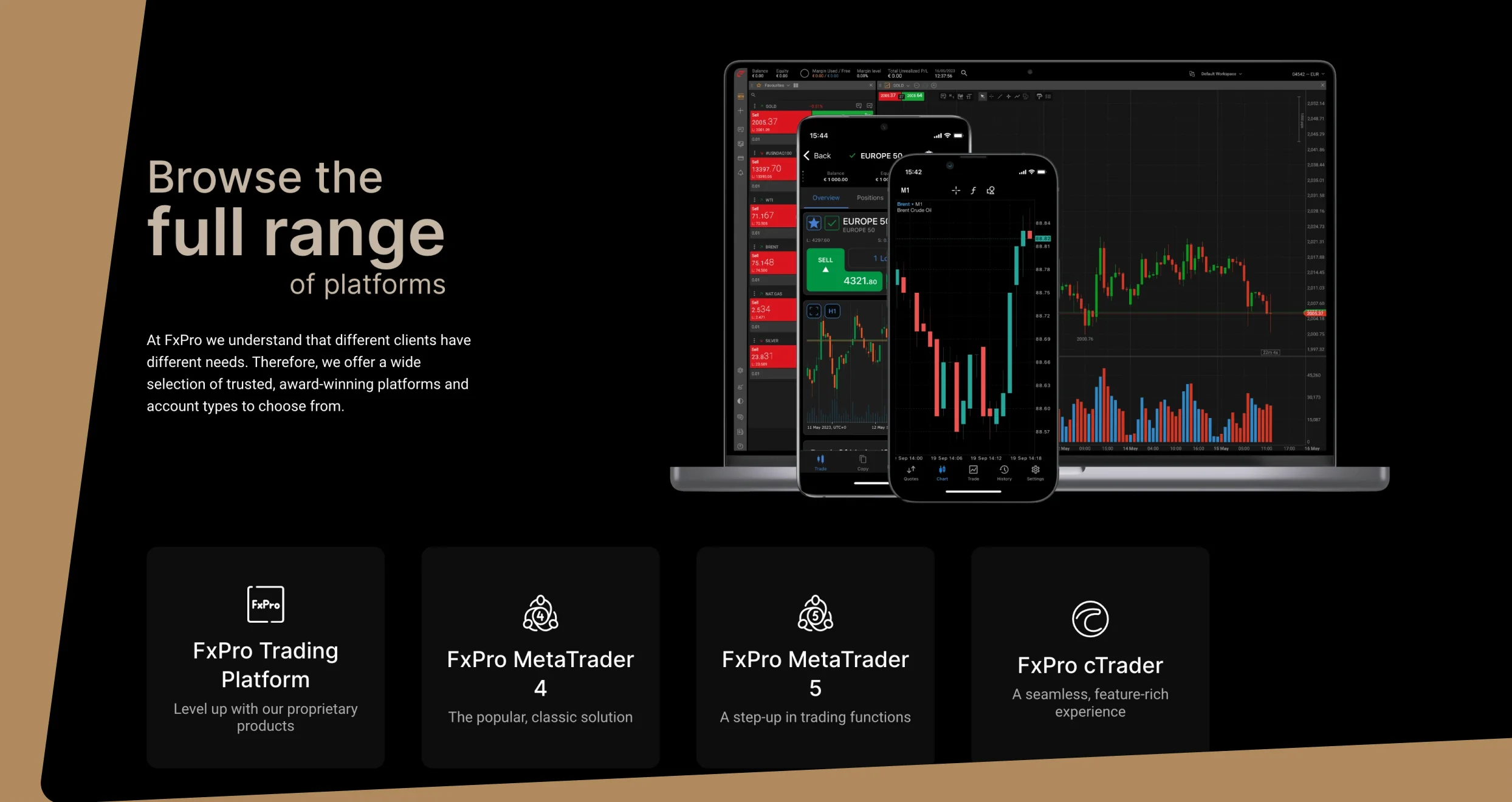

| FxPro | MAS, FCA, FMA, CySEC, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Credit/debit cards, Bank wire transfers, Neteller, Skrill, PayPal | Yes |

Platforms Overview

Don’t forget to check every platform’s prescribed fees and assets. If you don’t, you might inadvertently sign up with a service provider with high fees. When that happens, the repercussions will be severe: ungodly costs and reduced profit margins. On the other hand, if you are not careful, you might register with a platform that doesn’t have your favorite financial assets, causing immense disappointment and wasting valuable time.

Below, we’ve prepared 2 comparison tables highlighting our recommended service provider’s fees and assets.

Fees

| Best Trading Platform Singapore | Minimum Deposit Requirement | Commission/ Spreads | Deposits/ Withdrawals | Inactivity Fee |

|---|---|---|---|---|

| Pepperstone | $0 | From 0.0 pips | Free | $0 |

| eToro | $50 | From 0% | $5 withdrawal fee | $10 monthly |

| Plus500* | $100 | From 0% | Free | $10 monthly after three months of inactivity |

| AvaTrade | $100 | From 0.13% | Free | $50 after every 3 consecutive months of inactivity |

| FxPro | $100 | From $3.50 per lot | Free | $10 monthly |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Assets

| Best Trading Platform Singapore | Stocks | Forex | Crypto | Commodities | Indices | ETFs | Options |

|---|---|---|---|---|---|---|---|

| Pepperstone | Yes | Yes | Yes | Yes | Yes | Yes | No |

| eToro | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Plus500* (CFDs) | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| AvaTrade | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No |

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Our Opinion about the Best Trading Platforms in Singapore

Below, we’ve reviewed what we consider to be the best trading platforms in Singapore. Note that we didn’t pick random service providers to feature in our guide. Our experts worked hard and vetted countless brands. We focused on many factors while doing so, with licensing and regulation at the top of the list. The brands we’ve recommended are authorized and regulated by the Monetary Authority of Singapore (MAS).

Let’s discuss what the best trading platforms in Singapore offer in deeper detail.

1. Pepperstone – Best Low-Cost Platform

To enjoy higher returns in the long run, you need to trade with an affordable and cost-effective platform. An ideal platform should have friendly fees, spreads, and commissions. Having said that, we consider Pepperstone as the most cost-friendly service provider in Singapore.

Pepperstone has no minimum deposit requirement. That means it allows you to fund your account with any amount that’s within your means. This is a noteworthy aspect since most brokers have set deposit minimums that you must adhere to despite your budget limits. Also, while trading with Pepperstone, you won’t incur any additional transaction fees since it supports free deposits and withdrawals. Not to forget, Pepperstone offers super-low spreads and commissions. With a Razor Pepperstone account, you can enjoy spreads from 0.0 pips while trading diverse asses, including popular currency pairs like GBP/USD, EUR/USD, and AUD/USD. A Standardaccount also comes with tight variable spreads and zero commission.

We also recommend Pepperstone to low-budget traders and other individuals who want to enjoy minimum costs since the broker doesn’t charge account inactivity fees.

Pros

- No minimum deposit requirement

- Cost-free deposits and withdrawals

- Zero account inactivity fees

- Ultra-low spreads from 0.0 pips

- Robust trading and analysis tools

- Offers cTrader, TradingView, and MT 4/5

Cons

- Limited educational resources

- Fewer instruments than its peers

We identified numerous fees and costs on Pepperstone. First, from our exploration, we discovered that Pepperstone users are subjected to spreads and commissions that vary depending on market conditions and account type. This platform has two accounts: Standard and Razor. Both are associated with different charges and conditions. For instance, Razor accounts only attract commissions when users trade CFDs on Forex.

Pepperstone also charges overnight funding, which kicks in when a trader holds a position in commodities, equities, indices, metals, or cryptocurrencies overnight after 5 p.m. New York Time. This broker’s overnight funding charges vary depending on different factors, including underlying TomNext rate changes.

But here’s the best thing you can derive from our Pepperstone broker review, especially where fees are involved. Pepperstone doesn’t charge account inactivity fees. Moreover, this platform doesn’t charge a single dime for deposits and withdrawals. Furthermore, this broker has no minimum deposit requirements.

2. eToro – Overall Best Trading Platform

Based on our findings and experiences, eToro is the best trading platform in Singapore. We highly recommend this platform because, first, it has top-quality educational resources. The most noteworthy is the eToro Academy, a one-stop learning platform offering countless courses, guides, and tutorials. Almost all fundamentals of trading and investing have been covered in the academy, making it an incredible resource for both newbies and experts.

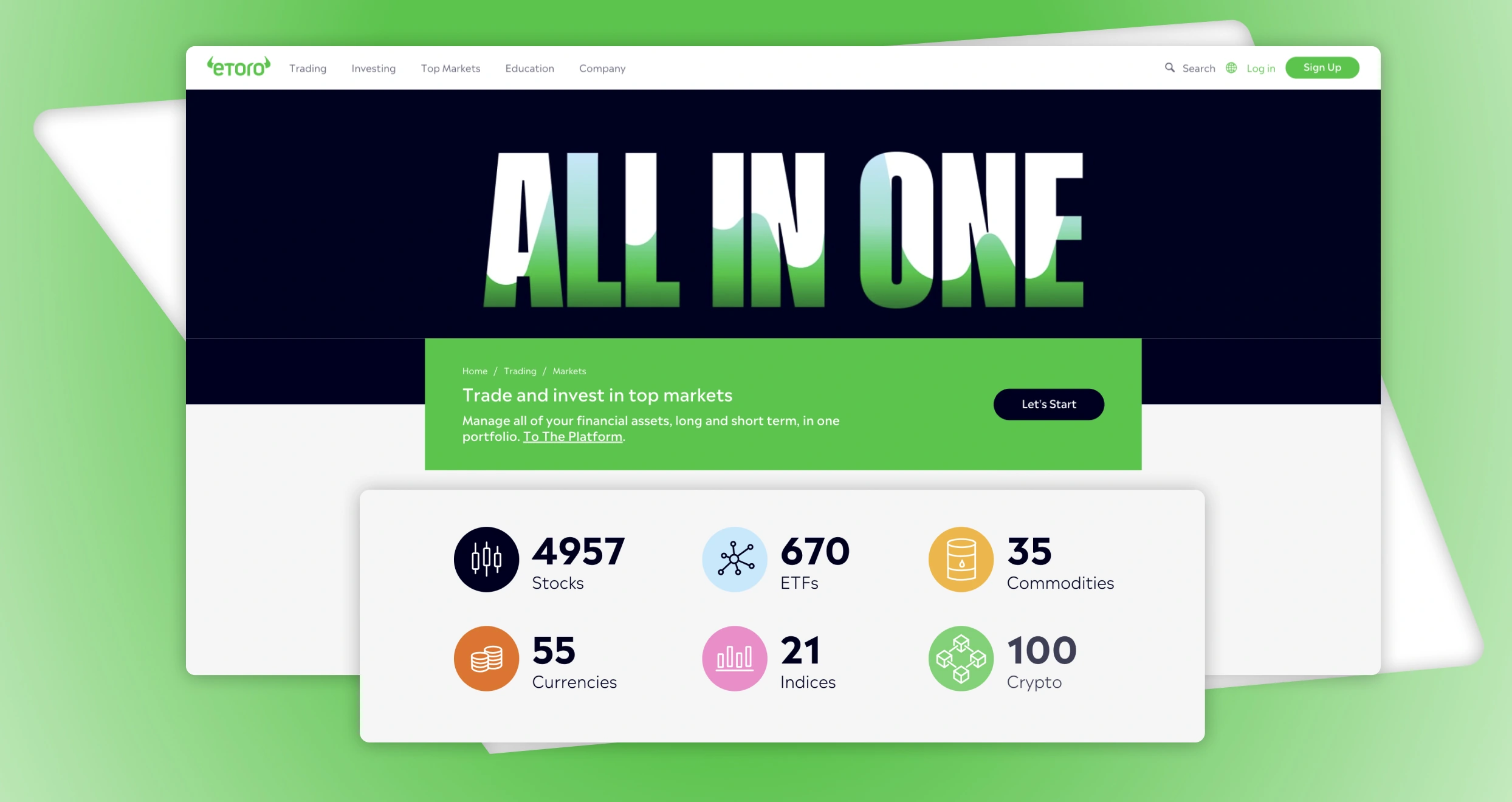

Also, compared to its peers, eToro has an unmatched product range. The platform offers its users thousands of tradable financial instruments, including over 55+ currencies, 680+ ETFS, and 5552+ stocks. Additionally, it gives traders the opportunity to diversify their portfolios and build wealth with real stocks from established companies like Nintendo, BMW, and Shopify, establishing it as a leading choice among stockbrokers.

Not to forget, eToro users can buy, sell, hold, and trade countless cryptocurrencies, including Bitcoin, Ethereum, and Solana. eToro has a powerful crypto trading platform that gives the opportunity to rake in juicy returns and be a part of a vibrant community. Moreover, you can boost your earnings by staking crypto on eToro.

Pros

- Simple, intuitive user interface

- A broad range of tradable and investment products

- Copy and social trading are supported

- Friendly and knowledgeable support representatives

- World-class educational resources

Cons

- Higher spreads than most of its peers

- $5 fee for every withdrawal request

- $10 monthly account inactivity fee

eToro doesn’t charge any account registration or deposit fees. We signed up and funded our account without incurring any costs. Of course, we had to adhere to eToro’s minimum deposit requirements, which vary depending on geographical location. For instance, the minimum amount you can deposit in your eToro account is $100 in the US or the UK. On the other hand, people in countries like Germany and Greece can deposit as little as $50. Visit eToro’s minimum deposit page to find out more.

That said, we encountered several eToro fees and expenses during our exploration, including:

- A $5 fixed withdrawal fee: According to eToro, this fee is indispensable in covering international money transfer costs.

- Currency conversion fees: All eToro accounts are USD-centered. If you fund your account or withdraw money using any other currency, expect to pay conversion fees. The charges vary depending on PIPs and payment methods. Luckily, traders can join the eToro club and enjoy significant discounts.

- A $10 monthly inactivity fee: If you fail to log into your account for 12 or more months, you will incur a monthly $10 fee.

- Crypto fees: eToro requires crypto investors to pay a 1% buy/sell fee. As an investor, you must also cover market spreads, which vary depending on market conditions. Transferring crypto to your eToro Money digital wallet also attracts a 2% fee. The crypto asset transfer fees are capped at 1$ minimum and a $100 maximum.

- CFD spreads: Like many other brokers, eToro has CFD spreads that vary depending on assets and instruments.

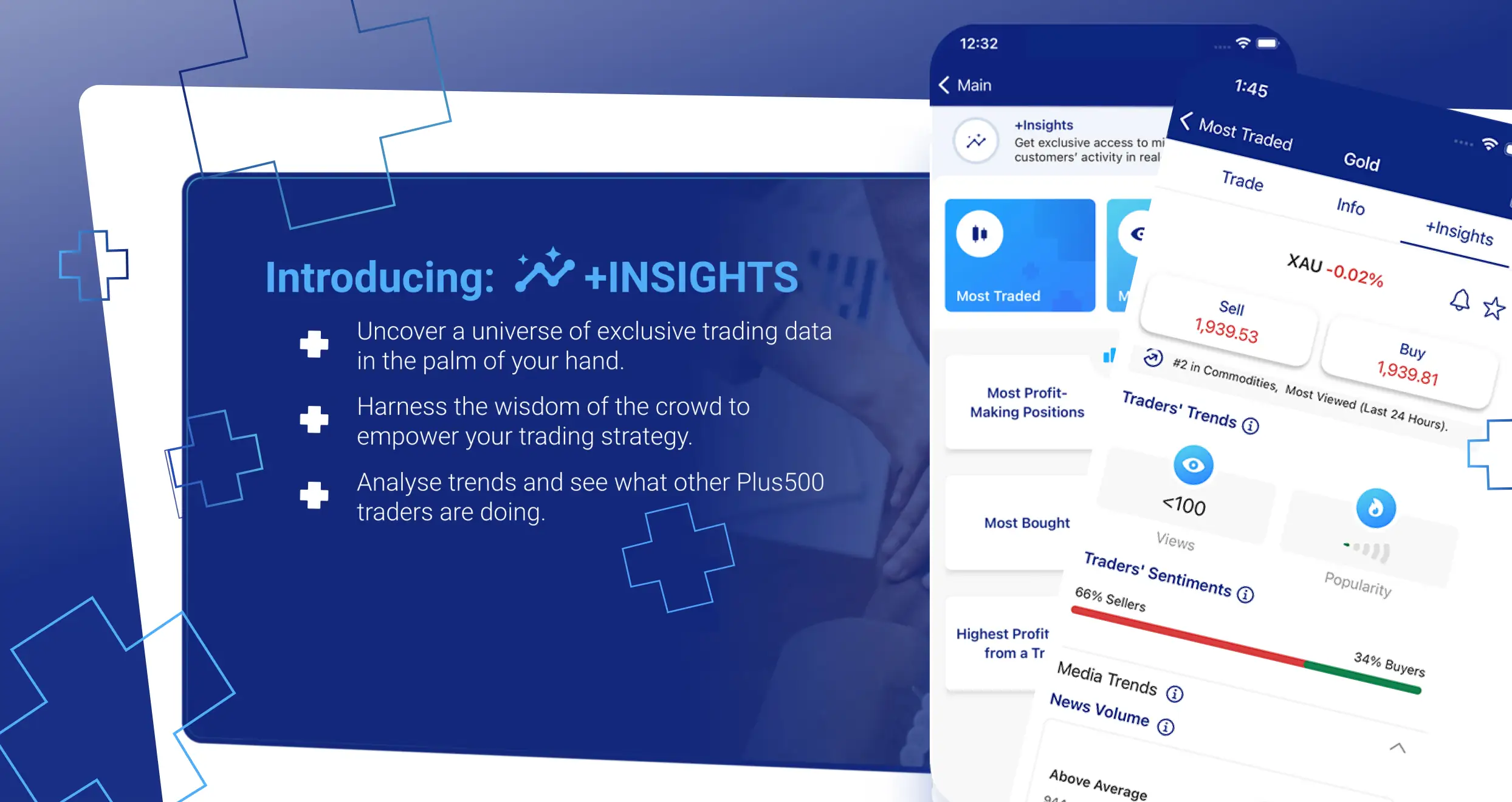

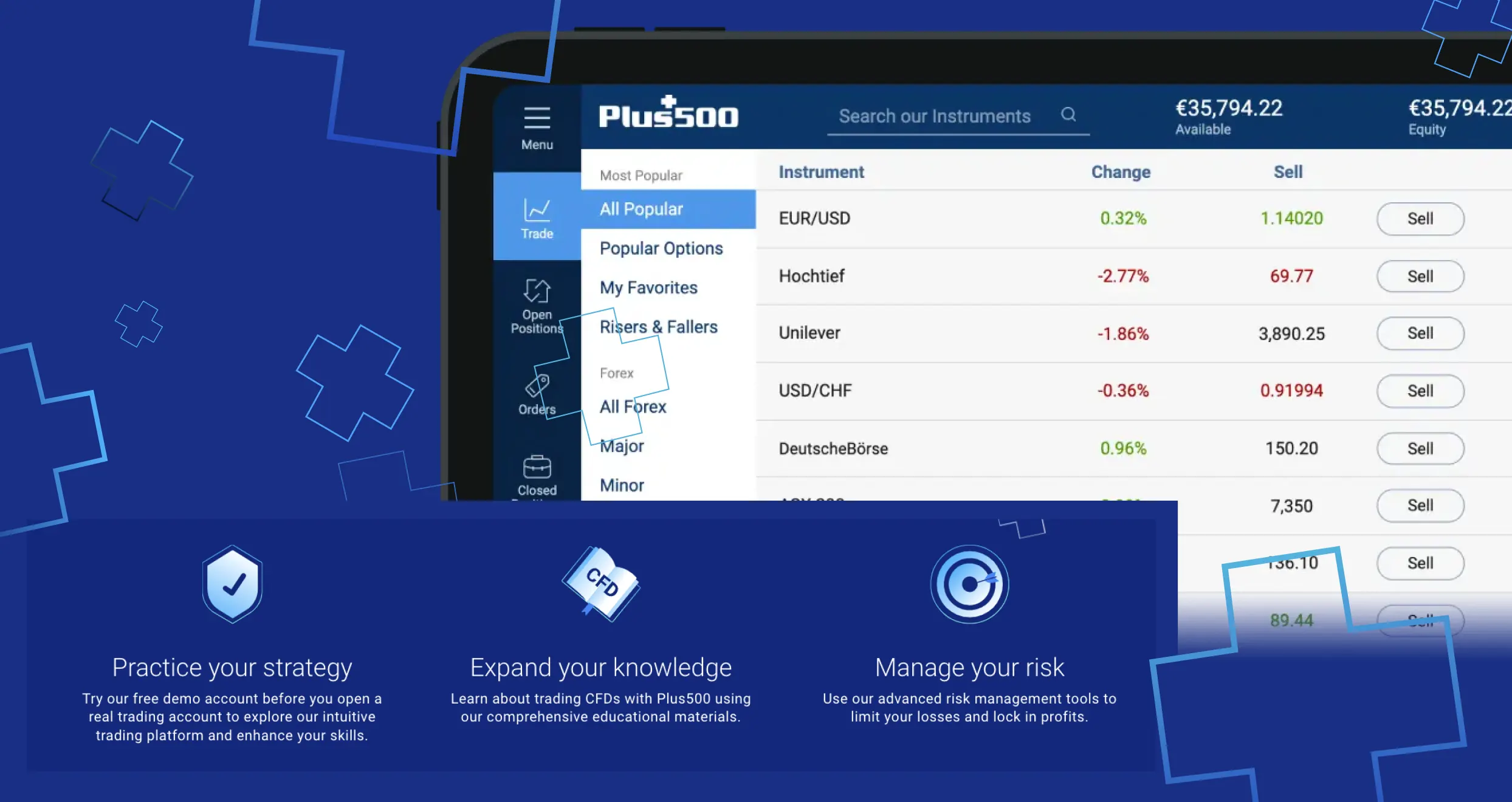

3. Plus500 – Top Platform for CFD Trading

Are you interested in CFD trading? Plus500 should be your go-to platform. We wholeheartedly endorse it for several reasons. First and foremost, the platform gives you uncapped access to 2,800+ CFDs on forex, commodities, indices, and other assets. That means you’ll have no problems finding your favorites, as well as other instruments for portfolio diversification.

The other admirable element we discovered while exploring this platform is its academy. Plus500 has an academy that can be of great help to both CFD trading for beginners and experts. If you are a newbie, you’ll find numerous outstanding materials that will help you understand the fundamentals of CFD trading and how to use the Plus500 platform. And once you start trading, the broker’s advanced materials will enable you to stay in tip-top shape and maintain consistent profitability.

Furthermore, Plus500 offers 24/7 support. Rest assured that any concerns or challenges you might face while trading with this platform will be addressed promptly and effectively. And if you’re worried about excessive cost, don’t fret. Plus500 offers tight spreads and doesn’t charge additional fees for deposits and withdrawals.

Note: Remember that CFDs are a leveraged product and can result in the loss of your entire deposit. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.

Pros

- Thousands of CFDs on popular assets like forex and commodities are available

- Offers expert, responsive support 24/7

- No additional charges for deposits and withdrawals

- Top-quality courses, webinars, and other educational resources

- A professional account with enhanced features is available

Cons

- Focuses chiefly on CFD trading

- Dormant accounts have a $10 monthly inactivity fee after three months of inactivity

- Limited trading platforms

One thing we love about Plus500 is that the platform offers most of its services without charging a dime. Moreover, the company practices optimum transparency regarding any costs or charges. While trading on Plus500, we enjoy that there are no* deposits and withdrawal fees (*Fees may be charged by the financial services provider).

However, we had to incur reasonable charges, courtesy of the buy/sell spreads. If you are a fan of swing trading and often deal with higher balances, you can check Plus500’s variable spreads. And don’t worry about paying commissions because Plus500 supports trades with low spreads.

Depending on your trading activities on Plus500, you may also incur the following fees and costs:

- Overnight funding: If you open a position and fail to close after a specific cut-off time, otherwise known as the Overnight Funding Time, Plus500 may add or subtract a certain amount of overnight funding from your account. Plus500 uses this formula to determine the exact amount of overnight funding to charge you: Trade Size x Position Opening Rate x Point Value x Daily Overnight Funding %.

- Currency conversion fee: While trading on Plus500, you will incur currency conversion charges every time you dabble with an instrument whose currency denomination differs from your trading account’s currency. During our test, Plus500’s currency conversion fee was up to 0.7% of each trade’s net profit and loss.

- Guaranteed stop order: Plus500 has a unique order type that guarantees the stop loss level even in highly volatile markets. You can use it to minimize losses and maximize returns, but it’ll cost you money. The fee comes in the form of a wider spread.

- Inactivity fee: Suppose your Plus500 trading account stays dormant for over three months. Your company will charge you up to $10 per month. This fee enables Plus500 to cover the costs of maintaining your inactive account.

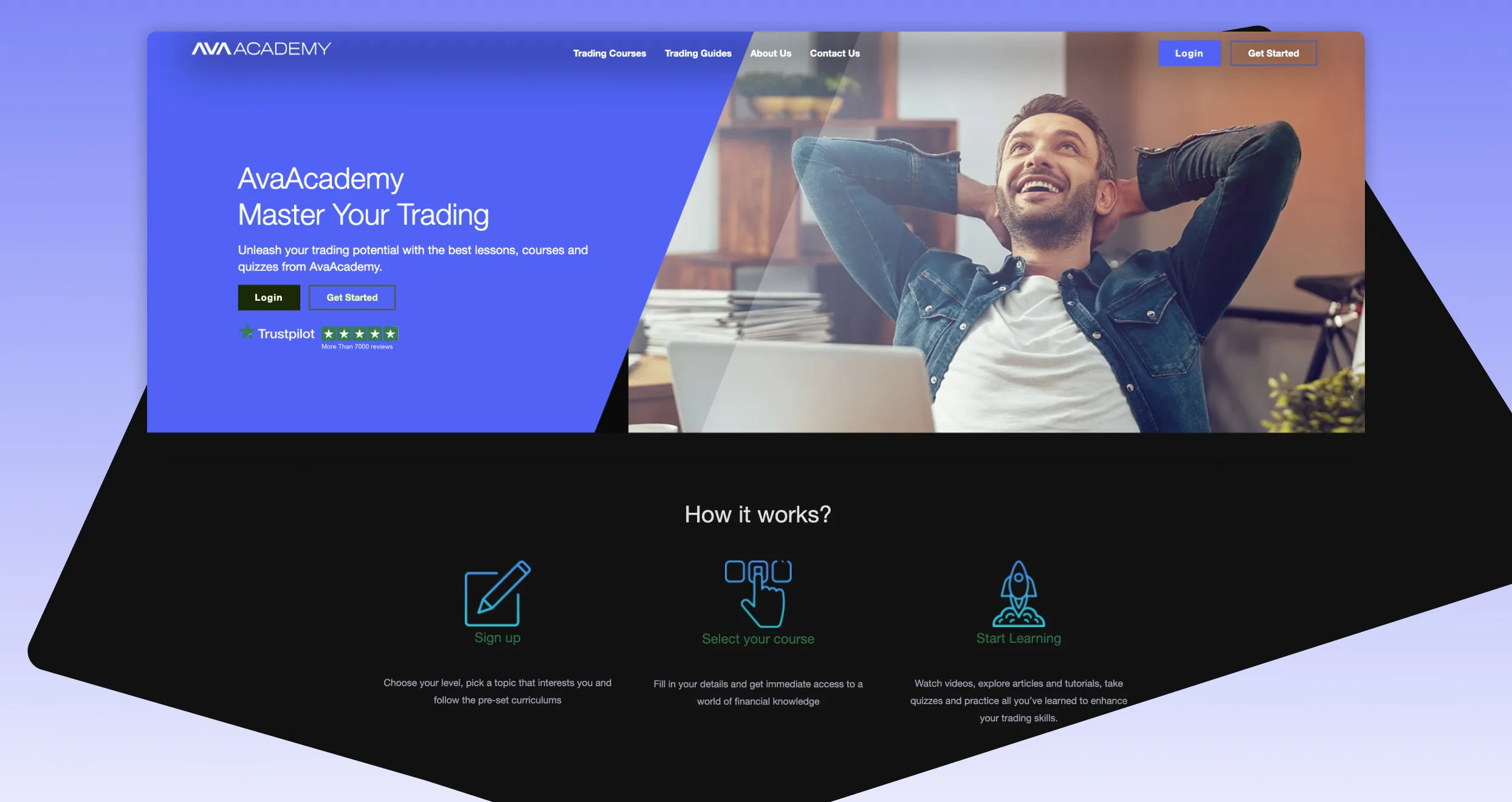

4. AvaTrade – Best Platform for Beginners

AvaTrade is, beyond any doubt, the best trading platform for beginners in Singapore. We urge every beginner to consider starting their journey on AvaTrade for myriad reasons. Let’s start with education. This platform has an outstanding academy tailored for beginners. It has many courses and learning materials that can help you transition from a noob to a knowledgeable trader.

The courses and other materials offered by the AvaTrade Academy (Ava Academy) are many and varied. For instance, there are courses designed to teach you how to start trading forex, commodities, and crypto quickly. Some lessons also cover the essentials of advanced trading techniques and strategies. Not to forget, Ava Academy has countless quizzes you can use to test your knowledge after devouring different learning materials.

We also recommend AvaTrade to newbies since the platform has a clutter-free, well-laid-out user interface. It’s easy to navigate and get used to. Moreover, the broker’s support team is always ready to help beginners and answer any questions they may have. As a newbie, you’ll be pressed to find better support than what AvaTrade offers.

Pros

- First-rate trading courses, guides, and other educational materials

- Simple, beginner-friendly user interface

- Excellent customer support service

- A wide selection trading platforms, including MT4 and MT5

- Competitive spreads and commissions

- Supports free deposits and withdrawals

Cons

- Fewer financial instruments than its peers

- High account inactivity fees

AvaTrade charges low fees for trading and non-trading services. When we started with the broker, we found the first deposit requirement of $100 or its equivalent to be low. Plus, all deposits and withdrawals at AvaTrade are free.

Commissions and spreads at AvaTrade are also low in our opinion. For instance, trading forex attracts low fees from 0.9 pips on major currency pairs. We also tried trading stocks and incurred low charges from 0.2 pips.

On the downside, AvaTrade charges a high inactivity fee of $50/£50/€50. This depends on your account currency. The fee applies should your account remain inactive for over three months. Plus, there is an annual administration fee of $100/€100/£100 after 12 months of inactivity. Other fee to expect with this broker is overnight charges for positions left overnight. Its margin rates are also low, from 3.33%, depending on your jurisdiction.

It is important to note that while AvaTrade offers social trading, accessing this feature via the DupliTrade and ZuluTrade platforms can be costly for low-budget traders. You are required to deposit at least $2,000 for DupliTrade and $200 for ZuluTrade platforms.

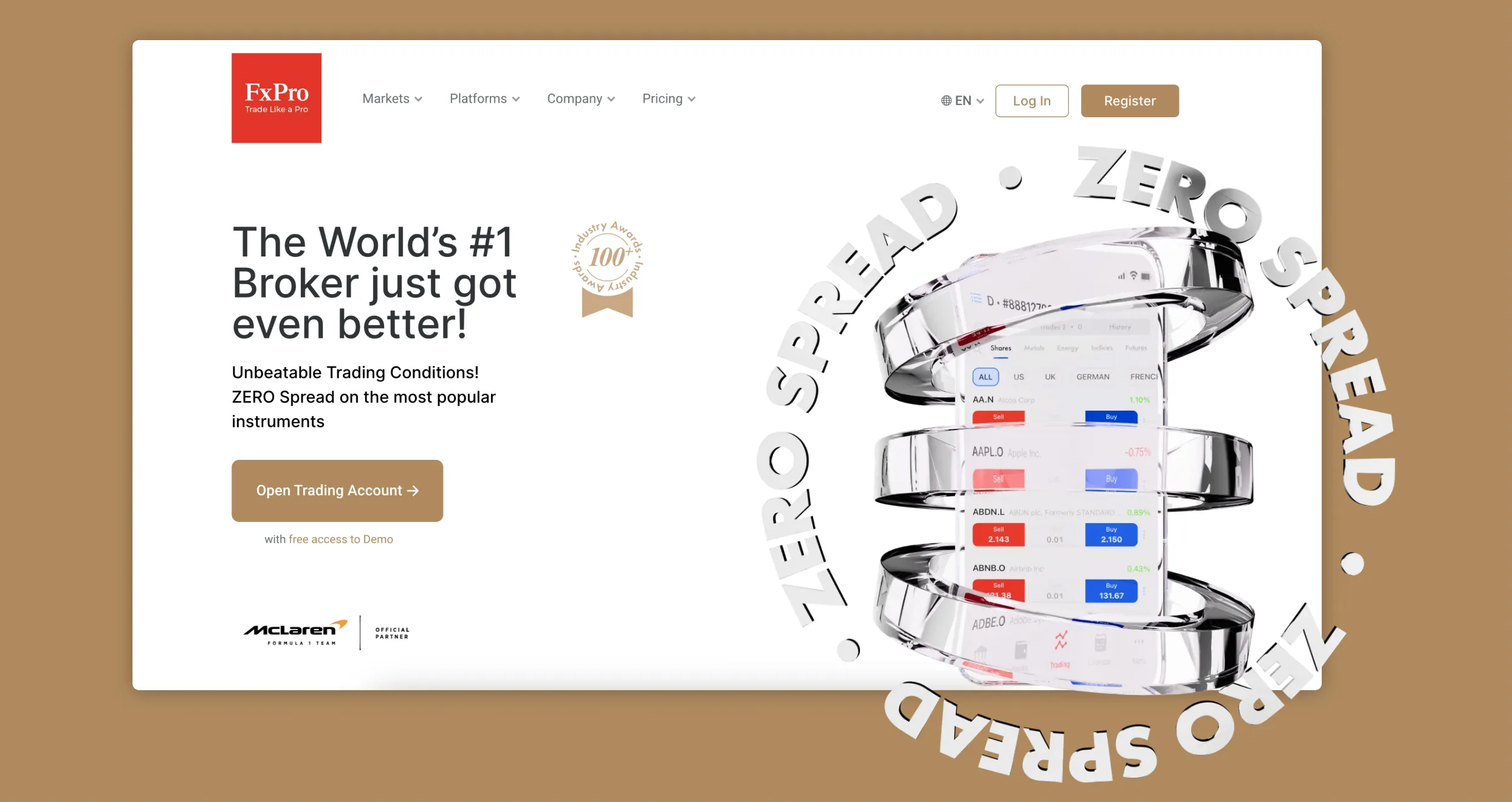

5. FxPro – Best Platform for Forex Traders in Singapore

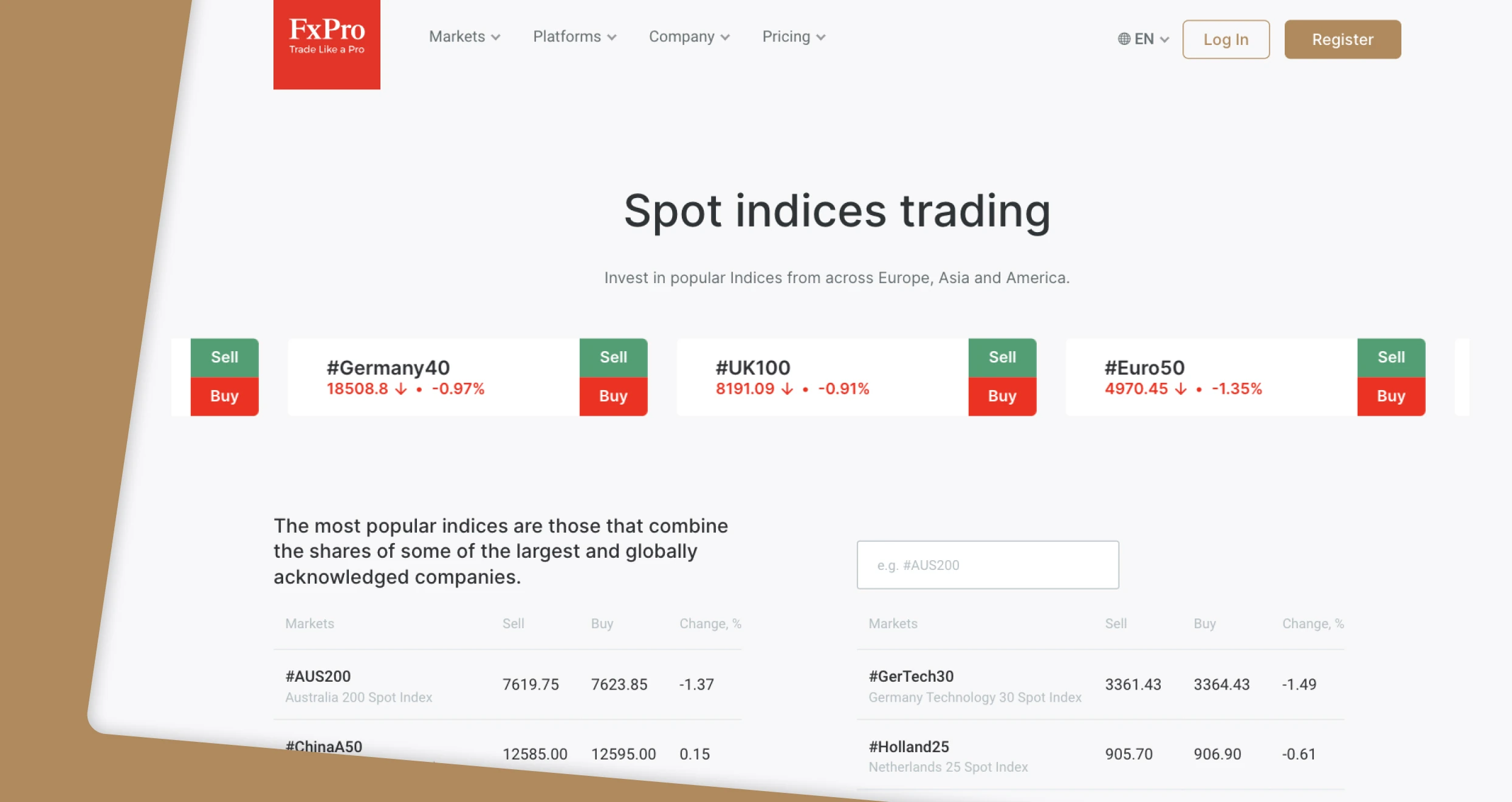

FxPro is a popular trading platform that boasts over 7.8 million people worldwide. We vetted it, and our findings have encouraged us to recommend it to forex traders. The platform has over 70 currency pairs that you can start trading today. Available products range from major pairs like EUR/GBP and GBP/CAD to minor pairs like GBP/DKK, EUR/SGD, and GBP/ZAR.

And since portfolio diversification is indispensable, even to forex traders, FxPro offers many other financial instruments besides FX pairs. They include shares, indices, and futures. Please note that FxPro exclusively supports CFD trading and spread betting. That means you can only trade CFDs on the aforementioned financial products.

We also recommend FxPro to Singaporean forex traders since the platform gives its users access to diverse trading systems. You can either trade with the broker’s powerful FxPro WebTrader platform or use the FxPro Mobile App for added convenience. And if you’d like to sample what exemplary third-party platforms offer, FxPro has cTrader, MetaTrader 4, and MetaTrader 5.

Pros

- Vast selection of major and minor currency pairs

- Tight spreads and commissions

- An ample variety of trading platforms, including MT4 and MT5

- Free deposits and withdrawals

- Rapid execution and ultra-low latency

Cons

- Focuses primarily on CFDs

- $10 monthly inactivity fee

- Limited educational resources

After signing up with FxPro, we discovered several key aspects. First, we had to adhere to FxPro minimum deposit requirements. Presently, this broker recommends that you fund your account with at least $1,000, but you can deposit as little as $100. And don’t worry about any charges. Deposits and withdrawals are free on this trading platform.

That aside, if you choose the cTrader platform and trade FX pairs of spot metals, expect to pay a commission, but it’s reasonable. This broker charges $35 for every $1 million traded. Additionally, if you keep a position open overnight, you will incur swap/rollover charges. FxPro will charge your account automatically at 21:59 (UK time).

FxPro has a cost calculation tool you can use to determine every available instrument’s quarterly charges. You should check it out.

Online Trading in Singapore

Online trading is legal and accessible to anyone above 18 in Singapore. It’s also incredibly popular and has attracted hundreds of thousands of investors. That said, to benefit from this venture, you need to be knowledgeable and skilled. If you are new to online trading, spend as much time as possible mastering the fundamentals before you start trading and risk your hard-earned money.

Also, you need to trade with an MAS-regulated broker. Founded in 1971, MAS is an authority dedicated to consumer protection. It monitors trading brokers and protects you from detrimental issues like market manipulation and unfair trading practices.

How to Choose the Right Trading Platform in Singapore

Many fraudulent service providers are operating all over the globe, including in Singapore. They are targeting innocent traders and ripping them off whenever they get the chance. To avoid falling prey to these actors and losing money, you must be cautious while choosing a platform to trade with. The following factors will help you identify trustworthy entities and avoid sub-par platforms, scammers, and fraudsters:

Before trading with any platform, ensure it’s regulated by MAS in Singapore. Also, to be safer, prioritize trading with entities that are authorized and monitored by authorities in other regions, like the FCA, CySEC, and ASIC. Never interact with an unregulated service provider since you might lose your money and personal data.

While searching for a reputable service provider, visit popular sites like the App Store, Google Play, and TrustPilot. Read every trading platform’s reviews and testimonials. A reputable and credible platform should have many glowing reviews and positive ratings. On the other hand, a substantial number of complaints are clear indicators of a platform with lousy products and services.

Before you start, familiarize yourself with popular financial assets and pick a few that align with your trading goals. Then, find a trading platform that offers your preferred assets. Remember, some brokers allow you to trade real assets, while others only offer CFDs on specific financial instruments.

Some brokers offer proprietary trading platforms exclusively, while others give users access to third-party software like MetaTrader. Depending on your preferences, choose a service provider with the right trading platforms.

Checking stipulated fees is crucial since high costs negatively impact your profit margins. The same applies to spreads and commissions. The less you spend while trading, the higher your potential earnings. Compare different trading platforms’ fees, spreads, and commissions to get the best deals.

If you are a beginner, you may have a few questions that require professional assistance. And once you start trading, you may encounter some problems along the way and need expert help. In both scenarios, good customer support is indispensable. Before committing to any trading platform, check if it offers outstanding support services and verify the support team’s availability.

How To Register an Account with a Trading Platform in Singapore

You can’t start trading without a live account. After identifying the best trading platform, you must sign up and verify your account. But don’t let that dishearten you. The process is quick and straightforward. We’ve covered the essential steps below:

To register, you must visit your chosen platform’s official site. Before going any further, check if the service provider meets all your needs and expectations. Don’t ignore or overlook anything, especially crucial aspects like fees and terms & conditions.

If you’re happy with what you see, open a new account by signing up. You’ll need to register with your personal information, including your full name and email address/phone number. Your service provider will also ask you to verify contact details and secure your account with an excellent password- do it.

MAS-regulated trading platforms ask new applicants to verify their identity and address with specific documents. They often range from a national ID card to recent bank statements. Check your chosen service provider’s requirements and do what’s required of you. To avoid getting rejected or being forced to register again, submit clear copies of valid documents.

Your account should be verified within a few hours, provided you share the right details and documents. Once verification is complete, choose a supported funding method and top up your account. If the service provider has set minimum deposit requirements, obey them. Otherwise, use your budget limits to decide on the right amount to start with.

Once you’ve successfully deposited funds into your account, choose a financial instrument and start trading. But don’t put all of your eggs in one basket. What does that mean? Invest in diverse assets. Also, try to risk approximately 2% of your whole capital on every trade. Never go all in because you might lose everything if things don’t go your way.

Conclusion

Online trading is risky. Finding the best platform might help you reach your trading goals, but it won’t protect you from the associated financial risks. You have to put in the effort. How? First, if you are new to trading, find quality educational materials and learn everything you can. Countless free materials are available online, so that shouldn’t present any challenges. After acquiring education, test yourself with a demo account and virtual funds before putting any money on the line.

Furthermore, online trading can be addictive and negatively impact other facets of your life. As a trader, you should take regular breaks and engage in other healthy activities, like meditating and exercising. Remember, addiction can lead to compulsive trading, unnecessary risky moves, and hefty financial losses. Also, if you see any signs of addiction, take an extended hiatus or seek professional assistance.

I've found that Interactive Brokers offers competitive fees and a wide range of assets - worth considering alongside these options!

I'd add a caveat about eToro - while their social trading features are innovative, the spreads can be quite wide during volatile market sessions